Thursday, August 30th, 2018 and is filed under AI Insight News

We recently enhanced our reporting capabilities for non-traded REITs to include the ability to sort and review programs by their investment structure, strategy, and primary sector allocation. These enhancements allow subscribers to more efficiently run comparative reports on programs with similar structures and strategies.

Structure

The first enhancement allows you to sort programs by their investment structure – lifecycle or perpetual.

Lifecycle REITs:

- Are intended to have a finite life with distinct stages as a new portfolio is built.

- Typically target a timeframe of five to seven years, with phases including capital raise, growth, maturation, and liquidation.

- Can be purchased only during the capital raise phase at a set public offering price and their NAV is determined no later than 150 days following the second anniversary of breaking escrow. Redemption options for lifecycle REITs are limited until the liquidation phase.

Perpetual REITs:

- Are intended to be managed for a long period of time with no set liquidity phase.

- Many include language in their offering documents that allow for a liquidation, including converting to a publicly traded REIT, but the goal is less about the liquidation than the management of the portfolio.

- Can be purchased or redeemed at any time at the most recent NAV, which is typically determined either monthly or quarterly, however, limitations still apply.

As of August 28th, 2018, the open non-traded REITs on the AI Insight platform include nine perpetual REITs and 12 lifecycle REITs. Based on first quarter 2018 data, the nine perpetual REITs represented 75% of total assets.

Strategy

The second enhancement allows you to sort programs by their investment strategy, which helps to define a program’s risk and return characteristics. The non-traded REITs on the AI Insight platform fall into one of the following five categories, which are based on definitions from CAIA and Preqin: Core, Core-Plus, Value-Add, and Opportunistic. Core programs are theoretically lower risk with lower return potential while opportunistic programs may provide higher returns with higher risk. AI Insight also includes mortgage REITs as an investment strategy, which have a distinct risk return profile.

- Core: Core strategies look to acquire assets that achieve a relatively high percentage of their return from income and are expected to have lower volatility. These tend to be the most liquid, most developed, most recognizable assets in a portfolio. The majority of returns come from cash flows with little appreciation expected. As of August 28th, 2018, there were 13 open programs on the AI Insight platform with a Core investment strategy, representing 84% of NTR AUM.

- Core-Plus: Core-Plus real estate funds invest in moderate risk real estate that provides moderate returns. Investments are predominantly core but with an emphasis on a modest value add approach. These funds typically focus on the main property types in both primary and secondary markets, investing in class A or lower quality buildings that require some form of enhancement. As of August 28th, 2018, there were five open programs on the AI Insight platform with a Core-Plus investment strategy representing 14% of NTR AUM.

- Value-Add: Value-Add programs look to acquire assets that have one or more of the following attributes: (i) achieving a substantial portion of returns from appreciation, (ii) moderate volatility, and (iii) not having the reliability of core properties. This can include hotels, resorts, assisted care living facilities, hospitals, storage, data centers, etc. These properties require a sub-specialty within the real estate market to be managed well and can involve repositioning, renovation or redevelopment. These programs focus on growth and income where opportunities created by dislocation and inefficiencies within segments are capitalized upon to enhance returns. As of August 28th, 2018, there were three open Value-Add programs on the AI Insight platform, representing 0.8% of NTR AUM.

- Opportunistic: Opportunistic programs look to acquire assets that have little or no current cash flow and will derive a substantial part of their return from appreciation. These funds tend to have more equity like characteristics, may have high rollover risk and less liquidity. These are generally distressed properties, new development properties or properties in emerging markets. As of August 28th, 2018, there were no open Opportunistic programs on the AI Insight platform.

- Mortgage: Mortgage programs invest substantially all of their capital raised in commercial real estate mortgages, debt or other real estate fixed income securities. As of August 28th, 2018, there were two open mortgage focused programs on the AI Insight platform representing 0.5% of NTR AUM.

For more information on the characteristics of each of the investment strategies, click here and here.

