Thursday, April 13th, 2023 and is filed under Industry Reporting

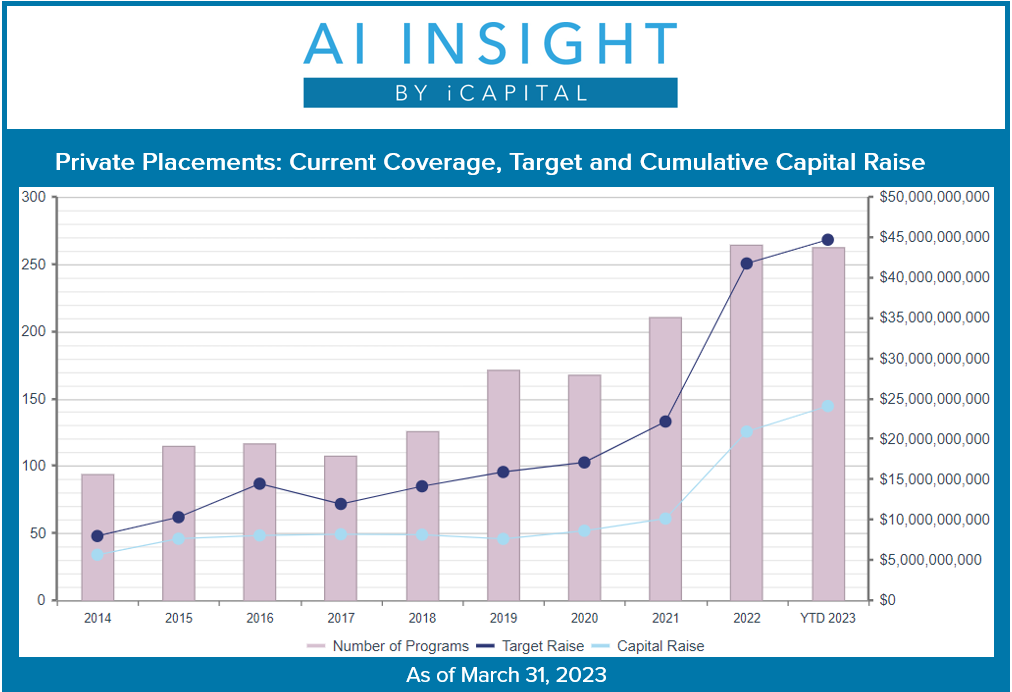

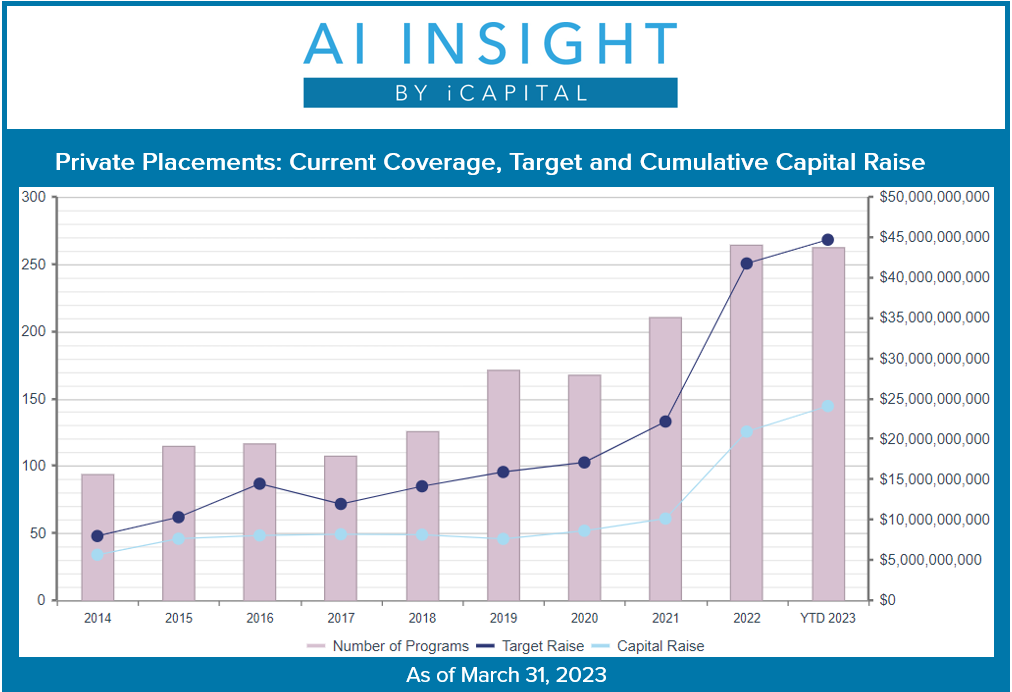

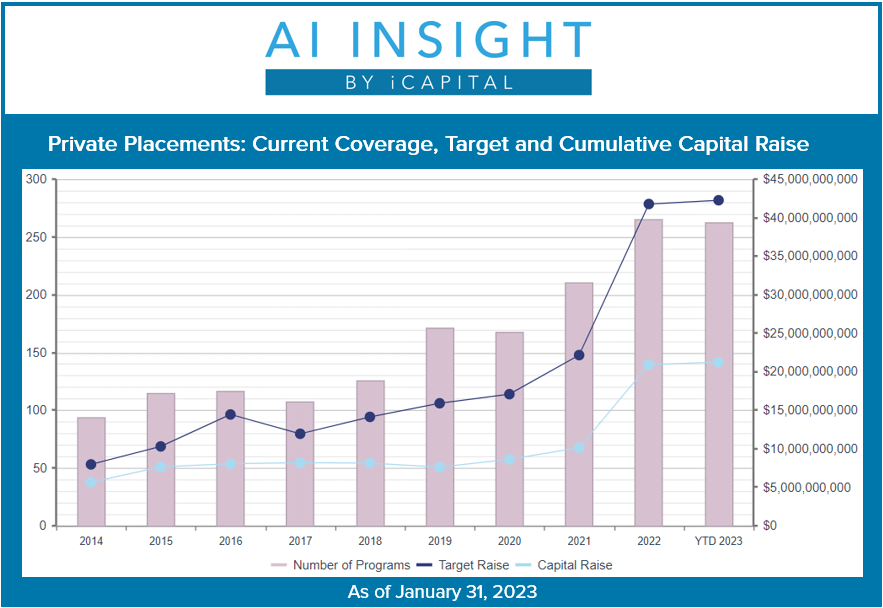

We recently released our March Private Placement Insights report. See the highlights from the report below, or if you are an AI Insight subscriber, log in now to see the entire report.

- Thirteen new private placements were added to investment product education in March, slower than February and well below 2022 monthly averages. On a year-to-date basis, 27% fewer funds have been added and those that have been added are seeking to raise 46% less capital.

- Much of this slowdown continues to be driven by the real estate categories, specifically 1031 exchanges and non-tax focused offerings. The Opportunity Zone segment was off to a strong start but that has also stalled. Preferred offerings have declined this year as well, while we have seen a few more energy funds, one hedge fund, and seven new private equity and debt funds.

- As of April 1st, AI Insight by iCapital covers 263 private placements currently raising capital, with an aggregate target raise of $44.7 billion and an aggregate reported raise of $22.0 billion or 54% of target.

- Real estate-related funds, including 1031s, Opportunity Zone funds, and non-1031 real estate LLCs, LPs, and private REITs represent 74% of the total number of funds, and 52% of aggregate target. The percentage of target is down recently as larger private equity and hedge funds have been added along with the slowdown in real estate. Additionally, private equity’s share of the target raise is likely much higher because there are 12 private equity funds that do not report a target or capital raise, as they are seeking instead to raise a percentage of a larger, institutional fund rather than a specific dollar amount.

- In terms of coverage by general objective, income has been and remains the largest component at 57% of funds, while growth and growth & income follow at 23% and 19%, respectively.

- The average size of funds currently raising capital is $170.5 million, up from $108.0 million last year and continuing a trend towards larger offerings. Funds range in size from $2.6 million for a specified 1031 exchange fund to the $11.9 billion target for a diversified private equity fund.

- 69% of private placements we cover use the 506(b) exemption, 20% use 506(c) and 11% have not yet filed their Form D with the SEC.

- Eleven private placements closed to new investors in March and 48 have closed year-to-date. The 44 funds that reported a raise were on the market for an average of 349 days and raised 65% of target on average.

For illustrative purposes only. Past performance is not indicative of future results.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, Non-Traded BDCs and Interval Funds. Receive up to 22 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of March 31, 2023, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose.

The material herein has been provided to you for informational purposes only by Institutional Capital Network, Inc. (“iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital. This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security offered by iCapital. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation. This material does not intend to address the financial objectives, situation or specific needs of any individual investor. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors.

This material may contain forward looking statements. Forward looking statements include, but are not limited to assumptions, estimates, projections, opinions, models and hypothetical performance analysis. Forward looking statements involve significant elements of subjective judgments and analyses and changes thereto and/or consideration of different or additional factors could have a material impact on the results indicated. Due to various risks and uncertainties, actual results may vary materially from the results contained herein. The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward looking statements or to any other financial information contained herein. The manner of circulation and distribution of this document may be restricted by law or regulation in certain countries, including the U.S. This document is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, including the U.S., where such distribution, publication, availability or use would be contrary to law or regulation or which would subject iCapital to any registration or licensing requirement within such jurisdiction not currently met within such jurisdiction. Persons into whose possession this document may come are required to inform themselves of, and to observe, such restrictions. It is the responsibility of the recipient of this document to comply with all relevant laws and regulations.

Alternative investment products and services may be offered through iCapital Securities, LLC. Structured investment products and services may be offered through Axio Financial LLC and/or SIMON Markets LLC. iCapital Securities LLC, Axio Financial LLC, and SIMON Markets LLC are each a registered broker/dealer, member FINRA and SIPC, and an affiliate of Institutional Capital Network, Inc. (“iCapital”). These registrations and memberships in no way imply that the SEC, FINRA or SIPC have endorsed the entities, products or services discussed herein. iCapital and iCapital Network are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2023 iCapital, Inc. All Rights Reserved.

