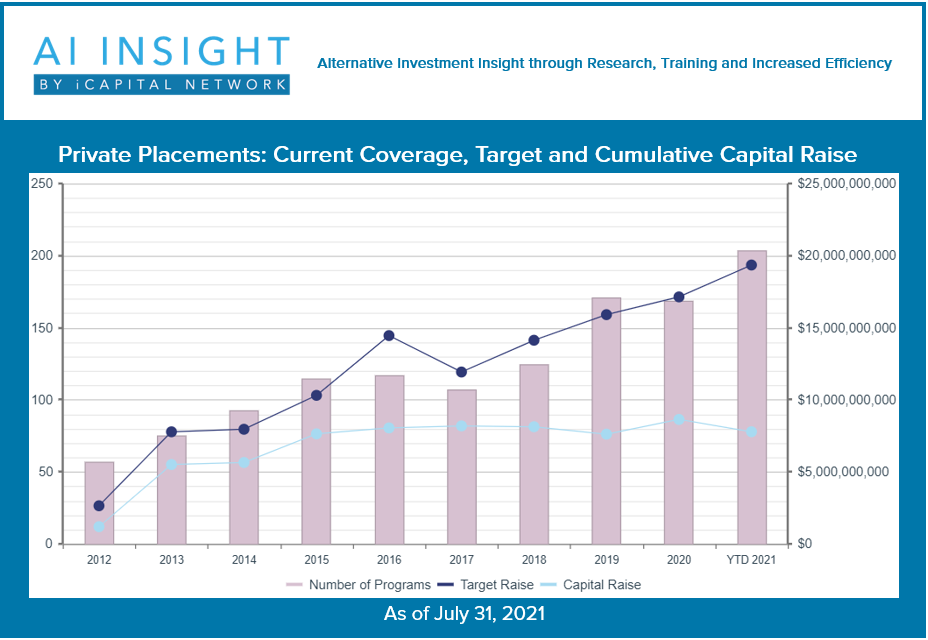

Thursday, August 12th, 2021 and is filed under Industry Reporting

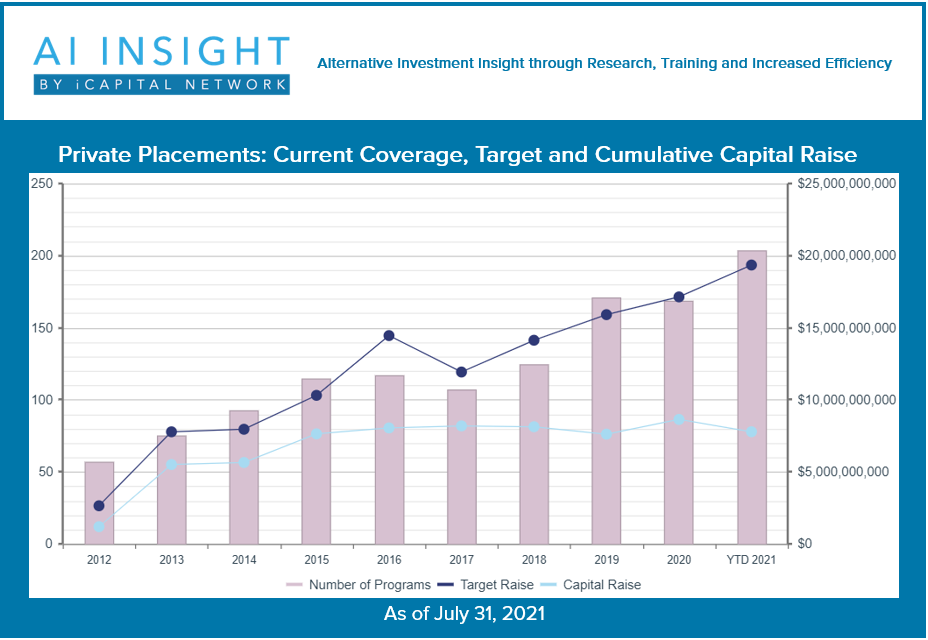

We recently released our July Private Placement Insights report. See the highlights from the report below, or if you are a Premium Reporting subscriber, log in now to see the entire report. If you don’t have access, you can request a free trial.

- May and June were big months in terms of new funds added to our coverage. July is no exception and is a record, with 29 new funds added. 1031 exchanges, hedge funds, and private equity/debt offerings led the way and we have seen a ramp up in non-tax focused real estate offerings as well. Energy and Opportunity Zones are slow this year, while preferred and conservation offerings are flat. President Biden’s proposal to reduce the deferral of gains under section 1031 to a maximum of $500,000, for those transactions completed in tax years prior to December 31, 2021, may be contributing to an increase in this category prior to any changes, something that we continue to watch as it could have an impact on future fund formation.

- 150 new funds have been added in 2021 making this a strong year and putting us well ahead in terms of new fund coverage (+69%) and aggregate target raise (+83%).

- As of August 1st, AI Insight covers 204 private placements currently raising capital, with an aggregate target raise of $19.3 billion and an aggregate reported raise of $7.8 billion or 40% of target.

- Real estate-related funds, including 1031s, Opportunity Zones, and non-1031 real estate LLCs and LPs represent the largest component of our private placement coverage, at 70% of funds and 62% of target raise. Private equity/debt funds represent a relatively small amount of our coverage in terms of the number of funds at only 16% but represents 27% of target raise even with several funds in the category not reporting a target.

- In terms of our coverage by general objective, income is the largest component at 54% of funds, while growth and growth & income follow at 27% and 19%, respectively.

- The average size of the funds currently raising capital is $94.8 million, ranging from $1.8 million for a specified private equity fund to $1.1 billion for a larger blind pool private equity fund. Seven funds do not report a target or current capital raise.

- 82% of private placements we cover use the 506(b) exemption, 14% use 506(c) and 4% have not yet filed their Form D with the SEC.

- 18 private placements closed to new investors in July and 118 have closed in 2021. Funds that closed this year have been on the market for an average of 339 days. The funds that reported, raised 93% of target. 84% met or exceeded their target and only six funds that missed their target raised less than half of target.

- ON DECK: there are six new private placements coming soon.

For illustrative purposes only.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, Non-Traded BDCs, Interval Funds, and Alternative Strategy Mutual Funds. Receive up to 24 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of July 31, 2021, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security offered by Institutional Capital Network, Inc. or its affiliates (together “iCapital Network”). Past performance is not indicative of future results. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors. An investment in an alternative investment entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. The information contained herein is subject to change and is also incomplete. This industry information and its importance is an opinion only and should not be relied upon as the only important information available. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed, and iCapital Network assumes no liability for the information provided.

Products offered by iCapital Network are typically private placements that are sold only to qualified clients of iCapital Network through transactions that are exempt from registration under the Securities Act of 1933 pursuant to Rule 506(b) of Regulation D promulgated thereunder (“Private Placements”). An investment in any product issued pursuant to a Private Placement, such as the funds described, entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. Further, such investments are not subject to the same levels of regulatory scrutiny as publicly listed investments, and as a result, investors may have access to significantly less information than they can access with respect to publicly listed investments. Prospective investors should also note that investments in the products described involve long lock-ups and do not provide investors with liquidity.

Securities may be offered through iCapital Securities, LLC, a registered broker dealer, member of FINRA and SIPC and subsidiary of Institutional Capital Network, Inc. (d/b/a iCapital Network). These registrations and memberships in no way imply that the SEC, FINRA or SIPC have endorsed the entities, products or services discussed herein. iCapital and iCapital Network are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2021 Institutional Capital Network, Inc. All Rights Reserved.

