Wednesday, June 22nd, 2022 and is filed under Industry Reporting

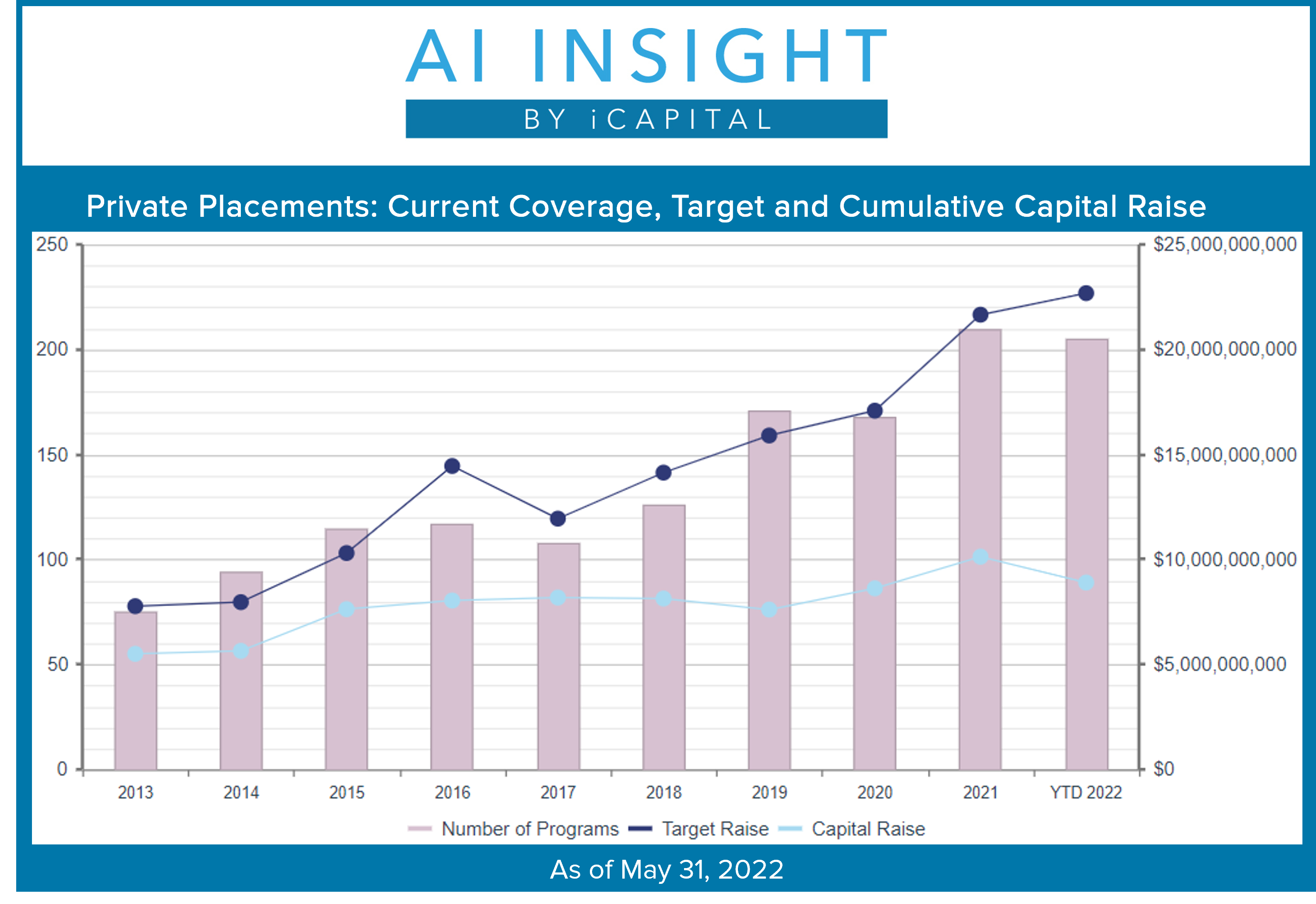

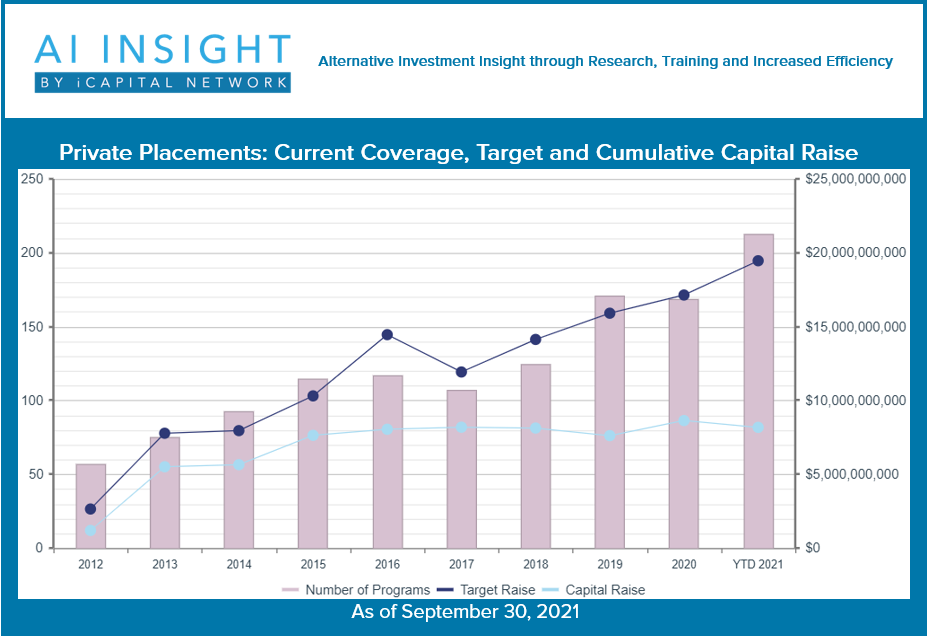

We recently released our May Private Placement Insights report. See the highlights from the report below, or if you are a Premium Reporting subscriber, log in now to see the entire report. If you don’t have access, you can request a free trial.

- 35 new private placements were added to our coverage in May, a record month with all but one category (managed futures) seeing additions. On a year-over-year basis, we have added more funds than last year (+29%), and these funds are targeting a larger amount of capital (+70%).

- Activity this year is led by all of the real estate categories, including Opportunity Zones, real estate LLCs/LPs, private non-traded REITs, and 1031 exchanges. Energy activity is slow on an absolute basis but is up from last year’s anemic levels. Activity has slowed in the private equity/debt and hedge fund categories.

- As of June 1st, AI Insight covers 205 private placements currently raising capital, with an aggregate target raise of $22.7 billion and an aggregate reported raise of $8.9 billion or 39% of target.

- Real estate-related funds, including 1031s, Opportunity Zone funds, and non-1031 real estate LLCs/LPs and private REITs represent the largest component of our private placement coverage at 73% of funds and 62% of target raise. Private equity/debt funds represent 13% of funds and 22% of target raise, although this does include seven private market feeder funds that do not specify an offering target.

- In terms of coverage by general objective, income is the largest component at 55% of funds, while growth and growth & income follow at 26% and 19%, respectively.

- The average size of the funds currently raising capital is $110 million, ranging from $4.0 million for a private managed futures fund to $2.0 billion for a private BDC.

- 78% of private placements we cover use the 506(b) exemption, 16% use 506(c) and 6% have not yet filed their Form D with the SEC.

- 27 private placements closed to new investors in May and 125 have closed year-to-date. Funds that closed this year have been on the market for an average of 273 days and reported they raised 81% of target on average.

For illustrative purposes only.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, Non-Traded BDCs and Interval Funds. Receive up to 22 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of May 31, 2022, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security offered by Institutional Capital Network, Inc. or its affiliates (together “iCapital Network”). Past performance is not indicative of future results. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors. An investment in an alternative investment entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. The information contained herein is subject to change and is also incomplete. This industry information and its importance is an opinion only and should not be relied upon as the only important information available. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed, and iCapital Network assumes no liability for the information provided.

Products offered by iCapital Network are typically private placements that are sold only to qualified clients of iCapital Network through transactions that are exempt from registration under the Securities Act of 1933 pursuant to Rule 506(b) of Regulation D promulgated thereunder (“Private Placements”). An investment in any product issued pursuant to a Private Placement, such as the funds described, entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. Further, such investments are not subject to the same levels of regulatory scrutiny as publicly listed investments, and as a result, investors may have access to significantly less information than they can access with respect to publicly listed investments. Prospective investors should also note that investments in the products described involve long lock-ups and do not provide investors with liquidity.

Securities may be offered through iCapital Securities, LLC, a registered broker dealer, member of FINRA and SIPC and subsidiary of Institutional Capital Network, Inc. (d/b/a iCapital Network). These registrations and memberships in no way imply that the SEC, FINRA or SIPC have endorsed the entities, products or services discussed herein. iCapital and iCapital Network are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2022 Institutional Capital Network, Inc. All Rights Reserved.

