Tuesday, November 3rd, 2020 and is filed under AI Insight News

NASAA’s Reg BI Implementation Committee conducted an examination initiative to evaluate key industry changes as financial firms seek to comply with the SEC’s Regulation Best Interest requirements.

NASAA – Phase 1 National Exam Initiative 2020

NASAA recently published a report on Phase One of this initiative. The top 10 priority areas included:

- Variations in the types of products sold

- Policies, procedures, and practices related to the sale of alternative investments or complex products types

- Cost comparison due diligence and disclosure practices

NASAA’s report states, “[Prior to Reg BI], few firms had policies and procedures governing specific product sales (26%) or used tools to assist agents/representatives and investors in comparing investment opportunities (19%).

|

Top 10 BD Products |

Top 10 IA Products |

| 1. |

Mutual funds (66%) |

Mutual funds (77%) |

| 2. |

Equities (60%) |

Equities (77%) |

| 3. |

Debt/Fixed income (57%) |

Debt/Fixed income (67%) |

| 4. |

Standard ETFs (52%) |

Standard ETFs (67%) |

| 5. |

Municipal funds (50%) |

Listed REITs (39%) |

| 6. |

Variable annuities (49%) |

No-load products (37%) |

| 7. |

Listed REITs (44%) |

Municipal funds (33%) |

| 8. |

Options (44%) |

Options (23%) |

| 9. |

No-load products (38%) |

Variable annuities (15%) |

| 10. |

UITs (37%) |

Leveraged- or inverse-ETFs (15%) |

Chart Source: NASAA Reg BI National Examination Initiative Phase One

Sales of complex products

“NASAA has focused much of its Reg BI examination focus on complex and high-risk products, namely, private securities, variable annuities, non-traded REITs, and leverage- or inverse-ETFs, due to investor confusion and harm emanating from these products.”

| Products |

All firms combined |

BD |

IA |

| Private securities |

7% |

21% |

3% |

| Variable annuities |

14% |

42% |

5% |

| Non-traded REITs |

6% |

18% |

2% |

| Leveraged- or Inverse-ETFs |

9% |

15% |

7% |

Chart Source: NASAA Reg BI National Examination Initiative Phase One

What’s Next?

NASAA will conduct a second examination initiative in 2021 to continue their evaluation of key industry changes.

