Tuesday, December 22nd, 2020 and is filed under AI Insight News

AI Insight CEO Sherri Cooke discusses her key reflections for 2020 including how alternative investments played an important role in portfolios and the impacts of Reg BI. She also shares what’s anticipated in 2021. Read the narrative below or listen to the podcast here.

Sherri formed AI Insight in 2005 with the primary goal of providing the financial planning community with a more efficient and consistent way to access factual information on alternative investment programs – and from that vision the AI Insight database was born.

Q: What are some of the key reflections you have about 2020 and some points of interest for the coming year?

SC: I would say as a ADISA Board member, I was fortunate to be able to spend quite a bit of time this year collaborating with others in the alternative investment industry focusing on some of the things we can do to make the industry better – and to increase the awareness and understanding of these products within a growing audience. I believe we all have to work together to bring this space to a whole new level. Also, as Reg BI requirements continue, we’re looking at ways to partner with compliance and technology workflow companies that are helping to support these needed processes. We’re also looking to connect with other companies – both inside and outside the traditional alternatives space to further increase consistency and transparency in the industry with an ultimate goal of making it easier to conduct alts business.

Q: How do you think alternative investments played an important role in portfolios this past year, especially given the pandemic?

SC: We’re always looking for ways to give more to people – who are of course qualified – access to alternative investments to help them really diversify their portfolio in a meaningful way. Our belief is that a person isn’t fully diversified if all of their underlying investments are either in some way tied to the markets or are invested in a fixed income security – which is effectively still tied to the market.

Despite the pandemic – and in some cases as a result of – there are a lot of really solid opportunities to invest in real assets, interesting investment structures, and institutionally supported opportunities through alternative investments that really provide true diversification.

That said, alternatives can certainly be complex and they need to be factually understood and appropriately sold. This industry really needs to educate financial professionals and investors in so many different ways. One of those has to be around creating realistic expectations about what these investments are intended to bring to a diversified investment portfolio…and what they are not. Stocks lose value all the time and there will be alts that don’t perform. As an industry, we really need to do our very best to ensure that these products are properly sold and positioned within client portfolios. And – as with all investments – we support conducting the best possible research and diligence to allow firms and advisors to select best of class – and help the vested financial firms and producers drive product sponsors toward best of class practices.

Q: We know that compliance is often an issue for advisors in considering alternative investments – and regulatory scrutiny continues to increase. The SEC’s Regulation Best Interest implementation took place on June 30. How does AI Insight help streamline Reg BI requirements?

SC: Compliance is one of the things that motivated me to create AI Insight in the first place. I wanted to build capabilities to facilitate due diligence and proper compliance along with education and documentation of these efforts when selling complex products – those products that the regulators have called out as needing heightened supervision or training.

From an audit perspective, we’ve found in any situation of which we’re aware with our clients, if a firm has stayed up-to-date on the requirements around selling different types of investments – and makes sure everyone involved is aware of their obligations, adheres to the processes, and documents their efforts – then the regulators are generally satisfied. If you fail to make these efforts up front and you’re inconsistent in how you conduct your business from a compliance perspective….you’re just leaving yourself open to trouble.

Reg BI – within the BD community – and I think even though the fiduciary standard has always applied RIA space – we’re going see a whole new layer of extra scrutiny in this regard. The processes that have been central to our platform for years can help support Reg BI requirements and help financial firms and professionals demonstrate the “good faith and reasonable efforts” that Reg BI requires on an ongoing basis. Specifically, we’ve created a comprehensive Reg BI Guide that steps through the Compliance and Care Obligations and correlates the AI Insight support resource to that particular SEC requirement. Again, this is just another way that we help to create efficient and consistent educational and compliance workflows that can help firms at both the product and the firm level.

Q: What is your focus for 2021?

SC: From a business owner’s perspective, ensuring that our team and our product continues to maintain consistent integrity of value and exceptional service; this is the backbone of our business – and making sure that our AI Insight team is challenged and fulfilled in their roles within our company.

From an industry perspective – we believe that there is a tremendous amount of value for advisors to differentiate themselves and bring really great opportunities through the thoughtful and diligent understanding of alternative products. We provide this value by building and bringing together our network of broker-dealers, advisors, RIAs, alternative investment firms and industry partners. Therefore, as in past years, I am always grateful for how far we’ve been able to come and to everyone who has helped us be successful in our efforts to support this industry – and I look forward to working with all of our business partners to explore new possibilities and find what more we can bring to the table for our customers in the new year.