Wednesday, May 18th, 2022 and is filed under Industry Reporting

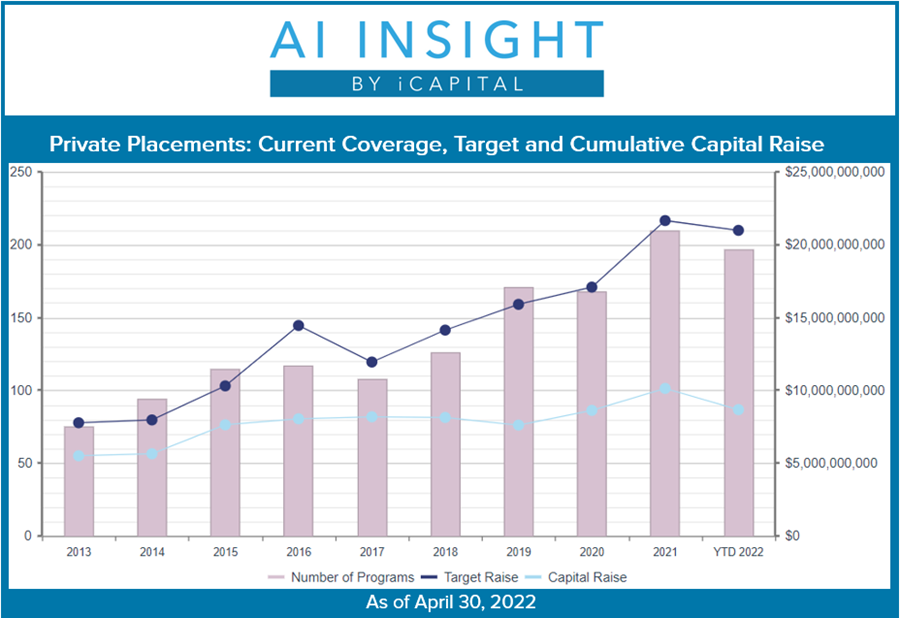

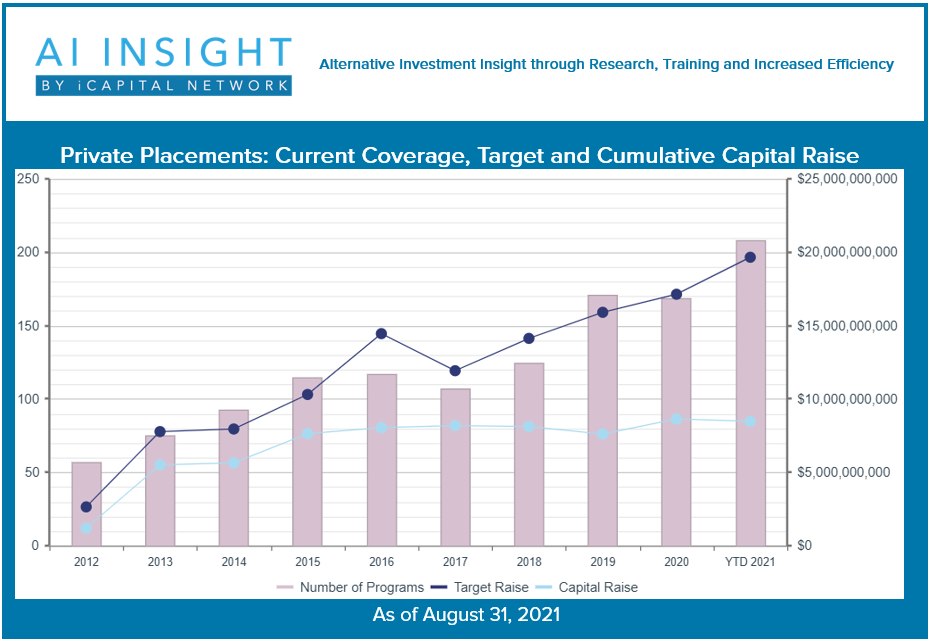

We recently released our April Private Placement Insights report. See the highlights from the report below, or if you are a Premium Reporting subscriber, log in now to see the entire report. If you don’t have access, you can request a free trial.

- 23 new private placements were added to our coverage in April, slower than prior months. On a year-over-year basis, however, we have added more funds than last year (+15%), and these funds are targeting a larger amount of capital (+51%).

- Activity this year is led by the real estate categories, including Opportunity Zones, real estate LLCs/LPs, private non-traded REITs, and 1031 exchanges. Activity has slowed in the private equity/debt and hedge fund categories while activity within the energy, managed futures, and preferred segments are flat year-over-year.

- As of May 1st, AI Insight covers 197 private placements currently raising capital, with an aggregate target raise of $21 billion and an aggregate reported raise of $9 billion or 43% of target.

- Real estate-related funds, including 1031s, Opportunity Zone funds, and non-1031 real estate LLCs/LPs and private REITs represent the largest component of our private placement coverage at 75% of funds and 61% of target raise. Private equity/debt funds represent 13% of funds and 24% of target raise, although this does include six private market feeder funds that do not specify an offering target.

- In terms of coverage by general objective, income is the largest component at 55% of funds, while growth and growth & income follow at 30% and 16%, respectively.

- The average size of the funds currently raising capital is $107 million, ranging from $4.0 million for a private managed futures fund to $2.0 billion for a private BDC.

- 77% of private placements we cover use the 506(b) exemption, 14% use 506(c) and 9% have not yet filed their Form D with the SEC.

- 22 private placements closed to new investors in April and 101 have closed year-to-date. Funds that closed this year have been on the market for an average of 272 days and reported they raised 78% of target on average.

For illustrative purposes only.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, Non-Traded BDCs and Interval Funds. Receive up to 22 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of April 30, 2022, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security offered by Institutional Capital Network, Inc. or its affiliates (together “iCapital Network”). Past performance is not indicative of future results. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors. An investment in an alternative investment entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. The information contained herein is subject to change and is also incomplete. This industry information and its importance is an opinion only and should not be relied upon as the only important information available. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed, and iCapital Network assumes no liability for the information provided.

Products offered by iCapital Network are typically private placements that are sold only to qualified clients of iCapital Network through transactions that are exempt from registration under the Securities Act of 1933 pursuant to Rule 506(b) of Regulation D promulgated thereunder (“Private Placements”). An investment in any product issued pursuant to a Private Placement, such as the funds described, entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. Further, such investments are not subject to the same levels of regulatory scrutiny as publicly listed investments, and as a result, investors may have access to significantly less information than they can access with respect to publicly listed investments. Prospective investors should also note that investments in the products described involve long lock-ups and do not provide investors with liquidity.

Securities may be offered through iCapital Securities, LLC, a registered broker dealer, member of FINRA and SIPC and subsidiary of Institutional Capital Network, Inc. (d/b/a iCapital Network). These registrations and memberships in no way imply that the SEC, FINRA or SIPC have endorsed the entities, products or services discussed herein. iCapital and iCapital Network are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2022 Institutional Capital Network, Inc. All Rights Reserved.