Thursday, March 16th, 2023 and is filed under Industry Reporting

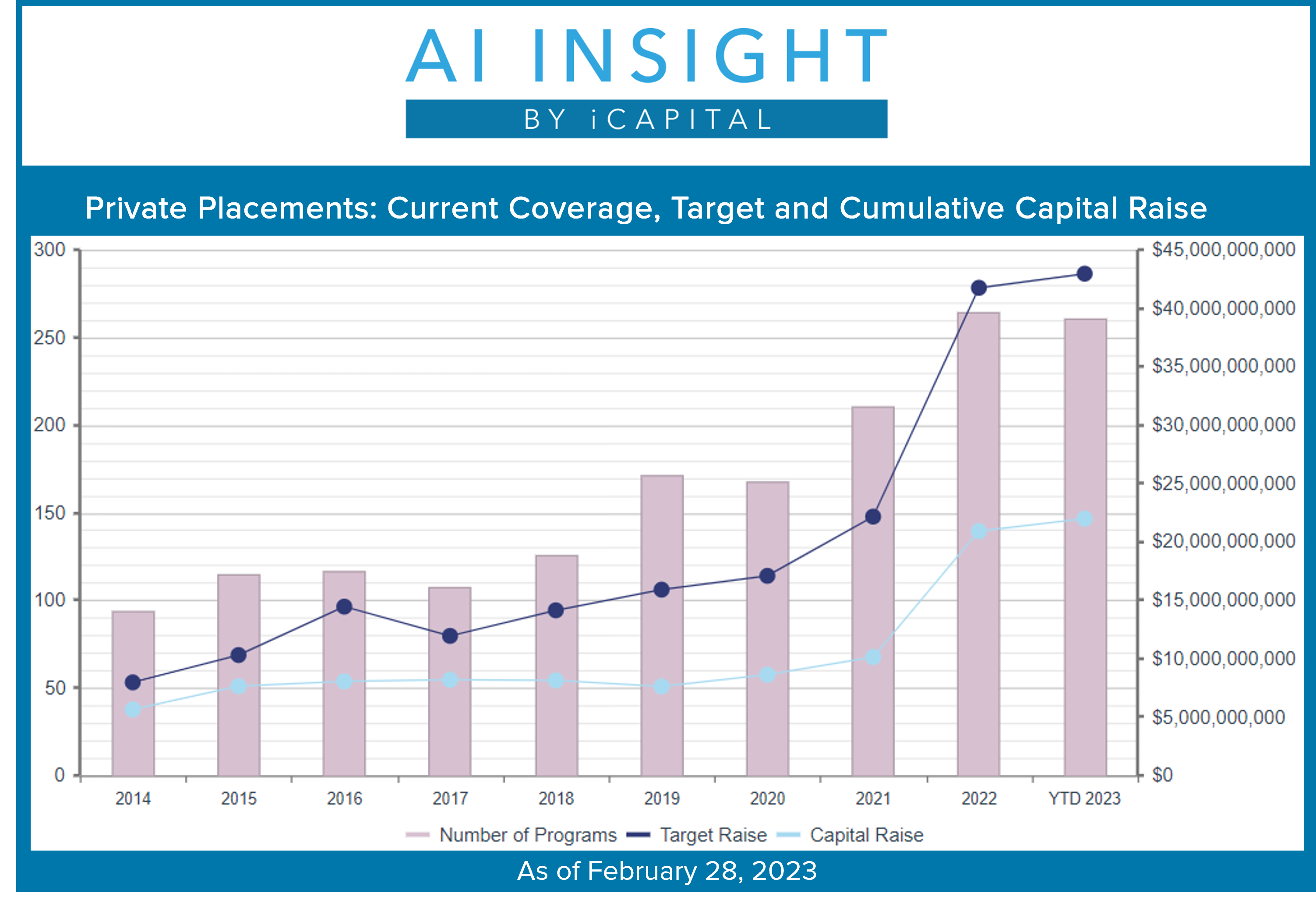

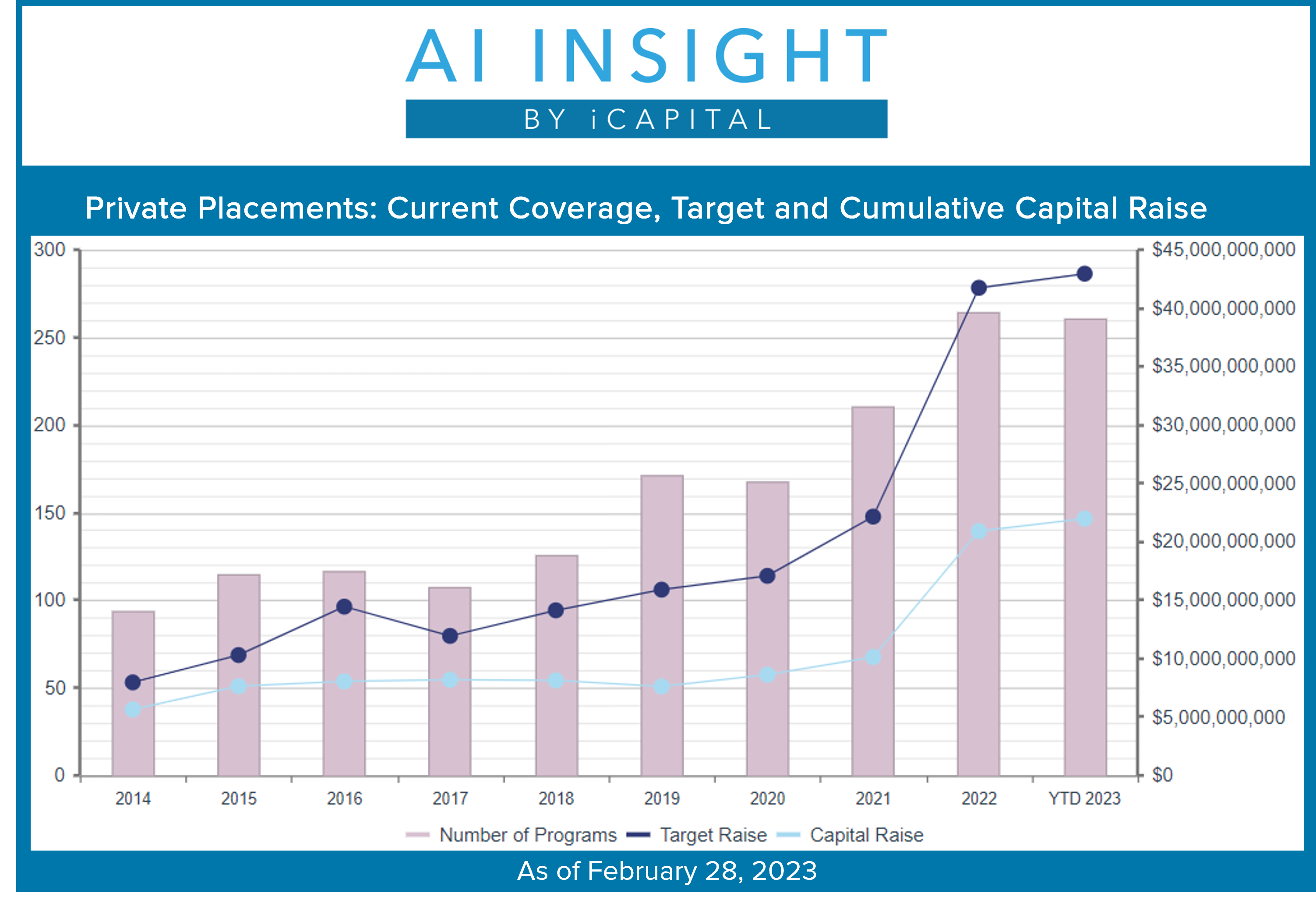

We recently released our February Private Placement Insights report. See the highlights from the report below, or if you are an AI Insight subscriber, log in now to see the entire report.

- 18 new private placements added investment product education in February, higher than January but still well below 2022 monthly averages. On a year-to-date basis, 13% fewer funds have added education and those that have added are seeking to raise 45% less capital.

- Much of this slowdown is driven by the real estate categories, specifically 1031 exchanges and non-tax focused offerings. The only real estate category experiencing growth is the Opportunity Zone segment. All other categories are either on par with or well above last year’s levels.

- As of March 1st, AI Insight by iCapital covers 261 private placements currently raising capital, with an aggregate target raise of $42.9 billion and an aggregate reported raise of $22.0 billion or 51% of target.

- Real estate-related funds, including 1031s, Opportunity Zone funds, and non-1031 real estate LLCs, LPs, and private REITs represent 74% of the total number of funds, and 54% of aggregate target. The percentage of target is down recently as larger private equity and hedge funds have been added. Additionally, private equity’s share of the target raise is likely much higher because there are 12 private equity funds that do not report a target or capital raise, as they are seeking instead to raise a percentage of a larger, institutional fund rather than a specific dollar amount.

- In terms of coverage by general objective, income has been and remains the largest component at 57% of funds, while growth and growth & income follow at 23% and 20%, respectively.

- The average size of funds currently raising capital is $165.1 million, up from $108.0 million last year and continuing a trend towards larger offerings. Funds range in size from $2.6 million for a specified 1031 exchange fund to the $9.7 billion target for a diversified private equity fund.

- 70% of private placements we cover use the 506(b) exemption, 20% use 506(c) and 10% have not yet filed their Form D with the SEC.

- Nineteen private placements closed to new investors in February and 37 have closed year-to-date. The 34 funds that reported a raise were on the market for an average of 295 days and raised 69% of target on average.

For illustrative purposes only. Past performance is not indicative of future results.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, Non-Traded BDCs and Interval Funds. Receive up to 22 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of February 28, 2023, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose.

The material herein has been provided to you for informational purposes only by Institutional Capital Network, Inc. (“iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital. This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security offered by iCapital. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation. This material does not intend to address the financial objectives, situation or specific needs of any individual investor. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors.

This material may contain forward looking statements. Forward looking statements include, but are not limited to assumptions, estimates, projections, opinions, models and hypothetical performance analysis. Forward looking statements involve significant elements of subjective judgments and analyses and changes thereto and/or consideration of different or additional factors could have a material impact on the results indicated. Due to various risks and uncertainties, actual results may vary materially from the results contained herein. The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward looking statements or to any other financial information contained herein. The manner of circulation and distribution of this document may be restricted by law or regulation in certain countries, including the U.S. This document is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, including the U.S., where such distribution, publication, availability or use would be contrary to law or regulation or which would subject iCapital to any registration or licensing requirement within such jurisdiction not currently met within such jurisdiction. Persons into whose possession this document may come are required to inform themselves of, and to observe, such restrictions. It is the responsibility of the recipient of this document to comply with all relevant laws and regulations.