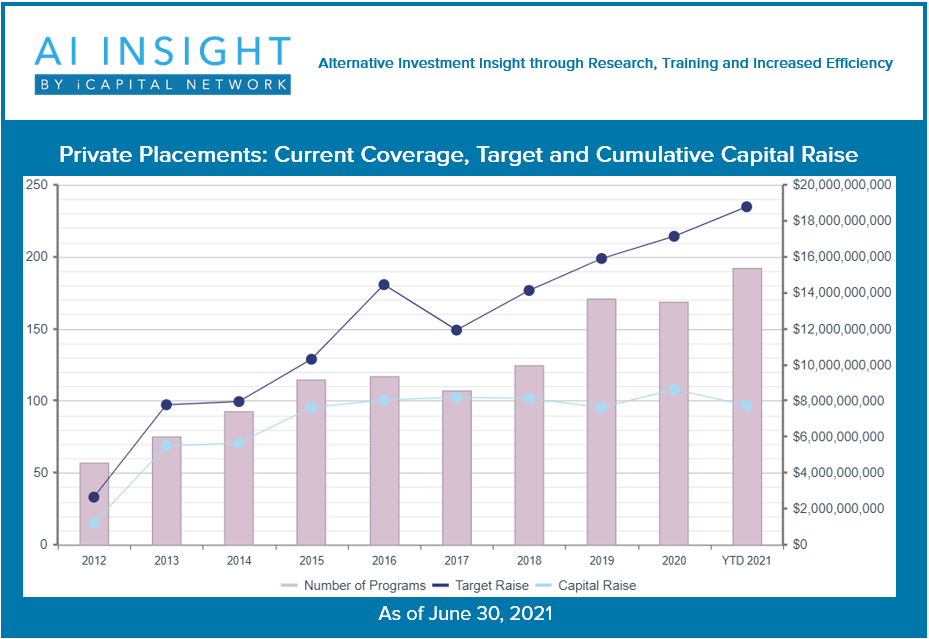

Wednesday, July 14th, 2021 and is filed under Industry Reporting

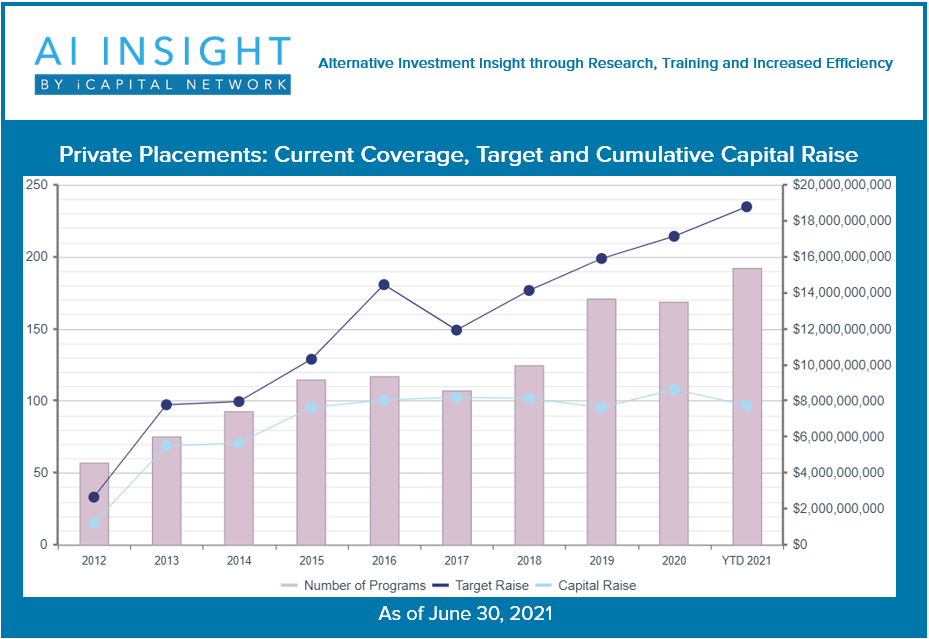

We recently released our June Private Placement Insights report. See the highlights from the report below, or if you are a Premium Reporting subscriber, log in now to see the entire report. If you don’t have access, you can request a free trial.

- The last two months were big months in terms of new funds added to our coverage, with 21 funds added each month compared to 13 in April. Energy, Opportunity Zones, and real estate 1031 exchanges led the way in terms of new fund formation, and we are seeing continued strength in private equity/debt offerings. President Biden’s proposal to reduce or eliminate section 1031 exchanges may be contributing to an increase in this category prior to any changes, something that we continue to watch as it could have an impact on future fund formation. iCapital’s Chief Investment Strategist, Anastasia Amoroso, sees growth in private markets and real estate through 2H, which aligns with the growth we’ve seen in the real estate and private equity/debt categories.

- 121 new funds have been added in the first half of 2021 making this a strong year and putting us ahead in terms of new fund coverage (+59%) and aggregate target raise (+102%).

- As of July 1st, AI Insight covers 192 private placements currently raising capital, with an aggregate target raise of $18.8 billion and an aggregate reported raise of $7.7 billion or 41% of target.

- Real estate-related funds, including 1031s, Opportunity Zones, and non-1031 real estate LLCs and LPs represent the largest component of our private placement coverage, at 67% of funds and 60% of target raise. Private equity/debt funds represent a relatively small amount of our coverage in terms of the number of funds at only 18%, but represents more than 28% of target raise even with several funds in the category not reporting a target.

- In terms of our coverage by general objective, income is the largest component at 52% of funds, while growth and growth & income follow at 27% and 20%, respectively.

- The average size of the funds currently raising capital is $97.8 million, ranging from $1.8 million for a specified private equity fund to $1.1 billion for a larger blind pool private equity fund. Eight funds do not report a target or current capital raise.

- 82% of private placements we cover use the 506(b) exemption, 13% use 506(c) and 4% have not yet filed their Form D with the SEC.

- 18 private placements closed to new investors in June and 100 have closed in 2021. Funds that closed this year have been on the market for an average of 357 days. The funds that reported, raised 88% of target. 86% met or exceeded their target and only two funds that closed raised less than half of their target.

- ON DECK: there are three new private placements coming soon.

For illustrative purposes only.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, Non-Traded BDCs, Interval Funds, and Alternative Strategy Mutual Funds. Receive up to 24 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of June 30, 2021, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security offered by Institutional Capital Network, Inc. or its affiliates (together “iCapital Network”). Past performance is not indicative of future results. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors. An investment in an alternative investment entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. The information contained herein is subject to change and is also incomplete. This industry information and its importance is an opinion only and should not be relied upon as the only important information available. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed, and iCapital Network assumes no liability for the information provided.

Products offered by iCapital Network are typically private placements that are sold only to qualified clients of iCapital Network through transactions that are exempt from registration under the Securities Act of 1933 pursuant to Rule 506(b) of Regulation D promulgated thereunder (“Private Placements”). An investment in any product issued pursuant to a Private Placement, such as the funds described, entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. Further, such investments are not subject to the same levels of regulatory scrutiny as publicly listed investments, and as a result, investors may have access to significantly less information than they can access with respect to publicly listed investments. Prospective investors should also note that investments in the products described involve long lock-ups and do not provide investors with liquidity.

Securities may be offered through iCapital Securities, LLC, a registered broker dealer, member of FINRA and SIPC and subsidiary of Institutional Capital Network, Inc. (d/b/a iCapital Network). These registrations and memberships in no way imply that the SEC, FINRA or SIPC have endorsed the entities, products or services discussed herein. iCapital and iCapital Network are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2021 Institutional Capital Network, Inc. All Rights Reserved.