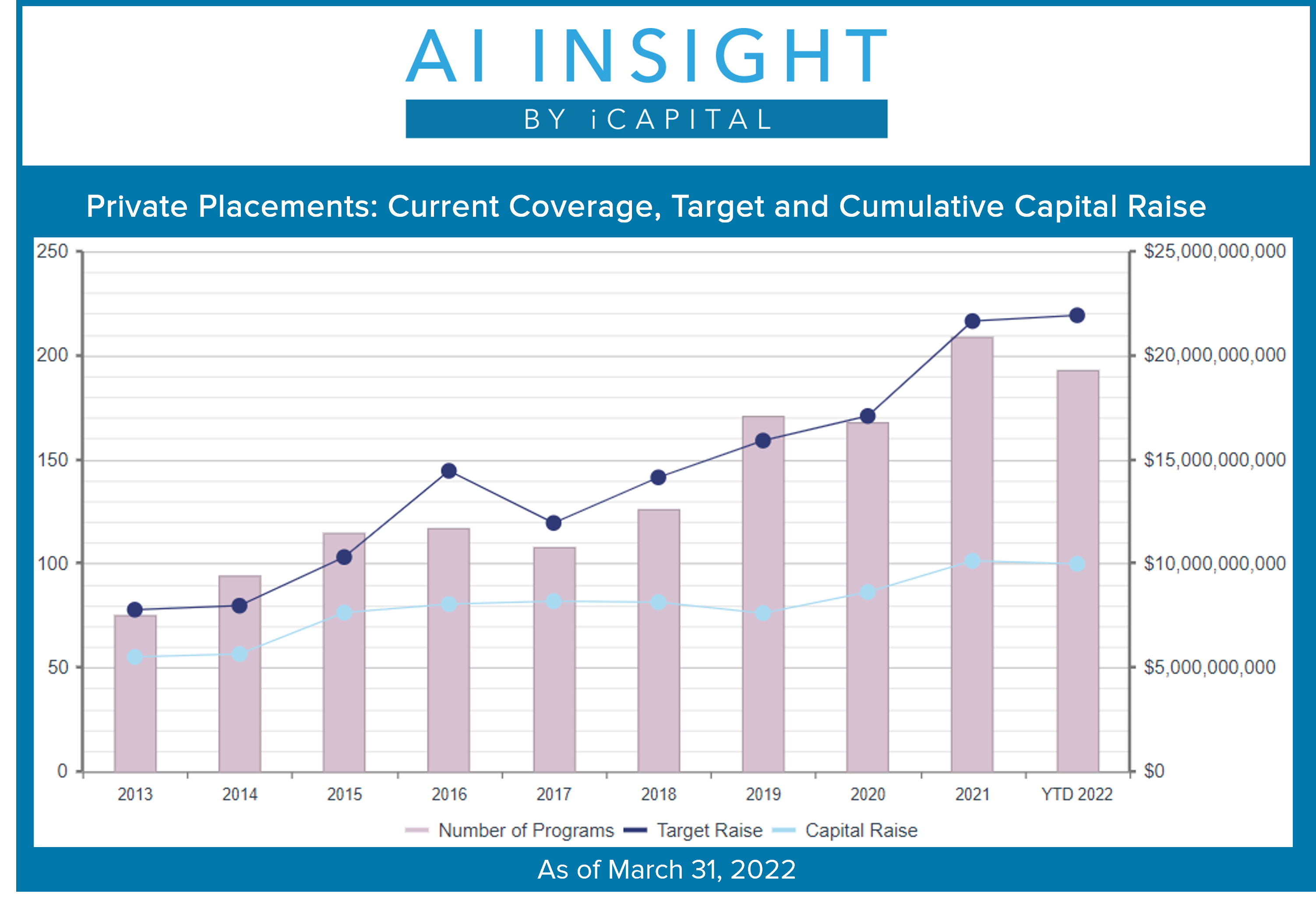

Tuesday, April 12th, 2022 and is filed under Industry Reporting

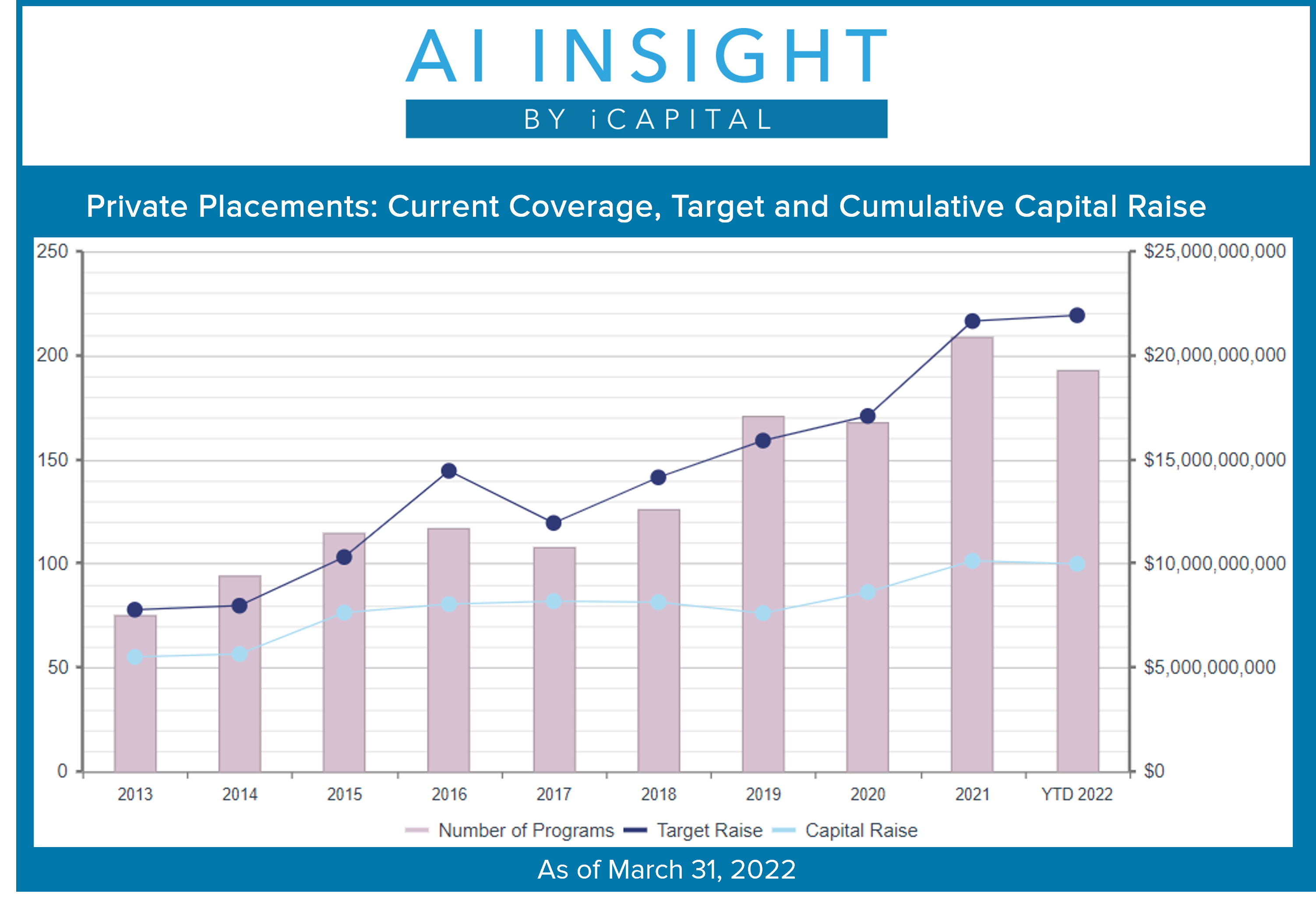

We recently released our March Private Placement Insights report. See the highlights from the report below, or if you are a Premium Reporting subscriber, log in now to see the entire report. If you don’t have access, you can request a free trial.

- 25 new private placements were added to our coverage in March, higher than prior months but still slower than the Q3 and Q4 2021 record levels. On a year-over-year basis we have added roughly the same amount of funds as last year (-2%), but these funds are targeting a larger amount of capital (+49%).

- Activity this year is led by the real estate categories, including 1031 exchanges, real estate LLCs/LPs, private non-traded REITs, and recently Opportunity Zone funds. Activity has slowed in the private equity/debt and hedge fund categories while activity within the energy, hedge fund, and preferred segments are flat year-over-year.

- As of April 1st, AI Insight covers 193 private placements currently raising capital, with an aggregate target raise of $21.9 billion and an aggregate reported raise of $10.0 billion or 46% of target.

- Real estate-related funds, including 1031s, Opportunity Zone funds, and non-1031 real estate LLCs/LPs and private REITs represent the largest component of our private placement coverage at 74% of funds and 62% of target raise. Private equity/debt funds represent 13% of funds and 23% of target raise, although this does include seven private market feeder funds that do not specify an offering target.

- In terms of our coverage by general objective, income is the largest component at 55% of funds, while growth and growth & income follow at 29% and 16%, respectively.

- The average size of the funds currently raising capital is $114.0 million, ranging from $8.0 million for a specified real estate fund to $2.0 billion for a private BDC.

- 77% of private placements we cover use the 506(b) exemption, 14% use 506(c) and 9% have not yet filed their Form D with the SEC.

- 25 private placements closed to new investors in March and 78 have closed year-to-date. Funds that closed this year have been on the market for an average of 263 days and reported they raised 83% of target on average.

For illustrative purposes only.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, Non-Traded BDCs and Interval Funds. Receive up to 22 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of March 31, 2022, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security offered by Institutional Capital Network, Inc. or its affiliates (together “iCapital Network”). Past performance is not indicative of future results. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors. An investment in an alternative investment entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. The information contained herein is subject to change and is also incomplete. This industry information and its importance is an opinion only and should not be relied upon as the only important information available. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed, and iCapital Network assumes no liability for the information provided.

Products offered by iCapital Network are typically private placements that are sold only to qualified clients of iCapital Network through transactions that are exempt from registration under the Securities Act of 1933 pursuant to Rule 506(b) of Regulation D promulgated thereunder (“Private Placements”). An investment in any product issued pursuant to a Private Placement, such as the funds described, entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. Further, such investments are not subject to the same levels of regulatory scrutiny as publicly listed investments, and as a result, investors may have access to significantly less information than they can access with respect to publicly listed investments. Prospective investors should also note that investments in the products described involve long lock-ups and do not provide investors with liquidity.

Securities may be offered through iCapital Securities, LLC, a registered broker dealer, member of FINRA and SIPC and subsidiary of Institutional Capital Network, Inc. (d/b/a iCapital Network). These registrations and memberships in no way imply that the SEC, FINRA or SIPC have endorsed the entities, products or services discussed herein. iCapital and iCapital Network are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2022 Institutional Capital Network, Inc. All Rights Reserved.

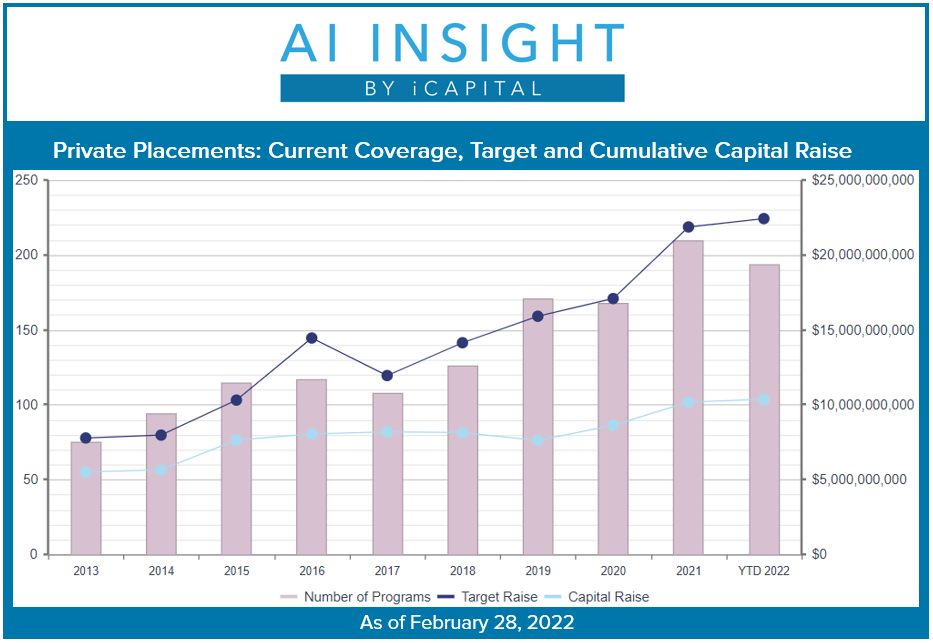

Thursday, March 17th, 2022 and is filed under Industry Reporting

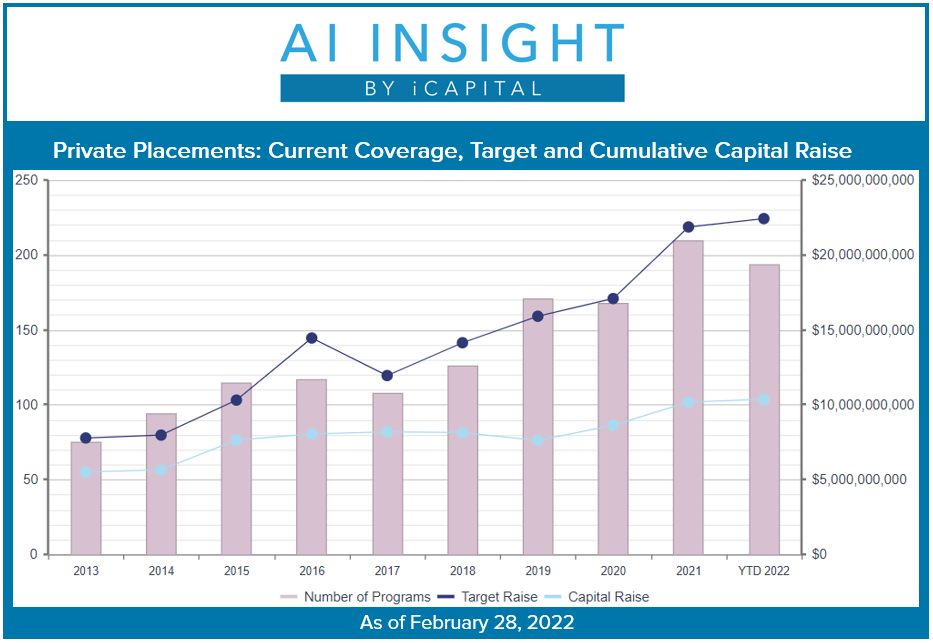

We recently released our February Private Placement Insights report. See the highlights from the report below, or if you are a Premium Reporting subscriber, log in now to see the entire report. If you don’t have access, you can request a free trial.

- 19 new private placements were added to our coverage in February, on par with January though slower than the Q3 and Q4 2021 record levels. On a year-over-year basis we have added roughly the same amount of funds as last year (+3%), but these funds are targeting a larger amount of capital (+87%).

