Friday, March 27th, 2020 and is filed under AI Insight News

|

Your daily routine may be in disarray, but it’s business as usual at AI Insight since we have been successfully operating as virtual company for many years. As always, we’re here to help you with your AI Insight needs and anything else that might help you when working remotely.

To be successful working remotely, you need a strategy, focus and a little fun. We’ve compiled some resources that we’ve used in practice to help you accomplish this. |

Get Started

It’s important to designate a specific area that you use solely as your workspace to establish your “work zone” not only for your benefit, but for family members who are at home with you. Traveling around your house with your laptop or working where you sleep invites interruption.

Stay Focused

It’s easy to become distracted by the TV, social media or the pile of dishes in the sink. Creating a schedule for yourself – including breaks and lunchtime as you would at the office – can help you concentrate on your work. Setting a specific work schedule will also help you set expectations for other family members who are at home and help you keep a healthy work-life balance.

Industry Resources

You may be used to attending industry conferences or face-to-face group meetings, which have been postponed or cancelled. AI Insight created a central resource to help you stay connected with industry groups such as ADISA, IPA, FINRA and more. Check back frequently as we will continue to post industry webinar events happening in lieu of conferences.

Technology Resources

Having the right equipment is essential to working from home. But, knowing how to make the most of technology tools can be challenging.

- Zoom is a remote video conferencing and web conferencing service.

- Microsoft Teams is a unified communication and collaboration platform that combines workplace chat, video meetings, file storage, and application integration.

Stay Connected

We all know that miscommunication can happen over email and text. Convey your tone with a phone call instead of email when you can. Even better, turn on your video during online meetings to express your body language. Remember to test out your video feature before you use it publicly, so you can check your background surroundings and test your microphone.

This is also a good opportunity to get to know your co-workers on a personal level. At AI Insight, we’ve created a social channel within our Microsoft Teams platform to talk about topics unrelated to work and share photos on occasions like Halloween and St. Patrick’s Day. This helps us get to know each other better and stay connected.

Be Mindful

We’ve created a “Get Up & Move” rewards program at AI Insight to encourage everyone to walk away from their computer once an hour. We also host quarterly Lunch & Learns to help our team stay healthy in mind and body such as chair yoga sessions and meditation practices. Taking breaks can boost productivity and rejuvenate you when motivation drops.

Contact Us

From everyone at AI Insight, we want you to be safe and healthy. Again, we’ve been incorporating these practices for many years. If there’s something we can help you with on any of these topics, please reach out to us Monday through Friday from 8:00 a.m. to 6:00 p.m. at 877-794-9448 ext. 710 or any time at customercare@aiinsight.com.

Monday, February 24th, 2020 and is filed under AI Insight News

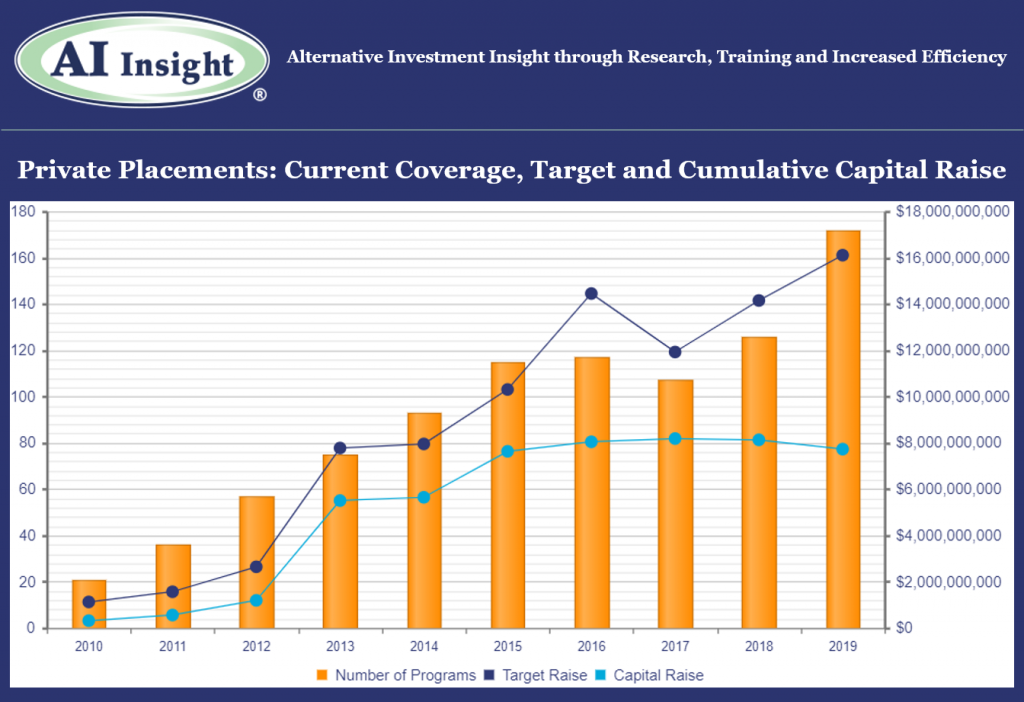

2019 was a record year for private placements on the AI Insight platform. Our December Private Placement Industry Report showed we added 200 new private placements to our coverage with an average target raise of $58.5 million, led by 1031s, opportunity zones and non-1031 real estate funds. We also reported that 158 private placements closed in 2019, having raised approximately 85% of their target.

