Monday, July 6th, 2020 and is filed under Industry Reporting

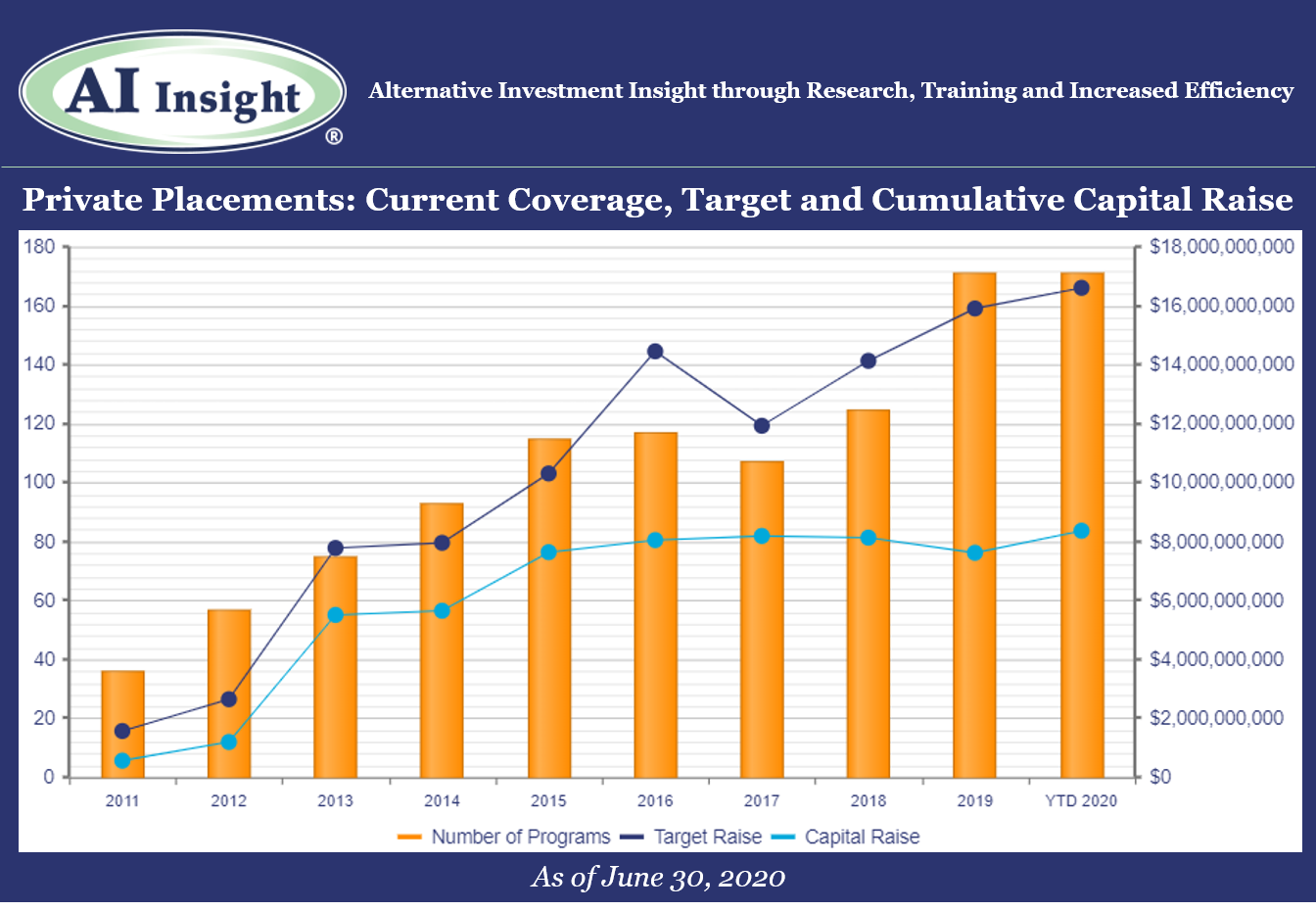

We recently released our June Private Placement Insights report. See the highlights from the report below, or if you are a Premium Reporting subscriber, log in now to see the entire report. If you don’t have access, you can request a free trial.

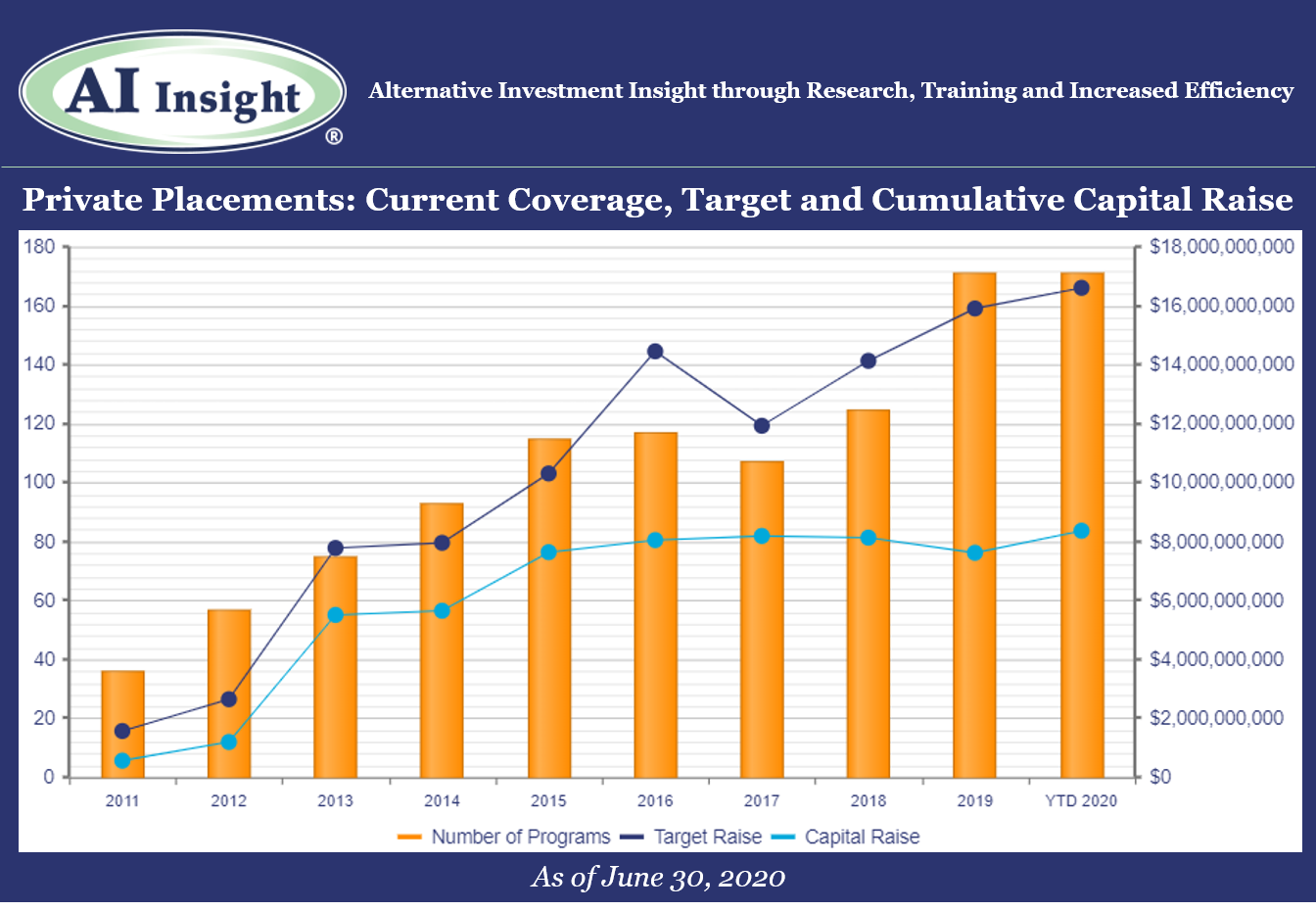

- After a slow couple of months, private placement fund formation accelerated in June, led by stronger activity in 1031s and the addition of distressed funds in the wake of the COVID-19 market disruption.