Tuesday, October 6th, 2020 and is filed under Industry Reporting

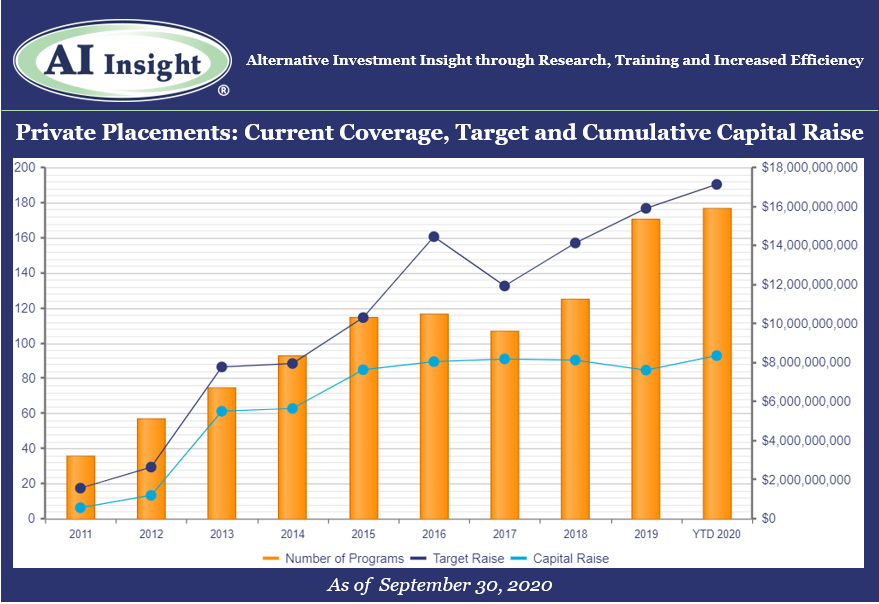

We recently released our September Private Placement Insights report. See the highlights from the report below, or if you are a Premium Reporting subscriber, log in now to see the entire report. If you don’t have access, you can request a free trial.

- Private placement fund activity ramped up in September, with more funds added to our coverage in the month than any since March. 19 new funds were added in September, led by 1031s, energy, and non-1031 real estate.

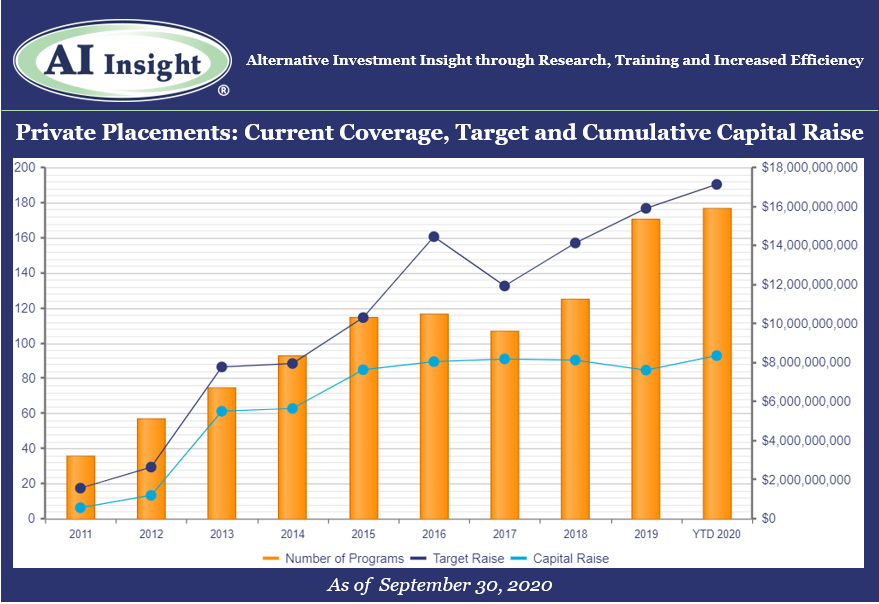

- As of October 1st, AI Insight covers 177 private placements currently raising capital, with an aggregate target raise of $17.1 billion and an aggregate reported raise of $8.4 billion or 49% of target.

- Real estate-related funds, including 1031s, opportunity zones, and non-1031 real estate LLCs and LPs represent the largest component of our private placement coverage, at 72% of funds and 60% of target raise. Private equity/debt funds represent a relatively small amount of our coverage in terms of the number of funds at only 9%, but tend to be larger and represent 27% of aggregate target raise.

- In terms of our coverage by general objective, income is the largest component at 52% of funds, while growth and growth & income follow at 29% and 18%, respectively.

- The average size of the funds currently raising capital is $96.8 million, ranging from $3.5 million for a single asset real estate fund to $2.8 billion for a sector specific private equity/debt fund.

- 76% of private placements we cover use the 506(b) exemption, 15% use 506(c) and 10% have not yet filed their Form D with the SEC.

- 11 private placements closed in September, with all either meeting or exceeding their target raise. 120 funds have closed year-to-date, having been on the market for an average of 333 days and reporting they raised 62% of their target on average.

- Seven private placements suspended offerings and one terminated due to uncertainties related to Covid-19.

- ON DECK: as of October 1st, there were seven new private placements coming soon.

