Tuesday, July 16th, 2019 and is filed under AI Insight News

We recently released our June Private Placement Insights. AI Insight currently covers 154 private funds that are raising capital, representing over $5 billion in capital raise/AUM. This includes 14 new private placements added to our coverage in June. Highlights from the report include:

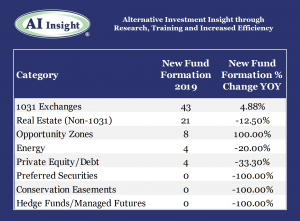

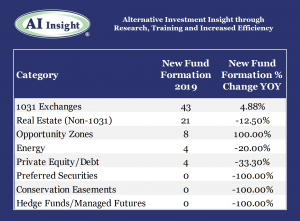

- 2019 fund formation overall is on par with 2018. Target raise is lower = smaller average fund size.

- Real estate funds continue to dominate the private placement space.

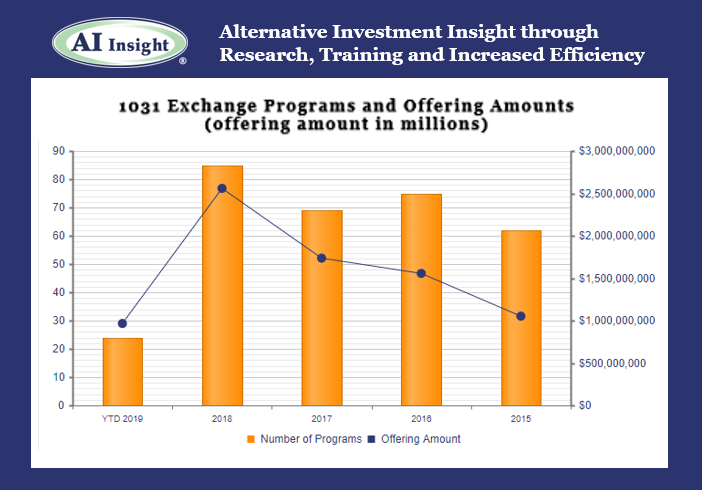

- 43 new 1031 exchanges and 21 new non-1031 real estate funds have been added to our coverage in 2019.

- 8 qualified opportunity zone funds have been added in 2019 with more coming soon. However, raise is slow, with the funds reporting an aggregate raise of 11.9% of target.

- Other niche strategies (energy, conservation easements, preferred offerings) are down for the year.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, BDCs, Closed-End Funds, and Alternative Mutual Funds. Receive up to 24 extensive reports per year to help broaden your alternative investment reviews.

Watch this tour or request a live demo of AI Insight’s expansive Industry Reports customized to your business needs.

_________________________________

Chart and data as of June 30, 2019, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose. Copyright © 2019 AI Insight. All Rights Reserved.

Friday, June 14th, 2019 and is filed under AI Insight News

AI Insight is a platinum sponsor of Real Assets Adviser. Read the articles contributed by our staff in this month’s issue:

- “2018 by the numbers: A performance review of non-traded REITs in the year past“, by Laura Sexton, who serves on the magazine’s Editorial Advisory Board.

- “Alt funds: Tepid numbers but low volatility“, by Lou Johnson, CFA, covers alternative mutual fund performance and reporting.

Real Assets Adviser is a monthly publication dedicated to providing actionable information on the real assets class to the broader private wealth community.

- Log in to your Real Assets Adviser account to view the June issue.

- Not a subscriber? Sign up for your free 1-, 2- or 3-year subscription to Real Assets Adviser.

Friday, June 7th, 2019 and is filed under AI Insight News

AI Insight recently added Industry Reporting capabilities to help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, BDCs, and Closed-End Funds, and Alternative Mutual Funds. You can receive up to 24 extensive reports per year to help broaden your alternative investment reviews. Read an overview of AI Insight’s expansive coverage as of May 31, 2019:

- AI Insight currently covers 145 private funds that are raising capital, representing just over $5 billion in capital raise/AUM. This includes 20 new funds added to our coverage in May, which was a significant month in terms of new fund formation.

