Thursday, August 12th, 2021 and is filed under Industry Reporting

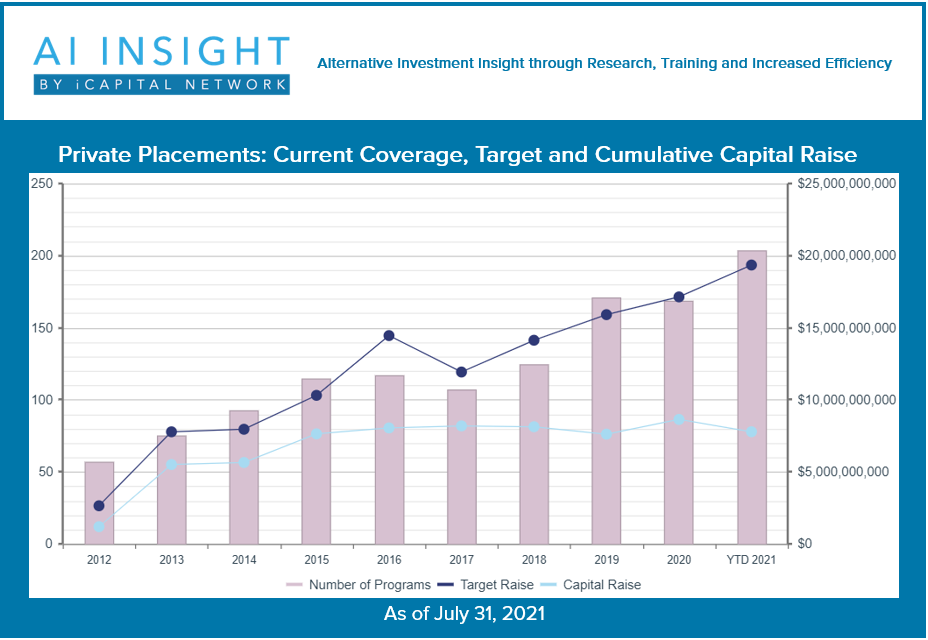

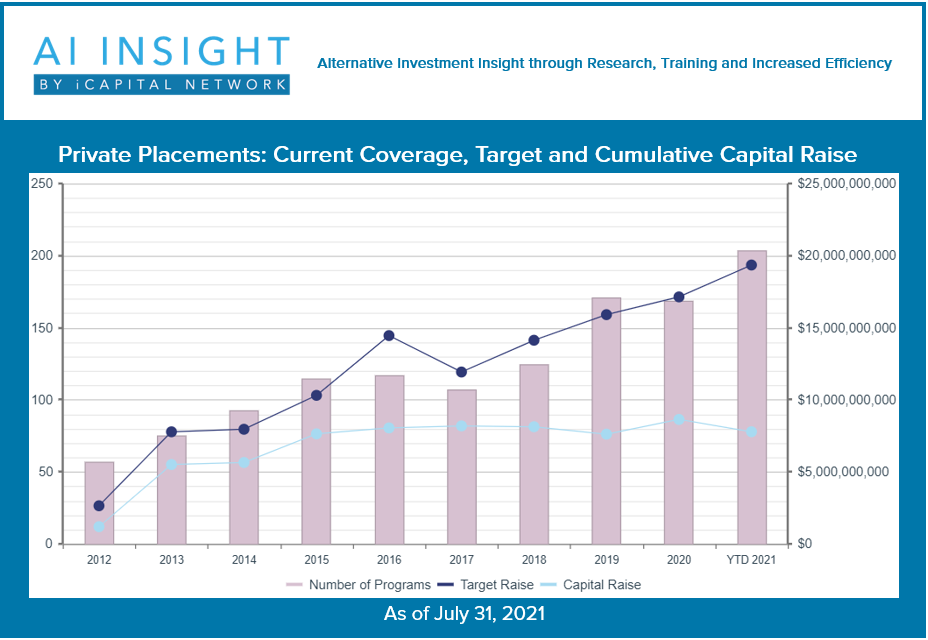

We recently released our July Private Placement Insights report. See the highlights from the report below, or if you are a Premium Reporting subscriber, log in now to see the entire report. If you don’t have access, you can request a free trial.

- May and June were big months in terms of new funds added to our coverage. July is no exception and is a record, with 29 new funds added. 1031 exchanges, hedge funds, and private equity/debt offerings led the way and we have seen a ramp up in non-tax focused real estate offerings as well. Energy and Opportunity Zones are slow this year, while preferred and conservation offerings are flat. President Biden’s proposal to reduce the deferral of gains under section 1031 to a maximum of $500,000, for those transactions completed in tax years prior to December 31, 2021, may be contributing to an increase in this category prior to any changes, something that we continue to watch as it could have an impact on future fund formation.

- 150 new funds have been added in 2021 making this a strong year and putting us well ahead in terms of new fund coverage (+69%) and aggregate target raise (+83%).

- As of August 1st, AI Insight covers 204 private placements currently raising capital, with an aggregate target raise of $19.3 billion and an aggregate reported raise of $7.8 billion or 40% of target.

- Real estate-related funds, including 1031s, Opportunity Zones, and non-1031 real estate LLCs and LPs represent the largest component of our private placement coverage, at 70% of funds and 62% of target raise. Private equity/debt funds represent a relatively small amount of our coverage in terms of the number of funds at only 16% but represents 27% of target raise even with several funds in the category not reporting a target.

- In terms of our coverage by general objective, income is the largest component at 54% of funds, while growth and growth & income follow at 27% and 19%, respectively.

- The average size of the funds currently raising capital is $94.8 million, ranging from $1.8 million for a specified private equity fund to $1.1 billion for a larger blind pool private equity fund. Seven funds do not report a target or current capital raise.

- 82% of private placements we cover use the 506(b) exemption, 14% use 506(c) and 4% have not yet filed their Form D with the SEC.

- 18 private placements closed to new investors in July and 118 have closed in 2021. Funds that closed this year have been on the market for an average of 339 days. The funds that reported, raised 93% of target. 84% met or exceeded their target and only six funds that missed their target raised less than half of target.

- ON DECK: there are six new private placements coming soon.

For illustrative purposes only.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, Non-Traded BDCs, Interval Funds, and Alternative Strategy Mutual Funds. Receive up to 24 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of July 31, 2021, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security offered by Institutional Capital Network, Inc. or its affiliates (together “iCapital Network”). Past performance is not indicative of future results. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors. An investment in an alternative investment entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. The information contained herein is subject to change and is also incomplete. This industry information and its importance is an opinion only and should not be relied upon as the only important information available. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed, and iCapital Network assumes no liability for the information provided.

Products offered by iCapital Network are typically private placements that are sold only to qualified clients of iCapital Network through transactions that are exempt from registration under the Securities Act of 1933 pursuant to Rule 506(b) of Regulation D promulgated thereunder (“Private Placements”). An investment in any product issued pursuant to a Private Placement, such as the funds described, entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. Further, such investments are not subject to the same levels of regulatory scrutiny as publicly listed investments, and as a result, investors may have access to significantly less information than they can access with respect to publicly listed investments. Prospective investors should also note that investments in the products described involve long lock-ups and do not provide investors with liquidity.

Securities may be offered through iCapital Securities, LLC, a registered broker dealer, member of FINRA and SIPC and subsidiary of Institutional Capital Network, Inc. (d/b/a iCapital Network). These registrations and memberships in no way imply that the SEC, FINRA or SIPC have endorsed the entities, products or services discussed herein. iCapital and iCapital Network are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2021 Institutional Capital Network, Inc. All Rights Reserved.

