Thursday, June 21st, 2018 and is filed under AI Insight News

Last week AI Insight made their first appearance at the annual Morningstar Investment Conference in Chicago, IL. As we look to expand our capabilities into alternative mutual funds, it was important to learn about the latest trends and developments within the financial industry.

Here are three key takeaways to consider:

- Goals-based financial planning is a growing trend within the advisory space. To help facilitate, advisors can make use of various product sets including liquid alts, interval funds, socially responsible investments, and ETFs. The challenge is in educating clients and applying within a portfolio context as these products can be complex.

- Transparency is the key to gaining client trust. This message needs to be clear to clients – that their interests are ahead of the firm or advisor interests. This is the essence of the DOL rule, which should simply be part of the process regardless. The real premise of investing is in people, not just how you invest their money.

- There’s never been a better time for financial advice considering lower fees, technology integration and the breadth of product offerings available. However, there has been a disconnect between what advisors and investors value within financial goals. To be successful, advisors need to be resourceful with technology in order to provide more efficient and client-centric advice.

Monday, June 18th, 2018 and is filed under AI Insight News

“About 67% of advisers say lack of understanding is one of the main reasons why they don’t invest more heavily in alternatives.” [i] Regulatory requirements and operational challenges add to the complexity. But, as complex investments become easily accessible to everyday investors who are looking for new investing opportunities, it’s critical that you stay one step ahead to understand these products and help your clients make sense of them.

Obstacle: Complex products can be difficult to track because many managers don’t make their data available.

Opportunity: Lack of understanding complex products can be addressed by gaining more transparency to help you better explain these products to your clients. Using an unbiased online resource to get hard-to-find industry data on complex products can help. For example, AI Insight provides data on hundreds of Alternative Investments including 120+ private offerings. Plus, get unbiased monitoring of key performance metrics for 140+ nontraded REITs, BDCs and closed-end interval funds.

________________________________________________________________________________

Obstacle: Not only do you need be able to clearly differentiate between traded and nontraded alts, but you also need training at the product level to gain a deeper understanding of the complex products you’re offering — and meet your regulatory requirements. Plus, the operational requirements can be overwhelming for broker dealers, RIAs and advisors. Working with illiquids requires a significant amount of paperwork, due diligence research and an infallible way to track for compliance purposes.

Opportunity: Over 150 broker dealers and RIAs use AI Insight to help research new products for due diligence purposes. Most require their advisors to use the platform to facilitate product education on nontraded alts, including 72 percent of the top broker dealers in 2016[ii]. Working with traded alts? Research reports will be available on AI Insight starting in August. Get more information.

________________________________________________________________________________

Obstacle: You’re concerned that you can’t explain certain alternative investment products to clients, but you want to include more complex products to provide more diversification in clients’ portfolios.

Opportunity: Educating yourself on complex products can better equip you to answer client questions and feel more confident in adding Alternative Investments to your clients’ portfolios. AI Insight’s News and Alerts feature can provide you with all the regulatory updates on the hundreds of funds available on the platform according to your preferences. If you need a deeper dive, you can easily connect with fund managers directly through the platform.

________________________________________________________________________________

Obstacle: Compliance and regulatory issues are ranked as the most stressful concern for advisors. [iii]

Opportunity: As the number of complex products available to investors increases, so do the regulatory requirements. When you conduct research or complete a product-specific education module on AI Insight, it automatically tracks your activity. You can access or download your documentation in the Training, Education and Research log.

Use AI Insight’s easy-to-use online platform as a solution help explain offerings efficiently to clients, enhance their portfolios and create confidence in your process. Contact us to learn more and request a live tour customized to your business needs.

[i] More Advisors Use Alts, But Few Understand Them by John Waggoner, InvestmentNews

[ii] Top Broker Dealers of 2016 – InvestmentNews Broker Dealer Data Center

[iii] Insights into Advisor Wellness by Flexshares

Tuesday, June 12th, 2018 and is filed under AI Insight News

It was great to connect with many of our industry partners at the recent FINRA Annual Conference in Washington, D.C. to discuss regulatory topics relevant to our industry. Here are three key takeaways to consider:

- The industry continues moving forward with a new approach to the standard of care registered representatives must undertake when working with clients. SEC Chairman Clayton was adamant about having industry stakeholders submit comments to help shape the actual outcome of the proposal. He was also quite vocal on the confusion people seem to have around the term “fiduciary” and that he was very much against using it in this proposal. The SEC’s Brett Redfearn provided an overview of Regulation Best Interest and enhancing the standard of conduct for broker-dealers. Read more

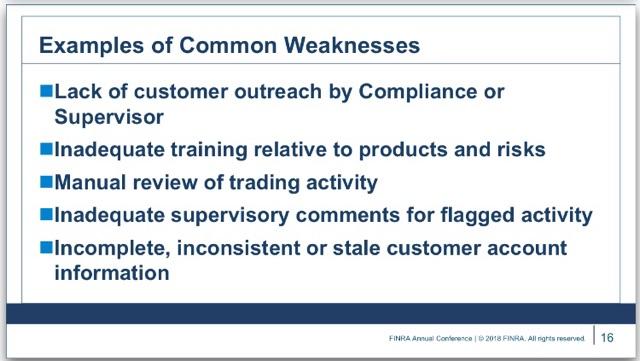

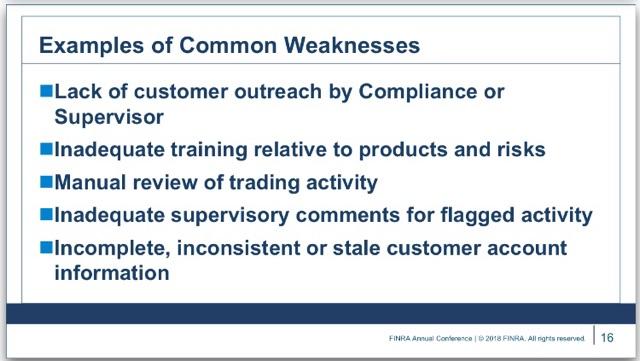

- On a suitability panel, “inadequate training relative to products and risks” was noted by FINRA as a common weakness found.

- Heightened diligence and advisor education are needed for the increasingly complex products being offered through traditional ’40 Act structures such as Alternative Mutual Funds and Interval Funds. FINRA mentioned their guidance on complex products as a resource when working with Alternative Mutual Funds, leveraged ETFs, Interval Funds and other alternative investments.