Resources

Monday, July 6th, 2020 and is filed under Industry Reporting

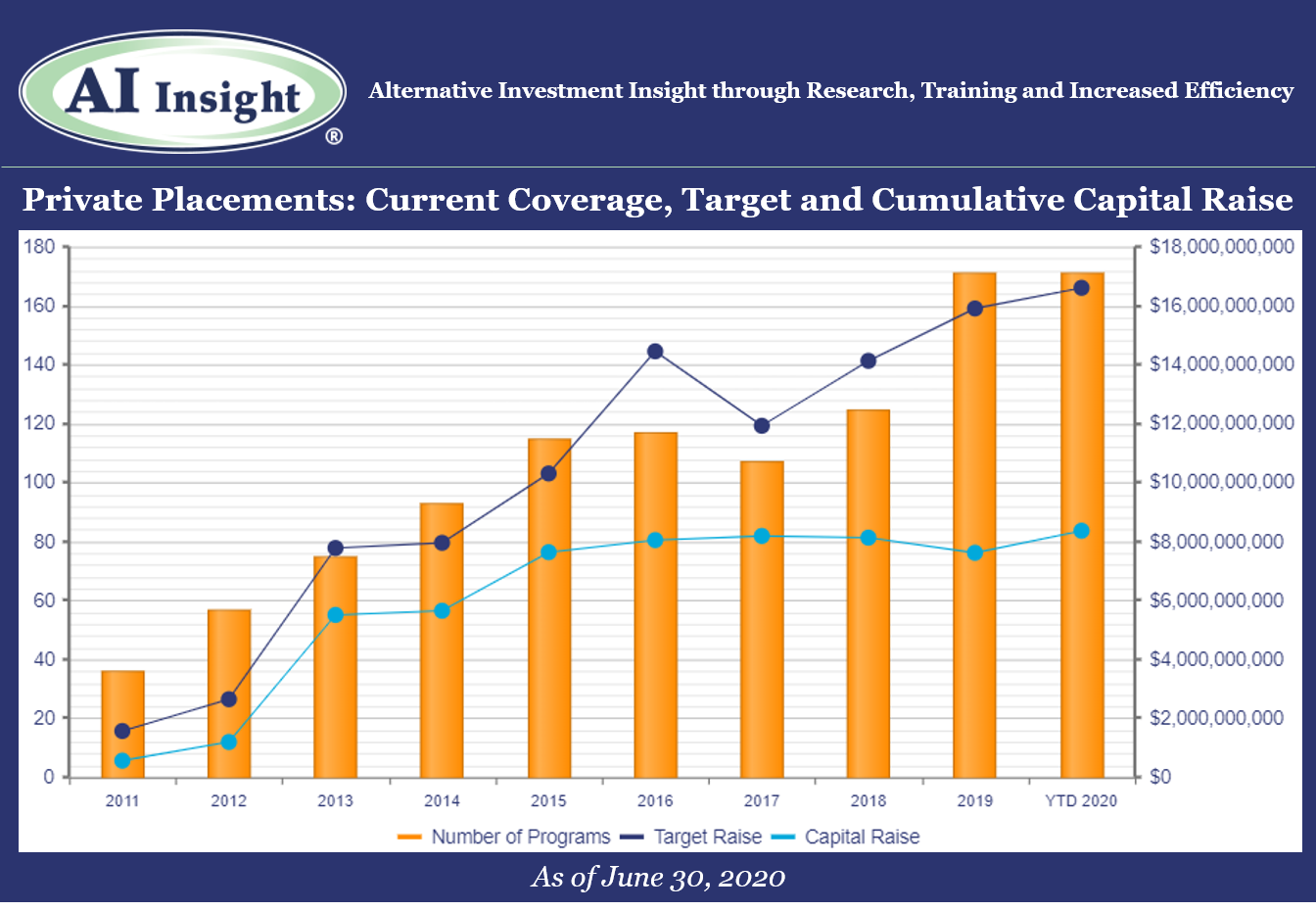

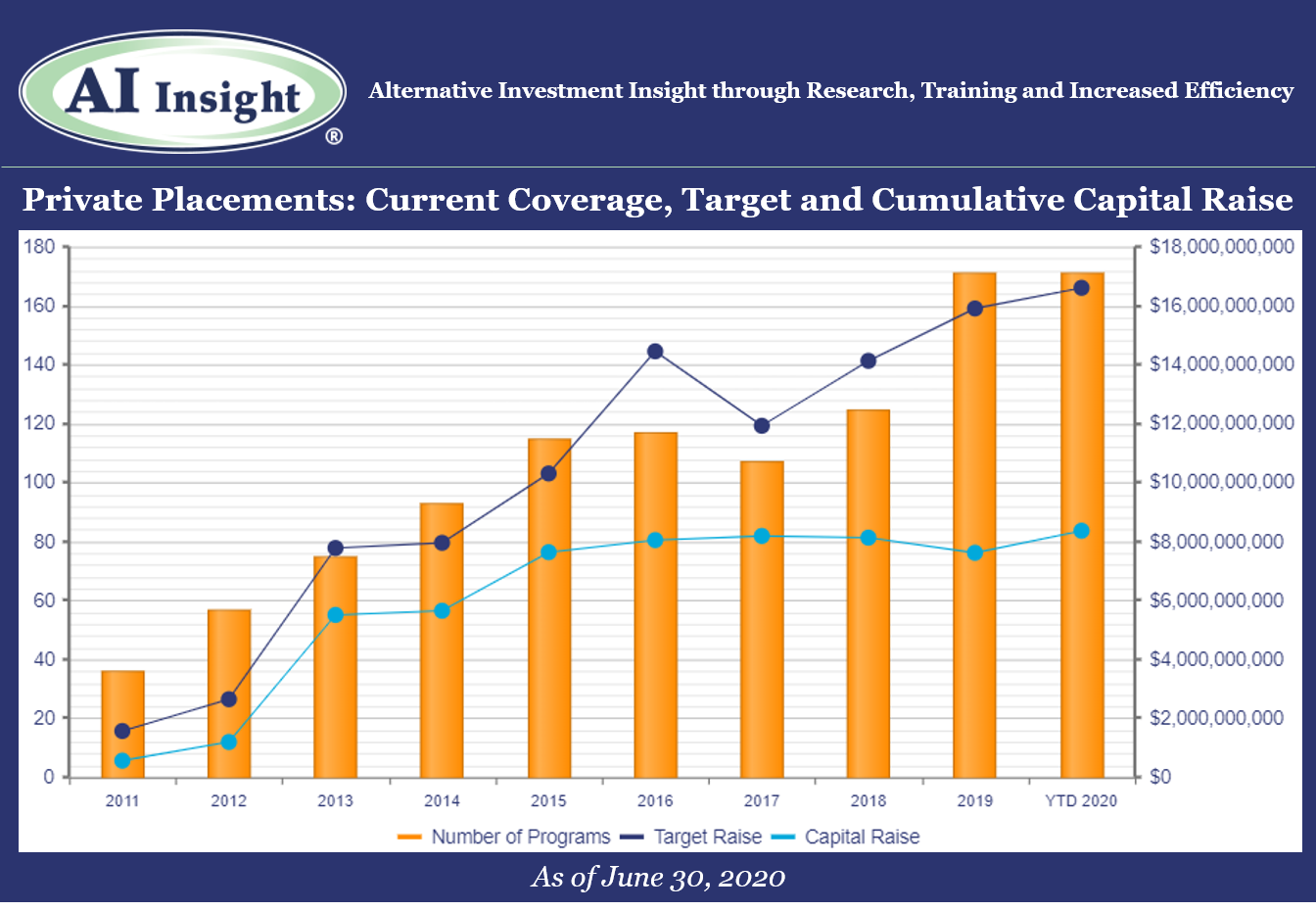

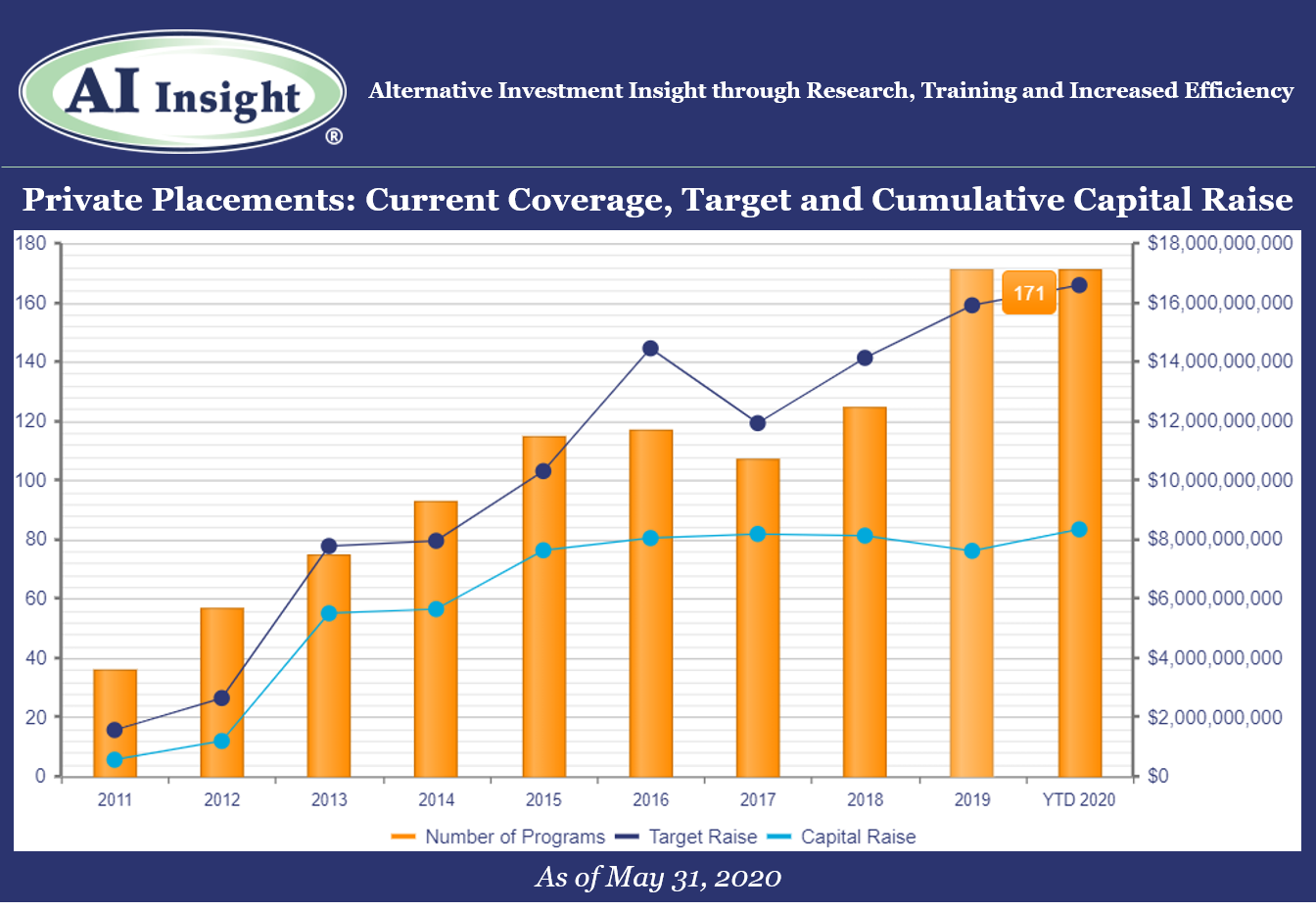

We recently released our June Private Placement Insights report. See the highlights from the report below, or if you are a Premium Reporting subscriber, log in now to see the entire report. If you don’t have access, you can request a free trial.

- After a slow couple of months, private placement fund formation accelerated in June, led by stronger activity in 1031s and the addition of distressed funds in the wake of the COVID-19 market disruption.

- As of July 1st, AI Insight covers 171 private placements currently raising capital, with an aggregate target raise of $16.6 billion and an aggregate reported raise of $8.4 billion or 51% of target. The average size of the current funds is $97.1 million, ranging from $3.5 million for a single asset real estate fund to $2.7 billion for a sector specific private equity/debt fund.

- 13 private placements closed in June, having raised approximately 65% of their target and having been on the market for an average of 408 days. 88 funds have closed in 2020, having raised 67% of their target.

- Five private placements suspended offerings and one terminated due to uncertainties related to COVID-19.

- ON DECK: as of July 1st, there were three new private placements coming soon, all opportunity zone funds (QOZs) as the category ramps back up with further regulatory guidance.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, BDCs, Interval Funds, and Alternative Mutual Funds. Receive up to 24 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of June 30, 2020, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose. Copyright ©2020 AI Insight. All Rights Reserved.

