Thursday, February 21st, 2019 and is filed under AI Insight News

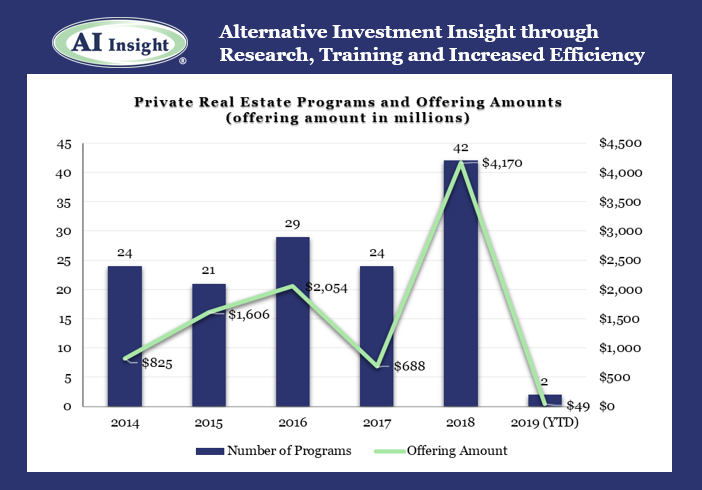

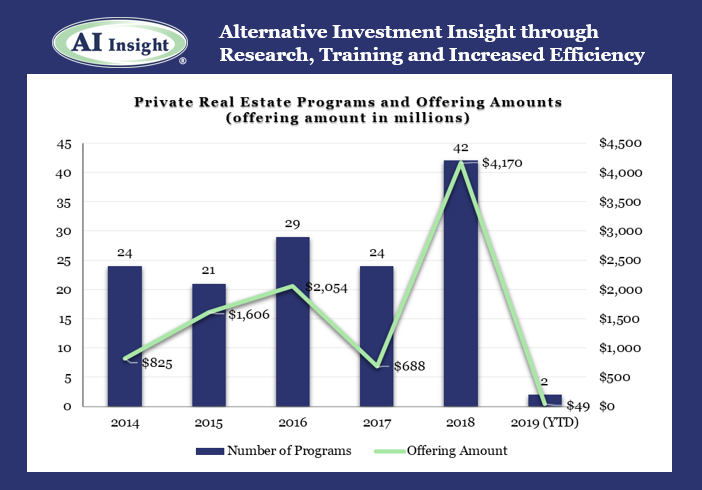

- Two non-1031 real estate programs activated in January for an aggregate maximum offering amount of $48.6 million.

- While the aggregate offering amount in January was roughly half of what it was last January, there was only one larger program seeking capital as opposed to two this year.

- Two sponsors offered programs in January, including one sponsor new to the space.

- Programs activated in January focused on hospitality and self-storage.

- ON DECK: As of February 11th, there were three non-1031 real estate program coming soon. Two of these are focused on healthcare and retail, with one diversified, opportunistic fund.

AI Insight is introducing Industry Reporting late in the first quarter of 2019, which will include this and many more insights into key non-traded markets, including the new Opportunity Zone Funds. To inquire about accessing these expansive data reports, contact us directly.

Charts Source: AI Insight. Data as of January 31, 2019, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

Wednesday, February 13th, 2019 and is filed under AI Insight News

FINRA recently issued its 2019 Risk Monitoring and Examination Priorities Letter along with its 2018 Examinations Finding Report. These reports highlight the continued focus on client suitability. Watch Video

Thursday, February 7th, 2019 and is filed under AI Insight News

Some financial firms have raised questions about the need for conducting additional research on alternative mutual funds given their complex structure compared to traditional mutual funds. See below for supporting regulatory detail to help differentiate the need for additional due diligence on alternative mutual funds.

In 2013, FINRA issued an alert identifying alternative mutual funds as having unique characteristics and risks separate from their traditional counterparts (stock and bond funds). The alert, Alternative Funds Are Not Your Typical Mutual Funds, focuses on defining liquid alternatives, how they compare to hedge funds, and what all investors need to be aware of.

Liquidity Risk Management proposed on September 22, 2015. The proposal included a comprehensive package of rule reforms designed to enhance effective liquidity risk management by open-end funds, including mutual funds and exchange-traded funds (ETFs). Under the proposed reforms, mutual funds and ETFs would be required to implement liquidity risk management programs and enhance disclosure regarding fund liquidity and redemption practices. The proposal is designed to better ensure investors can redeem their shares and receive their assets in a timely manner.