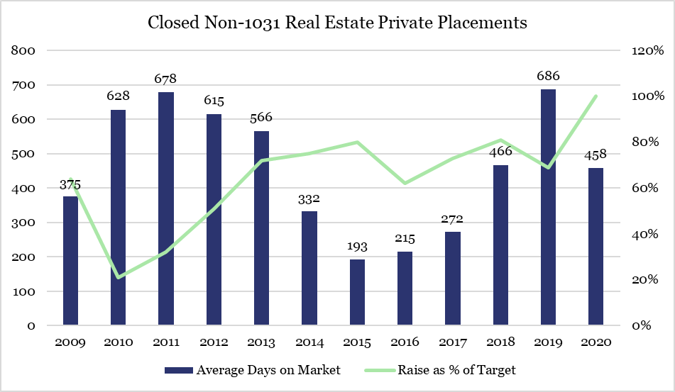

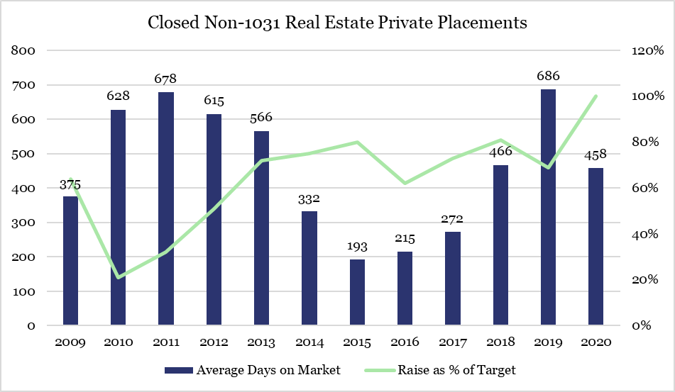

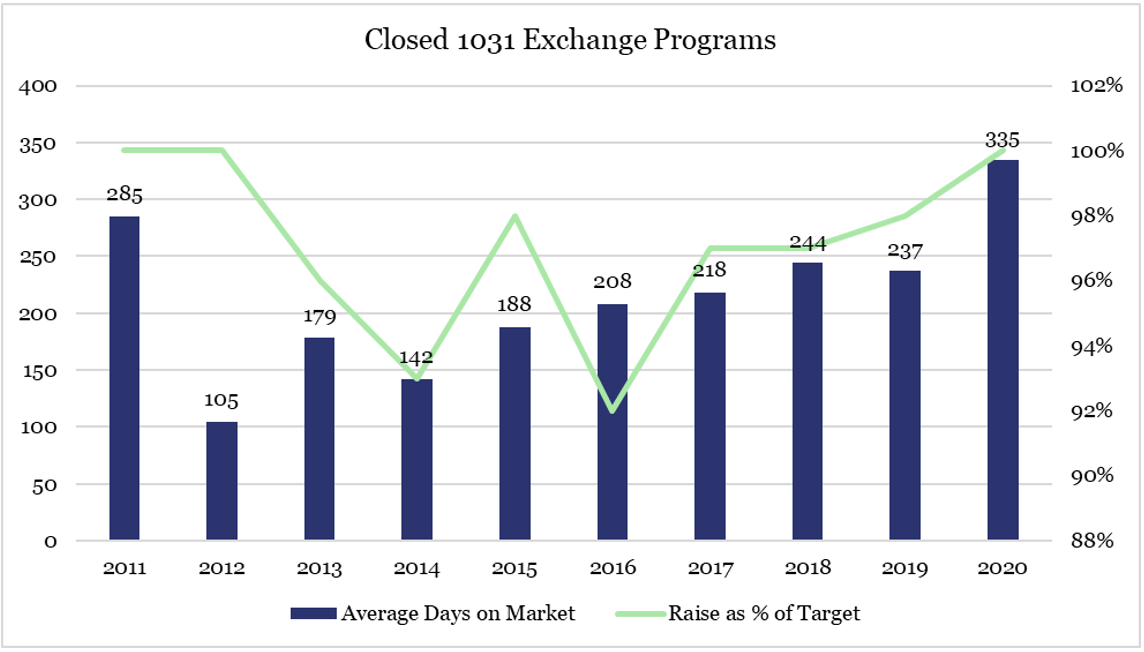

We recently analyzed the private placements on our platform that have closed to new investors since we started reporting in 2009 for a few statistics: (i) how long was the average fund within each category on the market (days on market), (ii) what was the average and range of capital raise targets and (iii) how close did the average fund come to meeting its capital raise target.

Overall, there are 987 funds on our platform that have closed to new investors since we started tracking data in 2009. The average target raise was $43.8 million, ranging from $800,000 to $4.1 billion. The average fund was on the market for 347 days and raised approximately 76% of its target.

Following is a closer look at some of the primary private placement categories. We report these and other statistics in our industry reports.

Private Real Estate

- 256 funds

- Real estate and real estate related securities

- LPs and LLCs

- Excludes 1031 exchanges and opportunity zone funds

- Target raise range per fund: $800k to $535 million

- Average days on market: 391

- Average raise as a percent of target

- Up to $25 million: 4%

- $25 million to $50 million: 3%

- $50 million and up: 4%

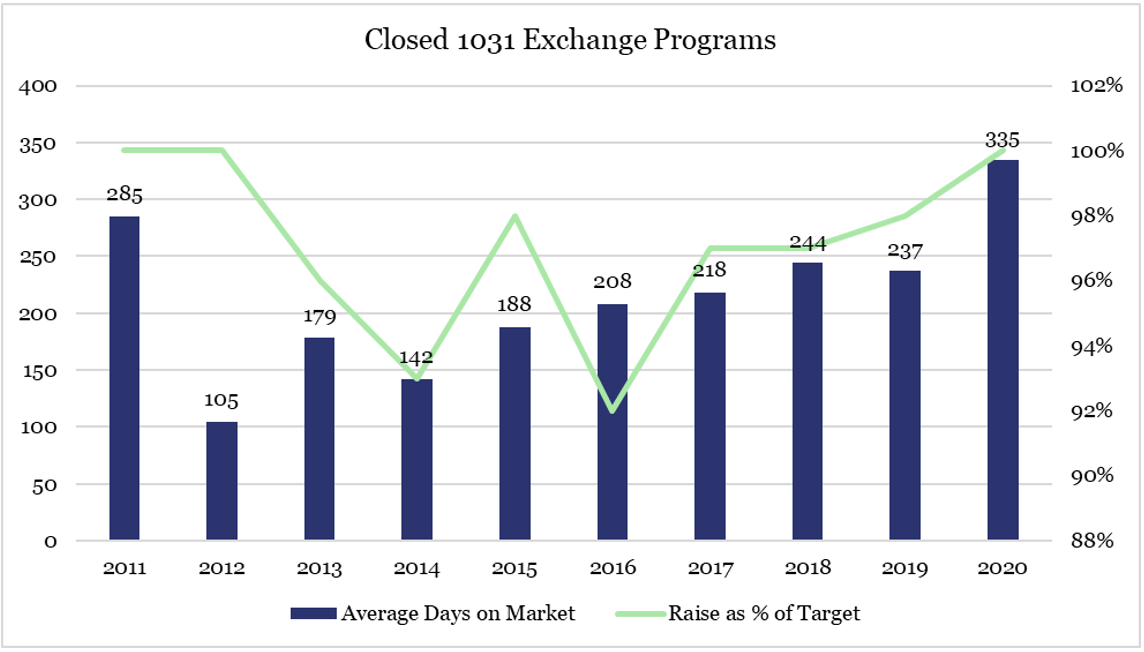

1031 Exchanges

- 442 funds

- 427 Delaware Statutory Trusts (DSTs) / 15 Tenant-in-Common (TICs)