- Activity this year is led by the real estate categories, including 1031 exchanges, real estate LLCs, LPs, and private non-traded REITs. One large Opportunity Zone added in January has kept availability in this category strong, although the addition of one new fund can hardly be considered a win. Activity has slowed in the private equity/debt category while activity within the energy, hedge fund, and preferred segments are flat year-over-year.

- As of March 1st, AI Insight covers 194 private placements currently raising capital, with an aggregate target raise of $22.4 billion and an aggregate reported raise of $10.4 billion or 46% of target.

- Real estate-related funds, including 1031s, Opportunity Zones, and non-1031 real estate LLCs/LPs and private REITs represent the largest component of our private placement coverage at 73% of funds and 63% of target raise. Private equity/debt funds represent 13% of funds and 24% of target raise, although this does include four private market feeder funds that do not specify an offering target.

- In terms of our coverage by general objective, income is the largest component at 56% of funds, while growth and growth & income follow at 28% and 17%, respectively.

- The average size of the funds currently raising capital is $108.0 million, ranging from $5.0 million for a specified real estate fund to $2.0 billion for a private BDC.

- 77% of private placements we cover use the 506(b) exemption, 14% use 506(c) and 9% have not yet filed their Form D with the SEC.

- 20 private placements closed to new investors in February and 53 have closed year-to-date. Funds that closed this year have been on the market for an average of 205 days and reported that they raised 87% of target on average.

For illustrative purposes only.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, Non-Traded BDCs and Interval Funds. Receive up to 22 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of February 28, 2022, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security offered by Institutional Capital Network, Inc. or its affiliates (together “iCapital Network”). Past performance is not indicative of future results. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors. An investment in an alternative investment entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. The information contained herein is subject to change and is also incomplete. This industry information and its importance is an opinion only and should not be relied upon as the only important information available. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed, and iCapital Network assumes no liability for the information provided.

Products offered by iCapital Network are typically private placements that are sold only to qualified clients of iCapital Network through transactions that are exempt from registration under the Securities Act of 1933 pursuant to Rule 506(b) of Regulation D promulgated thereunder (“Private Placements”). An investment in any product issued pursuant to a Private Placement, such as the funds described, entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. Further, such investments are not subject to the same levels of regulatory scrutiny as publicly listed investments, and as a result, investors may have access to significantly less information than they can access with respect to publicly listed investments. Prospective investors should also note that investments in the products described involve long lock-ups and do not provide investors with liquidity.

Securities may be offered through iCapital Securities, LLC, a registered broker dealer, member of FINRA and SIPC and subsidiary of Institutional Capital Network, Inc. (d/b/a iCapital Network). These registrations and memberships in no way imply that the SEC, FINRA or SIPC have endorsed the entities, products or services discussed herein. iCapital and iCapital Network are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2022 Institutional Capital Network, Inc. All Rights Reserved.

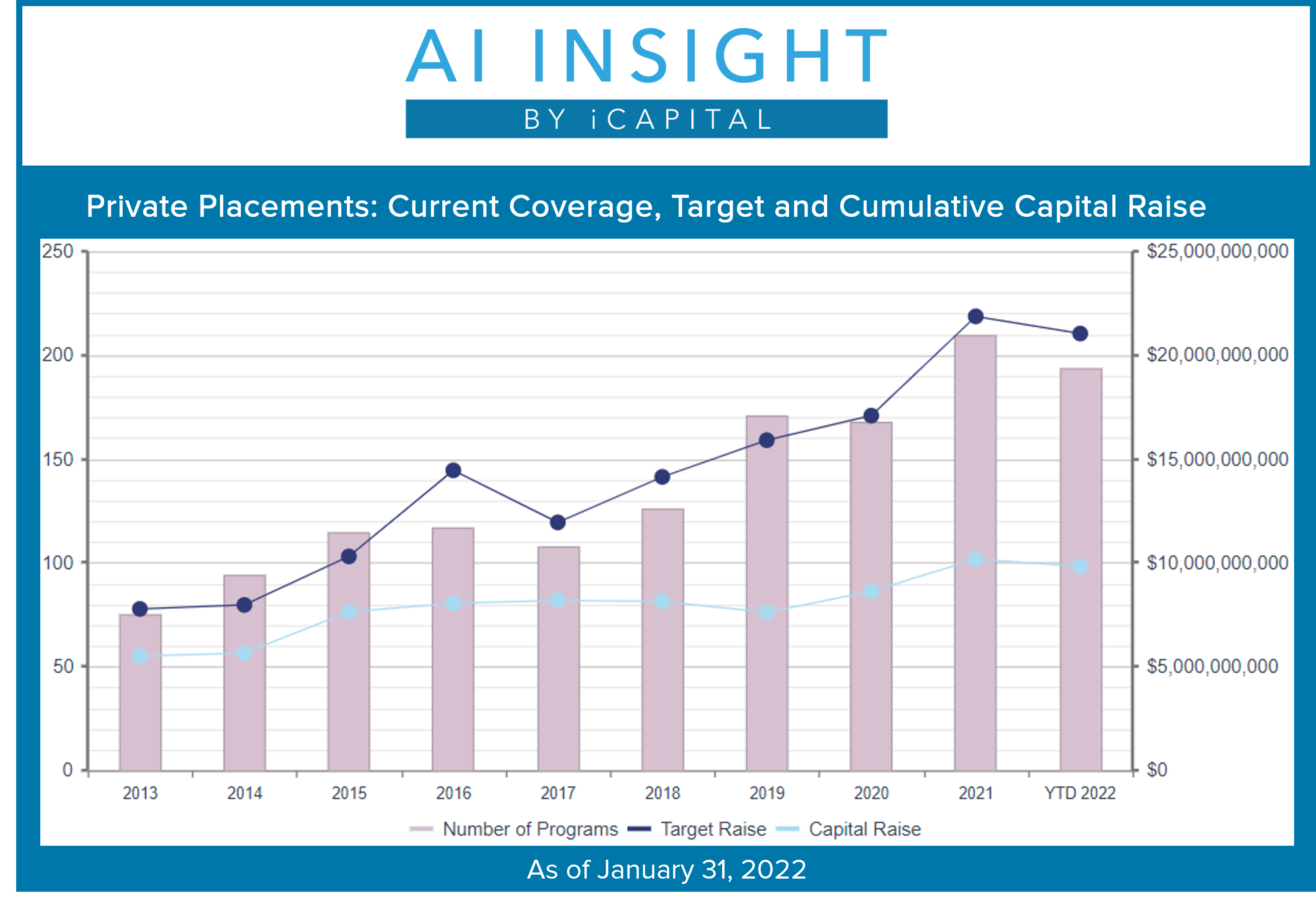

Wednesday, February 16th, 2022 and is filed under Industry Reporting

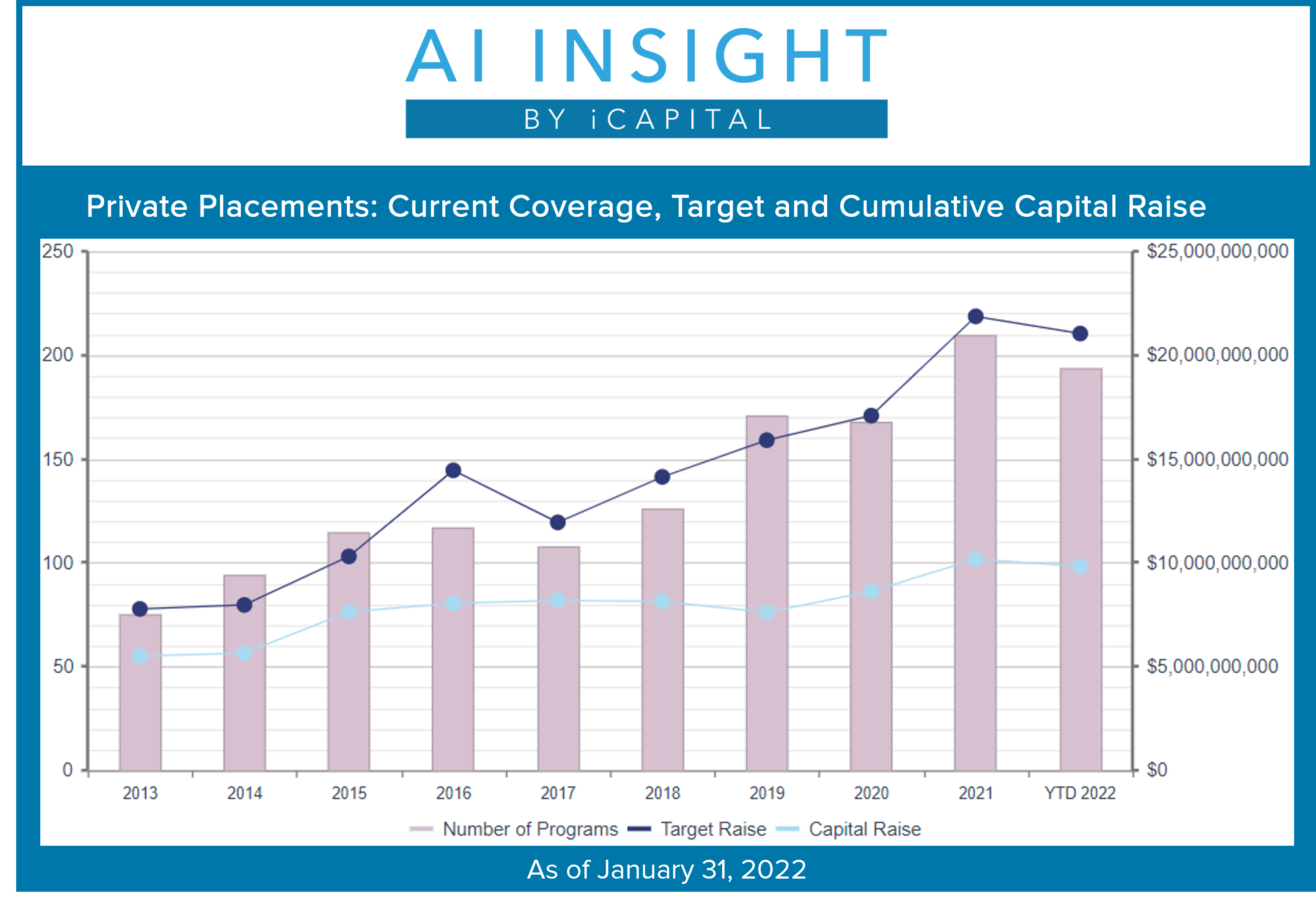

We recently released our January Private Placement Insights report. See the highlights from the report below, or if you are a Premium Reporting subscriber, log in now to see the entire report. If you don’t have access, you can request a free trial.