- Listen to the companion podcast for this blog.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, Non-Traded BDCs, Interval Funds, and Alternative Strategy Mutual Funds. Receive up to 24 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of September 30, 2020, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose. Copyright ©2020 AI Insight. All Rights Reserved.

Wednesday, April 29th, 2020 and is filed under Alternative Strategy Mutual Funds

Introduction

As the dust settles from the Corona Market, albeit perhaps temporarily, it is prudent to revisit one’s portfolio and assess the effectiveness of your asset allocation. Diversification is an important component to risk management, and at no time is this better tested than during an equity selloff. Beyond the traditional stock and bond allocation, alternative investments can be an effective way to accomplish this. Broadly speaking, the asset class is designed to provide alternative sources of return to traditional market beta and provide the potential for capital preservation during market drawdowns. As such, it is good to assess the performance of alternatives during these periods to see if the hypothesis holds. Specifically, this piece will focus on alternative mutual fund (AMF) performance through the 1st quarter of 2020. AMFs offer exposure to “hedge fund-like” strategies among other non-traditional approaches within a mutual fund structure. Thus, they can be a liquid and cost-effective means to enhance portfolio diversification.

For the scope of this piece we will define the Corona Market as the equity declines experienced from February 19th through March 23rd. As much uncertainty around the COVID-19 virus and its economic impacts remain, it is important to understand that volatility may persist and that a new low may be established before the drawdown is officially measured. Working with this definition of the Corona Market allows us to make some unique observations about the recent market drawdown.

The Corona Market

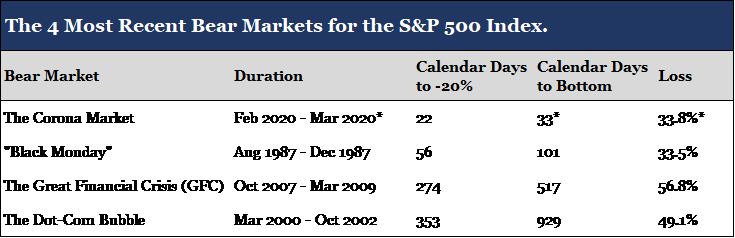

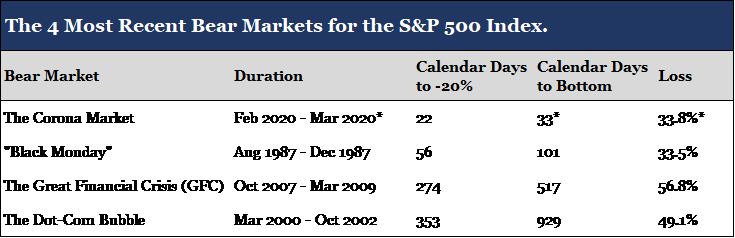

The total loss to the S&P 500 Index, a barometer for US equity markets, amounted to 33.8%. According to data from the CFRA, the average loss experienced during all bear markets dating back to 1929 is 38.2%. Thus, from a historical perspective, the Corona Market was below average in magnitude. However, what made the drawdown so extreme was the speed in which it took place.

*Assumes that the March 23rd index low is the bottom of the Corona Market. Data for the table was sourced from CFRA and S&P Down Jones Indices.