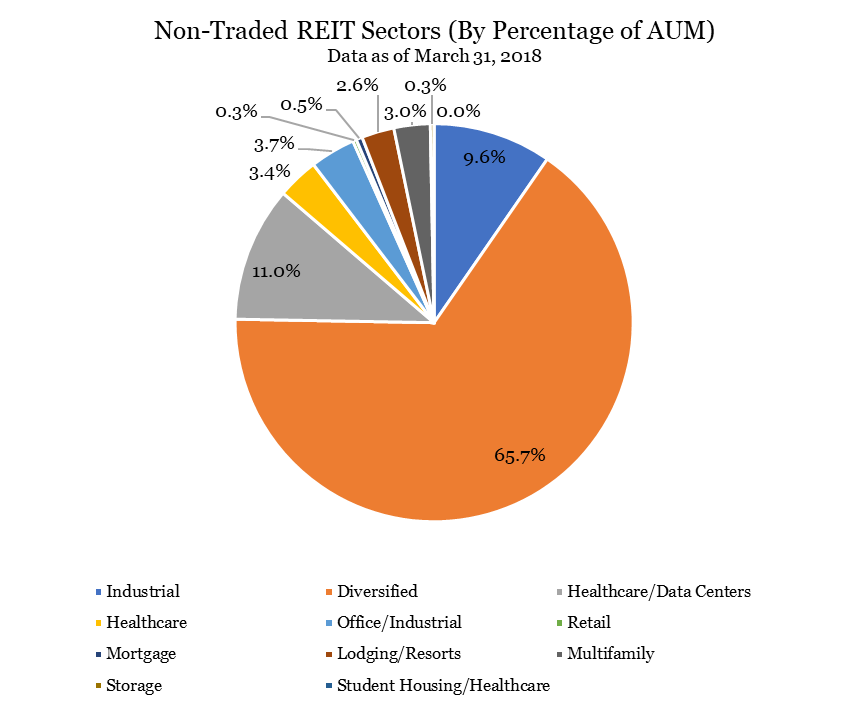

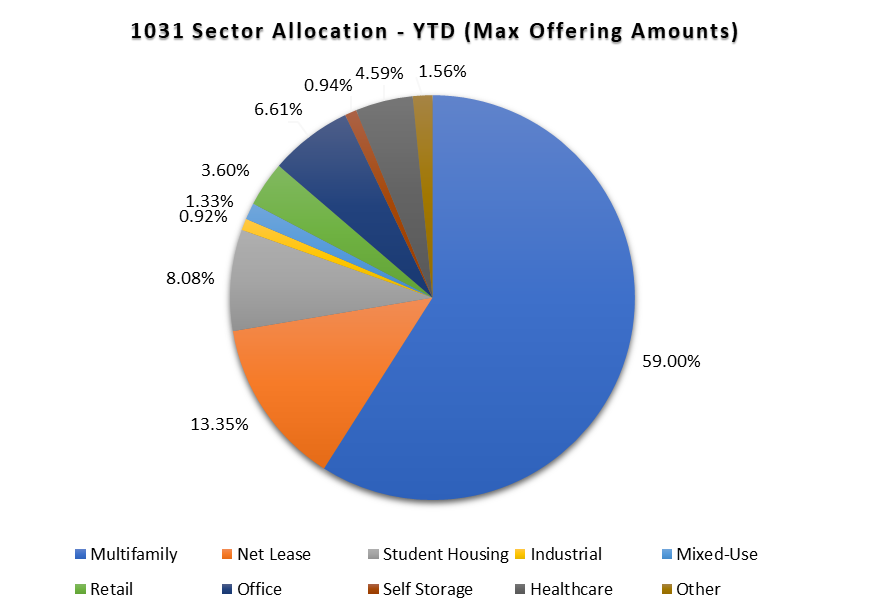

Sector

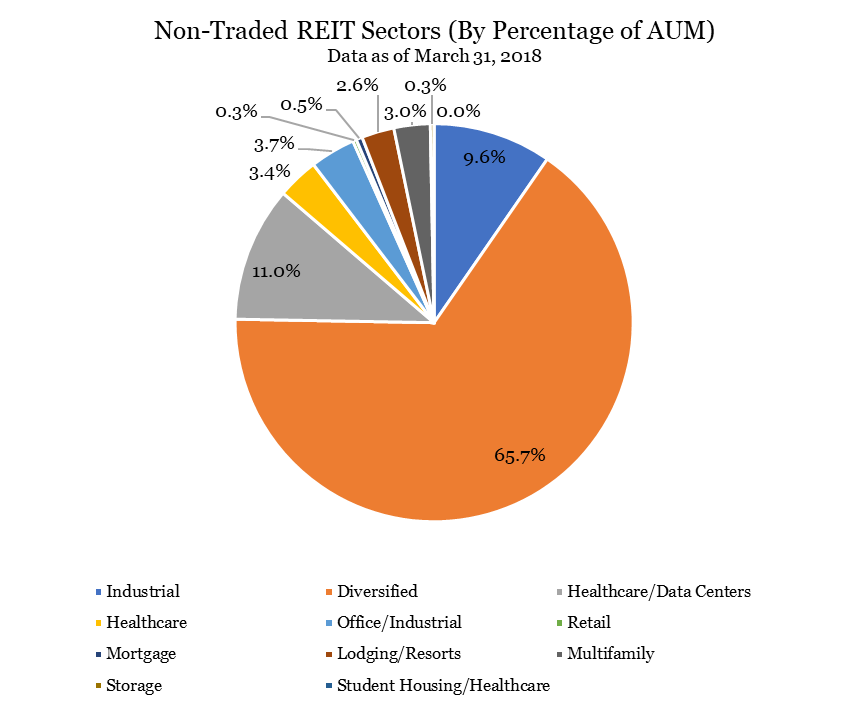

While the AI Insight platform has always included a sector review, we have streamlined this section to highlight each program’s overarching sector or sectors. This allows subscribers to more efficiently compare and sort programs within each of the primary sector categories. The included pie chart illustrates the allocation to the different sectors for open NTRs on the AI Insight platform with data as of Q1 2018.

Access

Subscribers to the AI Insight platform can access, download, and customize the data related to non-traded REITs on the AI Insight website, using comparative reports and the financial performance reporting tools.

Chart Source: AI Insight

Thursday, August 23rd, 2018 and is filed under AI Insight News

A review of private placements on the AI Insight Platform:

- There were 7 new 1031 programs activated on the AI Insight platform in July for a total of $187.4 million in total offering amount, with 49 activated YTD as of the end of July for a total offering amount of $1.4 million.

- Eight Energy programs have been activated YTD with $474.1 million in maximum offering amount.

- 26 non-1031 real estate focused private placement programs have been activated on the AI Insight platform so far in 2018, including two private non-traded REITs. This year’s private placement group includes two sponsors that formerly offered public non-traded REITs but have switched back to the private placement structure.

Click here to view more AI Insight Private Placement data and charts.

Friday, August 3rd, 2018 and is filed under AI Insight News

Non-Traded Closed-End Interval Funds Industry Insights – Second Quarter 2018

Data as of last reporting periods

- According to public filings, as of the end of Q2, 2018, there were 44 active closed-end interval funds:

- Total net assets were $24.2 billion, an increase of 9.61% over the prior AI Insight reporting period.

- Full year-end 2017 returns ranged from (-9.00%) to 25.52% with an average of 6.62%.

- Many of the funds have not reported returns for 2018 yet, although of those that have, the average is in line with 2017 numbers.

For more detailed NT Closed-End Interval Funds 2Q18 data, click here.

Friday, August 3rd, 2018 and is filed under AI Insight News

Non-Traded BDC Industry Insights – First Quarter 2018

Data as of March 31, 2018

- As of March 31, 2018, there were four open non-traded BDCs offered by four sponsors.

- Capital raise in the non-traded BDC space has been steadily declining since the peak in 2013.

- According to public filings, 2017 was the slowest year on record and 2018 is trending to come in even lower.

For more detailed BDC 1Q18 data, click here.

Wednesday, August 1st, 2018 and is filed under AI Insight News

Non-Traded REIT Industry Insights – First Quarter 2018

Data as of March 31, 2018

- Open and closed NTRs reported a total raise of $1.3 billion during the first quarter of 2018, an 8% decrease from the prior quarter.

- During Q1 2018, there were 23 open non-traded REITs offered by 19 sponsors.

- Blackstone REIT represented 60% of the $1 billion raised by open programs during the quarter.

For more detailed NTR 1Q18 data, click here.

Monday, July 9th, 2018 and is filed under AI Insight News

A review of private placements on the AI Insight Platform.