Wednesday, July 14th, 2021 and is filed under Industry Reporting

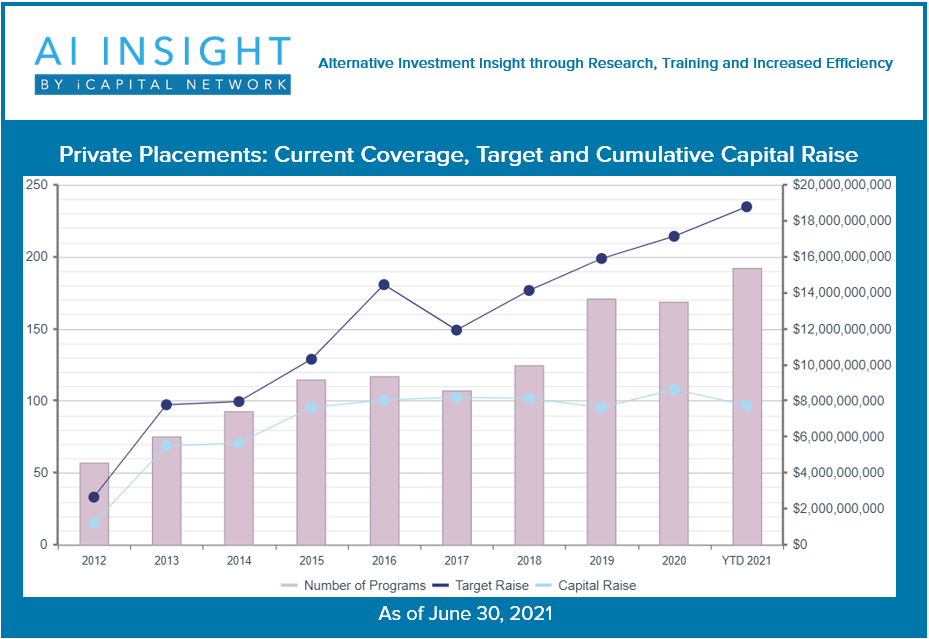

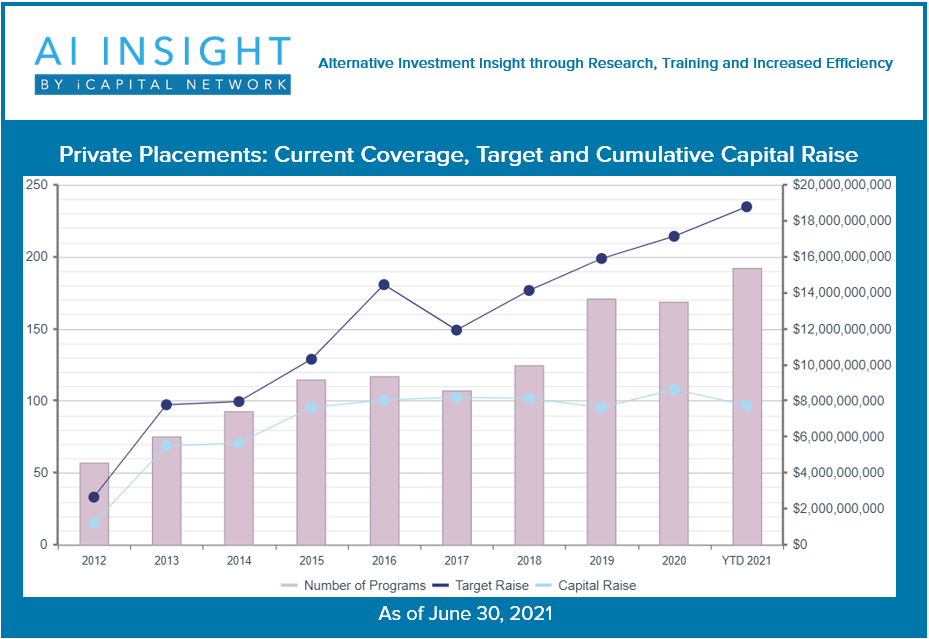

We recently released our June Private Placement Insights report. See the highlights from the report below, or if you are a Premium Reporting subscriber, log in now to see the entire report. If you don’t have access, you can request a free trial.

- The last two months were big months in terms of new funds added to our coverage, with 21 funds added each month compared to 13 in April. Energy, Opportunity Zones, and real estate 1031 exchanges led the way in terms of new fund formation, and we are seeing continued strength in private equity/debt offerings. President Biden’s proposal to reduce or eliminate section 1031 exchanges may be contributing to an increase in this category prior to any changes, something that we continue to watch as it could have an impact on future fund formation. iCapital’s Chief Investment Strategist, Anastasia Amoroso, sees growth in private markets and real estate through 2H, which aligns with the growth we’ve seen in the real estate and private equity/debt categories.

- 121 new funds have been added in the first half of 2021 making this a strong year and putting us ahead in terms of new fund coverage (+59%) and aggregate target raise (+102%).

- As of July 1st, AI Insight covers 192 private placements currently raising capital, with an aggregate target raise of $18.8 billion and an aggregate reported raise of $7.7 billion or 41% of target.

- Real estate-related funds, including 1031s, Opportunity Zones, and non-1031 real estate LLCs and LPs represent the largest component of our private placement coverage, at 67% of funds and 60% of target raise. Private equity/debt funds represent a relatively small amount of our coverage in terms of the number of funds at only 18%, but represents more than 28% of target raise even with several funds in the category not reporting a target.

- In terms of our coverage by general objective, income is the largest component at 52% of funds, while growth and growth & income follow at 27% and 20%, respectively.

- The average size of the funds currently raising capital is $97.8 million, ranging from $1.8 million for a specified private equity fund to $1.1 billion for a larger blind pool private equity fund. Eight funds do not report a target or current capital raise.

- 82% of private placements we cover use the 506(b) exemption, 13% use 506(c) and 4% have not yet filed their Form D with the SEC.

- 18 private placements closed to new investors in June and 100 have closed in 2021. Funds that closed this year have been on the market for an average of 357 days. The funds that reported, raised 88% of target. 86% met or exceeded their target and only two funds that closed raised less than half of their target.

- ON DECK: there are three new private placements coming soon.

For illustrative purposes only.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, Non-Traded BDCs, Interval Funds, and Alternative Strategy Mutual Funds. Receive up to 24 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of June 30, 2021, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security offered by Institutional Capital Network, Inc. or its affiliates (together “iCapital Network”). Past performance is not indicative of future results. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors. An investment in an alternative investment entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. The information contained herein is subject to change and is also incomplete. This industry information and its importance is an opinion only and should not be relied upon as the only important information available. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed, and iCapital Network assumes no liability for the information provided.

Products offered by iCapital Network are typically private placements that are sold only to qualified clients of iCapital Network through transactions that are exempt from registration under the Securities Act of 1933 pursuant to Rule 506(b) of Regulation D promulgated thereunder (“Private Placements”). An investment in any product issued pursuant to a Private Placement, such as the funds described, entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. Further, such investments are not subject to the same levels of regulatory scrutiny as publicly listed investments, and as a result, investors may have access to significantly less information than they can access with respect to publicly listed investments. Prospective investors should also note that investments in the products described involve long lock-ups and do not provide investors with liquidity.

Securities may be offered through iCapital Securities, LLC, a registered broker dealer, member of FINRA and SIPC and subsidiary of Institutional Capital Network, Inc. (d/b/a iCapital Network). These registrations and memberships in no way imply that the SEC, FINRA or SIPC have endorsed the entities, products or services discussed herein. iCapital and iCapital Network are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2021 Institutional Capital Network, Inc. All Rights Reserved.