Derivatives Rule proposed on December 11, 2015. The rule is designed to enhance the regulation of the use of derivatives by registered investment companies, including mutual funds, exchange-traded funds (ETFs) and closed-end funds, as well as business development companies. The proposed rule would limit funds’ use of derivatives and require them to put risk management measures in place which would result in better investor protections.

- The fate of the Derivatives Rule, which would impose aggregate exposure limits on a fund’s net assets, has become uncertain. The rule was proposed under the previous administration and former SEC Chair Mary Jo White. However, under the spring 2018 regulatory agenda for the division of investment management, it was recommended that the Commission revisit the rule. The SEC did ultimately adopt the Liquidity Risk Management Program Rule, in which funds will have to comply (generally speaking) with the new requirements imposed by June 2019. The rule requires each registered open-end management investment company, including open-end ETFs, but not including money market funds, to establish a written liquidity risk management program. The program requires each fund to classify the liquidity of its portfolio investments based on the number of days within which it determined that it reasonably expects an investment would be convertible to cash.

- The rule also requires funds to review its portfolio investments’ classifications at least monthly. Also, funds must determine their “highly liquid investment minimum,” or the minimum amount of the fund’s net assets it invests in highly liquid investments to increase the likelihood that it will meet redemption requests without significantly impacting its NAV. Given the nature of alternative mutual funds and its use of derivatives, investors should be aware of the associated risks fund managers face in complying with the rules and incorporate an understanding of the systems and programs in place as part of fund due diligence.

In 2017, FINRA took further steps to identify alternative mutual funds as a unique product set by introducing an e-learning course titled Understanding Alternative Mutual Funds. The course explains the unique characteristics and associated risks of these investments, and presents scenarios designed to further the understanding of the complexities and the importance of performing a thorough suitability analysis.

Additional Resources:

Thursday, February 7th, 2019 and is filed under AI Insight News

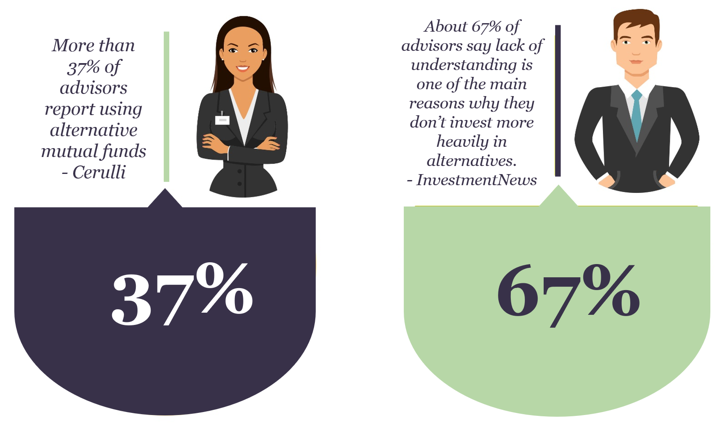

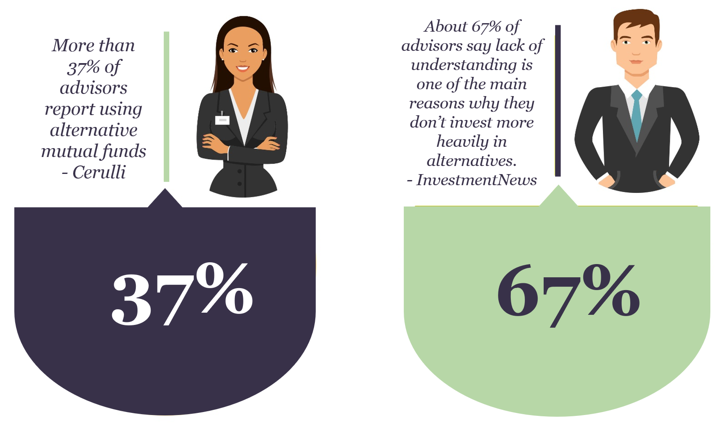

More advisors are working with alternatives as they become more accessible to average investors through the recent evolution of Alternative Mutual Funds. Cerulli’s recent report, “U.S. Alternative Investments 2018: Accessing Evolving Alternative Platforms“, focuses on trends in the U.S. alternative asset market. It concludes that more than 37% of advisors are working with alternative mutual funds.

