Friday, February 19th, 2021 and is filed under Industry Reporting

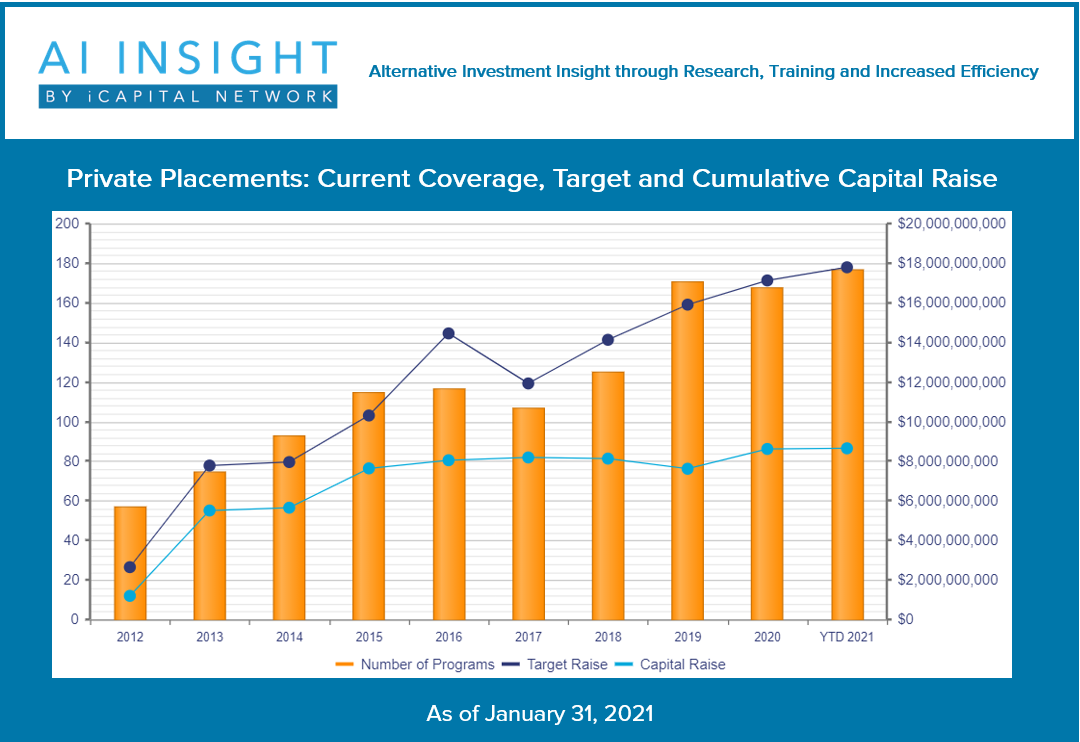

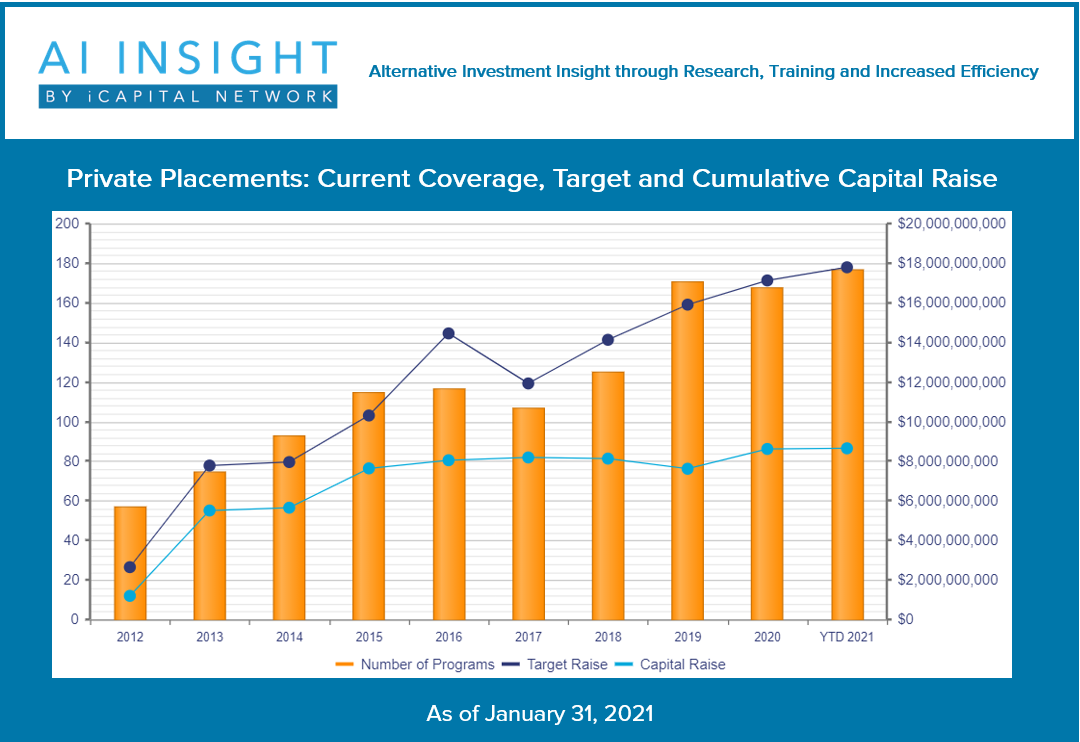

We recently released our January Private Placement Insights report. See the highlights from the report below, or if you are a Premium Reporting subscriber, log in now to see the entire report. If you don’t have access, you can request a free trial.

- While there was little to no activity in several categories in January, real estate and private equity/debt funds rallied to bring year-over-year new fund coverage and aggregate target raise up significantly (24% and 62%, respectively).

- As of February 1st, AI Insight covers 177 private placements currently raising capital, with an aggregate target raise of $17.8 billion and an aggregate reported raise of $8.6 billion or 49% of target.

- Real estate-related funds, including 1031s, opportunity zones, and non-1031 real estate LLCs and LPs represent the largest component of our private placement coverage, at 75% of funds and 59% of target raise. Private equity/debt funds represent a relatively small amount of our coverage in terms of the number of funds at only 11%, but tend to be larger and represent 33% of aggregate target raise.

- In terms of our coverage by general objective, income is the largest component at 52% of funds, while growth and growth & income follow at 30% and 16%, respectively.

- The average size of the funds currently raising capital is $100.5 million, ranging from $1.9 million for a preferred offering to $3.0 billion for a sector specific private equity/debt fund.

- 78% of private placements we cover use the 506(b) exemption, 12% use 506(c) and 10% have not yet filed their Form D with the SEC.

- 14 private placements closed in January, having been on the market for an average of 300 days. The 12 funds that reported a raise reported that they raised 73% of target. 64% met or exceeded their target and only one raised less than half of its target.

- ON DECK: as of February 1st, there were eleven new private placements coming soon.

For illustrative purposes only.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, Non-Traded BDCs, Interval Funds, and Alternative Strategy Mutual Funds. Receive up to 24 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of January 31, 2021, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security offered by Institutional Capital Network, Inc. or its affiliates (together “iCapital Network”). Past performance is not indicative of future results. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors. An investment in an alternative investment entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. The information contained herein is subject to change and is also incomplete. This industry information and its importance is an opinion only and should not be relied upon as the only important information available. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed, and iCapital Network assumes no liability for the information provided.

Products offered by iCapital Network are typically private placements that are sold only to qualified clients of iCapital Network through transactions that are exempt from registration under the Securities Act of 1933 pursuant to Rule 506(b) of Regulation D promulgated thereunder (“Private Placements”). An investment in any product issued pursuant to a Private Placement, such as the funds described, entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. Further, such investments are not subject to the same levels of regulatory scrutiny as publicly listed investments, and as a result, investors may have access to significantly less information than they can access with respect to publicly listed investments. Prospective investors should also note that investments in the products described involve long lock-ups and do not provide investors with liquidity.

