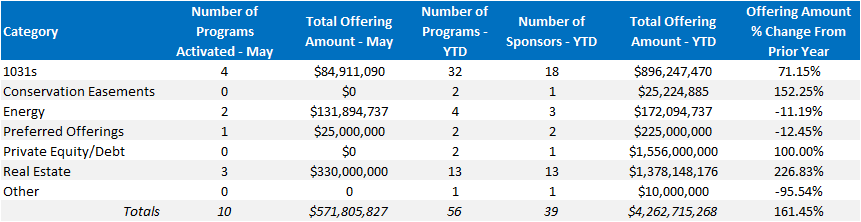

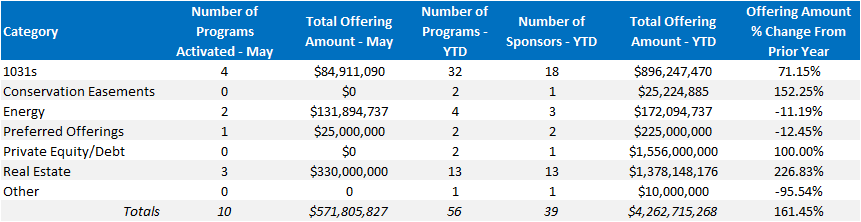

Private Placement Industry Highlights – May and YTD 2018

Monday, July 2nd, 2018 and is filed under AI Insight News

A review of private placements on the AI Insight Platform:

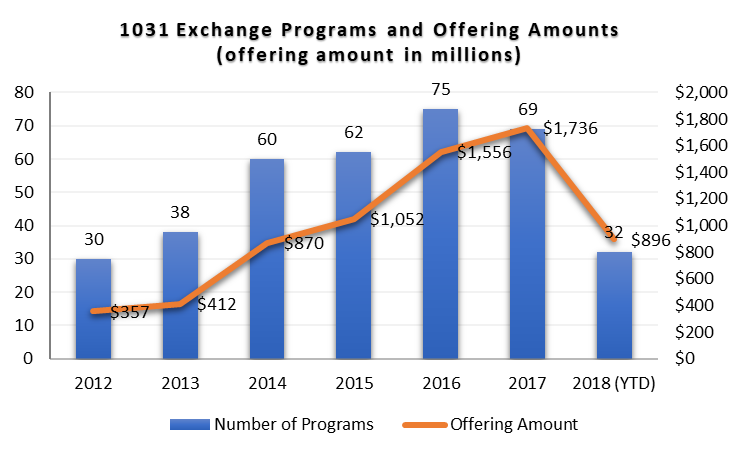

1031 Exchange Programs

- There were four new 1031 programs activated on the AI Insight platform in May for a total of $84.9 million in total offering amount, with 32 activated YTD as of the end of May for a total offering amount of $896.2 million.

- The aggregate May offering amount was above April levels and YTD is approximately 71% above 2017 YTD levels.

- Inland Private Capital remains the top sponsor in the industry with 32% of the offering amount YTD. The remainder of the programs were evenly spread between different sponsors.

- Multifamily and net lease programs represented the top sectors at 53% and 12% of offering amounts YTD, respectively. Student housing represented just under 9%, and two of the first healthcare programs were activated as well. Retail net lease programs represent less than 5% of offering amounts, a major shift from the dominance of the sector in prior years.

- ON DECK: As of June 25th, nine DST programs were activated in June with two more coming soon.

