Wednesday, April 8th, 2020 and is filed under Industry Reporting

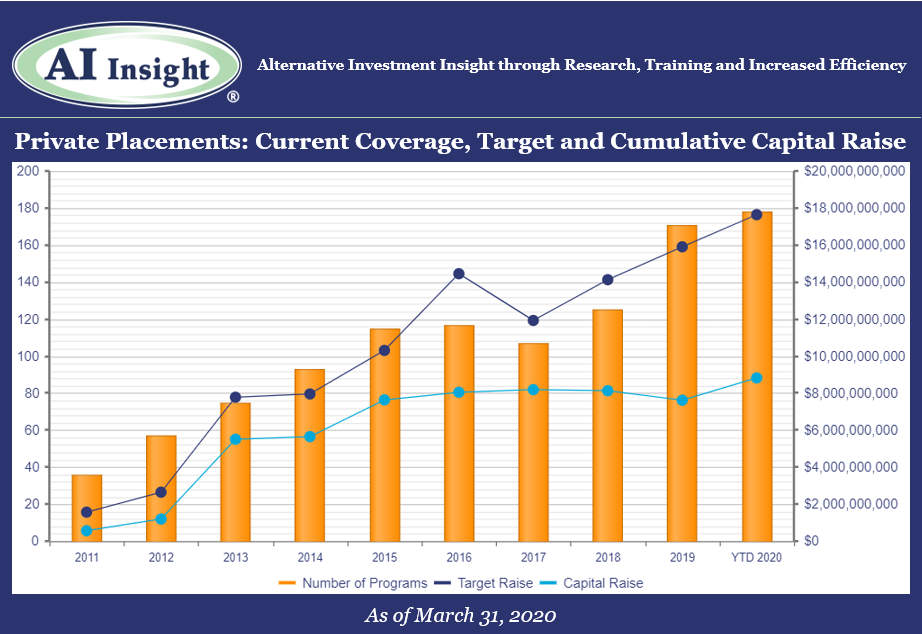

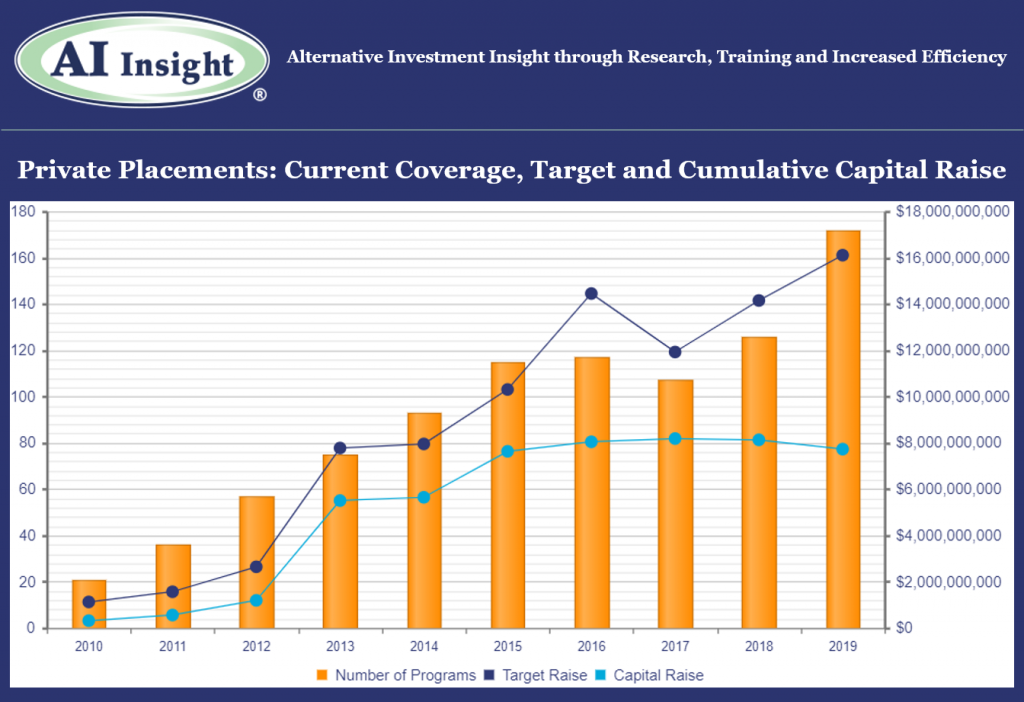

We recently released our March Private Placement Insights. See the highlights from the report below, or if you are a Premium Reporting subscriber, log in now to see the entire report. If you don’t have access, you can request a free trial.