Securities may be offered through iCapital Securities, LLC, a registered broker dealer, member of FINRA and SIPC and subsidiary of Institutional Capital Network, Inc. (d/b/a iCapital Network). These registrations and memberships in no way imply that the SEC, FINRA or SIPC have endorsed the entities, products or services discussed herein. iCapital and iCapital Network are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2021 Institutional Capital Network, Inc. All Rights Reserved.

Friday, January 8th, 2021 and is filed under Industry Reporting

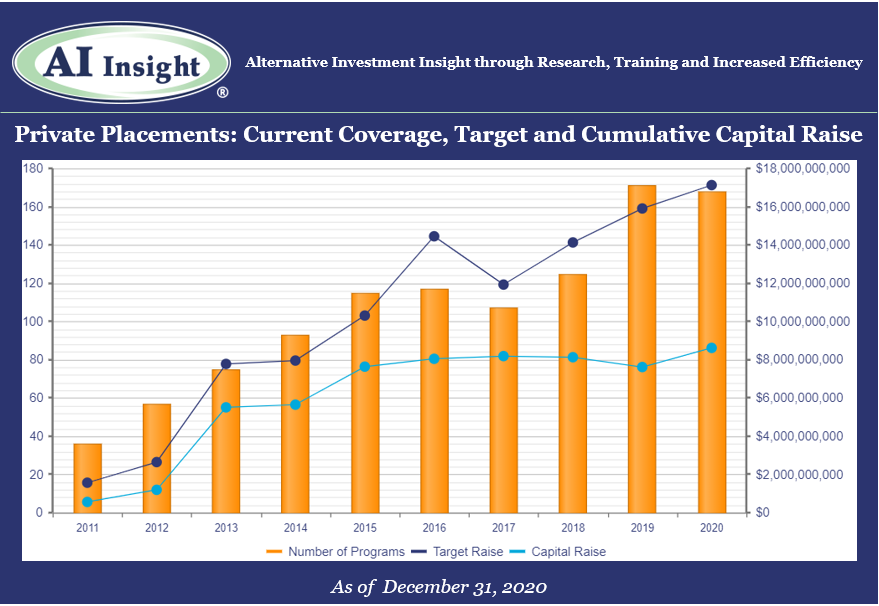

We recently released our December Private Placement Insights report. See the highlights from the report below, or if you are a Premium Reporting subscriber, log in now to see the entire report. If you don’t have access, you can request a free trial.

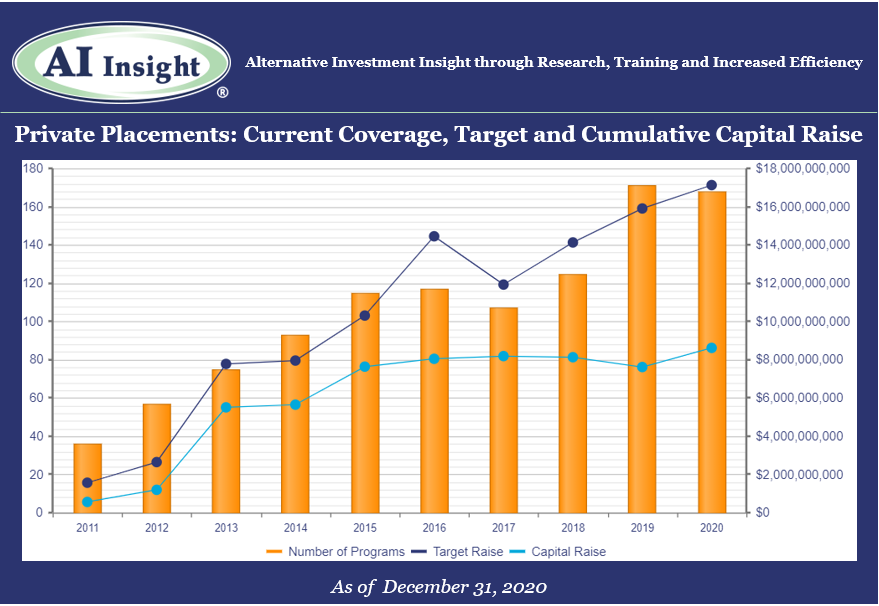

- Despite the COVID-19 related slowdown in Q2, AI Insight’s private placement coverage ended the year nearly on par with the record-setting 2019. The number of new private placements added to our coverage during the year was 2 fewer than 2019 (-1.00%), while aggregate target raise of $9.0 billion was roughly 8% less than the target in 2019. The 199 funds added in 2020 were offered by 75 separate sponsors.

- As of January 1st, AI Insight covers 167 private placements currently raising capital, with an aggregate target raise of $17.1 billion and an aggregate reported raise of $8.6 billion or 50% of target.

- Real estate-related funds, including 1031s, opportunity zones, and non-1031 real estate LLCs and LPs represent the largest component of our private placement coverage, at 75% of funds and 60% of target raise. Private equity/debt funds represent a relatively small amount of our coverage in terms of the number of funds at only 10%, but tend to be larger and represent 32% of aggregate target raise.

- In terms of our coverage by general objective, income is the largest component at 52% of funds, while growth and growth & income follow at 28% and 18%, respectively.

- The average size of the funds currently raising capital is $102.3 million, ranging from $1.9 million for a preferred offering to $3.0 billion for a sector specific private equity/debt fund.

- 76% of private placements we cover use the 506(b) exemption, 13% use 506(c) and 12% have not yet filed their Form D with the SEC.

- 55 private placements closed in December (higher than average primarily due to the closing of all open conservation funds), with roughly 66% of those reporting a raise meeting or exceeding their target raise. 209 private placements closed in full year 2020, having been on the market for an average of 299 days and reporting they raised 71% of their target on average (of those that reported). 70% met or exceeded targets, and only 12% were able to raise less than half of their target. 11 funds did not report a raise.

- Seven private placements suspended offerings and one terminated due to uncertainties related to COVID-19.

- ON DECK: as of January 1st, there were seven new private placements coming soon.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, Non-Traded BDCs, Interval Funds, and Alternative Strategy Mutual Funds. Receive up to 24 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of December 31, 2020, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose. Copyright ©2021 AI Insight. All Rights Reserved.

Tuesday, December 22nd, 2020 and is filed under AI Insight News

AI Insight CEO Sherri Cooke discusses her key reflections for 2020 including how alternative investments played an important role in portfolios and the impacts of Reg BI. She also shares what’s anticipated in 2021. Read the narrative below or listen to the podcast here.

Sherri formed AI Insight in 2005 with the primary goal of providing the financial planning community with a more efficient and consistent way to access factual information on alternative investment programs – and from that vision the AI Insight database was born.

Q: What are some of the key reflections you have about 2020 and some points of interest for the coming year?

SC: I would say as a ADISA Board member, I was fortunate to be able to spend quite a bit of time this year collaborating with others in the alternative investment industry focusing on some of the things we can do to make the industry better – and to increase the awareness and understanding of these products within a growing audience. I believe we all have to work together to bring this space to a whole new level. Also, as Reg BI requirements continue, we’re looking at ways to partner with compliance and technology workflow companies that are helping to support these needed processes. We’re also looking to connect with other companies – both inside and outside the traditional alternatives space to further increase consistency and transparency in the industry with an ultimate goal of making it easier to conduct alts business.

Q: How do you think alternative investments played an important role in portfolios this past year, especially given the pandemic?

SC: We’re always looking for ways to give more to people – who are of course qualified – access to alternative investments to help them really diversify their portfolio in a meaningful way. Our belief is that a person isn’t fully diversified if all of their underlying investments are either in some way tied to the markets or are invested in a fixed income security – which is effectively still tied to the market.