Monday, June 11th, 2018 and is filed under AI Insight News

As Alternative Mutual Funds evolve, regulators are taking a closer look at these investments.

FINRA has highlighted a need for investor awareness around the unique characteristics and risks in their investor alert, “Alternative Funds Are Not Your Typical Mutual Funds”. Specific considerations include ensuring that investors fully understand the alternative fund’s:

- Investment structure

- Strategy risk factors

- Investment objectives

- Operating expenses

- Fund manager

- Performance history

Additionally, the SEC has implemented liquidity rules for registered investment companies to help improve management of fund liquidity risks. The rules are intended to better protect investors and strengthen securities markets.

Not only is it important to get the resources you need to stay compliant, but also to have a reliable regulatory-compliant documentation system in place. Check out these related resources to support your efforts:

Monday, May 21st, 2018 and is filed under AI Insight News

Challenges faced by the non-traded industry over the last market cycle have caused investors and advisors to pause.

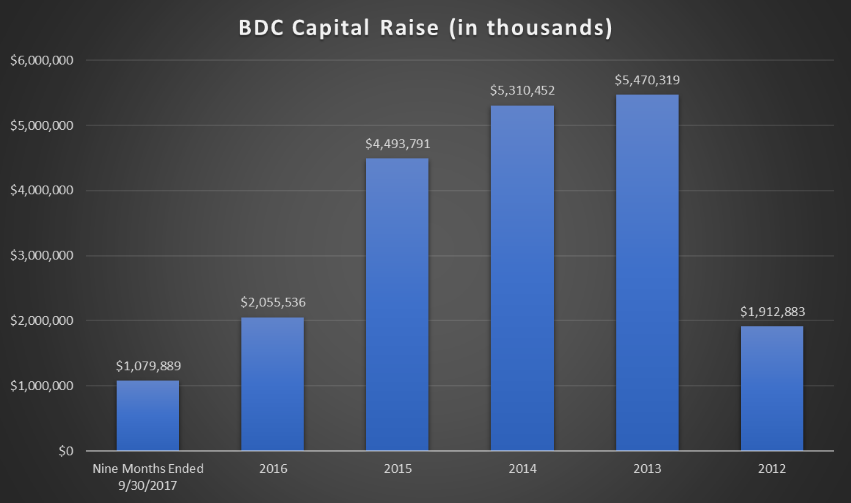

- As predicted, capital raise slowed again in 2017 causing continued consolidation and changes in the non-traded space. The traditional “lifecycle” non-traded REIT has become less prevalent, as has the non-traded BDC structure.

- Sponsors have shifted either to a more institutional “perpetual life” structure in the real estate category or a more flexible closed-end interval fund structure.

- Institutional money managers have replaced the original non-traded REIT sponsors as industry leaders.

- All are trends many believe are the keys to helping right the non-traded industry ship.

To view NTR and BDC data in more detail, read the full article by Laura Sexton, AI Insight Senior Director-Project Management, in the June issue of Real Assets Adviser.

Monday, May 14th, 2018 and is filed under AI Insight News

A review of the private placements on the AI Insight Platform by Laura Sexton – AI Insight Senior Director-Project Management

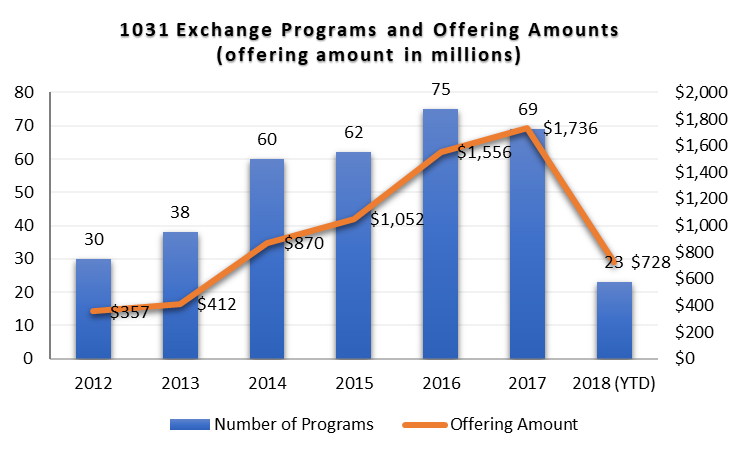

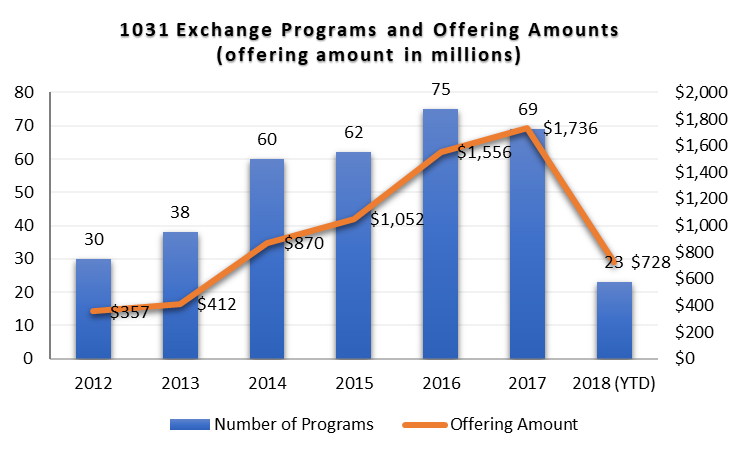

1031 Exchange Programs

- There were seven new 1031 programs activated on the AI Insight platform in April for a total of $68.1 million in total offering amount, with 23 activated YTD as of the end April for a total offering amount of $728.3 million.

- The aggregate number of offerings and offering amounts were above March levels and YTD the category is approximately 76% above the aggregate YTD offering amount levels in 2017.

- Inland Private Capital remains the top sponsor in the industry with 35% of the offering amount YTD. The remainder of the programs were evenly spread between different sponsors, including two new entrants on the AI Insight platform.