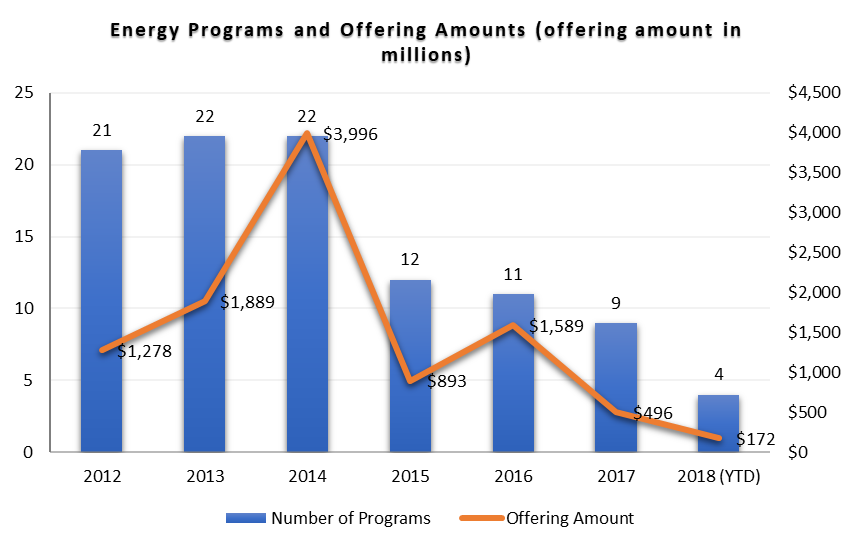

Energy

- Two energy focused programs were activated in May, for a total of four programs YTD with $172.1 million in maximum offering amount.

- A large program focused on oil and gas development activated in May, which brings the sector back to a similar run rate as 2017 in terms of offering amount.

- ON DECK: As of June 25th, four programs have been activated in June. The sector seems to be ramping up as the year moves on, as it typically does. It will be interesting to see whether the reversal in oil prices brings new life to the energy sector, which has seen much slower activity since the 2014 peak in oil prices.

