February Private Placement Insights: Focus on Opportunity Zone Funds

Thursday, March 21st, 2019 and is filed under AI Insight News

- The first three Opportunity Zone Funds activated in February, for an aggregate maximum offering amount of $335.0 million.

- Fund size ranged from $35.0 million to $200.0 million.

- Leverage is anticipated around 60% to 70% of the total value for one of the funds, while the other two allow for leverage but have not specified anticipated levels.

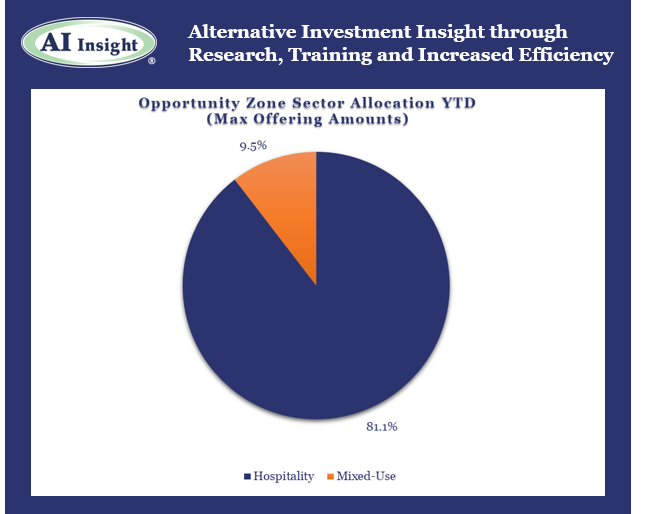

- Two of the funds are blind pool funds focused on hospitality and one is focused on a specified mixed-use development project.

- All of the funds include a preferred return component, ranging from 6.0% to 8.0%.

- ON DECK: As of March 20th, there were two Opportunity Zone Funds coming soon, with one focused on multifamily and one on mixed-use development.

AI Insight recently added Industry Reporting capabilities to the Financial Performance Reporting tool, which includes this and many more insights into key non-traded markets. AI Insight is the only provider of industry-level Private Placement reporting. To inquire about accessing these expansive data reports, contact us directly.

Charts Source: AI Insight. Data as of February 28, 2019, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.