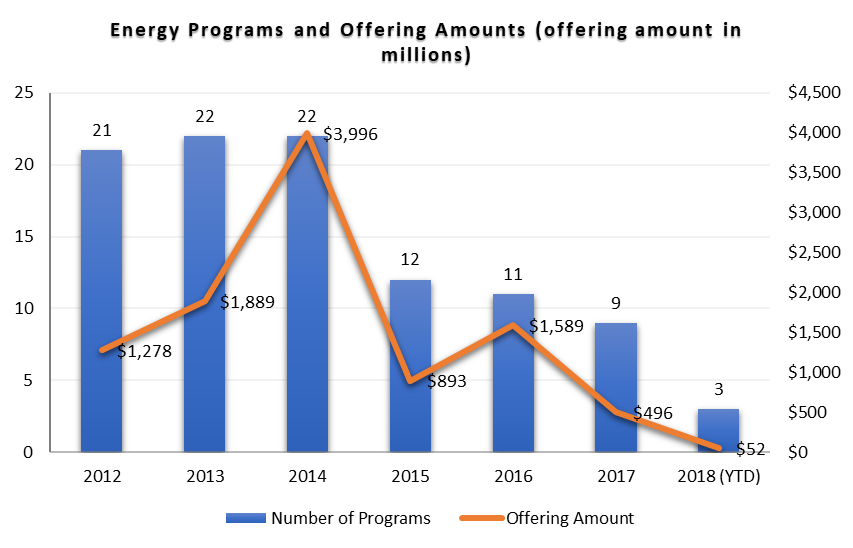

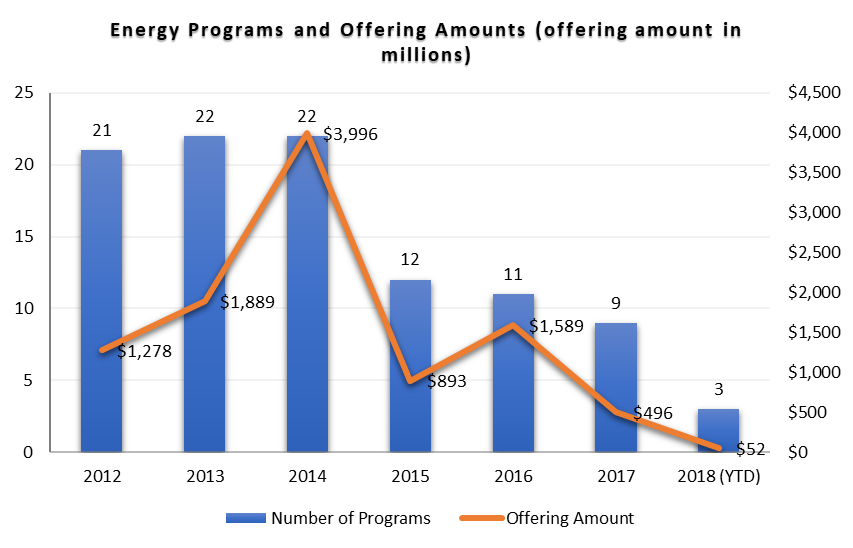

Energy

- One energy focused program activated in April after only one activated in Q1. A third activated in May. All three for the year have been focused on royalty and mineral interests. As of May 9, 2018, there were two programs in entry.

- Energy programs generally ramp up towards the middle to the end of the calendar year. However, the category is roughly 66% behind in terms of offering amounts as compared to the same time last year. We have seen a steady decline in the number of energy programs since the cyclical peak in 2014, which coincides with the cyclical peak in oil prices the same year.

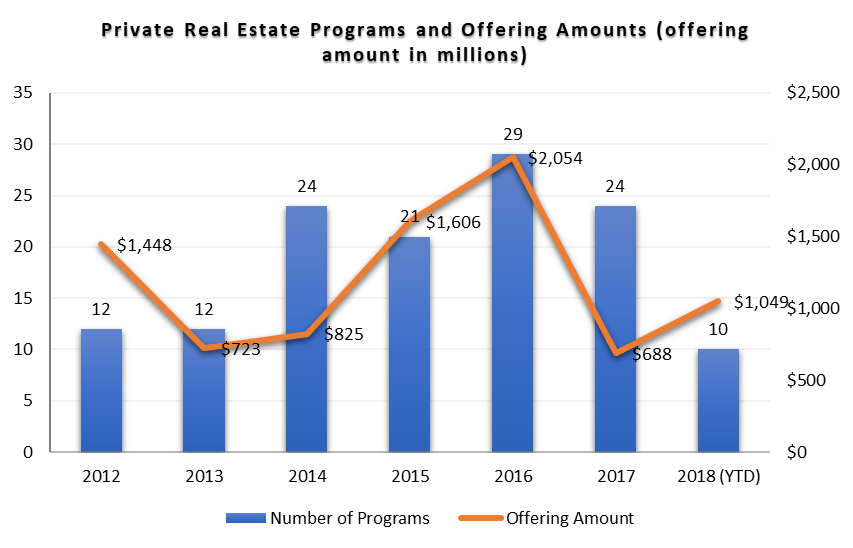

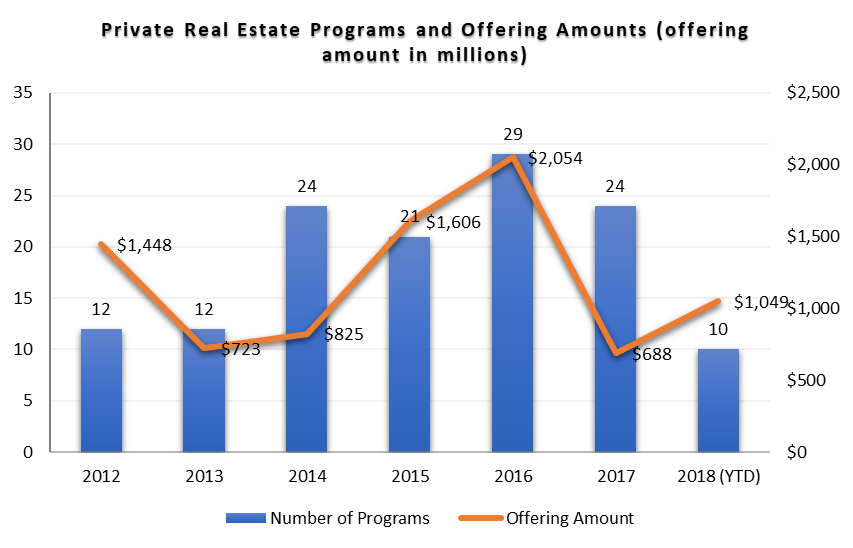

Real Estate

Real Estate

- There have been 10 real estate focused private placement programs activated on the AI Insight platform so far in 2018. The number of programs activated is on-par with last year’s numbers, but the offering amounts are higher.