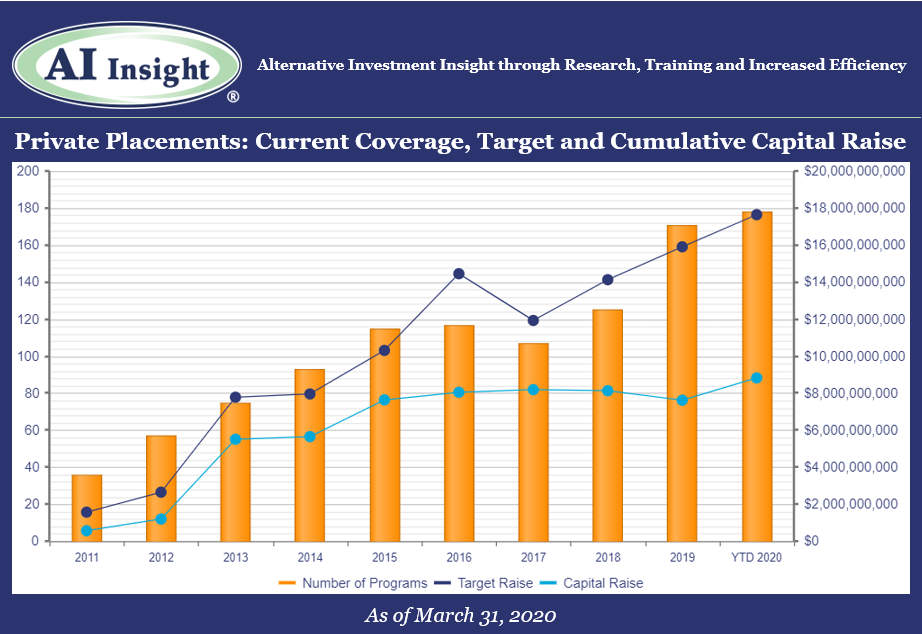

- 15 new private placements were added to our coverage in March, just below the last couple of months but still well over last year’s levels. The industry continues to be led by real estate focused categories including 1031s and real estate LPs and LLCs.

- As of April 1st, AI Insight covers 178 private placements currently raising capital, with an aggregate target raise of $17.6 billion and an aggregate reported raise of $8.8 billion or 50% of target. The average size of the current funds is $99.1 million, ranging from $3.5 million for a single asset real estate fund to $2.5 billion for a sector specific private equity/debt fund.

- 13 private placements closed in March, having raised approximately 70% of their target and having been on the market for an average of 311 days.

- ON DECK: as of April 1st, there were five new private placements coming soon.

Market Update: COVID-19 Impact on Private Placement Markets

On March 11, 2020, the World Health Organization (the WHO) declared the COVID-19 coronavirus a global pandemic. Trade and travel have since grind to a halt with travel restrictions and stay at home orders issued across the globe. The US and global economies are in recession territory, with GDP in the United States now forecast to decline by 0.2% instead of expanding by 2.0% in 2020 as a result of COVID-19. While the full impact of the global pandemic may take years to determine, the one thing we do know is that it will have a significant impact on all aspects of investing both in the public and private markets. Transactions are slowing across the private placement categories and valuations, which require transactions, may be less reliable or difficult to obtain.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, BDCs, Closed-End Funds, and Alternative Mutual Funds. Receive up to 24 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of March 31, 2020, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose. Copyright ©2020 AI Insight. All Rights Reserved.

Friday, March 27th, 2020 and is filed under AI Insight News

|

Your daily routine may be in disarray, but it’s business as usual at AI Insight since we have been successfully operating as virtual company for many years. As always, we’re here to help you with your AI Insight needs and anything else that might help you when working remotely.

To be successful working remotely, you need a strategy, focus and a little fun. We’ve compiled some resources that we’ve used in practice to help you accomplish this. |

Get Started

It’s important to designate a specific area that you use solely as your workspace to establish your “work zone” not only for your benefit, but for family members who are at home with you. Traveling around your house with your laptop or working where you sleep invites interruption.

Stay Focused

It’s easy to become distracted by the TV, social media or the pile of dishes in the sink. Creating a schedule for yourself – including breaks and lunchtime as you would at the office – can help you concentrate on your work. Setting a specific work schedule will also help you set expectations for other family members who are at home and help you keep a healthy work-life balance.

Industry Resources

You may be used to attending industry conferences or face-to-face group meetings, which have been postponed or cancelled. AI Insight created a central resource to help you stay connected with industry groups such as ADISA, IPA, FINRA and more. Check back frequently as we will continue to post industry webinar events happening in lieu of conferences.

Technology Resources

Having the right equipment is essential to working from home. But, knowing how to make the most of technology tools can be challenging.

- Zoom is a remote video conferencing and web conferencing service.

- Microsoft Teams is a unified communication and collaboration platform that combines workplace chat, video meetings, file storage, and application integration.

Stay Connected

We all know that miscommunication can happen over email and text. Convey your tone with a phone call instead of email when you can. Even better, turn on your video during online meetings to express your body language. Remember to test out your video feature before you use it publicly, so you can check your background surroundings and test your microphone.

This is also a good opportunity to get to know your co-workers on a personal level. At AI Insight, we’ve created a social channel within our Microsoft Teams platform to talk about topics unrelated to work and share photos on occasions like Halloween and St. Patrick’s Day. This helps us get to know each other better and stay connected.

Be Mindful

We’ve created a “Get Up & Move” rewards program at AI Insight to encourage everyone to walk away from their computer once an hour. We also host quarterly Lunch & Learns to help our team stay healthy in mind and body such as chair yoga sessions and meditation practices. Taking breaks can boost productivity and rejuvenate you when motivation drops.

Contact Us

From everyone at AI Insight, we want you to be safe and healthy. Again, we’ve been incorporating these practices for many years. If there’s something we can help you with on any of these topics, please reach out to us Monday through Friday from 8:00 a.m. to 6:00 p.m. at 877-794-9448 ext. 710 or any time at customercare@aiinsight.com.

Thursday, March 12th, 2020 and is filed under Industry Reporting

AI Insight currently covers 72 1031 exchange programs and 58 non-1031 real estate private placements. In our February 2020 Private Placement Industry Report, it shows that both categories are growing again in 2020, with 1031s continuing their record growth from the last couple of years.

We wanted to look at fees within both categories, from a current standpoint – what do fees look like now, and from a historical standpoint – have up-front selling commissions declined and have net proceeds increased?