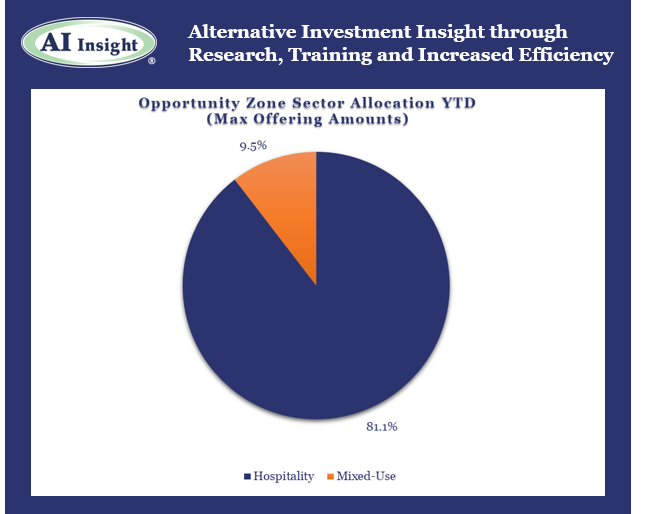

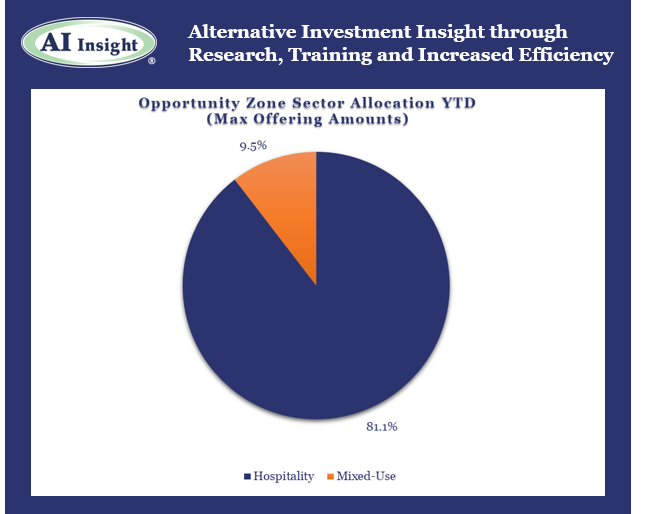

- Five new opportunity zone funds have been added to our coverage YTD, including two in May, for an aggregate target raise of $640.0 million. Target raise ranges from $30 million to $275 million.

- Geographic focus ranges from specifically Maryland to the broader United States. Two funds are blind pool funds focused on hospitality, one is a blind pool fund focused on multifamily, and two are focused on specific mixed-use development projects.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. Plus, you can view more stats on other private placement categories and access Excel charts of this data.

Watch this tour or request a live demo of AI Insight’s expansive Industry Reports customized to your business needs.

_________________________________

Data as of May 31, 2019, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose. Copyright © 2019 AI Insight. All Rights Reserved.

Tuesday, May 28th, 2019 and is filed under AI Insight News

Improve your research process using AI Insight’s Alternative Mutual Fund Research capabilities. Our alternatives-centric strategy provides comprehensive information covering investment methods to help you apply liquid alternatives in your practice. Watch a short tour

- Conduct Research: Use reports to research quantitative and qualitative data including fund

company, strategy and investment advisor overviews.

- Understand Fund Strategies: Research strategies including managed futures, long-short, market

neutral and alternative allocation.

- Track Performance: Stay current with performance using portfolio-oriented peer groups and

strategy-based benchmarks for comparison insight.

- Grow Your Business: Use tools to expand your knowledge and track your due diligence efforts

to more confidently identify and apply alternative investment solutions.

Thursday, May 9th, 2019 and is filed under AI Insight News

AI Insight recently added Industry Reporting capabilities to the platform to help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, BDCs, and Closed-End Funds, and Alternative Mutual Funds.

You can receive up to 24 extensive reports per year to help broaden your alternative investment review coverage. View an excerpt of the April Private Placements report below.

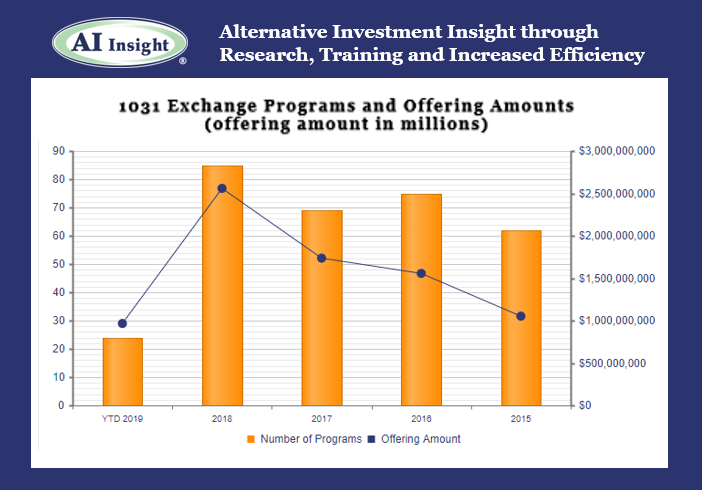

- There were three new 1031 programs activated on the AI Insight platform in April for a combined $180.8 million in total offering amount.

