Monday, December 17th, 2018 and is filed under AI Insight News

Opportunity Zone investments through Opportunity Funds are quickly gaining interest as new offerings become available. Take our latest CE course, “Introduction to Opportunity Zones“, to better prepare yourself and your clients while helping to meet regulatory-compliance requirements.

Friday, December 7th, 2018 and is filed under AI Insight News

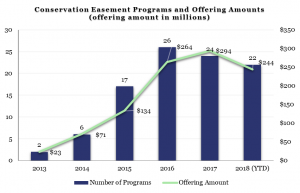

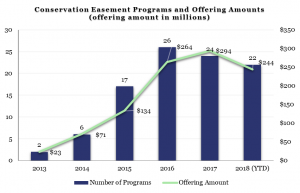

- Seven conservation easement programs activated on the AI Insight platform in November for a total of $78.2 million in aggregate offering amount for the month.

- The category is positioned to meet or exceed its record in 2016, with four programs coming soon for a total of $35.5 million in aggregate offering amount.

Additional Resources

Coming soon:

- AI Insight is introducing Industry Reporting in the first quarter of 2019, which will include this data and many more insights into key non-traded markets.To inquire about accessing these expansive data reports, please contact us.

- AI Insight CE Course – Conservation Easements. View the course catalog to see all available courses.

Wednesday, November 28th, 2018 and is filed under AI Insight News

Complex investments are becoming more accessible to average investors looking for new investing opportunities, especially given the recent evolution of Alternative Mutual Funds. In order to effectively include these investments within client portfolios, one should understand the complexity of the funds and meet other regulatory requirements associated with them.

Read the interview below with AI Insight’s Mike Kell and Lou Johnson to help gain an understanding of Alternative Mutual Funds to better equip yourself to answer client’s questions and feel more confident in applying these investments.

Q: From an investment objective perspective, how do Alternative Mutual Funds differ from traditional Mutual Funds?

Mike Kell: Alternative Mutual Funds use more complex strategies than traditional mutual funds. By investing in alternative strategies like long-short, arbitrage and trend following, among others, they offer the potential for diversified returns relative to traditional funds investing long only in stocks or bonds. We recently launched a CE course, “Introduction to Alternative Mutual Funds”, that addresses this and other related topics such as risks, fees and expenses.

Q: From a regulatory perspective, how do Alternative Mutual Funds differ from traditional Mutual Funds?

Mike Kell: As the number of complex products available to investors increases, so does the regulatory focus. The non-traditional strategies and investments Alternative Mutual Funds use increase the risk and complexity compared to traditional mutual funds. The SEC has been focused on liquidity risk management and derivatives exposure with these funds. FINRA has echoed the SEC with an investor letter and e-learning course cautioning the risks of these strategies in an open-end ‘40 Act structure.

Q: How can financial firms address the SEC and FINRA alerts when working with Alternative Mutual Funds?

Mike Kell: When we see increased regulatory focus in a direction like this, we want to provide a solution to help our clients remain regulatory-compliant. When considering a solution, we focus on the gap that exists between what’s available today and a reasonable approach to meeting regulatory requirements while considering operational efficiencies. There are various entities providing quantitative data at high levels but fall short of delivering enough information to meet a reasonable threshold of understanding the complexities of Alternative Mutual Funds

We’ve created an enhanced framework for organizing the Alternative Mutual Fund industry inclusive of peer group, strategy and sub-strategy to better address the breadth and diversity of the space. AI Insight provides education modules at the industry and strategy-levels along with fund-level research for Alternative Mutual Funds, which helps you understand the complexities of the products and how to use them in different market conditions. Plus, we make it easy to document for regulatory-compliance purposes.

Q: AI Insight is known not just for research but for providing education modules for more traditional alternative investments. Are you providing a similar solution for Alternative Mutual Funds?

Lou Johnson: Yes, you can access education modules that cover the key features, risks and considerations of alternative strategy mutual funds but not at the fund-level as clients are familiar with traditional alternatives. We offer a comprehensive education module as well as complementary strategy-level education modules based on the strategies we cover in our research including Alternative Allocation, Alternative Credit, Equity Long Short, Equity Market Neutral, Equity Option, Global Macro, and Managed Futures.