- Target raise range per fund: $995k to $138.2 million

- Average days on market: 210

- Average raise as a percent of target

- Up to $25 million: 6%

- $25 million to $50 million: 6%

- $50 million and up: 100%

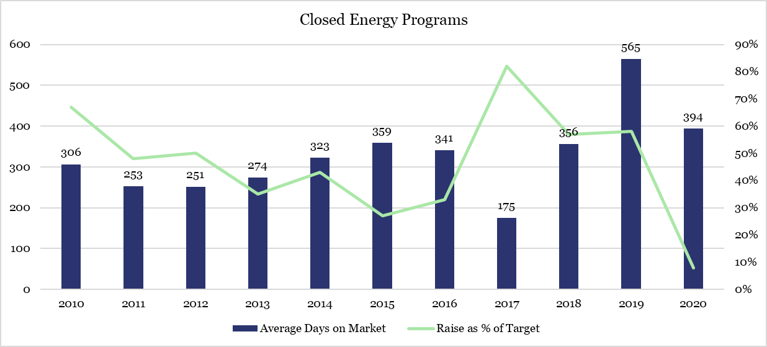

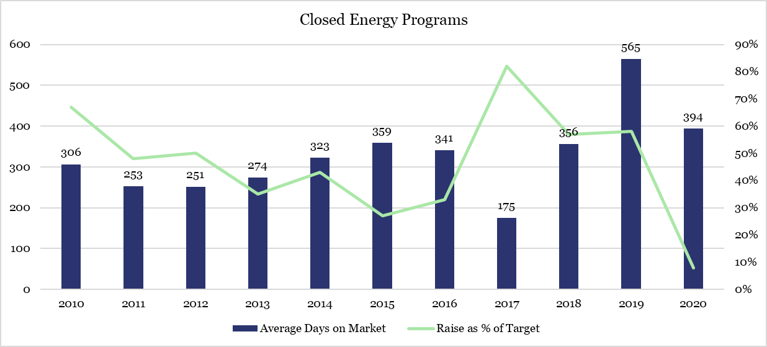

Energy

- 126 funds

- LPs and LLCs

- Target raise range per fund: $3.5 million to $300 million

- Average days on market: 313

- Average raise as a percent of target: 8%

Opportunity Zones

- This is a new category with only five funds on our platform that have closed to date and we currently cover 15 additional funds.

- Target raise range per closed fund: $7 million to $335 million

- Average days on market: 248

- Average raise as a percent of target: 6%

Other Resources

_________________________________

Charts and data based on programs activated on the AI Insight platform.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose. Copyright ©2020 AI Insight. All Rights Reserved.

Wednesday, February 12th, 2020 and is filed under AI Insight News

FINRA recently issued its 2020 Risk Monitoring and Examination Priorities Letter along with its 2019 Report on Examination Findings and Observations. As expected, Regulation Best Interest (Reg BI) takes the lead in this discussion. These reports also highlight, among other things, the continued focus on sales practices regarding supervision and client suitability.

Specifically, the 2020 Priorities Letter states,

“In the first part of the year, FINRA will review firms’ preparedness for Reg BI to gain an understanding of implementation challenges they face and, after the compliance date, will examine firms’ compliance with Reg BI, Form CRS and related SEC guidance and interpretations. FINRA staff expects to work with SEC staff to ensure consistency in examining broker-dealers and their associated persons for compliance with Reg BI and Form CRS.”

The 2019 Findings Report stated,

“Some firms did not have adequate systems of supervision to review that recommendations were suitable in light of a customer’s individual financial situation and needs, investment experience, risk tolerance, time horizon, investment objectives, liquidity needs and other investment profile factors. This report shares some new suitability-related findings, as well as additional nuances on prior years’ findings.”

Cybersecurity

At the end of the letter, FINRA addresses firm operations, technology and cybersecurity noting, “FINRA recognizes that there is no one-size-fits-all approach to cybersecurity, but expects firms to implement controls appropriate to their business model and scale of operations.”

Key Takeaways

- See this checklist, which explains key differences between FINRA rules and Reg BI and Form CRS.

- Carefully review and understand the specific suitability requirements for each non-traded or private placement program utilized and ensure that your firm has a documented process in place to monitor the compliance with suitability requirements.

- Document the due diligence process – remember, if it isn’t documented, it was never done.

- Review how regulators look at cybersecurity and key strategies to be compliant. Click here for additional resources and take the CE Course, “Cybersecurity Awareness for Financial Professionals”.

Let AI Insight help you stay compliant

- Discover how you can create efficiencies in your due diligence review process using our database of 350+ alternative investments to source new products as well as analyze and compare hundreds of alternative investment programs, including non-traded programs, private placements, and alternative mutual funds.

- Demonstrate your due diligence by conducing product-specific training on the features, risks and suitability for hundreds of offerings.

- Document what you’re doing to support your firm’s regulatory requirements in a transparent way. AI Insight captures all of the activity you and your firm members complete within the platform including training modules, offering document reviews and research conducted.