- After a record 2021, new fund activity slowed modestly in January. However, while fewer funds were added, the 19 funds added were targeting a larger amount of capital. New fund coverage is down 5% while the aggregate target is up nearly 80%. Activity was up for the tax-focused real estate strategies including 1031 Exchanges and Opportunity Zones, while Private Equity/Debt activity slowed. All others were on par with 2021 on a year-over-year basis.

- As of February 1st, AI Insight covers 194 private placements currently raising capital, with an aggregate target raise of $21 billion and an aggregate reported raise of $9.8 billion or 47% of target.

- Real estate-related funds, including 1031s, Opportunity Zones, and non-1031 real estate LLCs/LPs and private REITs represent the largest component of our private placement coverage at 73% of funds and 61% of target raise. Private equity/debt funds represent 13% of funds and 25% of target raise, although this does include five private market feeder funds that do not specify an offering target.

- In terms of our coverage by general objective, income is the largest component at 57% of funds, while growth and growth & income follow at 27% and 17%, respectively.

- The average size of the funds currently raising capital is $108.0 million, ranging from $5.0 million for a specified real estate fund to $2.0 billion for a private BDC.

- 82% of private placements we cover use the 506(b) exemption, 12% use 506(c) and 6% have not yet filed their Form D with the SEC.

- 36 private placements closed to new investors in January. Funds that closed this year have been on the market for an average of 186 days and the 35 funds that reported raised 103% of target on average.

Preqin recently released its updated forecasts for growth in private markets. The firm expects private market AUM to expand from its current level of $13.2 trillion to more than $23 trillion by 2026, with 15% annualized growth. Private equity and private debt are expected to increase the most through this period. Real estate, infrastructure, and hedge fund assets are forecast to increase modestly.

Part of the continued expansion into private markets is their continued outperformance. According to Preqin, private market strategies have outperformed global stocks for the last 13 years over all rolling time periods, with lower volatility.

Preqin also recently released a study on interest rates and private market performance. The firm reported that two segments, real estate and infrastructure, exhibited the highest positive performance correlation to rising rates, with performance in real estate actually higher than in times of flat rates. While returns were still positive for other categories in rising rate scenarios, venture capital and private debt exhibited the widest gap in returns in flat and rising rate markets (meaning returns were eroded the most by rising rates), and venture capital posted the strongest negative correlation to rising rates.

For illustrative purposes only.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, Non-Traded BDCs, Interval Funds, and Alternative Strategy Mutual Funds. Receive up to 24 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of January 31, 2022, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security offered by Institutional Capital Network, Inc. or its affiliates (together “iCapital Network”). Past performance is not indicative of future results. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors. An investment in an alternative investment entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. The information contained herein is subject to change and is also incomplete. This industry information and its importance is an opinion only and should not be relied upon as the only important information available. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed, and iCapital Network assumes no liability for the information provided.

Products offered by iCapital Network are typically private placements that are sold only to qualified clients of iCapital Network through transactions that are exempt from registration under the Securities Act of 1933 pursuant to Rule 506(b) of Regulation D promulgated thereunder (“Private Placements”). An investment in any product issued pursuant to a Private Placement, such as the funds described, entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. Further, such investments are not subject to the same levels of regulatory scrutiny as publicly listed investments, and as a result, investors may have access to significantly less information than they can access with respect to publicly listed investments. Prospective investors should also note that investments in the products described involve long lock-ups and do not provide investors with liquidity.

Securities may be offered through iCapital Securities, LLC, a registered broker dealer, member of FINRA and SIPC and subsidiary of Institutional Capital Network, Inc. (d/b/a iCapital Network). These registrations and memberships in no way imply that the SEC, FINRA or SIPC have endorsed the entities, products or services discussed herein. iCapital and iCapital Network are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2022 Institutional Capital Network, Inc. All Rights Reserved.

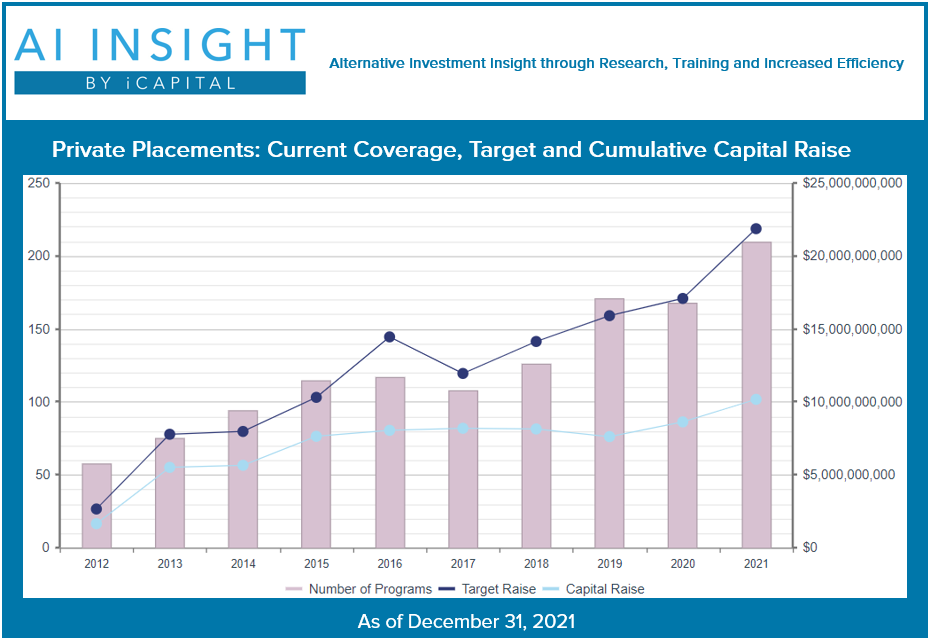

Tuesday, January 18th, 2022 and is filed under Industry Reporting

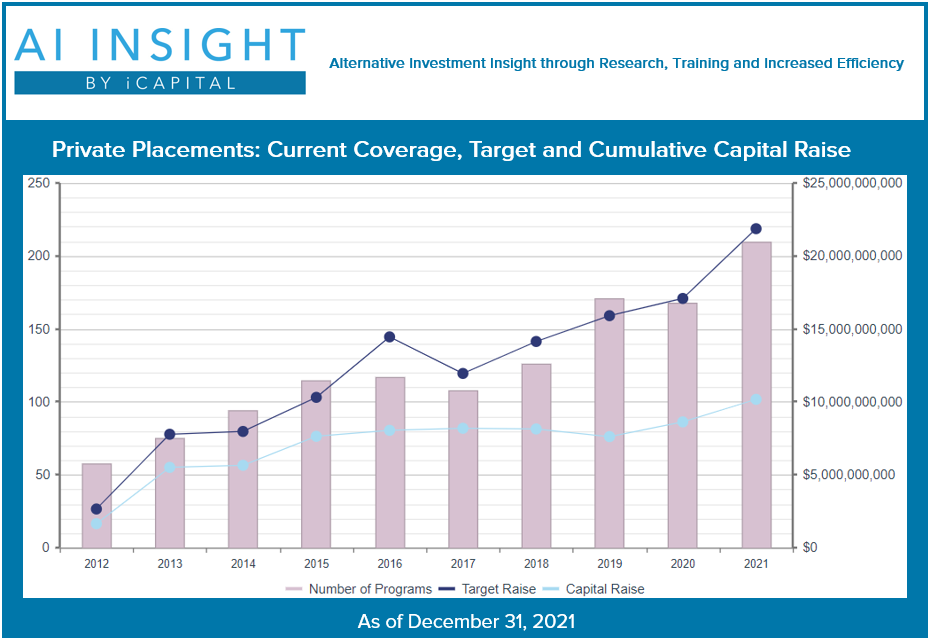

We recently released our December Private Placement Insights report. See the highlights from the report below, or if you are a Premium Reporting subscriber, log in now to see the entire report. If you don’t have access, you can request a free trial.

- Despite continued weakness in energy and some of the real estate categories, December was another strong month for funds added to our coverage, driven primarily by additions to the tax strategies including 1031 exchanges and conservation funds. Additions for the year were lead by private equity/debt followed by hedge funds and 1031 exchanges. Areas that were slower over the year included energy, Opportunity Zones, preferred funds and non-tax focused other real estate LLCs and LPs.

- 297 new funds were added in 2021 making this the strongest year on record putting us well ahead in terms of new fund coverage (+50%) and aggregate target raise (+79%).

- As of January 1st, AI Insight covers 210 private placements currently raising capital, with an aggregate target raise of $21.9 billion and an aggregate reported raise of $10.2 billion or 47% of target.

- Real estate-related funds, including 1031s, Opportunity Zones, and non-1031 real estate LLCs/LPs and private REITs represent the largest component of our private placement coverage at 73% of funds and 57% of target raise. Private equity/debt funds represent 12% of funds and 26% of target raise, although this does include five private market feeder funds that do not specify an offering target.

- In terms of our coverage by general objective, income is the largest component at 56% of funds, while growth and growth & income follow at 28% and 16%, respectively.

- The average size of the funds currently raising capital is $104.1 million, ranging from $5.0 million for a specified real estate fund to $2.0 billion for a private BDC.

- 83% of private placements we cover use the 506(b) exemption, 13% use 506(c) and 6% have not yet filed their Form D with the SEC.

- 60 private placements closed to new investors in December and 256 have closed in 2021. Funds that closed this year have been on the market for an average of 260 days and funds that reported, raised 84% of target.

- ON DECK: there are five new private funds coming soon.

For illustrative purposes only.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, Non-Traded BDCs, Interval Funds, and Alternative Strategy Mutual Funds. Receive up to 24 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of December 31, 2021, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security offered by Institutional Capital Network, Inc. or its affiliates (together “iCapital Network”). Past performance is not indicative of future results. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors. An investment in an alternative investment entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. The information contained herein is subject to change and is also incomplete. This industry information and its importance is an opinion only and should not be relied upon as the only important information available. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed, and iCapital Network assumes no liability for the information provided.