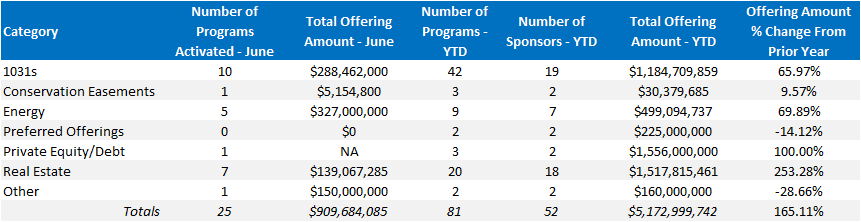

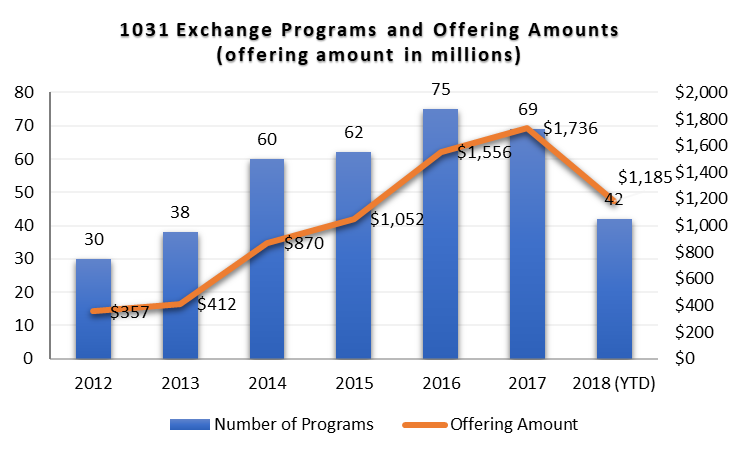

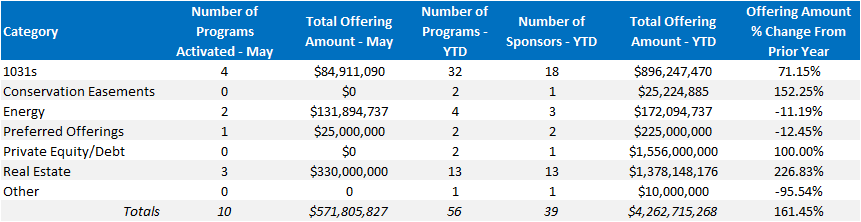

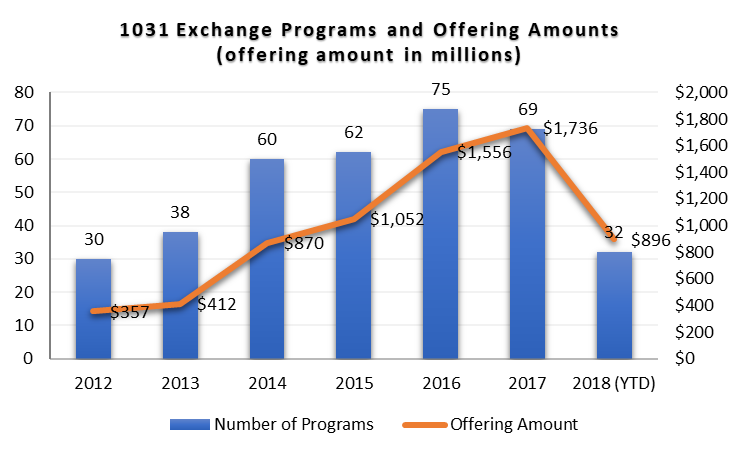

1031 Exchange Programs

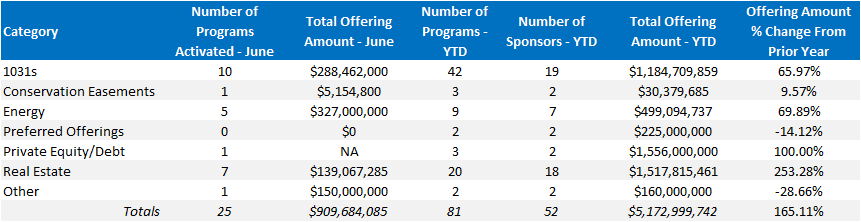

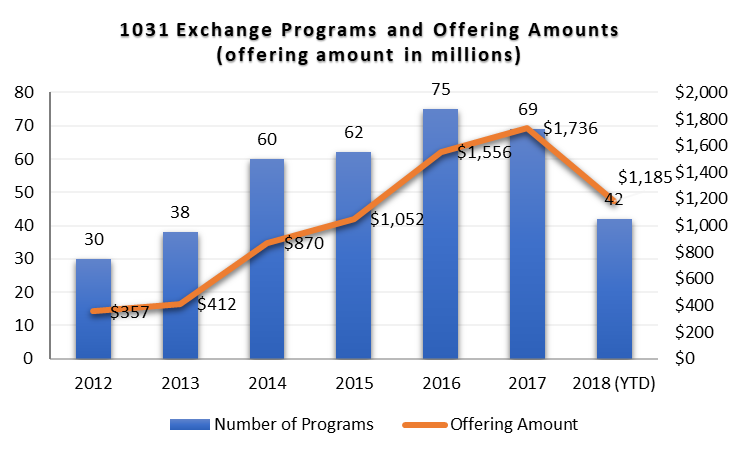

- There were 10 new 1031 programs activated on the AI Insight platform in June for a total of $302.4 million in total offering amount, with 42 activated YTD as of the end of June for a total offering amount of $1,198.7 million.

- The aggregate June offering amount was well above May levels and YTD is approximately 68% above 2017 YTD levels.

- Inland Private Capital remains the top sponsor in the industry with 32% of the offering amount YTD. Passco Companies, LLC comes in at second with 12% of offering amount YTD, while the remainder of the programs were evenly spread between different sponsors.

- One new sponsor entered the market in June with one offering.