Monday, June 8th, 2020 and is filed under Industry Reporting

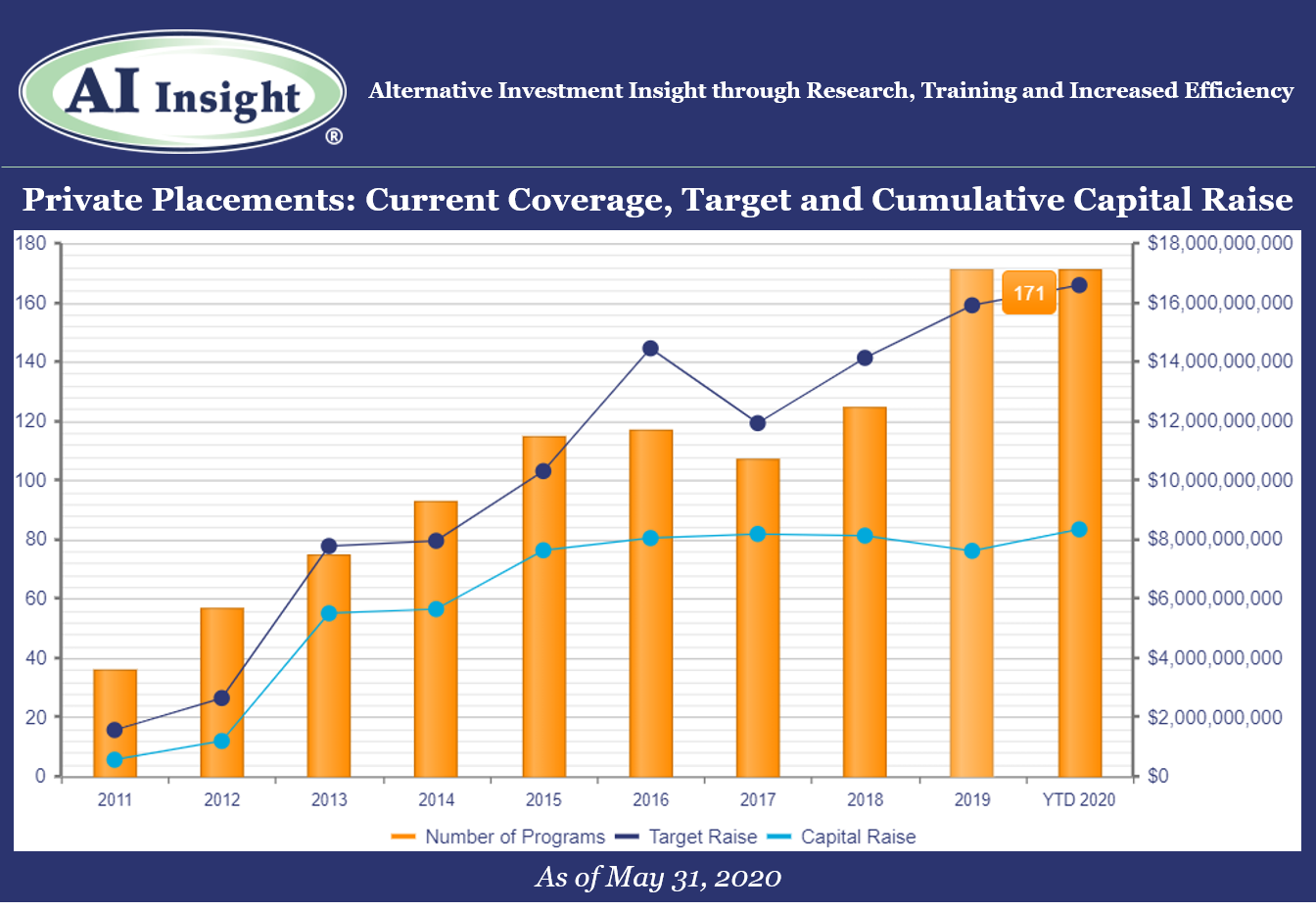

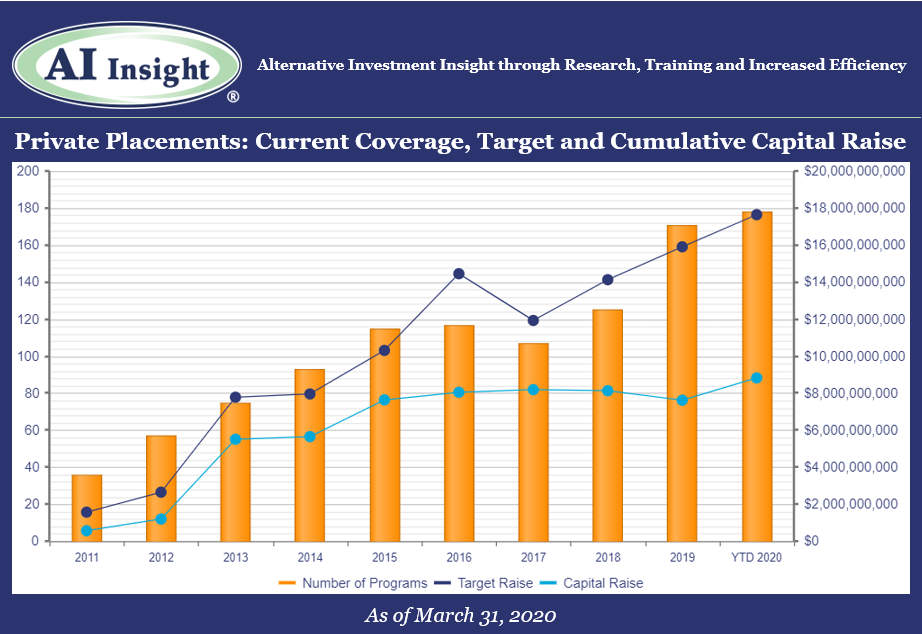

We recently released our May Private Placement Insights report. See the highlights from the report below, or if you are a Premium Reporting subscriber, log in now to see the entire report. If you don’t have access, you can request a free trial.

- Private placement fund formation has slowed in the wake of COVID-19. Eight new private placements were added to our coverage in May, roughly half of the monthly level we’ve seen on average over the last few years. The first few months of 2020 were strong but with the slowdown in May, we are now flat in terms of new funds added to over coverage year-over-year and down modestly in aggregate target raise.

- The slowdown was most visible in the 1031 category, where only four new funds were added to our coverage in May compared to well over double digit additions for the last several years. This may be partially due to a slowdown in real estate transactions overall as well as a lack of confidence in valuations. Also, fewer highly appreciated properties are being sold right now, which reduces the demand for 1031 exchanges at least in the near-term. The consensus in the industry is that demand will accelerate once transaction activity resumes and valuations are more reliable.

- We are seeing more activity this year in preferred securities and private equity/debt funds, and we are also starting to see sector-specific opportunistic funds ramp up in the wake of the COVID-19 market disruption. Opportunity zone (QOZ) funds, which had paused for several months, are back on track with three in the queue to be added to our coverage soon. Recent events around the US could continue to highlight the importance of QOZ strategies.

- As of June 1st, AI Insight covers 171 private placements currently raising capital, with an aggregate target raise of $16.6 billion and an aggregate reported raise of $8.3 billion or 50% of target. The average size of the current funds is $97.0 million, ranging from $3.5 million for a single asset real estate fund to $2.7 billion for a sector specific private equity/debt fund.

- 14 private placements closed in May, having raised approximately 52% of their target and having been on the market for an average of 336 days.

- Five private placements suspended offerings due to uncertainties related to COVID-19.

- ON DECK: as of June 1st, there were four new private placements coming soon.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, BDCs, Closed-End Funds, and Alternative Mutual Funds. Receive up to 24 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of May 31, 2020, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose. Copyright ©2020 AI Insight. All Rights Reserved.

Tuesday, May 5th, 2020 and is filed under AI Insight News

AI Insight’s Mike Kell, senior vice president – business development and program management, recently participated in an ADISA panel discussion regarding investment considerations during COVID-19. Panelists included moderator Lilian Morvay, principal and founder of Independent Broker Dealer Consortium, LLC (“IBDC”), along with Michael Schwartzberg, founding partner, Winget Spadafora & Schwartzberg; Gary Saretsky, founding partner, Saretsky Hart Michaels + Gould; Sheri Pontolillo, founder and director of InterWeb Insurance; and Bob Valker, managing director, Capital Forensics.

Following are some of the highlights of this discussion, including several helpful and actionable risk management best practices.

- Arbitration claims increase in times of market dislocation. There’s no reason to think this time would be any different so its important to be prepared.

- According to a recent Financial Advisor article, the Pandemic has driven 1 in 4 Americans to reach out to a financial advisor for the first time.

- Being proactive with existing clients is especially important but there’s also a good opportunity for prospective clients as well to protect your own business.

- Support your clients and your business by connecting people. For example, bring together a family you work with to put together a plan to support a specific cause or community need. This may allow you to talk with younger relatives, parents, or heirs. Neighbors may want to come together.

- It’s a chance to lead and connect yourself with people around you. Positive for the community and business.

- Best practices for market dislocations: Review all alternative products in your book and:

- Understand exposures.

- Take a hard look to ensure the proper due diligence was and is being done on an ongoing basis.

- Documenting the due diligence.

- Be aware of potential areas of risk (triage your risk) including but not limited to:

- Concentration

- Elderly clients with exposure to alts

- Review the investment rationale, objectives, risk tolerance, paperwork, and ensure documentation is in place for all alternative investment decisions. Ensure that actions are backed up with verifiable data.

- Ensure that you are taking the responsibility for analyzing your own business and knowing your risk. Don’t wait for attorney. Start now.