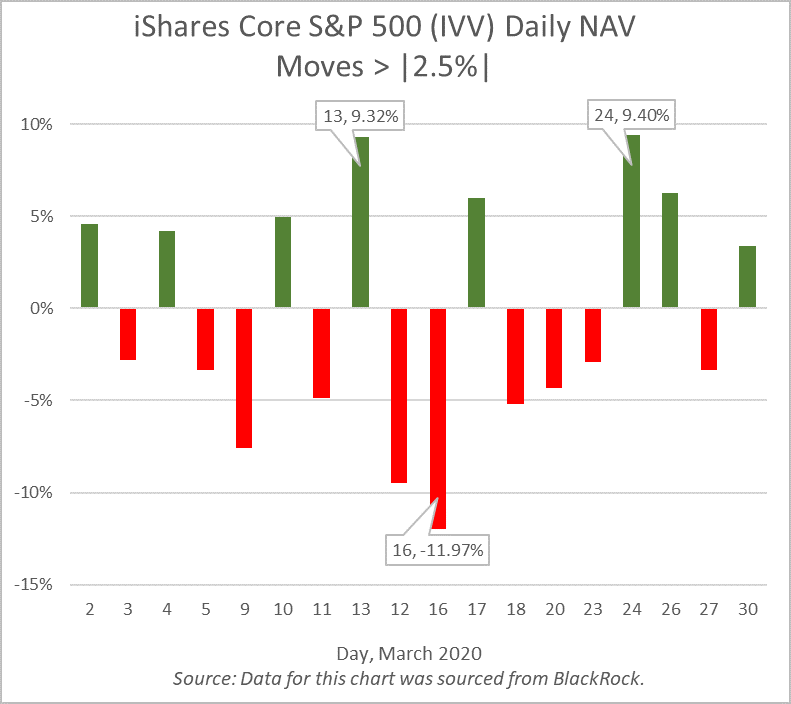

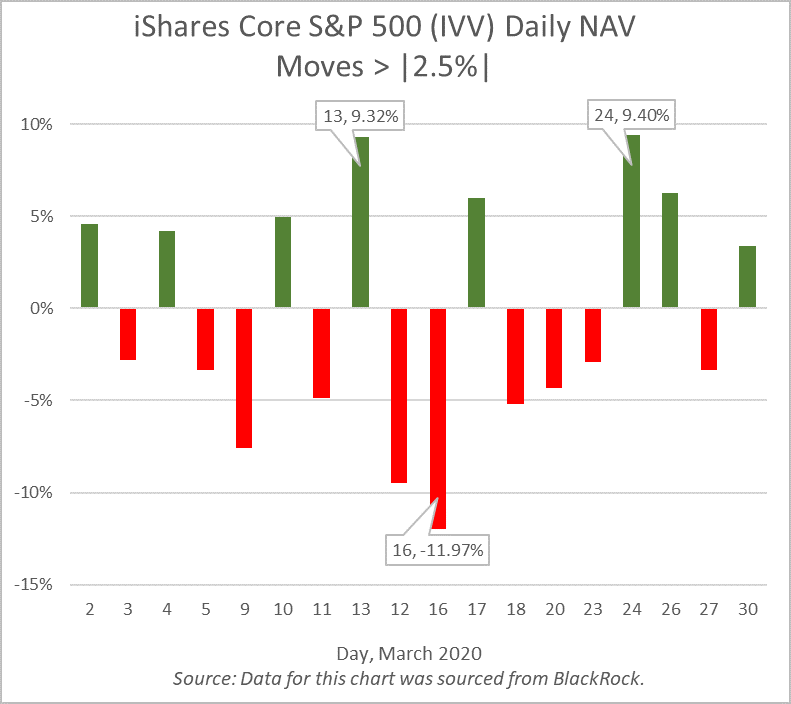

As demonstrated by the table above, the Corona Market decline reached 20% (the definition of a bear market) in 22 calendar days. This is less than half the time it took markets to reach bear territory in 1987 (“Black Monday”) and far below the average of 254 calendar days dating back to 1929. The Corona Market also reached its current low in just 33 days. Such extreme price volatility highlights the uniqueness of a pandemic induced selloff. Taking a closer look, the following chart represents daily NAV changes in excess of +/- 2.5% for the iShares Core S&P 500 ETF (IVV), a passive ETF that tracks the returns of the S&P 500 Index.

The ETF, ticker IVV, had daily NAV moves in excess of +/- 2.5% for 18 out of the 22 trading days in March. This included the March 16th decline of nearly 12%, the S&P’s third largest daily price decline in history (“Black Friday” is the largest daily price decline at -20.5%). As a result, the VIX Index, the market’s forward-looking indicator of volatility, closed at an all-time high of 82.69 the same day.

Alternative Mutual Funds, Passing the Test

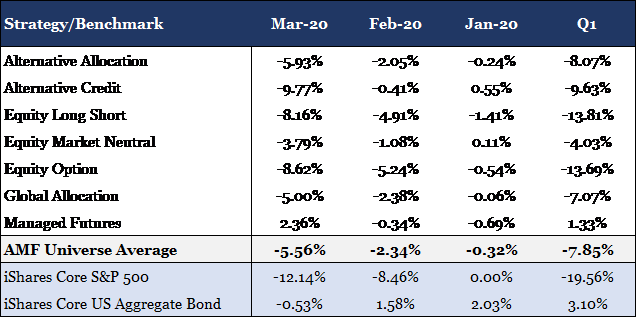

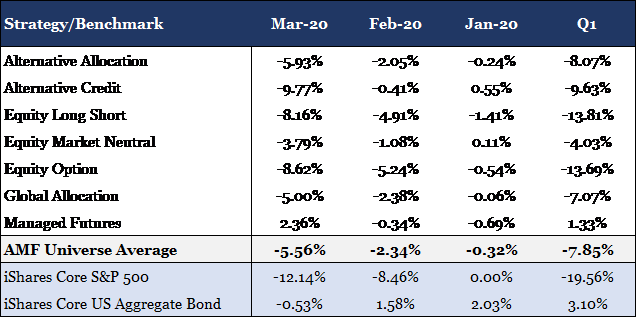

The speed and volatility witnessed during the market drawdown was historic. Working with this understanding of the Corona Market, we can now visit AMF performance for this period within the appropriate lens. The following table represents the performance of the AI Insight universe of AMFs. AI Insight focuses our coverage on funds that execute alternative strategies designed to be held as part (or as all) of an alternative allocation. We also aim to limit our coverage to funds with established track records and sustainable levels of total AUM. The universe is organized into 7 strategy groups, for which the table presents the average performance of each.