Wednesday, June 23rd, 2021 and is filed under Industry Reporting

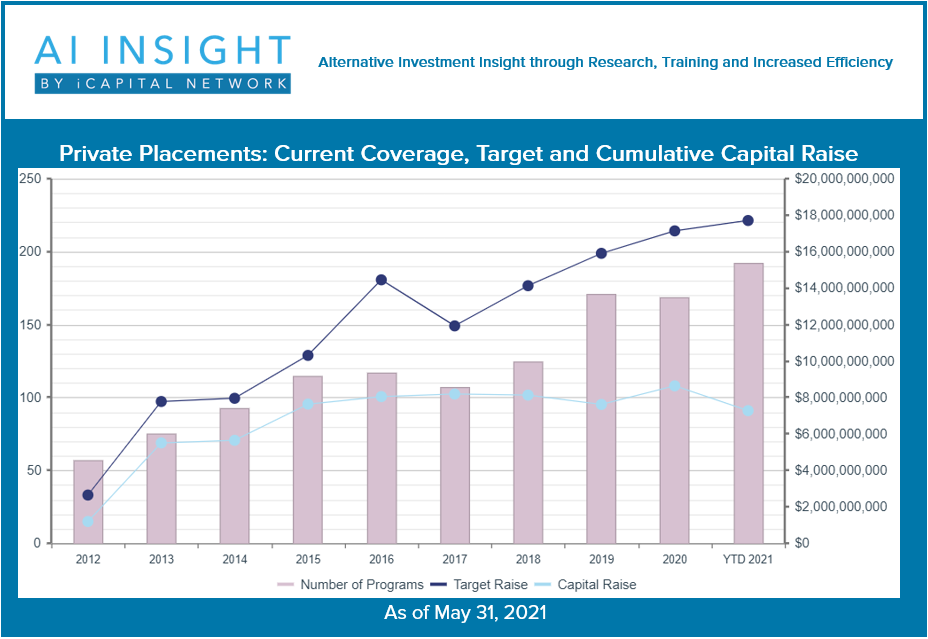

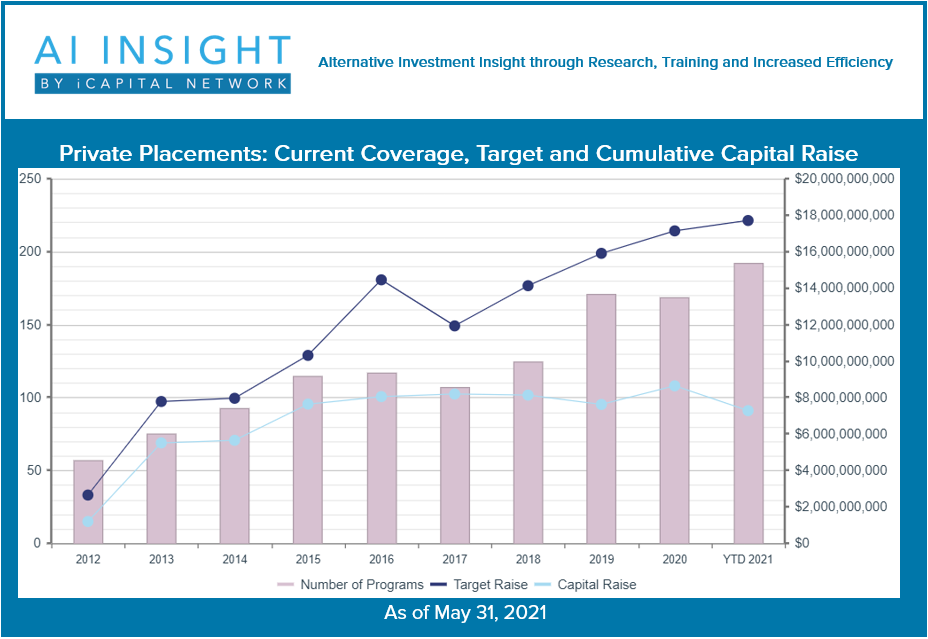

We recently released our May Private Placement Insights report. See the highlights from the report below, or if you are a Premium Reporting subscriber, log in now to see the entire report. If you don’t have access, you can request a free trial.

- May was a big month in terms of coverage on the AI Insight platform. 21 new funds were added during the month compared to just 13 in April. Real estate activity picked up after a slow start to the year, and new funds were added for the first time this year in the energy and conservation categories.

- 100 new funds have been added this year, putting us ahead in terms of new fund coverage (+54%) and aggregate target raise (+82%).

- As of June 1st, AI Insight covers 192 private placements currently raising capital, with an aggregate target raise of $17.7 billion and an aggregate reported raise of $7.3 billion or 41% of target.

- Real estate-related funds, including 1031s, opportunity zones, and non-1031 real estate LLCs and LPs represent the largest component of our private placement coverage, at 70% of funds and 63% of target raise. Private equity/debt funds represent a relatively small amount of our coverage in terms of the number of funds at only 18%, but represents more than 30% of target raise even with several funds in the category not reporting a target.

- In terms of our coverage by general objective, income is the largest component at 51% of funds, while growth and growth & income follow at 28% and 19%, respectively.

- The average size of the funds currently raising capital is $97.3 million, ranging from $1.8 million for a specified private equity offering to $1.1 billion for a larger blind pool private equity offering. Eight funds do not report a target or current capital raise.

- 83% of private placements we cover use the 506(b) exemption, 13% use 506(c) and 5% have not yet filed their Form D with the SEC.

- 20 private placements closed to new investors in May and 81 have closed in 2021. Funds that closed this year have been on the market for an average of 346 days. The funds that reported, raised 92% of target. 86% met or exceeded their target and only two funds that closed raised less than half of their target.

- ON DECK: there are seven new private placements coming soon.

For illustrative purposes only.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, Non-Traded BDCs, Interval Funds, and Alternative Strategy Mutual Funds. Receive up to 24 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of May 31, 2021, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security offered by Institutional Capital Network, Inc. or its affiliates (together “iCapital Network”). Past performance is not indicative of future results. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors. An investment in an alternative investment entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. The information contained herein is subject to change and is also incomplete. This industry information and its importance is an opinion only and should not be relied upon as the only important information available. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed, and iCapital Network assumes no liability for the information provided.

Products offered by iCapital Network are typically private placements that are sold only to qualified clients of iCapital Network through transactions that are exempt from registration under the Securities Act of 1933 pursuant to Rule 506(b) of Regulation D promulgated thereunder (“Private Placements”). An investment in any product issued pursuant to a Private Placement, such as the funds described, entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. Further, such investments are not subject to the same levels of regulatory scrutiny as publicly listed investments, and as a result, investors may have access to significantly less information than they can access with respect to publicly listed investments. Prospective investors should also note that investments in the products described involve long lock-ups and do not provide investors with liquidity.

Securities may be offered through iCapital Securities, LLC, a registered broker dealer, member of FINRA and SIPC and subsidiary of Institutional Capital Network, Inc. (d/b/a iCapital Network). These registrations and memberships in no way imply that the SEC, FINRA or SIPC have endorsed the entities, products or services discussed herein. iCapital and iCapital Network are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2021 Institutional Capital Network, Inc. All Rights Reserved.