- With more remote work, review your E&O insurance to ensure you are fully covered. Determine if cyber-security coverage is needed and that you have the appropriate technology in place.

- Effective communication is critical, especially in times like this where there is fear and anxiety. Respond to the emotional concerns. Three suggestions for communications:

- Get on the phone, call clients, do not avoid this. It’s not fun but silence will cause feelings to magnify. Acknowledgement helps to diffuse anxiety. In many ways, this market dislocation helps to highlight the benefit of alternatives and takes the argument against them away. It’s tougher to highlight alternatives when all market indexes are outperforming them. That’s not the case now.

- Don’t wait to communicate, do it now, immediately.

- Do it right. Listen to concerns but listen to what is not said. This is an amazing opportunity to really flesh out the true risk tolerance of clients and bring it to light. It might be painful, but it is helpful.

- Phone calls are the best approach for communicating.

- Texting is mostly prohibited and e-mail can be misinterpreted.

- Phone calls are typically the best approach for communicating, and then confirm in writing or e-mail something verifiable from the conversation.

- Firms may still have a small pocket of exposure in recent sales (ie: those who purchased them just prior to suspension), but big picture down the road this will be helpful.

- Firms should have a documented rationale for suspensions or other offering actions.

Click here to watch the full replay.

Wednesday, April 8th, 2020 and is filed under Industry Reporting

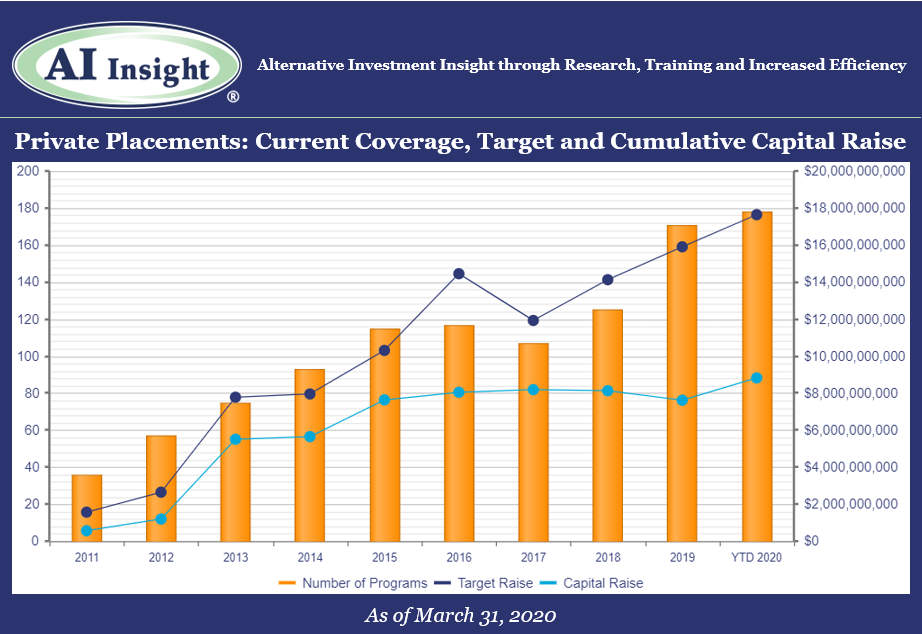

We recently released our March Private Placement Insights. See the highlights from the report below, or if you are a Premium Reporting subscriber, log in now to see the entire report. If you don’t have access, you can request a free trial.

- 15 new private placements were added to our coverage in March, just below the last couple of months but still well over last year’s levels. The industry continues to be led by real estate focused categories including 1031s and real estate LPs and LLCs.

- As of April 1st, AI Insight covers 178 private placements currently raising capital, with an aggregate target raise of $17.6 billion and an aggregate reported raise of $8.8 billion or 50% of target. The average size of the current funds is $99.1 million, ranging from $3.5 million for a single asset real estate fund to $2.5 billion for a sector specific private equity/debt fund.

- 13 private placements closed in March, having raised approximately 70% of their target and having been on the market for an average of 311 days.

- ON DECK: as of April 1st, there were five new private placements coming soon.

Market Update: COVID-19 Impact on Private Placement Markets

On March 11, 2020, the World Health Organization (the WHO) declared the COVID-19 coronavirus a global pandemic. Trade and travel have since grind to a halt with travel restrictions and stay at home orders issued across the globe. The US and global economies are in recession territory, with GDP in the United States now forecast to decline by 0.2% instead of expanding by 2.0% in 2020 as a result of COVID-19. While the full impact of the global pandemic may take years to determine, the one thing we do know is that it will have a significant impact on all aspects of investing both in the public and private markets. Transactions are slowing across the private placement categories and valuations, which require transactions, may be less reliable or difficult to obtain.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, BDCs, Closed-End Funds, and Alternative Mutual Funds. Receive up to 24 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of March 31, 2020, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose. Copyright ©2020 AI Insight. All Rights Reserved.

Friday, March 27th, 2020 and is filed under AI Insight News

|

Your daily routine may be in disarray, but it’s business as usual at AI Insight since we have been successfully operating as virtual company for many years. As always, we’re here to help you with your AI Insight needs and anything else that might help you when working remotely.

To be successful working remotely, you need a strategy, focus and a little fun. We’ve compiled some resources that we’ve used in practice to help you accomplish this. |

Get Started

It’s important to designate a specific area that you use solely as your workspace to establish your “work zone” not only for your benefit, but for family members who are at home with you. Traveling around your house with your laptop or working where you sleep invites interruption.

Stay Focused

It’s easy to become distracted by the TV, social media or the pile of dishes in the sink. Creating a schedule for yourself – including breaks and lunchtime as you would at the office – can help you concentrate on your work. Setting a specific work schedule will also help you set expectations for other family members who are at home and help you keep a healthy work-life balance.

Industry Resources

You may be used to attending industry conferences or face-to-face group meetings, which have been postponed or cancelled. AI Insight created a central resource to help you stay connected with industry groups such as ADISA, IPA, FINRA and more. Check back frequently as we will continue to post industry webinar events happening in lieu of conferences.

Technology Resources

Having the right equipment is essential to working from home. But, knowing how to make the most of technology tools can be challenging.