Alternative investment products and services may be offered through iCapital Securities, LLC. Structured investment products and services may be offered through Axio Financial LLC and/or SIMON Markets LLC. iCapital Securities LLC, Axio Financial LLC, and SIMON Markets LLC are each a registered broker/dealer, member FINRA and SIPC, and an affiliate of Institutional Capital Network, Inc. (“iCapital”). These registrations and memberships in no way imply that the SEC, FINRA or SIPC have endorsed the entities, products or services discussed herein. iCapital and iCapital Network are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2023 iCapital, Inc. All Rights Reserved.

Friday, February 10th, 2023 and is filed under Industry Reporting

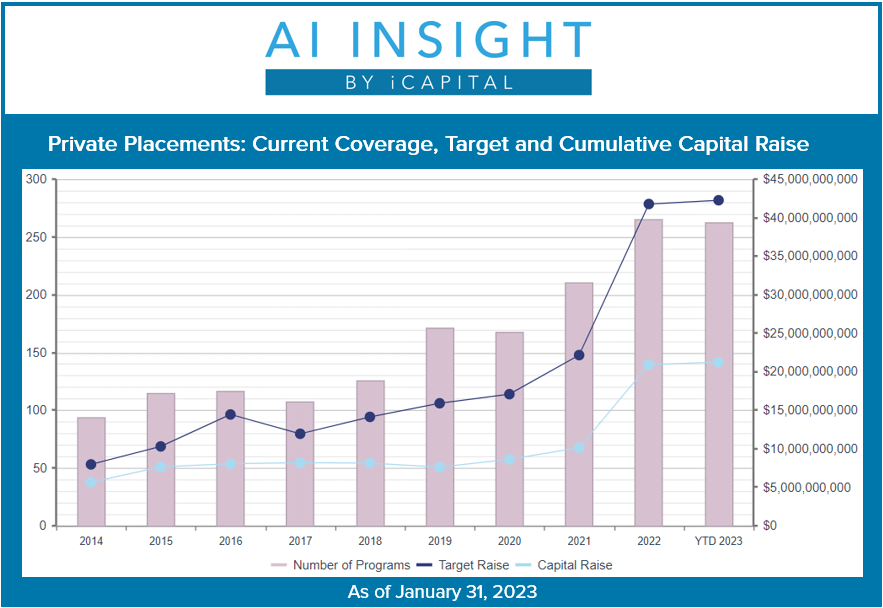

We recently released our January Private Placement Insights report. See the highlights from the report below, or if you are an AI Insight subscriber, log in now to see the entire report.

- 15 new private placements added investment product education in January, well below the 27 in December and more than 21% below January of 2022. Funds added are also seeking to raise 29% less capital on a year-over-year basis.

- 1031 exchange activity is notably slower, as anticipated, given the uncertainty in the real estate markets and higher debt costs. Real estate volume overall slowed in 2022 (-27% as of the end of Q3) and CBRE forecasts volume to slow another 15% in 2023, which directly impacts the 1031 exchange market. Interestingly, the non-tax-focused real estate segment increased in January, with three housing-focused funds added and several value-added and opportunistic funds added recently as well. CBRE also reports that while volumes are forecast to come down, investors indicated they will likely continue to invest in multifamily, opportunistic, and real estate debt in 2023.

- As of February 1st, AI Insight by iCapital covers 263 private placements currently raising capital, with an aggregate target raise of $42.3 billion and an aggregate reported raise of $21.2 billion or 50% of target.

- Real estate-related funds, including 1031s, Opportunity Zone funds, and non-1031 real estate LLCs, LPs, and private REITs represent 75% of the total number of funds, and 55% of aggregate target. The percentage of target is down recently as larger private equity funds have been added. Additionally, private equity’s share of the target raise is likely much higher. There are 12 private equity funds that do not report a target or capital raise, as they are seeking instead to raise a percentage of a larger, institutional fund rather than a specific dollar amount.

- In terms of coverage by general objective, income has been and remains the largest component at 59% of funds, while growth and growth & income follow at 22% and 19%, respectively.

- The average size of funds currently raising capital is $160.7 million, up from $108.0 million last year and continuing a trend towards larger offerings. Funds range in size from $2.6 million for a specified 1031 exchange fund to the $9.7 billion target for a diversified private equity fund.

- 70% of private placements we cover use the 506(b) exemption, 19% use 506(c) and 11% have not yet filed their Form D with the SEC.

- Eighteen private placements closed to new investors in January. The 15 funds that reported a raise were on the market for an average of 270 days and raised 61% of target on average.

For illustrative purposes only. Past performance is not indicative of future results.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, Non-Traded BDCs and Interval Funds. Receive up to 22 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of January 31, 2023, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose.

The material herein has been provided to you for informational purposes only by Institutional Capital Network, Inc. (“iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital. This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security offered by iCapital. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation. This material does not intend to address the financial objectives, situation or specific needs of any individual investor. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors.

This material may contain forward looking statements. Forward looking statements include, but are not limited to assumptions, estimates, projections, opinions, models and hypothetical performance analysis. Forward looking statements involve significant elements of subjective judgments and analyses and changes thereto and/or consideration of different or additional factors could have a material impact on the results indicated. Due to various risks and uncertainties, actual results may vary materially from the results contained herein. The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward looking statements or to any other financial information contained herein. The manner of circulation and distribution of this document may be restricted by law or regulation in certain countries, including the U.S. This document is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, including the U.S., where such distribution, publication, availability or use would be contrary to law or regulation or which would subject iCapital to any registration or licensing requirement within such jurisdiction not currently met within such jurisdiction. Persons into whose possession this document may come are required to inform themselves of, and to observe, such restrictions. It is the responsibility of the recipient of this document to comply with all relevant laws and regulations.

Alternative investment products and services may be offered through iCapital Securities, LLC. Structured investment products and services may be offered through Axio Financial LLC and/or SIMON Markets LLC. iCapital Securities LLC, Axio Financial LLC, and SIMON Markets LLC are each a registered broker/dealer, member FINRA and SIPC, and an affiliate of Institutional Capital Network, Inc. (“iCapital”). These registrations and memberships in no way imply that the SEC, FINRA or SIPC have endorsed the entities, products or services discussed herein. iCapital and iCapital Network are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2023 iCapital, Inc. All Rights Reserved.