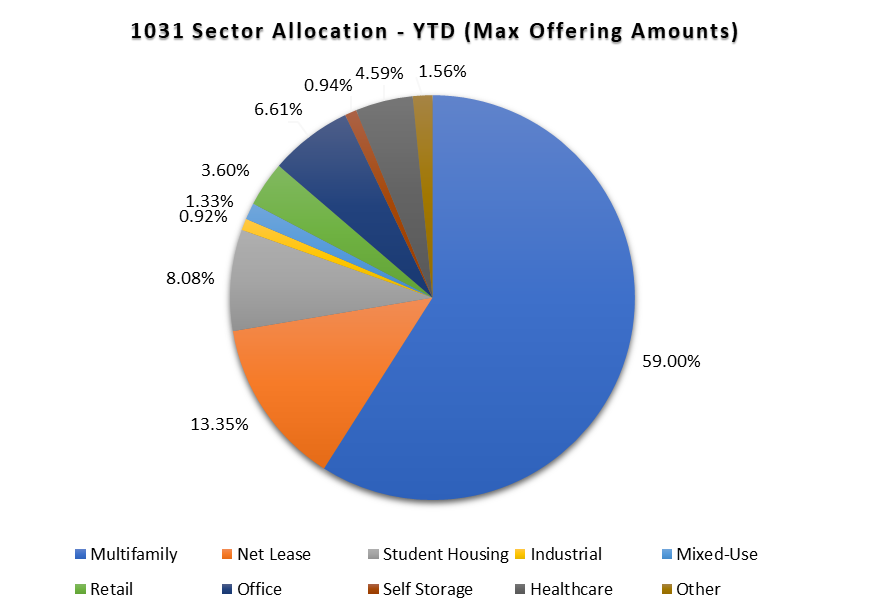

- Multifamily and net lease programs continue to dominate the space, with 60% and 13% of offering amounts YTD, respectively. Student housing represented just under 8% and healthcare represented approximately 5%.

- ON DECK: As of July 5th, two DST programs were activated in July with one coming soon.

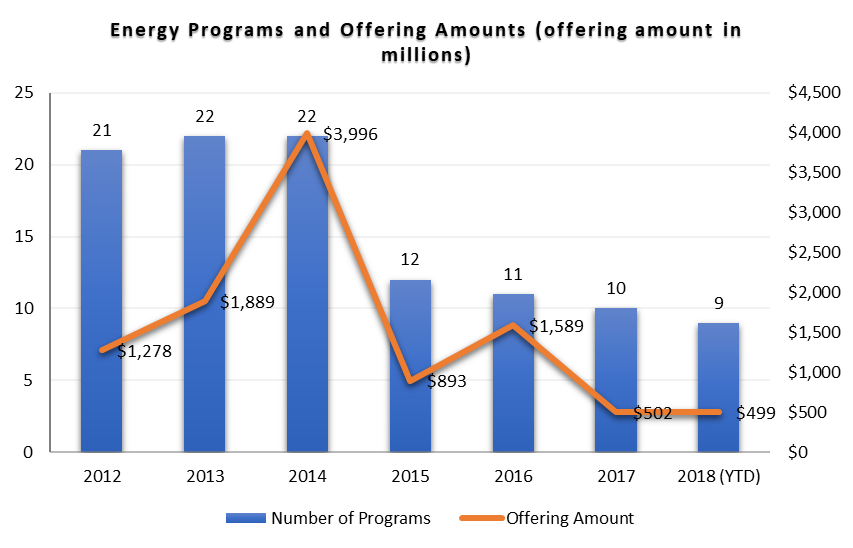

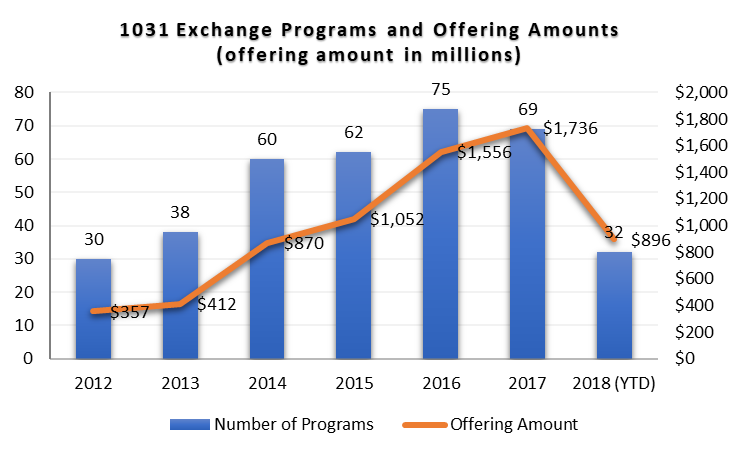

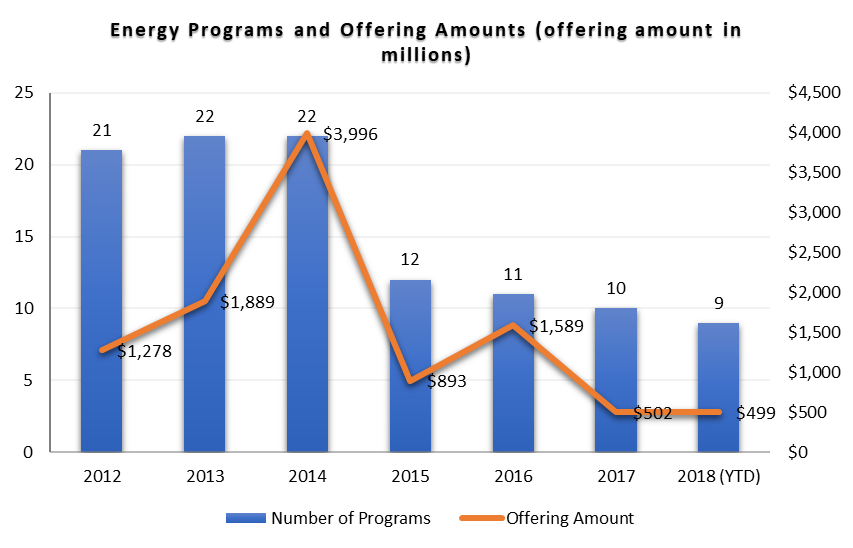

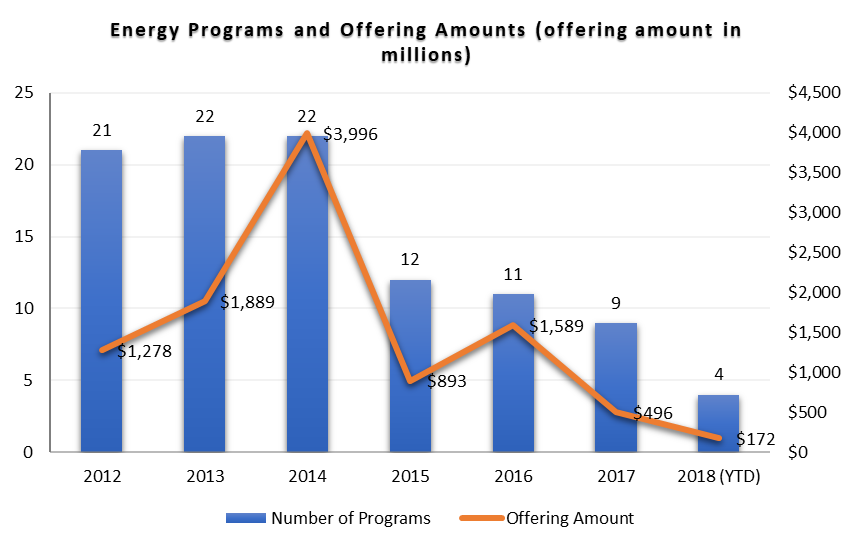

Energy

Energy

- Five energy focused programs were activated in June, for a total of nine programs YTD with $499.1 million in maximum offering amount.