- As of April 30, the total max offering amount for real estate focused funds was just over $1 billion, which already eclipses to the total offering amount of $687 million for the full year 2017.

Other

Other

- Similar to real estate, we have seen the same amount of private equity and debt programs YTD as we did last year, but the offering sizes have increased, including one $1 billion+ program offered by GPB.

- Preferred programs and offering amounts appear to be on par with 2017 levels.

- Two conservation easement programs have activated so far in 2017, both offered by EcoVest Capital. There were no offerings as of this time last year. However, the year was back-end heavy, with 24 programs for $294 million offered between May and the end of the year.

Source: AI Insight. Data as of April 30, 2018, based on programs activated on the AI Insight platform as of this date.

Monday, April 23rd, 2018 and is filed under AI Insight News

It was great to connect with many of our AI Insight subscribers and industry partners last week at the 2018 IPASummit in Washington, D.C. to discuss the increasing importance of due diligence and impacts future legislation may have on our industry. Here are three key takeaways to keep in mind:

1. SEC proposes new standard of conduct rules for brokers

If the rule passes, “broker-dealers will be required to act in the best interest of a retail customer when making a recommendation of any securities transaction or investment strategy involving securities to a retail customer.”

Our take: The industry seemed more accepting of the SEC taking the lead on a uniform standard of care proposal versus the Department of Labor.

2. A push for institutional products

- The industry seemed to agree that the best way to improve the non-traded marketplace was the growing push towards an institutionalized product structure – more streamlined (lower and simplified) fee structure, further transparency around fees and conflicts of interest, and managing performance expectations.

- What does this mean for the product wrapper itself? It seems the industry is still trying to figure this out. The Non-Traded Evergreen (Perpetual) REIT seems to be the front runner with the success of Blackstone and Jones Lang LaSalle (JLL), and now Nuveen entering the space with a perpetual REIT.

Our take: It will be interesting to see how the existing landscape of sponsors will handle the institutional pedigree of Blackstone, JLL, and Nuveen entering the market. It seems some will be able to survive the transition, others will not. Also, it seems that there is risk that the initial transition to an institutionalized product is going to lower the number of products available on the market, at least initially.

3. The jury is still out on interval funds

- The product structure seems to make a lot of sense on paper and there have been sponsors who have had success in both the IBD channel and the RIA channel.

- However, concerns still exist around (a) down market performance and what this will do to the liquidity provisions, and (b) what exactly is the health of the distributions for these funds. Industry still seems to be figuring out how coverage works and its impacts to the investor. Both are simply just going to require more time for these funds to develop a healthy performance track record as an industry.

Our take: An establishment of a performance track record will also help with determining whether there’s value in using one of these products versus one of their liquid mutual fund counterparts. Do these products provide enough alpha/diversification/volatility reduction to make it suitable for an investor to give up daily liquidity?