Current Fees

To look at current fees, we utilized our Fee and Expense Report which compares fees on similar programs within our coverage universe. This report updates as programs close and new coverage is added. Below is a snapshot of programs raising capital as of March 9, 2020.

1031 Exchanges

- Up-front selling commission

- Industry Range: 5 – 6.55%

- Industry Average: 5.76%

- Net Proceeds (Before Acquisition Fees)

- Industry Range: 84.78 – 92.50%

- Industry Average: 90.11%

- Acquisition Fees and Expenses

- Industry Range: 0.16 – 13.25%

- Industry Average: 4.29%

- Liquidation Fees

- Industry Range: 1 – 8.50%

- Industry Average: 3.08%

Non-1031 Real Estate LPs and LLCs:

- Up-front selling commission

- Industry Range: 0 – 8%

- Industry Average: 5.49%

- Net Proceeds (Before Acquisition Fees)

- Industry Range: 86.50 – 98%

- Industry Average: 90.32%

- Acquisition Fees and Expenses

- Industry Range: 0 – 19%

- Industry Average: 2.74%

- Liquidation Fees

- Industry Range: 0 – 40%

- Industry Average: 7.98%

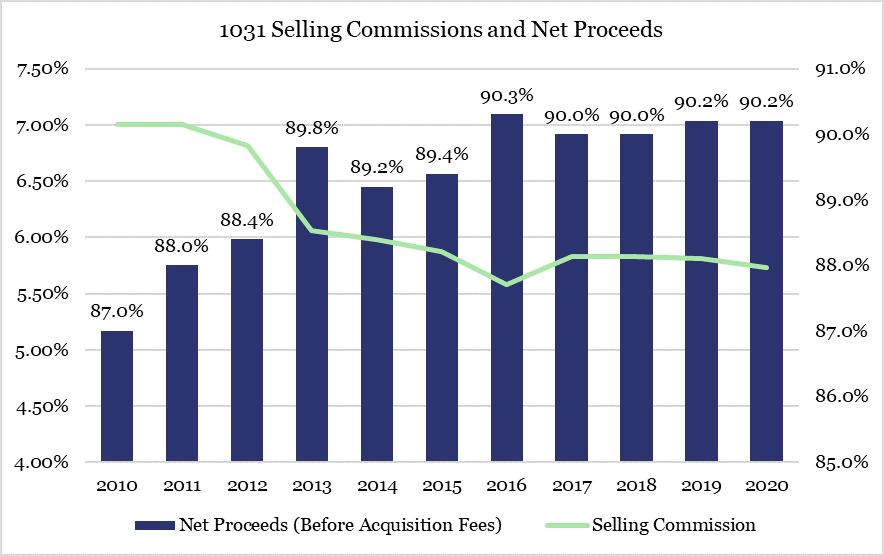

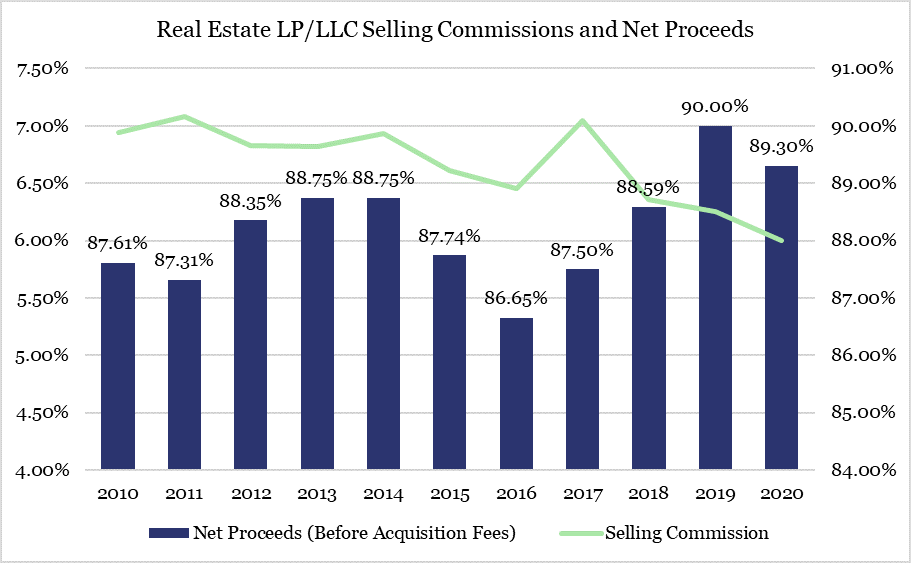

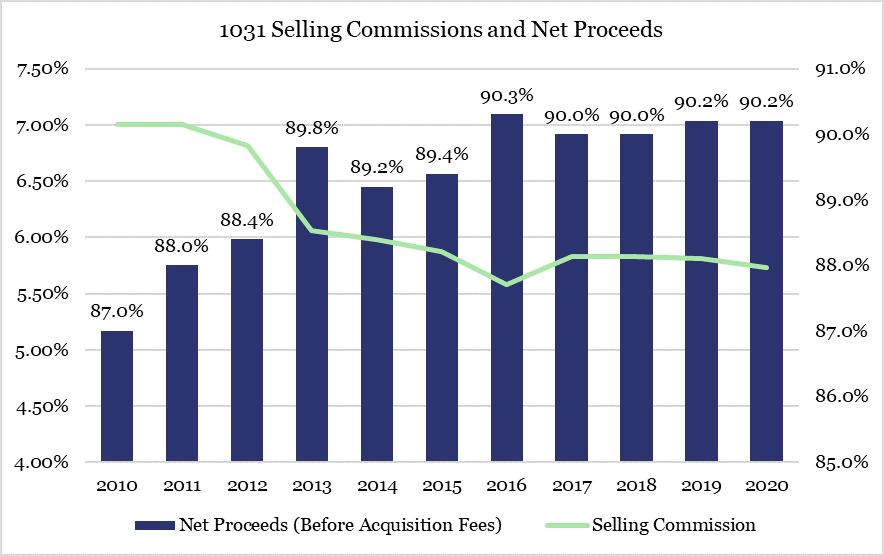

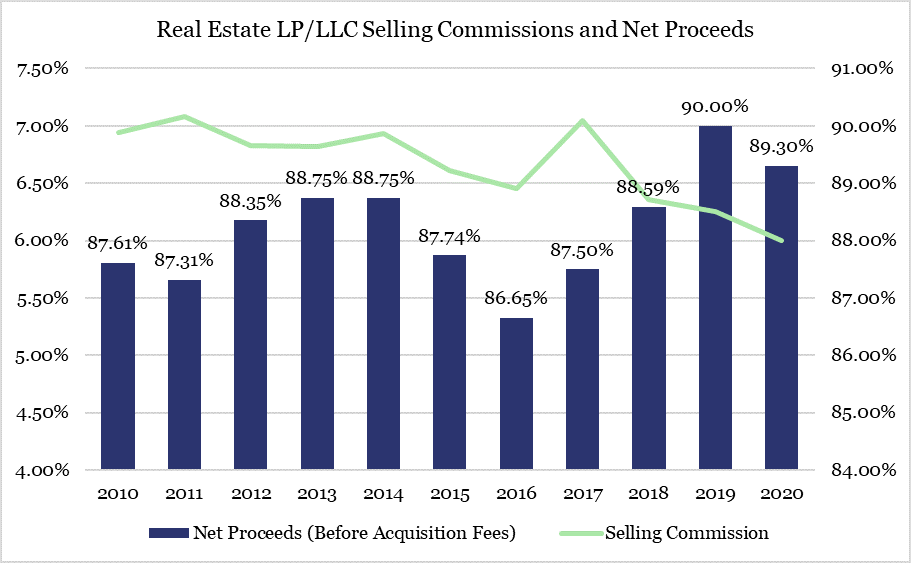

Historical Fees – Up-front Selling Commissions

Fees have always been a focus of regulatory concern, although up-front selling commissions have been at the forefront of regulatory scrutiny over the last decade. FINRA Regulatory Notice 15-02 required greater transparency into pricing including fees for direct participation programs and non-traded REITs. The DOL’s previously proposed Fiduciary Rule and now Regulation Best Interest, require financial professionals to carefully review and disclose the material fees and costs related to a client’s holdings.