Tuesday, January 17th, 2023 and is filed under Industry Reporting

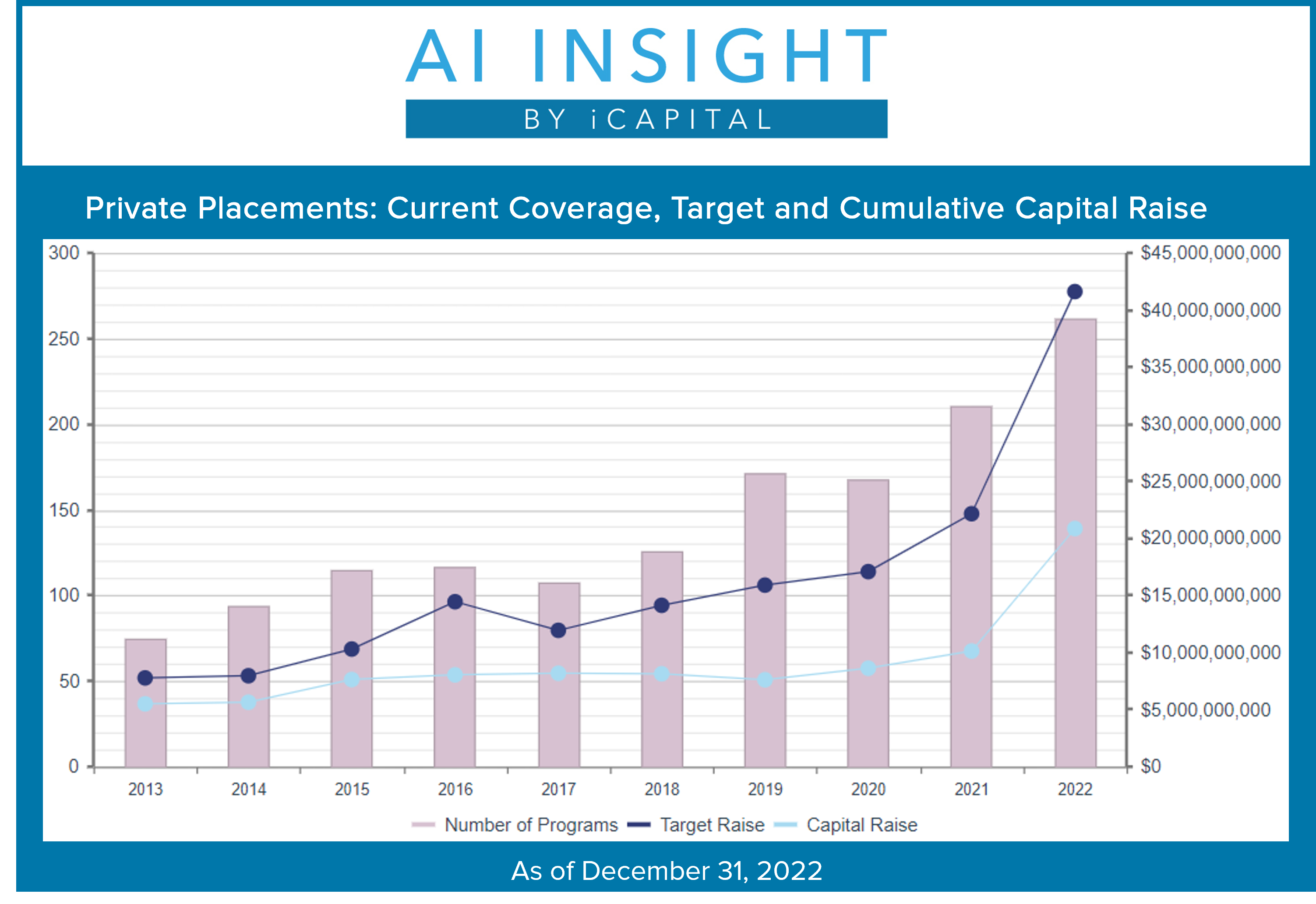

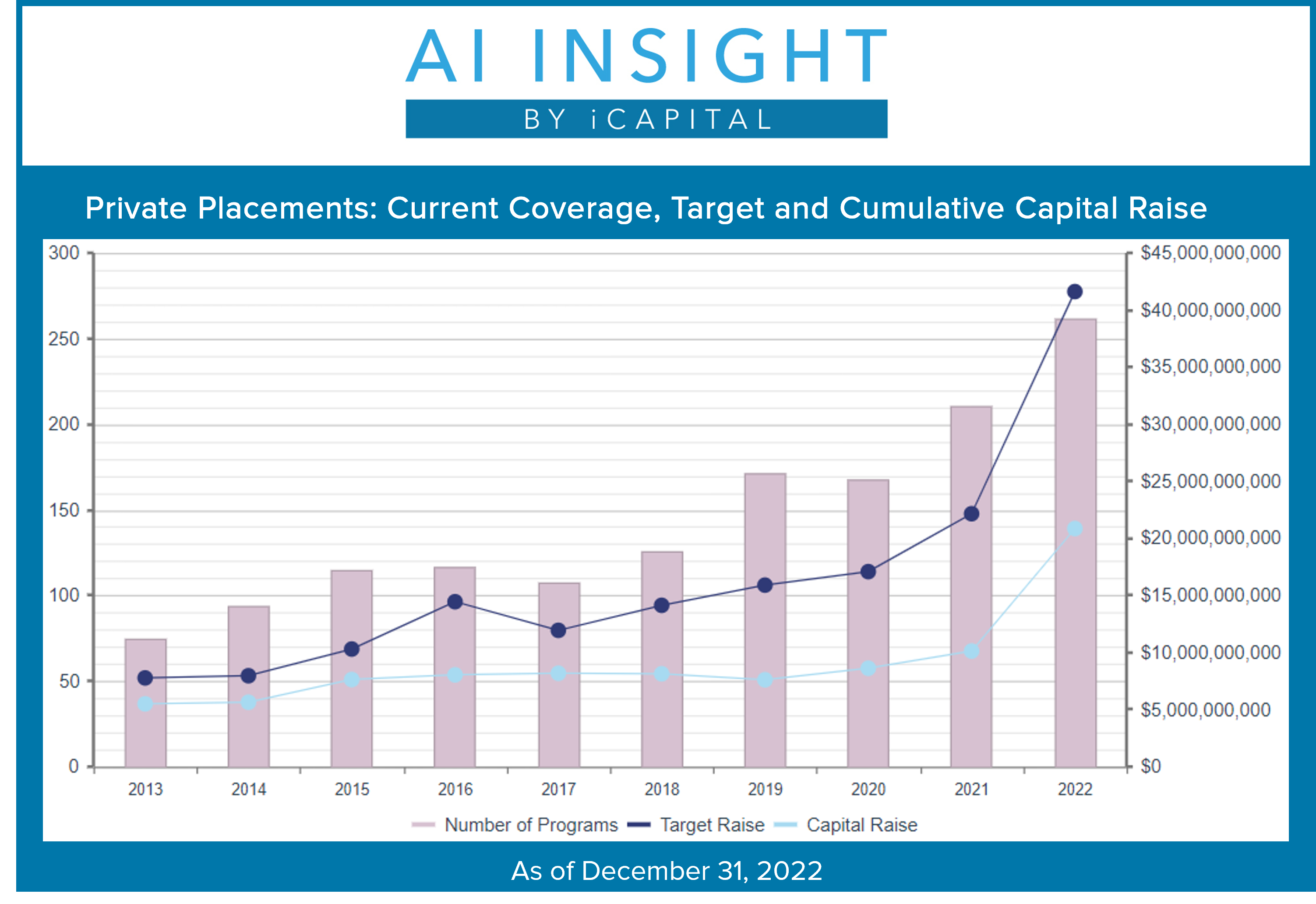

We recently released our December Private Placement Insights report. See the highlights from the report below, or if you are an AI Insight subscriber, log in now to see the entire report.

- 27 new private placements were added to investment product education in December, slightly higher than what was added in November, but well below the highs from mid-year 2022 when more than 30 funds were added each month. Real estate activity noticeably declined through the year, while some of the other categories, including private equity, recovered from a slower start.

- A total of 326 new funds added investment product education in 2022. While we saw a slowdown in Q4, funds adding education was up 10% year-over-year, and those funds are seeking to raise 44% more capital, on average. The two categories down year-over-year are hedge funds and conservation funds, while all others are above what we experienced in 2021.

- As of January 1st, AI Insight covers 262 private placements currently raising capital, with an aggregate target raise of $41.6 billion and an aggregate reported raise of $20.1 billion or 50% of target.

- Real estate-related funds, including 1031s, Opportunity Zone funds, and non-1031 real estate LLCs, LPs, and private REITs represent 75% of the total number of funds, and 56% of aggregate target. The percentage of target is down recently as larger private equity funds have been added. Additionally, private equity’s share of the target raise is likely much higher. There are 13 private equity funds that do not report a target or a raise, as they are seeking instead to raise a percentage of a larger, institutional fund rather than a specific dollar amount.

- In terms of coverage by general objective, income has been and remains the largest component at 60% of funds, while growth and growth & income follow at 22% and 18%, respectively.

- The average size of funds currently raising capital is $159.2 million, up from $120.1 million at the end of Q3 primarily due to the large private equity fund added in November. Funds range in size from $2.6 million for a specified 1031 exchange fund to the $9.7 billion target for a diversified private equity fund.

- 72% of private placements we cover use the 506(b) exemption, 19% use 506(c) and 9% have not yet filed their Form D with the SEC.

- Forty-one private placements closed to new investors in December and 275 closed in full-year 2022. Funds that closed through the year were on the market for an average of 300 days and the 249 funds reporting, raised 86% of target on average.

For illustrative purposes only. Past performance is not indicative of future results.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, Non-Traded BDCs and Interval Funds. Receive up to 22 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of December 31, 2022 based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose.

This material is confidential and the property of iCapital, and may not be shared with any party other than the intended recipient or his or her professional advisors. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital. This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security offered by Institutional Capital Network, Inc. or its affiliates (together “iCapital Network”). Past performance is not indicative of future results. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors. An investment in an alternative investment entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. The information contained herein is subject to change and is also incomplete. This industry information and its importance is an opinion only and should not be relied upon as the only important information available. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed, and iCapital assumes no liability for the information provided.

Products offered by iCapital are typically private placements that are sold only to qualified clients of iCapital through transactions that are exempt from registration under the Securities Act of 1933 pursuant to Rule 506(b) of Regulation D promulgated thereunder (“Private Placements”). An investment in any product issued pursuant to a Private Placement, such as the funds described, entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. Further, such investments are not subject to the same levels of regulatory scrutiny as publicly listed investments, and as a result, investors may have access to significantly less information than they can access with respect to publicly listed investments. Prospective investors should also note that investments in the products described involve long lock-ups and do not provide investors with liquidity.

Securities may be offered through iCapital Securities, LLC, a registered broker dealer, member of FINRA and SIPC and subsidiary of Institutional Capital Network, Inc. (d/b/a iCapital Network). These registrations and memberships in no way imply that the SEC, FINRA or SIPC have endorsed the entities, products or services discussed herein. iCapital and iCapital Network are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2023 Institutional Capital Network, Inc. All Rights Reserved.

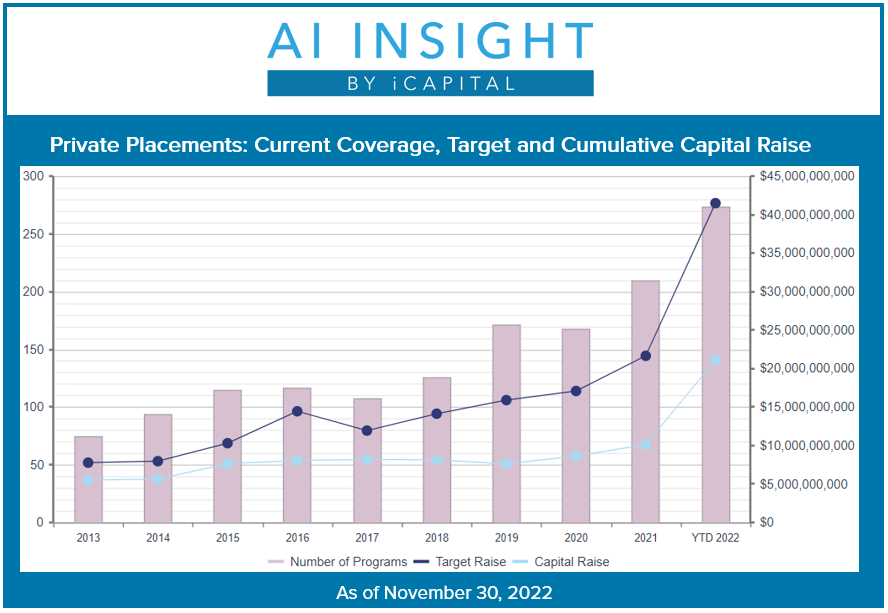

Tuesday, December 13th, 2022 and is filed under Industry Reporting

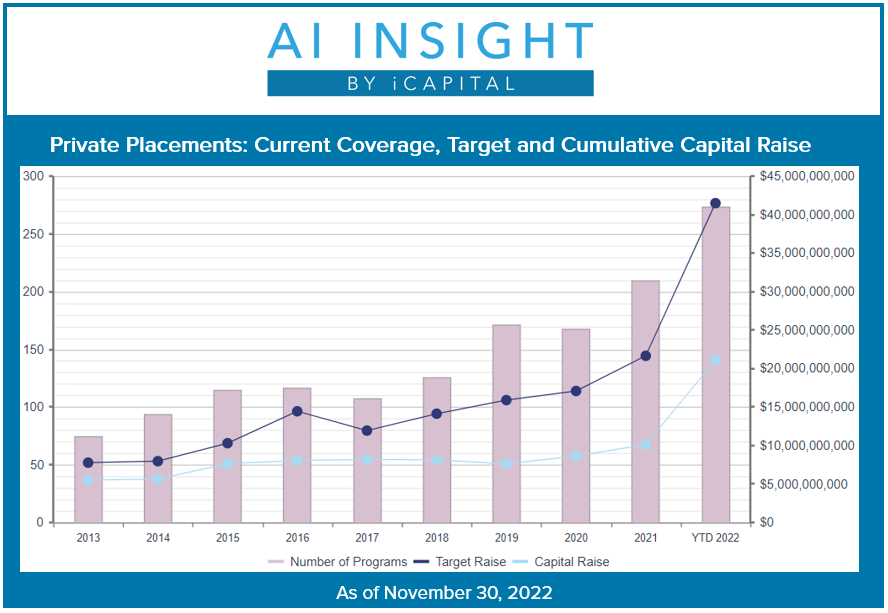

We recently released our November Private Placement Insights report. See the highlights from the report below, or if you are an AI Insight subscriber, log in now to see the entire report.