Monday, April 16th, 2018 and is filed under AI Insight News

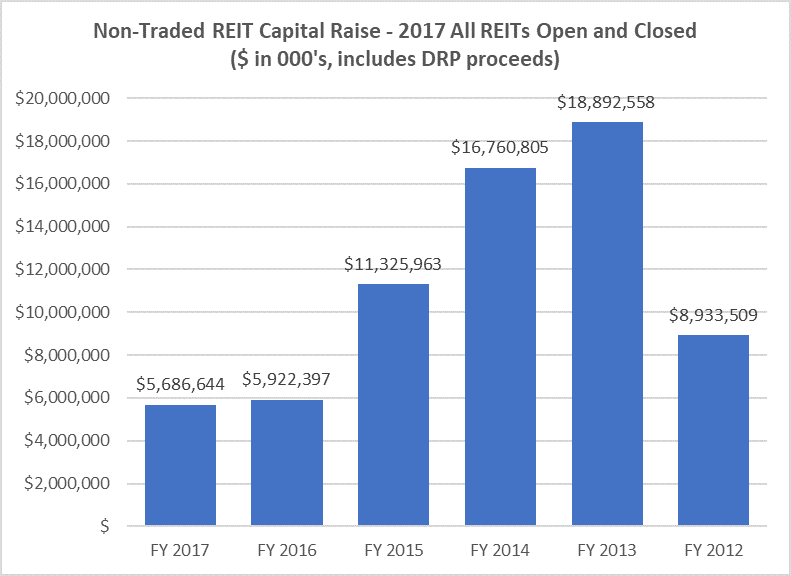

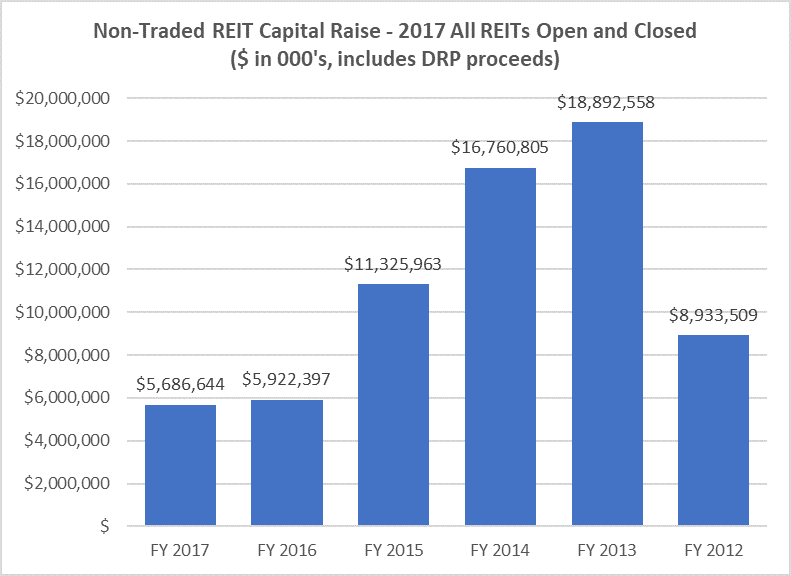

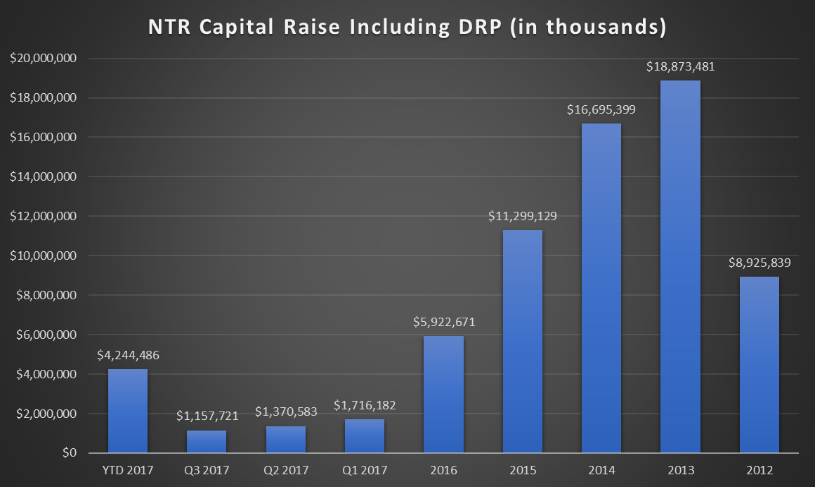

- Non-traded REITs raised $6.6 billion in 2017, an increase over the $5.9 billion raised in 2016 when including DRP and merger proceeds from open and closed programs.

- The $6.6 billion includes $921.9 million from the merger of American Finance Trust, Inc. with Retail Centers of America (RCA). Removing this would reflect a total capital raise for the year of $5.7 billion.

- Approximately $4.3 billion was raised by REITs actively raising capital during the year, with the remainder raised through dividend reinvestment in closed programs.

- 11 programs closed during 2017, reducing the number of those actively raising from 33 at the beginning of the year to 22 as of December 31, 2017.

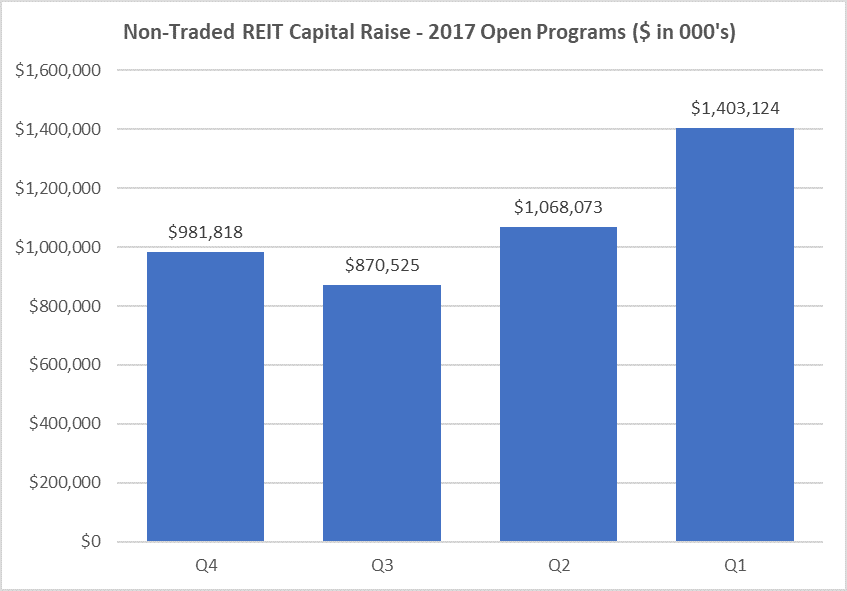

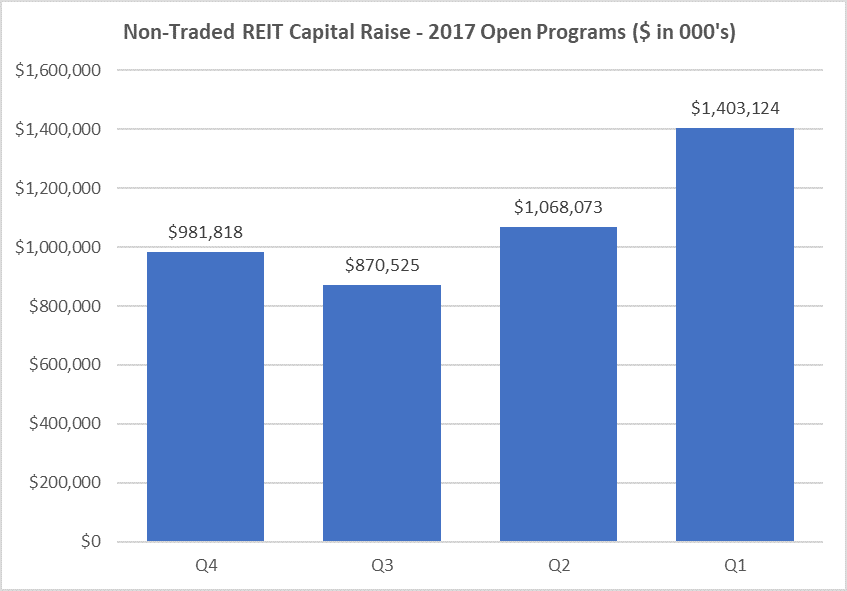

- Capital raise for actively raising funds was highest in Q1. Capital raise slowed in Q2 and Q3 but saw a modest increase in Q4. The higher raise early in the year was likely due to program closures, including those sponsored by W.P. Carey who exited the non-traded REIT business in June.