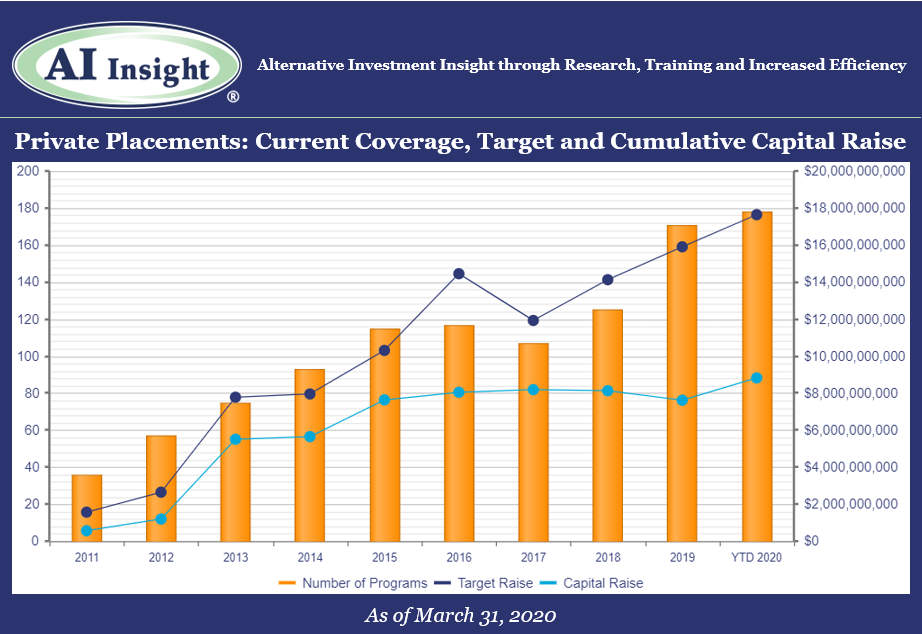

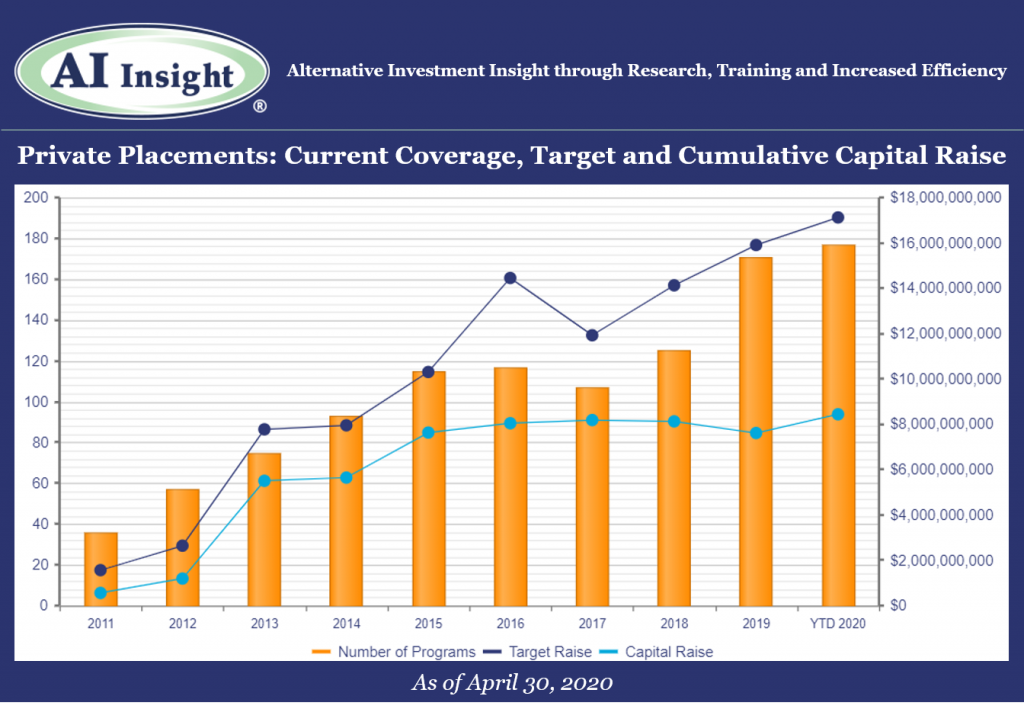

- As of July 1st, AI Insight covers 171 private placements currently raising capital, with an aggregate target raise of $16.6 billion and an aggregate reported raise of $8.4 billion or 51% of target. The average size of the current funds is $97.1 million, ranging from $3.5 million for a single asset real estate fund to $2.7 billion for a sector specific private equity/debt fund.

- 13 private placements closed in June, having raised approximately 65% of their target and having been on the market for an average of 408 days. 88 funds have closed in 2020, having raised 67% of their target.

- Five private placements suspended offerings and one terminated due to uncertainties related to COVID-19.

- ON DECK: as of July 1st, there were three new private placements coming soon, all opportunity zone funds (QOZs) as the category ramps back up with further regulatory guidance.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, BDCs, Interval Funds, and Alternative Mutual Funds. Receive up to 24 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of June 30, 2020, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose. Copyright ©2020 AI Insight. All Rights Reserved.

Monday, June 8th, 2020 and is filed under Industry Reporting

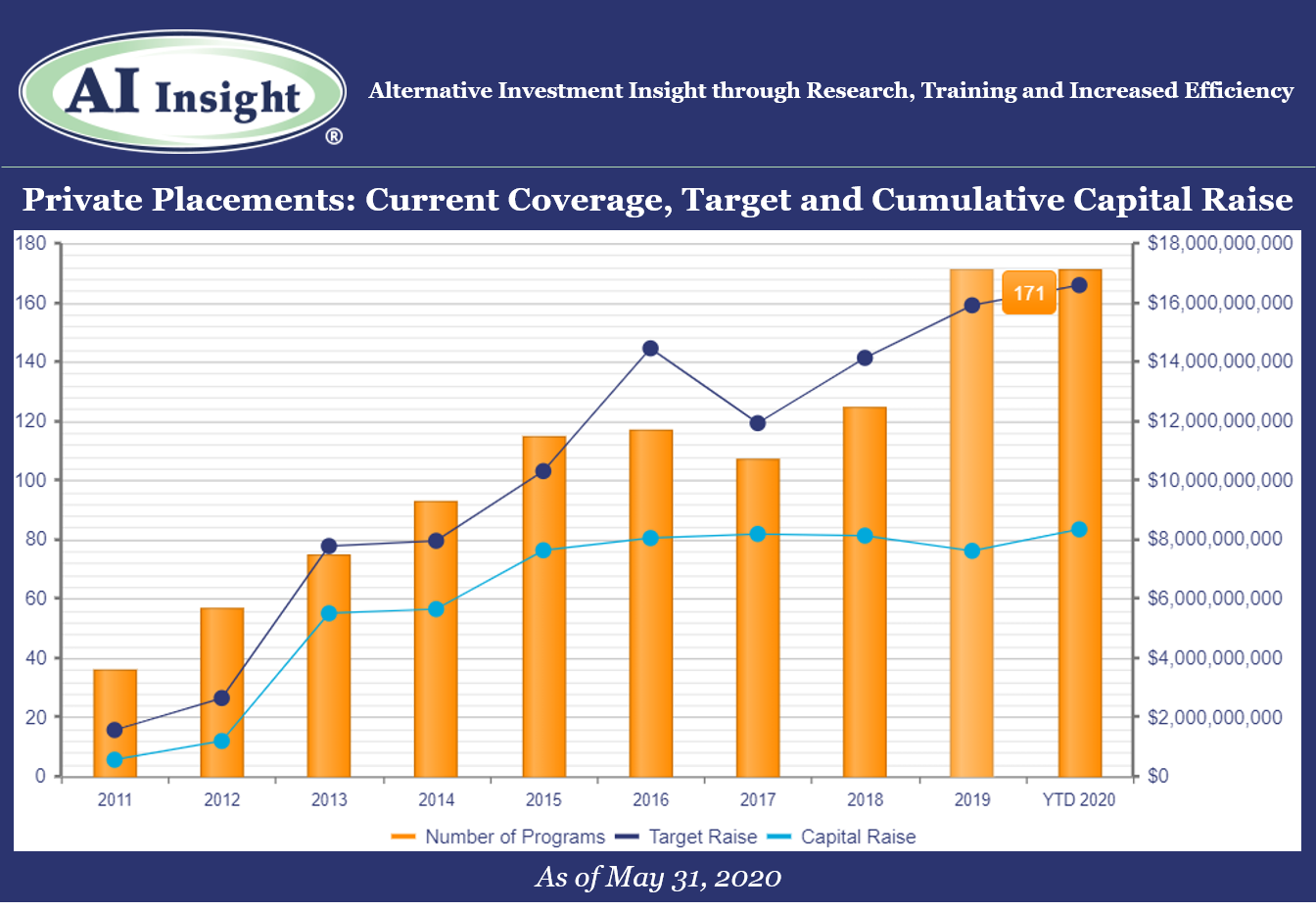

We recently released our May Private Placement Insights report. See the highlights from the report below, or if you are a Premium Reporting subscriber, log in now to see the entire report. If you don’t have access, you can request a free trial.