- 21 new private placements were added to our coverage in December, a notable decline from the 31 added in October. A big part of this is attributable to the slowdown in 1031 exchange activity, where we were seeing 20+ funds added each month, well above November’s nine new additions. We have also seen fewer conservation funds this year, as anticipated, and even the non-tax focused real estate segment has slowed considerably.

- Based on the increased activity early in the year, new fund coverage is still up 15% year-over-year, and those funds are seeking to raise 87% more capital, on average. The two categories that are down year-over-year are hedge funds and conservation funds, while all others are still above.

- As of December 1st, AI Insight covers 274 private placements currently raising capital, with an aggregate target raise of $41.5 billion and an aggregate reported raise of $21.1 billion or 52% of target.

- Real estate-related funds, including 1031s, Opportunity Zone funds, and non-1031 real estate LLCs, LPs, and private REITs have historically represented the largest component of our private placement coverage. While these funds still represent 71% of our coverage by number of funds, private equity and debt funds now represent a much larger amount of aggregate target raise as we have seen larger funds added here recently. Real estate funds are still 55% of aggregate target, down from 73% last month, while private equity and debt funds are 36% of target, up from 16% last month. Private equity’s share of the target is also likely much higher, as there are 13 funds that do not report a target or a raise, as they are seeking instead to raise a percentage of a larger, institutional fund rather than a specific dollar amount.

- In terms of coverage by general objective, income has been and remains the largest component at 61% of funds, while growth and growth & income follow at 21% and 18%, respectively.

- The average size of funds currently raising capital is $151.4 million, up from $120.1 million last month primarily due to the large private equity fund added in November. Funds range in size from $1.2 million for a specified 1031 exchange fund to the $9.7 billion target of the recently added private equity fund.

- 74% of private placements we cover use the 506(b) exemption, 17% use 506(c) and 9% have not yet filed their Form D with the SEC.

- Twelve private placements closed to new investors in October and 234 have closed year-to-date. Funds that closed this year have been on the market for an average of 383 days and the 219 funds reporting raised 86% of target on average.

- According to Pitchbook, overall private markets fundraising is down 7.6% year-over-year as of the end of the third quarter of this year. The steepest declines were seen in fund-of-funds, secondaries, and real estate-focused funds. Pitchbook also reports that firms may be extending offering periods to bridge into 2023, as portfolios are well over-allocated based on 2022 budgets. The largest funds, or those seeking to raise over $1 billion, took in 73% of assets.

For illustrative purposes only. Past performance is not indicative of future results.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, Non-Traded BDCs and Interval Funds. Receive up to 22 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of November 30, 2022, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose.

This material is confidential and the property of iCapital, and may not be shared with any party other than the intended recipient or his or her professional advisors. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital. This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security offered by Institutional Capital Network, Inc. or its affiliates (together “iCapital Network”). Past performance is not indicative of future results. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors. An investment in an alternative investment entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. The information contained herein is subject to change and is also incomplete. This industry information and its importance is an opinion only and should not be relied upon as the only important information available. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed, and iCapital assumes no liability for the information provided.

Products offered by iCapital are typically private placements that are sold only to qualified clients of iCapital through transactions that are exempt from registration under the Securities Act of 1933 pursuant to Rule 506(b) of Regulation D promulgated thereunder (“Private Placements”). An investment in any product issued pursuant to a Private Placement, such as the funds described, entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. Further, such investments are not subject to the same levels of regulatory scrutiny as publicly listed investments, and as a result, investors may have access to significantly less information than they can access with respect to publicly listed investments. Prospective investors should also note that investments in the products described involve long lock-ups and do not provide investors with liquidity.

Securities may be offered through iCapital Securities, LLC, a registered broker dealer, member of FINRA and SIPC and subsidiary of Institutional Capital Network, Inc. (d/b/a iCapital Network). These registrations and memberships in no way imply that the SEC, FINRA or SIPC have endorsed the entities, products or services discussed herein. iCapital and iCapital Network are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2022 Institutional Capital Network, Inc. All Rights Reserved.

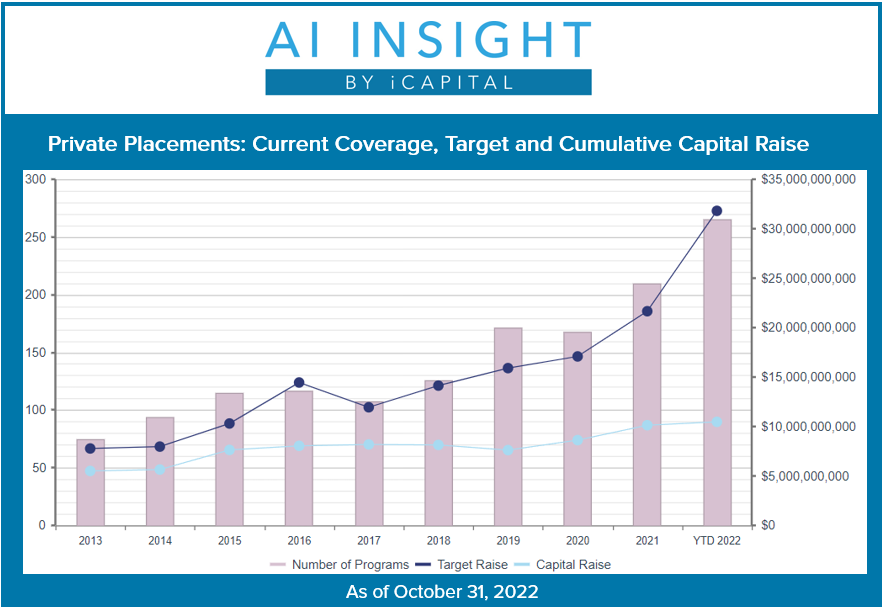

Tuesday, November 15th, 2022 and is filed under Industry Reporting

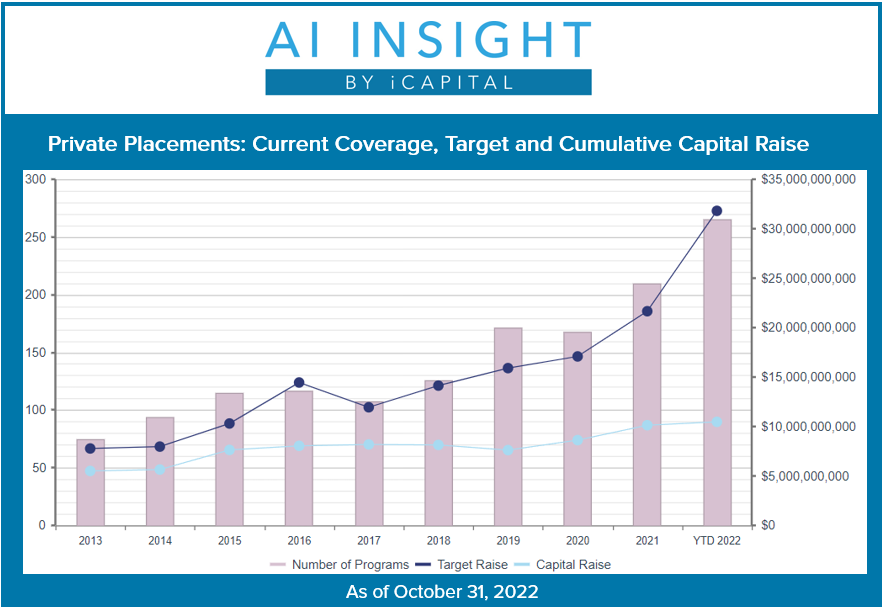

We recently released our October Private Placement Insights report. See the highlights from the report below, or if you are an AI Insight subscriber, log in now to see the entire report.

- 31 new private placements were added to our coverage in October, an increase from prior months as the year-end tax strategies start to come in and strength continues in the non-tax-focused real estate category. Five new conservation funds were added during the month and eleven so far this year, 10% more than last year at this time, while 74 new real estate funds have been added, 126% more than last year. The only category with slower growth on a year-over-year basis is the hedge fund category, which was strong last year as iCapital funds were added.

- Overall, on a year-over-year basis, we have added more funds than last year (+23%), and these funds are targeting a larger amount of capital (+100%). We have also added more than 30 new sponsor relationships across the categories. The increase in volume is indicative of the continued growth in alternative investment options for high-net-worth investors, as well as a focus on education within the space.

- As of November 1st, AI Insight covers 265 private placements currently raising capital, with an aggregate target raise of $31.8 billion and an aggregate reported raise of $10.5 billion or 33% of target.

- Real estate-related funds, including 1031s, Opportunity Zone funds, and non-1031 real estate LLCs, LPs, and private REITs represent the largest component of our private placement coverage at 72% of funds and target raise. Private equity/debt funds represent 13% of funds and 16% of target raise, although this does include 12 private market feeder funds that do not specify an offering target.

- In terms of coverage by general objective, income is the largest component at 61% of funds, while growth and growth & income follow at 21% and 18%, respectively.

- The average size of funds currently raising capital is $120.1 million, ranging from $1.2 million for a specified 1031 exchange fund to $2.5 billion for a private REIT focused on single-family housing.

- 72% of private placements we cover use the 506(b) exemption, 18% use 506(c) and 10% have not yet filed their Form D with the SEC.

- 22 private placements closed to new investors in October and 222 have closed year-to-date. Funds that closed this year have been on the market for an average of 293 days and the 207 funds reporting raised 86% of target on average.