Wednesday, June 23rd, 2021 and is filed under Industry Reporting

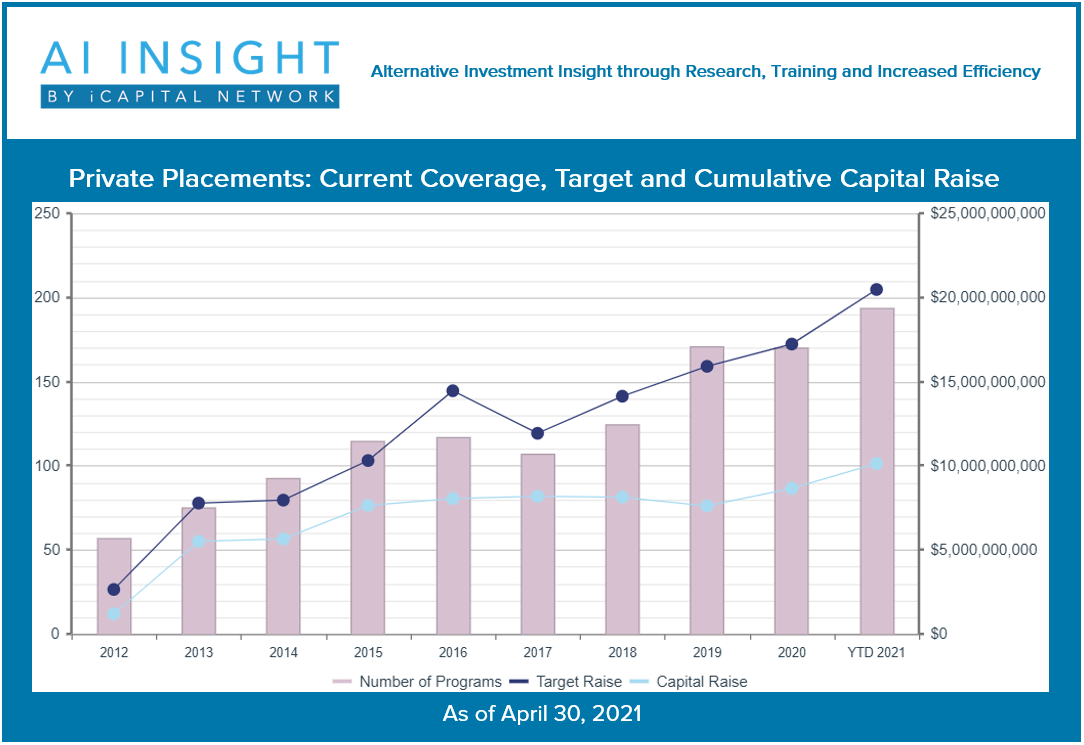

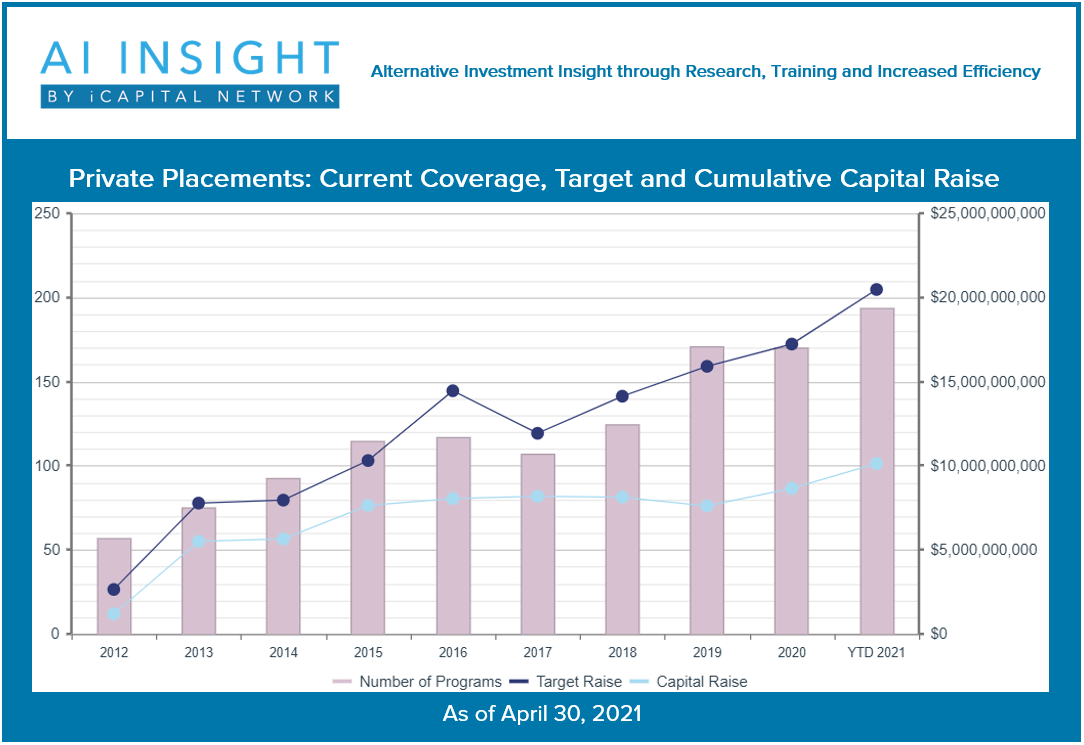

We recently released our April Private Placement Insights report. See the highlights from the report below, or if you are a Premium Reporting subscriber, log in now to see the entire report. If you don’t have access, you can request a free trial.

- April was the slowest month of the year in terms of private placement fund activity but historically this is the case as well. The 13 funds added during the month was less than half the 28 added in March but is three funds more than April 2020 – which was one of our slowest months ever as the pandemic had started to impact the markets.

- 79 new funds have been added this year, putting us ahead in terms of new fund coverage (+36%) and aggregate target raise (+44%). Real estate categories have slowed, while our coverage of private equity/debt and hedge funds has increased.

- As of May 1st, AI Insight covers 194 private placements currently raising capital, with an aggregate target raise of $20.5 billion and an aggregate reported raise of $10.1 billion or 49% of target.

- Despite a slowdown recently, real estate-related funds, including 1031s, opportunity zones, and non-1031 real estate LLCs and LPs represent the largest component of our private placement coverage, at 69% of funds and 55% of target raise. Private equity/debt funds represent a relatively small amount of our coverage in terms of the number of funds at only 17%. However, our acquisition by iCapital is allowing us to enhance our coverage of private equity and debt more than ever before.

- In terms of our coverage by general objective, income is the largest component at 49% of funds, while growth and growth & income follow at 30% and 21%, respectively.

- The average size of the funds currently raising capital is $105.5 million, ranging from $1.8 million for a specified private equity offering to $3.1 billion for a sector specific private BDC. Six funds do not report a target or current capital raise.

- 85% of private placements we cover use the 506(b) exemption, 12% use 506(c) and 3% have not yet filed their Form D with the SEC.

- 17 private placements closed to new investors in April and 59 have closed in 2021. Funds that closed this year have been on the market for an average of 352 days. The funds that reported raised 92% of target. 86% met or exceeded their target and only two funds that closed raised less than half of their target.

- ON DECK: there are nine new private placements coming soon.

For illustrative purposes only.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, Non-Traded BDCs, Interval Funds, and Alternative Strategy Mutual Funds. Receive up to 24 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of April 30, 2021, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security offered by Institutional Capital Network, Inc. or its affiliates (together “iCapital Network”). Past performance is not indicative of future results. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors. An investment in an alternative investment entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. The information contained herein is subject to change and is also incomplete. This industry information and its importance is an opinion only and should not be relied upon as the only important information available. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed, and iCapital Network assumes no liability for the information provided.

Products offered by iCapital Network are typically private placements that are sold only to qualified clients of iCapital Network through transactions that are exempt from registration under the Securities Act of 1933 pursuant to Rule 506(b) of Regulation D promulgated thereunder (“Private Placements”). An investment in any product issued pursuant to a Private Placement, such as the funds described, entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. Further, such investments are not subject to the same levels of regulatory scrutiny as publicly listed investments, and as a result, investors may have access to significantly less information than they can access with respect to publicly listed investments. Prospective investors should also note that investments in the products described involve long lock-ups and do not provide investors with liquidity.

Securities may be offered through iCapital Securities, LLC, a registered broker dealer, member of FINRA and SIPC and subsidiary of Institutional Capital Network, Inc. (d/b/a iCapital Network). These registrations and memberships in no way imply that the SEC, FINRA or SIPC have endorsed the entities, products or services discussed herein. iCapital and iCapital Network are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2021 Institutional Capital Network, Inc. All Rights Reserved.