With this in mind, we reviewed the data on our platform for the real estate private placements we covered over the last decade to see if there has been any change in the average up-front selling commissions and the average net proceeds (before acquisition fees, which includes up-front fees and expenses taken from offering proceeds) for these programs.

We found that up-front selling commissions have declined and net proceeds before acquisition fees has increased for 1031 exchanges and non-1031 real estate private placements over the last decade.

1031 selling commissions went from an average of 7% in 2010 to 5.73% for programs that opened in 2020, while the average net proceeds increased from 87 to 90.2%. This is a difference of approximately $3,200 on a $100,000 investment.

Results are similar for non-1031 real estate LPs and LLCs, with selling commissions declining from an average of 6.94% in 2010 to 6% in 2020. Net proceeds are up from 87.61% in 2010 to 89.30% in 2020 for a difference of $2,390 per $100,000 investment.

When looking at fees over time for real estate private placements, it appears the industry has responded to regulatory focus over the last decade by reducing up-front fees and expenses; even for private placements that may not be applicable to FINRA Regulatory Notice 15-02. However, real estate by its very nature can be an expensive asset class.

It is important to remember that although it may be good to see up-front fees decline, there are many other fees and expenses related to owning and operating direct real estate that must be considered reasonable including, but not limited to, construction costs, acquisition-related expenses, financing costs, leasing commissions, insurance and legal costs, and property management fees.