Pitchbook recently released its private market benchmark return analysis with final Q1 2022 data and preliminary Q2 data. Overall, private capital funds lost ground in Q2, declining 1.09%, after a positive Q1. Private equity (-3.16%), venture capital (-2.29%), and private debt funds (-1.80%) posted the lowest returns, while real estate (+3.61%), real assets (+2.16%), and secondaries (+4.65%) remained in positive territory. This year is clearly a reversal from the last two years, where growth and venture capital funds led, and the lower-risk income strategies lagged. Further downside risk in returns could be expected given the lag in valuations in the private markets. However, when considering that the S&P 500 lost nearly 16% in Q2, these markets appear to have done their job in diversifying risk and return streams.

For illustrative purposes only. Past performance is not indicative of future results.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, Non-Traded BDCs and Interval Funds. Receive up to 22 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of October 31, 2022, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose.

This material is confidential and the property of iCapital, and may not be shared with any party other than the intended recipient or his or her professional advisors. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital. This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security offered by Institutional Capital Network, Inc. or its affiliates (together “iCapital Network”). Past performance is not indicative of future results. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors. An investment in an alternative investment entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. The information contained herein is subject to change and is also incomplete. This industry information and its importance is an opinion only and should not be relied upon as the only important information available. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed, and iCapital Network assumes no liability for the information provided.

Products offered by iCapital Network are typically private placements that are sold only to qualified clients of iCapital Network through transactions that are exempt from registration under the Securities Act of 1933 pursuant to Rule 506(b) of Regulation D promulgated thereunder (“Private Placements”). An investment in any product issued pursuant to a Private Placement, such as the funds described, entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. Further, such investments are not subject to the same levels of regulatory scrutiny as publicly listed investments, and as a result, investors may have access to significantly less information than they can access with respect to publicly listed investments. Prospective investors should also note that investments in the products described involve long lock-ups and do not provide investors with liquidity.

Securities may be offered through iCapital Securities, LLC, a registered broker dealer, member of FINRA and SIPC and subsidiary of Institutional Capital Network, Inc. (d/b/a iCapital Network). These registrations and memberships in no way imply that the SEC, FINRA or SIPC have endorsed the entities, products or services discussed herein. iCapital and iCapital Network are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2022 Institutional Capital Network, Inc. All Rights Reserved.

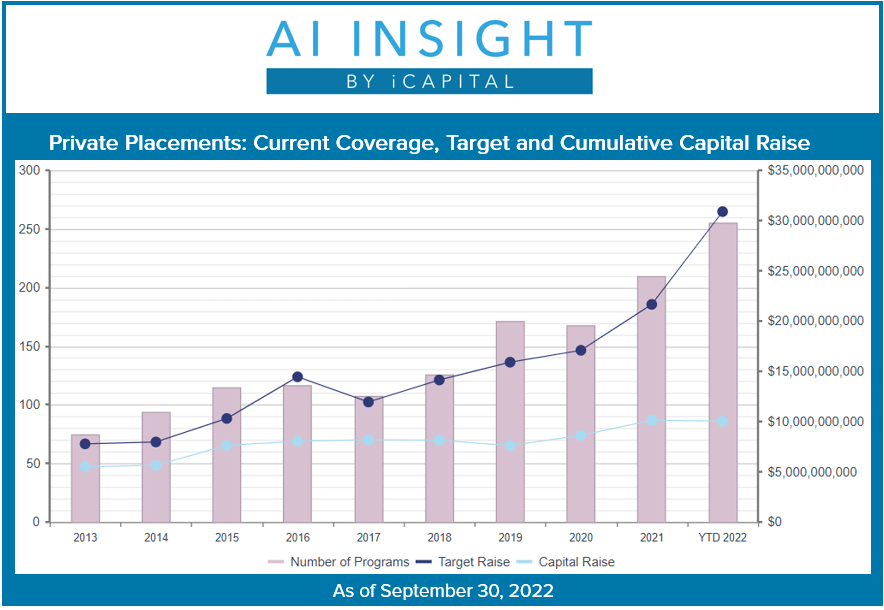

Thursday, October 13th, 2022 and is filed under AI Insight News

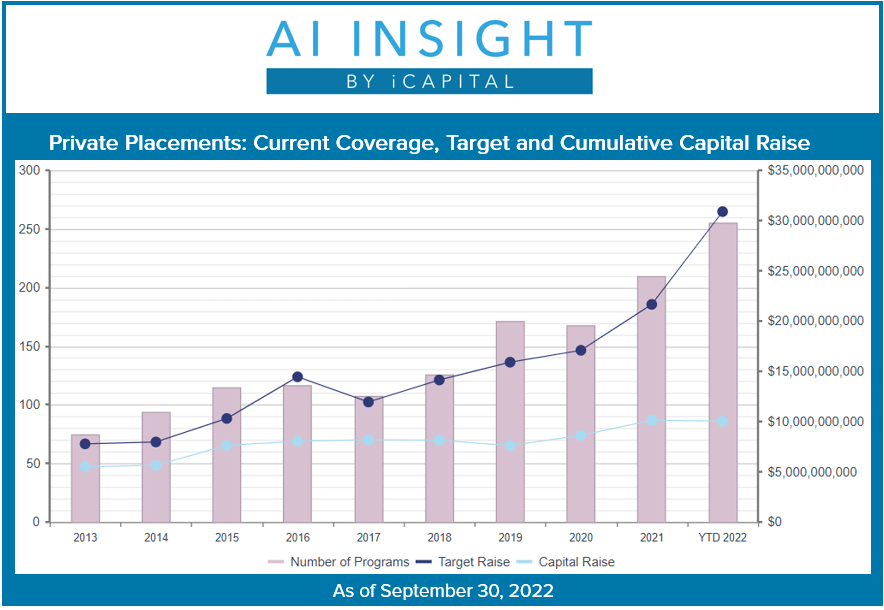

We recently released our September Private Placement Insights report. See the highlights from the report below, or if you are a Premium Reporting subscriber, log in now to see the entire report. If you don’t have access, you can request a free trial.

- 22 new private placements were added to our coverage in September, slower than prior months primarily due to fewer 1031 exchanges added. However, we have added more funds in all categories other than energy and hedge funds this year compared to last, although activity is ramping up in the hedge fund category with new funds coming soon. Real estate funds still lead in terms of funds added and raise targets. Non-tax focused real estate LLCs, LPs, and private REITs are up 96% from a year ago and are seeking to raise 489% more capital. 1031 exchange additions have slowed recently although they are still up year-over-year, while we continue to see slow but steady activity in Opportunity Zone fund additions.

- Overall, on a year-over-year basis, we have added more funds than last year (+26%), and these funds are targeting a larger amount of capital (+101%). We have also added more than 30 new sponsor relationships across the categories. The increase in volume is indicative of the continued growth in alternative investment options for high-net-worth investors, as well as a focus on education within the space.

- As of October 1st, AI Insight covers 255 private placements currently raising capital, with an aggregate target raise of $30.9 billion and an aggregate reported raise of $10.0 billion or 32% of target.

- Real estate-related funds, including 1031s, Opportunity Zone funds, and non-1031 real estate LLCs, LPs, and private REITs represent the largest component of our private placement coverage at 71% of funds and 72% of target raise. Private equity/debt funds represent 15% of funds and 17% of target raise, although this does include 12 private market feeder funds that do not specify an offering target.

- In terms of coverage by general objective, income is the largest component at 57% of funds, while growth and growth & income follow at 25% and 18%, respectively.

- The average size of funds currently raising capital is $121.6 million, ranging from $3.9 million for a specified Opportunity Zone fund to $2.5 billion for a private REIT focused on single-family housing.

- 72% of private placements we cover use the 506(b) exemption, 18% use 506(c) and 10% have not yet filed their Form D with the SEC.

- 27 private placements closed to new investors in September and 203 have closed year-to-date. Funds that closed this year have been on the market for an average of 275 days and the 188 funds reporting raised 89% of target on average.

For illustrative purposes only. Past performance is not indicative of future results.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, Non-Traded BDCs and Interval Funds. Receive up to 22 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of September, 2022, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose.

This material is confidential and the property of iCapital, and may not be shared with any party other than the intended recipient or his or her professional advisors. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital. This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security offered by Institutional Capital Network, Inc. or its affiliates (together “iCapital Network”). Past performance is not indicative of future results. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors. An investment in an alternative investment entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. The information contained herein is subject to change and is also incomplete. This industry information and its importance is an opinion only and should not be relied upon as the only important information available. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed, and iCapital Network assumes no liability for the information provided.

Products offered by iCapital Network are typically private placements that are sold only to qualified clients of iCapital Network through transactions that are exempt from registration under the Securities Act of 1933 pursuant to Rule 506(b) of Regulation D promulgated thereunder (“Private Placements”). An investment in any product issued pursuant to a Private Placement, such as the funds described, entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. Further, such investments are not subject to the same levels of regulatory scrutiny as publicly listed investments, and as a result, investors may have access to significantly less information than they can access with respect to publicly listed investments. Prospective investors should also note that investments in the products described involve long lock-ups and do not provide investors with liquidity.

Securities may be offered through iCapital Securities, LLC, a registered broker dealer, member of FINRA and SIPC and subsidiary of Institutional Capital Network, Inc. (d/b/a iCapital Network). These registrations and memberships in no way imply that the SEC, FINRA or SIPC have endorsed the entities, products or services discussed herein. iCapital and iCapital Network are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2022 Institutional Capital Network, Inc. All Rights Reserved.