Despite the pandemic – and in some cases as a result of – there are a lot of really solid opportunities to invest in real assets, interesting investment structures, and institutionally supported opportunities through alternative investments that really provide true diversification.

That said, alternatives can certainly be complex and they need to be factually understood and appropriately sold. This industry really needs to educate financial professionals and investors in so many different ways. One of those has to be around creating realistic expectations about what these investments are intended to bring to a diversified investment portfolio…and what they are not. Stocks lose value all the time and there will be alts that don’t perform. As an industry, we really need to do our very best to ensure that these products are properly sold and positioned within client portfolios. And – as with all investments – we support conducting the best possible research and diligence to allow firms and advisors to select best of class – and help the vested financial firms and producers drive product sponsors toward best of class practices.

Q: We know that compliance is often an issue for advisors in considering alternative investments – and regulatory scrutiny continues to increase. The SEC’s Regulation Best Interest implementation took place on June 30. How does AI Insight help streamline Reg BI requirements?

SC: Compliance is one of the things that motivated me to create AI Insight in the first place. I wanted to build capabilities to facilitate due diligence and proper compliance along with education and documentation of these efforts when selling complex products – those products that the regulators have called out as needing heightened supervision or training.

From an audit perspective, we’ve found in any situation of which we’re aware with our clients, if a firm has stayed up-to-date on the requirements around selling different types of investments – and makes sure everyone involved is aware of their obligations, adheres to the processes, and documents their efforts – then the regulators are generally satisfied. If you fail to make these efforts up front and you’re inconsistent in how you conduct your business from a compliance perspective….you’re just leaving yourself open to trouble.

Reg BI – within the BD community – and I think even though the fiduciary standard has always applied RIA space – we’re going see a whole new layer of extra scrutiny in this regard. The processes that have been central to our platform for years can help support Reg BI requirements and help financial firms and professionals demonstrate the “good faith and reasonable efforts” that Reg BI requires on an ongoing basis. Specifically, we’ve created a comprehensive Reg BI Guide that steps through the Compliance and Care Obligations and correlates the AI Insight support resource to that particular SEC requirement. Again, this is just another way that we help to create efficient and consistent educational and compliance workflows that can help firms at both the product and the firm level.

Q: What is your focus for 2021?

SC: From a business owner’s perspective, ensuring that our team and our product continues to maintain consistent integrity of value and exceptional service; this is the backbone of our business – and making sure that our AI Insight team is challenged and fulfilled in their roles within our company.

From an industry perspective – we believe that there is a tremendous amount of value for advisors to differentiate themselves and bring really great opportunities through the thoughtful and diligent understanding of alternative products. We provide this value by building and bringing together our network of broker-dealers, advisors, RIAs, alternative investment firms and industry partners. Therefore, as in past years, I am always grateful for how far we’ve been able to come and to everyone who has helped us be successful in our efforts to support this industry – and I look forward to working with all of our business partners to explore new possibilities and find what more we can bring to the table for our customers in the new year.

Tuesday, December 8th, 2020 and is filed under Industry Reporting

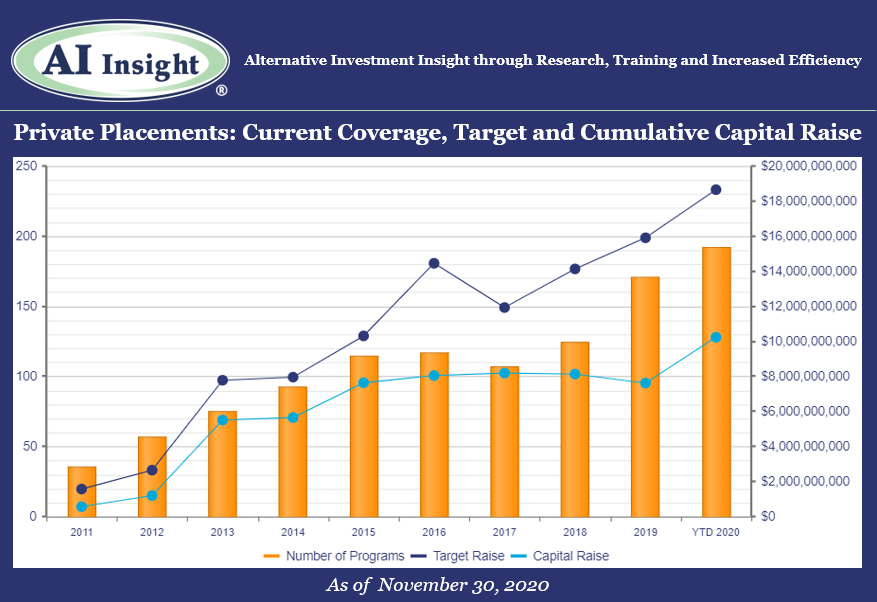

We recently released our November Private Placement Insights report. See the highlights from the report below, or if you are a Premium Reporting subscriber, log in now to see the entire report. If you don’t have access, you can request a free trial.

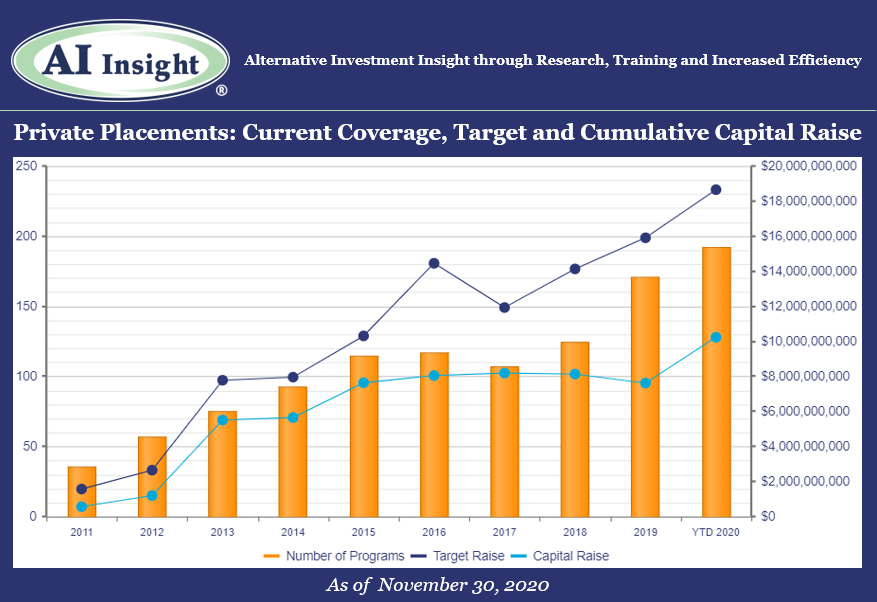

- Private placement fund activity slowed in November although it remains well above the mid-year COVID-19 slowdown. Year-over-year our coverage is down (-4% in new funds and -7% in target raise), especially on the real estate side, while some of the smaller areas of our coverage have increased. Energy, preferred, and private equity/ debt offerings are way up with strategies focused on opportunities created by the COVID-19 market dislocation. The 170 funds added in 2020 were offered by 69 separate sponsors.

- As of December 1st, AI Insight covers 192 private placements currently raising capital, with an aggregate target raise of $18.6 billion and an aggregate reported raise of $10.2 billion or 55% of target.

- Real estate-related funds, including 1031s, opportunity zones, and non-1031 real estate LLCs and LPs represent the largest component of our private placement coverage, at 68% of funds and 59% of target raise. Private equity/debt funds represent a relatively small amount of our coverage in terms of the number of funds at only 9%, but tend to be larger and represent 29% of aggregate target raise.

- In terms of our coverage by general objective, income is the largest component at 51% of funds, while growth and growth & income follow at 30% and 18%, respectively.

- The average size of the funds currently raising capital is $97.1 million, ranging from $1.9 million for a preferred offering to $3.0 billion for a sector specific private equity/debt fund.