The data for the table was sourced from the AI Insight AMF database.

The strongest performer for the period was Managed Futures delivering positive 1.33% through the first quarter. It was the only strategy to remain in the black propelled by a positive 2.36% return during the month of March. Historically, Managed Futures have struggled to capture sharp price reversals as the strategy relies on sustained price trends to build portfolio positions. However, many managers today have increased their weighting toward short term trading strategies and trend signals to better capture downward price swings. This is often referred to as “crisis alpha”, the ability to capture persistent trends that occur across markets during turbulent periods.

Below the AMF universe average for the period were the equity and credit alternative strategies (e.g. Equity Long Short, Equity Option, and Alternative Credit). These funds will typically have higher exposures to risk assets, and as a result, a higher correlation to traditional markets. Furthermore, it is possible the orientation of this market crisis (virus induced shutdown) may have led managers to be more aggressive than they otherwise would have been in a low growth and/or fundamentally weak economy. Prior to the selloff, the financial health of companies and consumers was considerably stronger than what was seen in 2008.

One exception to the equity alternative strategies was Equity Market Neutral. More specifically, the Event Driven sub-strategy of Equity Market Neutral that focuses on mergers and acquisitions among other corporate related events. The sub-strategy was a stronger performer for the period delivering -2.83% performance through the first quarter. These funds are unique in that they invest almost exclusively in equity and equity related securities yet provide a low beta return profile. The -2.83% return equates to a 16.73% outperformance over the iShares Core S&P 500 ETF for the first quarter.

Conclusion

Overall, AMFs delivered strong relative results during the Corona Market with the universe average outperforming the S&P 500 by 11.71% during the first quarter. This included downside protection for both the month of February and March as the average outperformed the equity index by 6.12% and 6.58% respectively. Strategies performed as expected with the more correlated strategies under-performing the average AMF but still out-performing equities, and the less correlated strategies out-performing both the average AMF and the equity markets.

Consistent with these results was the Alternative Allocation strategy which delivered -8.07% for the first quarter as compared to the -7.85% return for the universe. These funds actively invest across multiple alternative strategies and managers within a single fund, providing broad exposure to alternative sources of return. Similarly, the strategy delivered downside protection in both February and March outperforming the equity index by 6.41% and 6.07% respectively.

As demonstrated during the first quarter of 2020, AMFs provide the potential for increased portfolio diversification and downside protection relative to traditional equities. This may serve to reduce portfolio risk during an equity selloff as witnessed during the Corona Market. As mentioned previously, the current low to equity markets occurred on March 23rd. However, there is still much uncertainty that remains around the COVID-19 virus such as potential treatments and vaccines, how best to re-open the economy, and how we will manage the increased debt load that the government and many companies are undertaking to weather the economic shutdown. Despite these uncertainties, equity markets have stabilized since the March 23rd lows appreciating approximately 27% on the backbone of positive hospitalization trends and historic fiscal and monetary policy measures (the S&P 500 is currently down 12.2% through Friday, April 24th). The road may be long, but as mentioned before, diversification is an effective tool in any risk management strategy.

Friday, March 27th, 2020 and is filed under AI Insight News

|

Your daily routine may be in disarray, but it’s business as usual at AI Insight since we have been successfully operating as virtual company for many years. As always, we’re here to help you with your AI Insight needs and anything else that might help you when working remotely.

To be successful working remotely, you need a strategy, focus and a little fun. We’ve compiled some resources that we’ve used in practice to help you accomplish this. |

Get Started

It’s important to designate a specific area that you use solely as your workspace to establish your “work zone” not only for your benefit, but for family members who are at home with you. Traveling around your house with your laptop or working where you sleep invites interruption.

Stay Focused

It’s easy to become distracted by the TV, social media or the pile of dishes in the sink. Creating a schedule for yourself – including breaks and lunchtime as you would at the office – can help you concentrate on your work. Setting a specific work schedule will also help you set expectations for other family members who are at home and help you keep a healthy work-life balance.

Industry Resources

You may be used to attending industry conferences or face-to-face group meetings, which have been postponed or cancelled. AI Insight created a central resource to help you stay connected with industry groups such as ADISA, IPA, FINRA and more. Check back frequently as we will continue to post industry webinar events happening in lieu of conferences.

Technology Resources

Having the right equipment is essential to working from home. But, knowing how to make the most of technology tools can be challenging.

- Zoom is a remote video conferencing and web conferencing service.

- Microsoft Teams is a unified communication and collaboration platform that combines workplace chat, video meetings, file storage, and application integration.

Stay Connected

We all know that miscommunication can happen over email and text. Convey your tone with a phone call instead of email when you can. Even better, turn on your video during online meetings to express your body language. Remember to test out your video feature before you use it publicly, so you can check your background surroundings and test your microphone.