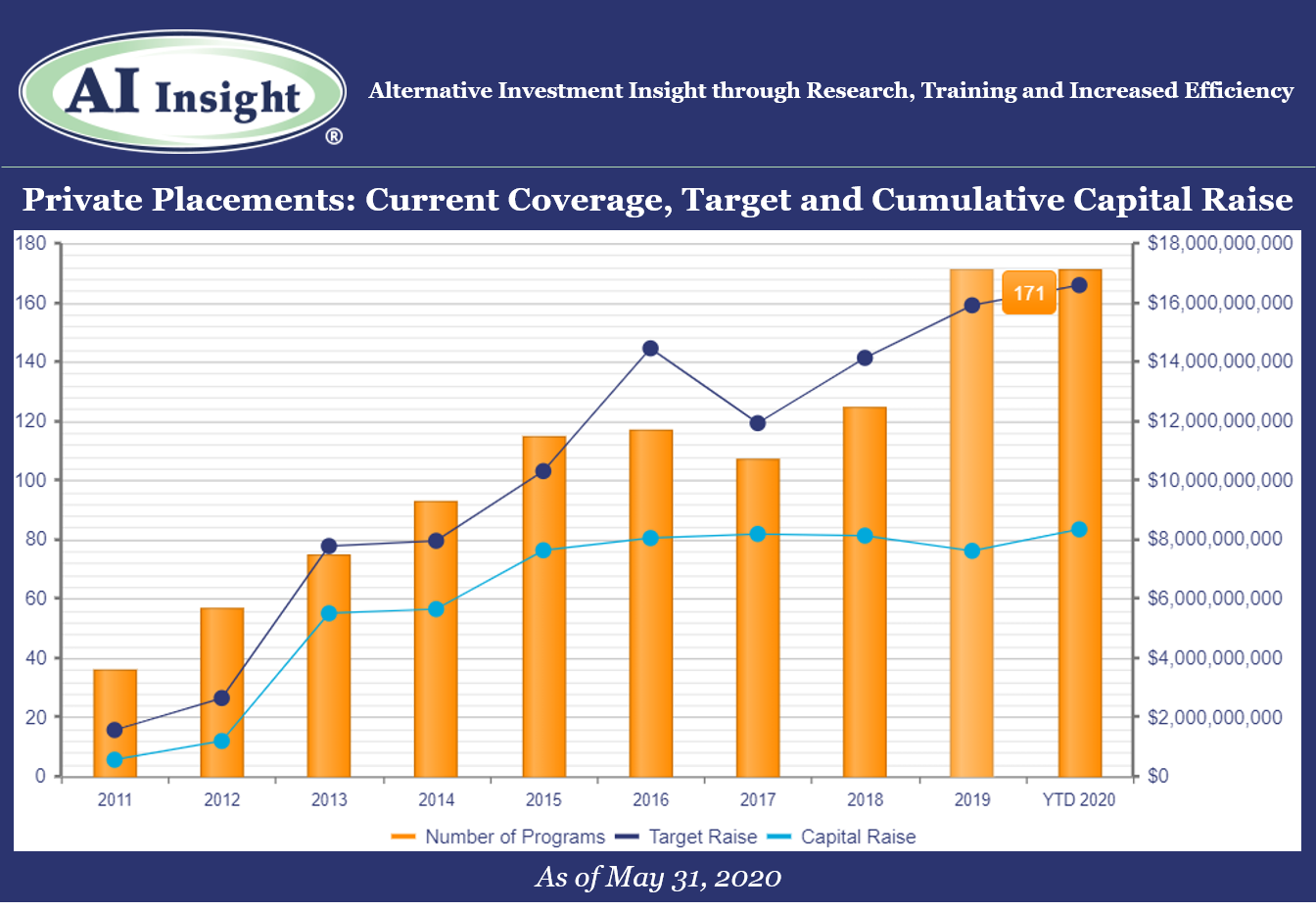

- Private placement fund formation has slowed in the wake of COVID-19. Eight new private placements were added to our coverage in May, roughly half of the monthly level we’ve seen on average over the last few years. The first few months of 2020 were strong but with the slowdown in May, we are now flat in terms of new funds added to over coverage year-over-year and down modestly in aggregate target raise.

- The slowdown was most visible in the 1031 category, where only four new funds were added to our coverage in May compared to well over double digit additions for the last several years. This may be partially due to a slowdown in real estate transactions overall as well as a lack of confidence in valuations. Also, fewer highly appreciated properties are being sold right now, which reduces the demand for 1031 exchanges at least in the near-term. The consensus in the industry is that demand will accelerate once transaction activity resumes and valuations are more reliable.

- We are seeing more activity this year in preferred securities and private equity/debt funds, and we are also starting to see sector-specific opportunistic funds ramp up in the wake of the COVID-19 market disruption. Opportunity zone (QOZ) funds, which had paused for several months, are back on track with three in the queue to be added to our coverage soon. Recent events around the US could continue to highlight the importance of QOZ strategies.

- As of June 1st, AI Insight covers 171 private placements currently raising capital, with an aggregate target raise of $16.6 billion and an aggregate reported raise of $8.3 billion or 50% of target. The average size of the current funds is $97.0 million, ranging from $3.5 million for a single asset real estate fund to $2.7 billion for a sector specific private equity/debt fund.

- 14 private placements closed in May, having raised approximately 52% of their target and having been on the market for an average of 336 days.

- Five private placements suspended offerings due to uncertainties related to COVID-19.

- ON DECK: as of June 1st, there were four new private placements coming soon.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, BDCs, Closed-End Funds, and Alternative Mutual Funds. Receive up to 24 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of May 31, 2020, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose. Copyright ©2020 AI Insight. All Rights Reserved.

Thursday, May 7th, 2020 and is filed under Industry Reporting

We recently released our April Private Placement Insights. See the highlights from the report below, or if you are a Premium Reporting subscriber, log in now to see the entire report. If you don’t have access, you can request a free trial.