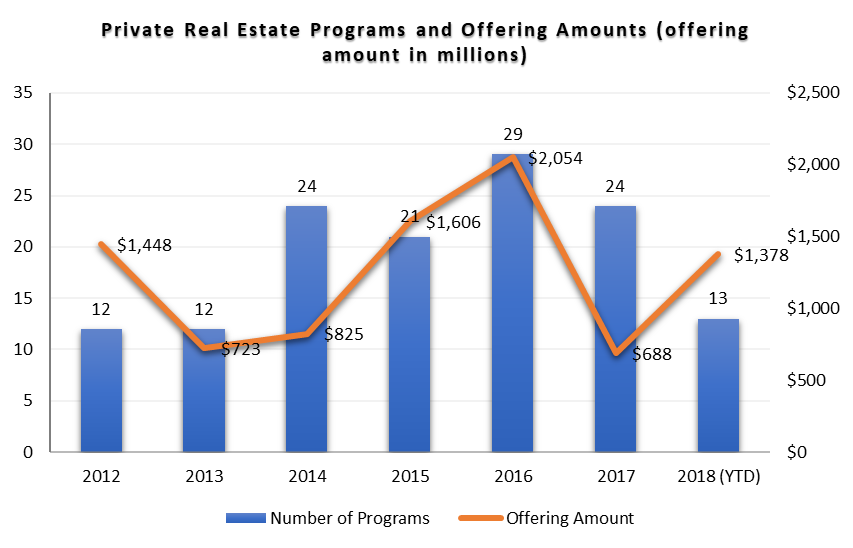

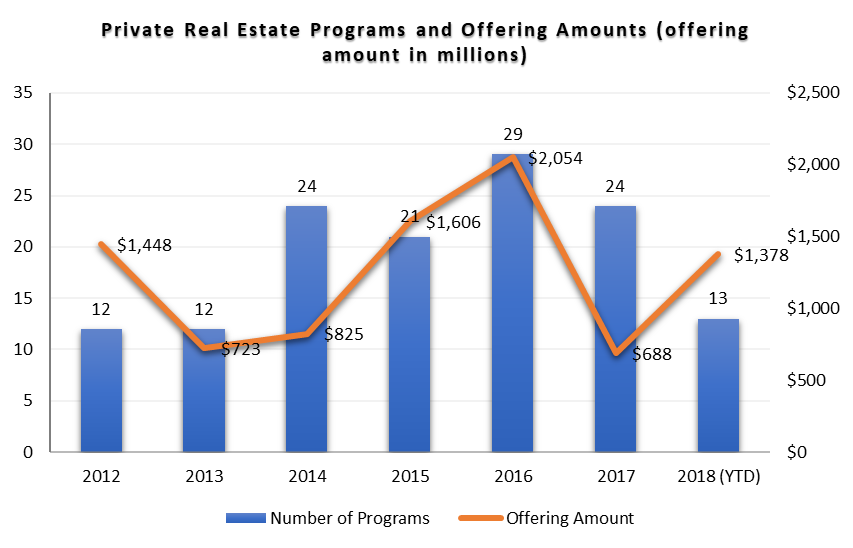

Real Estate

- 13 non-1031 real estate focused private placement programs have been activated on the AI Insight platform so far in 2018. This is on-par with last year’s numbers, but the offering amounts are higher.

- As of May 31, 2018, the total maximum offering amount for real estate focused funds was over $1.3 billion, which doubles the total offering amount of $687 million for the full year 2017.

- ON DECK: As of June 25th, seven real estate private placement programs were activated so far in June with two more coming soon.

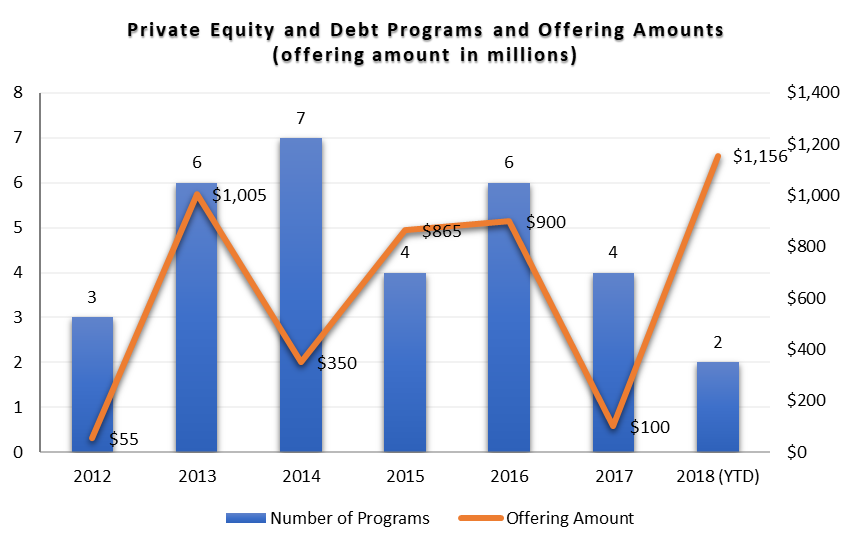

Other

Other

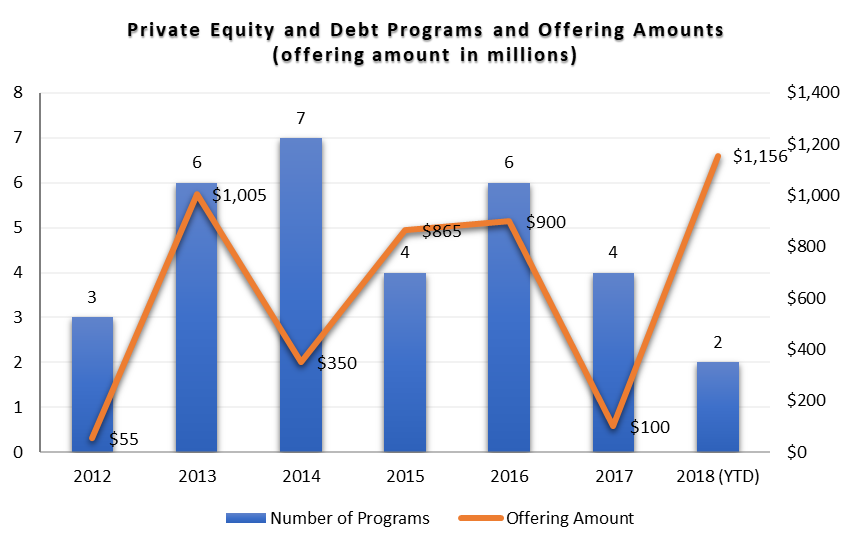

- Similar to real estate, we have seen the same amount of private equity and debt programs YTD as we did last year, but the offering sizes have increased, including a $1 billion+ program offered by GPB.