Products offered by iCapital Network are typically private placements that are sold only to qualified clients of iCapital Network through transactions that are exempt from registration under the Securities Act of 1933 pursuant to Rule 506(b) of Regulation D promulgated thereunder (“Private Placements”). An investment in any product issued pursuant to a Private Placement, such as the funds described, entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. Further, such investments are not subject to the same levels of regulatory scrutiny as publicly listed investments, and as a result, investors may have access to significantly less information than they can access with respect to publicly listed investments. Prospective investors should also note that investments in the products described involve long lock-ups and do not provide investors with liquidity.

Securities may be offered through iCapital Securities, LLC, a registered broker dealer, member of FINRA and SIPC and subsidiary of Institutional Capital Network, Inc. (d/b/a iCapital Network). These registrations and memberships in no way imply that the SEC, FINRA or SIPC have endorsed the entities, products or services discussed herein. iCapital and iCapital Network are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2022 Institutional Capital Network, Inc. All Rights Reserved.

Tuesday, December 14th, 2021 and is filed under Industry Reporting

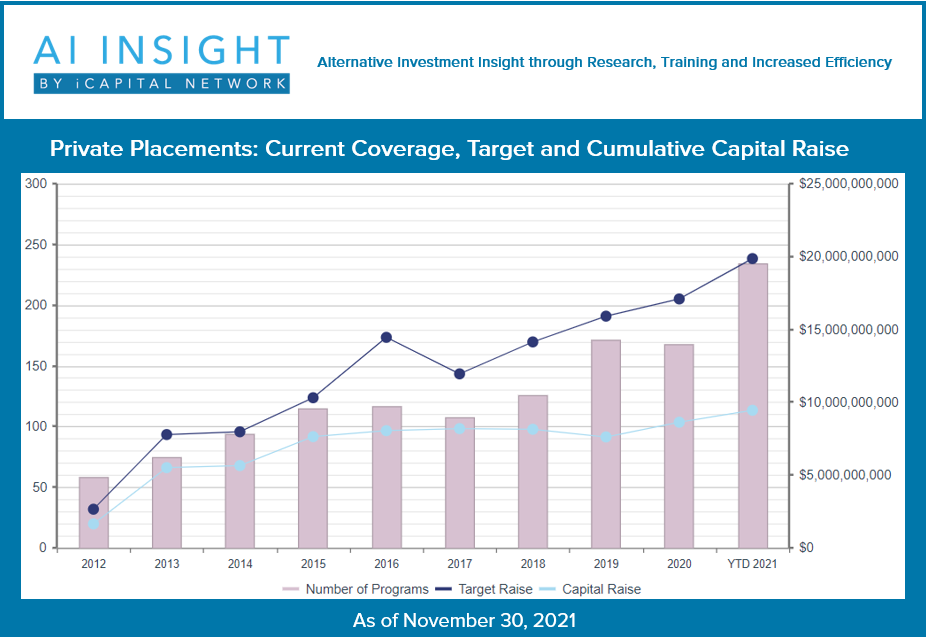

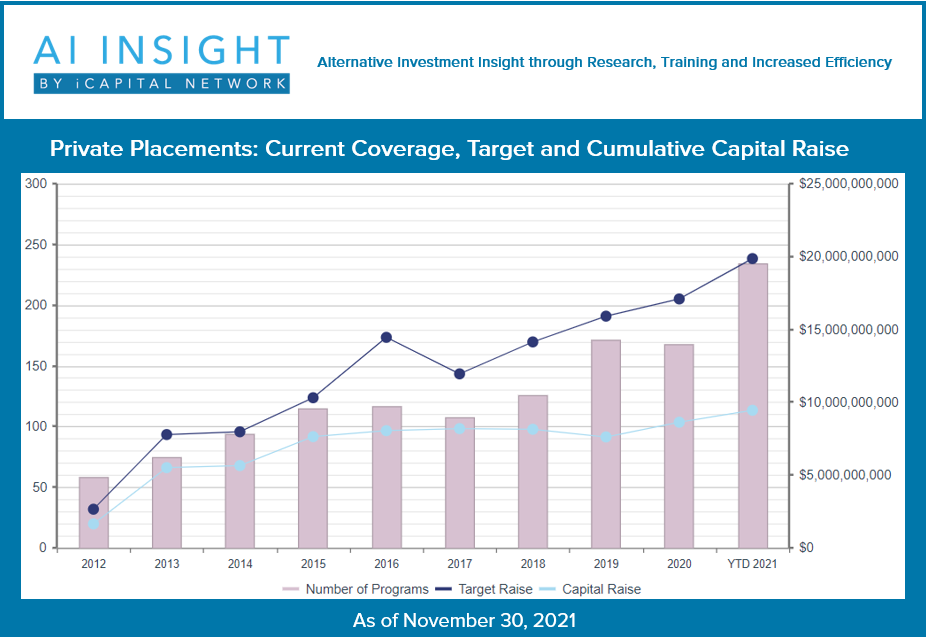

We recently released our November Private Placement Insights report. See the highlights from the report below, or if you are a Premium Reporting subscriber, log in now to see the entire report. If you don’t have access, you can request a free trial.

- Despite continued weakness in energy and some of the real estate categories, November was another strong month for funds added to our coverage, driven primarily for the second month by additions to the tax strategies including 1031 exchanges and conservation funds. On a year-to-date basis, private equity/debt leads the way, followed by hedge funds and 1031s.

- 261 new funds have been added in 2021 making this a strong year and putting us well ahead in terms of new fund coverage (+54%) and aggregate target raise (+47%).

- As of December 1st, AI Insight covers 234 private placements currently raising capital, with an aggregate target raise of $19.9 billion and an aggregate reported raise of $9.4 billion or 47% of target.

- Real estate-related funds, including 1031s, Opportunity Zones, and non-1031 real estate LLCs/LPs and private REITs represent the largest component of our private placement coverage at 65% of funds and 67% of target raise. Private equity/debt funds represent 14% of funds and 17% of target raise, although this does include seven private market feeder funds that do not specify an offering target.

- In terms of our coverage by general objective, income is the largest component at 58% of funds, while growth and growth & income follow at 26% and 16%, respectively.

- The average size of the funds currently raising capital is $84.8 million, ranging from $5.0 million for a specified real estate fund to $1.1 billion for a private equity tender offer fund.

- 81% of private placements we cover use the 506(b) exemption, 12% use 506(c) and 7% have not yet filed their Form D with the SEC.

- 23 private placements closed to new investors in November and 197 have closed in 2021. Funds that closed this year have been on the market for an average of 331 days. The funds that reported, raised 89% of target. 86% met or exceeded their target and only ten funds that missed their target reported they raised less than half of the target.

- ON DECK: there are 17 new private funds coming soon.

For illustrative purposes only.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, Non-Traded BDCs, Interval Funds, and Alternative Strategy Mutual Funds. Receive up to 24 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of November 30, 2021, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security offered by Institutional Capital Network, Inc. or its affiliates (together “iCapital Network”). Past performance is not indicative of future results. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors. An investment in an alternative investment entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. The information contained herein is subject to change and is also incomplete. This industry information and its importance is an opinion only and should not be relied upon as the only important information available. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed, and iCapital Network assumes no liability for the information provided.

Products offered by iCapital Network are typically private placements that are sold only to qualified clients of iCapital Network through transactions that are exempt from registration under the Securities Act of 1933 pursuant to Rule 506(b) of Regulation D promulgated thereunder (“Private Placements”). An investment in any product issued pursuant to a Private Placement, such as the funds described, entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. Further, such investments are not subject to the same levels of regulatory scrutiny as publicly listed investments, and as a result, investors may have access to significantly less information than they can access with respect to publicly listed investments. Prospective investors should also note that investments in the products described involve long lock-ups and do not provide investors with liquidity.

Securities may be offered through iCapital Securities, LLC, a registered broker dealer, member of FINRA and SIPC and subsidiary of Institutional Capital Network, Inc. (d/b/a iCapital Network). These registrations and memberships in no way imply that the SEC, FINRA or SIPC have endorsed the entities, products or services discussed herein. iCapital and iCapital Network are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2021 Institutional Capital Network, Inc. All Rights Reserved.