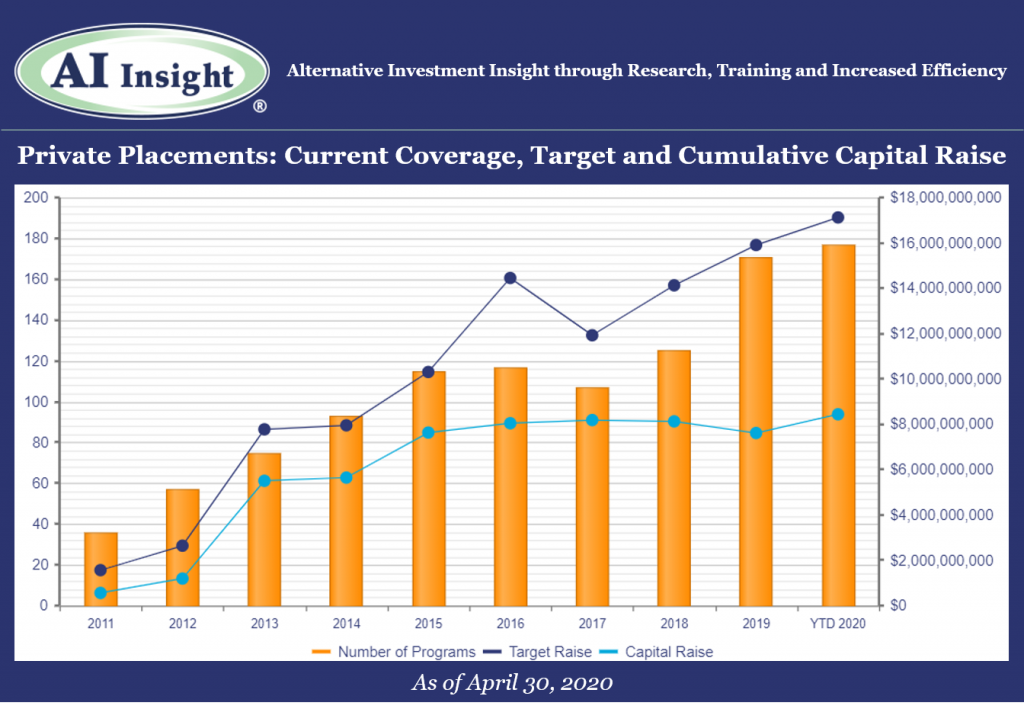

- 10 new private placements were added to our coverage in April, ahead of last year’s levels on a YTD basis but below the last couple of months. The industry is still led by real estate funds including 1031s and real estate LPs and LLCs, although 1031s have slowed significantly.

- As of May 1st, AI Insight covers 177 private placements currently raising capital, with an aggregate target raise of $17.1 billion and an aggregate reported raise of $8.4 billion or 49% of target. The average size of the current funds is $96.7 million, ranging from $3.5 million for a single asset real estate fund to $2.5 billion for a sector specific private equity/debt fund.

- 12 private placements closed in April, having raised approximately 63% of their target and having been on the market for an average of 422 days. Two private placements suspended offerings due to uncertainties related to COVID-19.

- ON DECK: as of May 1st, there were three new private placements coming soon.

Private Market Update: COVID-19

- According to a recent report by Preqin, COVID-19 has disrupted the private capital markets significantly across all categories.

- Fewer private equity funds met their target fundraising goals and were able to close in Q1 versus prior quarters. Many had established high fundraising targets prior to COVID-19.

- Private equity fundraising was actually up year-over-year, with the largest and most established funds securing the majority of capital raised.

- Fewer private equity transactions were completed as managers held off on M&A activity anticipating that asset prices would fall in a recession.

- The level of dry powder in the private equity industry is at a record $1.4 trillion as of April 2020. Additionally, 2019 vintage funds, which were originally projected to underperform prior vintages, are now more likely to outperform given the drop in asset prices.

- Private debt fundraising declined in Q1. Direct lending and special situations funds accounted for the majority of fundraising within the category.

- Private real estate fundraising fell in Q1 2020. Managers raised $81 billion from 51 funds versus $51 billion from 83 funds in Q1 2019.

- Private real estate transactions also declined year-over-year, with 1,797 deals completed in Q1 2020 compared to 2,417 deals in Q1 2019.

- Within the real assets category, infrastructure and natural resource fundraising actually increased, and the volume of infrastructure transactions was in line with the prior year. Energy slowed significantly, while social infrastructure sectors such as telecom actually saw increases in fundraising and deal activity.

- Hedge fund launches have stalled from prior months, especially in the equity strategy sector. This makes sense given the recent downturn, although most hedge fund categories performed as expected. The Preqin All Strategies Hedge Fund benchmark declined 10.38% in Q1 2020, compared to the 20% loss in the S&P 500 Index.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, BDCs, Closed-End Funds, and Alternative Mutual Funds. Receive up to 24 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of April 30, 2020, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose. Copyright ©2020 AI Insight. All Rights Reserved.

Tuesday, May 5th, 2020 and is filed under AI Insight News

AI Insight’s Mike Kell, senior vice president – business development and program management, recently participated in an ADISA panel discussion regarding investment considerations during COVID-19. Panelists included moderator Lilian Morvay, principal and founder of Independent Broker Dealer Consortium, LLC (“IBDC”), along with Michael Schwartzberg, founding partner, Winget Spadafora & Schwartzberg; Gary Saretsky, founding partner, Saretsky Hart Michaels + Gould; Sheri Pontolillo, founder and director of InterWeb Insurance; and Bob Valker, managing director, Capital Forensics.

Following are some of the highlights of this discussion, including several helpful and actionable risk management best practices.

- Arbitration claims increase in times of market dislocation. There’s no reason to think this time would be any different so its important to be prepared.

- According to a recent Financial Advisor article, the Pandemic has driven 1 in 4 Americans to reach out to a financial advisor for the first time.

- Being proactive with existing clients is especially important but there’s also a good opportunity for prospective clients as well to protect your own business.

- Support your clients and your business by connecting people. For example, bring together a family you work with to put together a plan to support a specific cause or community need. This may allow you to talk with younger relatives, parents, or heirs. Neighbors may want to come together.

- It’s a chance to lead and connect yourself with people around you. Positive for the community and business.

- Best practices for market dislocations: Review all alternative products in your book and:

- Understand exposures.

- Take a hard look to ensure the proper due diligence was and is being done on an ongoing basis.

- Documenting the due diligence.

- Be aware of potential areas of risk (triage your risk) including but not limited to:

- Concentration

- Elderly clients with exposure to alts

- Review the investment rationale, objectives, risk tolerance, paperwork, and ensure documentation is in place for all alternative investment decisions. Ensure that actions are backed up with verifiable data.

- Ensure that you are taking the responsibility for analyzing your own business and knowing your risk. Don’t wait for attorney. Start now.

- With more remote work, review your E&O insurance to ensure you are fully covered. Determine if cyber-security coverage is needed and that you have the appropriate technology in place.

- Effective communication is critical, especially in times like this where there is fear and anxiety. Respond to the emotional concerns. Three suggestions for communications:

- Get on the phone, call clients, do not avoid this. It’s not fun but silence will cause feelings to magnify. Acknowledgement helps to diffuse anxiety. In many ways, this market dislocation helps to highlight the benefit of alternatives and takes the argument against them away. It’s tougher to highlight alternatives when all market indexes are outperforming them. That’s not the case now.

- Don’t wait to communicate, do it now, immediately.

- Do it right. Listen to concerns but listen to what is not said. This is an amazing opportunity to really flesh out the true risk tolerance of clients and bring it to light. It might be painful, but it is helpful.

- Phone calls are the best approach for communicating.

- Texting is mostly prohibited and e-mail can be misinterpreted.

- Phone calls are typically the best approach for communicating, and then confirm in writing or e-mail something verifiable from the conversation.

- Firms may still have a small pocket of exposure in recent sales (ie: those who purchased them just prior to suspension), but big picture down the road this will be helpful.

- Firms should have a documented rationale for suspensions or other offering actions.

Click here to watch the full replay.

Wednesday, April 29th, 2020 and is filed under Alternative Strategy Mutual Funds

Introduction

As the dust settles from the Corona Market, albeit perhaps temporarily, it is prudent to revisit one’s portfolio and assess the effectiveness of your asset allocation. Diversification is an important component to risk management, and at no time is this better tested than during an equity selloff. Beyond the traditional stock and bond allocation, alternative investments can be an effective way to accomplish this. Broadly speaking, the asset class is designed to provide alternative sources of return to traditional market beta and provide the potential for capital preservation during market drawdowns. As such, it is good to assess the performance of alternatives during these periods to see if the hypothesis holds. Specifically, this piece will focus on alternative mutual fund (AMF) performance through the 1st quarter of 2020. AMFs offer exposure to “hedge fund-like” strategies among other non-traditional approaches within a mutual fund structure. Thus, they can be a liquid and cost-effective means to enhance portfolio diversification.