Resources

Monday, January 13th, 2020 and is filed under AI Insight News

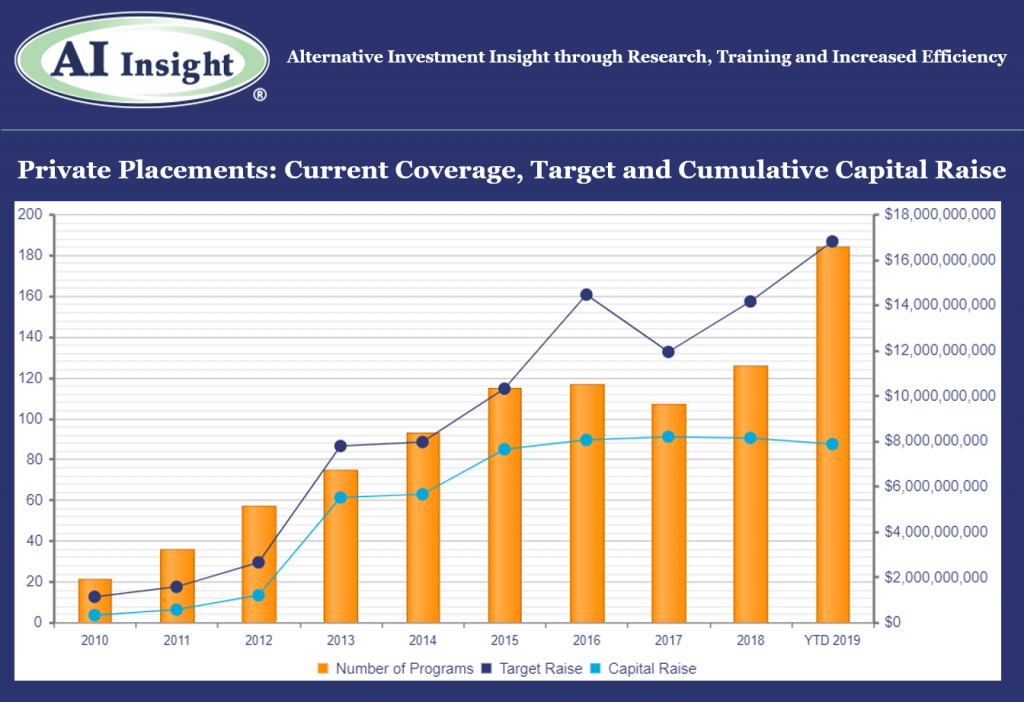

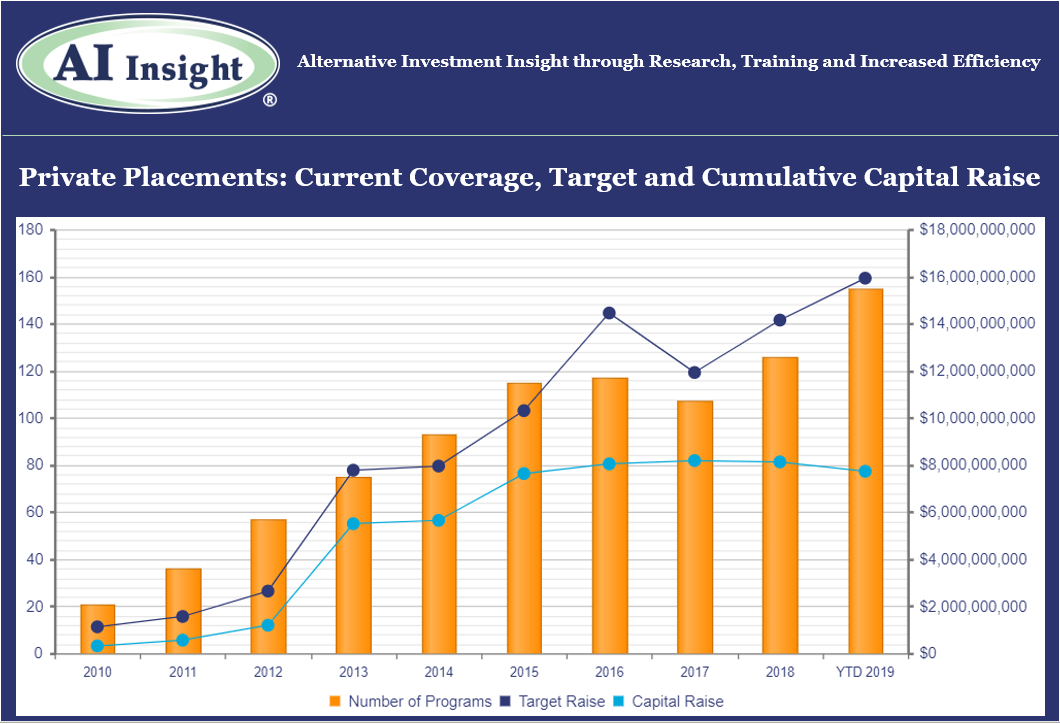

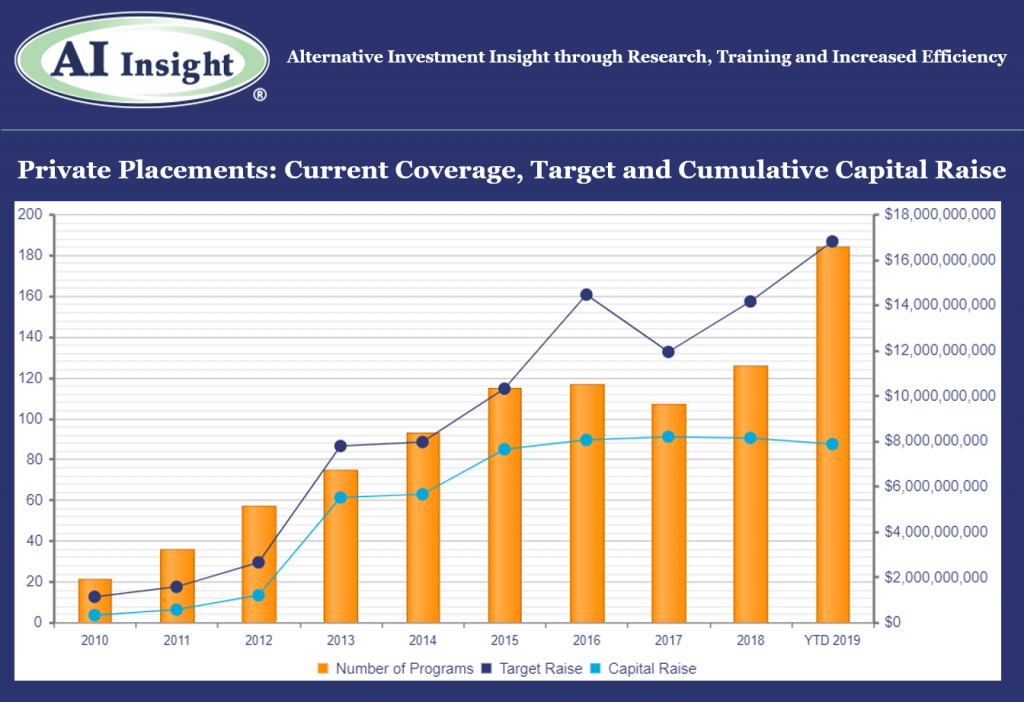

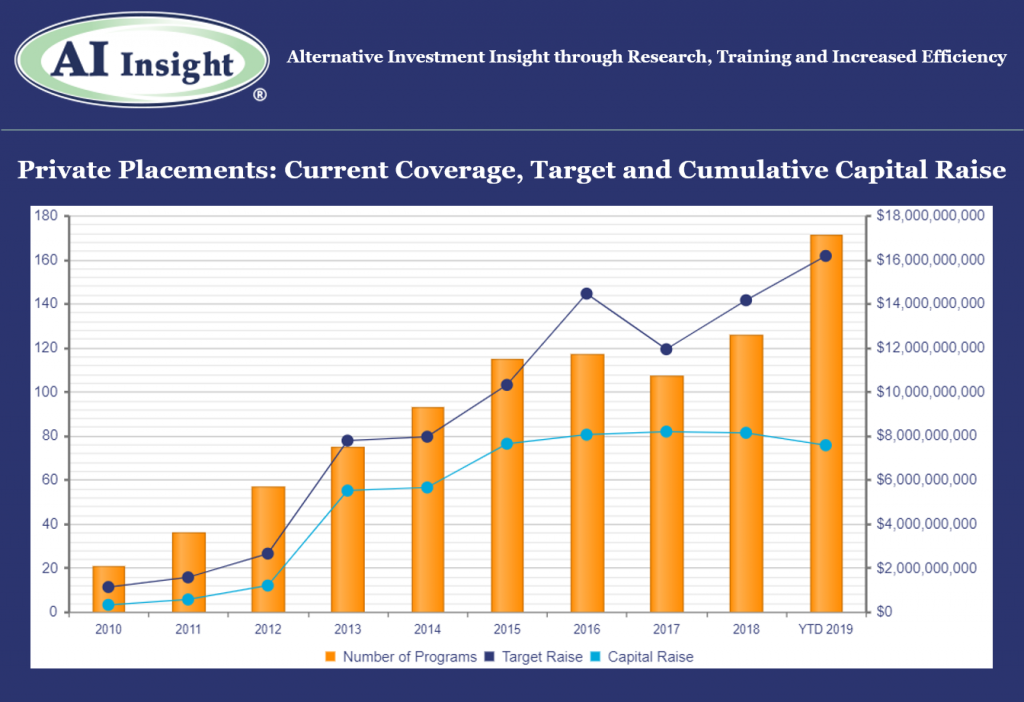

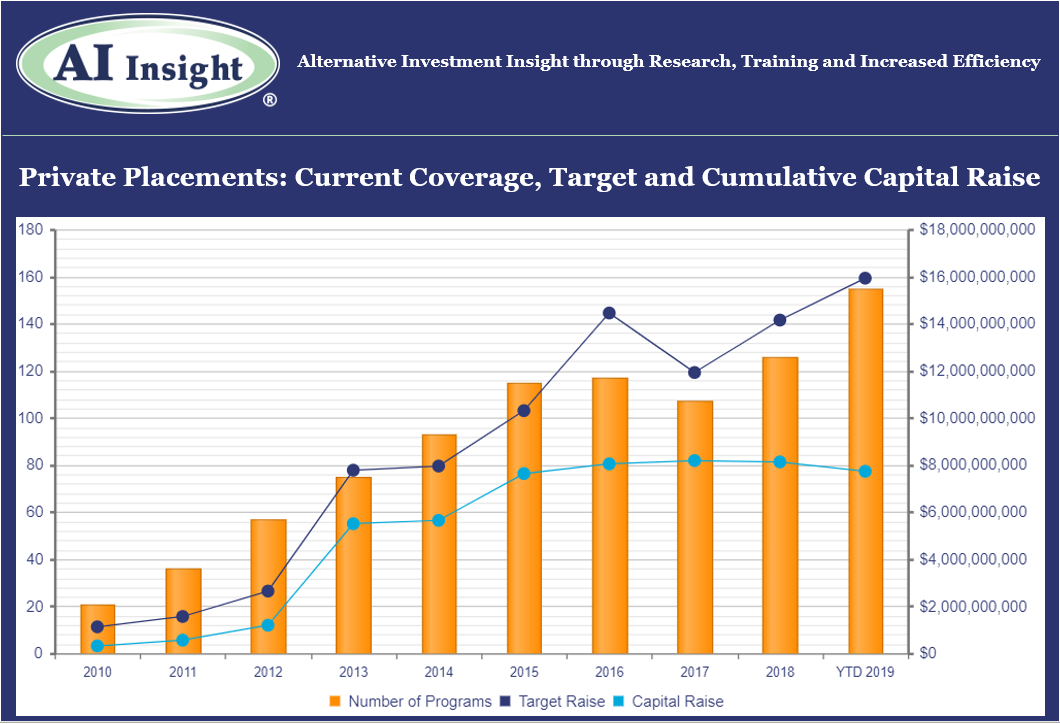

We recently released our December Private Placement Insights. See the highlights from the report below, or if you are a subscriber, log in now to see the entire report.

- More private placements were added to our coverage in 2019 than ever before with record months in November and December. The 200 private placement funds added during the year were slightly smaller in overall target raise than 2018, with the aggregate just 1.3% above last year despite the increased number of funds.

- The industry was led primarily by continued growth in 1031 exchanges and the addition of Opportunity Zone funds. Private equity/debt activity picked up late in the year, as did conservation contributions and energy funds. Other real estate, which includes non-1031 real estate LLCs and LPs trailed, with fund sizes significantly smaller than in prior years.

- As of January 1st, AI Insight covers 172 private placements currently raising capital, with an aggregate target raise of $16.1 billion and an aggregate reported raise of $7.7 billion or 48% of target. The average size of the current funds is $93.2 million, ranging from $3.4 million for a single asset fund to $2.2 billion for a sector specific private equity/debt fund.

- 158 private placements closed in 2019, having raised approximately 85% of their target.

- ON DECK: as of January 1st, there were eight new private placements coming soon.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, BDCs, Closed-End Funds, and Alternative Mutual Funds. Receive up to 24 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of Dec. 31, 2019, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose. Copyright ©2020 AI Insight. All Rights Reserved.