Wednesday, June 23rd, 2021 and is filed under Industry Reporting

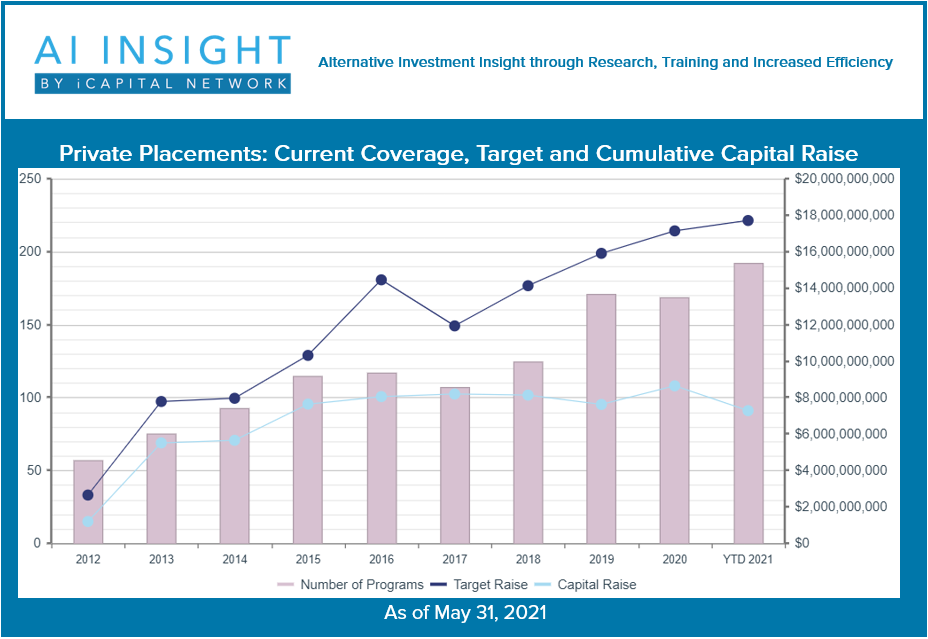

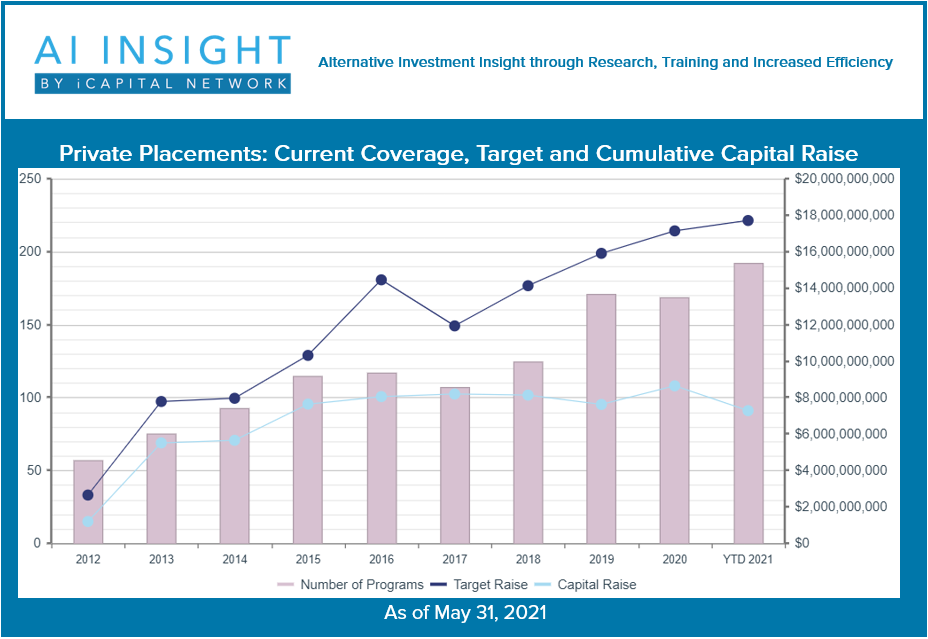

We recently released our May Private Placement Insights report. See the highlights from the report below, or if you are a Premium Reporting subscriber, log in now to see the entire report. If you don’t have access, you can request a free trial.

- May was a big month in terms of coverage on the AI Insight platform. 21 new funds were added during the month compared to just 13 in April. Real estate activity picked up after a slow start to the year, and new funds were added for the first time this year in the energy and conservation categories.

- 100 new funds have been added this year, putting us ahead in terms of new fund coverage (+54%) and aggregate target raise (+82%).

- As of June 1st, AI Insight covers 192 private placements currently raising capital, with an aggregate target raise of $17.7 billion and an aggregate reported raise of $7.3 billion or 41% of target.

- Real estate-related funds, including 1031s, opportunity zones, and non-1031 real estate LLCs and LPs represent the largest component of our private placement coverage, at 70% of funds and 63% of target raise. Private equity/debt funds represent a relatively small amount of our coverage in terms of the number of funds at only 18%, but represents more than 30% of target raise even with several funds in the category not reporting a target.

- In terms of our coverage by general objective, income is the largest component at 51% of funds, while growth and growth & income follow at 28% and 19%, respectively.

- The average size of the funds currently raising capital is $97.3 million, ranging from $1.8 million for a specified private equity offering to $1.1 billion for a larger blind pool private equity offering. Eight funds do not report a target or current capital raise.

- 83% of private placements we cover use the 506(b) exemption, 13% use 506(c) and 5% have not yet filed their Form D with the SEC.

- 20 private placements closed to new investors in May and 81 have closed in 2021. Funds that closed this year have been on the market for an average of 346 days. The funds that reported, raised 92% of target. 86% met or exceeded their target and only two funds that closed raised less than half of their target.

- ON DECK: there are seven new private placements coming soon.

For illustrative purposes only.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, Non-Traded BDCs, Interval Funds, and Alternative Strategy Mutual Funds. Receive up to 24 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of May 31, 2021, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security offered by Institutional Capital Network, Inc. or its affiliates (together “iCapital Network”). Past performance is not indicative of future results. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors. An investment in an alternative investment entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. The information contained herein is subject to change and is also incomplete. This industry information and its importance is an opinion only and should not be relied upon as the only important information available. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed, and iCapital Network assumes no liability for the information provided.

Products offered by iCapital Network are typically private placements that are sold only to qualified clients of iCapital Network through transactions that are exempt from registration under the Securities Act of 1933 pursuant to Rule 506(b) of Regulation D promulgated thereunder (“Private Placements”). An investment in any product issued pursuant to a Private Placement, such as the funds described, entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. Further, such investments are not subject to the same levels of regulatory scrutiny as publicly listed investments, and as a result, investors may have access to significantly less information than they can access with respect to publicly listed investments. Prospective investors should also note that investments in the products described involve long lock-ups and do not provide investors with liquidity.

Securities may be offered through iCapital Securities, LLC, a registered broker dealer, member of FINRA and SIPC and subsidiary of Institutional Capital Network, Inc. (d/b/a iCapital Network). These registrations and memberships in no way imply that the SEC, FINRA or SIPC have endorsed the entities, products or services discussed herein. iCapital and iCapital Network are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2021 Institutional Capital Network, Inc. All Rights Reserved.