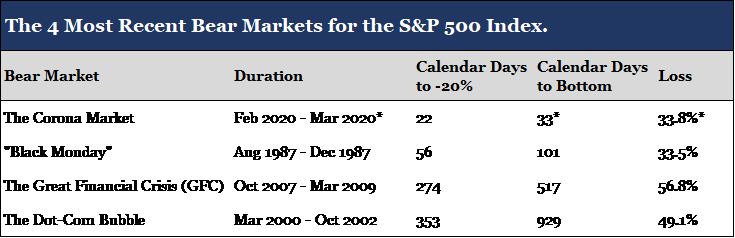

For the scope of this piece we will define the Corona Market as the equity declines experienced from February 19th through March 23rd. As much uncertainty around the COVID-19 virus and its economic impacts remain, it is important to understand that volatility may persist and that a new low may be established before the drawdown is officially measured. Working with this definition of the Corona Market allows us to make some unique observations about the recent market drawdown.

The Corona Market

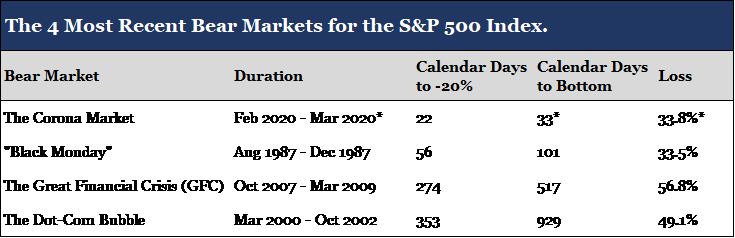

The total loss to the S&P 500 Index, a barometer for US equity markets, amounted to 33.8%. According to data from the CFRA, the average loss experienced during all bear markets dating back to 1929 is 38.2%. Thus, from a historical perspective, the Corona Market was below average in magnitude. However, what made the drawdown so extreme was the speed in which it took place.

*Assumes that the March 23rd index low is the bottom of the Corona Market. Data for the table was sourced from CFRA and S&P Down Jones Indices.

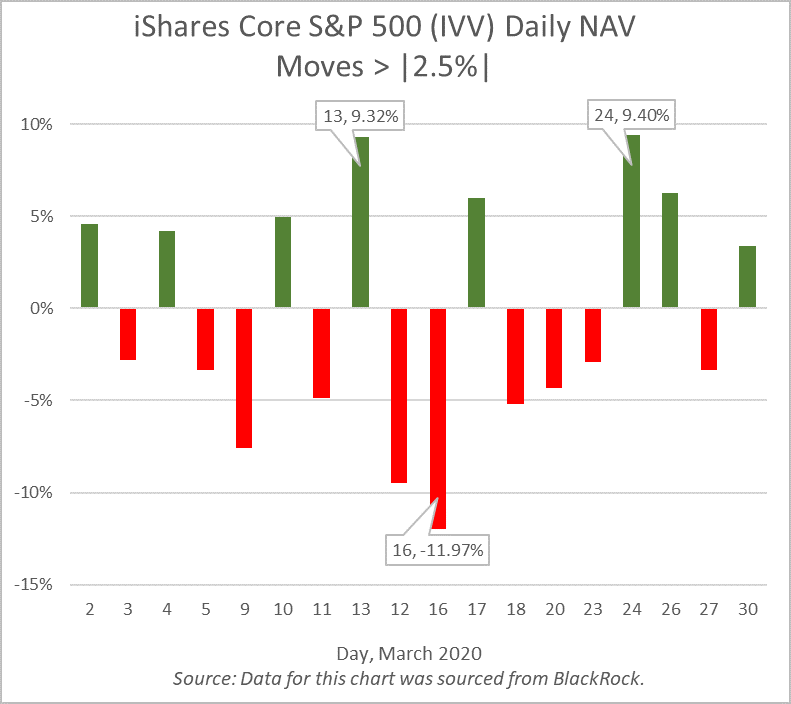

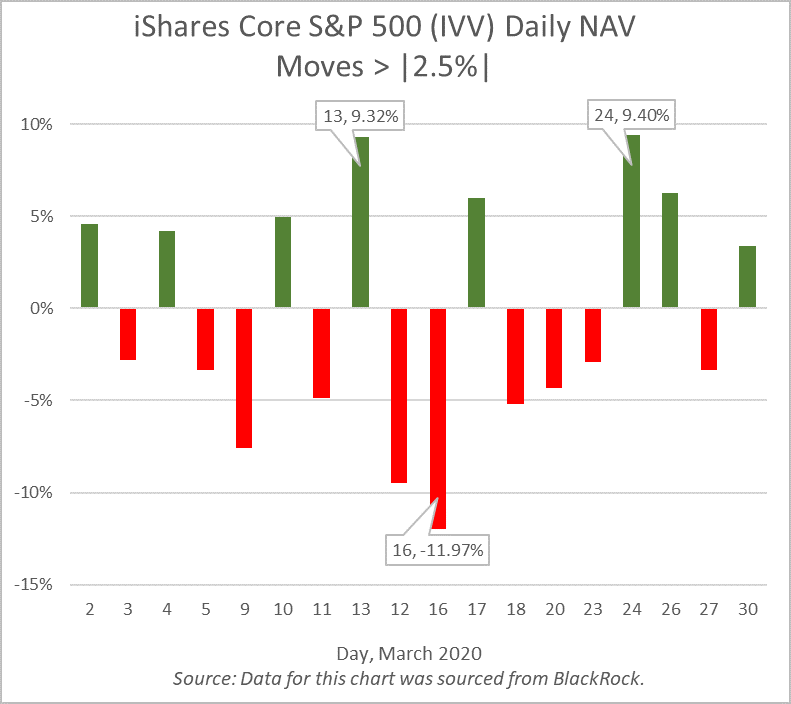

As demonstrated by the table above, the Corona Market decline reached 20% (the definition of a bear market) in 22 calendar days. This is less than half the time it took markets to reach bear territory in 1987 (“Black Monday”) and far below the average of 254 calendar days dating back to 1929. The Corona Market also reached its current low in just 33 days. Such extreme price volatility highlights the uniqueness of a pandemic induced selloff. Taking a closer look, the following chart represents daily NAV changes in excess of +/- 2.5% for the iShares Core S&P 500 ETF (IVV), a passive ETF that tracks the returns of the S&P 500 Index.

The ETF, ticker IVV, had daily NAV moves in excess of +/- 2.5% for 18 out of the 22 trading days in March. This included the March 16th decline of nearly 12%, the S&P’s third largest daily price decline in history (“Black Friday” is the largest daily price decline at -20.5%). As a result, the VIX Index, the market’s forward-looking indicator of volatility, closed at an all-time high of 82.69 the same day.

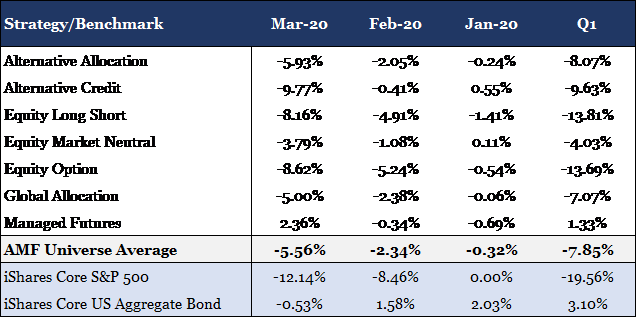

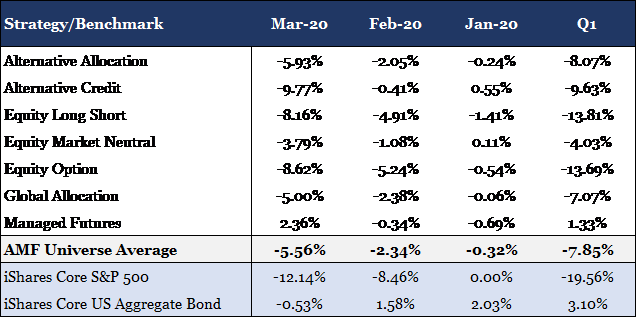

Alternative Mutual Funds, Passing the Test

The speed and volatility witnessed during the market drawdown was historic. Working with this understanding of the Corona Market, we can now visit AMF performance for this period within the appropriate lens. The following table represents the performance of the AI Insight universe of AMFs. AI Insight focuses our coverage on funds that execute alternative strategies designed to be held as part (or as all) of an alternative allocation. We also aim to limit our coverage to funds with established track records and sustainable levels of total AUM. The universe is organized into 7 strategy groups, for which the table presents the average performance of each.