- A large program focused on drilling activated in June, which puts the sector ahead of its 2017 run rate – a welcome sign after a few dismal years.

- Energy focused private placements are still well below their 2013-2014 peak, which corresponds with oil pricing trends. The entire energy industry has seen significant consolidation, debt reduction, and restructuring. It remains to be seen whether the private placement structure can thrive once again after all of these changes.

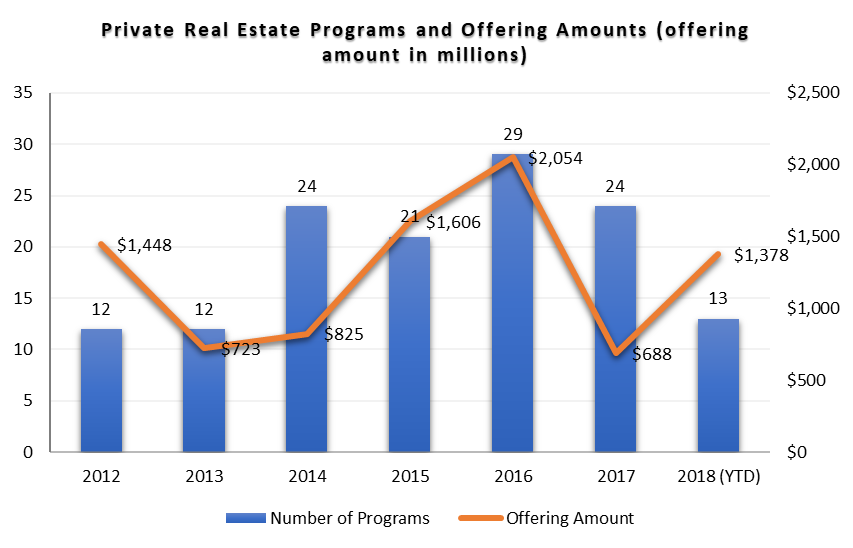

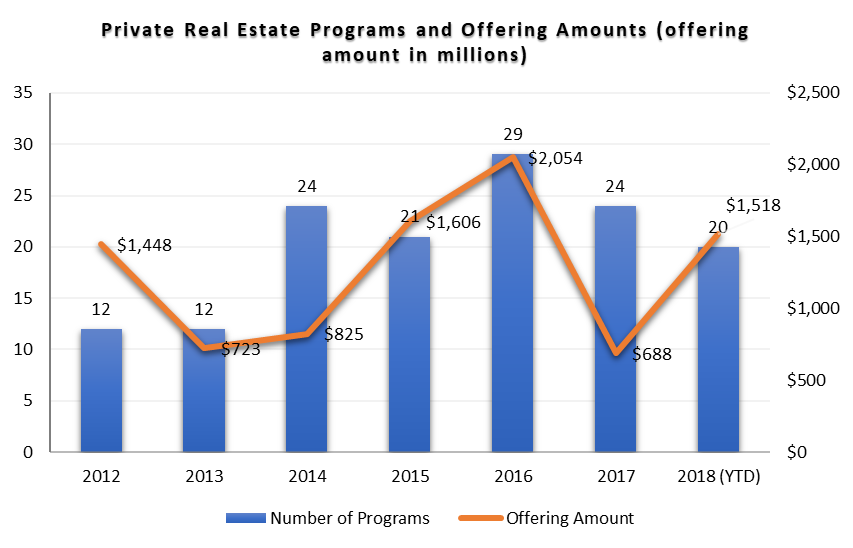

Real Estate

Real Estate

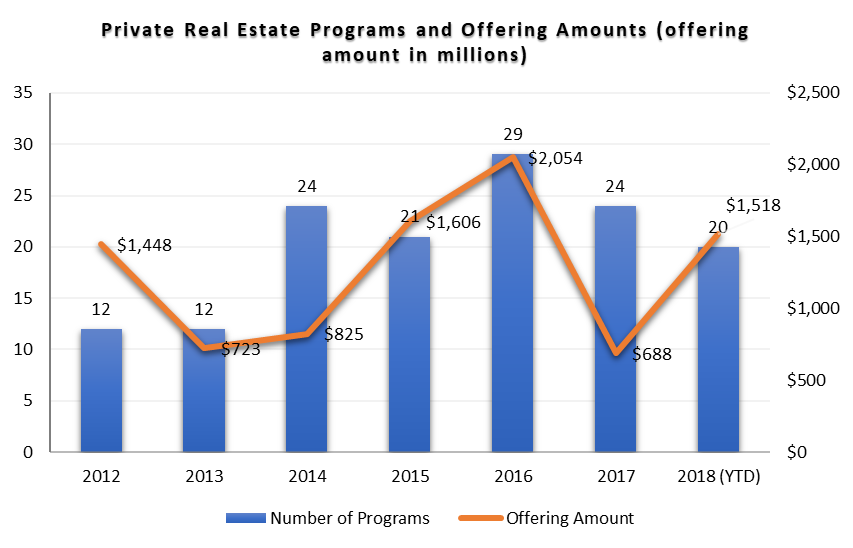

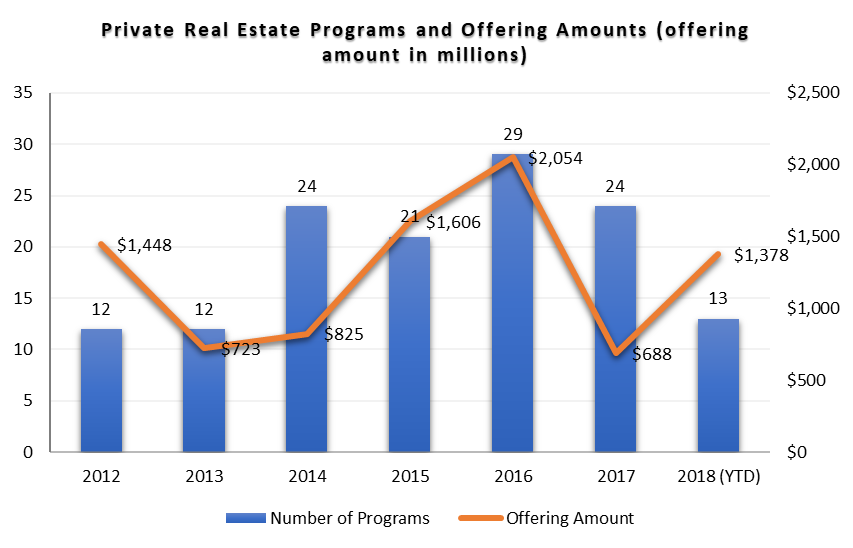