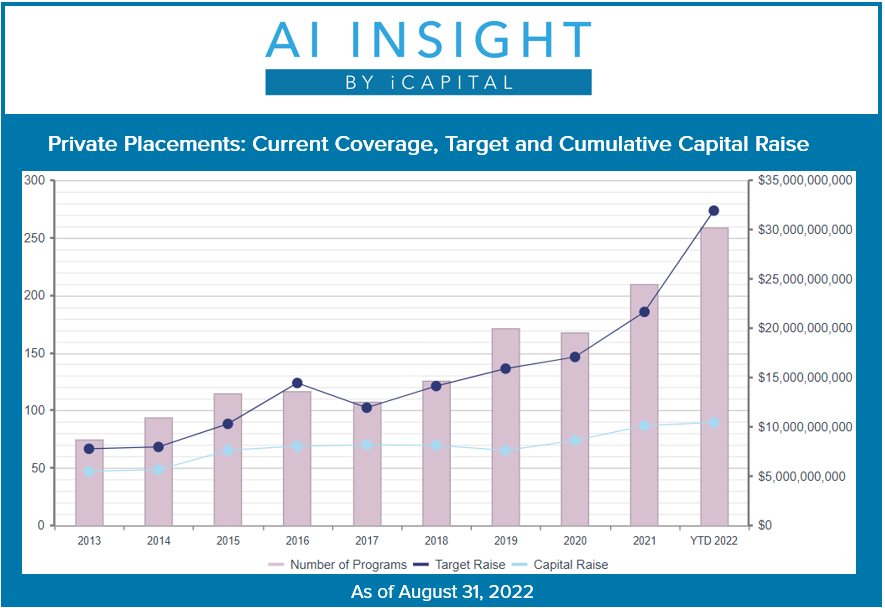

Wednesday, September 14th, 2022 and is filed under Industry Reporting

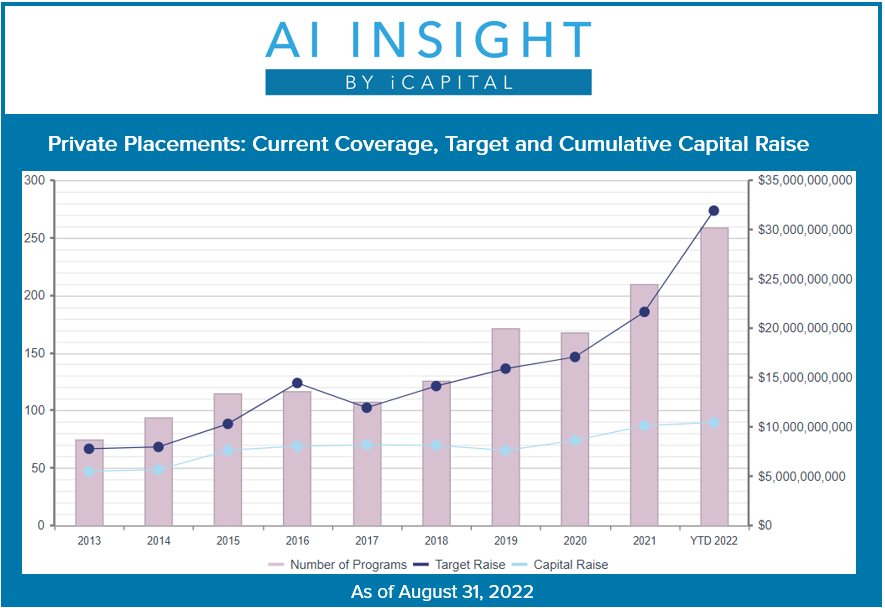

We recently released our August Private Placement Insights report. See the highlights from the report below, or if you are a Premium Reporting subscriber, log in now to see the entire report. If you don’t have access, you can request a free trial.

- 36 new private placements were added to our coverage in August, tying July as another record month. We have added more funds in all categories other than hedge funds this year compared to last, although activity is ramping up in that category with new funds coming soon. Real estate funds still lead in terms of funds added and raise targets. Non-tax-focused real estate LLCs, LPs, and private REITs are up 95% from a year ago and are seeking to raise 514% more. 1031 exchange additions have slowed recently although they are still up year-over-year, while we continue to see steady activity in Opportunity Zone fund additions.

- Overall, on a year-over-year basis, we have added more funds than last year (+31%), and these funds are targeting a larger amount of capital (+111%). We have also added nearly 30 new sponsor relationships across the categories. The increase in volume is indicative of the continued growth in alternative investment options for high-net-worth investors, as well as a focus on education within the space.

- As of September 1st, AI Insight covers 259 private placements currently raising capital, with an aggregate target raise of $31.9 billion and an aggregate reported raise of $10.4 billion or 34% of target.

- Real estate-related funds, including 1031s, Opportunity Zone funds, and non-1031 real estate LLCs, LPs, and private REITs represent the largest component of our private placement coverage at 68% of funds and 70% of target raise. Private equity/debt funds represent 16% of funds and 17% of target raise, although this does include 14 private market feeder funds that do not specify an offering target.

- In terms of coverage by general objective, income is the largest component at 56% of funds, while growth and growth & income follow at 26% and 18%, respectively.

- The average size of funds currently raising capital is $122.8 million (up from $117 million as of the beginning of August), ranging from $3.9 million for a specified Opportunity Zone fund to $2.5 billion for a private REIT focused on single-family housing.

- 73% of private placements we cover use the 506(b) exemption, 16% use 506(c), and 11% have not yet filed their Form D with the SEC.

- Twenty-three private placements closed to new investors in August and 176 have closed year-to-date. Funds that closed this year have been on the market for an average of 285 days and the 145 funds reporting, raised 83% of target on average.

- According to Pitchbook, private market fundraising has flattened since peaking pre-pandemic in 2019. However, first half 2022 levels are still on par with 2021, with the difference being fewer funds seeking a larger share of the raise. Larger funds continue to gain more share, taking in 33.6% of commitments in 2022 versus 22.1% in 2021. Additionally, successor funds are getting larger, with the median successor fund in private debt 90.3% larger than its predecessor, and median funds in real assets 87.7% larger than their prior funds. These bigger funds hold a larger percentage of dry powder than ever as well, which may translate into more take-private deals as these dollars are put to work and public market valuations have come down. On the flip side, first-time fundraisers have struggled this year, with the amount raised by new managers and the number of first-time funds well below 2021[1].

- Pitchbook also reports that private equity, private debt, and real estate strategies have taken less a share of the raise in the first half of 2022 compared to 2021, while real assets (excluding real estate) and venture capital strategies have taken a larger share[2].

For illustrative purposes only. Past performance is not indicative of future results.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, Non-Traded BDCs and Interval Funds. Receive up to 22 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of August 31, 2022, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose.

This material is confidential and the property of iCapital, and may not be shared with any party other than the intended recipient or his or her professional advisors. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital. This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security offered by Institutional Capital Network, Inc. or its affiliates (together “iCapital Network”). Past performance is not indicative of future results. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors. An investment in an alternative investment entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. The information contained herein is subject to change and is also incomplete. This industry information and its importance is an opinion only and should not be relied upon as the only important information available. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed, and iCapital Network assumes no liability for the information provided.

Products offered by iCapital Network are typically private placements that are sold only to qualified clients of iCapital Network through transactions that are exempt from registration under the Securities Act of 1933 pursuant to Rule 506(b) of Regulation D promulgated thereunder (“Private Placements”). An investment in any product issued pursuant to a Private Placement, such as the funds described, entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. Further, such investments are not subject to the same levels of regulatory scrutiny as publicly listed investments, and as a result, investors may have access to significantly less information than they can access with respect to publicly listed investments. Prospective investors should also note that investments in the products described involve long lock-ups and do not provide investors with liquidity.

Securities may be offered through iCapital Securities, LLC, a registered broker dealer, member of FINRA and SIPC and subsidiary of Institutional Capital Network, Inc. (d/b/a iCapital Network). These registrations and memberships in no way imply that the SEC, FINRA or SIPC have endorsed the entities, products or services discussed herein. iCapital and iCapital Network are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2022 Institutional Capital Network, Inc. All Rights Reserved.

[1] Source: Pitchbook, August 2022

[2] Source: Pitchbook, August 2022

Wednesday, August 10th, 2022 and is filed under Industry Reporting

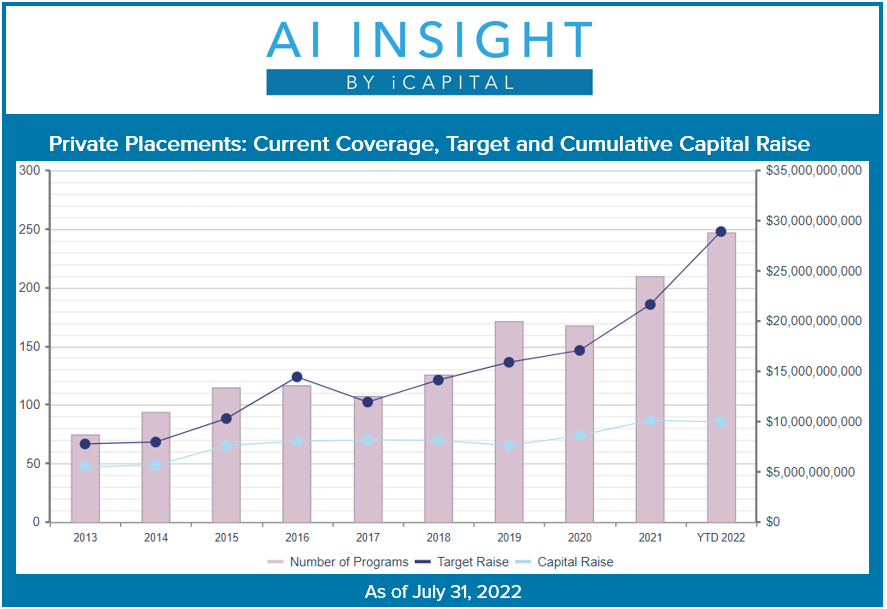

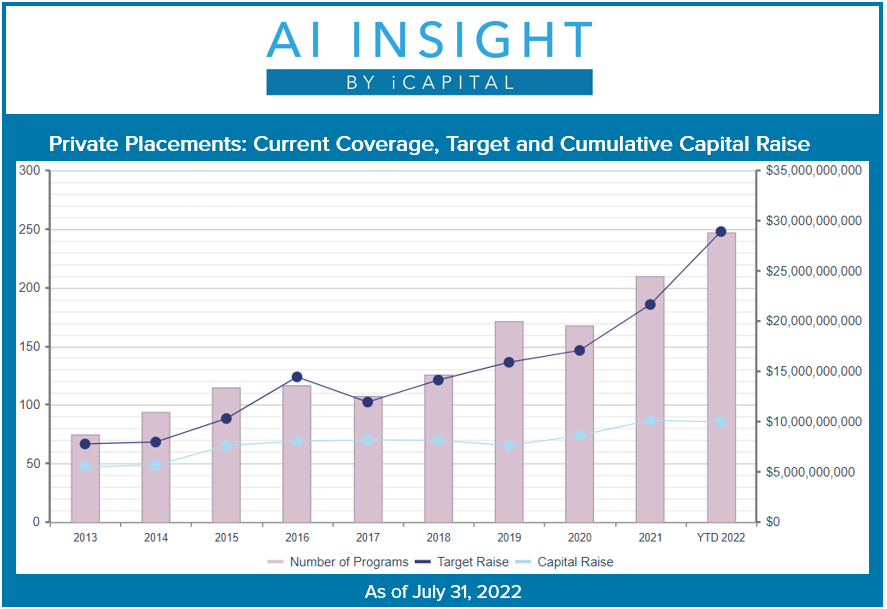

We recently released our July Private Placement Insights report. See the highlights from the report below, or if you are a Premium Reporting subscriber, log in now to see the entire report. If you don’t have access, you can request a free trial.

