Private Placement Industry Highlights – April and YTD 2018

Monday, May 14th, 2018 and is filed under AI Insight News

A review of the private placements on the AI Insight Platform by Laura Sexton – AI Insight Senior Director-Project Management

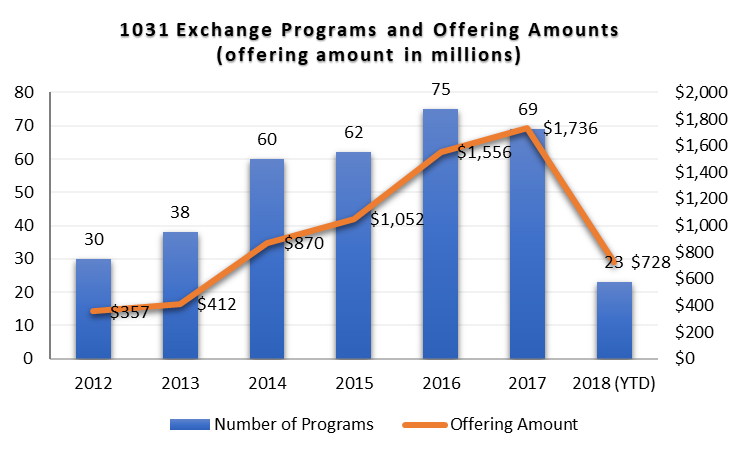

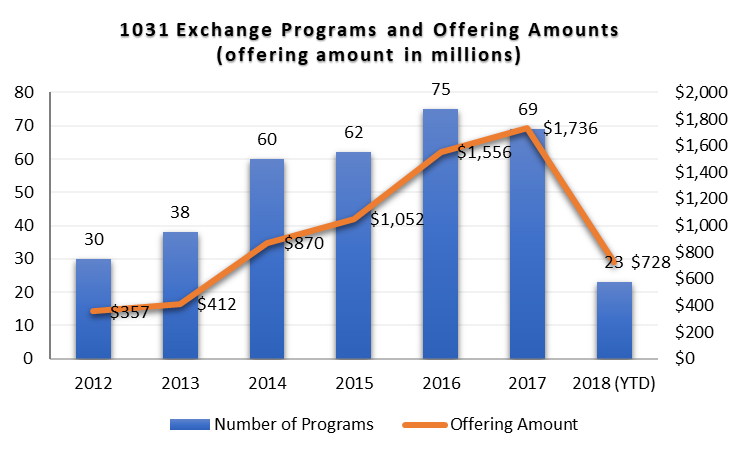

1031 Exchange Programs

- There were seven new 1031 programs activated on the AI Insight platform in April for a total of $68.1 million in total offering amount, with 23 activated YTD as of the end April for a total offering amount of $728.3 million.

- The aggregate number of offerings and offering amounts were above March levels and YTD the category is approximately 76% above the aggregate YTD offering amount levels in 2017.

- Inland Private Capital remains the top sponsor in the industry with 35% of the offering amount YTD. The remainder of the programs were evenly spread between different sponsors, including two new entrants on the AI Insight platform.