- Twenty-seven programs had activated through April 2018 for an aggregate offering amount of $792.5 million compared to 24 programs and $966.0 million in aggregate offering amount through April 2019.

- ON DECK: As of May 7, 2019, there were four new DSTs coming soon.

See how this comprehensive one-click tool gives you easy access to both market-industry and fund-level reports to help you efficiently track market industries and funds.

Watch this video or request a live demo of AI Insight’s expansive Industry Reports customized to your business needs.

_________________________________

Charts Source: AI Insight. Data as of April 30, 2019, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose. Copyright © 2019 AI Insight. All Rights Reserved.

Tuesday, April 30th, 2019 and is filed under AI Insight News

Working with alternative investments can be complex given operational challenges and increasing scrutiny from regulators. If you’re using technology tools for everything in your business – practice management, investment research, communicating with clients – why not use it to track your compliance efforts?

Securely document compliance efforts to meet regulatory requirements

- AI Insight’s secure web-based Training, Education and Research (TER) log offers centralized online compliance documentation and tracking.

- Document your training per FINRA NTMs 03-71, 05-26, 10-22 and 12-03.

- Download on-demand compliance reports for proactive supporting documentation including consolidated compliance logs and education module failed question analysis.

Streamline your document management process

AI Insight’s TER log automatically tracks your documentation all on one convenient platform to help you efficiently manage your research, education and training activity, such as:

- Viewing research reports related to alternative investments

- Product offering document reviews

- Creating product comparison reports based on 120+ program features

- Training activity including product-specific education modules, Firm Element and more

- Alternative investment industry marketing materials and white papers

Easily access your documentation to save time

The TER log will save you time, so you can focus less on how to manage your regulatory obligations and focus more on your clients’ needs.

- If you need access to your records, it’s easy to log in, view and filter the information you need quickly.

- You can easily export if you want to share your records, save for your files, or quickly produce the information you need in the event of an audit.

- Switching firms? We’ll work with you and your new firm to securely transfer your training history, if applicable.

Be proactive

Use these resources to help you use technology to your advantage:

- Re-evaluate the technology tools, as well as the technology training you’re currently using, to understand what improvements you may want to make.

- Prepare yourself for internet security risks and unauthorized data access, which can impact clients and your business. Take our latest CE course, “Cybersecurity Awareness for Financial Professionals“, to learn more while helping to meet regulatory-compliance requirements.

- Watch a 3-minute video to see the AI Insight platform in action including the TER log and other important features. Or, request a live tour customized to your business needs.

Thursday, April 18th, 2019 and is filed under AI Insight News

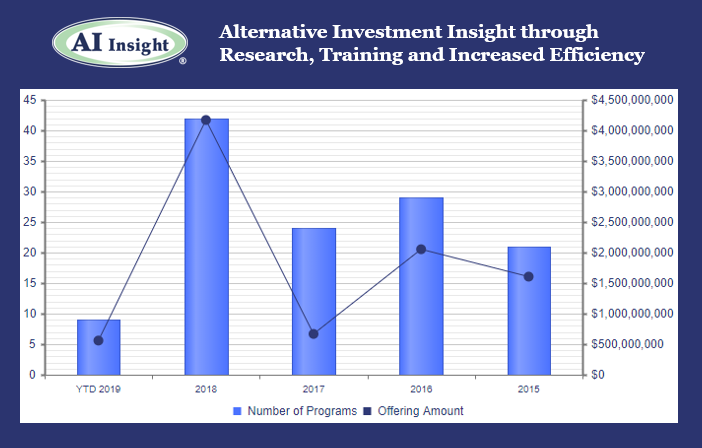

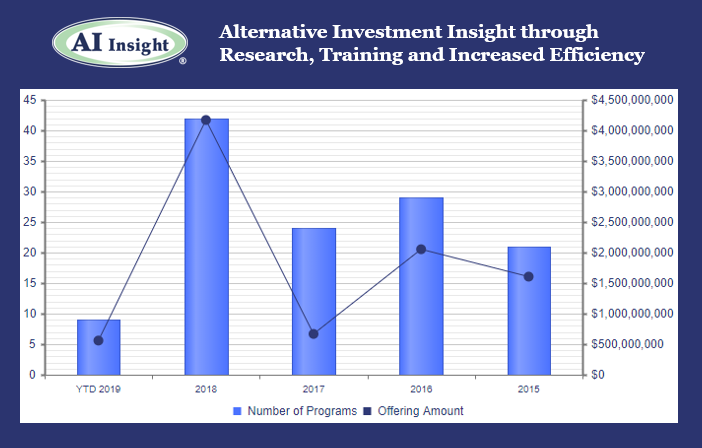

- Five non-1031 real estate programs activated in March for an aggregate maximum offering amount of $390.8 million.