- 75% of private placements we cover use the 506(b) exemption, 12% use 506(c) and 13% have not yet filed their Form D with the SEC.

- 17 private placements closed in November, with roughly 83% meeting or exceeding their target raise. 157 funds have closed year-to-date, having been on the market for an average of 330 days and reporting they raised 69% of their target on average. 85% met or exceeded targets, and only 10% were able to raise less than half of their target. Four funds did not report a raise.

- Seven private placements suspended offerings and one terminated due to uncertainties related to COVID-19.

- ON DECK: as of December 1st, there were eight new private placements coming soon.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, Non-Traded BDCs, Interval Funds, and Alternative Strategy Mutual Funds. Receive up to 24 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of November 30, 2020, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose. Copyright ©2020 AI Insight. All Rights Reserved.

Tuesday, November 10th, 2020 and is filed under Industry Reporting

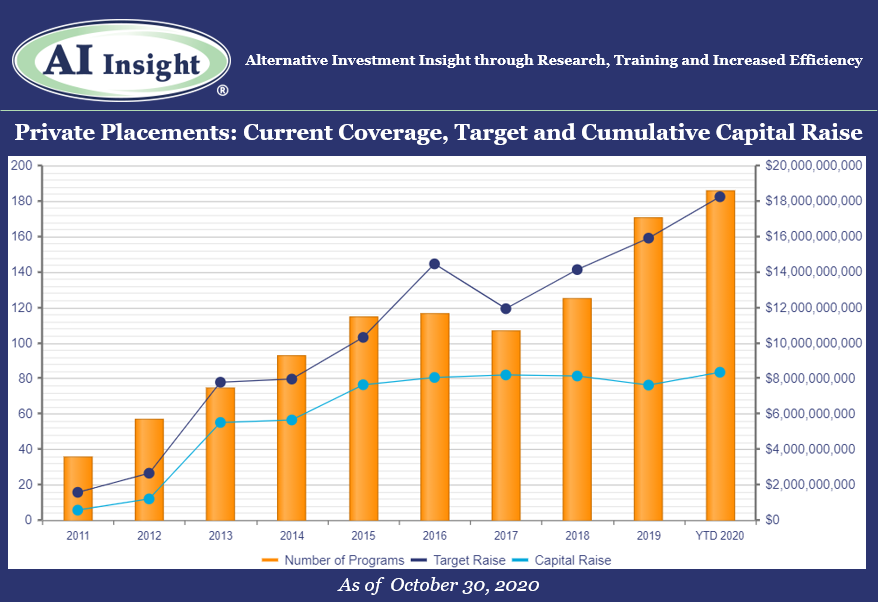

We recently released our October Private Placement Insights report. See the highlights from the report below, or if you are a Premium Reporting subscriber, log in now to see the entire report. If you don’t have access, you can request a free trial.

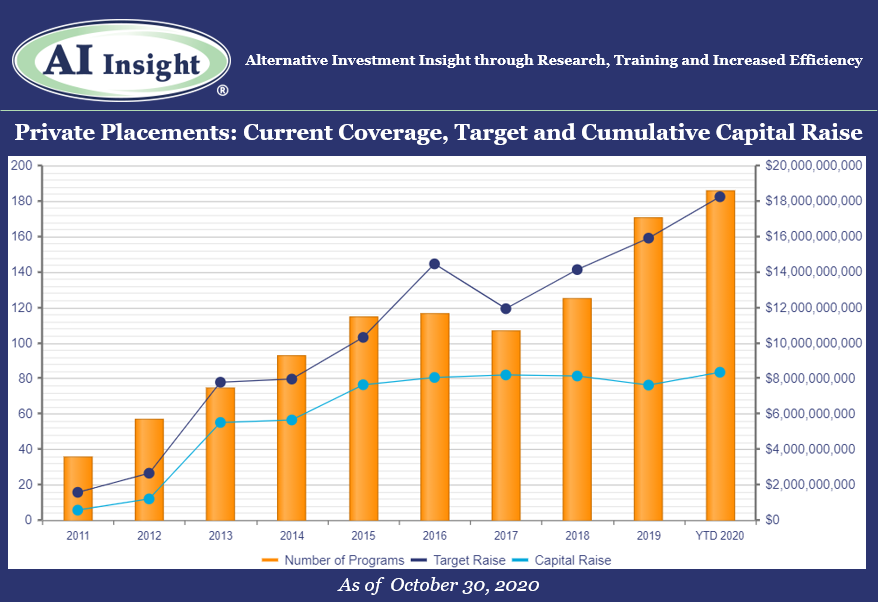

- Private placement fund activity continued its strong pace in October, with more funds added to our coverage in the month than any since March. 26 new funds were added in October, led primarily by real estate funds but also including energy, private equity/debt, and preferred offerings.

- As of November 1st, AI Insight covers 186 private placements currently raising capital, with an aggregate target raise of $18.2 billion and an aggregate reported raise of $8.34 billion or 46% of target.

- Real estate-related funds, including 1031s, opportunity zones, and non-1031 real estate LLCs and LPs represent the largest component of our private placement coverage, at 72% of funds and 59% of target raise. Private equity/debt funds represent a relatively small amount of our coverage in terms of the number of funds at only 10%, but tend to be larger and represent 29% of aggregate target raise.

- In terms of our coverage by general objective, income is the largest component at 52% of funds, while growth and growth & income follow at 28% and 19%, respectively.

- The average size of the funds currently raising capital is $98.0 million, ranging from $3.5 million for a single asset real estate fund to $2.8 billion for a sector specific private equity/debt fund.

- 74% of private placements we cover use the 506(b) exemption, 13% use 506(c) and 13% have not yet filed their Form D with the SEC.

- 18 private placements closed in October, with roughly 70% meeting or exceeding their target raise. 137 funds have closed year-to-date, having been on the market for an average of 339 days and reporting they raised 68% of their target on average. 72% met or exceeded targets, and only 16% were able to raise less than half of their target.

- Seven private placements suspended offerings and one terminated due to uncertainties related to COVID-19.

- ON DECK: as of November 1st, there were seven new private placements coming soon.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, Non-Traded BDCs, Interval Funds, and Alternative Strategy Mutual Funds. Receive up to 24 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of October 31, 2020, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose. Copyright ©2020 AI Insight. All Rights Reserved.

Tuesday, October 6th, 2020 and is filed under Industry Reporting

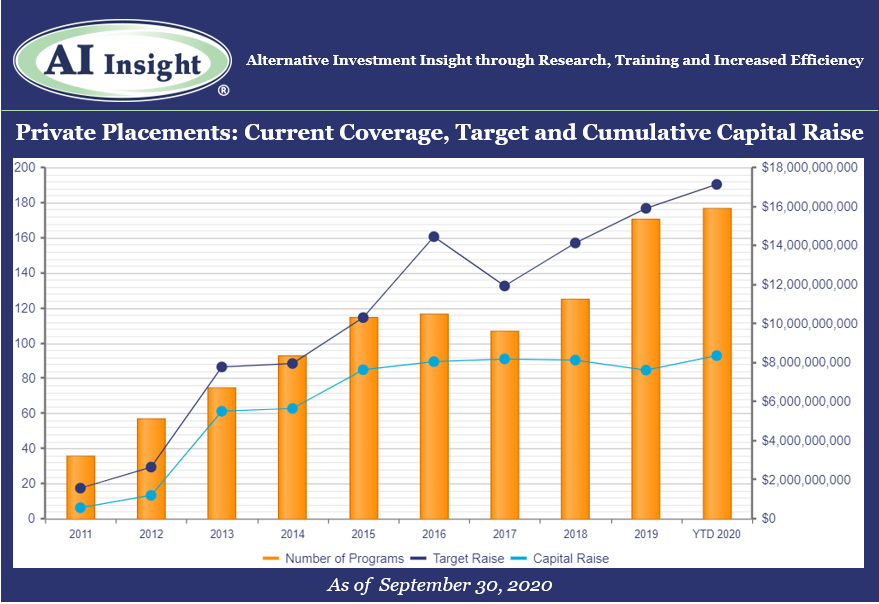

We recently released our September Private Placement Insights report. See the highlights from the report below, or if you are a Premium Reporting subscriber, log in now to see the entire report. If you don’t have access, you can request a free trial.