Monday, March 9th, 2020 and is filed under Industry Reporting

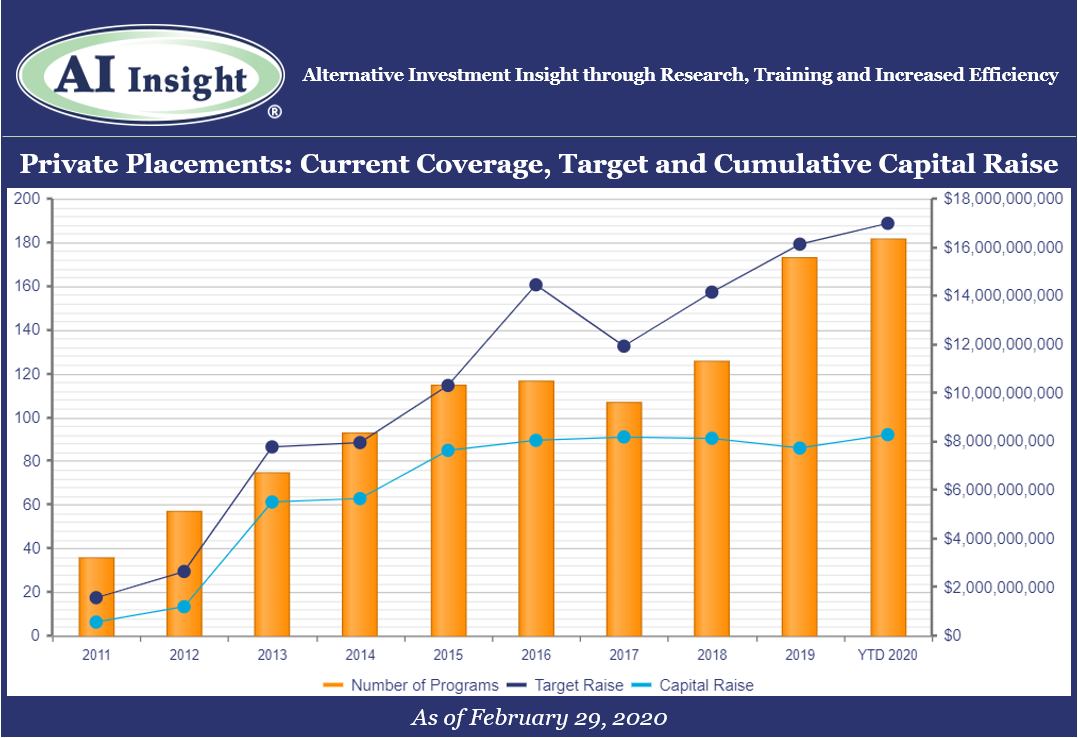

We recently released our February Private Placement Insights. See the highlights from the report below, or if you are an AI Insight Premium Reporting subscriber, log in now to see the entire report.

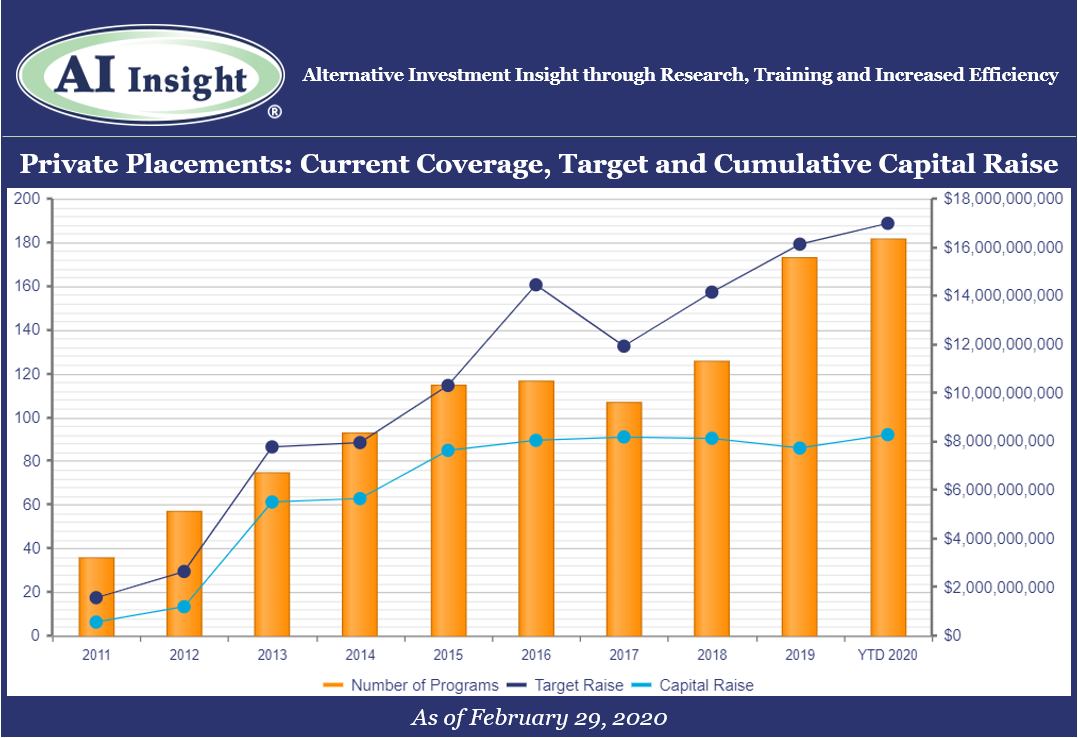

• 16 new private placements were added to our coverage in February, just below the last couple of months but still well over last year’s levels. The industry is again being led by the real estate focused categories including 1031s and real estate LPs and LLCs.

• As of March 1st, AI Insight covers 182 private placements currently raising capital, with an aggregate target raise of $17.0 billion and an aggregate reported raise of $8.3 billion or 49% of target. The average size of the current funds is $92.6 million, ranging from $3.5 million for a single asset real estate fund to $2.2 billion for a sector specific private equity/debt fund.

• 13 private placements closed in February, having raised approximately 87% of their target and having been on the market for an average of 393 days.

• ON DECK: as of March 1st, there were eight new private placements coming soon.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, BDCs, Closed-End Funds, and Alternative Mutual Funds. Receive up to 24 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of Feb. 29, 2020, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose. Copyright ©2020 AI Insight. All Rights Reserved.

Wednesday, February 12th, 2020 and is filed under AI Insight News

FINRA recently issued its 2020 Risk Monitoring and Examination Priorities Letter along with its 2019 Report on Examination Findings and Observations. As expected, Regulation Best Interest (Reg BI) takes the lead in this discussion. These reports also highlight, among other things, the continued focus on sales practices regarding supervision and client suitability.

Specifically, the 2020 Priorities Letter states,

“In the first part of the year, FINRA will review firms’ preparedness for Reg BI to gain an understanding of implementation challenges they face and, after the compliance date, will examine firms’ compliance with Reg BI, Form CRS and related SEC guidance and interpretations. FINRA staff expects to work with SEC staff to ensure consistency in examining broker-dealers and their associated persons for compliance with Reg BI and Form CRS.”