- 20 non-1031 real estate focused private placement programs have been activated on the AI Insight platform so far in 2018.

- As of June 30, 2018, the total maximum offering amount for real estate focused funds was over $1.5 billion, which more than doubles the total offering amount of $688 million for the full year 2017.

- ON DECK: As of July 5th, there was one non-1031 real estate private placement programs coming soon.

Other

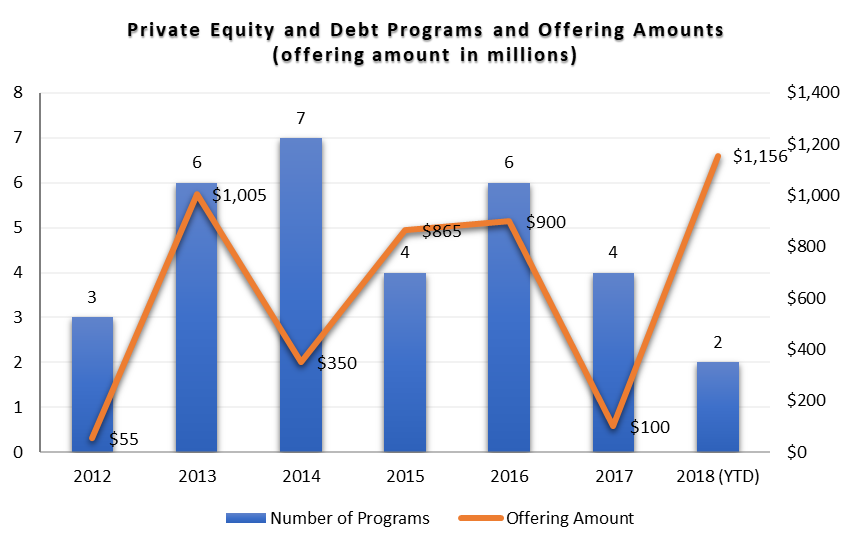

Other

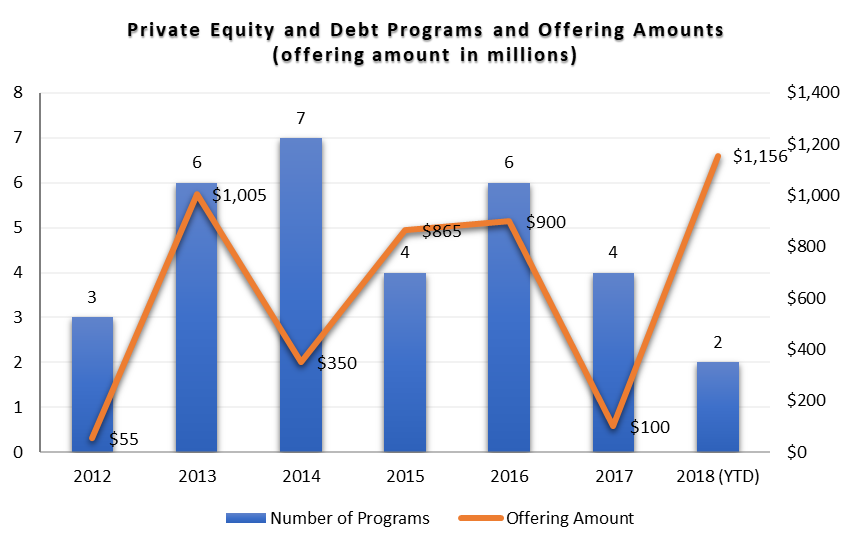

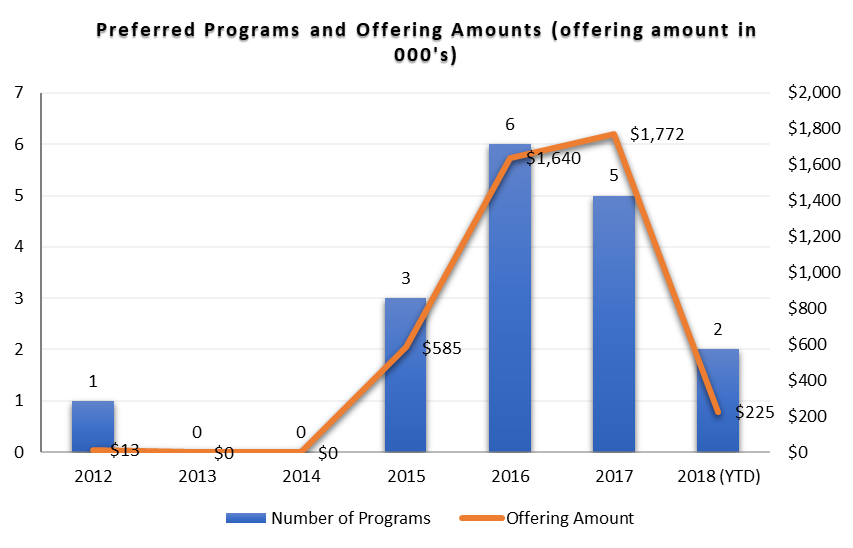

- One private equity program activated in June, bringing the total for private equity/debt programs to three for the year.