Friday, April 16th, 2021 and is filed under Industry Reporting

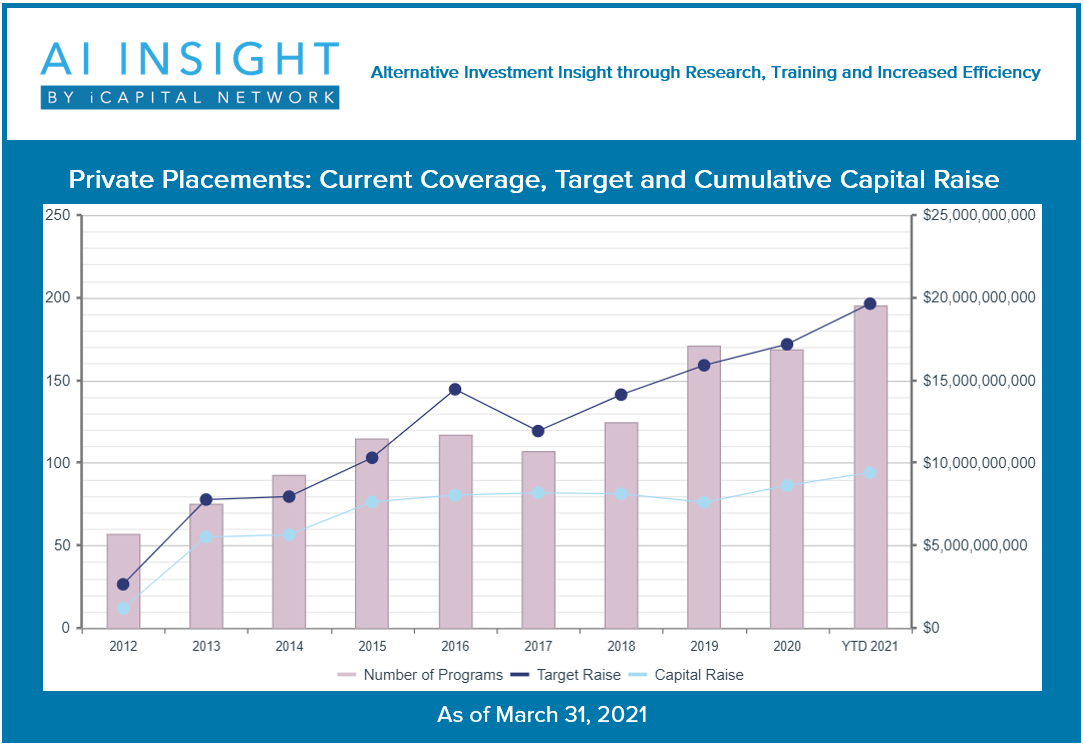

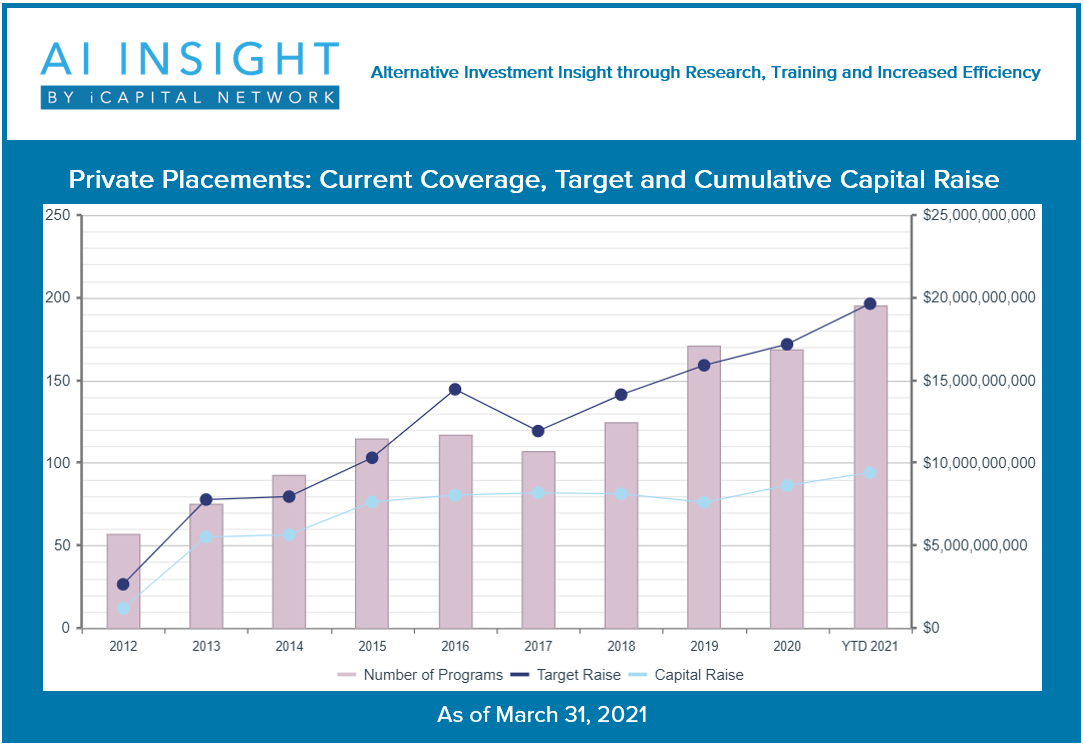

We recently released our March Private Placement Insights report. See the highlights from the report below, or if you are a Premium Reporting subscriber, log in now to see the entire report. If you don’t have access, you can request a free trial.

- Private placement fund formation picked up significantly in March, with 28 new funds added compared to 17 in February. 66 new funds have been added this year, putting us ahead in terms of new fund coverage (+38%) and aggregate target raise (+32%). Real estate categories have slowed other than 1031s, while our coverage of private equity/debt and hedge funds has increased.

- As of April 1st, AI Insight covers 195 private placements currently raising capital, with an aggregate target raise of $19.6 billion and an aggregate reported raise of $9.4 billion or 48% of target.

- Despite a slowdown recently, real estate-related funds, including 1031s, opportunity zones, and non-1031 real estate LLCs and LPs represent the largest component of our private placement coverage, at 71% of funds and 57% of target raise. Private equity/debt funds represent a relatively small amount of our coverage in terms of the number of funds at only 15%. However, our acquisition by iCapital is allowing us to enhance our coverage of private equity and debt with more coverage than ever before.

- In terms of our coverage by general objective, income is the largest component at 52% of funds, while growth and growth & income follow at 26% and 21%, respectively.

- The average size of the funds currently raising capital is $100.4 million, ranging from $1.8 million for a specified private equity offering to $3.0 billion for a sector specific private BDC.

- 76% of private placements we cover use the 506(b) exemption, 12% use 506(c) and 12% have not yet filed their Form D with the SEC.

- 17 private placements closed in March and 41 have closed in 2021. Funds that closed this year have been on the market for an average of 303 days. The funds that reported raised 92% of target. 98% met or exceeded their target and only two funds that closed raised less than half of their target.

- ON DECK: there are eight new private placements coming soon.

For illustrative purposes only.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, Non-Traded BDCs, Interval Funds, and Alternative Strategy Mutual Funds. Receive up to 24 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of March 31, 2021, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security offered by Institutional Capital Network, Inc. or its affiliates (together “iCapital Network”). Past performance is not indicative of future results. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors. An investment in an alternative investment entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. The information contained herein is subject to change and is also incomplete. This industry information and its importance is an opinion only and should not be relied upon as the only important information available. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed, and iCapital Network assumes no liability for the information provided.

Products offered by iCapital Network are typically private placements that are sold only to qualified clients of iCapital Network through transactions that are exempt from registration under the Securities Act of 1933 pursuant to Rule 506(b) of Regulation D promulgated thereunder (“Private Placements”). An investment in any product issued pursuant to a Private Placement, such as the funds described, entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. Further, such investments are not subject to the same levels of regulatory scrutiny as publicly listed investments, and as a result, investors may have access to significantly less information than they can access with respect to publicly listed investments. Prospective investors should also note that investments in the products described involve long lock-ups and do not provide investors with liquidity.

Securities may be offered through iCapital Securities, LLC, a registered broker dealer, member of FINRA and SIPC and subsidiary of Institutional Capital Network, Inc. (d/b/a iCapital Network). These registrations and memberships in no way imply that the SEC, FINRA or SIPC have endorsed the entities, products or services discussed herein. iCapital and iCapital Network are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2021 Institutional Capital Network, Inc. All Rights Reserved.

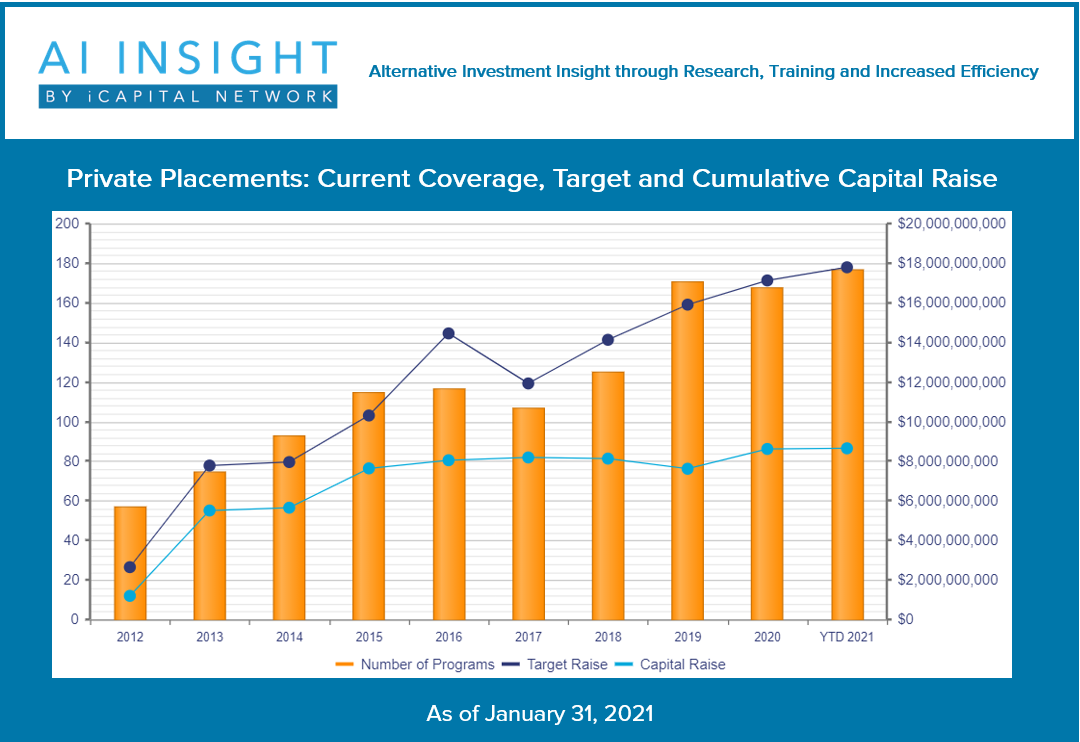

Friday, February 19th, 2021 and is filed under Industry Reporting

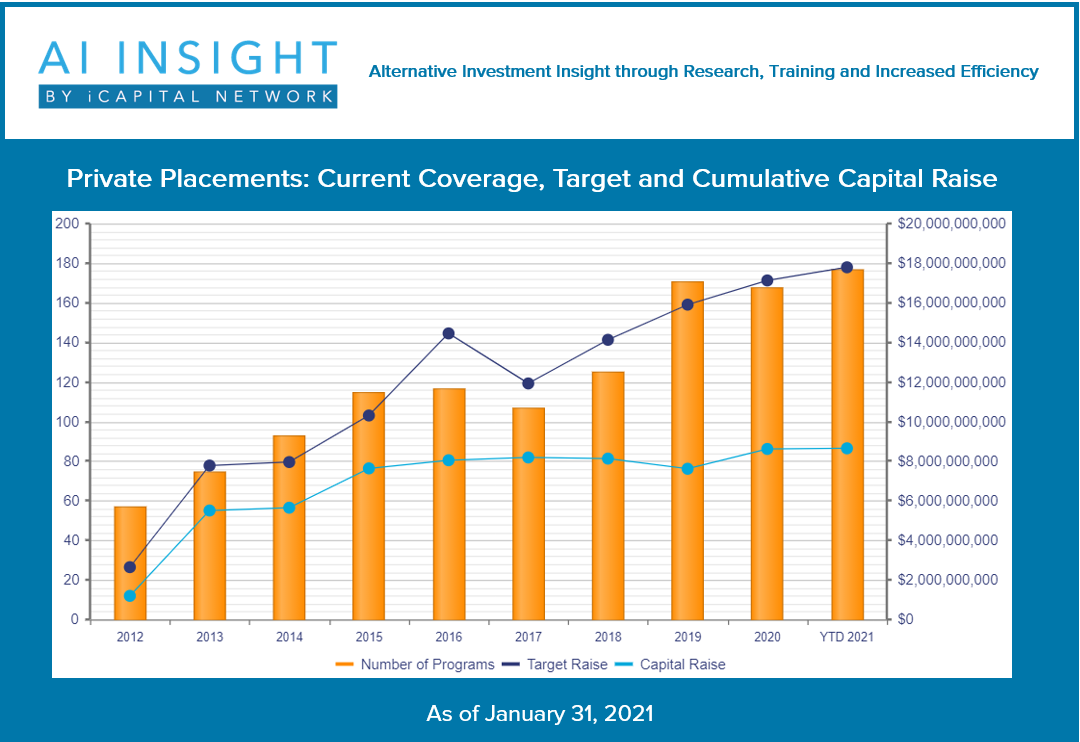

We recently released our January Private Placement Insights report. See the highlights from the report below, or if you are a Premium Reporting subscriber, log in now to see the entire report. If you don’t have access, you can request a free trial.