The AI Insight platform also serves as a documentation protocol to support regulatory-compliance requirements. When you conduct research on Alternative Mutual Funds or complete the education module, it’s automatically recorded in our Training, Education and Research Log for regulatory-compliance purposes. You can easily download your log and share it as needed to support any regulatory or other similar requests.

Q: Can you discuss the fund-level research and performance data components of the tool?

Lou Johnson: We have both a quantitative and qualitative approach to the Alternative Mutual Fund research. The last thing we want to do is recreate the wheel – we don’t want to be one more provider doing the same thing as everyone else. We looked at what’s in the marketplace today and discovered the missing piece was third-party research focused on understanding and applying the product rather than quantitative information with a corresponding rating.

The qualitative side is where we really try to add value. Our goal is to provide a framework for breaking these funds down into their individual components in order to provide a better wholistic picture of what it is the fund does. This is the focus of our tiered grouping system including peer group, strategy, and sub-strategy as well as our comprehensive write up that targets the investment strategy and process. We then use the quantitative side, such as our exposure and performance summary, to bring the insight full circle.

We wanted to make this information very accessible as well. So, pulling from our investment review, we provide key summaries including our Analyst Key Takeaways, Category Specific Risks, and our alternative-centric Exposure Summary. When combined with the various shareholder information including portfolio management, fees, and detailed performance, it provides a complete picture of the fund which could be considered a “due diligence fact sheet” for these complex products.

Resources

Friday, November 23rd, 2018 and is filed under AI Insight News

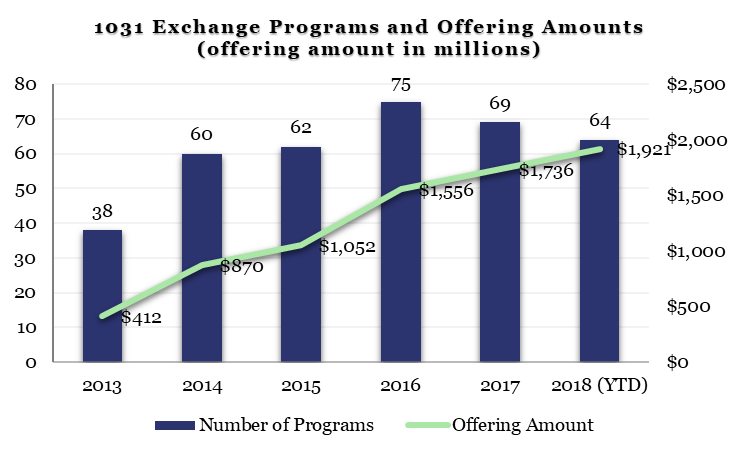

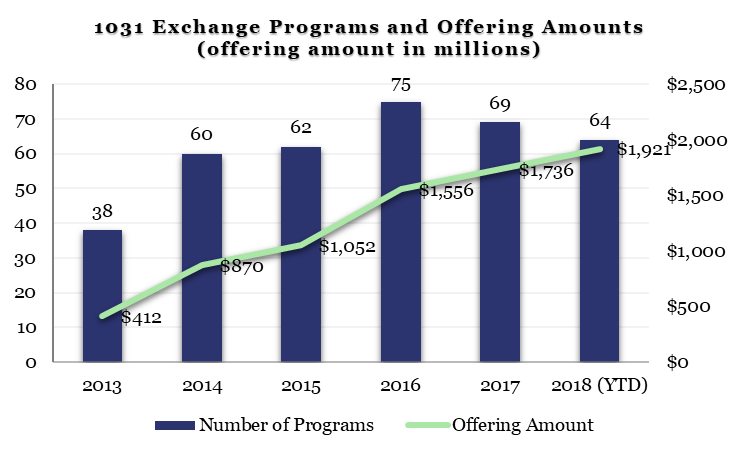

- There were 8 new 1031 programs activated on the AI Insight platform in October for a combined $266.9 million in total offering amount.

- The category is up 67.4% from the prior year in total YTD offering amount, and is on track to exceed 2016’s record of number of programs activated.