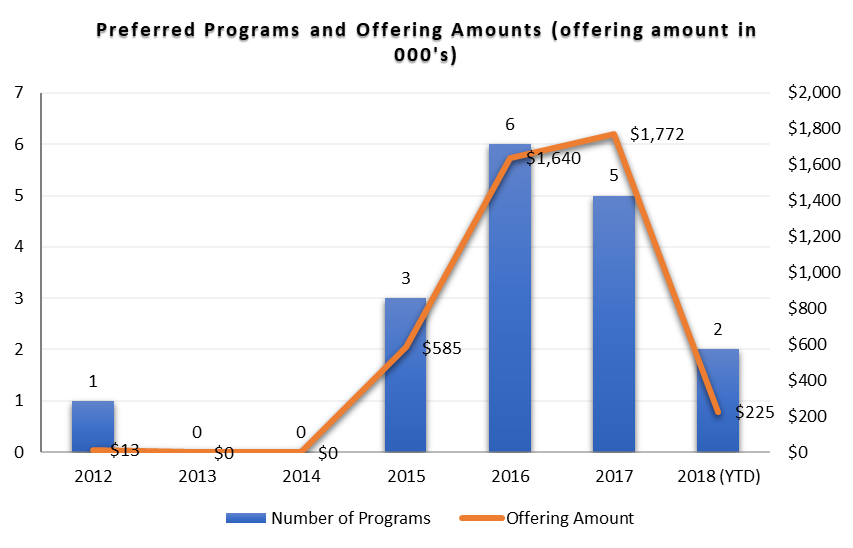

- Preferred programs are slightly below 2017 levels, with no new activations in June.

- Three conservation easement programs have activated so far in 2018, This is on par with 2017; however, the year was back-end heavy with 24 programs for $294 million offered between May and the end of 2017.

- One private non-traded REIT activated in June.

- ON DECK: As of July 5th, there was one hedge fund program coming soon.

| Glossary:

Activated: Program and education module are live on the AI Insight platform. Subscribers are able to view and download data for the program and take the education module. |

| Charts Source: AI Insight. Data as of June 30, 2018, based on programs activated on the AI Insight platform as of this date. |

Monday, July 2nd, 2018 and is filed under AI Insight News

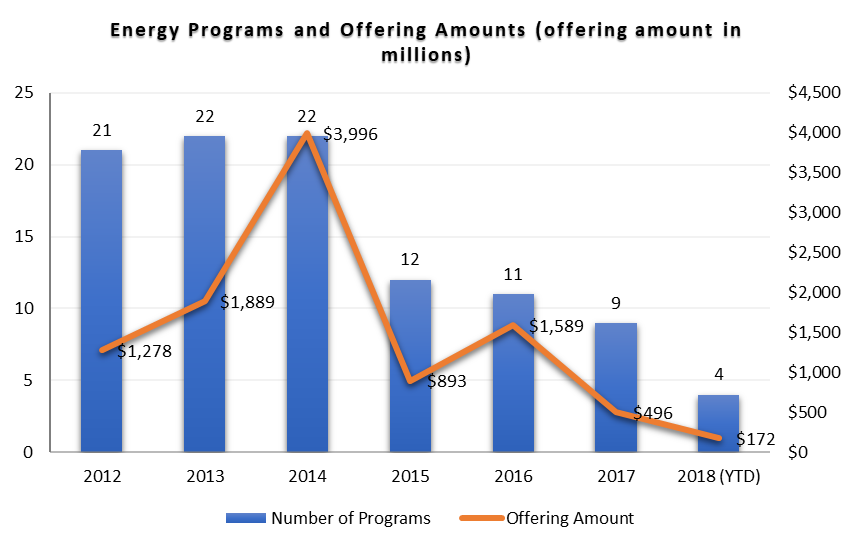

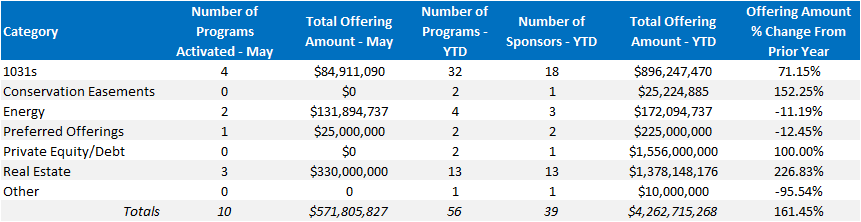

A review of private placements on the AI Insight Platform:

1031 Exchange Programs

- There were four new 1031 programs activated on the AI Insight platform in May for a total of $84.9 million in total offering amount, with 32 activated YTD as of the end of May for a total offering amount of $896.2 million.

- The aggregate May offering amount was above April levels and YTD is approximately 71% above 2017 YTD levels.

- Inland Private Capital remains the top sponsor in the industry with 32% of the offering amount YTD. The remainder of the programs were evenly spread between different sponsors.

- Multifamily and net lease programs represented the top sectors at 53% and 12% of offering amounts YTD, respectively. Student housing represented just under 9%, and two of the first healthcare programs were activated as well. Retail net lease programs represent less than 5% of offering amounts, a major shift from the dominance of the sector in prior years.

- ON DECK: As of June 25th, nine DST programs were activated in June with two more coming soon.

Energy

- Two energy focused programs were activated in May, for a total of four programs YTD with $172.1 million in maximum offering amount.

- A large program focused on oil and gas development activated in May, which brings the sector back to a similar run rate as 2017 in terms of offering amount.

- ON DECK: As of June 25th, four programs have been activated in June. The sector seems to be ramping up as the year moves on, as it typically does. It will be interesting to see whether the reversal in oil prices brings new life to the energy sector, which has seen much slower activity since the 2014 peak in oil prices.

Real Estate

- 13 non-1031 real estate focused private placement programs have been activated on the AI Insight platform so far in 2018. This is on-par with last year’s numbers, but the offering amounts are higher.

- As of May 31, 2018, the total maximum offering amount for real estate focused funds was over $1.3 billion, which doubles the total offering amount of $687 million for the full year 2017.

- ON DECK: As of June 25th, seven real estate private placement programs were activated so far in June with two more coming soon.

Other

Other

- Similar to real estate, we have seen the same amount of private equity and debt programs YTD as we did last year, but the offering sizes have increased, including a $1 billion+ program offered by GPB.

- Preferred programs appear to be on par with 2017 levels.

- Two conservation easement programs have activated so far in 2017, both offered by EcoVest Capital. There were no offerings as of this time last year, however, the year was back-end heavy with 24 programs for $294 million offered between May and the end of the year.

Charts Source: AI Insight. Data as of May 31, 2018, based on programs activate on the AI Insight platform as of this date.

Glossary:

Activated: Program and education module are live on the AI Insight platform. Subscribers are able to view and download data for the program and take the education module.