Wednesday, June 23rd, 2021 and is filed under Industry Reporting

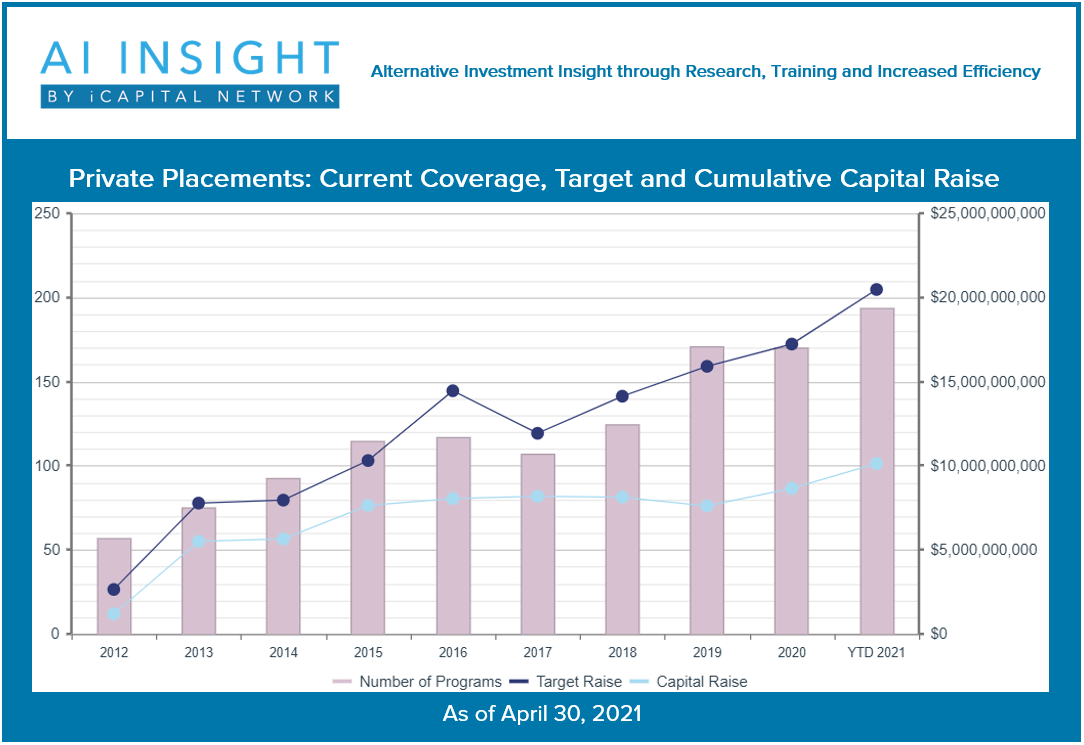

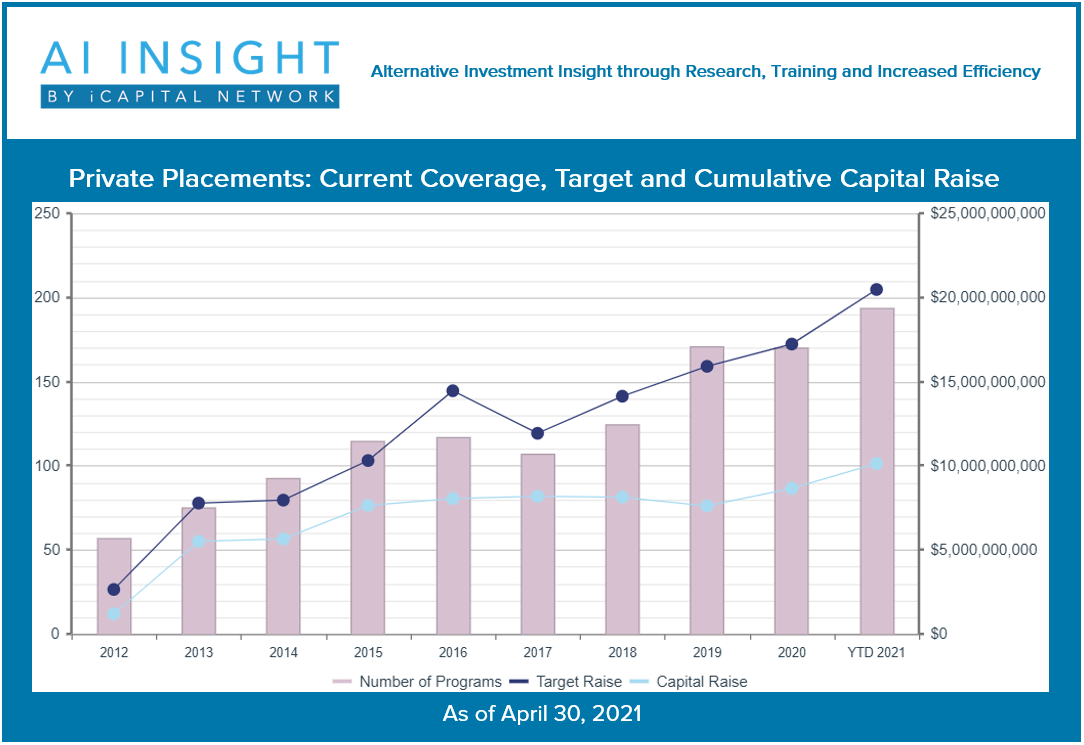

We recently released our April Private Placement Insights report. See the highlights from the report below, or if you are a Premium Reporting subscriber, log in now to see the entire report. If you don’t have access, you can request a free trial.

- April was the slowest month of the year in terms of private placement fund activity but historically this is the case as well. The 13 funds added during the month was less than half the 28 added in March but is three funds more than April 2020 – which was one of our slowest months ever as the pandemic had started to impact the markets.

- 79 new funds have been added this year, putting us ahead in terms of new fund coverage (+36%) and aggregate target raise (+44%). Real estate categories have slowed, while our coverage of private equity/debt and hedge funds has increased.

- As of May 1st, AI Insight covers 194 private placements currently raising capital, with an aggregate target raise of $20.5 billion and an aggregate reported raise of $10.1 billion or 49% of target.

- Despite a slowdown recently, real estate-related funds, including 1031s, opportunity zones, and non-1031 real estate LLCs and LPs represent the largest component of our private placement coverage, at 69% of funds and 55% of target raise. Private equity/debt funds represent a relatively small amount of our coverage in terms of the number of funds at only 17%. However, our acquisition by iCapital is allowing us to enhance our coverage of private equity and debt more than ever before.

- In terms of our coverage by general objective, income is the largest component at 49% of funds, while growth and growth & income follow at 30% and 21%, respectively.

- The average size of the funds currently raising capital is $105.5 million, ranging from $1.8 million for a specified private equity offering to $3.1 billion for a sector specific private BDC. Six funds do not report a target or current capital raise.

- 85% of private placements we cover use the 506(b) exemption, 12% use 506(c) and 3% have not yet filed their Form D with the SEC.

- 17 private placements closed to new investors in April and 59 have closed in 2021. Funds that closed this year have been on the market for an average of 352 days. The funds that reported raised 92% of target. 86% met or exceeded their target and only two funds that closed raised less than half of their target.

- ON DECK: there are nine new private placements coming soon.

For illustrative purposes only.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, Non-Traded BDCs, Interval Funds, and Alternative Strategy Mutual Funds. Receive up to 24 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of April 30, 2021, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security offered by Institutional Capital Network, Inc. or its affiliates (together “iCapital Network”). Past performance is not indicative of future results. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors. An investment in an alternative investment entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. The information contained herein is subject to change and is also incomplete. This industry information and its importance is an opinion only and should not be relied upon as the only important information available. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed, and iCapital Network assumes no liability for the information provided.

Products offered by iCapital Network are typically private placements that are sold only to qualified clients of iCapital Network through transactions that are exempt from registration under the Securities Act of 1933 pursuant to Rule 506(b) of Regulation D promulgated thereunder (“Private Placements”). An investment in any product issued pursuant to a Private Placement, such as the funds described, entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. Further, such investments are not subject to the same levels of regulatory scrutiny as publicly listed investments, and as a result, investors may have access to significantly less information than they can access with respect to publicly listed investments. Prospective investors should also note that investments in the products described involve long lock-ups and do not provide investors with liquidity.

Securities may be offered through iCapital Securities, LLC, a registered broker dealer, member of FINRA and SIPC and subsidiary of Institutional Capital Network, Inc. (d/b/a iCapital Network). These registrations and memberships in no way imply that the SEC, FINRA or SIPC have endorsed the entities, products or services discussed herein. iCapital and iCapital Network are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2021 Institutional Capital Network, Inc. All Rights Reserved.