- Zoom is a remote video conferencing and web conferencing service.

- Microsoft Teams is a unified communication and collaboration platform that combines workplace chat, video meetings, file storage, and application integration.

Stay Connected

We all know that miscommunication can happen over email and text. Convey your tone with a phone call instead of email when you can. Even better, turn on your video during online meetings to express your body language. Remember to test out your video feature before you use it publicly, so you can check your background surroundings and test your microphone.

This is also a good opportunity to get to know your co-workers on a personal level. At AI Insight, we’ve created a social channel within our Microsoft Teams platform to talk about topics unrelated to work and share photos on occasions like Halloween and St. Patrick’s Day. This helps us get to know each other better and stay connected.

Be Mindful

We’ve created a “Get Up & Move” rewards program at AI Insight to encourage everyone to walk away from their computer once an hour. We also host quarterly Lunch & Learns to help our team stay healthy in mind and body such as chair yoga sessions and meditation practices. Taking breaks can boost productivity and rejuvenate you when motivation drops.

Contact Us

From everyone at AI Insight, we want you to be safe and healthy. Again, we’ve been incorporating these practices for many years. If there’s something we can help you with on any of these topics, please reach out to us Monday through Friday from 8:00 a.m. to 6:00 p.m. at 877-794-9448 ext. 710 or any time at customercare@aiinsight.com.

Thursday, March 12th, 2020 and is filed under Industry Reporting

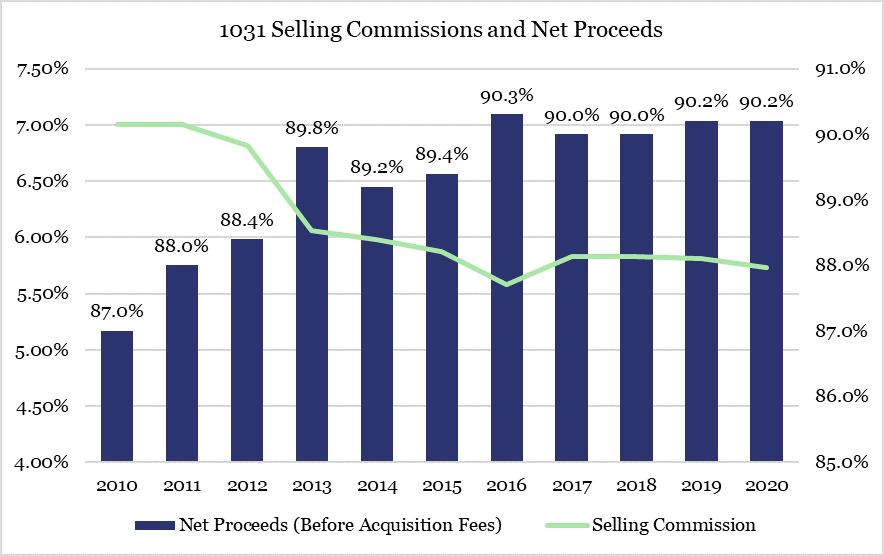

AI Insight currently covers 72 1031 exchange programs and 58 non-1031 real estate private placements. In our February 2020 Private Placement Industry Report, it shows that both categories are growing again in 2020, with 1031s continuing their record growth from the last couple of years.

We wanted to look at fees within both categories, from a current standpoint – what do fees look like now, and from a historical standpoint – have up-front selling commissions declined and have net proceeds increased?

Current Fees

To look at current fees, we utilized our Fee and Expense Report which compares fees on similar programs within our coverage universe. This report updates as programs close and new coverage is added. Below is a snapshot of programs raising capital as of March 9, 2020.

1031 Exchanges

- Up-front selling commission

- Industry Range: 5 – 6.55%

- Industry Average: 5.76%

- Net Proceeds (Before Acquisition Fees)

- Industry Range: 84.78 – 92.50%

- Industry Average: 90.11%

- Acquisition Fees and Expenses

- Industry Range: 0.16 – 13.25%

- Industry Average: 4.29%

- Liquidation Fees

- Industry Range: 1 – 8.50%

- Industry Average: 3.08%

Non-1031 Real Estate LPs and LLCs:

- Up-front selling commission

- Industry Range: 0 – 8%

- Industry Average: 5.49%

- Net Proceeds (Before Acquisition Fees)