Thursday, June 21st, 2018 and is filed under AI Insight News

Last week AI Insight made their first appearance at the annual Morningstar Investment Conference in Chicago, IL. As we look to expand our capabilities into alternative mutual funds, it was important to learn about the latest trends and developments within the financial industry.

Here are three key takeaways to consider:

- Goals-based financial planning is a growing trend within the advisory space. To help facilitate, advisors can make use of various product sets including liquid alts, interval funds, socially responsible investments, and ETFs. The challenge is in educating clients and applying within a portfolio context as these products can be complex.

- Transparency is the key to gaining client trust. This message needs to be clear to clients – that their interests are ahead of the firm or advisor interests. This is the essence of the DOL rule, which should simply be part of the process regardless. The real premise of investing is in people, not just how you invest their money.

- There’s never been a better time for financial advice considering lower fees, technology integration and the breadth of product offerings available. However, there has been a disconnect between what advisors and investors value within financial goals. To be successful, advisors need to be resourceful with technology in order to provide more efficient and client-centric advice.

Monday, June 18th, 2018 and is filed under AI Insight News

“About 67% of advisers say lack of understanding is one of the main reasons why they don’t invest more heavily in alternatives.” [i] Regulatory requirements and operational challenges add to the complexity. But, as complex investments become easily accessible to everyday investors who are looking for new investing opportunities, it’s critical that you stay one step ahead to understand these products and help your clients make sense of them.

Obstacle: Complex products can be difficult to track because many managers don’t make their data available.

Opportunity: Lack of understanding complex products can be addressed by gaining more transparency to help you better explain these products to your clients. Using an unbiased online resource to get hard-to-find industry data on complex products can help. For example, AI Insight provides data on hundreds of Alternative Investments including 120+ private offerings. Plus, get unbiased monitoring of key performance metrics for 140+ nontraded REITs, BDCs and closed-end interval funds.

________________________________________________________________________________

Obstacle: Not only do you need be able to clearly differentiate between traded and nontraded alts, but you also need training at the product level to gain a deeper understanding of the complex products you’re offering — and meet your regulatory requirements. Plus, the operational requirements can be overwhelming for broker dealers, RIAs and advisors. Working with illiquids requires a significant amount of paperwork, due diligence research and an infallible way to track for compliance purposes.

Opportunity: Over 150 broker dealers and RIAs use AI Insight to help research new products for due diligence purposes. Most require their advisors to use the platform to facilitate product education on nontraded alts, including 72 percent of the top broker dealers in 2016[ii]. Working with traded alts? Research reports will be available on AI Insight starting in August. Get more information.

________________________________________________________________________________

Obstacle: You’re concerned that you can’t explain certain alternative investment products to clients, but you want to include more complex products to provide more diversification in clients’ portfolios.

Opportunity: Educating yourself on complex products can better equip you to answer client questions and feel more confident in adding Alternative Investments to your clients’ portfolios. AI Insight’s News and Alerts feature can provide you with all the regulatory updates on the hundreds of funds available on the platform according to your preferences. If you need a deeper dive, you can easily connect with fund managers directly through the platform.

________________________________________________________________________________

Obstacle: Compliance and regulatory issues are ranked as the most stressful concern for advisors. [iii]

Opportunity: As the number of complex products available to investors increases, so do the regulatory requirements. When you conduct research or complete a product-specific education module on AI Insight, it automatically tracks your activity. You can access or download your documentation in the Training, Education and Research log.

Use AI Insight’s easy-to-use online platform as a solution help explain offerings efficiently to clients, enhance their portfolios and create confidence in your process. Contact us to learn more and request a live tour customized to your business needs.

[i] More Advisors Use Alts, But Few Understand Them by John Waggoner, InvestmentNews

[ii] Top Broker Dealers of 2016 – InvestmentNews Broker Dealer Data Center

[iii] Insights into Advisor Wellness by Flexshares

Tuesday, June 12th, 2018 and is filed under AI Insight News

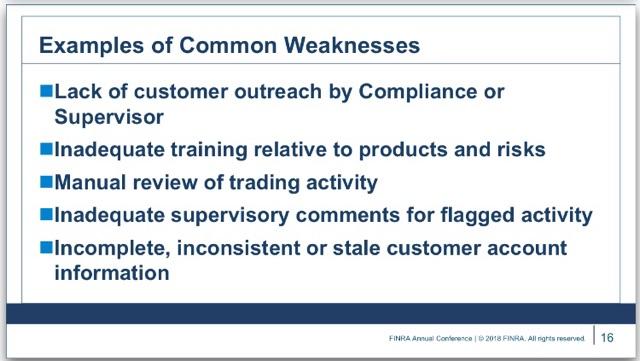

It was great to connect with many of our industry partners at the recent FINRA Annual Conference in Washington, D.C. to discuss regulatory topics relevant to our industry. Here are three key takeaways to consider:

- The industry continues moving forward with a new approach to the standard of care registered representatives must undertake when working with clients. SEC Chairman Clayton was adamant about having industry stakeholders submit comments to help shape the actual outcome of the proposal. He was also quite vocal on the confusion people seem to have around the term “fiduciary” and that he was very much against using it in this proposal. The SEC’s Brett Redfearn provided an overview of Regulation Best Interest and enhancing the standard of conduct for broker-dealers. Read more

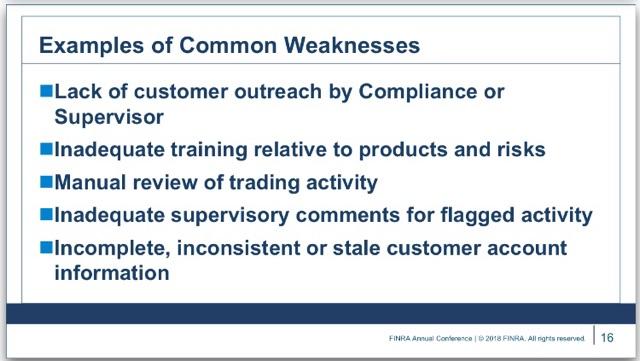

- On a suitability panel, “inadequate training relative to products and risks” was noted by FINRA as a common weakness found.

- Heightened diligence and advisor education are needed for the increasingly complex products being offered through traditional ’40 Act structures such as Alternative Mutual Funds and Interval Funds. FINRA mentioned their guidance on complex products as a resource when working with Alternative Mutual Funds, leveraged ETFs, Interval Funds and other alternative investments.

Other

Other

Other

Other