Friday, April 16th, 2021 and is filed under Industry Reporting

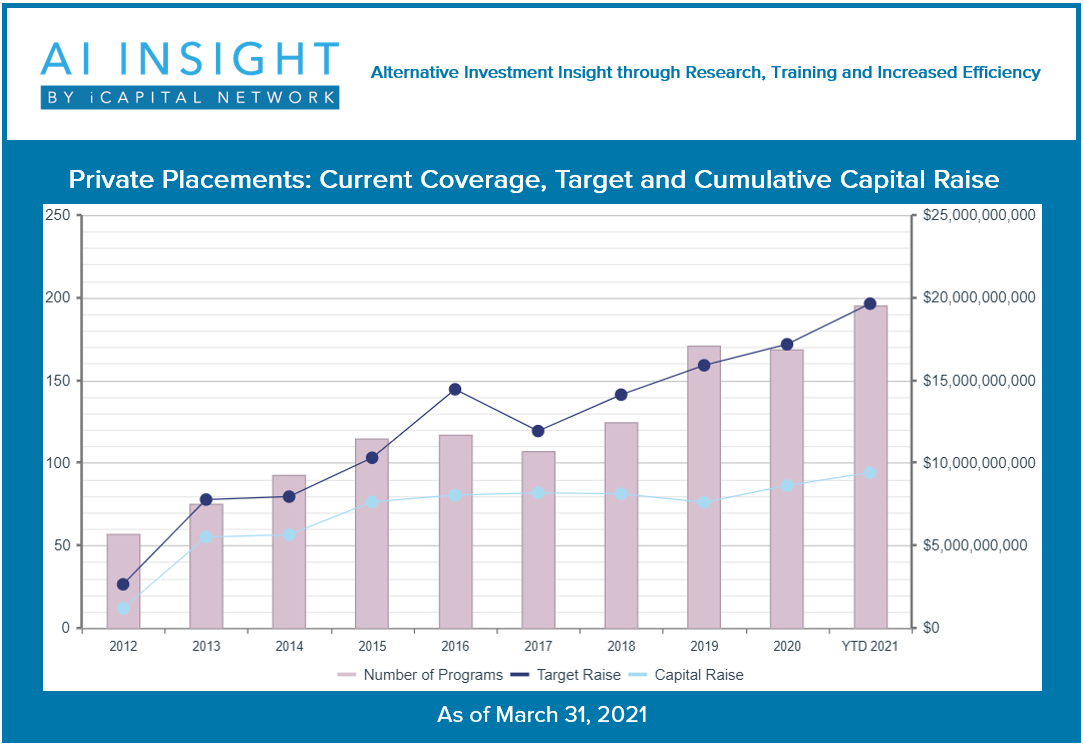

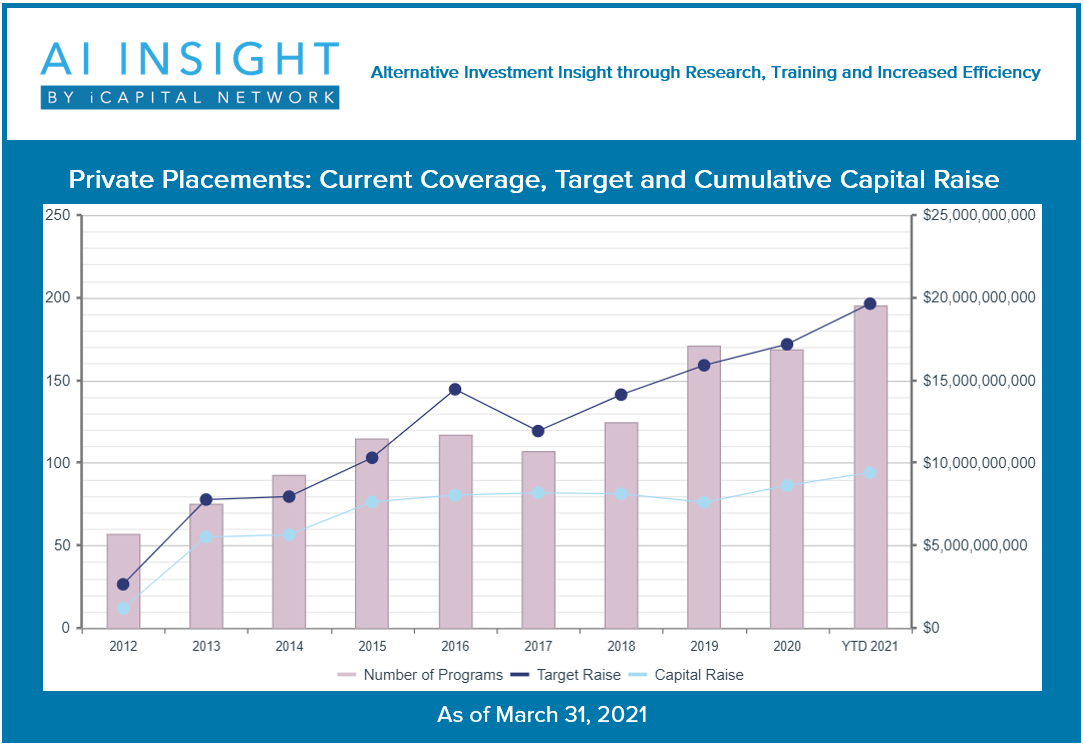

We recently released our March Private Placement Insights report. See the highlights from the report below, or if you are a Premium Reporting subscriber, log in now to see the entire report. If you don’t have access, you can request a free trial.

- Private placement fund formation picked up significantly in March, with 28 new funds added compared to 17 in February. 66 new funds have been added this year, putting us ahead in terms of new fund coverage (+38%) and aggregate target raise (+32%). Real estate categories have slowed other than 1031s, while our coverage of private equity/debt and hedge funds has increased.

- As of April 1st, AI Insight covers 195 private placements currently raising capital, with an aggregate target raise of $19.6 billion and an aggregate reported raise of $9.4 billion or 48% of target.

- Despite a slowdown recently, real estate-related funds, including 1031s, opportunity zones, and non-1031 real estate LLCs and LPs represent the largest component of our private placement coverage, at 71% of funds and 57% of target raise. Private equity/debt funds represent a relatively small amount of our coverage in terms of the number of funds at only 15%. However, our acquisition by iCapital is allowing us to enhance our coverage of private equity and debt with more coverage than ever before.

- In terms of our coverage by general objective, income is the largest component at 52% of funds, while growth and growth & income follow at 26% and 21%, respectively.

- The average size of the funds currently raising capital is $100.4 million, ranging from $1.8 million for a specified private equity offering to $3.0 billion for a sector specific private BDC.

- 76% of private placements we cover use the 506(b) exemption, 12% use 506(c) and 12% have not yet filed their Form D with the SEC.

- 17 private placements closed in March and 41 have closed in 2021. Funds that closed this year have been on the market for an average of 303 days. The funds that reported raised 92% of target. 98% met or exceeded their target and only two funds that closed raised less than half of their target.

- ON DECK: there are eight new private placements coming soon.

For illustrative purposes only.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, Non-Traded BDCs, Interval Funds, and Alternative Strategy Mutual Funds. Receive up to 24 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of March 31, 2021, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security offered by Institutional Capital Network, Inc. or its affiliates (together “iCapital Network”). Past performance is not indicative of future results. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors. An investment in an alternative investment entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. The information contained herein is subject to change and is also incomplete. This industry information and its importance is an opinion only and should not be relied upon as the only important information available. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed, and iCapital Network assumes no liability for the information provided.

Products offered by iCapital Network are typically private placements that are sold only to qualified clients of iCapital Network through transactions that are exempt from registration under the Securities Act of 1933 pursuant to Rule 506(b) of Regulation D promulgated thereunder (“Private Placements”). An investment in any product issued pursuant to a Private Placement, such as the funds described, entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. Further, such investments are not subject to the same levels of regulatory scrutiny as publicly listed investments, and as a result, investors may have access to significantly less information than they can access with respect to publicly listed investments. Prospective investors should also note that investments in the products described involve long lock-ups and do not provide investors with liquidity.

Securities may be offered through iCapital Securities, LLC, a registered broker dealer, member of FINRA and SIPC and subsidiary of Institutional Capital Network, Inc. (d/b/a iCapital Network). These registrations and memberships in no way imply that the SEC, FINRA or SIPC have endorsed the entities, products or services discussed herein. iCapital and iCapital Network are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2021 Institutional Capital Network, Inc. All Rights Reserved.

Monday, March 22nd, 2021 and is filed under Alternative Strategy Mutual Funds

What Happened

On Monday, February 22, 2021, the Infinity Q Diversified Alpha Fund (Fund) and its investment adviser, Infinity Q Capital Management (Infinity Q), sought and obtained an order from the Securities and Exchange Commission (SEC) permitting the Fund to suspend redemptions indefinitely. The Fund is expected to liquidate assets and distribute the proceeds to shareholders with the assistance of a third-party valuation service and the oversight of the SEC’s Division of Investment Management[i]. At this time, there is no estimate of when the liquidation and distribution will be completed. Until then, redemptions of Fund shares will remain suspended[ii].

Why It Happened

The Fund invested according to an alternative investment strategy that primarily used complex derivative instruments to derive intended exposures. According to the Fund’s most recent financial statement, this included correlation swaps, dispersion swaps, and variance swaps, among various other contracts. Adding to the complexity, a significant portion of these assets were categorized as Level 3 for which market prices are not readily available[iii]. For such securities, third-party services are required in estimating the fair value for purposes of calculating the Fund’s net asset value (NAV).

Based on information learned by the SEC and shared with Infinity Q, it was determined the Fund’s portfolio manager had been adjusting certain parameters within the third-party pricing model being used to estimate the fair value of the Fund’s swap contracts[iv]. Upon review, Infinity Q released the Fund’s portfolio manager, who is also the firm’s CIO and Founder, and determined that it was unable to value the current positions nor confirm the historical values of the Fund’s swap contracts. Presumably to avoid a “run on the bank” situation, which can lead to depressed prices and further losses for investors, Infinity Q sought the order from the SEC while it enlists the services of an independent valuation firm to calculate an accurate NAV for the fund.

Key Takeaways for Alternative Mutual Fund Investors

Despite the increased regulatory oversight of the mutual fund structure, relative to private funds and hedge funds, financial professionals and investors must exercise caution when using alternative mutual funds (AMFs). This is due to the increased complexity that may be present within the product structure including short positions, derivatives instruments, illiquid investments, and leverage. The complexity broadens the opportunity set of these funds allowing portfolio managers to pursue non-traditional investment strategies that may provide enhanced portfolio diversification, systematic risk reduction, and alternative sources of return. However, they may also increase risk and reduce transparency for investors, as demonstrated by the recent developments in the Infinity Q Diversified Alpha Fund. As such, consider the following:

- Is the strategy comprehendible? If upon reviewing the fund, you are unclear as to what the fund does and why, exercise extreme caution. An overly complicated strategy that cannot be explained is potentially a red flag. Furthermore, if the fund cannot be understood completely, nor can the inherent risks.

- Does the fund make heavy use of derivatives? This alone is not a red flag. Derivative instruments increase efficiencies in capital markets and provide increased opportunity for return[v]. However, they also increase the potential for investors bearing risk they do not fully understand. As such, if you are unable to determine why a fund is investing in the types of contracts they do, or what exposures they provide, exercise extreme caution.

- Alternatives require increased due diligence. The complexity of an AMF calls for increased due diligence[vi]. If research resources are constrained or limited, consider the use of third-party services for education and research surrounding alternative investments. Services may help drive efficiencies in research, improve understanding, and increase regulatory compliance.

iCapital Network[1]

AI Insight by iCapital Network currently offers an AMF platform designed to provide financial firms and advisors a comprehensive tool for research with a focus on education and application (versus an investment rating). The platform is a web-based, subscription service and consists of two main components specific to AMFs:

- Comprehensive fund-level research reports that focus on a qualitative understanding of team, strategy, and process.

- A training and education platform inclusive of an extensive AMF module and strategy specific modules.

The platform focuses on mutual funds with alternative investment strategies consistent with the hedge fund industry. Funds covered by the platform are portfolio oriented and will typically have a minimum 2-year track record and $200 million in AUM.

The platform currently covers the Fund on a limited basis. As part of our fund-level research, we have a tiered system that includes full and limited reviews. The former includes investment due diligence summarized within the report while the latter aggregates only the available public data. Considering the Fund’s developments, the platform is actively pursuing ways to improve our process including an increase in our screening parameters for limited reviews, enhancing the existing derivative contract reporting, and summarizing Level 3 assets within each report.

For more information on the platform, please contact AI Insight Customer Care at (877) 794-9448 ext. 710 or via email at customercare@aiinsight.com.