- 36 new private placements were added to our coverage in July, ahead of June and another record month. We have added more funds in all categories other than hedge funds this year compared to last, as some of the early lagging categories including energy, preferred securities, and private equity/debt have ramped up recently. 1031 exchange additions have slowed recently although they are still up year-over-year, while Opportunity Zone funds and the non-tax focused real estate funds are up significantly.

- Overall, on a year-over-year basis, we have added more funds than last year (+33%), and these funds are targeting a larger amount of capital (+97%). We have also added 27 new sponsor relationships across the categories.

- As of August 1st, AI Insight covers 247 private placements currently raising capital, with an aggregate target raise of $28.9 billion and an aggregate reported raise of $10 billion or 34% of target.

- Real estate-related funds, including 1031s, Opportunity Zone funds, and non-1031 real estate LLCs/LPs and private REITs represent the largest component of our private placement coverage at 70% of funds and 68% of target raise. Private equity/debt funds represent 15% of funds and 18% of target raise, although this does include 13 private market feeder funds that do not specify an offering target.

- In terms of coverage by general objective, income is the largest component at 56% of funds, while growth and growth & income follow at 27% and 17%, respectively.

- The average size of funds currently raising capital is $117 million, ranging from $4.0 million for a private managed futures fund to $2.5 billion for a private REIT focused on single-family housing.

- 71% of private placements we cover use the 506(b) exemption, 18% use 506(c) and 10% have not yet filed their Form D with the SEC.

- Sixteen private placements closed to new investors in June and 154 have closed year-to-date. Funds that closed this year have been on the market for an average of 255 days and the 145 funds reporting, raised 88% of target on average.

For illustrative purposes only. Past performance is not indicative of future results.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, Non-Traded BDCs and Interval Funds. Receive up to 22 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of July 31, 2022, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose.

This material is confidential and the property of iCapital, and may not be shared with any party other than the intended recipient or his or her professional advisors. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital. This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security offered by Institutional Capital Network, Inc. or its affiliates (together “iCapital Network”). Past performance is not indicative of future results. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors. An investment in an alternative investment entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. The information contained herein is subject to change and is also incomplete. This industry information and its importance is an opinion only and should not be relied upon as the only important information available. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed, and iCapital Network assumes no liability for the information provided.

Products offered by iCapital Network are typically private placements that are sold only to qualified clients of iCapital Network through transactions that are exempt from registration under the Securities Act of 1933 pursuant to Rule 506(b) of Regulation D promulgated thereunder (“Private Placements”). An investment in any product issued pursuant to a Private Placement, such as the funds described, entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. Further, such investments are not subject to the same levels of regulatory scrutiny as publicly listed investments, and as a result, investors may have access to significantly less information than they can access with respect to publicly listed investments. Prospective investors should also note that investments in the products described involve long lock-ups and do not provide investors with liquidity.

Securities may be offered through iCapital Securities, LLC, a registered broker dealer, member of FINRA and SIPC and subsidiary of Institutional Capital Network, Inc. (d/b/a iCapital Network). These registrations and memberships in no way imply that the SEC, FINRA or SIPC have endorsed the entities, products or services discussed herein. iCapital and iCapital Network are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2022 Institutional Capital Network, Inc. All Rights Reserved.

Tuesday, July 19th, 2022 and is filed under Industry Reporting

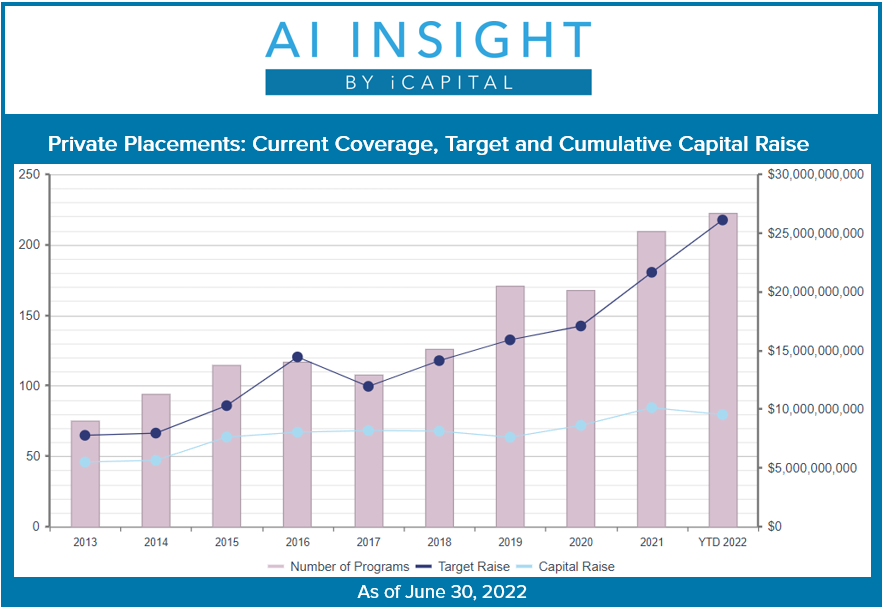

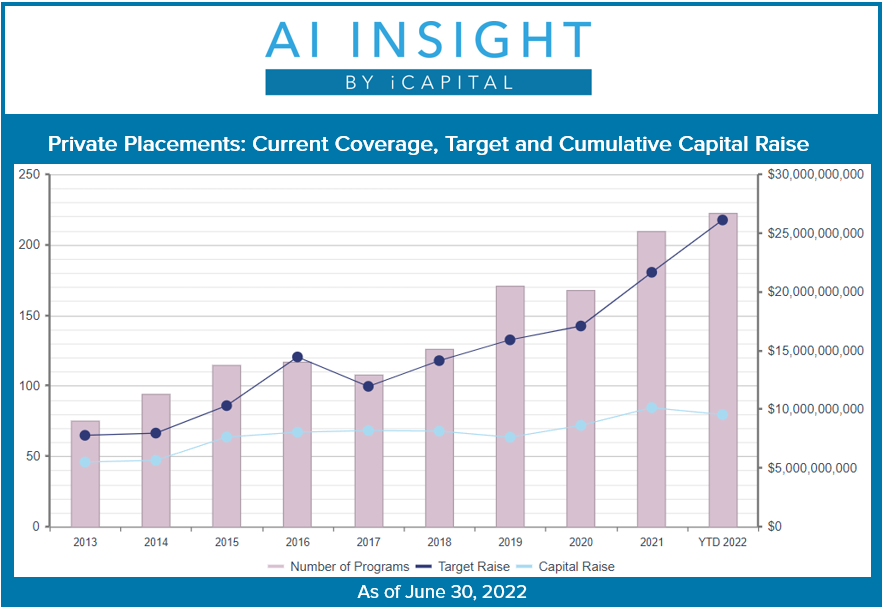

We recently released our June Private Placement Insights report. See the highlights from the report below, or if you are a Premium Reporting subscriber, log in now to see the entire report. If you don’t have access, you can request a free trial.

- 34 new private placements were added to our coverage in June, just one fund off from the prior month’s record. Real estate funds including tax-focused and other funds continued to lead the pack, although energy and private equity/debt strategies have seen upticks in recent months. On a year-over-year basis, we have added more funds than last year (+35%), and these funds are targeting a larger amount of capital (+99%).

- As of July 1st, AI Insight covers 223 private placements currently raising capital, with an aggregate target raise of $26.1 billion and an aggregate reported raise of $9.5 billion or 36% of target.

- Real estate-related funds, including 1031s, Opportunity Zone funds, and non-1031 real estate LLCs/LPs and private REITs represent the largest component of our private placement coverage at 71% of funds and 66% of target raise. Private equity/debt funds represent 13% of funds and 19% of target raise, although this does include seven private market feeder funds that do not specify an offering target.

- In terms of coverage by general objective, income is the largest component at 54% of funds, while growth and growth & income follow at 27% and 19%, respectively.

- The average size of the funds currently raising capital is $116 million, ranging from $4.0 million for a private managed futures fund to $2.5 billion for a private REIT focused on single family housing.

- 75% of private placements we cover use the 506(b) exemption, 16% use 506(c) and 9% have not yet filed their Form D with the SEC.

- Fourteen private placements closed to new investors in June and 139 have closed year-to-date. Funds that closed this year have been on the market for an average of 282 days and the 130 funds reporting raised 87% of target on average.

For illustrative purposes only. Past performance is not indicative of future results.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, Non-Traded BDCs and Interval Funds. Receive up to 22 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of June 30, 2022, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose.

This material is confidential and the property of iCapital, and may not be shared with any party other than the intended recipient or his or her professional advisors. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital. This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security offered by Institutional Capital Network, Inc. or its affiliates (together “iCapital Network”). Past performance is not indicative of future results. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors. An investment in an alternative investment entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. The information contained herein is subject to change and is also incomplete. This industry information and its importance is an opinion only and should not be relied upon as the only important information available. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed, and iCapital Network assumes no liability for the information provided.

Products offered by iCapital Network are typically private placements that are sold only to qualified clients of iCapital Network through transactions that are exempt from registration under the Securities Act of 1933 pursuant to Rule 506(b) of Regulation D promulgated thereunder (“Private Placements”). An investment in any product issued pursuant to a Private Placement, such as the funds described, entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. Further, such investments are not subject to the same levels of regulatory scrutiny as publicly listed investments, and as a result, investors may have access to significantly less information than they can access with respect to publicly listed investments. Prospective investors should also note that investments in the products described involve long lock-ups and do not provide investors with liquidity.

Securities may be offered through iCapital Securities, LLC, a registered broker dealer, member of FINRA and SIPC and subsidiary of Institutional Capital Network, Inc. (d/b/a iCapital Network). These registrations and memberships in no way imply that the SEC, FINRA or SIPC have endorsed the entities, products or services discussed herein. iCapital and iCapital Network are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2022 Institutional Capital Network, Inc. All Rights Reserved.