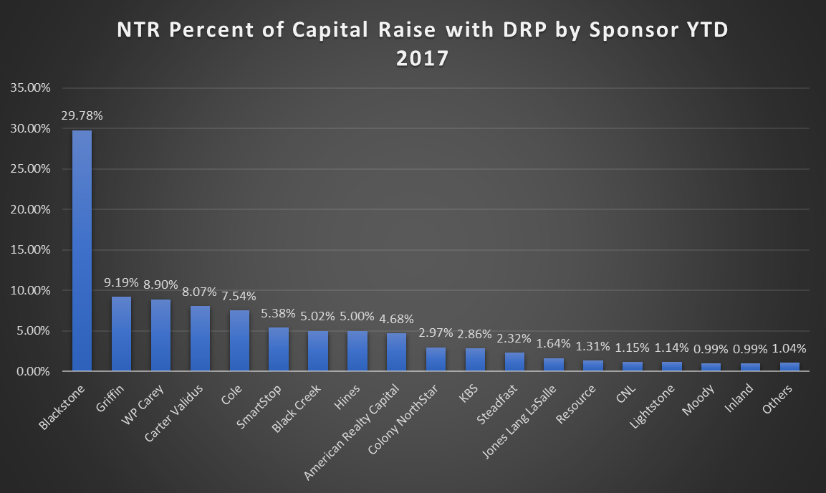

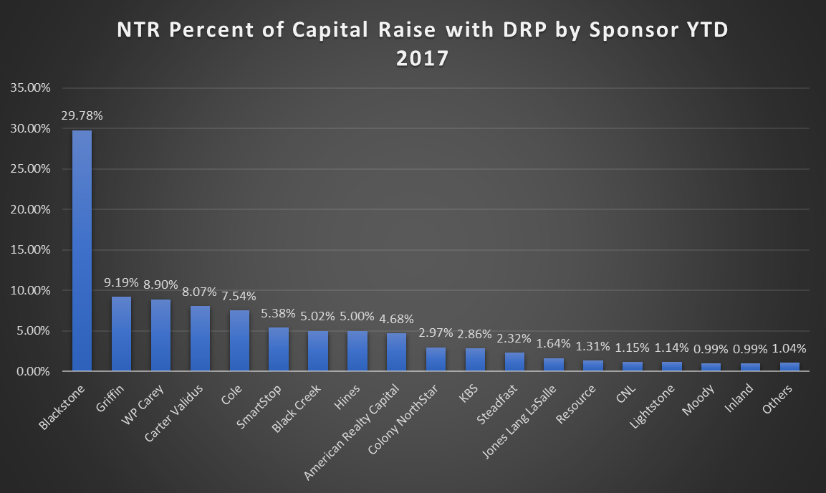

- Blackstone Real Estate Income Trust, which began its capital raise in January 2017, led the pack. The program raised $1.7 billion, or 40% of the raise for open programs during the year. Carter Validus came in second, raising $418 million or 10%.

Chart Source: AI Insight. Data based on open, closed, or liquidated programs reporting on the AI Insight platform as of December 31, 2017.

Thursday, January 11th, 2018 and is filed under AI Insight News

by Laura Sexton – AI Insight Senior Director-Project Management

Non-Traded REITs

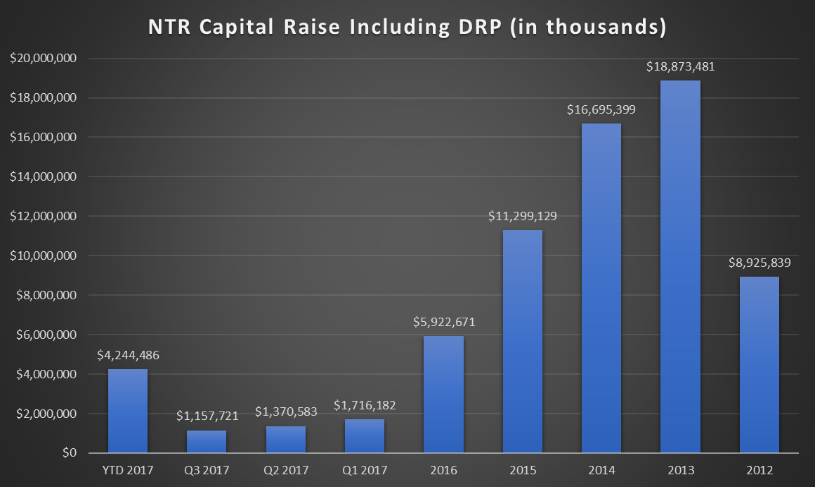

- Non-traded REITs raised $1.18 billion in Q3 2017 and had raised $4.28 billion year-to-date as of September 30, 2017.

- The industry is poised for its slowest capital raise year in over a decade.

- Blackstone Real Estate Investment Trust, Inc. led the capital raise pack, raising over $1.25 billion or approximately half of the capital raised in the industry. Carter Validus came in second, raising $292 million.

- $14.3 billion in AUM managed by 24 actively-raising non-traded REITs, with 56% in diversified funds. ($88 billion including closed non-traded REITs that have not yet liquidated).

- Average distribution rate of 5.81%, down from 6.17% in 2012.

- Average debt ratio of 44.04%, relatively unchanged from 2012.

- The average interest rate on debt has declined approximately 80 basis points over the last five years from 4.61% in 2012 to 3.81% as of September 30, 2017.

- New entrants to the non-traded REIT space through Q3 2017 include Nuveen (Nuveen Global Cities REIT, Inc.), Starwood Capital (Starwood Real Estate Income Trust, Inc.) and Cantor Fitzgerald (Rodin Income Trust, Inc.), in addition to Blackstone’s registration in 2016.

- The entrance of institutional money managers into the market may signal better times to come.

Non-Traded BDCs

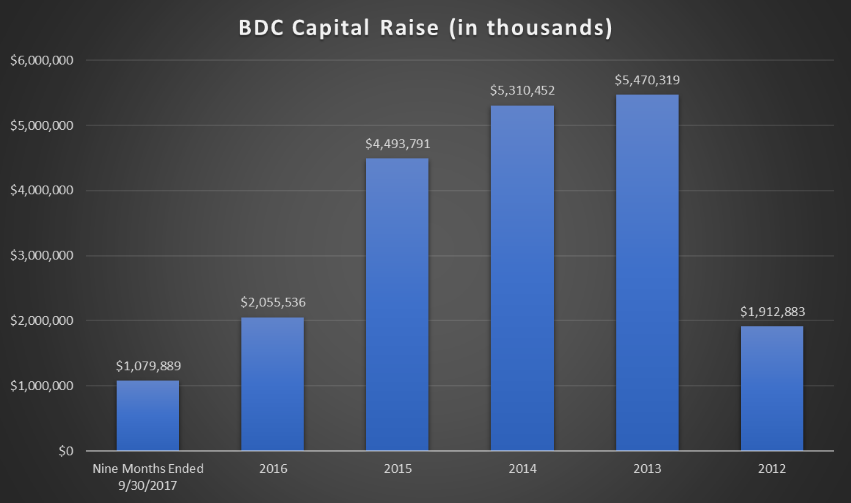

- The industry raised approximately $301.1 million in Q3 2017 and has raised $1.08 billion year-to-date as of September 30, 2017.