This is also a good opportunity to get to know your co-workers on a personal level. At AI Insight, we’ve created a social channel within our Microsoft Teams platform to talk about topics unrelated to work and share photos on occasions like Halloween and St. Patrick’s Day. This helps us get to know each other better and stay connected.

Be Mindful

We’ve created a “Get Up & Move” rewards program at AI Insight to encourage everyone to walk away from their computer once an hour. We also host quarterly Lunch & Learns to help our team stay healthy in mind and body such as chair yoga sessions and meditation practices. Taking breaks can boost productivity and rejuvenate you when motivation drops.

Contact Us

From everyone at AI Insight, we want you to be safe and healthy. Again, we’ve been incorporating these practices for many years. If there’s something we can help you with on any of these topics, please reach out to us Monday through Friday from 8:00 a.m. to 6:00 p.m. at 877-794-9448 ext. 710 or any time at customercare@aiinsight.com.

Wednesday, February 12th, 2020 and is filed under AI Insight News

FINRA recently issued its 2020 Risk Monitoring and Examination Priorities Letter along with its 2019 Report on Examination Findings and Observations. As expected, Regulation Best Interest (Reg BI) takes the lead in this discussion. These reports also highlight, among other things, the continued focus on sales practices regarding supervision and client suitability.

Specifically, the 2020 Priorities Letter states,

“In the first part of the year, FINRA will review firms’ preparedness for Reg BI to gain an understanding of implementation challenges they face and, after the compliance date, will examine firms’ compliance with Reg BI, Form CRS and related SEC guidance and interpretations. FINRA staff expects to work with SEC staff to ensure consistency in examining broker-dealers and their associated persons for compliance with Reg BI and Form CRS.”

The 2019 Findings Report stated,

“Some firms did not have adequate systems of supervision to review that recommendations were suitable in light of a customer’s individual financial situation and needs, investment experience, risk tolerance, time horizon, investment objectives, liquidity needs and other investment profile factors. This report shares some new suitability-related findings, as well as additional nuances on prior years’ findings.”

Cybersecurity

At the end of the letter, FINRA addresses firm operations, technology and cybersecurity noting, “FINRA recognizes that there is no one-size-fits-all approach to cybersecurity, but expects firms to implement controls appropriate to their business model and scale of operations.”

Key Takeaways

- See this checklist, which explains key differences between FINRA rules and Reg BI and Form CRS.

- Carefully review and understand the specific suitability requirements for each non-traded or private placement program utilized and ensure that your firm has a documented process in place to monitor the compliance with suitability requirements.

- Document the due diligence process – remember, if it isn’t documented, it was never done.

- Review how regulators look at cybersecurity and key strategies to be compliant. Click here for additional resources and take the CE Course, “Cybersecurity Awareness for Financial Professionals”.

Let AI Insight help you stay compliant

- Discover how you can create efficiencies in your due diligence review process using our database of 350+ alternative investments to source new products as well as analyze and compare hundreds of alternative investment programs, including non-traded programs, private placements, and alternative mutual funds.

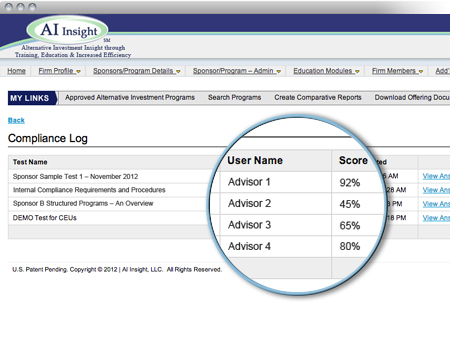

- Demonstrate your due diligence by conducing product-specific training on the features, risks and suitability for hundreds of offerings.

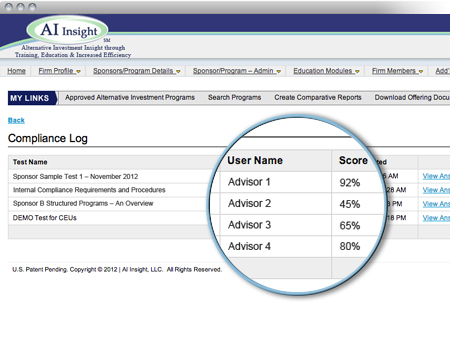

- Document what you’re doing to support your firm’s regulatory requirements in a transparent way. AI Insight captures all of the activity you and your firm members complete within the platform including training modules, offering document reviews and research conducted.

Resources

Wednesday, November 20th, 2019 and is filed under AI Insight News

Considerations when working with non-traditional ETFs

North American Securities Administrators Association (NASAA) recently released a report recommending that broker dealers review policies and procedures for non-traditional exchange traded funds (ETFs).

“The NASAA report recommends tailored supervisory procedures be established for firms that allow leveraged and/or inverse ETF transactions. Further, that the supervisory procedures address the heightened and specific risks associated with these complex products.”