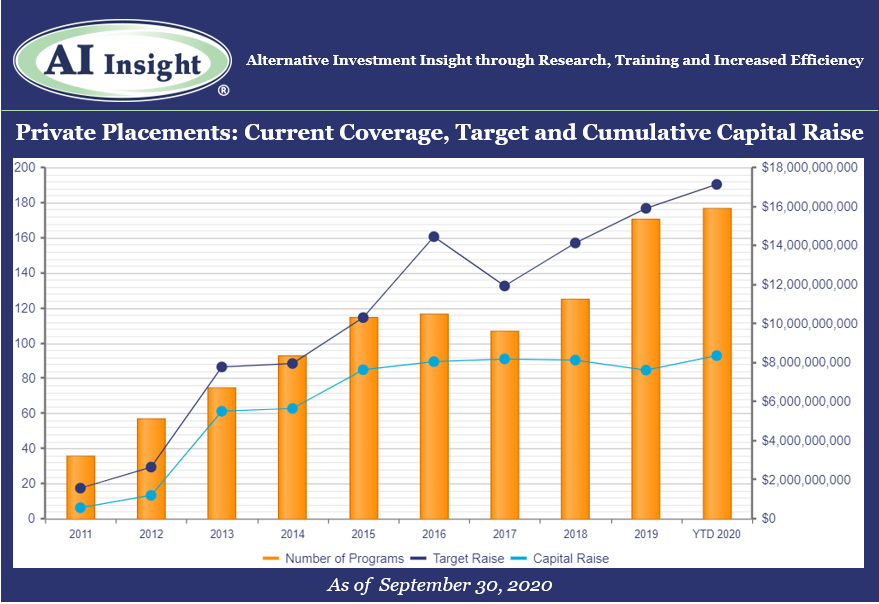

- Private placement fund activity ramped up in September, with more funds added to our coverage in the month than any since March. 19 new funds were added in September, led by 1031s, energy, and non-1031 real estate.

- As of October 1st, AI Insight covers 177 private placements currently raising capital, with an aggregate target raise of $17.1 billion and an aggregate reported raise of $8.4 billion or 49% of target.

- Real estate-related funds, including 1031s, opportunity zones, and non-1031 real estate LLCs and LPs represent the largest component of our private placement coverage, at 72% of funds and 60% of target raise. Private equity/debt funds represent a relatively small amount of our coverage in terms of the number of funds at only 9%, but tend to be larger and represent 27% of aggregate target raise.

- In terms of our coverage by general objective, income is the largest component at 52% of funds, while growth and growth & income follow at 29% and 18%, respectively.

- The average size of the funds currently raising capital is $96.8 million, ranging from $3.5 million for a single asset real estate fund to $2.8 billion for a sector specific private equity/debt fund.

- 76% of private placements we cover use the 506(b) exemption, 15% use 506(c) and 10% have not yet filed their Form D with the SEC.

- 11 private placements closed in September, with all either meeting or exceeding their target raise. 120 funds have closed year-to-date, having been on the market for an average of 333 days and reporting they raised 62% of their target on average.

- Seven private placements suspended offerings and one terminated due to uncertainties related to Covid-19.

- ON DECK: as of October 1st, there were seven new private placements coming soon.

- Listen to the companion podcast for this blog.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, Non-Traded BDCs, Interval Funds, and Alternative Strategy Mutual Funds. Receive up to 24 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of September 30, 2020, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose. Copyright ©2020 AI Insight. All Rights Reserved.

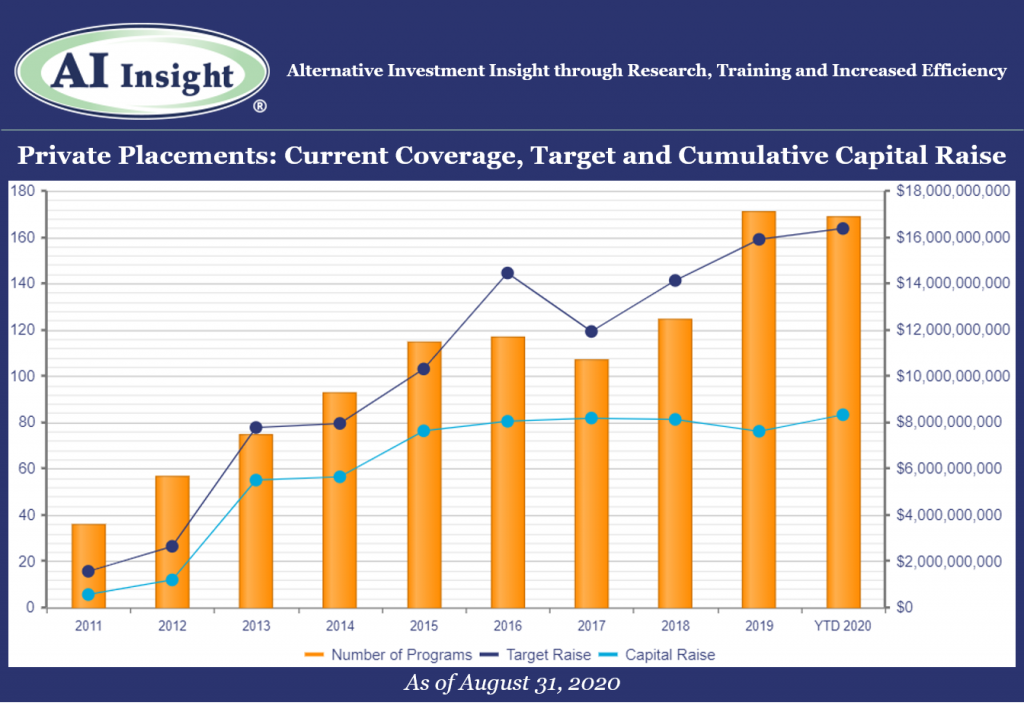

Wednesday, September 2nd, 2020 and is filed under Industry Reporting

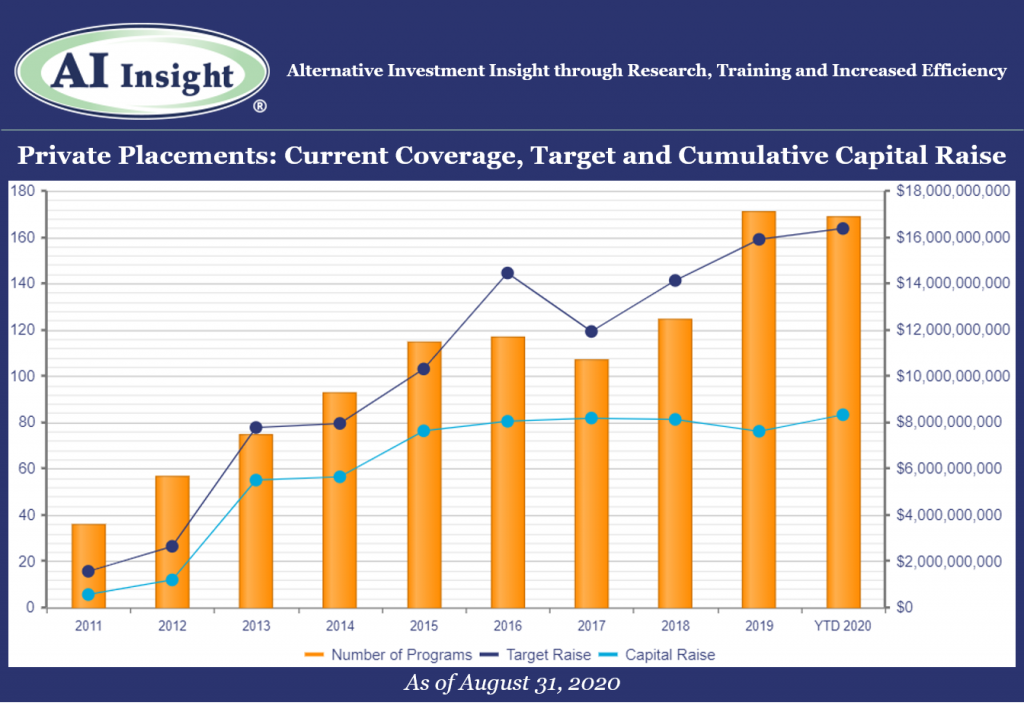

We recently released our August Private Placement Insights report. See the highlights from the report below, or if you are a Premium Reporting subscriber, log in now to see the entire report. If you don’t have access, you can request a free trial.