- While the category is below 2018 levels in terms of maximum offering amounts, there are more offerings seeking to raise a smaller amount of capital.

- The eight programs offered YTD have been offered by eight separate sponsors, including three new sponsors.

- ON DECK: as of April 17th, five more non-1031 real estate programs had activated.

AI Insight recently added Industry Reporting capabilities to our Financial Performance Reporting tool, which includes this and many more insights into key non-traded markets including Opportunity Zone Funds. AI Insight is the only provider of industry-level Private Placement reporting. To request a live demo of these expansive data reports, contact us directly.

Charts Source: AI Insight. Data as of March 31, 2019, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose. Copyright © 2019 AI Insight. All Rights Reserved.

Thursday, April 18th, 2019 and is filed under AI Insight News

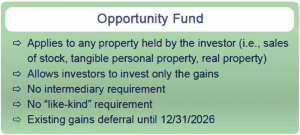

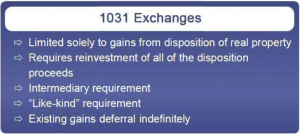

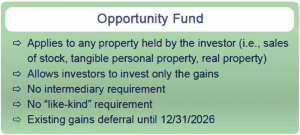

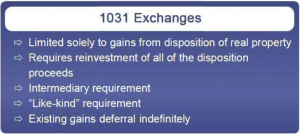

It’s important to understand the differences between 1031 Exchanges and the newest alternative investment, Opportunity Zone Funds. While Opportunity Funds and 1031 Exchanges both provide tax deferral mechanisms, there are important differences between the two programs. Read the comparison below, then review the education and training resources available to you.

3 key differences

- When investing in an Opportunity Fund, the deferral of capital gains applies to any property held by the investor (i.e., sales of stock, tangible personal property, real property), whereas 1031 Exchanges are now limited solely to gains from disposition of real property.

- 1031 Exchanges require reinvestment of all of the disposition proceeds, whereas Opportunity Funds allow investors to invest only the gains. This provides investors with a degree of liquidity, as they can sell an asset and retain an amount of cash equal to the basis in the disposed-of asset and invest an amount equal to the capital gains without facing an immediate tax bill.

- There is no intermediary requirement for an Opportunity Fund investment. There is also no “likekind” requirement for an Opportunity Fund investment to qualify to its tax deferral benefits, unlike 1031 Exchanges.

Tax deferral regulations

Investors should also keep in mind that gains can be deferred indefinitely through 1031 exchanges. According to proposed regulations, the latest a taxpayer will be able to defer paying taxes on existing capital gains through Opportunity Fund investments is December 31, 2026. Opportunity Funds may provide tax relief for non-qualifying transactions under Section 1031, namely short-term gain property and “blown” I.D. period situations.

Comparison chart

Resources

Content Source: AI Insight CE course, “Introduction to Opportunity Zones”, created in collaboration with Kyla M. Ehrisman, JD, MBA and Alan Lincoln, MBA, CCIM of Mick Law P.C. LLO.