However, other data tells us that advisors may not have the resources they need to research and apply alternative mutual funds in their practices. According to Investment News, about 67% of advisors say lack of understanding is one of the main reasons why they don’t use alternatives more frequently in their asset allocation models.

Get started now with 3 easy steps to help advisors understand the complexities of alternative mutual funds and help them remain regulatory-compliant.

- First, take 3 minutes to read this Q&A and gain a basic understanding of how Alternative Mutual Funds differ from traditional funds, learn how to address regulatory requirements and view our extensive list of resources.

- Next, take the CE course, “Introduction to Alternative Mutual Funds“ to understand key aspects, benefits and risks of these complex products.

- Finally, request a demo customized to your business needs to take a closer look at how an alternative-centered focus on research on various strategies including managed futures, long-short, market neutral and alternative allocation can help create efficiencies in your business.

Friday, February 1st, 2019 and is filed under AI Insight News

FINRA recently issued its 2019 Risk Monitoring and Examination Priorities Letter along with its 2018 Examinations Finding Report. These reports highlight, among other things, the continued focus on client suitability and overconcentration in non-traded investments, and the need for reasonable due diligence for private placements that is well documented.

Specifically, the 2019 Priorities Letter states,

“As always, suitability will remain one of FINRA’s top priorities. This year, some of the specific areas on which we may focus include: (1) deficient quantitative suitability determinations or related supervisory controls; (2) overconcentration in illiquid securities, such as variable annuities, non-traded alternative investments and securities sold through private placements; and (3) recommendations to purchase share classes that are not in line with the customer’s investment time horizon or hold for a period that is inconsistent with the security’s performance characteristics…”

The 2018 Findings Report stated,

“FINRA has observed instances where some firms that have suitability obligations under FINRA Rule 2111 (Suitability) failed to conduct reasonable diligence on private placements and failed to meet their supervisory requirements under FINRA Rule 3110 (Supervision). FINRA Regulatory Notice 10-22 describes the circumstances under which firms have an obligation to conduct a “reasonable investigation” by evaluating “the issuer and its management; the business prospects of the issuer; the assets held by or to be acquired by the issuer; the claims being made; and the intended use of proceeds of the offering.”

Additionally, in the 2018 Findings Report, FINRA outlines the characteristics of firms that have performed reasonable due diligence, and reminds firms conducting due diligence of their obligation to document both the “process and results” of such reasonable due diligence analysis.

Key Takeaways

- Carefully review and understand the specific suitability requirements for each non-traded or private placement program utilized, and ensure that your firm has a documented process in place to monitor the compliance with suitability requirements.

- Perform a “reasonable investigation” of all complex products, focusing on the specific factors outlined by FINRA in the 2018 Findings Report. For further guidance on what constitutes a “reasonable investigation,” review FINRA Regulatory Notice 10-22.

- Document the due diligence process – remember, if it isn’t documented, it was never done.

- If utilizing third party due diligence vendors, ensure that your firm independently investigates any red flags identified, and document your firm’s investigation and findings.

Let AI Insight help you stay Compliant

- Unbiased education: Access product-specific training on the features, risks and suitability for hundreds of offerings.

- Conduct research: Create efficiencies in your due diligence review process using our robust database to source new products as well as analyze and compare hundreds of alternative investment programs, including non-traded programs, private placements, and alternative mutual funds.

- Compliance documentation: Demonstrate what you’re doing to support your firm’s regulatory requirements in a transparent way. AI Insight captures all of the activity your firm members complete within the platform including training modules, offering document reviews and research conducted.

Resources

Tuesday, January 8th, 2019 and is filed under AI Insight News

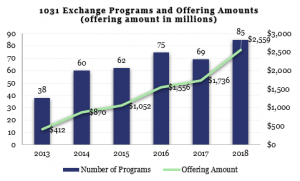

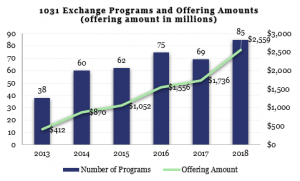

- The 1031 industry ramped up significantly in 2018, posting a record year in terms of the number of offerings and offering amounts. The industry appears to be keeping a similar pace in 2019, with two programs activated in January and three coming soon, as of January 8, 2019.