Thursday, November 11th, 2021 and is filed under Industry Reporting

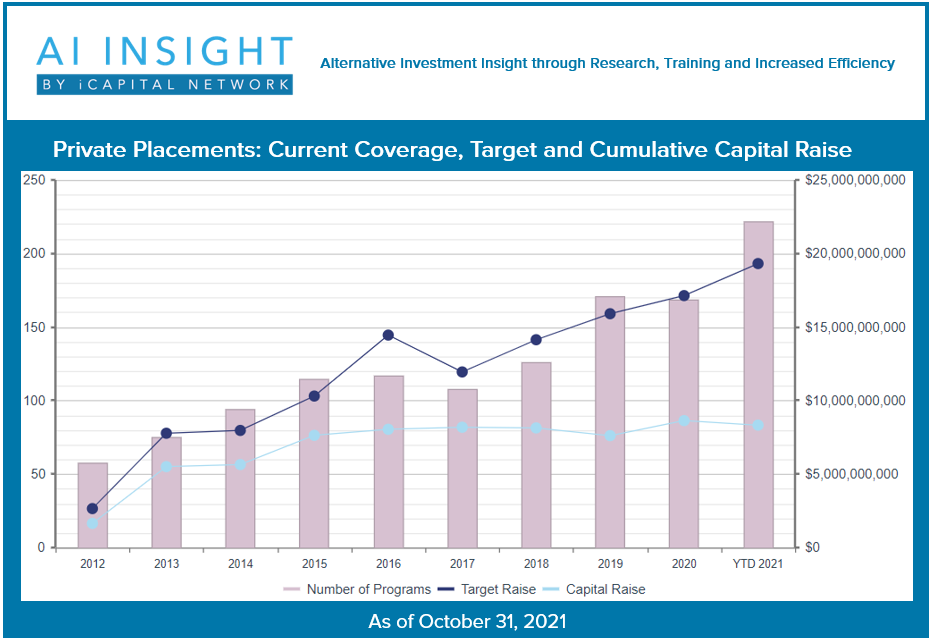

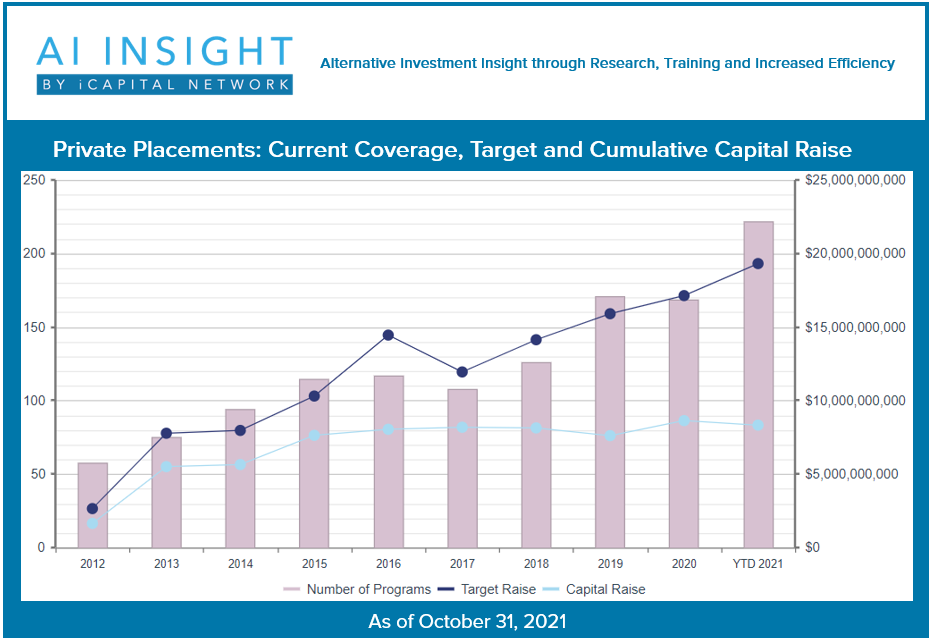

We recently released our October Private Placement Insights report. See the highlights from the report below, or if you are a Premium Reporting subscriber, log in now to see the entire report. If you don’t have access, you can request a free trial.

- Despite weakness in energy and some of the real estate categories, October was another strong month for funds added to our coverage, driven primarily by additions to the tax strategies including 1031 exchanges and conservation funds. On a year-to-date basis, private equity/debt leads the way, followed by hedge funds and 1031s.

- 227 new funds have been added in 2021 making this a strong year and putting us well ahead in terms of new fund coverage (+54%) and aggregate target raise (+43%).

- As of November 1st, AI Insight covers 222 private placements currently raising capital, with an aggregate target raise of $19.3 billion and an aggregate reported raise of $8.3 billion or 43% of target.

- Real estate-related funds, including 1031s, Opportunity Zones, and non-1031 real estate LLCs/LPs and private REITs represent the largest component of our private placement coverage at 66% of funds and 59% of target raise. Private equity/debt funds represent a relatively small amount of our coverage in terms of the number of funds at only 16% but represents 22% of target raise even with several funds in the category not reporting a target.

- In terms of our coverage by general objective, income is the largest component at 55% of funds, while growth and growth & income follow at 29% and 16%, respectively.

- The average size of the funds currently raising capital is $95.4 million, ranging from $5.0 million for a specified real estate fund to $1.1 billion for a private equity tender offer fund.

- 80% of private placements we cover use the 506(b) exemption, 13% use 506(c) and 8% have not yet filed their Form D with the SEC.

- 21 private placements closed to new investors in September and 174 have closed in 2021. Funds that closed this year have been on the market for an average of 315 days. The funds that reported raised 93% of target. 81% met or exceeded their target and only seven funds that missed their target reported that they raised less than half of the target.

- ON DECK: there are 13 new private funds coming soon.

For illustrative purposes only.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, Non-Traded BDCs, Interval Funds, and Alternative Strategy Mutual Funds. Receive up to 24 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of October 31, 2021, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security offered by Institutional Capital Network, Inc. or its affiliates (together “iCapital Network”). Past performance is not indicative of future results. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors. An investment in an alternative investment entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. The information contained herein is subject to change and is also incomplete. This industry information and its importance is an opinion only and should not be relied upon as the only important information available. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed, and iCapital Network assumes no liability for the information provided.

Products offered by iCapital Network are typically private placements that are sold only to qualified clients of iCapital Network through transactions that are exempt from registration under the Securities Act of 1933 pursuant to Rule 506(b) of Regulation D promulgated thereunder (“Private Placements”). An investment in any product issued pursuant to a Private Placement, such as the funds described, entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. Further, such investments are not subject to the same levels of regulatory scrutiny as publicly listed investments, and as a result, investors may have access to significantly less information than they can access with respect to publicly listed investments. Prospective investors should also note that investments in the products described involve long lock-ups and do not provide investors with liquidity.

Securities may be offered through iCapital Securities, LLC, a registered broker dealer, member of FINRA and SIPC and subsidiary of Institutional Capital Network, Inc. (d/b/a iCapital Network). These registrations and memberships in no way imply that the SEC, FINRA or SIPC have endorsed the entities, products or services discussed herein. iCapital and iCapital Network are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2021 Institutional Capital Network, Inc. All Rights Reserved.

Tuesday, October 12th, 2021 and is filed under Industry Reporting

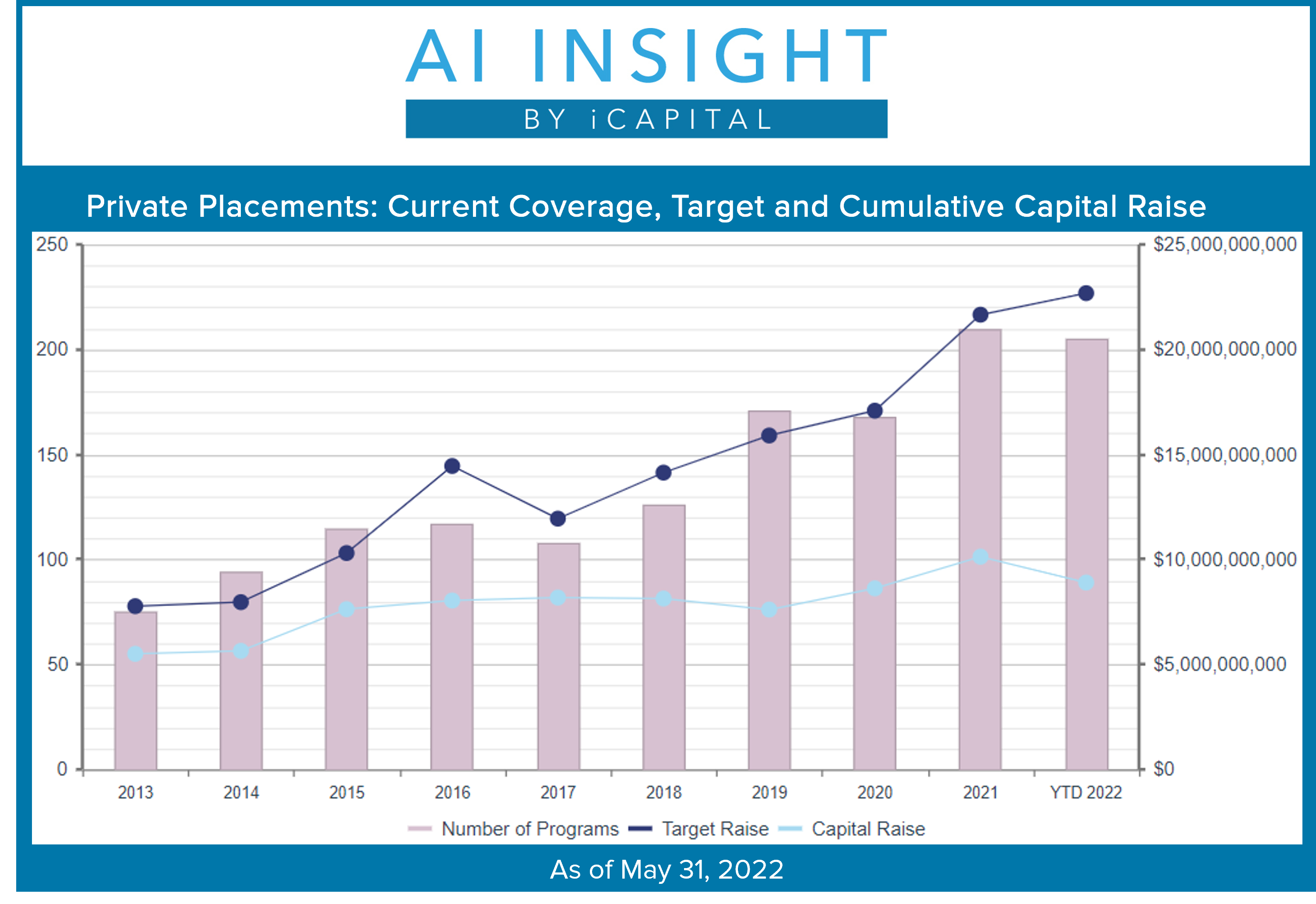

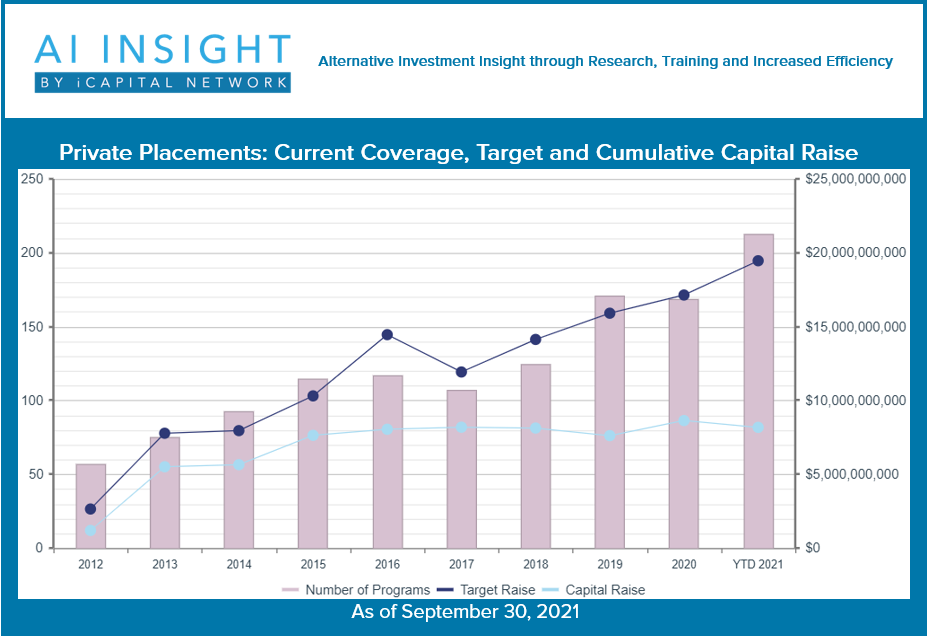

We recently released our September Private Placement Insights report. See the highlights from the report below, or if you are a Premium Reporting subscriber, log in now to see the entire report. If you don’t have access, you can request a free trial.