Infinity Q Diversified Alpha Fund

The Fund sought to generate positive absolute returns by combining risk management with diversified alpha strategies. Per the latest summary prospectus, the four primary strategies included Volatility, Equity Long Short, Relative Value, and Global Macro. The investable universe included global markets across equities, fixed income, commodities, credit, and foreign exchange.

________________________________

Endnotes

[1] Institutional Capital Network, Inc. and affiliates (herein “iCapital Network”)

[i] Securities and Exchange Commission. https://www.sec.gov/rules/ic/2021/ic-34198.pdf

[ii] Infinity Q Capital Management, LLC. http://www.infinityqfunds.com/

[iii] Financial Accounting Standard 157 (FAS 157). https://www.investopedia.com/terms/f/fasb_157.asp

[iv] Securities and Exchange Commission. https://www.sec.gov/rules/ic/2021/ic-34198.pdf

[v] The Economics of Derivatives. https://www.nber.org/digest/jan05/economics-derivatives

[vi] FINRA Investor Alert. https://www.finra.org/investors/alerts/alternative-funds-are-not-your-typical-mutual-funds

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security offered by Institutional Capital Network, Inc. or its affiliates (together “iCapital Network”). Past performance is not indicative of future results. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors. An investment in an alternative investment entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. The information contained herein is subject to change and is also incomplete. This industry information and its importance is an opinion only and should not be relied upon as the only important information available. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed, and iCapital Network assumes no liability for the information provided.

This material is confidential and the property of iCapital Network, and may not be shared with any party other than the intended recipient or his or her professional advisors. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital Network.

Products offered by iCapital Network are typically private placements that are sold only to qualified clients of iCapital Network through transactions that are exempt from registration under the Securities Act of 1933 pursuant to Rule 506(b) of Regulation D promulgated thereunder (“Private Placements”). An investment in any product issued pursuant to a Private Placement, such as the funds described, entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. Further, such investments are not subject to the same levels of regulatory scrutiny as publicly listed investments, and as a result, investors may have access to significantly less information than they can access with respect to publicly listed investments. Prospective investors should also note that investments in the products described involve long lock-ups and do not provide investors with liquidity.

Securities may be offered through iCapital Securities, LLC, a registered broker dealer, member of FINRA and SIPC and subsidiary of Institutional Capital Network, Inc. (d/b/a iCapital Network). These registrations and memberships in no way imply that the SEC, FINRA or SIPC have endorsed the entities, products or services discussed herein. iCapital and iCapital Network are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2021 Institutional Capital Network, Inc. All Rights Reserved.

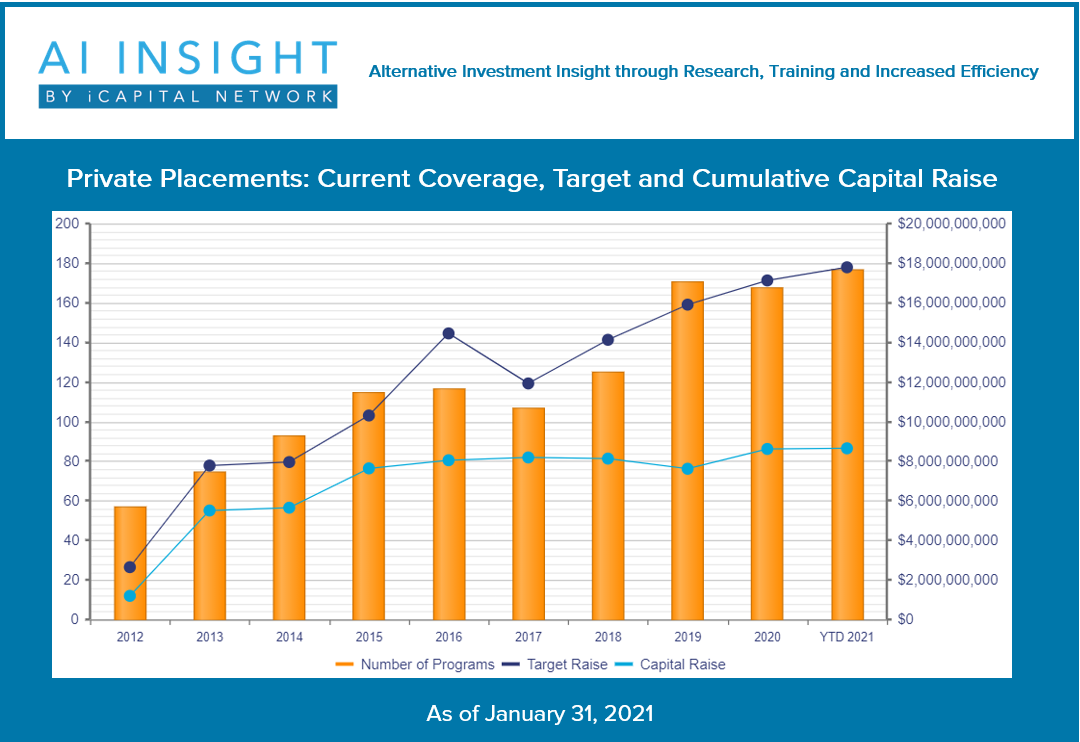

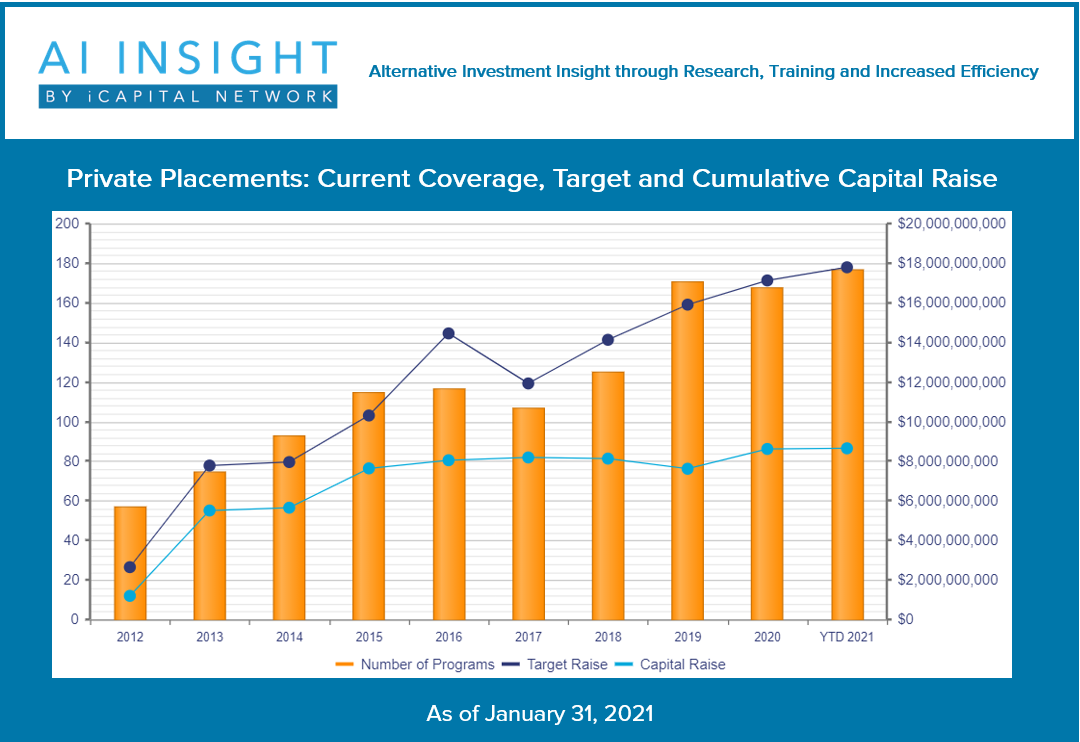

Friday, February 19th, 2021 and is filed under Industry Reporting

We recently released our January Private Placement Insights report. See the highlights from the report below, or if you are a Premium Reporting subscriber, log in now to see the entire report. If you don’t have access, you can request a free trial.

- While there was little to no activity in several categories in January, real estate and private equity/debt funds rallied to bring year-over-year new fund coverage and aggregate target raise up significantly (24% and 62%, respectively).

- As of February 1st, AI Insight covers 177 private placements currently raising capital, with an aggregate target raise of $17.8 billion and an aggregate reported raise of $8.6 billion or 49% of target.

- Real estate-related funds, including 1031s, opportunity zones, and non-1031 real estate LLCs and LPs represent the largest component of our private placement coverage, at 75% of funds and 59% of target raise. Private equity/debt funds represent a relatively small amount of our coverage in terms of the number of funds at only 11%, but tend to be larger and represent 33% of aggregate target raise.

- In terms of our coverage by general objective, income is the largest component at 52% of funds, while growth and growth & income follow at 30% and 16%, respectively.