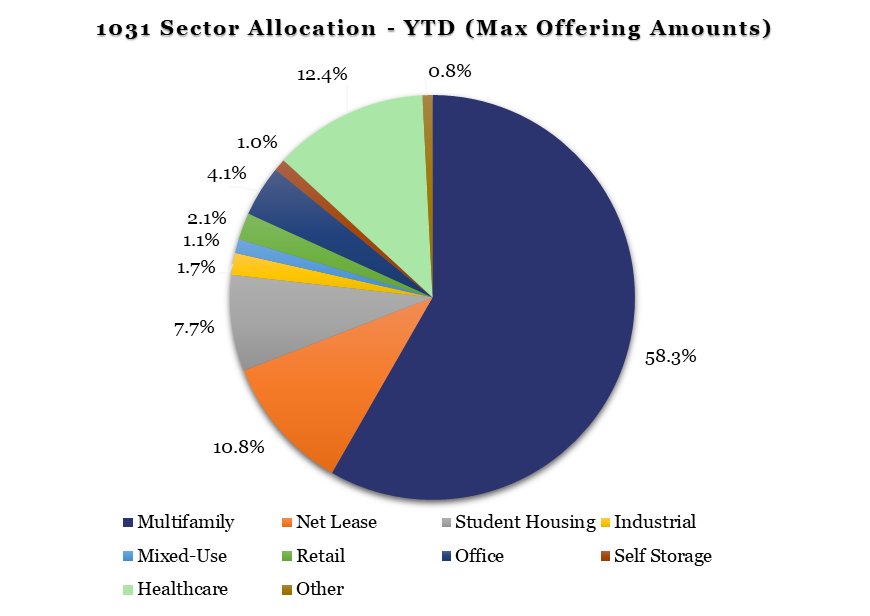

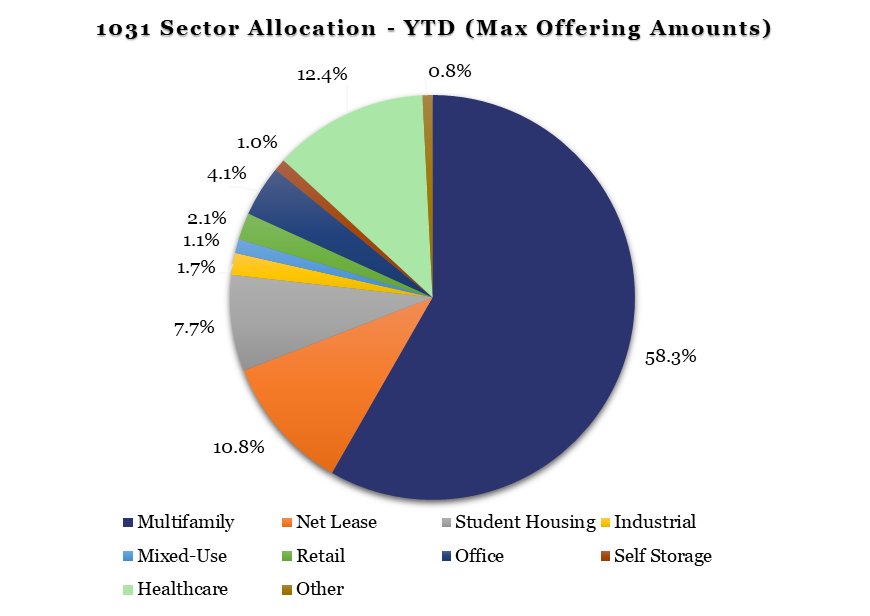

- Multifamily remains the top sector within the 1031 space, with 35 of the 72 programs and 58.3% of max offering amount. Healthcare, Net Lease, and Student Housing are next, representing 12.4%, 10.8%, and 7.7%, respectively, while Retail and Industrial represent less than 3.0% each – a major change from the pre-recession marketplace.

- ON DECK: As of November 21, six DST programs activated in November with one more coming soon.

AI Insight is introducing Industry Reporting in the first quarter of 2019, which will include this data and many more insights into key non-traded markets. To inquire about accessing these expansive data reports, please contact us directly.