- Despite weakness in some of the real estate categories, September was another strong month for funds added to our coverage, driven primarily by additions to the hedge fund and 1031 categories. On a year-to-date basis, private equity/debt leads the way, followed by hedge funds and 1031s.

- 197 new funds have been added in 2021 making this a strong year and putting us well ahead in terms of new fund coverage (+63%) and aggregate target raise (+75%).

- As of October 1st, AI Insight covers 213 private placements currently raising capital, with an aggregate target raise of $19.5 billion and an aggregate reported raise of $8.2 billion or 42% of target.

- Real estate-related funds, including 1031s, Opportunity Zones, and non-1031 real estate LLCs/LPs and private REITs represent the largest component of our private placement coverage, at 68% of funds and 62% of target raise. Private equity/debt funds represent a relatively small amount of our coverage in terms of the number of funds at only 15% but represents 22% of target raise even with several funds in the category not reporting a target.

- In terms of our coverage by general objective, income is the largest component at 54% of funds, while growth and growth & income follow at 30% and 15%, respectively.

- The average size of the funds currently raising capital is $95.4 million, ranging from $5.0 million for a specified real estate fund to $1.1 billion for a private equity tender offer fund.

- 79% of private placements we cover use the 506(b) exemption, 13% use 506(c) and 9% have not yet filed their Form D with the SEC.

18 private placements closed to new investors in September and 153 have closed in 2021. Funds that closed this year have been on the market for an average of 315 days. The funds that reported raised 92% of target. 84% met or exceeded their target and only eight funds that missed their target reported that they raised less than half of target.

For illustrative purposes only.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, Non-Traded BDCs, Interval Funds, and Alternative Strategy Mutual Funds. Receive up to 24 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of September 30, 2021, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security offered by Institutional Capital Network, Inc. or its affiliates (together “iCapital Network”). Past performance is not indicative of future results. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors. An investment in an alternative investment entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. The information contained herein is subject to change and is also incomplete. This industry information and its importance is an opinion only and should not be relied upon as the only important information available. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed, and iCapital Network assumes no liability for the information provided.

Products offered by iCapital Network are typically private placements that are sold only to qualified clients of iCapital Network through transactions that are exempt from registration under the Securities Act of 1933 pursuant to Rule 506(b) of Regulation D promulgated thereunder (“Private Placements”). An investment in any product issued pursuant to a Private Placement, such as the funds described, entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. Further, such investments are not subject to the same levels of regulatory scrutiny as publicly listed investments, and as a result, investors may have access to significantly less information than they can access with respect to publicly listed investments. Prospective investors should also note that investments in the products described involve long lock-ups and do not provide investors with liquidity.

Securities may be offered through iCapital Securities, LLC, a registered broker dealer, member of FINRA and SIPC and subsidiary of Institutional Capital Network, Inc. (d/b/a iCapital Network). These registrations and memberships in no way imply that the SEC, FINRA or SIPC have endorsed the entities, products or services discussed herein. iCapital and iCapital Network are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2021 Institutional Capital Network, Inc. All Rights Reserved.

Wednesday, September 15th, 2021 and is filed under Industry Reporting

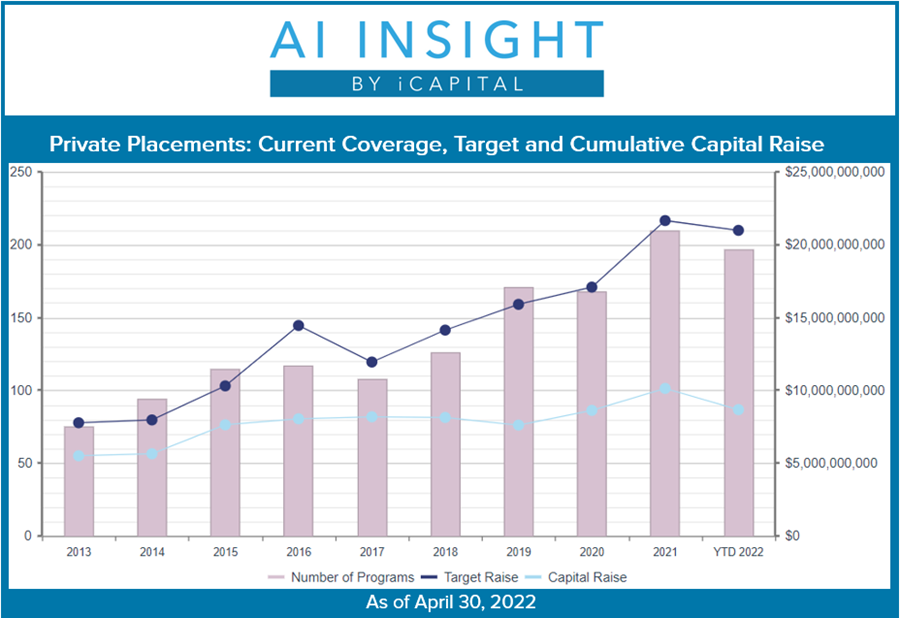

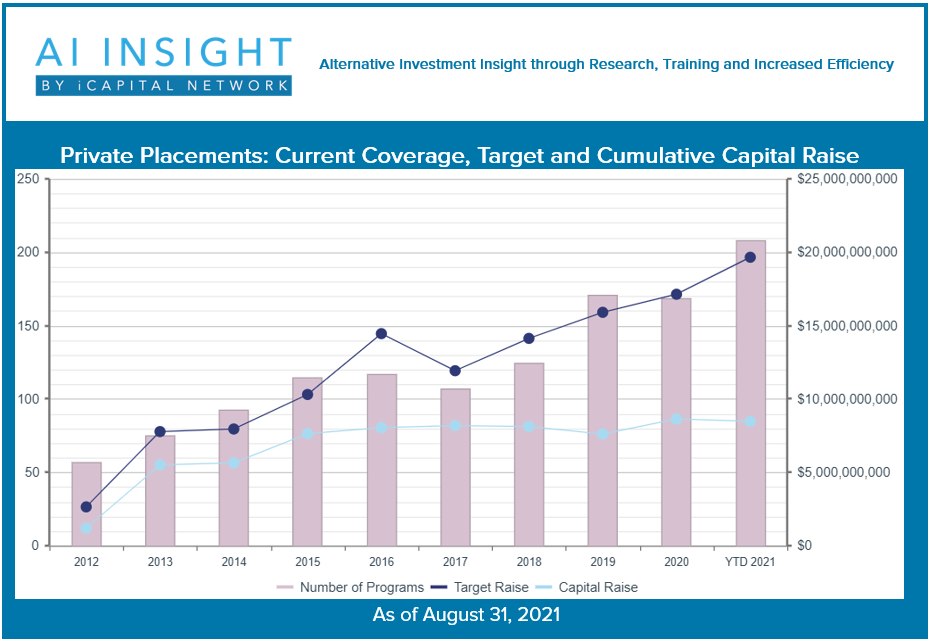

We recently released our August Private Placement Insights report. See the highlights from the report below, or if you are a Premium Reporting subscriber, log in now to see the entire report. If you don’t have access, you can request a free trial.

- Despite a slowdown in 1031 activity, August was another strong month for funds added to our coverage. Private equity/debt, hedge funds, 1031s, and conservation funds have driven growth year-to-date, while opportunity zone activity is the only negative.

- 178 new funds have been added in 2021 making this a strong year and putting us well ahead in terms of new fund coverage (+75%) and aggregate target raise (+109%).

- As of September 1st, AI Insight covers 208 private placements currently raising capital, with an aggregate target raise of $19.7 billion and an aggregate reported raise of $8.5 billion or 43% of target.

- Real estate-related funds, including 1031s, Opportunity Zones, and non-1031 real estate LLCs and LPs represent the largest component of our private placement coverage, at 68% of funds and 61% of target raise. Private equity/debt funds represent a relatively small amount of our coverage in terms of the number of funds at only 16% but represents 28% of target raise even with several funds in the category not reporting a target.

- In terms of our coverage by general objective, income is the largest component at 54% of funds, while growth and growth & income follow at 29% and 17%, respectively.

- The average size of the funds currently raising capital is $95.5 million, ranging from $1.8 million for a specified private equity fund to $1.2 billion for a larger blind pool private equity fund. Seven funds do not report a target or current capital raise.

- 82% of private placements we cover use the 506(b) exemption, 14% use 506(c) and 4% have not yet filed their Form D with the SEC.

- 24 private placements closed to new investors in August and 141 have closed in 2021. Funds that closed this year have been on the market for an average of 339 days. The funds that reported raised 90% of target. 84% met or exceeded their target and only eight funds that missed their target raised less than half of target.

- ON DECK: there are four new private placements coming soon.

For illustrative purposes only.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, Non-Traded BDCs, Interval Funds, and Alternative Strategy Mutual Funds. Receive up to 24 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of August 31, 2021, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security offered by Institutional Capital Network, Inc. or its affiliates (together “iCapital Network”). Past performance is not indicative of future results. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors. An investment in an alternative investment entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. The information contained herein is subject to change and is also incomplete. This industry information and its importance is an opinion only and should not be relied upon as the only important information available. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed, and iCapital Network assumes no liability for the information provided.

Products offered by iCapital Network are typically private placements that are sold only to qualified clients of iCapital Network through transactions that are exempt from registration under the Securities Act of 1933 pursuant to Rule 506(b) of Regulation D promulgated thereunder (“Private Placements”). An investment in any product issued pursuant to a Private Placement, such as the funds described, entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. Further, such investments are not subject to the same levels of regulatory scrutiny as publicly listed investments, and as a result, investors may have access to significantly less information than they can access with respect to publicly listed investments. Prospective investors should also note that investments in the products described involve long lock-ups and do not provide investors with liquidity.

Securities may be offered through iCapital Securities, LLC, a registered broker dealer, member of FINRA and SIPC and subsidiary of Institutional Capital Network, Inc. (d/b/a iCapital Network). These registrations and memberships in no way imply that the SEC, FINRA or SIPC have endorsed the entities, products or services discussed herein. iCapital and iCapital Network are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2021 Institutional Capital Network, Inc. All Rights Reserved.