The data for the table was sourced from the AI Insight AMF database.

The strongest performer for the period was Managed Futures delivering positive 1.33% through the first quarter. It was the only strategy to remain in the black propelled by a positive 2.36% return during the month of March. Historically, Managed Futures have struggled to capture sharp price reversals as the strategy relies on sustained price trends to build portfolio positions. However, many managers today have increased their weighting toward short term trading strategies and trend signals to better capture downward price swings. This is often referred to as “crisis alpha”, the ability to capture persistent trends that occur across markets during turbulent periods.

Below the AMF universe average for the period were the equity and credit alternative strategies (e.g. Equity Long Short, Equity Option, and Alternative Credit). These funds will typically have higher exposures to risk assets, and as a result, a higher correlation to traditional markets. Furthermore, it is possible the orientation of this market crisis (virus induced shutdown) may have led managers to be more aggressive than they otherwise would have been in a low growth and/or fundamentally weak economy. Prior to the selloff, the financial health of companies and consumers was considerably stronger than what was seen in 2008.

One exception to the equity alternative strategies was Equity Market Neutral. More specifically, the Event Driven sub-strategy of Equity Market Neutral that focuses on mergers and acquisitions among other corporate related events. The sub-strategy was a stronger performer for the period delivering -2.83% performance through the first quarter. These funds are unique in that they invest almost exclusively in equity and equity related securities yet provide a low beta return profile. The -2.83% return equates to a 16.73% outperformance over the iShares Core S&P 500 ETF for the first quarter.

Conclusion

Overall, AMFs delivered strong relative results during the Corona Market with the universe average outperforming the S&P 500 by 11.71% during the first quarter. This included downside protection for both the month of February and March as the average outperformed the equity index by 6.12% and 6.58% respectively. Strategies performed as expected with the more correlated strategies under-performing the average AMF but still out-performing equities, and the less correlated strategies out-performing both the average AMF and the equity markets.

Consistent with these results was the Alternative Allocation strategy which delivered -8.07% for the first quarter as compared to the -7.85% return for the universe. These funds actively invest across multiple alternative strategies and managers within a single fund, providing broad exposure to alternative sources of return. Similarly, the strategy delivered downside protection in both February and March outperforming the equity index by 6.41% and 6.07% respectively.

As demonstrated during the first quarter of 2020, AMFs provide the potential for increased portfolio diversification and downside protection relative to traditional equities. This may serve to reduce portfolio risk during an equity selloff as witnessed during the Corona Market. As mentioned previously, the current low to equity markets occurred on March 23rd. However, there is still much uncertainty that remains around the COVID-19 virus such as potential treatments and vaccines, how best to re-open the economy, and how we will manage the increased debt load that the government and many companies are undertaking to weather the economic shutdown. Despite these uncertainties, equity markets have stabilized since the March 23rd lows appreciating approximately 27% on the backbone of positive hospitalization trends and historic fiscal and monetary policy measures (the S&P 500 is currently down 12.2% through Friday, April 24th). The road may be long, but as mentioned before, diversification is an effective tool in any risk management strategy.

Thursday, April 23rd, 2020 and is filed under AI Insight News

We recently hosted a webinar titled “COVID-19 Impact and Outlook, Alternative Investment Markets.” We were joined by three incredibly insightful speakers:

- Randy I. Anderson, Ph.D., CRE, President of Griffin Capital Asset Management Company

- Robert Hoffman, CFA, Managing Director, FS Investments

- Richard Kimble, CFA, Portfolio Manager, Americas for the Nuveen Global Cities REIT

See the key takeaways from our discussion with them as well as due diligence action steps provided by Mick Law, PC, or watch the full replay here:

Richard Kimble, Nuveen

- Real estate asset classes with shorter leases will suffer the most:

- Hospitality, seniors housing, student housing, discretionary retail

- Development will struggle

- Some retail will close for good

- Industrial, non-discretionary retail, and housing are in a better position:

- Multifamily and single-family rentals, life-sciences, technology (towers, data centers)

- Housing still has demographic trend benefits and now may be more difficult to own.

- US will continue to be a safe haven for overseas investors. Manhattan will still be a focus, but some groups may look to diversify to other large US cities.

- Real estate transactions are down:

- Of the deals awarded pre-crisis, some have gone through with purchases thinking this will be shorter-term V-shaped recovery, some backed out, and some pushed out 30-60 days to see if underwriting needs to be modified.

- Transactions slowing down but once there’s normalcy there will be a lot of transactions.

- It is critical to use well-known and trusted valuation firms to properly assess risk:

- They are using one of the largest third-party valuation firms that works with a number of clients and work with other appraisers similar to them to make sure the market is being consistent.

- Making sure people are consistently pricing in risk is key.

- For their fund, normally a third of the portfolio is appraised each month but during times like this they can appraise earlier.

- In Nuveen’s real estate platform, they have collected 94% of April rent.

- A handful have asked for payment plans and they are using creative strategies that can be used to ease the pain of the deferred rent.

- Not really working through force majeure because this doesn’t qualify for it or other MAC clauses, non-essential retail clients are struggling the most, but they want to be part of the solution to help make sure as many companies stay in business and keep as many employees – not abating rent but helping to defer.

- For example, many retailers asking for deferral for the next couple of months. They can work with tenants to amortize or add on to the end.

- They have set up a task force with a hotline to help small businesses access funds to stay in business.

- The real estate markets are in a stronger place than back in the global financial crisis (the GFC).

- For example, CMBS issuance 2017-2019 was less than half 2006-2007 time period. There is more discipline in lending, looking at in-place cash flow vs. forward looking NOI, more equity in transactions.

- Before COVID-19, they were maybe losing deals on the lending side due to pricing and structure or relationship, whereas before the GFC it was because other guy was giving more leverage. Covenants have also held up versus covenant lite environment pre-GFC.

- Looking at where traded REITs are now relative to NAV, and where spreads are, we’re seeing tremendous opportunities.

Robert Hoffman, FS Investments

- High yield bond markets will see volatility, defaults, downgrades, lack of CLO issuance, and fallout from the energy markets.

- Defaults may hit 10% later this year, compared to mid-teens in the GFC.

- Corporate bonds have proven to be resilient.

- There’s never been two years in a row that the HY debt market has been negative.

- When looking at the history of the high yield bond markets, when spreads are as wide as they are now, or around 800bps, the median 12-month forward return is 26%.

- This is probably not the time for broad, passive allocations, but the volatility creates opportunities.

- There will be volatility, but there are positives:

- The speed to which the Fed came into the market with the stimulus packages is helping the markets work more normally so risk can be properly priced and help speed the recovery.

- It also helps with resolving debt issues, if defaults or other actions can be worked out in a properly functioning market it lessens the impact.

- Public markets are seeing issuance and liquidity.

- Debt is more expensive and more situational but its moving.

- The fifth largest deal occurred last week amidst the pandemic.

- On the private debt side, most firms use reputable third-party valuation firms to mark to market as best and consistent as they can similar to real estate and there is also an analogous public market as an indication of value.

- Debt markets were so strong coming into this, and there is a fair amount of dry powder.

- Funds are more properly leveraged and have built up cash and been more defensive even prior to COVID-19.

- Most managers are taking care of their own book first, working with borrowers, and then will look to be opportunistic.

- Real estate debt is also in a better position than it was going into the GFC.

- Debt service coverage ratios are better than before, LTVs are more appropriate.

- Every downturn is different, but lenders are in a better position going into this.

- On the corporate debt side, there’s a much greater prevalence of covenant lite than pre-GFC:

- It remains to be seen what impact this has on the market and this could prove challenging.

- Covenant-lite loans recovered better than covenant-heavy post GFC but not sure that will happen again with significant weakening of fundamentals.

- Another factor that could be a challenge is a large shift to lower rated issuers from higher rated, and a higher percentage of loan-only Single B issuers as opposed to those issuing a loan and bond. However, ratings are higher than ever in history in the high-yield market and asset coverage is stronger than ever which may offset challenges.