- While there was little to no activity in several categories in January, real estate and private equity/debt funds rallied to bring year-over-year new fund coverage and aggregate target raise up significantly (24% and 62%, respectively).

- As of February 1st, AI Insight covers 177 private placements currently raising capital, with an aggregate target raise of $17.8 billion and an aggregate reported raise of $8.6 billion or 49% of target.

- Real estate-related funds, including 1031s, opportunity zones, and non-1031 real estate LLCs and LPs represent the largest component of our private placement coverage, at 75% of funds and 59% of target raise. Private equity/debt funds represent a relatively small amount of our coverage in terms of the number of funds at only 11%, but tend to be larger and represent 33% of aggregate target raise.

- In terms of our coverage by general objective, income is the largest component at 52% of funds, while growth and growth & income follow at 30% and 16%, respectively.

- The average size of the funds currently raising capital is $100.5 million, ranging from $1.9 million for a preferred offering to $3.0 billion for a sector specific private equity/debt fund.

- 78% of private placements we cover use the 506(b) exemption, 12% use 506(c) and 10% have not yet filed their Form D with the SEC.

- 14 private placements closed in January, having been on the market for an average of 300 days. The 12 funds that reported a raise reported that they raised 73% of target. 64% met or exceeded their target and only one raised less than half of its target.

- ON DECK: as of February 1st, there were eleven new private placements coming soon.

For illustrative purposes only.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, Non-Traded BDCs, Interval Funds, and Alternative Strategy Mutual Funds. Receive up to 24 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of January 31, 2021, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security offered by Institutional Capital Network, Inc. or its affiliates (together “iCapital Network”). Past performance is not indicative of future results. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors. An investment in an alternative investment entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. The information contained herein is subject to change and is also incomplete. This industry information and its importance is an opinion only and should not be relied upon as the only important information available. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed, and iCapital Network assumes no liability for the information provided.

Products offered by iCapital Network are typically private placements that are sold only to qualified clients of iCapital Network through transactions that are exempt from registration under the Securities Act of 1933 pursuant to Rule 506(b) of Regulation D promulgated thereunder (“Private Placements”). An investment in any product issued pursuant to a Private Placement, such as the funds described, entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. Further, such investments are not subject to the same levels of regulatory scrutiny as publicly listed investments, and as a result, investors may have access to significantly less information than they can access with respect to publicly listed investments. Prospective investors should also note that investments in the products described involve long lock-ups and do not provide investors with liquidity.

Securities may be offered through iCapital Securities, LLC, a registered broker dealer, member of FINRA and SIPC and subsidiary of Institutional Capital Network, Inc. (d/b/a iCapital Network). These registrations and memberships in no way imply that the SEC, FINRA or SIPC have endorsed the entities, products or services discussed herein. iCapital and iCapital Network are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2021 Institutional Capital Network, Inc. All Rights Reserved.

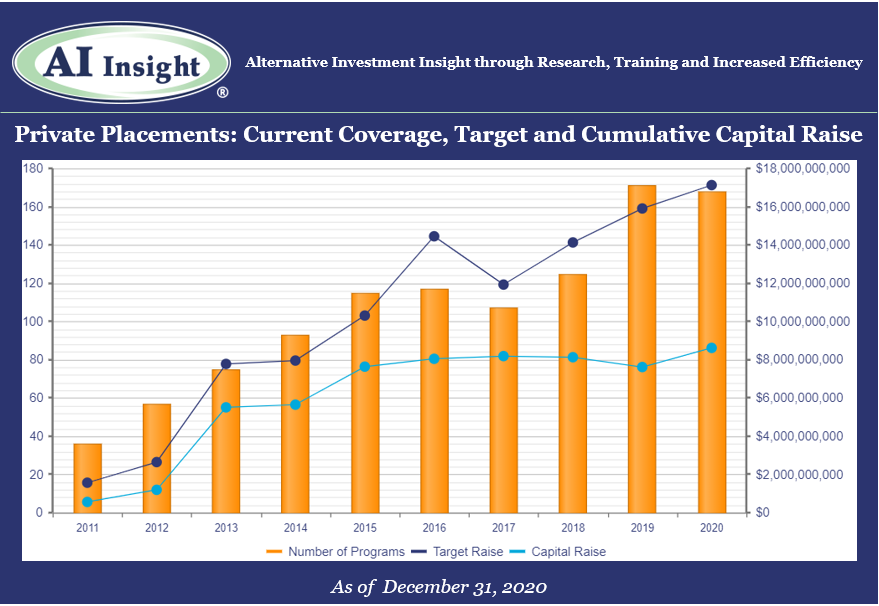

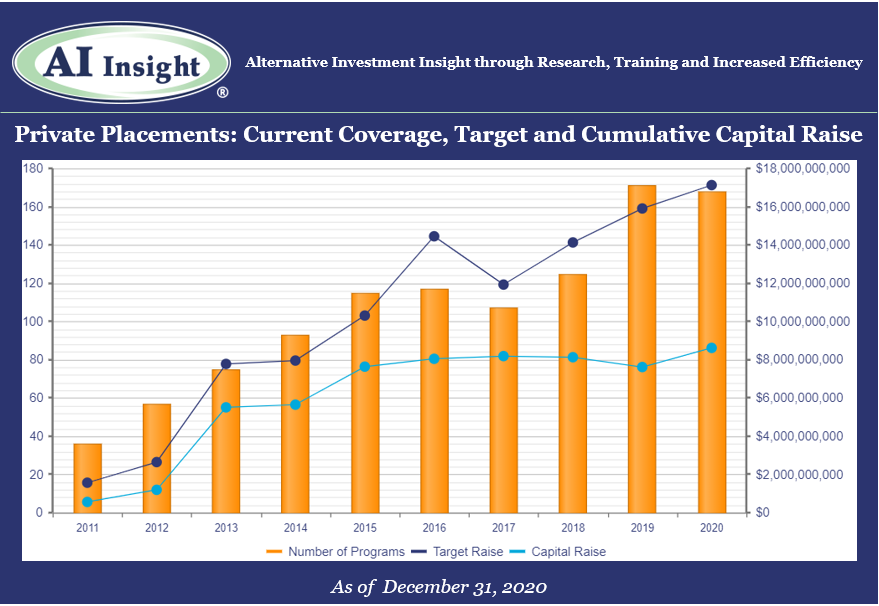

Friday, January 8th, 2021 and is filed under Industry Reporting

We recently released our December Private Placement Insights report. See the highlights from the report below, or if you are a Premium Reporting subscriber, log in now to see the entire report. If you don’t have access, you can request a free trial.

- Despite the COVID-19 related slowdown in Q2, AI Insight’s private placement coverage ended the year nearly on par with the record-setting 2019. The number of new private placements added to our coverage during the year was 2 fewer than 2019 (-1.00%), while aggregate target raise of $9.0 billion was roughly 8% less than the target in 2019. The 199 funds added in 2020 were offered by 75 separate sponsors.

- As of January 1st, AI Insight covers 167 private placements currently raising capital, with an aggregate target raise of $17.1 billion and an aggregate reported raise of $8.6 billion or 50% of target.

- Real estate-related funds, including 1031s, opportunity zones, and non-1031 real estate LLCs and LPs represent the largest component of our private placement coverage, at 75% of funds and 60% of target raise. Private equity/debt funds represent a relatively small amount of our coverage in terms of the number of funds at only 10%, but tend to be larger and represent 32% of aggregate target raise.

- In terms of our coverage by general objective, income is the largest component at 52% of funds, while growth and growth & income follow at 28% and 18%, respectively.

- The average size of the funds currently raising capital is $102.3 million, ranging from $1.9 million for a preferred offering to $3.0 billion for a sector specific private equity/debt fund.