- The average size of the funds currently raising capital is $100.5 million, ranging from $1.9 million for a preferred offering to $3.0 billion for a sector specific private equity/debt fund.

- 78% of private placements we cover use the 506(b) exemption, 12% use 506(c) and 10% have not yet filed their Form D with the SEC.

- 14 private placements closed in January, having been on the market for an average of 300 days. The 12 funds that reported a raise reported that they raised 73% of target. 64% met or exceeded their target and only one raised less than half of its target.

- ON DECK: as of February 1st, there were eleven new private placements coming soon.

For illustrative purposes only.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, Non-Traded BDCs, Interval Funds, and Alternative Strategy Mutual Funds. Receive up to 24 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of January 31, 2021, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security offered by Institutional Capital Network, Inc. or its affiliates (together “iCapital Network”). Past performance is not indicative of future results. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors. An investment in an alternative investment entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. The information contained herein is subject to change and is also incomplete. This industry information and its importance is an opinion only and should not be relied upon as the only important information available. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed, and iCapital Network assumes no liability for the information provided.

Products offered by iCapital Network are typically private placements that are sold only to qualified clients of iCapital Network through transactions that are exempt from registration under the Securities Act of 1933 pursuant to Rule 506(b) of Regulation D promulgated thereunder (“Private Placements”). An investment in any product issued pursuant to a Private Placement, such as the funds described, entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. Further, such investments are not subject to the same levels of regulatory scrutiny as publicly listed investments, and as a result, investors may have access to significantly less information than they can access with respect to publicly listed investments. Prospective investors should also note that investments in the products described involve long lock-ups and do not provide investors with liquidity.

Securities may be offered through iCapital Securities, LLC, a registered broker dealer, member of FINRA and SIPC and subsidiary of Institutional Capital Network, Inc. (d/b/a iCapital Network). These registrations and memberships in no way imply that the SEC, FINRA or SIPC have endorsed the entities, products or services discussed herein. iCapital and iCapital Network are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2021 Institutional Capital Network, Inc. All Rights Reserved.

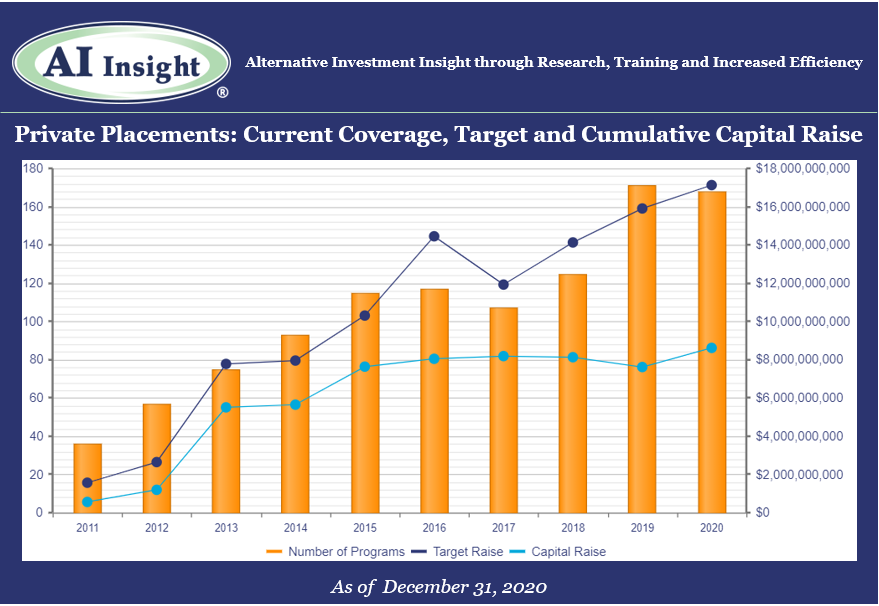

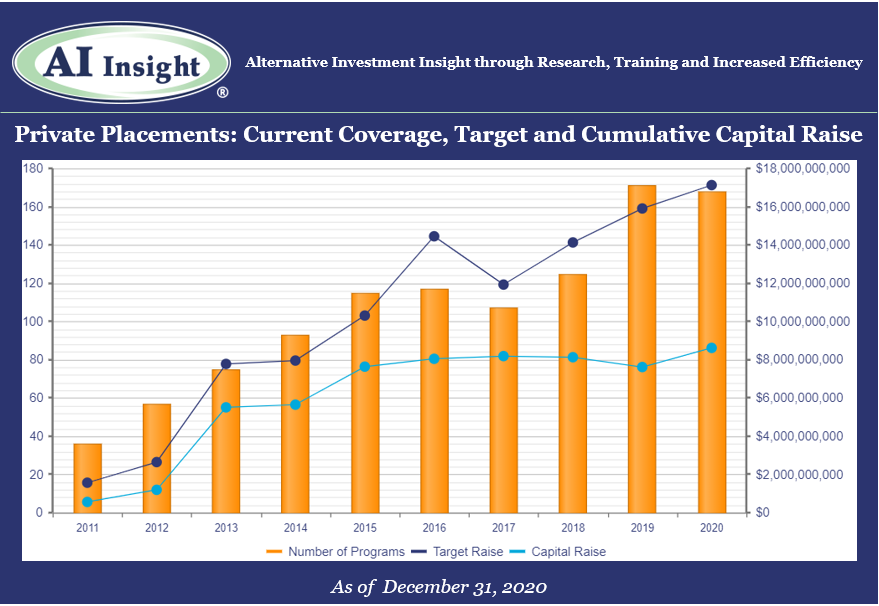

Friday, January 8th, 2021 and is filed under Industry Reporting

We recently released our December Private Placement Insights report. See the highlights from the report below, or if you are a Premium Reporting subscriber, log in now to see the entire report. If you don’t have access, you can request a free trial.

- Despite the COVID-19 related slowdown in Q2, AI Insight’s private placement coverage ended the year nearly on par with the record-setting 2019. The number of new private placements added to our coverage during the year was 2 fewer than 2019 (-1.00%), while aggregate target raise of $9.0 billion was roughly 8% less than the target in 2019. The 199 funds added in 2020 were offered by 75 separate sponsors.

- As of January 1st, AI Insight covers 167 private placements currently raising capital, with an aggregate target raise of $17.1 billion and an aggregate reported raise of $8.6 billion or 50% of target.

- Real estate-related funds, including 1031s, opportunity zones, and non-1031 real estate LLCs and LPs represent the largest component of our private placement coverage, at 75% of funds and 60% of target raise. Private equity/debt funds represent a relatively small amount of our coverage in terms of the number of funds at only 10%, but tend to be larger and represent 32% of aggregate target raise.

- In terms of our coverage by general objective, income is the largest component at 52% of funds, while growth and growth & income follow at 28% and 18%, respectively.

- The average size of the funds currently raising capital is $102.3 million, ranging from $1.9 million for a preferred offering to $3.0 billion for a sector specific private equity/debt fund.

- 76% of private placements we cover use the 506(b) exemption, 13% use 506(c) and 12% have not yet filed their Form D with the SEC.

- 55 private placements closed in December (higher than average primarily due to the closing of all open conservation funds), with roughly 66% of those reporting a raise meeting or exceeding their target raise. 209 private placements closed in full year 2020, having been on the market for an average of 299 days and reporting they raised 71% of their target on average (of those that reported). 70% met or exceeded targets, and only 12% were able to raise less than half of their target. 11 funds did not report a raise.

- Seven private placements suspended offerings and one terminated due to uncertainties related to COVID-19.

- ON DECK: as of January 1st, there were seven new private placements coming soon.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, Non-Traded BDCs, Interval Funds, and Alternative Strategy Mutual Funds. Receive up to 24 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of December 31, 2020, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose. Copyright ©2021 AI Insight. All Rights Reserved.

Tuesday, December 22nd, 2020 and is filed under AI Insight News

AI Insight CEO Sherri Cooke discusses her key reflections for 2020 including how alternative investments played an important role in portfolios and the impacts of Reg BI. She also shares what’s anticipated in 2021. Read the narrative below or listen to the podcast here.

Sherri formed AI Insight in 2005 with the primary goal of providing the financial planning community with a more efficient and consistent way to access factual information on alternative investment programs – and from that vision the AI Insight database was born.

Q: What are some of the key reflections you have about 2020 and some points of interest for the coming year?

SC: I would say as a ADISA Board member, I was fortunate to be able to spend quite a bit of time this year collaborating with others in the alternative investment industry focusing on some of the things we can do to make the industry better – and to increase the awareness and understanding of these products within a growing audience. I believe we all have to work together to bring this space to a whole new level. Also, as Reg BI requirements continue, we’re looking at ways to partner with compliance and technology workflow companies that are helping to support these needed processes. We’re also looking to connect with other companies – both inside and outside the traditional alternatives space to further increase consistency and transparency in the industry with an ultimate goal of making it easier to conduct alts business.