Dr. Randy Anderson, Griffin Capital

- There will be volatility and the full impact depends on how long the virus takes to work its way through

- In this downturn as opposed to the GFC, two of the three legs of the chair are stable – fiscal (stimulus packages) and monetary (interest rate reductions) are a positive.

- The virus is the third leg and is variable. There is reason to be optimistic about a recovery in Q3 2020 but more likely in Q4.

- The IMF is forecasting the US economy to be down 6% 2020 and then stronger in 2021, up 4.7%.

- Markets have stabilized recently as the majority of the fear has been priced in.

- Many managers were already somewhat defensive going into this based on high real estate prices and low cap rates.

- They were expecting slower GDP growth anyways and were focused on defensive sectors including multifamily and industrial and had increased liquidity.

- Like Nuveen, they are seeing high levels of collections on multifamily. People need a place to live.

- Public REIT markets overreacted by a factor of almost 3 times during the GFC and proved to be a great investment post GFC.

- The forecast for real estate over the five to seven-year period hasn’t change, with 4-6% income and a similar amount based on appreciation based on inflation rates. With bumps and volatility. No one makes money trying to time the bottom.

- They have employed low leverage and lines of credit were not drawn (similar across many managers), so now they can take advantage of opportunities.

- May take some time to accurately price in risk, but most managers use highly competent third-party valuation experts who follow standards that are widely adopted. The standards require them to look at all conditions and fairly reflect those values.

- One of the main things investors can be looking at is if managers have unfunded commitments.

- It may be harder to raise capital in this environment, so you don’t want to have many outstanding unfunded commitments.

- Also want to have enough cash on hand, liquid securities if it is possible in fund structure, and lines of credit.

- It is important to play defense and then you also want to be positioned to play offense, when the third leg the virus starts to mitigate then markets will start to move and you want to be able to accretively acquire.

Due Diligence Action Steps (Provided by Mick Law, PC)

- Monitor for status updates for funds you have exposure to.

- Monitor for any suspensions of an offering, share redemptions, or distributions (AI Insight Alerts) and immediately communicate to investors.

- Proactively communicate the potential.

- Questions to ask sponsors in your discussions with them include have they:

- Taken any proactive measures to protect asset value?

- Adequately providing “specific information” to investors in offering materials and public filings about how COVID-19 “currently” affects, and may reasonably effect in the future, the operations and liquidity of such sponsors and their managed investment programs? The SEC has advised that it intends to monitor how companies are communicating with their investors concerning the effects of COVID-19.

- Able to service its debt and any portfolio debt?

- Able to continue operating without syndicating additional offerings in the short-term? (review financials)

- Adjusting their distribution payment policies appropriately to account for the present and future effects of COVID-19?

- For oil/gas sponsors that use reserve-based lines of credit,

- Are they appropriately prepared to address borrowing base deficiencies and related loan repayments in the probable event that their credit limits are adjusted due to lower commodities prices?

- For qualified opportunity fund (“QOF”) sponsors with identified asset funds,

- What adjustments are they having to make to development timelines?

- Do they still anticipate being able to meet the 30-month timeline to have their capital invested?

- If not, are they reserving money to pay any potential penalties?

- For QOF sponsors with partial or complete blind pool funds,

- What percentage of capital is already committed to projects (i.e., do they have capital available to take advantage of declining asset prices)?

Wednesday, April 8th, 2020 and is filed under Industry Reporting

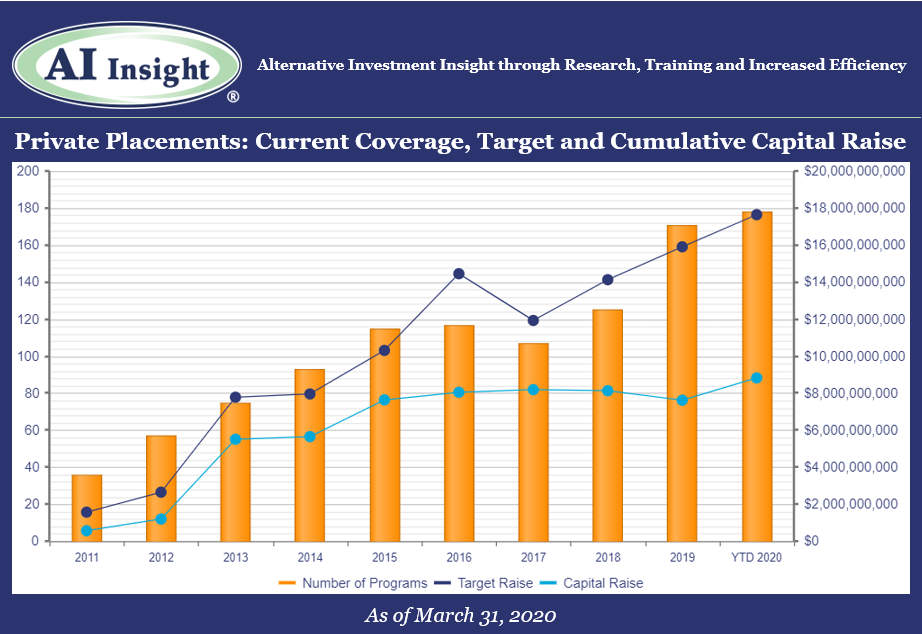

We recently released our March Private Placement Insights. See the highlights from the report below, or if you are a Premium Reporting subscriber, log in now to see the entire report. If you don’t have access, you can request a free trial.

- 15 new private placements were added to our coverage in March, just below the last couple of months but still well over last year’s levels. The industry continues to be led by real estate focused categories including 1031s and real estate LPs and LLCs.

- As of April 1st, AI Insight covers 178 private placements currently raising capital, with an aggregate target raise of $17.6 billion and an aggregate reported raise of $8.8 billion or 50% of target. The average size of the current funds is $99.1 million, ranging from $3.5 million for a single asset real estate fund to $2.5 billion for a sector specific private equity/debt fund.

- 13 private placements closed in March, having raised approximately 70% of their target and having been on the market for an average of 311 days.

- ON DECK: as of April 1st, there were five new private placements coming soon.

Market Update: COVID-19 Impact on Private Placement Markets

On March 11, 2020, the World Health Organization (the WHO) declared the COVID-19 coronavirus a global pandemic. Trade and travel have since grind to a halt with travel restrictions and stay at home orders issued across the globe. The US and global economies are in recession territory, with GDP in the United States now forecast to decline by 0.2% instead of expanding by 2.0% in 2020 as a result of COVID-19. While the full impact of the global pandemic may take years to determine, the one thing we do know is that it will have a significant impact on all aspects of investing both in the public and private markets. Transactions are slowing across the private placement categories and valuations, which require transactions, may be less reliable or difficult to obtain.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, BDCs, Closed-End Funds, and Alternative Mutual Funds. Receive up to 24 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of March 31, 2020, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose. Copyright ©2020 AI Insight. All Rights Reserved.

Friday, March 27th, 2020 and is filed under AI Insight News

|

Your daily routine may be in disarray, but it’s business as usual at AI Insight since we have been successfully operating as virtual company for many years. As always, we’re here to help you with your AI Insight needs and anything else that might help you when working remotely.

To be successful working remotely, you need a strategy, focus and a little fun. We’ve compiled some resources that we’ve used in practice to help you accomplish this. |

Get Started

It’s important to designate a specific area that you use solely as your workspace to establish your “work zone” not only for your benefit, but for family members who are at home with you. Traveling around your house with your laptop or working where you sleep invites interruption.

Stay Focused

It’s easy to become distracted by the TV, social media or the pile of dishes in the sink. Creating a schedule for yourself – including breaks and lunchtime as you would at the office – can help you concentrate on your work. Setting a specific work schedule will also help you set expectations for other family members who are at home and help you keep a healthy work-life balance.

Industry Resources

You may be used to attending industry conferences or face-to-face group meetings, which have been postponed or cancelled. AI Insight created a central resource to help you stay connected with industry groups such as ADISA, IPA, FINRA and more. Check back frequently as we will continue to post industry webinar events happening in lieu of conferences.

Technology Resources

Having the right equipment is essential to working from home. But, knowing how to make the most of technology tools can be challenging.