Thursday, November 8th, 2018 and is filed under AI Insight News

Qualified Opportunity Zone investments are quickly gaining interest as new offerings are becoming available. Read the introductory FAQ below to learn more.

What are Qualified Opportunity Zones?

An Opportunity Zone is a community nominated by the state and certified by the Secretary of the U.S. Treasury. These are typically located in areas under economic distress or in low income communities. Opportunity Zones were added to the tax code by the Tax Cuts and Jobs Act in December 2017, with the purpose of encouraging economic development and job creation in these distressed areas.

What are Qualified Opportunity Funds?

A Qualified Opportunity Fund (QOF) is a new investment vehicle that is set up as either a partnership or corporation and may be eligible for preferential tax treatment. The Fund invests in eligible property located in a Qualified Opportunity Zone using the investor’s gains from a previous investment to fund the QOF.

What is considered a Qualified Opportunity Zone?

Many commercial, industrial and residential areas in the U.S. are considered eligible property for designation. According to CNBC.com:

- More than 8,700 properties across the country have already been certified as opportunity zones.

- About 90 percent of Opportunity Funds’ capital must be invested in projects located in deemed opportunity zones.

- Eligible projects include investing in new development, a property upgrades or funding a start-up business.

What are the potential benefits?

The new tax law outlines two major incentives: 1) The temporary deferral of inclusion in gross income for capital gains reinvested in a QOF, and 2) the permanent exclusion of capital gains must apply only to the appreciation in the investment in the QOF.

Specific tax exclusion benefits include:

- All gains invested in the QOF may be deferred in the year the temporary deferral election is made.

- Investments held in the QOF:

- For at least five years, will receive a basis increase equal to 10%;

- For at least seven years, will receive an additional basis increase of 5%, for a total increase of 15%;

- For at least 10 years, will receive permanent exclusion from taxable income of capital gains from the sale or exchange of an investment. This exclusion applies to the gains accrued from an investment in a QOF and not the original gains invested.

Where can I learn more?

Visit the FAQs put together by the IRS, read this article recently published by Sound West’s President Greg Genovese, as well as this article by the Economic Innovation Group, which discusses how the zones were created and includes a nationwide map.

AI Insight is currently working with fund sponsors who are considering offering Opportunity Zone Funds and we have begun launching these offerings on our platform, along with the hundreds of open and closed alternative investments we currently offer to help with your regulatory-compliance needs.

AI Insight also includes Opportunity Zone investments as a new category in our private placement industry reporting provided monthly. You can also take an Opportunity Zone CE course for generic education as part of our extensive e-learning library. We are also available as a platform for customized training and unbiased product-level research.

If you do not currently subscribe to AI Insight and would like to learn more, contact us to request a live tour.

Information sources: Treasury.gov and IRS.gov

Monday, October 29th, 2018 and is filed under AI Insight News

Do you have a new Alternative Investment offering? Hear from Jen Ronan about how AI Insight will provide an unbiased presentation of your program facts, features and risks, offering RIAs and FAs easy access to your current offering documents including updates to quarterly performance. View Vlog

Tuesday, October 23rd, 2018 and is filed under AI Insight News

Do you understand the complexities of Alternative Mutual Funds? Hear from Mike Kell about how AI Insight can help you research and apply these investments in your practice. View vlog

Tuesday, October 16th, 2018 and is filed under AI Insight News

Last week AI Insight attended the ADISA Annual Conference in Las Vegas, NV. AI Insight’s Mike Kell, Senior Vice President of Business Development and Program Management, presented an update on Private Placement industry trends during the General Session.

Last week AI Insight attended the ADISA Annual Conference in Las Vegas, NV. AI Insight’s Mike Kell, Senior Vice President of Business Development and Program Management, presented an update on Private Placement industry trends during the General Session.

Here are three key takeaways to consider:

- Similar to the recent IPA Vision Conference, Qualified Opportunity Zone investments were a prevalent topic. We recommend reading an article recently published by Sound West’s President Greg Genovese explaining more about the growing interest around these investments.