Tuesday, March 26th, 2019 and is filed under AI Insight News

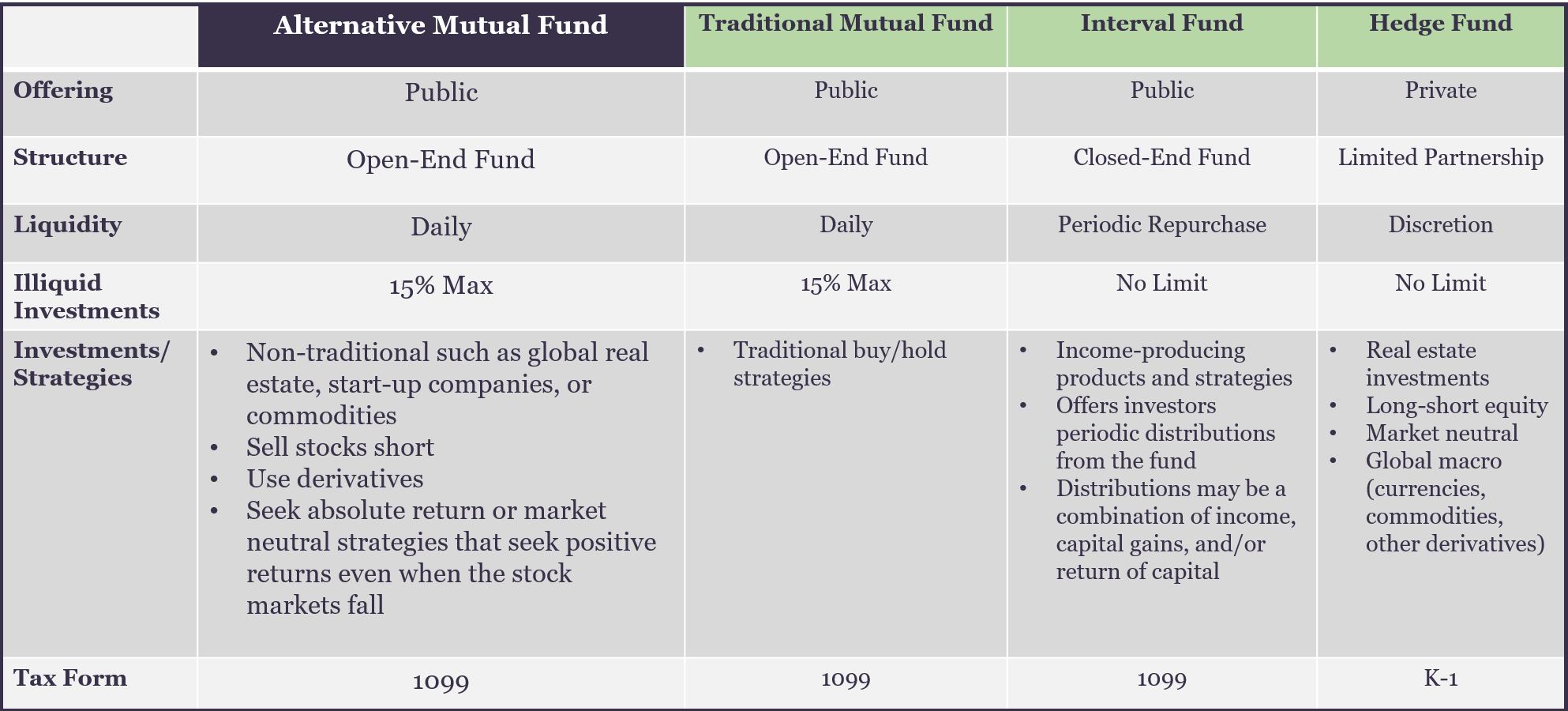

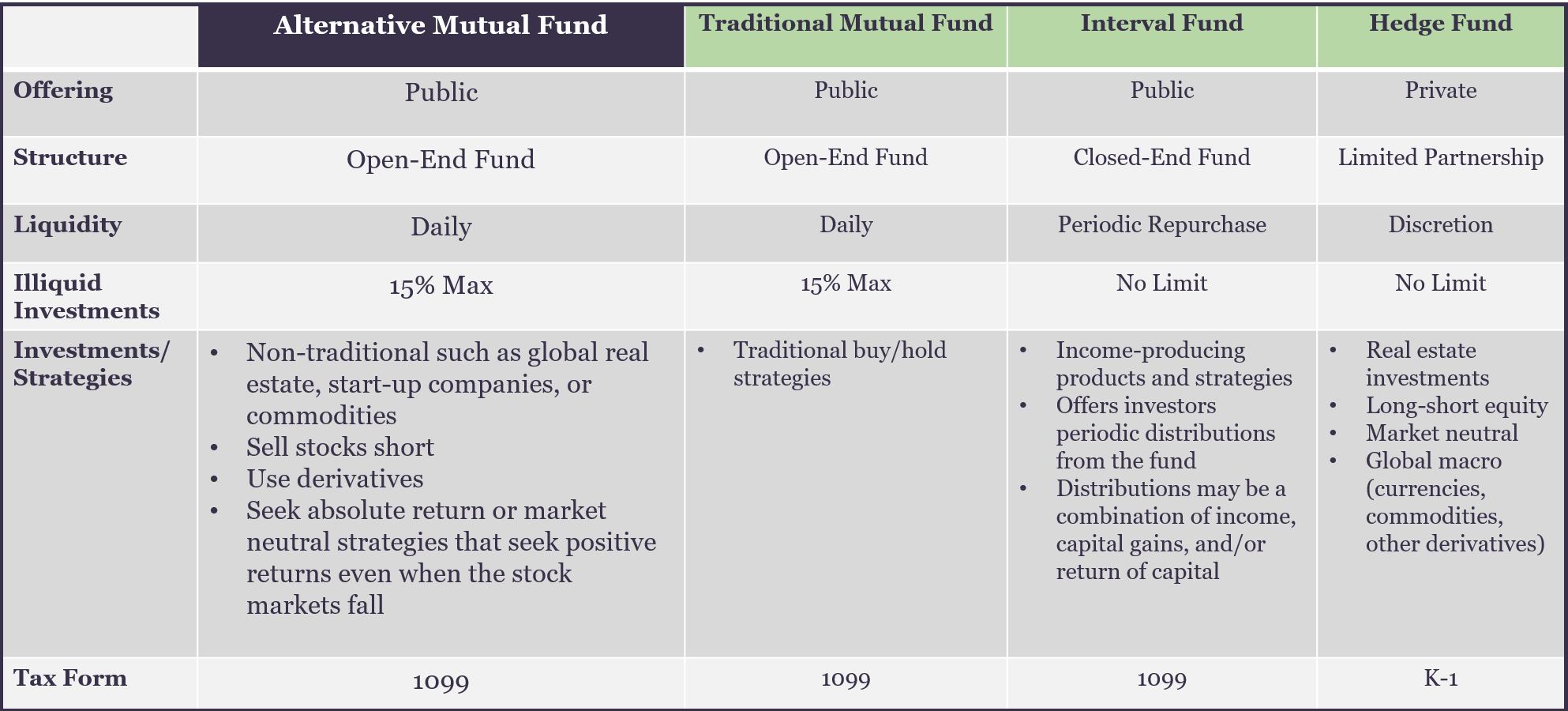

Alternative Mutual Funds experienced significant growth in total assets during and after the Great Recession as investors scrambled for investment options with a lower correlation to the equity/bond markets to protect their investments from increased volatility. Regulators followed the capital flows with heightened suitability concerns to the retail investor focused ‘40 Act structure given the non-traditional strategies and investments Alternative Mutual Funds use. This increases the risk and complexity profile compared to traditional mutual funds.

While there are similarities with Alternative Mutual Funds and traditional mutual funds, as well as other investments, there are key differences to be aware of such as liquidity, risk factors given the complexity of underlying strategies and the level of due diligence needed to remain regulatory compliant.

Due Diligence is a Necessary Obligation

FINRA’s e-learning course, Understanding Alternative Mutual Funds calls out, “Regardless of the funds’ regulatory regimes, firms are required to perform adequate due diligence on these products…”. Given the information in the above chart, we’ve determined that additional scrutiny is needed prior to advisors offering Alternative Mutual Funds to clients to make them aware of possible risks and help them understand these complex fund strategies.

AI Insight’s Alternative Mutual Fund Research can help with due diligence based on continued regulatory guidance using easy and efficient support tools to:

- Review independent, unbiased reports addressing the breadth and diversity of alternative mutual funds as well as differences across the underlying strategies.

- Evaluate an aggregation of insightful quantitative and qualitative data including fund company, strategy, portfolio and investment advisor overviews.

- Run side-by-side fund comparisons based on 70+ features, such as strategy, exposure, fees and performance.

Thursday, March 21st, 2019 and is filed under AI Insight News

- The first three Opportunity Zone Funds activated in February, for an aggregate maximum offering amount of $335.0 million.

- Fund size ranged from $35.0 million to $200.0 million.

- Leverage is anticipated around 60% to 70% of the total value for one of the funds, while the other two allow for leverage but have not specified anticipated levels.

- Two of the funds are blind pool funds focused on hospitality and one is focused on a specified mixed-use development project.

- All of the funds include a preferred return component, ranging from 6.0% to 8.0%.

- ON DECK: As of March 20th, there were two Opportunity Zone Funds coming soon, with one focused on multifamily and one on mixed-use development.

AI Insight recently added Industry Reporting capabilities to the Financial Performance Reporting tool, which includes this and many more insights into key non-traded markets. AI Insight is the only provider of industry-level Private Placement reporting. To inquire about accessing these expansive data reports, contact us directly.

Charts Source: AI Insight. Data as of February 28, 2019, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.