- Private placement fund activity remained steady in August. However, our coverage remains down year-over-year after an anemic spring.

- Thirteen new funds were added to our coverage in August, on par with the last couple of months but well below the 20 or more funds added each month in 2019. Our coverage is down 10.53% in terms of new funds added year-over year, and 28.26% in terms of the aggregate target raise. Fewer funds have been added and they’ve been targeting less capital.

- As of September 1st, AI Insight covers 169 private placements currently raising capital, with an aggregate target raise of $16.4 billion and an aggregate reported raise of $8.3 billion or 51% of target.

- Real estate-related funds, including 1031s, opportunity zones, and non-1031 real estate LLCs and LPs represent the largest component of our private placement coverage, at 73% of funds and 60% of target raise. Private equity/debt funds represent a relatively small amount of our coverage in terms of the number of funds at only 9%, but tend to be larger and represent 28% of aggregate target raise.

- In terms of our coverage by general objective, income is the largest component at 52% of funds, while growth and growth & income follow at 29% and 18%, respectively.

- The average size of the funds currently raising capital is $96.9 million, ranging from $3.5 million for a single asset real estate fund to $2.8 billion for a sector specific private equity/debt fund.

- 76% of private placements we cover use the 506(b) exemption, 15% use 506(c) and 10% have not yet filed their Form D with the SEC.

- 12 private placements closed in August, having raised approximately 57% of their target and having been on the market for an average of 292 days. 109 funds have closed in 2020, having raised 64% of their target. 67% of funds that closed this year met or exceeded their target.

- Five private placements suspended offerings and one terminated due to uncertainties related to Covid-19.

- ON DECK: as of September 1st, there were four new private placements coming soon.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, Non-Traded BDCs, Interval Funds, and Alternative Strategy Mutual Funds. Receive up to 24 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of August 31, 2020, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose. Copyright ©2020 AI Insight. All Rights Reserved.