- The average YTD return for non-traded REITs was 4.98% as of September 30, 2017 (NAV return).

- Non-traded BDCs have maintained a steady focus on senior debt, but have increased their allocation to variable rate debt over the last five years from an average of 57% in 2012 to an average of 80% through Q3 2017.

- Several funds have converted from the non-traded BDC structure to a closed-end interval fund structure to allow for greater flexibility.

Closed-End Funds

- According to Intervalfundtracker.com, the closed-end interval fund segment of the market has seen the greatest growth trajectory of all of the non-traded investment vehicles, with a 46% increased in total net assets over the last 12 months. As of September 30, 2017, there were 23 interval funds pending registration with the SEC.

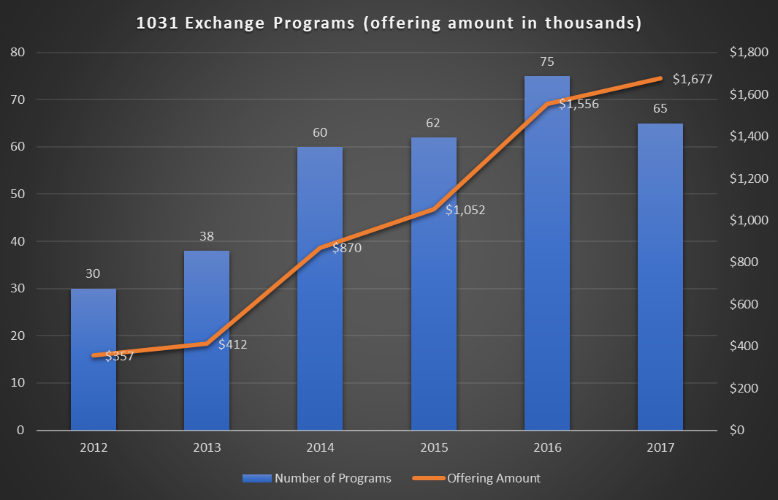

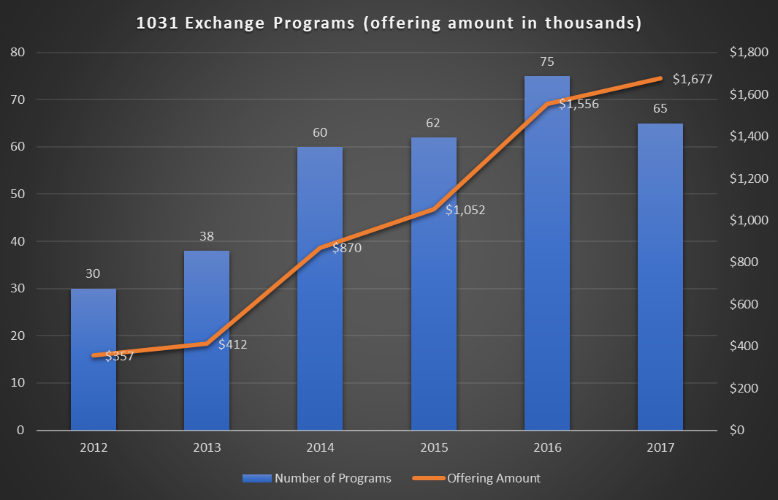

1031 Exchange Programs

- The number of 1031 exchange programs have increased as commercial real estate prices have appreciated.

- The number of programs offered in 2017 was more than double 2012 levels with an offering amount of nearly for times.

- Inland Private Capital and Passco Companies dominated the landscape, capturing 30% and 12% of offering amounts, respectively, over the last five years.

LLCs/LPs

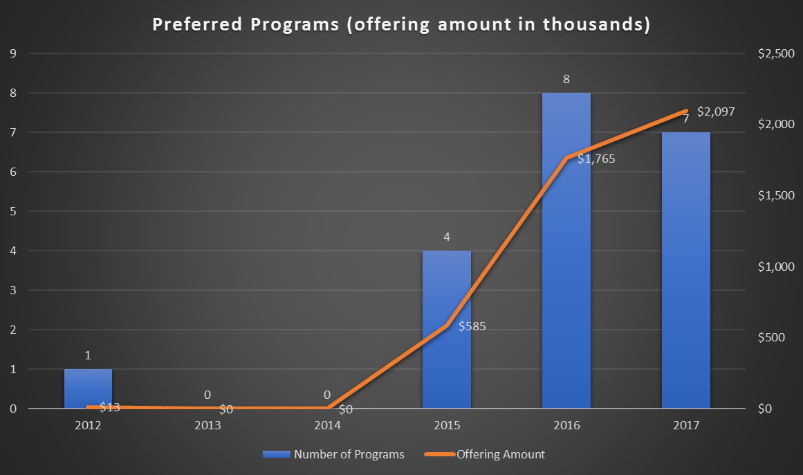

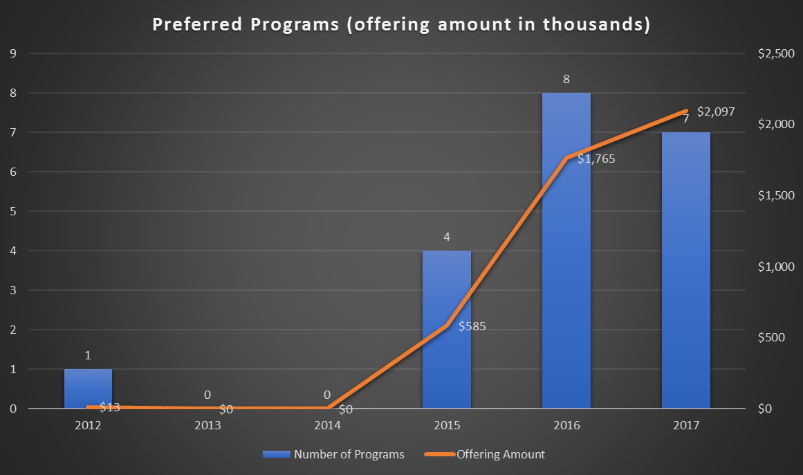

- Private program offerings have declined since peaking in 2013, outside of an increase in preferred investment programs.

- The number of preferred offerings and offering amount, while still lower than other non-traded segments, has increased significantly in the last five years with 2017 seeing a record-setting $2.1 billion in seven programs offered.