- 76% of private placements we cover use the 506(b) exemption, 13% use 506(c) and 12% have not yet filed their Form D with the SEC.

- 55 private placements closed in December (higher than average primarily due to the closing of all open conservation funds), with roughly 66% of those reporting a raise meeting or exceeding their target raise. 209 private placements closed in full year 2020, having been on the market for an average of 299 days and reporting they raised 71% of their target on average (of those that reported). 70% met or exceeded targets, and only 12% were able to raise less than half of their target. 11 funds did not report a raise.

- Seven private placements suspended offerings and one terminated due to uncertainties related to COVID-19.

- ON DECK: as of January 1st, there were seven new private placements coming soon.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, Non-Traded BDCs, Interval Funds, and Alternative Strategy Mutual Funds. Receive up to 24 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of December 31, 2020, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose. Copyright ©2021 AI Insight. All Rights Reserved.

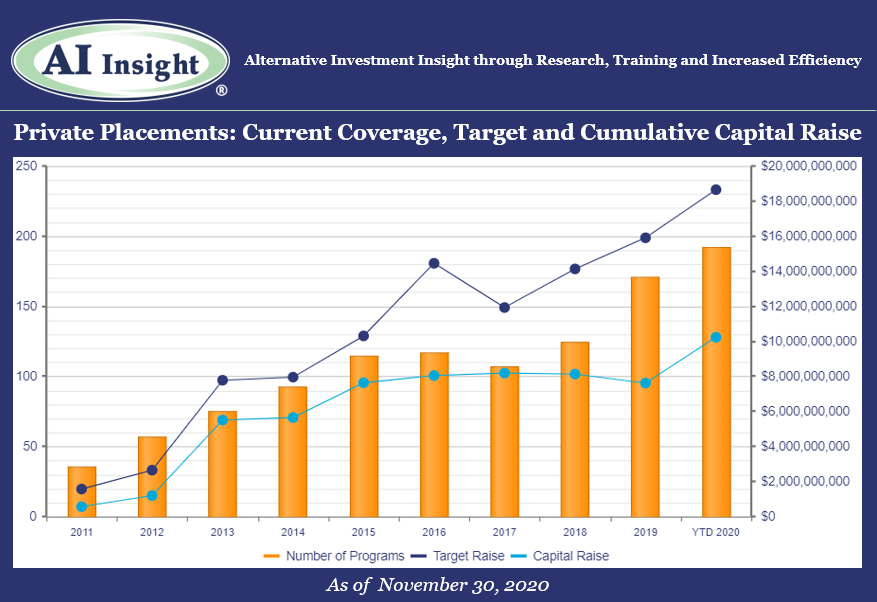

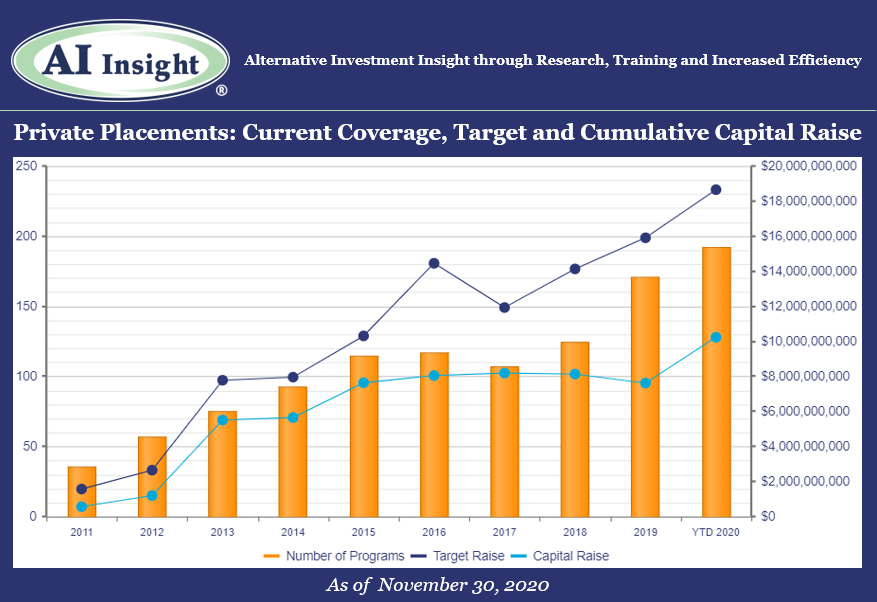

Tuesday, December 8th, 2020 and is filed under Industry Reporting

We recently released our November Private Placement Insights report. See the highlights from the report below, or if you are a Premium Reporting subscriber, log in now to see the entire report. If you don’t have access, you can request a free trial.

- Private placement fund activity slowed in November although it remains well above the mid-year COVID-19 slowdown. Year-over-year our coverage is down (-4% in new funds and -7% in target raise), especially on the real estate side, while some of the smaller areas of our coverage have increased. Energy, preferred, and private equity/ debt offerings are way up with strategies focused on opportunities created by the COVID-19 market dislocation. The 170 funds added in 2020 were offered by 69 separate sponsors.

- As of December 1st, AI Insight covers 192 private placements currently raising capital, with an aggregate target raise of $18.6 billion and an aggregate reported raise of $10.2 billion or 55% of target.

- Real estate-related funds, including 1031s, opportunity zones, and non-1031 real estate LLCs and LPs represent the largest component of our private placement coverage, at 68% of funds and 59% of target raise. Private equity/debt funds represent a relatively small amount of our coverage in terms of the number of funds at only 9%, but tend to be larger and represent 29% of aggregate target raise.

- In terms of our coverage by general objective, income is the largest component at 51% of funds, while growth and growth & income follow at 30% and 18%, respectively.

- The average size of the funds currently raising capital is $97.1 million, ranging from $1.9 million for a preferred offering to $3.0 billion for a sector specific private equity/debt fund.

- 75% of private placements we cover use the 506(b) exemption, 12% use 506(c) and 13% have not yet filed their Form D with the SEC.

- 17 private placements closed in November, with roughly 83% meeting or exceeding their target raise. 157 funds have closed year-to-date, having been on the market for an average of 330 days and reporting they raised 69% of their target on average. 85% met or exceeded targets, and only 10% were able to raise less than half of their target. Four funds did not report a raise.

- Seven private placements suspended offerings and one terminated due to uncertainties related to COVID-19.

- ON DECK: as of December 1st, there were eight new private placements coming soon.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, Non-Traded BDCs, Interval Funds, and Alternative Strategy Mutual Funds. Receive up to 24 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of November 30, 2020, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose. Copyright ©2020 AI Insight. All Rights Reserved.