- There were 5 new 1031 programs activated on the AI Insight platform in December for a combined $167 million in total offering amount, with 85 activated in FY 2018 for a total offering amount of $2.6 billion.

- Multifamily was the top sector, at 57.3% of max offering amount, followed by Healthcare and Net Lease, at 12.6% and 11.7%, respectively.

AI Insight is introducing Industry Reporting in the first quarter of 2019, which will include this and many more insights into key non-traded markets.

View data insights for non-traded REITs, BDCs, Closed-End Interval Funds, Private Placements and Alternative Mutual Funds. Keep watch on trends using our extensive review of available programs providing key financial statistics for each industry and program, such as distributions and coverage ratios, sector allocations, capital raise, leverage ratios and more.

To inquire about accessing these expansive data reports, please contact us directly.

Wednesday, January 2nd, 2019 and is filed under AI Insight News

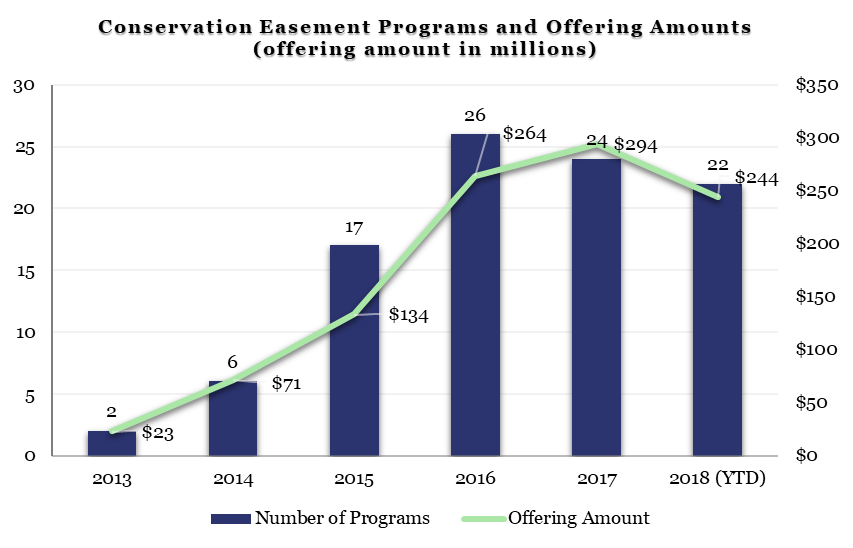

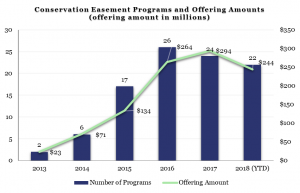

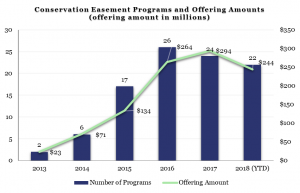

- Seven conservation easement programs activated on the AI Insight platform in November for a total of $78.2 million in aggregate offering amount for the month.

- The category is positioned to meet or exceed its record in 2016, with four programs coming soon for a total of $35.5 million in aggregate offering amount.

Additional Resources

Coming soon:

- AI Insight is introducing Industry Reporting in the first quarter of 2019, which will include this data and many more insights into key non-traded markets. To inquire about accessing these expansive data reports, please contact us directly.

- AI Insight CE Course – Conservation Easements. View the course catalog

Monday, December 17th, 2018 and is filed under AI Insight News

Opportunity Zone investments through Opportunity Funds are quickly gaining interest as new offerings become available. Take our latest CE course, “Introduction to Opportunity Zones“, to better prepare yourself and your clients while helping to meet regulatory-compliance requirements.

Friday, December 7th, 2018 and is filed under AI Insight News

- Seven conservation easement programs activated on the AI Insight platform in November for a total of $78.2 million in aggregate offering amount for the month.

- The category is positioned to meet or exceed its record in 2016, with four programs coming soon for a total of $35.5 million in aggregate offering amount.

Additional Resources

Coming soon:

- AI Insight is introducing Industry Reporting in the first quarter of 2019, which will include this data and many more insights into key non-traded markets.To inquire about accessing these expansive data reports, please contact us.

- AI Insight CE Course – Conservation Easements. View the course catalog to see all available courses.