Monday, December 9th, 2019 and is filed under AI Insight News

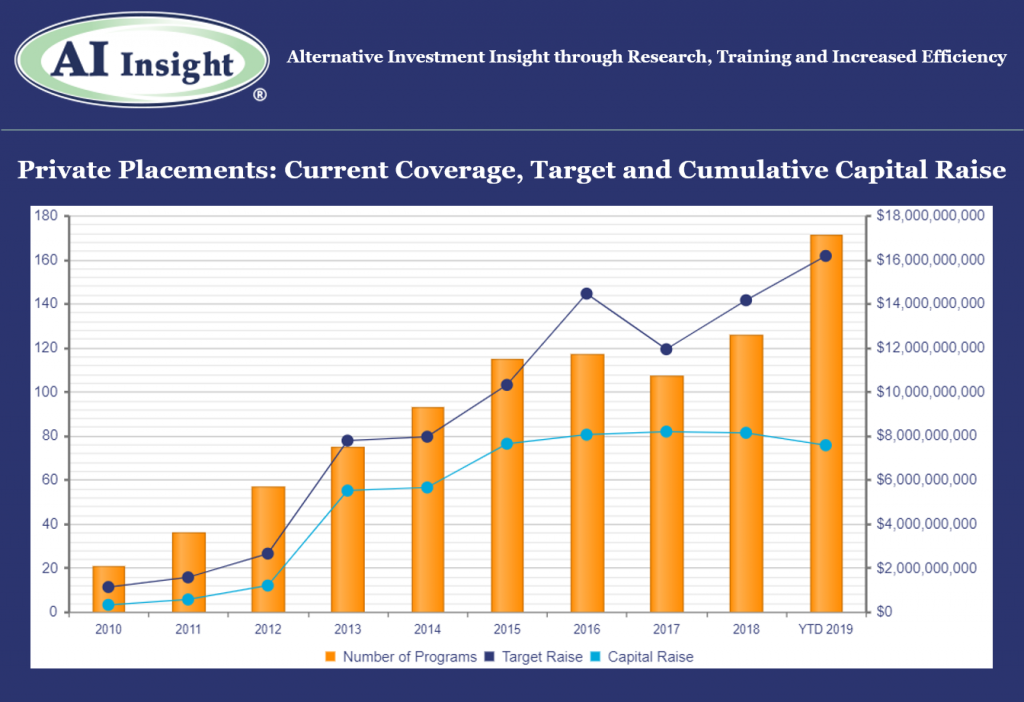

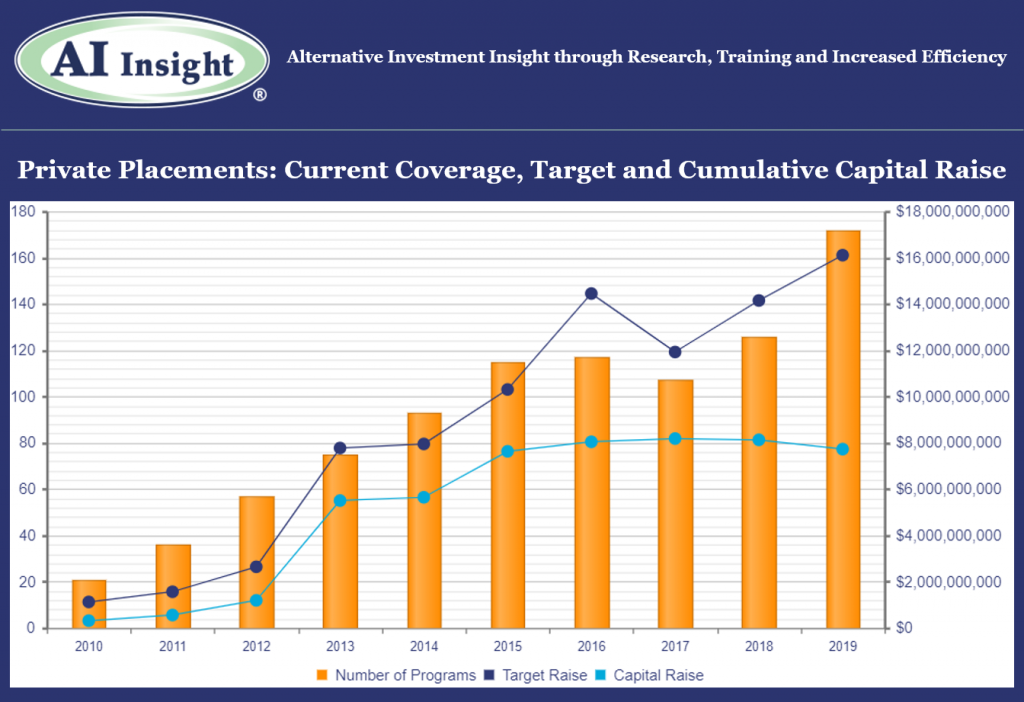

We recently released our November Private Placement Insights. Highlights from the report include:

- November was a record month for private placements, with 30 new funds looking to raise $854 million added to our coverage.

- Our overall private placement coverage is up year-over-year in terms of new fund coverage and aggregate target raise, led primarily by 1031s and Opportunity Zones. Non-1031 real estate fund activity has picked up again, after trailing most of the year.

- As of December 1st, AI Insight covers 184 private placements currently raising capital, with an aggregate target raise of $16.8 billion and an aggregate reported raise of $7.9 billion or 47% of target. This includes the 177 private placements added to our coverage in 2019. The average size of the current funds is $90.9 million, ranging from $3.4 million for a single asset fund to $2.2 billion for a sector specific private equity/debt fund.

- As of December 1st, 122 private placements have closed year-to-date which have raised approximately 88% of their target.

- As of December 5th, there were twelve new private placements coming soon.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, BDCs, Closed-End Funds, and Alternative Mutual Funds. Receive up to 24 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of Nov. 30, 2019, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose. Copyright © 2019 AI Insight. All Rights Reserved.

Friday, December 6th, 2019 and is filed under AI Insight News

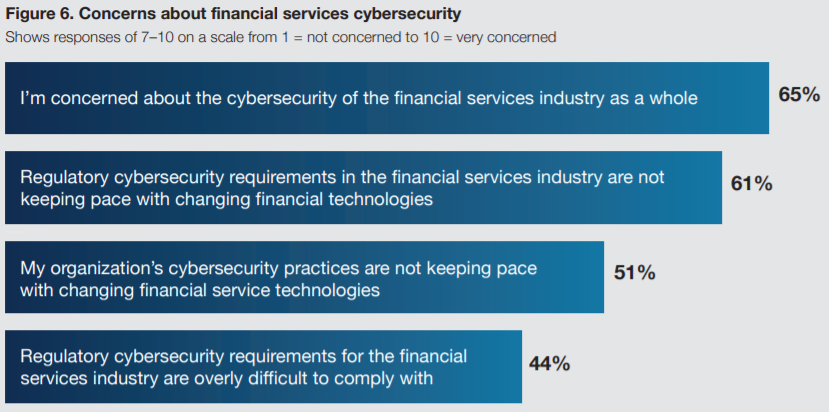

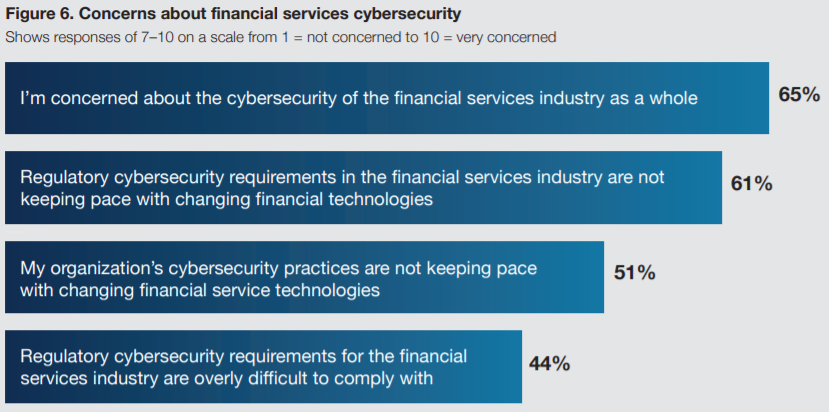

Be proactive about internet security risks and unauthorized data access that can impact clients and your business.

The financial services industry is certainly aware of potential security vulnerabilities and risks. While protections are in place, cybersecurity isn’t keeping pace with the technology advances in the financial services industry according to “The State of Software Security in the Financial Services Industry”. The survey conducted as part of the report also shows that 65% of respondents are concerned with complying with cybersecurity requirements.

Source: The State of Software Security in the Financial Services Industry

How does your firm compare?

The research report was commissioned by the Synopsys Cybersecurity Research Center (CyRC) and conducted by the Ponemon Institute. It includes a survey of over 400 IT security practitioners in various sectors of the financial services industry, including banking, insurance, mortgage lending/processing, and brokerage.