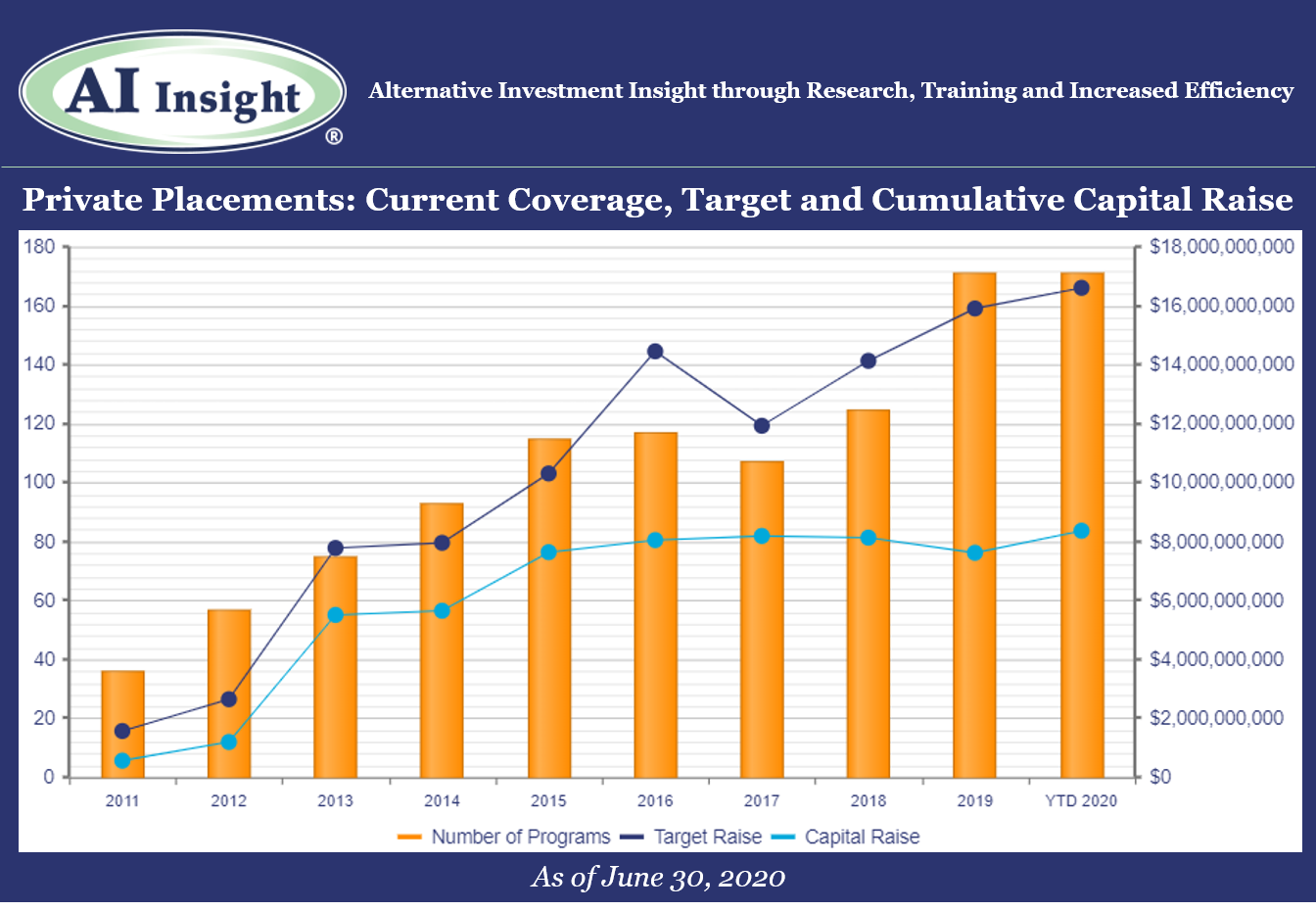

Monday, July 6th, 2020 and is filed under Industry Reporting

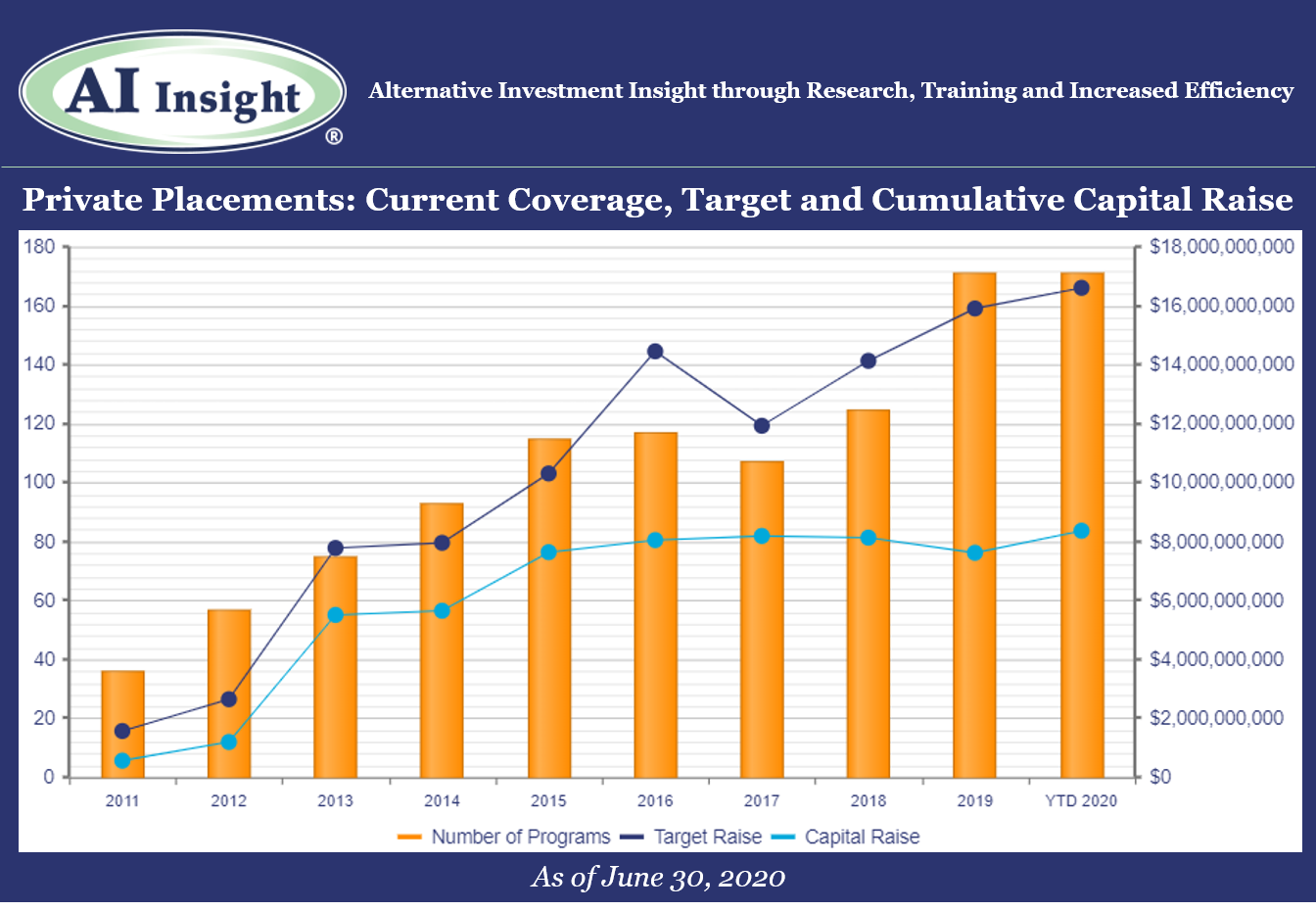

We recently released our June Private Placement Insights report. See the highlights from the report below, or if you are a Premium Reporting subscriber, log in now to see the entire report. If you don’t have access, you can request a free trial.

- After a slow couple of months, private placement fund formation accelerated in June, led by stronger activity in 1031s and the addition of distressed funds in the wake of the COVID-19 market disruption.

- As of July 1st, AI Insight covers 171 private placements currently raising capital, with an aggregate target raise of $16.6 billion and an aggregate reported raise of $8.4 billion or 51% of target. The average size of the current funds is $97.1 million, ranging from $3.5 million for a single asset real estate fund to $2.7 billion for a sector specific private equity/debt fund.

- 13 private placements closed in June, having raised approximately 65% of their target and having been on the market for an average of 408 days. 88 funds have closed in 2020, having raised 67% of their target.

- Five private placements suspended offerings and one terminated due to uncertainties related to COVID-19.

- ON DECK: as of July 1st, there were three new private placements coming soon, all opportunity zone funds (QOZs) as the category ramps back up with further regulatory guidance.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, BDCs, Interval Funds, and Alternative Mutual Funds. Receive up to 24 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of June 30, 2020, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose. Copyright ©2020 AI Insight. All Rights Reserved.

Tuesday, May 5th, 2020 and is filed under AI Insight News

AI Insight’s Mike Kell, senior vice president – business development and program management, recently participated in an ADISA panel discussion regarding investment considerations during COVID-19. Panelists included moderator Lilian Morvay, principal and founder of Independent Broker Dealer Consortium, LLC (“IBDC”), along with Michael Schwartzberg, founding partner, Winget Spadafora & Schwartzberg; Gary Saretsky, founding partner, Saretsky Hart Michaels + Gould; Sheri Pontolillo, founder and director of InterWeb Insurance; and Bob Valker, managing director, Capital Forensics.

Following are some of the highlights of this discussion, including several helpful and actionable risk management best practices.

- Arbitration claims increase in times of market dislocation. There’s no reason to think this time would be any different so its important to be prepared.

- According to a recent Financial Advisor article, the Pandemic has driven 1 in 4 Americans to reach out to a financial advisor for the first time.

- Being proactive with existing clients is especially important but there’s also a good opportunity for prospective clients as well to protect your own business.

- Support your clients and your business by connecting people. For example, bring together a family you work with to put together a plan to support a specific cause or community need. This may allow you to talk with younger relatives, parents, or heirs. Neighbors may want to come together.

- It’s a chance to lead and connect yourself with people around you. Positive for the community and business.

- Best practices for market dislocations: Review all alternative products in your book and:

- Understand exposures.

- Take a hard look to ensure the proper due diligence was and is being done on an ongoing basis.

- Documenting the due diligence.

- Be aware of potential areas of risk (triage your risk) including but not limited to:

- Concentration

- Elderly clients with exposure to alts

- Review the investment rationale, objectives, risk tolerance, paperwork, and ensure documentation is in place for all alternative investment decisions. Ensure that actions are backed up with verifiable data.

- Ensure that you are taking the responsibility for analyzing your own business and knowing your risk. Don’t wait for attorney. Start now.

- With more remote work, review your E&O insurance to ensure you are fully covered. Determine if cyber-security coverage is needed and that you have the appropriate technology in place.

- Effective communication is critical, especially in times like this where there is fear and anxiety. Respond to the emotional concerns. Three suggestions for communications:

- Get on the phone, call clients, do not avoid this. It’s not fun but silence will cause feelings to magnify. Acknowledgement helps to diffuse anxiety. In many ways, this market dislocation helps to highlight the benefit of alternatives and takes the argument against them away. It’s tougher to highlight alternatives when all market indexes are outperforming them. That’s not the case now.

- Don’t wait to communicate, do it now, immediately.

- Do it right. Listen to concerns but listen to what is not said. This is an amazing opportunity to really flesh out the true risk tolerance of clients and bring it to light. It might be painful, but it is helpful.

- Phone calls are the best approach for communicating.

- Texting is mostly prohibited and e-mail can be misinterpreted.

- Phone calls are typically the best approach for communicating, and then confirm in writing or e-mail something verifiable from the conversation.

- Firms may still have a small pocket of exposure in recent sales (ie: those who purchased them just prior to suspension), but big picture down the road this will be helpful.

- Firms should have a documented rationale for suspensions or other offering actions.

Click here to watch the full replay.