- RIAs are beginning to take a closer look at Alternative Investments. There has been an upward trend of portfolio allocation to alts among RIAs over the last couple of years. While the need for diligent product reviews and the associated paperwork present some capacity barriers, AI Insight was highlighted as the go-to research and compliance tracking tool to help streamline this process for RIAs.

- Regulatory processes for broker-dealers and RIAs are becoming more closely aligned. Broker dealer firms have prioritized implementing consistent due diligence policies. Given increased scrutiny, RIAs are becoming more like broker dealers with respect to advertising rules and implementing procedures given regulatory guidance to help increase transparency.

Monday, October 15th, 2018 and is filed under AI Insight News

- There were 8 new 1031 programs activated on the AI Insight platform in September for a combined $331.6 million in total offering amount, with 64 activated YTD for a total offering amount of $1.9 billion.

- 63 of the 64 programs activated were DSTs, and the other was a TIC.

- The aggregate September offering amount was above August levels and the category has already exceeded FY 2017 offering amounts.

AI Insight is introducing Industry Reporting in the first quarter of 2019, which will include this data and many more insights into key non-traded markets. To inquire about accessing these expansive data reports, please contact us directly.

Wednesday, October 10th, 2018 and is filed under AI Insight News

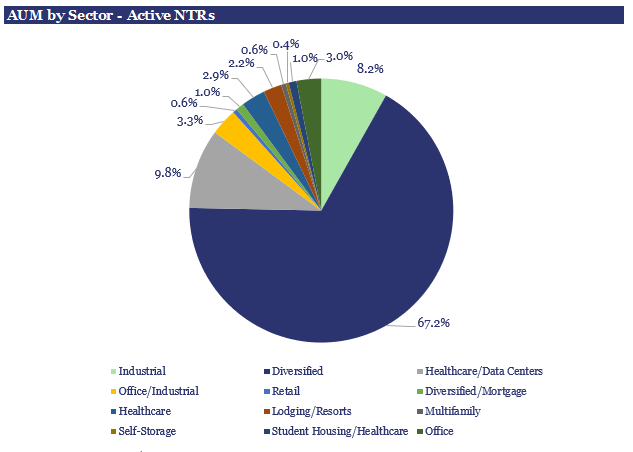

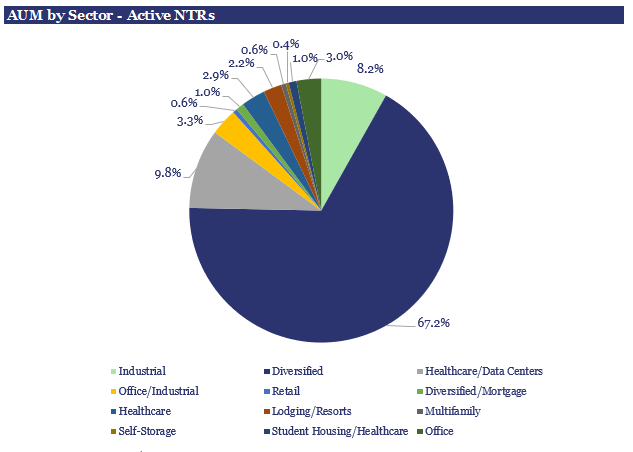

Total AUM for the non-traded REIT market remained steady in Q2 2018 at $86.2 billion, a tiny slice of the $1.145 trillion traded REIT market.

- Open programs represent $19.5 billion or 23% of this total, a larger percentage than prior quarters as capital raise has increased for active NTRs and older generation NTRs have liquidated assets.

- In terms of sector exposures, the industry is primarily allocated to diversified programs at 67.2% of total AUM, with healthcare/data center and industrial programs the closest competitors at 9.8% and 8.2% of total AUM, respectively.

AI Insight is introducing Industry Reporting in the first quarter of 2019, which will include this and many more insights into the key non-traded markets. To inquire about accessing these expansive data reports, please contact us directly.

Last week AI Insight attended the ADISA Annual Conference in Las Vegas, NV. AI Insight’s Mike Kell, Senior Vice President of Business Development and Program Management, presented an update on

Last week AI Insight attended the ADISA Annual Conference in Las Vegas, NV. AI Insight’s Mike Kell, Senior Vice President of Business Development and Program Management, presented an update on