Read the detailed survey results here to see how your firm compares, including:

- The software security posture of financial services companies

- Risks to financial software and applications

- Security practices in the design and development of financial service software and technologies

How regulators look at cybersecurity and key strategies to be compliant

Not only is data security a concern, but regulators have also taken interest in cybersecurity risks that may impact financial firms. Below are five things every regulator looks for during an audit:

- Risk Register

- Framework and Assessment of the Security Program

- Strategy and Roadmap

- Incident Response Plan

- Governance & Centralized Management

7 security tips for financial firms

Take a look at 7 security tips for financial firms to learn about steps you can take such as training, establishing policies and securing devices to help lessen your security risks. The first tip recommends employee training, which the Ponemon Institute study mentions is often not mandated within organizations.

AI Insight collaborated with Docupace Technologies, LLC and Beacon Strategies, LLC to develop a CE Course, “Cybersecurity Awareness for Financial Professionals” to help you better understand the regulatory focus on cybersecurity, the threat landscape and practical things you can do to protect client data. This course is eligible for 1 credit toward the CFP® and other designations. Learn more

Wednesday, November 20th, 2019 and is filed under AI Insight News

Considerations when working with non-traditional ETFs

North American Securities Administrators Association (NASAA) recently released a report recommending that broker dealers review policies and procedures for non-traditional exchange traded funds (ETFs).

“The NASAA report recommends tailored supervisory procedures be established for firms that allow leveraged and/or inverse ETF transactions. Further, that the supervisory procedures address the heightened and specific risks associated with these complex products.”

Click here to download the full report.

Be proactive to fully understand non-traditional ETFs

Leveraged ETFs are investment vehicles for sophisticated investors who are looking to gain short-term magnified exposure to the markets. However, it’s important to clearly understand that their unique characteristics come with inherent risk. Take AI Insight’s CE course, Introduction to Leveraged and Inverse ETFs, to help you understand the composition of leveraged ETFs, mechanics of how they operate, and risks associated with them. This course is eligible for 1 CE credit toward the CFP® and other designations.

Friday, November 8th, 2019 and is filed under AI Insight News

We recently released our October Private Placement Insights. Highlights from the report include:

- October private placement activity picked up after a slow September, primarily in the 1031 category.

- Our overall private placement coverage is up year-over-year in terms of new fund coverage and aggregate target raise, led primarily by 1031s and Opportunity Zones, while most other categories remain below last year’s levels.

- Our coverage of hedge funds and managed futures has not expanded in 2019. We discussed this in our September Private Placements podcast. We believe the minimal activity in the hedging and futures space can be attributable to a few factors. One is that funds and fund-of-funds used by many retail firms tend to be larger with a perpetual life that have been around for many years and used as needed. Allocations to hedging and futures strategies also tend to be smaller in the retail channel than the institutional side, so fewer options are available and many use liquid alternatives for these allocations, where we have seen a lot of growth and increased coverage in recent years. Additionally, the strong equity market over the last decade has minimized the focus on hedging and futures strategies.

- As of November 1st, AI Insight covers 171 private placements currently raising capital, with an aggregate target raise of $16.2 billion and an aggregate reported raise of $7.6 billion or 46.9% of target. This includes the 147 private placements added to our coverage in 2019.

- As of November 1st, 111 private placements have closed year-to-date which raised approximately 86% of their target raise. While there are still two months remaining, funds this year have come closer to their targets than last year, when the 160 private placements that closed in FY 2018 raised approximately 63% of their target.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, BDCs, Closed-End Funds, and Alternative Mutual Funds. Receive up to 24 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of Oct. 31, 2019, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose. Copyright © 2019 AI Insight. All Rights Reserved.

Saturday, October 19th, 2019 and is filed under AI Insight News

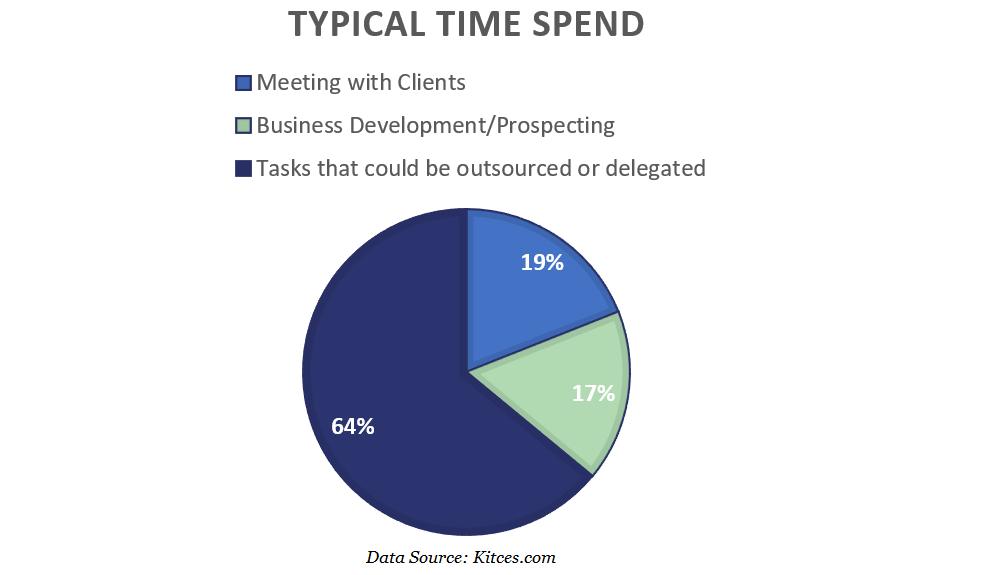

Put your focus on non-delegable tasks and pass on the rest to help you create a leading advisory practice.