- Zoom is a remote video conferencing and web conferencing service.

- Microsoft Teams is a unified communication and collaboration platform that combines workplace chat, video meetings, file storage, and application integration.

Stay Connected

We all know that miscommunication can happen over email and text. Convey your tone with a phone call instead of email when you can. Even better, turn on your video during online meetings to express your body language. Remember to test out your video feature before you use it publicly, so you can check your background surroundings and test your microphone.

This is also a good opportunity to get to know your co-workers on a personal level. At AI Insight, we’ve created a social channel within our Microsoft Teams platform to talk about topics unrelated to work and share photos on occasions like Halloween and St. Patrick’s Day. This helps us get to know each other better and stay connected.

Be Mindful

We’ve created a “Get Up & Move” rewards program at AI Insight to encourage everyone to walk away from their computer once an hour. We also host quarterly Lunch & Learns to help our team stay healthy in mind and body such as chair yoga sessions and meditation practices. Taking breaks can boost productivity and rejuvenate you when motivation drops.

Contact Us

From everyone at AI Insight, we want you to be safe and healthy. Again, we’ve been incorporating these practices for many years. If there’s something we can help you with on any of these topics, please reach out to us Monday through Friday from 8:00 a.m. to 6:00 p.m. at 877-794-9448 ext. 710 or any time at customercare@aiinsight.com.

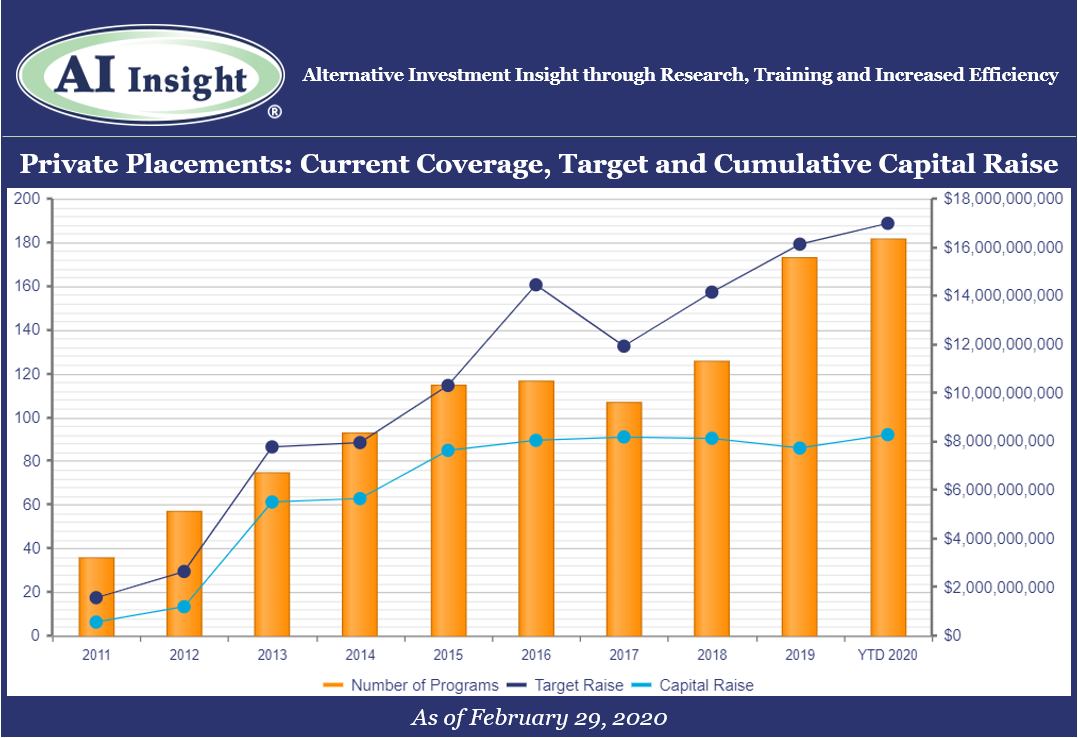

Monday, March 9th, 2020 and is filed under Industry Reporting

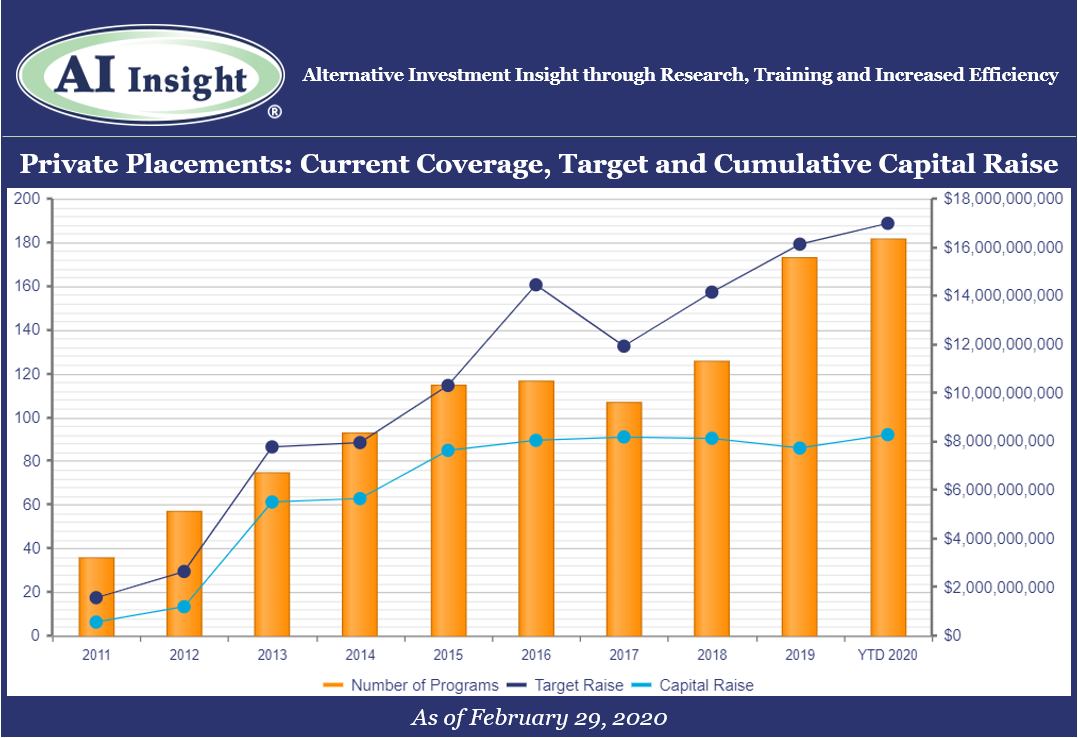

We recently released our February Private Placement Insights. See the highlights from the report below, or if you are an AI Insight Premium Reporting subscriber, log in now to see the entire report.

• 16 new private placements were added to our coverage in February, just below the last couple of months but still well over last year’s levels. The industry is again being led by the real estate focused categories including 1031s and real estate LPs and LLCs.

• As of March 1st, AI Insight covers 182 private placements currently raising capital, with an aggregate target raise of $17.0 billion and an aggregate reported raise of $8.3 billion or 49% of target. The average size of the current funds is $92.6 million, ranging from $3.5 million for a single asset real estate fund to $2.2 billion for a sector specific private equity/debt fund.

• 13 private placements closed in February, having raised approximately 87% of their target and having been on the market for an average of 393 days.

• ON DECK: as of March 1st, there were eight new private placements coming soon.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, BDCs, Closed-End Funds, and Alternative Mutual Funds. Receive up to 24 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of Feb. 29, 2020, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose. Copyright ©2020 AI Insight. All Rights Reserved.

Monday, August 19th, 2019 and is filed under AI Insight News

Have you recently reviewed your policies and procedures around Alternative Mutual Funds? Use the resources below to help your advisors better understand your firm’s best practices. It’s always best to address areas for improvement prior to market corrections, which seem to highlight such deficiencies.

How would you answer the following questions?

- Does your firm approve all fund company mutual funds?

- Is your firm performing the additional due diligence needed based on continued regulatory guidance?

- Does your firm have an efficient solution to establish and enforce best practices?

Related Regulatory References

Watch the video and view this checklist to learn more.