Thursday, April 23rd, 2020 and is filed under AI Insight News

We recently hosted a webinar titled “COVID-19 Impact and Outlook, Alternative Investment Markets.” We were joined by three incredibly insightful speakers:

- Randy I. Anderson, Ph.D., CRE, President of Griffin Capital Asset Management Company

- Robert Hoffman, CFA, Managing Director, FS Investments

- Richard Kimble, CFA, Portfolio Manager, Americas for the Nuveen Global Cities REIT

See the key takeaways from our discussion with them as well as due diligence action steps provided by Mick Law, PC, or watch the full replay here:

Richard Kimble, Nuveen

- Real estate asset classes with shorter leases will suffer the most:

- Hospitality, seniors housing, student housing, discretionary retail

- Development will struggle

- Some retail will close for good

- Industrial, non-discretionary retail, and housing are in a better position:

- Multifamily and single-family rentals, life-sciences, technology (towers, data centers)

- Housing still has demographic trend benefits and now may be more difficult to own.

- US will continue to be a safe haven for overseas investors. Manhattan will still be a focus, but some groups may look to diversify to other large US cities.

- Real estate transactions are down:

- Of the deals awarded pre-crisis, some have gone through with purchases thinking this will be shorter-term V-shaped recovery, some backed out, and some pushed out 30-60 days to see if underwriting needs to be modified.

- Transactions slowing down but once there’s normalcy there will be a lot of transactions.

- It is critical to use well-known and trusted valuation firms to properly assess risk:

- They are using one of the largest third-party valuation firms that works with a number of clients and work with other appraisers similar to them to make sure the market is being consistent.

- Making sure people are consistently pricing in risk is key.

- For their fund, normally a third of the portfolio is appraised each month but during times like this they can appraise earlier.

- In Nuveen’s real estate platform, they have collected 94% of April rent.

- A handful have asked for payment plans and they are using creative strategies that can be used to ease the pain of the deferred rent.

- Not really working through force majeure because this doesn’t qualify for it or other MAC clauses, non-essential retail clients are struggling the most, but they want to be part of the solution to help make sure as many companies stay in business and keep as many employees – not abating rent but helping to defer.

- For example, many retailers asking for deferral for the next couple of months. They can work with tenants to amortize or add on to the end.

- They have set up a task force with a hotline to help small businesses access funds to stay in business.

- The real estate markets are in a stronger place than back in the global financial crisis (the GFC).

- For example, CMBS issuance 2017-2019 was less than half 2006-2007 time period. There is more discipline in lending, looking at in-place cash flow vs. forward looking NOI, more equity in transactions.

- Before COVID-19, they were maybe losing deals on the lending side due to pricing and structure or relationship, whereas before the GFC it was because other guy was giving more leverage. Covenants have also held up versus covenant lite environment pre-GFC.

- Looking at where traded REITs are now relative to NAV, and where spreads are, we’re seeing tremendous opportunities.

Robert Hoffman, FS Investments

- High yield bond markets will see volatility, defaults, downgrades, lack of CLO issuance, and fallout from the energy markets.

- Defaults may hit 10% later this year, compared to mid-teens in the GFC.

- Corporate bonds have proven to be resilient.

- There’s never been two years in a row that the HY debt market has been negative.

- When looking at the history of the high yield bond markets, when spreads are as wide as they are now, or around 800bps, the median 12-month forward return is 26%.

- This is probably not the time for broad, passive allocations, but the volatility creates opportunities.

- There will be volatility, but there are positives:

- The speed to which the Fed came into the market with the stimulus packages is helping the markets work more normally so risk can be properly priced and help speed the recovery.

- It also helps with resolving debt issues, if defaults or other actions can be worked out in a properly functioning market it lessens the impact.

- Public markets are seeing issuance and liquidity.

- Debt is more expensive and more situational but its moving.

- The fifth largest deal occurred last week amidst the pandemic.

- On the private debt side, most firms use reputable third-party valuation firms to mark to market as best and consistent as they can similar to real estate and there is also an analogous public market as an indication of value.

- Debt markets were so strong coming into this, and there is a fair amount of dry powder.

- Funds are more properly leveraged and have built up cash and been more defensive even prior to COVID-19.

- Most managers are taking care of their own book first, working with borrowers, and then will look to be opportunistic.

- Real estate debt is also in a better position than it was going into the GFC.

- Debt service coverage ratios are better than before, LTVs are more appropriate.

- Every downturn is different, but lenders are in a better position going into this.

- On the corporate debt side, there’s a much greater prevalence of covenant lite than pre-GFC:

- It remains to be seen what impact this has on the market and this could prove challenging.

- Covenant-lite loans recovered better than covenant-heavy post GFC but not sure that will happen again with significant weakening of fundamentals.

- Another factor that could be a challenge is a large shift to lower rated issuers from higher rated, and a higher percentage of loan-only Single B issuers as opposed to those issuing a loan and bond. However, ratings are higher than ever in history in the high-yield market and asset coverage is stronger than ever which may offset challenges.

Dr. Randy Anderson, Griffin Capital

- There will be volatility and the full impact depends on how long the virus takes to work its way through

- In this downturn as opposed to the GFC, two of the three legs of the chair are stable – fiscal (stimulus packages) and monetary (interest rate reductions) are a positive.

- The virus is the third leg and is variable. There is reason to be optimistic about a recovery in Q3 2020 but more likely in Q4.

- The IMF is forecasting the US economy to be down 6% 2020 and then stronger in 2021, up 4.7%.

- Markets have stabilized recently as the majority of the fear has been priced in.

- Many managers were already somewhat defensive going into this based on high real estate prices and low cap rates.

- They were expecting slower GDP growth anyways and were focused on defensive sectors including multifamily and industrial and had increased liquidity.

- Like Nuveen, they are seeing high levels of collections on multifamily. People need a place to live.

- Public REIT markets overreacted by a factor of almost 3 times during the GFC and proved to be a great investment post GFC.

- The forecast for real estate over the five to seven-year period hasn’t change, with 4-6% income and a similar amount based on appreciation based on inflation rates. With bumps and volatility. No one makes money trying to time the bottom.

- They have employed low leverage and lines of credit were not drawn (similar across many managers), so now they can take advantage of opportunities.

- May take some time to accurately price in risk, but most managers use highly competent third-party valuation experts who follow standards that are widely adopted. The standards require them to look at all conditions and fairly reflect those values.

- One of the main things investors can be looking at is if managers have unfunded commitments.

- It may be harder to raise capital in this environment, so you don’t want to have many outstanding unfunded commitments.

- Also want to have enough cash on hand, liquid securities if it is possible in fund structure, and lines of credit.

- It is important to play defense and then you also want to be positioned to play offense, when the third leg the virus starts to mitigate then markets will start to move and you want to be able to accretively acquire.

Due Diligence Action Steps (Provided by Mick Law, PC)

- Monitor for status updates for funds you have exposure to.

- Monitor for any suspensions of an offering, share redemptions, or distributions (AI Insight Alerts) and immediately communicate to investors.

- Proactively communicate the potential.

- Questions to ask sponsors in your discussions with them include have they:

- Taken any proactive measures to protect asset value?

- Adequately providing “specific information” to investors in offering materials and public filings about how COVID-19 “currently” affects, and may reasonably effect in the future, the operations and liquidity of such sponsors and their managed investment programs? The SEC has advised that it intends to monitor how companies are communicating with their investors concerning the effects of COVID-19.

- Able to service its debt and any portfolio debt?

- Able to continue operating without syndicating additional offerings in the short-term? (review financials)

- Adjusting their distribution payment policies appropriately to account for the present and future effects of COVID-19?

- For oil/gas sponsors that use reserve-based lines of credit,

- Are they appropriately prepared to address borrowing base deficiencies and related loan repayments in the probable event that their credit limits are adjusted due to lower commodities prices?

- For qualified opportunity fund (“QOF”) sponsors with identified asset funds,

- What adjustments are they having to make to development timelines?

- Do they still anticipate being able to meet the 30-month timeline to have their capital invested?

- If not, are they reserving money to pay any potential penalties?

- For QOF sponsors with partial or complete blind pool funds,

- What percentage of capital is already committed to projects (i.e., do they have capital available to take advantage of declining asset prices)?