The 2019 Findings Report stated,

“Some firms did not have adequate systems of supervision to review that recommendations were suitable in light of a customer’s individual financial situation and needs, investment experience, risk tolerance, time horizon, investment objectives, liquidity needs and other investment profile factors. This report shares some new suitability-related findings, as well as additional nuances on prior years’ findings.”

Cybersecurity

At the end of the letter, FINRA addresses firm operations, technology and cybersecurity noting, “FINRA recognizes that there is no one-size-fits-all approach to cybersecurity, but expects firms to implement controls appropriate to their business model and scale of operations.”

Key Takeaways

- See this checklist, which explains key differences between FINRA rules and Reg BI and Form CRS.

- Carefully review and understand the specific suitability requirements for each non-traded or private placement program utilized and ensure that your firm has a documented process in place to monitor the compliance with suitability requirements.

- Document the due diligence process – remember, if it isn’t documented, it was never done.

- Review how regulators look at cybersecurity and key strategies to be compliant. Click here for additional resources and take the CE Course, “Cybersecurity Awareness for Financial Professionals”.

Let AI Insight help you stay compliant

- Discover how you can create efficiencies in your due diligence review process using our database of 350+ alternative investments to source new products as well as analyze and compare hundreds of alternative investment programs, including non-traded programs, private placements, and alternative mutual funds.

- Demonstrate your due diligence by conducing product-specific training on the features, risks and suitability for hundreds of offerings.

- Document what you’re doing to support your firm’s regulatory requirements in a transparent way. AI Insight captures all of the activity you and your firm members complete within the platform including training modules, offering document reviews and research conducted.

Resources

Tuesday, February 11th, 2020 and is filed under Industry Reporting

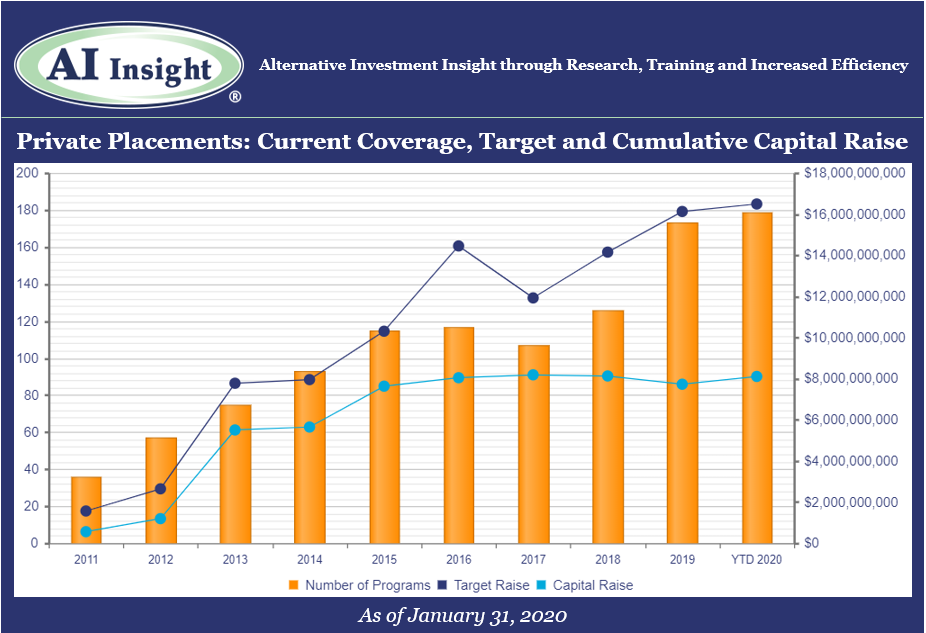

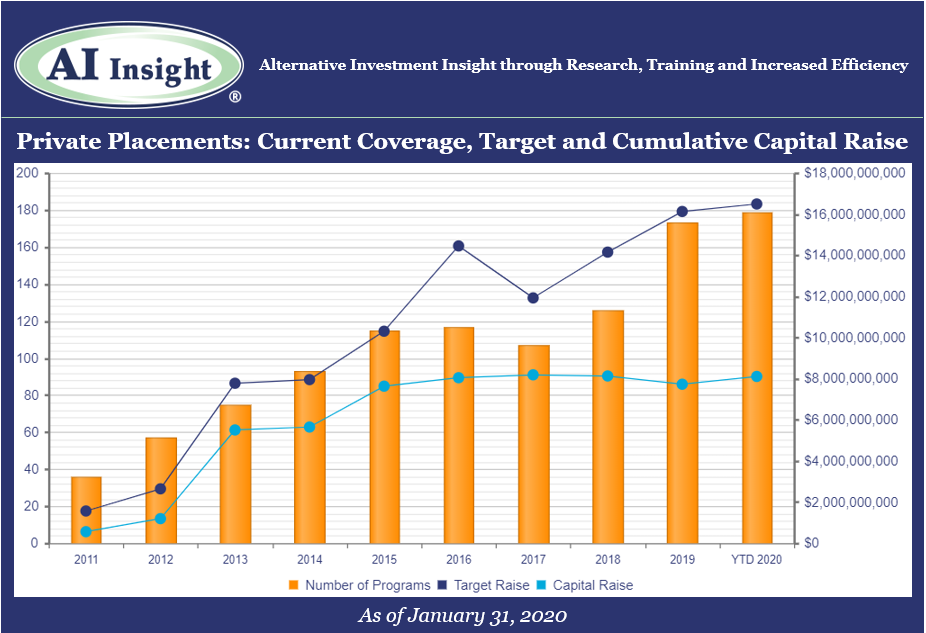

We recently released our January Private Placement Insights. See the highlights from the report below, or if you are a subscriber, log in now to see the entire report.