Wednesday, November 28th, 2018 and is filed under AI Insight News

Complex investments are becoming more accessible to average investors looking for new investing opportunities, especially given the recent evolution of Alternative Mutual Funds. In order to effectively include these investments within client portfolios, one should understand the complexity of the funds and meet other regulatory requirements associated with them.

Read the interview below with AI Insight’s Mike Kell and Lou Johnson to help gain an understanding of Alternative Mutual Funds to better equip yourself to answer client’s questions and feel more confident in applying these investments.

Q: From an investment objective perspective, how do Alternative Mutual Funds differ from traditional Mutual Funds?

Mike Kell: Alternative Mutual Funds use more complex strategies than traditional mutual funds. By investing in alternative strategies like long-short, arbitrage and trend following, among others, they offer the potential for diversified returns relative to traditional funds investing long only in stocks or bonds. We recently launched a CE course, “Introduction to Alternative Mutual Funds”, that addresses this and other related topics such as risks, fees and expenses.

Q: From a regulatory perspective, how do Alternative Mutual Funds differ from traditional Mutual Funds?

Mike Kell: As the number of complex products available to investors increases, so does the regulatory focus. The non-traditional strategies and investments Alternative Mutual Funds use increase the risk and complexity compared to traditional mutual funds. The SEC has been focused on liquidity risk management and derivatives exposure with these funds. FINRA has echoed the SEC with an investor letter and e-learning course cautioning the risks of these strategies in an open-end ‘40 Act structure.

Q: How can financial firms address the SEC and FINRA alerts when working with Alternative Mutual Funds?

Mike Kell: When we see increased regulatory focus in a direction like this, we want to provide a solution to help our clients remain regulatory-compliant. When considering a solution, we focus on the gap that exists between what’s available today and a reasonable approach to meeting regulatory requirements while considering operational efficiencies. There are various entities providing quantitative data at high levels but fall short of delivering enough information to meet a reasonable threshold of understanding the complexities of Alternative Mutual Funds

We’ve created an enhanced framework for organizing the Alternative Mutual Fund industry inclusive of peer group, strategy and sub-strategy to better address the breadth and diversity of the space. AI Insight provides education modules at the industry and strategy-levels along with fund-level research for Alternative Mutual Funds, which helps you understand the complexities of the products and how to use them in different market conditions. Plus, we make it easy to document for regulatory-compliance purposes.

Q: AI Insight is known not just for research but for providing education modules for more traditional alternative investments. Are you providing a similar solution for Alternative Mutual Funds?

Lou Johnson: Yes, you can access education modules that cover the key features, risks and considerations of alternative strategy mutual funds but not at the fund-level as clients are familiar with traditional alternatives. We offer a comprehensive education module as well as complementary strategy-level education modules based on the strategies we cover in our research including Alternative Allocation, Alternative Credit, Equity Long Short, Equity Market Neutral, Equity Option, Global Macro, and Managed Futures.

The AI Insight platform also serves as a documentation protocol to support regulatory-compliance requirements. When you conduct research on Alternative Mutual Funds or complete the education module, it’s automatically recorded in our Training, Education and Research Log for regulatory-compliance purposes. You can easily download your log and share it as needed to support any regulatory or other similar requests.

Q: Can you discuss the fund-level research and performance data components of the tool?

Lou Johnson: We have both a quantitative and qualitative approach to the Alternative Mutual Fund research. The last thing we want to do is recreate the wheel – we don’t want to be one more provider doing the same thing as everyone else. We looked at what’s in the marketplace today and discovered the missing piece was third-party research focused on understanding and applying the product rather than quantitative information with a corresponding rating.

The qualitative side is where we really try to add value. Our goal is to provide a framework for breaking these funds down into their individual components in order to provide a better wholistic picture of what it is the fund does. This is the focus of our tiered grouping system including peer group, strategy, and sub-strategy as well as our comprehensive write up that targets the investment strategy and process. We then use the quantitative side, such as our exposure and performance summary, to bring the insight full circle.

We wanted to make this information very accessible as well. So, pulling from our investment review, we provide key summaries including our Analyst Key Takeaways, Category Specific Risks, and our alternative-centric Exposure Summary. When combined with the various shareholder information including portfolio management, fees, and detailed performance, it provides a complete picture of the fund which could be considered a “due diligence fact sheet” for these complex products.

Resources