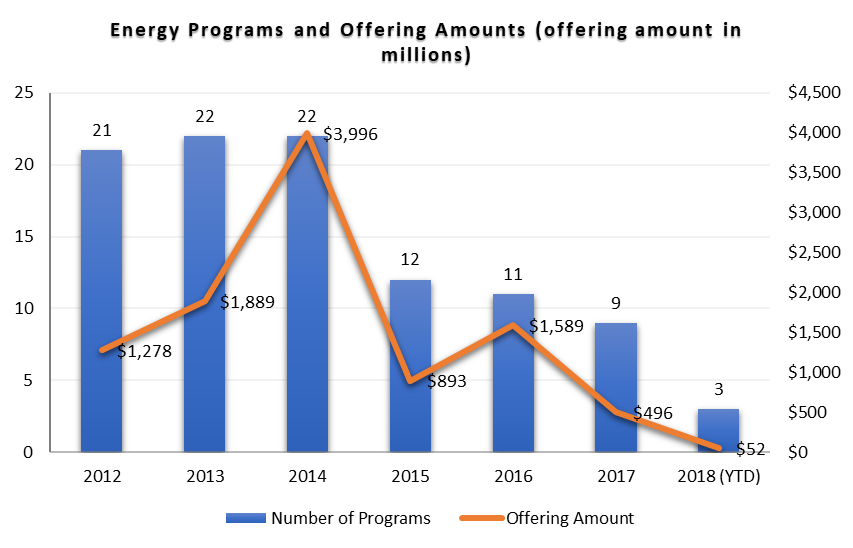

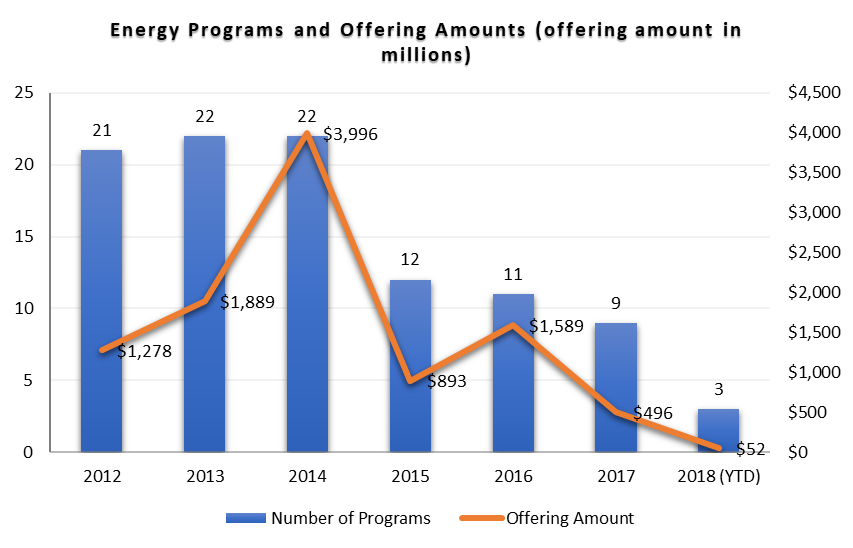

Energy

- One energy focused program activated in April after only one activated in Q1. A third activated in May. All three for the year have been focused on royalty and mineral interests. As of May 9, 2018, there were two programs in entry.

- Energy programs generally ramp up towards the middle to the end of the calendar year. However, the category is roughly 66% behind in terms of offering amounts as compared to the same time last year. We have seen a steady decline in the number of energy programs since the cyclical peak in 2014, which coincides with the cyclical peak in oil prices the same year.

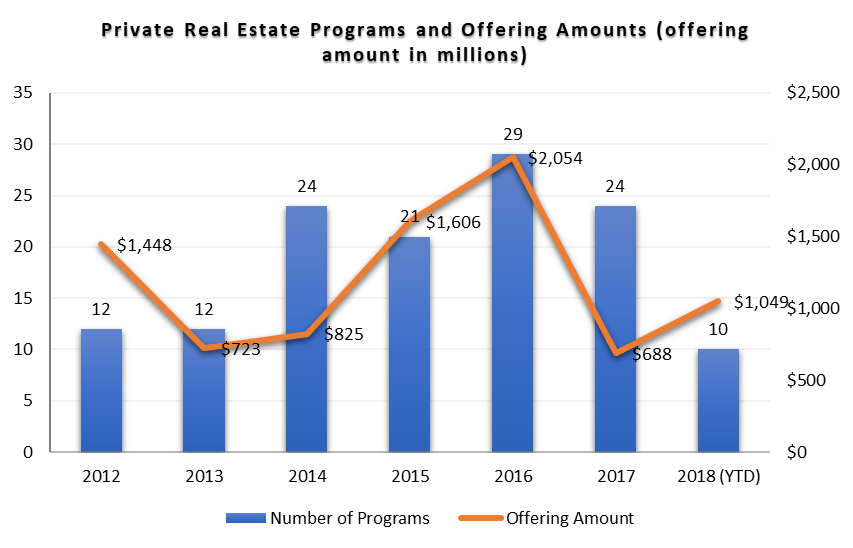

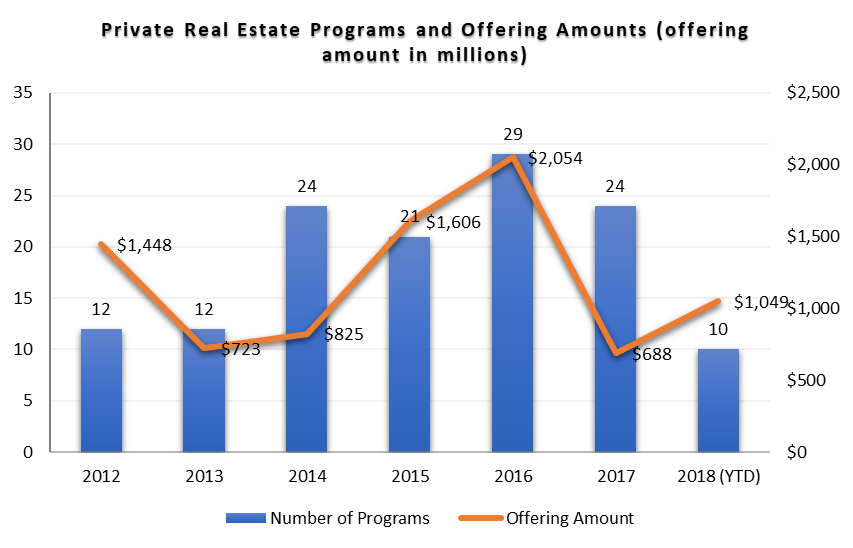

Real Estate

Real Estate

- There have been 10 real estate focused private placement programs activated on the AI Insight platform so far in 2018. The number of programs activated is on-par with last year’s numbers, but the offering amounts are higher.

- As of April 30, the total max offering amount for real estate focused funds was just over $1 billion, which already eclipses to the total offering amount of $687 million for the full year 2017.

Other

Other

- Similar to real estate, we have seen the same amount of private equity and debt programs YTD as we did last year, but the offering sizes have increased, including one $1 billion+ program offered by GPB.

- Preferred programs and offering amounts appear to be on par with 2017 levels.

- Two conservation easement programs have activated so far in 2017, both offered by EcoVest Capital. There were no offerings as of this time last year. However, the year was back-end heavy, with 24 programs for $294 million offered between May and the end of the year.

Source: AI Insight. Data as of April 30, 2018, based on programs activated on the AI Insight platform as of this date.

Real Estate

Real Estate Other

Other