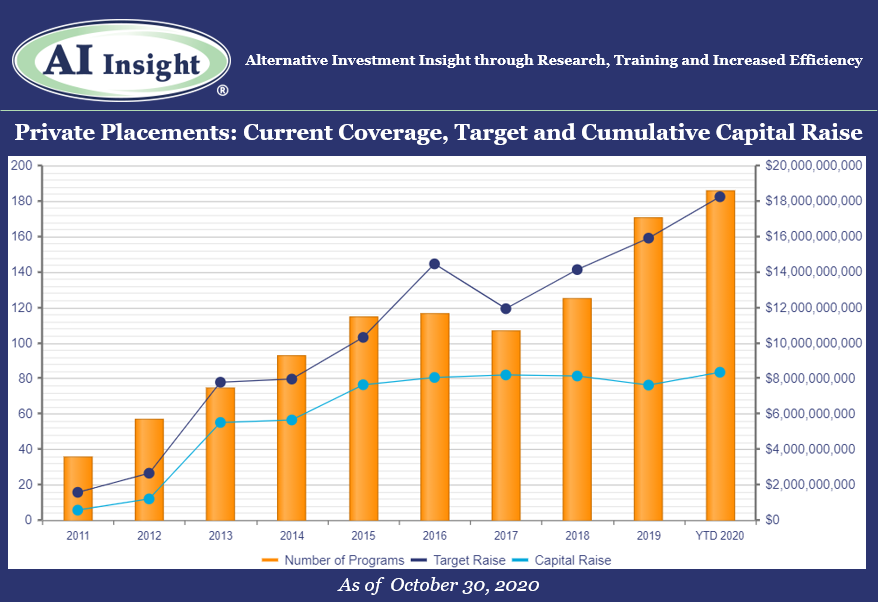

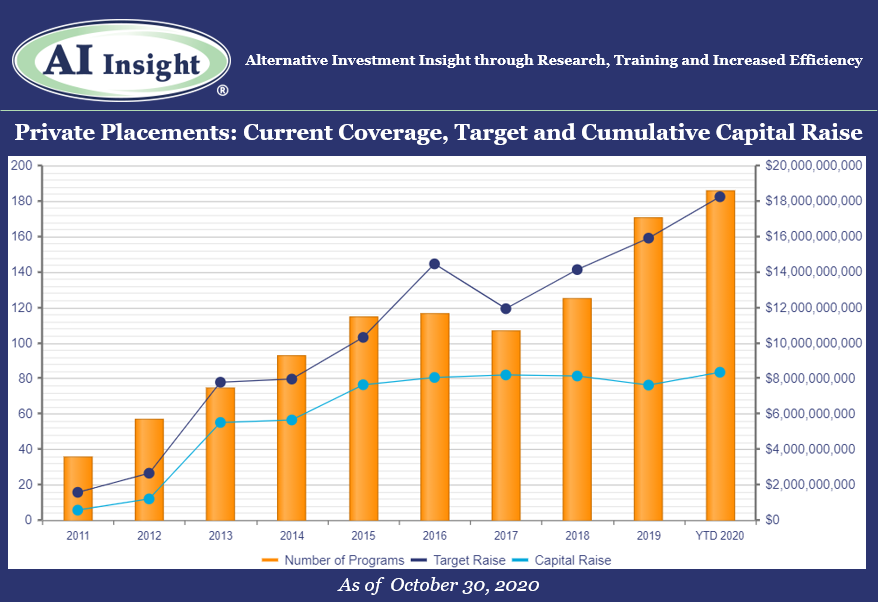

Tuesday, November 10th, 2020 and is filed under Industry Reporting

We recently released our October Private Placement Insights report. See the highlights from the report below, or if you are a Premium Reporting subscriber, log in now to see the entire report. If you don’t have access, you can request a free trial.

- Private placement fund activity continued its strong pace in October, with more funds added to our coverage in the month than any since March. 26 new funds were added in October, led primarily by real estate funds but also including energy, private equity/debt, and preferred offerings.

- As of November 1st, AI Insight covers 186 private placements currently raising capital, with an aggregate target raise of $18.2 billion and an aggregate reported raise of $8.34 billion or 46% of target.

- Real estate-related funds, including 1031s, opportunity zones, and non-1031 real estate LLCs and LPs represent the largest component of our private placement coverage, at 72% of funds and 59% of target raise. Private equity/debt funds represent a relatively small amount of our coverage in terms of the number of funds at only 10%, but tend to be larger and represent 29% of aggregate target raise.

- In terms of our coverage by general objective, income is the largest component at 52% of funds, while growth and growth & income follow at 28% and 19%, respectively.

- The average size of the funds currently raising capital is $98.0 million, ranging from $3.5 million for a single asset real estate fund to $2.8 billion for a sector specific private equity/debt fund.

- 74% of private placements we cover use the 506(b) exemption, 13% use 506(c) and 13% have not yet filed their Form D with the SEC.

- 18 private placements closed in October, with roughly 70% meeting or exceeding their target raise. 137 funds have closed year-to-date, having been on the market for an average of 339 days and reporting they raised 68% of their target on average. 72% met or exceeded targets, and only 16% were able to raise less than half of their target.

- Seven private placements suspended offerings and one terminated due to uncertainties related to COVID-19.

- ON DECK: as of November 1st, there were seven new private placements coming soon.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, Non-Traded BDCs, Interval Funds, and Alternative Strategy Mutual Funds. Receive up to 24 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of October 31, 2020, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose. Copyright ©2020 AI Insight. All Rights Reserved.

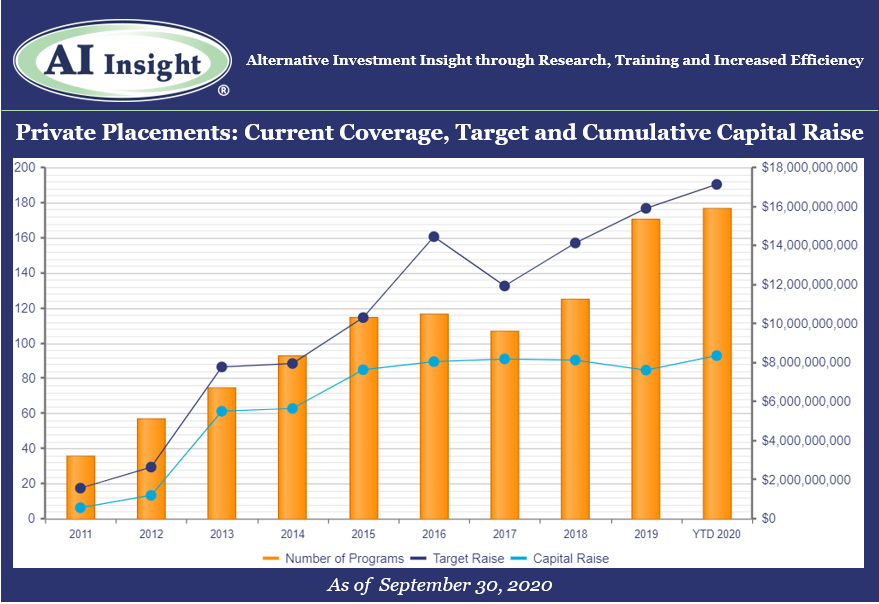

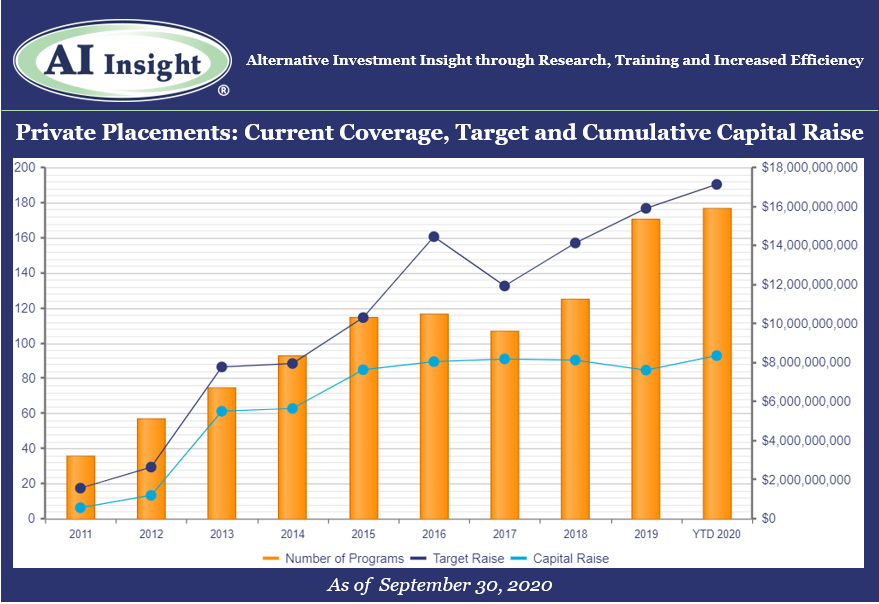

Tuesday, October 6th, 2020 and is filed under Industry Reporting

We recently released our September Private Placement Insights report. See the highlights from the report below, or if you are a Premium Reporting subscriber, log in now to see the entire report. If you don’t have access, you can request a free trial.

- Private placement fund activity ramped up in September, with more funds added to our coverage in the month than any since March. 19 new funds were added in September, led by 1031s, energy, and non-1031 real estate.

- As of October 1st, AI Insight covers 177 private placements currently raising capital, with an aggregate target raise of $17.1 billion and an aggregate reported raise of $8.4 billion or 49% of target.

- Real estate-related funds, including 1031s, opportunity zones, and non-1031 real estate LLCs and LPs represent the largest component of our private placement coverage, at 72% of funds and 60% of target raise. Private equity/debt funds represent a relatively small amount of our coverage in terms of the number of funds at only 9%, but tend to be larger and represent 27% of aggregate target raise.

- In terms of our coverage by general objective, income is the largest component at 52% of funds, while growth and growth & income follow at 29% and 18%, respectively.

- The average size of the funds currently raising capital is $96.8 million, ranging from $3.5 million for a single asset real estate fund to $2.8 billion for a sector specific private equity/debt fund.

- 76% of private placements we cover use the 506(b) exemption, 15% use 506(c) and 10% have not yet filed their Form D with the SEC.

- 11 private placements closed in September, with all either meeting or exceeding their target raise. 120 funds have closed year-to-date, having been on the market for an average of 333 days and reporting they raised 62% of their target on average.

- Seven private placements suspended offerings and one terminated due to uncertainties related to Covid-19.

- ON DECK: as of October 1st, there were seven new private placements coming soon.

- Listen to the companion podcast for this blog.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, Non-Traded BDCs, Interval Funds, and Alternative Strategy Mutual Funds. Receive up to 24 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of September 30, 2020, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose. Copyright ©2020 AI Insight. All Rights Reserved.