- Industry Range: 86.50 – 98%

- Industry Average: 90.32%

- Acquisition Fees and Expenses

- Industry Range: 0 – 19%

- Industry Average: 2.74%

- Liquidation Fees

- Industry Range: 0 – 40%

- Industry Average: 7.98%

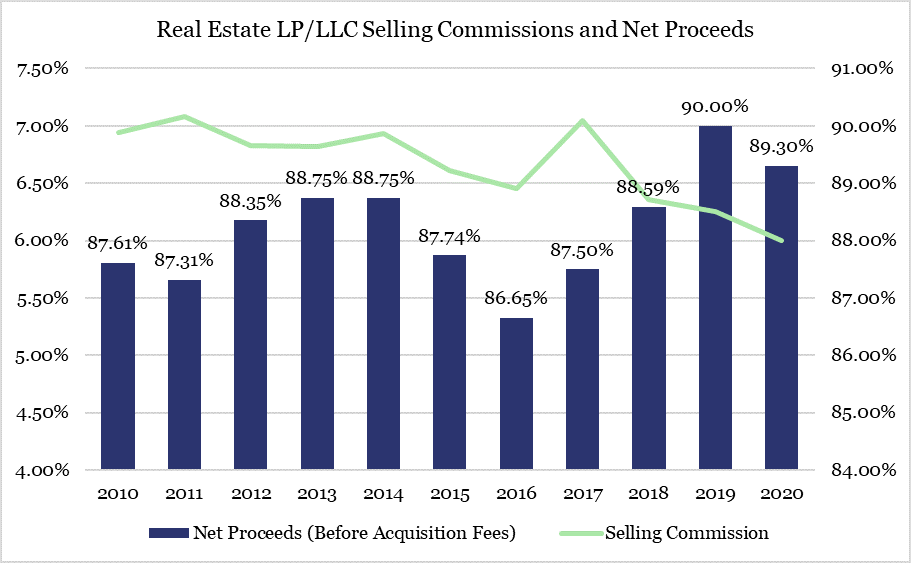

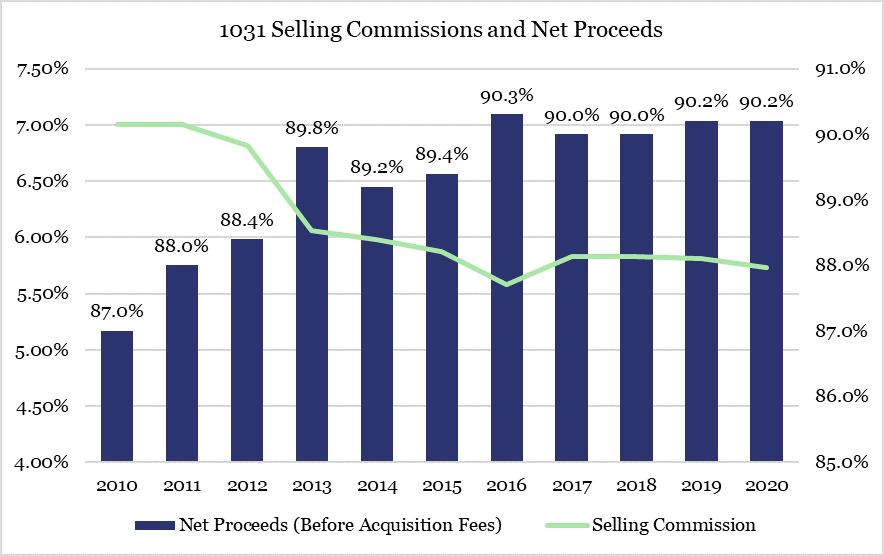

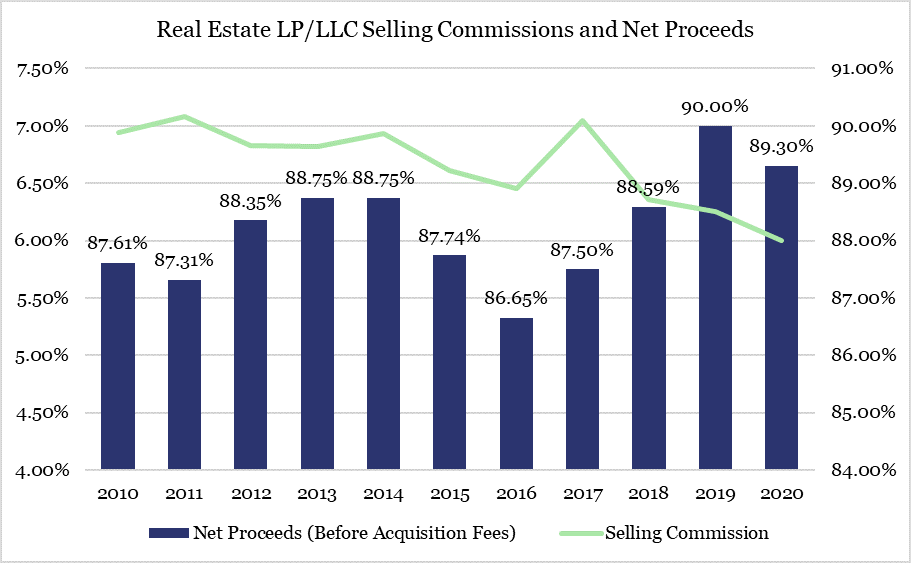

Historical Fees – Up-front Selling Commissions

Fees have always been a focus of regulatory concern, although up-front selling commissions have been at the forefront of regulatory scrutiny over the last decade. FINRA Regulatory Notice 15-02 required greater transparency into pricing including fees for direct participation programs and non-traded REITs. The DOL’s previously proposed Fiduciary Rule and now Regulation Best Interest, require financial professionals to carefully review and disclose the material fees and costs related to a client’s holdings.

With this in mind, we reviewed the data on our platform for the real estate private placements we covered over the last decade to see if there has been any change in the average up-front selling commissions and the average net proceeds (before acquisition fees, which includes up-front fees and expenses taken from offering proceeds) for these programs.

We found that up-front selling commissions have declined and net proceeds before acquisition fees has increased for 1031 exchanges and non-1031 real estate private placements over the last decade.

1031 selling commissions went from an average of 7% in 2010 to 5.73% for programs that opened in 2020, while the average net proceeds increased from 87 to 90.2%. This is a difference of approximately $3,200 on a $100,000 investment.

Results are similar for non-1031 real estate LPs and LLCs, with selling commissions declining from an average of 6.94% in 2010 to 6% in 2020. Net proceeds are up from 87.61% in 2010 to 89.30% in 2020 for a difference of $2,390 per $100,000 investment.

When looking at fees over time for real estate private placements, it appears the industry has responded to regulatory focus over the last decade by reducing up-front fees and expenses; even for private placements that may not be applicable to FINRA Regulatory Notice 15-02. However, real estate by its very nature can be an expensive asset class.

It is important to remember that although it may be good to see up-front fees decline, there are many other fees and expenses related to owning and operating direct real estate that must be considered reasonable including, but not limited to, construction costs, acquisition-related expenses, financing costs, leasing commissions, insurance and legal costs, and property management fees.

Wednesday, February 12th, 2020 and is filed under AI Insight News

FINRA recently issued its 2020 Risk Monitoring and Examination Priorities Letter along with its 2019 Report on Examination Findings and Observations. As expected, Regulation Best Interest (Reg BI) takes the lead in this discussion. These reports also highlight, among other things, the continued focus on sales practices regarding supervision and client suitability.

Specifically, the 2020 Priorities Letter states,

“In the first part of the year, FINRA will review firms’ preparedness for Reg BI to gain an understanding of implementation challenges they face and, after the compliance date, will examine firms’ compliance with Reg BI, Form CRS and related SEC guidance and interpretations. FINRA staff expects to work with SEC staff to ensure consistency in examining broker-dealers and their associated persons for compliance with Reg BI and Form CRS.”

The 2019 Findings Report stated,

“Some firms did not have adequate systems of supervision to review that recommendations were suitable in light of a customer’s individual financial situation and needs, investment experience, risk tolerance, time horizon, investment objectives, liquidity needs and other investment profile factors. This report shares some new suitability-related findings, as well as additional nuances on prior years’ findings.”