- 17 new private placements were added to our coverage in January, less than December’s record month, but higher on a year-over-year basis. The industry is again being led by 1031 exchanges, although target raise is higher than last year in all but one category.

- As of February 1st, AI Insight covers 179 private placements currently raising capital, with an aggregate target raise of $16.5 billion and an aggregate reported raise of $8.1 billion or 49% of target. The average size of the current funds is $92.1 million, ranging from $3.4 million for a single asset real estate fund to $2.2 billion for a sector specific private equity/debt fund.

- 13 private placements closed in January, having raised approximately 96% of their target.

- ON DECK: as of February 1st, there were 11 new private placements coming soon.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, BDCs, Closed-End Funds, and Alternative Mutual Funds. Receive up to 24 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of Jan. 31, 2020, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose. Copyright ©2020 AI Insight. All Rights Reserved.

Friday, January 24th, 2020 and is filed under Alternative Strategy Mutual Funds

If your firm approves all fund company mutual funds, additional due diligence may be needed based on continued regulatory guidance on alternative strategy mutual funds.

_________________________________________________________________________________________

Some financial firms have raised questions about the need for conducting additional research on alternative mutual funds given their complex structure compared to traditional mutual funds. Both FINRA and the SEC have published supporting regulatory detail to help differentiate the need for additional due diligence on alternative mutual funds.

How are you demonstrating your understanding of the complexities of alternative strategy mutual funds?

According to PwC’s recent report, Alternative asset management 2020-Fast forward to centre stage, “In the light of the attention from regulators, asset management firms should enter this new line of business well-prepared from a compliance and organisational standpoint. This includes:

- training

- assessing customer suitability

- marketing and education

- building out compliance and surveillance, and

- robust liquidity risk management.”

Take the first step. Let AI Insight help your firm:

1) Identify potential risk exposure

2) Determine due diligence needs

3) Establish policies and procedures around Alternative Strategy Mutual Funds

Contact us for a complimentary Risk Exposure Analysis to see if your firm may need to conduct additional due diligence on alternative strategy mutual funds.

Related Regulatory References

Training Resources

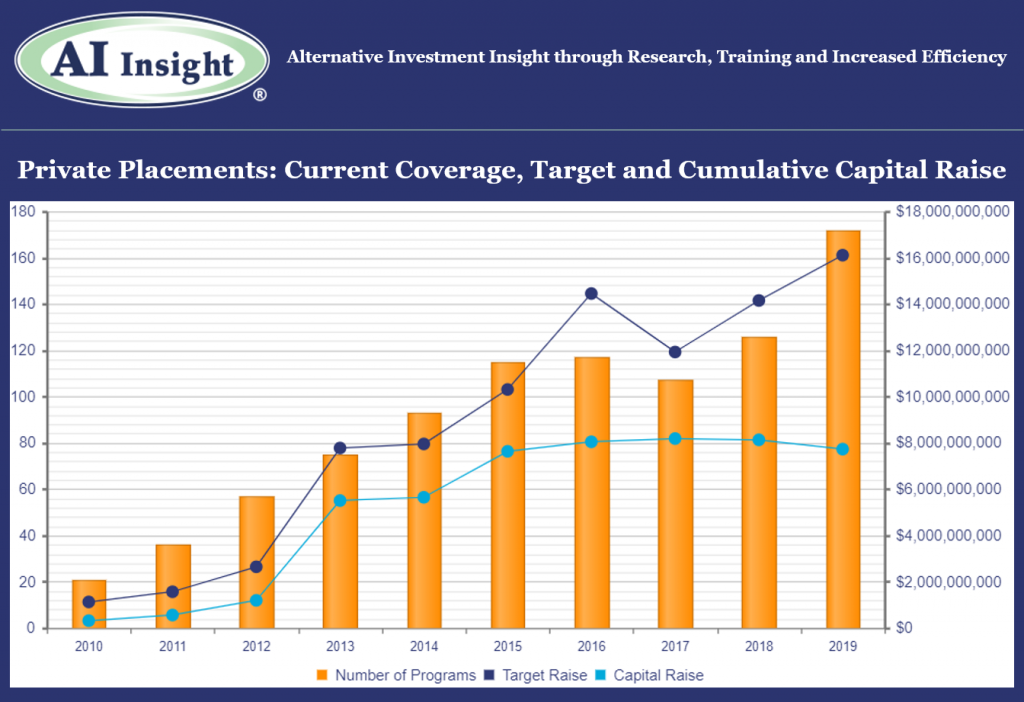

Monday, January 13th, 2020 and is filed under AI Insight News

We recently released our December Private Placement Insights. See the highlights from the report below, or if you are a subscriber, log in now to see the entire report.

- More private placements were added to our coverage in 2019 than ever before with record months in November and December. The 200 private placement funds added during the year were slightly smaller in overall target raise than 2018, with the aggregate just 1.3% above last year despite the increased number of funds.

- The industry was led primarily by continued growth in 1031 exchanges and the addition of Opportunity Zone funds. Private equity/debt activity picked up late in the year, as did conservation contributions and energy funds. Other real estate, which includes non-1031 real estate LLCs and LPs trailed, with fund sizes significantly smaller than in prior years.

- As of January 1st, AI Insight covers 172 private placements currently raising capital, with an aggregate target raise of $16.1 billion and an aggregate reported raise of $7.7 billion or 48% of target. The average size of the current funds is $93.2 million, ranging from $3.4 million for a single asset fund to $2.2 billion for a sector specific private equity/debt fund.