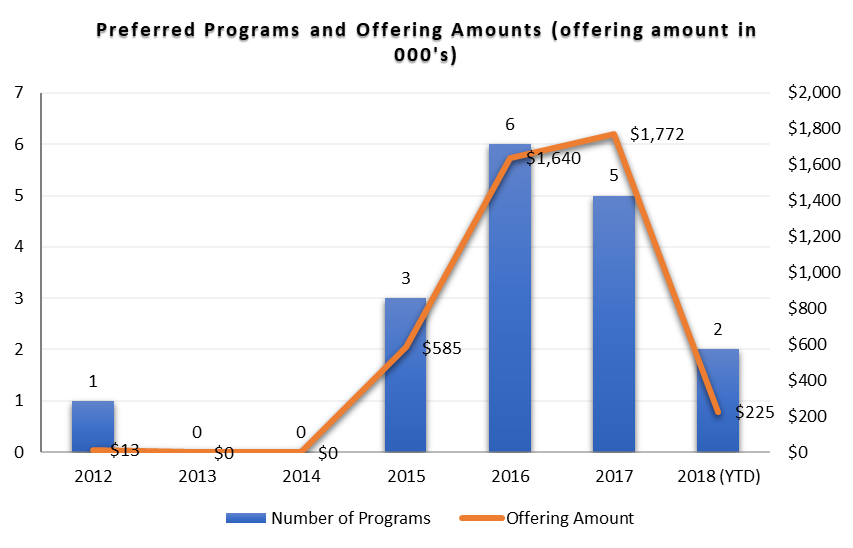

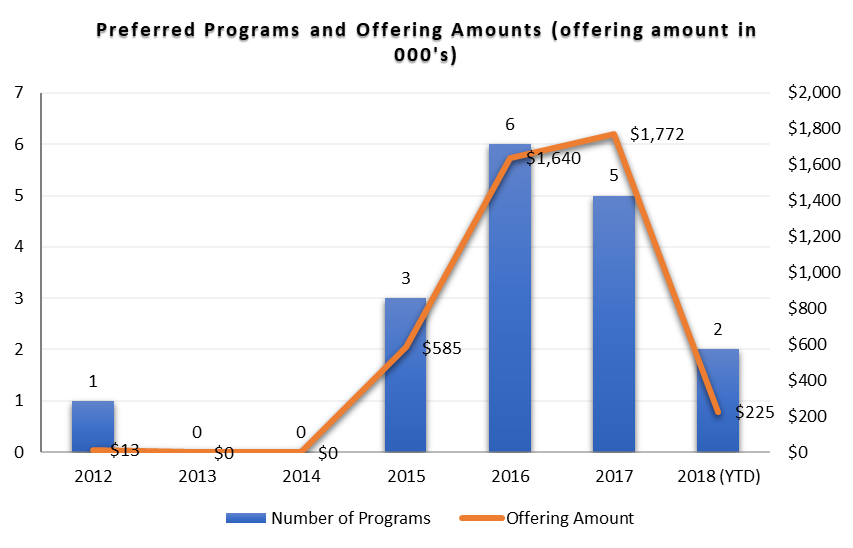

- Preferred programs appear to be on par with 2017 levels.

- Two conservation easement programs have activated so far in 2017, both offered by EcoVest Capital. There were no offerings as of this time last year, however, the year was back-end heavy with 24 programs for $294 million offered between May and the end of the year.

Charts Source: AI Insight. Data as of May 31, 2018, based on programs activate on the AI Insight platform as of this date.

Glossary:

Activated: Program and education module are live on the AI Insight platform. Subscribers are able to view and download data for the program and take the education module.

Other

Other