*Charts Source: AI Insight

Tuesday, December 19th, 2017 and is filed under AI Insight News

As 2017 comes to a close, AI Insight CEO Sherri Cooke reflects on the past year and looks forward to what’s coming up in 2018.

Q: What are some of the key reflections you have about 2017 and some points of interest for the coming year?

SC: This year we increased the number of RIAs using the AI Insight platform, so I’m glad that we’re able to support RIAs as this channel continues to grow. We look forward to continuing to expand these relationships in 2018. We also made significant upgrades to our AI Insight Education Module functionality, and we’ve received a lot of positive feedback on the updates. We’re always working to make the platform easy to use and add more valuable capabilities.

One of the most exciting highlights as we close out 2017 is the fact that we will be launching a new feature with expanded alternative mutual fund research capabilities in the new year. Advisors will be able to compare the details and financial performance of alternative investment mutual funds with reporting and documentation features our subscribers have come to rely on for more traditional Alternative Investment research. We’ve just hired Lucas Johnson who was a due diligence analyst with National Planning Holdings, Inc., where he specialized in due diligence reviews of liquid alternatives and other alternative investments. He’ll be stepping in to help launch our liquid alternative research program. You’ll see much more about this in the first quarter.

From an industry perspective, there’s been a bit of a relief relative to the DOL Fiduciary Rule implementation date, yet it doesn’t change the focus on compliance and regulatory scrutiny. The continued market run is remarkable, to say the least, inspiring growth and confidence. But that kind of house-of-straws confidence can increase concern about the negative consequences of a potential market correction. Smooth or bumpy, it’s our commitment to help advisors and clients manage the environment no matter what 2018 may bring.

Q: What are some of the major misconceptions you see that advisors have about alternative investments?

SC: A couple of misconceptions come to mind. The first would be that illiquidity or alternatives are intrinsically inferior planning tools. Another would be the challenges around compliance and regulatory scrutiny.

Q: Ok – let’s address the liquidity issue first.

SC:

I don’t believe that liquidity is the true issue. If a client’s portfolio is well diversified including appropriately positioned liquid and illiquid investments, then the illiquidity can actually be a true positive. It can prevent clients from selling investments when their motivation is emotionally-driven or reactive to the market.

Second, some people use the generalized claim that alternatives haven’t performed well over the last several years. As with all securities, some do well and some do not – and as with other investments there have certainly been a share of alternatives that haven’t performed as expected. However, there are a lot that have performed well when diligence has been taken in selecting and vetting – and they have been sold correctly. If a key goal is for alts to be used as a portfolio stabilizer, then we wouldn’t have seen them stand out during the crazy bull markets we’ve experienced. That’s not one of their key purposes. Many advisors want a significant premium for the illiquidity, but I don’t believe you should expect to get both the downside market protection in a bear market and returns that exceed the average in bull markets from the same vehicle.

It’s a challenge for me when I hear the expectation of alts always having to perform. Stocks lose value all the time. It really comes down to making sure these products are properly sold and positioned within client portfolios; and – as with all investments – conducting the best possible research and diligence to select best in class.

Q: You mentioned compliance – we know that compliance is often an issue for advisors in considering alternative investments and regulatory scrutiny continues to increase. What is your experience with compliance issues?

SC: Compliance is one of the things that motivated me to create AI Insight in the first place. I wanted to build capabilities to facilitate due diligence and proper compliance along with education and documentation of these efforts when selling complex products – those products that the regulators have called out as needing heightened supervision or training.

From a company perspective, we have found in any situation of which we’re aware, if you stay up-to-date on the requirements around selling any type of investment – and make sure everyone involved is aware of their obligations, adhering to the process, plus documenting all efforts – then the regulators are generally satisfied. That’s been our experience with our clients and their audits.

If you fail to make these efforts up front and you’re inconsistent in how you conduct your business from a compliance perspective, you’re just leaving yourself open to trouble from a client who ends up unhappy about something or getting in the news for the all the wrong reasons.

Q: You are involved in mentoring young women in the financial industry. Tell us about it.

SC: A group of members of the Investment Program Association (IPA) formed the Women’s Initiative Network (WIN). One of our key goals has been to help promote and support women within the financial services industry, which traditionally has been very male-dominated. I launched our first local initiative with Ohio State University’s Fisher School of Business this past year. We had a group of young women who had an interest in Financial Services get together once a month to hear stories about the journeys of women in our area who have been successful in the financial world.

We talked through some of their concerns and real-life challenges they’ve encountered or that we, as mentors, have experienced. We also introduced them to many unknown and non-mainstream facets of the investment world, which was really exciting.

Q: What is your focus for 2018?

SC: From a business owner’s perspective, ensuring that our team and our product continues to maintain consistent integrity of value and exceptional service; this is the backbone of our business – and making sure that our AI Insight team is challenged and fulfilled in their roles within our company.

From an industry perspective – we believe that there is a tremendous amount of value for advisors to differentiate themselves and bring really great opportunities through the thoughtful and diligent understanding of alternative products. We provide this value by building and bringing together our network of broker-dealers, advisors, RIAs, alternative investment firms and industry partners.

Therefore, as in past years, I always look forward to working with our business partners to explore new possibilities and find what more we can bring to the table for our customers in the new year.

As I’ve already mentioned, I’m excited about developing even more education and support in the liquid alternatives space. These funds are gaining increased awareness from a due diligence and compliance perspective. We currently have education and training for 30 closed-end funds available on our platform and expect to see real growth in this area in the coming year. We’ve expanded our CE course offerings to include a FINRA alternative mutual fund course and a course on interval funds. Plus, we’ve recently published a comprehensive white paper called, “Understanding the Complexities of Liquid Alternatives” to help support these growth plans in 2018. I’m really proud of our efforts when it comes to education on key industry initiatives and concerns, so we are particularly excited about the new plans around the liquid alts sector for the coming year. It’s important to our entire team that we continue to do our very best to evolve with the industry – hopefully always a few steps ahead of the primary curve – to bring our customers what they need to confidently offer their clients a full and rich palette of investment solutions. That’s our goal for 2018…and every year after!

Sherri Cooke is the CEO and founder of AI Insight, Inc. and has been in the financial services industry for over 25 years. Cooke formed AI Insight in 2005 with the primary goal of providing the financial planning community with a consistent database of alternative investment programs.

Real Estate

Real Estate Other

Other