Cybersecurity

At the end of the letter, FINRA addresses firm operations, technology and cybersecurity noting, “FINRA recognizes that there is no one-size-fits-all approach to cybersecurity, but expects firms to implement controls appropriate to their business model and scale of operations.”

Key Takeaways

- See this checklist, which explains key differences between FINRA rules and Reg BI and Form CRS.

- Carefully review and understand the specific suitability requirements for each non-traded or private placement program utilized and ensure that your firm has a documented process in place to monitor the compliance with suitability requirements.

- Document the due diligence process – remember, if it isn’t documented, it was never done.

- Review how regulators look at cybersecurity and key strategies to be compliant. Click here for additional resources and take the CE Course, “Cybersecurity Awareness for Financial Professionals”.

Let AI Insight help you stay compliant

- Discover how you can create efficiencies in your due diligence review process using our database of 350+ alternative investments to source new products as well as analyze and compare hundreds of alternative investment programs, including non-traded programs, private placements, and alternative mutual funds.

- Demonstrate your due diligence by conducing product-specific training on the features, risks and suitability for hundreds of offerings.

- Document what you’re doing to support your firm’s regulatory requirements in a transparent way. AI Insight captures all of the activity you and your firm members complete within the platform including training modules, offering document reviews and research conducted.

Resources

Thursday, February 7th, 2019 and is filed under AI Insight News

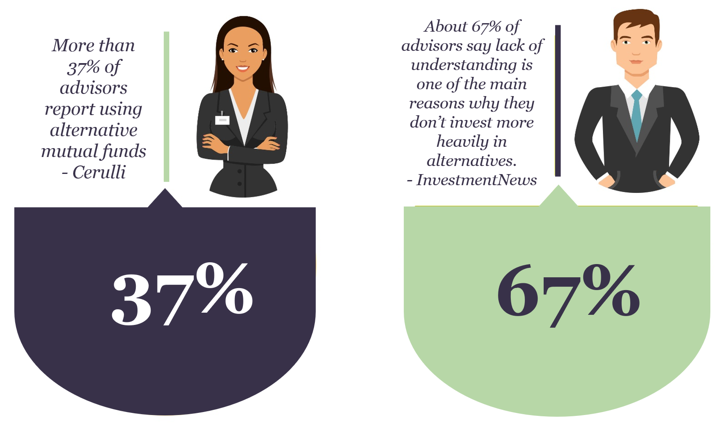

More advisors are working with alternatives as they become more accessible to average investors through the recent evolution of Alternative Mutual Funds. Cerulli’s recent report, “U.S. Alternative Investments 2018: Accessing Evolving Alternative Platforms“, focuses on trends in the U.S. alternative asset market. It concludes that more than 37% of advisors are working with alternative mutual funds.

However, other data tells us that advisors may not have the resources they need to research and apply alternative mutual funds in their practices. According to Investment News, about 67% of advisors say lack of understanding is one of the main reasons why they don’t use alternatives more frequently in their asset allocation models.

Get started now with 3 easy steps to help advisors understand the complexities of alternative mutual funds and help them remain regulatory-compliant.

- First, take 3 minutes to read this Q&A and gain a basic understanding of how Alternative Mutual Funds differ from traditional funds, learn how to address regulatory requirements and view our extensive list of resources.

- Next, take the CE course, “Introduction to Alternative Mutual Funds“ to understand key aspects, benefits and risks of these complex products.

- Finally, request a demo customized to your business needs to take a closer look at how an alternative-centered focus on research on various strategies including managed futures, long-short, market neutral and alternative allocation can help create efficiencies in your business.

Tuesday, June 12th, 2018 and is filed under AI Insight News

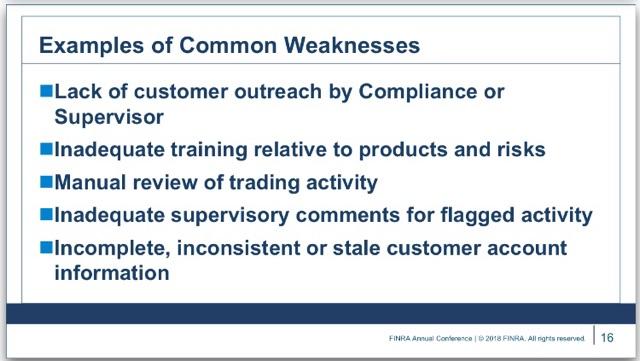

It was great to connect with many of our industry partners at the recent FINRA Annual Conference in Washington, D.C. to discuss regulatory topics relevant to our industry. Here are three key takeaways to consider:

- The industry continues moving forward with a new approach to the standard of care registered representatives must undertake when working with clients. SEC Chairman Clayton was adamant about having industry stakeholders submit comments to help shape the actual outcome of the proposal. He was also quite vocal on the confusion people seem to have around the term “fiduciary” and that he was very much against using it in this proposal. The SEC’s Brett Redfearn provided an overview of Regulation Best Interest and enhancing the standard of conduct for broker-dealers. Read more

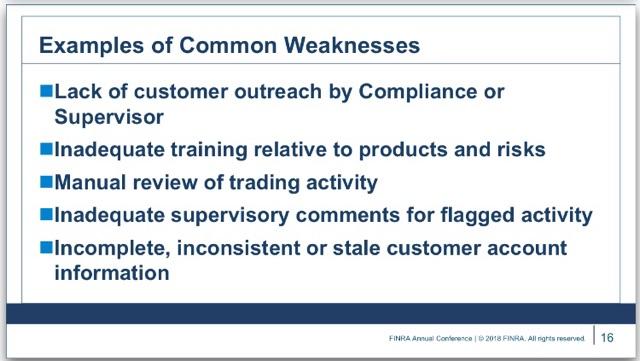

- On a suitability panel, “inadequate training relative to products and risks” was noted by FINRA as a common weakness found.

- Heightened diligence and advisor education are needed for the increasingly complex products being offered through traditional ’40 Act structures such as Alternative Mutual Funds and Interval Funds. FINRA mentioned their guidance on complex products as a resource when working with Alternative Mutual Funds, leveraged ETFs, Interval Funds and other alternative investments.