- 158 private placements closed in 2019, having raised approximately 85% of their target.

- ON DECK: as of January 1st, there were eight new private placements coming soon.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, BDCs, Closed-End Funds, and Alternative Mutual Funds. Receive up to 24 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of Dec. 31, 2019, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose. Copyright ©2020 AI Insight. All Rights Reserved.

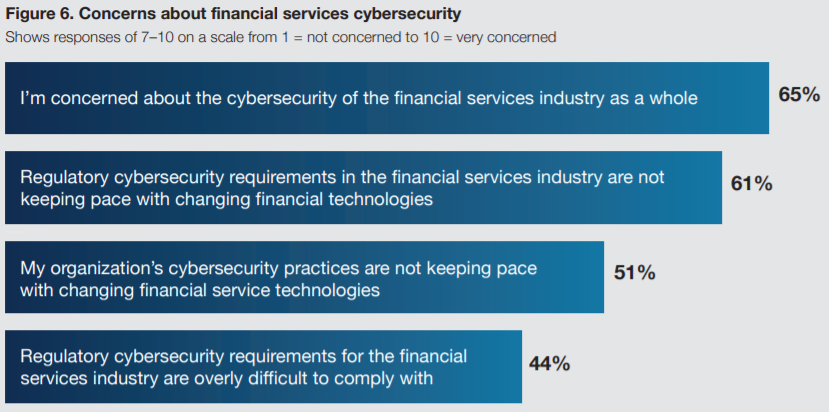

Friday, December 6th, 2019 and is filed under AI Insight News

Be proactive about internet security risks and unauthorized data access that can impact clients and your business.

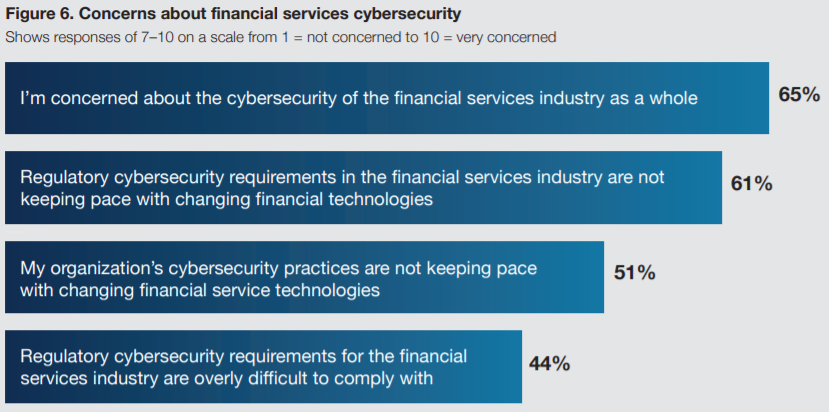

The financial services industry is certainly aware of potential security vulnerabilities and risks. While protections are in place, cybersecurity isn’t keeping pace with the technology advances in the financial services industry according to “The State of Software Security in the Financial Services Industry”. The survey conducted as part of the report also shows that 65% of respondents are concerned with complying with cybersecurity requirements.

Source: The State of Software Security in the Financial Services Industry

How does your firm compare?

The research report was commissioned by the Synopsys Cybersecurity Research Center (CyRC) and conducted by the Ponemon Institute. It includes a survey of over 400 IT security practitioners in various sectors of the financial services industry, including banking, insurance, mortgage lending/processing, and brokerage.

Read the detailed survey results here to see how your firm compares, including:

- The software security posture of financial services companies

- Risks to financial software and applications

- Security practices in the design and development of financial service software and technologies

How regulators look at cybersecurity and key strategies to be compliant

Not only is data security a concern, but regulators have also taken interest in cybersecurity risks that may impact financial firms. Below are five things every regulator looks for during an audit:

- Risk Register

- Framework and Assessment of the Security Program

- Strategy and Roadmap

- Incident Response Plan

- Governance & Centralized Management

7 security tips for financial firms

Take a look at 7 security tips for financial firms to learn about steps you can take such as training, establishing policies and securing devices to help lessen your security risks. The first tip recommends employee training, which the Ponemon Institute study mentions is often not mandated within organizations.

AI Insight collaborated with Docupace Technologies, LLC and Beacon Strategies, LLC to develop a CE Course, “Cybersecurity Awareness for Financial Professionals” to help you better understand the regulatory focus on cybersecurity, the threat landscape and practical things you can do to protect client data. This course is eligible for 1 credit toward the CFP® and other designations. Learn more

Wednesday, November 20th, 2019 and is filed under AI Insight News

Considerations when working with non-traditional ETFs

North American Securities Administrators Association (NASAA) recently released a report recommending that broker dealers review policies and procedures for non-traditional exchange traded funds (ETFs).

“The NASAA report recommends tailored supervisory procedures be established for firms that allow leveraged and/or inverse ETF transactions. Further, that the supervisory procedures address the heightened and specific risks associated with these complex products.”

Click here to download the full report.

Be proactive to fully understand non-traditional ETFs

Leveraged ETFs are investment vehicles for sophisticated investors who are looking to gain short-term magnified exposure to the markets. However, it’s important to clearly understand that their unique characteristics come with inherent risk. Take AI Insight’s CE course, Introduction to Leveraged and Inverse ETFs, to help you understand the composition of leveraged ETFs, mechanics of how they operate, and risks associated with them. This course is eligible for 1 CE credit toward the CFP® and other designations.