Q: How do you think alternative investments played an important role in portfolios this past year, especially given the pandemic?

SC: We’re always looking for ways to give more to people – who are of course qualified – access to alternative investments to help them really diversify their portfolio in a meaningful way. Our belief is that a person isn’t fully diversified if all of their underlying investments are either in some way tied to the markets or are invested in a fixed income security – which is effectively still tied to the market.

Despite the pandemic – and in some cases as a result of – there are a lot of really solid opportunities to invest in real assets, interesting investment structures, and institutionally supported opportunities through alternative investments that really provide true diversification.

That said, alternatives can certainly be complex and they need to be factually understood and appropriately sold. This industry really needs to educate financial professionals and investors in so many different ways. One of those has to be around creating realistic expectations about what these investments are intended to bring to a diversified investment portfolio…and what they are not. Stocks lose value all the time and there will be alts that don’t perform. As an industry, we really need to do our very best to ensure that these products are properly sold and positioned within client portfolios. And – as with all investments – we support conducting the best possible research and diligence to allow firms and advisors to select best of class – and help the vested financial firms and producers drive product sponsors toward best of class practices.

Q: We know that compliance is often an issue for advisors in considering alternative investments – and regulatory scrutiny continues to increase. The SEC’s Regulation Best Interest implementation took place on June 30. How does AI Insight help streamline Reg BI requirements?

SC: Compliance is one of the things that motivated me to create AI Insight in the first place. I wanted to build capabilities to facilitate due diligence and proper compliance along with education and documentation of these efforts when selling complex products – those products that the regulators have called out as needing heightened supervision or training.

From an audit perspective, we’ve found in any situation of which we’re aware with our clients, if a firm has stayed up-to-date on the requirements around selling different types of investments – and makes sure everyone involved is aware of their obligations, adheres to the processes, and documents their efforts – then the regulators are generally satisfied. If you fail to make these efforts up front and you’re inconsistent in how you conduct your business from a compliance perspective….you’re just leaving yourself open to trouble.

Reg BI – within the BD community – and I think even though the fiduciary standard has always applied RIA space – we’re going see a whole new layer of extra scrutiny in this regard. The processes that have been central to our platform for years can help support Reg BI requirements and help financial firms and professionals demonstrate the “good faith and reasonable efforts” that Reg BI requires on an ongoing basis. Specifically, we’ve created a comprehensive Reg BI Guide that steps through the Compliance and Care Obligations and correlates the AI Insight support resource to that particular SEC requirement. Again, this is just another way that we help to create efficient and consistent educational and compliance workflows that can help firms at both the product and the firm level.

Q: What is your focus for 2021?

SC: From a business owner’s perspective, ensuring that our team and our product continues to maintain consistent integrity of value and exceptional service; this is the backbone of our business – and making sure that our AI Insight team is challenged and fulfilled in their roles within our company.

From an industry perspective – we believe that there is a tremendous amount of value for advisors to differentiate themselves and bring really great opportunities through the thoughtful and diligent understanding of alternative products. We provide this value by building and bringing together our network of broker-dealers, advisors, RIAs, alternative investment firms and industry partners. Therefore, as in past years, I am always grateful for how far we’ve been able to come and to everyone who has helped us be successful in our efforts to support this industry – and I look forward to working with all of our business partners to explore new possibilities and find what more we can bring to the table for our customers in the new year.

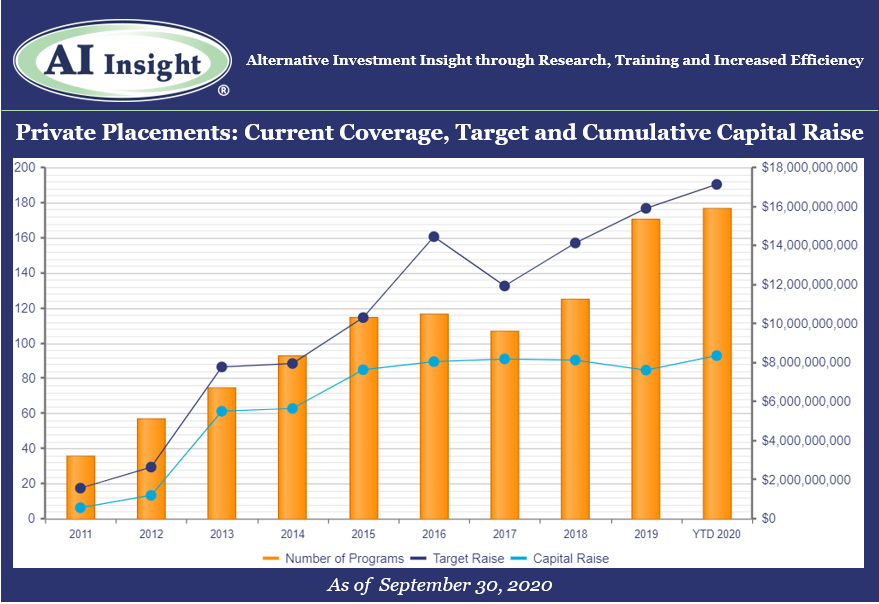

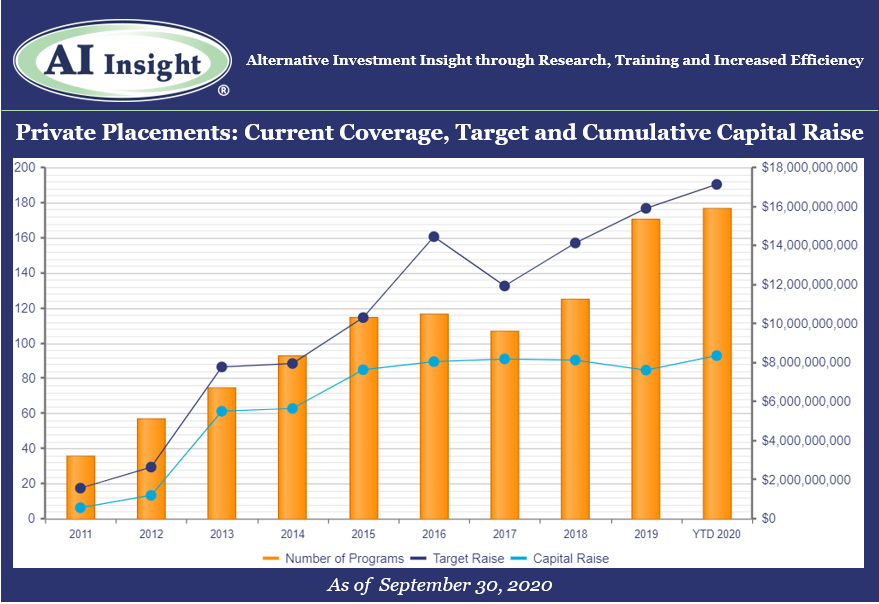

Tuesday, October 6th, 2020 and is filed under Industry Reporting

We recently released our September Private Placement Insights report. See the highlights from the report below, or if you are a Premium Reporting subscriber, log in now to see the entire report. If you don’t have access, you can request a free trial.

- Private placement fund activity ramped up in September, with more funds added to our coverage in the month than any since March. 19 new funds were added in September, led by 1031s, energy, and non-1031 real estate.

- As of October 1st, AI Insight covers 177 private placements currently raising capital, with an aggregate target raise of $17.1 billion and an aggregate reported raise of $8.4 billion or 49% of target.

- Real estate-related funds, including 1031s, opportunity zones, and non-1031 real estate LLCs and LPs represent the largest component of our private placement coverage, at 72% of funds and 60% of target raise. Private equity/debt funds represent a relatively small amount of our coverage in terms of the number of funds at only 9%, but tend to be larger and represent 27% of aggregate target raise.

- In terms of our coverage by general objective, income is the largest component at 52% of funds, while growth and growth & income follow at 29% and 18%, respectively.

- The average size of the funds currently raising capital is $96.8 million, ranging from $3.5 million for a single asset real estate fund to $2.8 billion for a sector specific private equity/debt fund.

- 76% of private placements we cover use the 506(b) exemption, 15% use 506(c) and 10% have not yet filed their Form D with the SEC.

- 11 private placements closed in September, with all either meeting or exceeding their target raise. 120 funds have closed year-to-date, having been on the market for an average of 333 days and reporting they raised 62% of their target on average.

- Seven private placements suspended offerings and one terminated due to uncertainties related to Covid-19.

- ON DECK: as of October 1st, there were seven new private placements coming soon.

- Listen to the companion podcast for this blog.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, Non-Traded BDCs, Interval Funds, and Alternative Strategy Mutual Funds. Receive up to 24 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of September 30, 2020, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose. Copyright ©2020 AI Insight. All Rights Reserved.