Click here to download the full report.

Be proactive to fully understand non-traditional ETFs

Leveraged ETFs are investment vehicles for sophisticated investors who are looking to gain short-term magnified exposure to the markets. However, it’s important to clearly understand that their unique characteristics come with inherent risk. Take AI Insight’s CE course, Introduction to Leveraged and Inverse ETFs, to help you understand the composition of leveraged ETFs, mechanics of how they operate, and risks associated with them. This course is eligible for 1 CE credit toward the CFP® and other designations.

Monday, August 19th, 2019 and is filed under AI Insight News

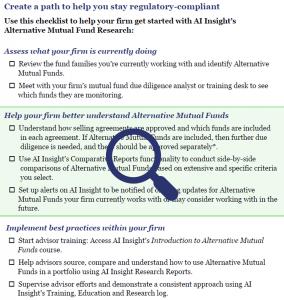

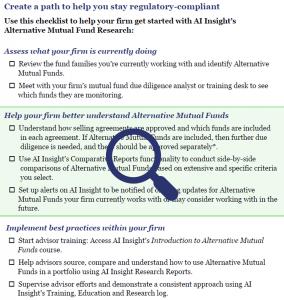

Have you recently reviewed your policies and procedures around Alternative Mutual Funds? Use the resources below to help your advisors better understand your firm’s best practices. It’s always best to address areas for improvement prior to market corrections, which seem to highlight such deficiencies.

How would you answer the following questions?

- Does your firm approve all fund company mutual funds?

- Is your firm performing the additional due diligence needed based on continued regulatory guidance?

- Does your firm have an efficient solution to establish and enforce best practices?

Related Regulatory References

Watch the video and view this checklist to learn more.

Tuesday, December 19th, 2017 and is filed under AI Insight News

As 2017 comes to a close, AI Insight CEO Sherri Cooke reflects on the past year and looks forward to what’s coming up in 2018.

Q: What are some of the key reflections you have about 2017 and some points of interest for the coming year?

SC: This year we increased the number of RIAs using the AI Insight platform, so I’m glad that we’re able to support RIAs as this channel continues to grow. We look forward to continuing to expand these relationships in 2018. We also made significant upgrades to our AI Insight Education Module functionality, and we’ve received a lot of positive feedback on the updates. We’re always working to make the platform easy to use and add more valuable capabilities.

One of the most exciting highlights as we close out 2017 is the fact that we will be launching a new feature with expanded alternative mutual fund research capabilities in the new year. Advisors will be able to compare the details and financial performance of alternative investment mutual funds with reporting and documentation features our subscribers have come to rely on for more traditional Alternative Investment research. We’ve just hired Lucas Johnson who was a due diligence analyst with National Planning Holdings, Inc., where he specialized in due diligence reviews of liquid alternatives and other alternative investments. He’ll be stepping in to help launch our liquid alternative research program. You’ll see much more about this in the first quarter.

From an industry perspective, there’s been a bit of a relief relative to the DOL Fiduciary Rule implementation date, yet it doesn’t change the focus on compliance and regulatory scrutiny. The continued market run is remarkable, to say the least, inspiring growth and confidence. But that kind of house-of-straws confidence can increase concern about the negative consequences of a potential market correction. Smooth or bumpy, it’s our commitment to help advisors and clients manage the environment no matter what 2018 may bring.

Q: What are some of the major misconceptions you see that advisors have about alternative investments?

SC: A couple of misconceptions come to mind. The first would be that illiquidity or alternatives are intrinsically inferior planning tools. Another would be the challenges around compliance and regulatory scrutiny.

Q: Ok – let’s address the liquidity issue first.

SC:

I don’t believe that liquidity is the true issue. If a client’s portfolio is well diversified including appropriately positioned liquid and illiquid investments, then the illiquidity can actually be a true positive. It can prevent clients from selling investments when their motivation is emotionally-driven or reactive to the market.

Second, some people use the generalized claim that alternatives haven’t performed well over the last several years. As with all securities, some do well and some do not – and as with other investments there have certainly been a share of alternatives that haven’t performed as expected. However, there are a lot that have performed well when diligence has been taken in selecting and vetting – and they have been sold correctly. If a key goal is for alts to be used as a portfolio stabilizer, then we wouldn’t have seen them stand out during the crazy bull markets we’ve experienced. That’s not one of their key purposes. Many advisors want a significant premium for the illiquidity, but I don’t believe you should expect to get both the downside market protection in a bear market and returns that exceed the average in bull markets from the same vehicle.

It’s a challenge for me when I hear the expectation of alts always having to perform. Stocks lose value all the time. It really comes down to making sure these products are properly sold and positioned within client portfolios; and – as with all investments – conducting the best possible research and diligence to select best in class.

Q: You mentioned compliance – we know that compliance is often an issue for advisors in considering alternative investments and regulatory scrutiny continues to increase. What is your experience with compliance issues?

SC: Compliance is one of the things that motivated me to create AI Insight in the first place. I wanted to build capabilities to facilitate due diligence and proper compliance along with education and documentation of these efforts when selling complex products – those products that the regulators have called out as needing heightened supervision or training.

From a company perspective, we have found in any situation of which we’re aware, if you stay up-to-date on the requirements around selling any type of investment – and make sure everyone involved is aware of their obligations, adhering to the process, plus documenting all efforts – then the regulators are generally satisfied. That’s been our experience with our clients and their audits.

If you fail to make these efforts up front and you’re inconsistent in how you conduct your business from a compliance perspective, you’re just leaving yourself open to trouble from a client who ends up unhappy about something or getting in the news for the all the wrong reasons.

Q: You are involved in mentoring young women in the financial industry. Tell us about it.

SC: A group of members of the Investment Program Association (IPA) formed the Women’s Initiative Network (WIN). One of our key goals has been to help promote and support women within the financial services industry, which traditionally has been very male-dominated. I launched our first local initiative with Ohio State University’s Fisher School of Business this past year. We had a group of young women who had an interest in Financial Services get together once a month to hear stories about the journeys of women in our area who have been successful in the financial world.

We talked through some of their concerns and real-life challenges they’ve encountered or that we, as mentors, have experienced. We also introduced them to many unknown and non-mainstream facets of the investment world, which was really exciting.

Q: What is your focus for 2018?

SC: From a business owner’s perspective, ensuring that our team and our product continues to maintain consistent integrity of value and exceptional service; this is the backbone of our business – and making sure that our AI Insight team is challenged and fulfilled in their roles within our company.

From an industry perspective – we believe that there is a tremendous amount of value for advisors to differentiate themselves and bring really great opportunities through the thoughtful and diligent understanding of alternative products. We provide this value by building and bringing together our network of broker-dealers, advisors, RIAs, alternative investment firms and industry partners.

Therefore, as in past years, I always look forward to working with our business partners to explore new possibilities and find what more we can bring to the table for our customers in the new year.

As I’ve already mentioned, I’m excited about developing even more education and support in the liquid alternatives space. These funds are gaining increased awareness from a due diligence and compliance perspective. We currently have education and training for 30 closed-end funds available on our platform and expect to see real growth in this area in the coming year. We’ve expanded our CE course offerings to include a FINRA alternative mutual fund course and a course on interval funds. Plus, we’ve recently published a comprehensive white paper called, “Understanding the Complexities of Liquid Alternatives” to help support these growth plans in 2018. I’m really proud of our efforts when it comes to education on key industry initiatives and concerns, so we are particularly excited about the new plans around the liquid alts sector for the coming year. It’s important to our entire team that we continue to do our very best to evolve with the industry – hopefully always a few steps ahead of the primary curve – to bring our customers what they need to confidently offer their clients a full and rich palette of investment solutions. That’s our goal for 2018…and every year after!

Sherri Cooke is the CEO and founder of AI Insight, Inc. and has been in the financial services industry for over 25 years. Cooke formed AI Insight in 2005 with the primary goal of providing the financial planning community with a consistent database of alternative investment programs.

Wednesday, May 28th, 2014 and is filed under AI Insight News

Broker Dealers are finding the Regulatory focus and the need to provide documentation increasingly demanding – particularly when it comes to offering complex products to their clients. As new regulations are released, a trend toward a fiduciary standard for broker dealers and their advisors appears to be emerging. Read More

Broker Dealers are finding the Regulatory focus and the need to provide documentation increasingly demanding – particularly when it comes to offering complex products to their clients. As new regulations are released, a trend toward a fiduciary standard for broker dealers and their advisors appears to be emerging. Read More

Tuesday, May 13th, 2014 and is filed under AI Insight News

Considering the sheer size of the financial industry in the United States, you may think the odds of a regulatory review are fairly slim. However, FINRA Chairman and CEO Richard Ketchum recently stated that while FINRA regulates about 4,100 brokerage firms and about 635,000 registered securities representatives, “we are out there on the ground and in the field every single day—in offices all across the country—overseeing virtually every aspect of the securities business.” Read More

Considering the sheer size of the financial industry in the United States, you may think the odds of a regulatory review are fairly slim. However, FINRA Chairman and CEO Richard Ketchum recently stated that while FINRA regulates about 4,100 brokerage firms and about 635,000 registered securities representatives, “we are out there on the ground and in the field every single day—in offices all across the country—overseeing virtually every aspect of the securities business.” Read More

Considering the sheer size of the financial industry in the United States, you may think the odds of a regulatory review are fairly slim. However, FINRA Chairman and CEO Richard Ketchum recently stated that while

Considering the sheer size of the financial industry in the United States, you may think the odds of a regulatory review are fairly slim. However, FINRA Chairman and CEO Richard Ketchum recently stated that while