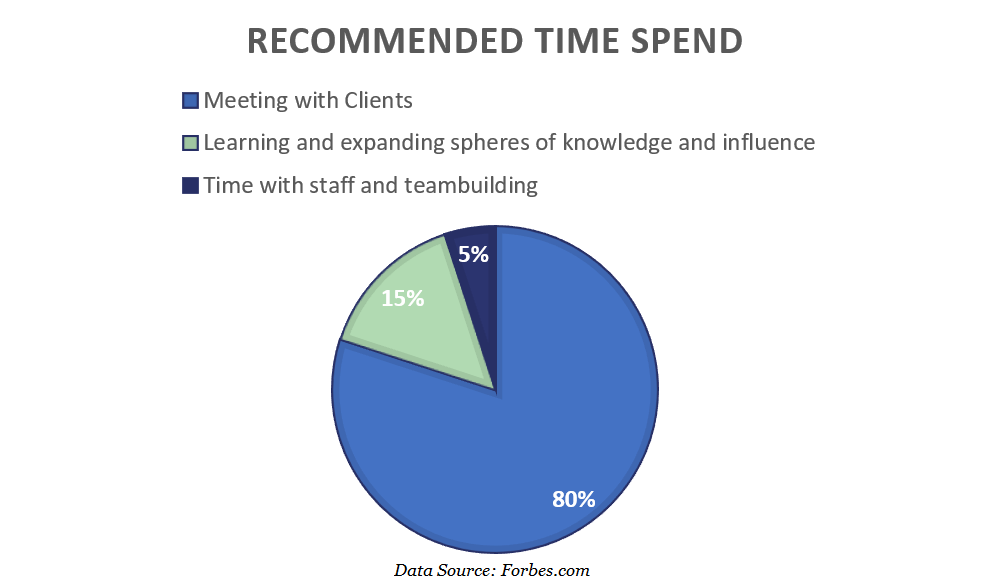

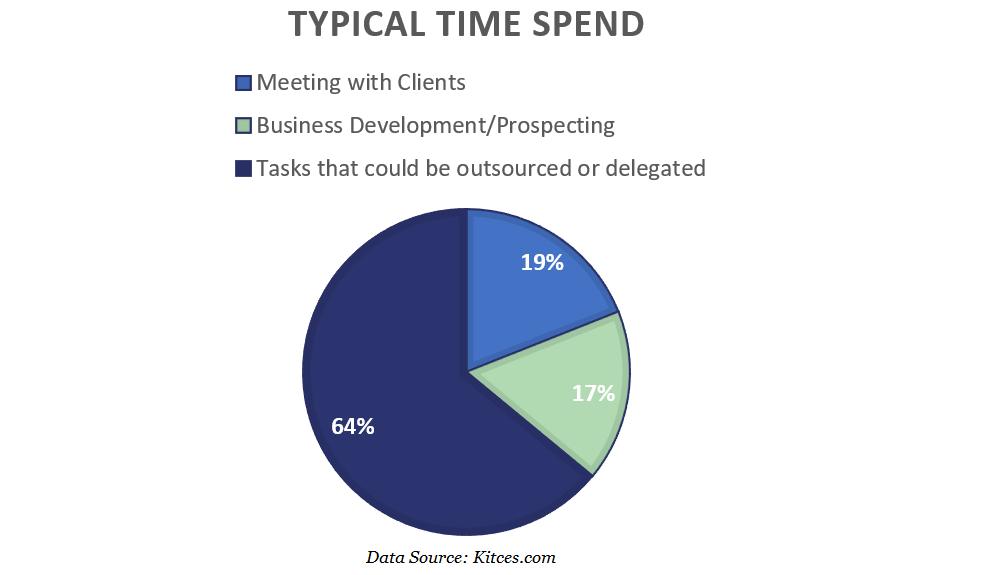

A typical financial advisor works an average of 43 hours per week, yet spends only 19% of their time meeting with clients according to a recent study conducted by Kitces.com. The study shows that only an additional 17% of time is spent on prospecting, leaving a significant gap of time spent on tasks that they should consider delegating to help improve their business results.

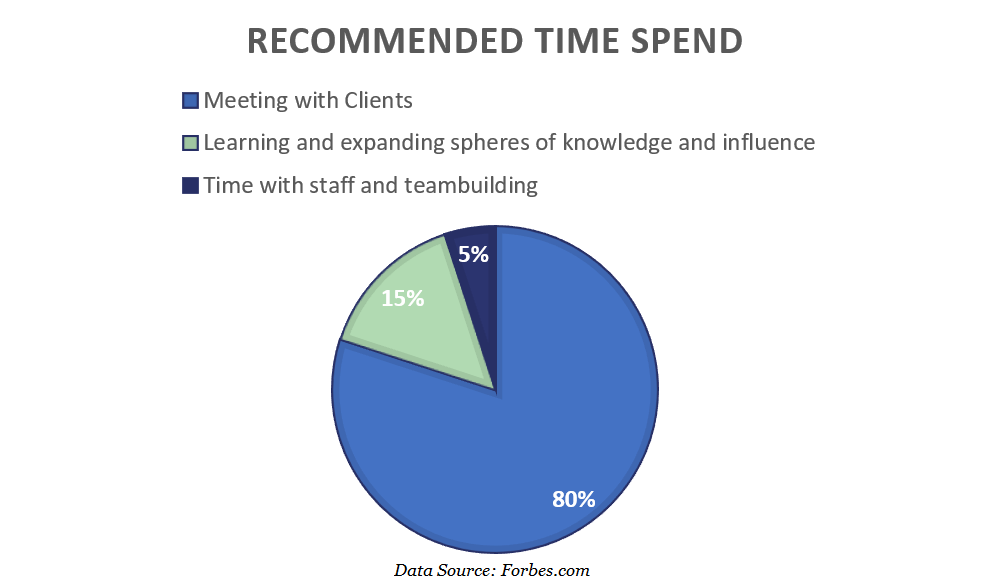

What should my practice look like?

The 80/15/5 Rule For Financial Advisors by Forbes suggests the Kitces study is a “wake-up call” for advisors noting that their practice should be treated as any small business. To increase the potential for success, an advisor should focus 80% of their time on their expertise – meeting with clients and prospecting. For the remaining time, they suggested that advisors focus 15% on “learning and expanding spheres of knowledge and influence, and 5% with staff or team-building”.

What efficiencies can help improve my practice?

The Kitces study calls out that “a combination of technology and delegation of tasks” outside of an advisor’s expertise such as administration, human resources, marketing and meeting preparation can help an advisor transition to spending a much larger percentage of time face-to-face with clients.

The Forbes article notes that while there are additional costs incurred with outsourcing, the cost is actually greater when the advisor spends time doing delegable tasks rather than leaving it to an expert or creating efficiencies using technology tools.

3 steps to start your advisory practice transition

- Make a list of your recurring tasks that could be delegated such as calling to set appointments, posting on social media to promote your business, investment research, or inputting data for your financial plans.

- Gather references to connect with people who have expertise to help fill your gaps, such as a freelance marketer or a financial support professional.

- Look at tasks that can be done more efficiently through technology such as managing clients with a reliable CRM or implementing financial planning software.

If you’re working with alternative investments, consider using the AI Insight platform to research hundreds of alternative investments and efficiently conduct side-by-side feature comparisons to help you source products. AI Insight currently covers over 200 non-traded alternative investment funds representing $33 billion in assets, and over 80 alternative strategy mutual funds, representing nearly 80% of the AUM of the alternative strategy mutual fund market.

Monday, October 14th, 2019 and is filed under AI Insight News

We recently released our September Private Placement Insights. Highlights from the report include:

- September private placement fund formation was the slowest of the year, coming off of a strong August.

- Given the slower pace in September, our private placement coverage is essentially flat year-over-year, with all categories down in terms of new fund coverage and target raise except 1031 exchanges and Opportunity Zone funds.

- As of September 30th, AI Insight covers 155 private placements that are currently raising capital, with an aggregate target raise of $15.9 billion and an aggregate reported raise of $7.7 billion or 51.5% of target. This includes the 120 private placements added to our coverage in 2019.

- As of September 30th, 87 private placements have closed year-to-date which raised approximately 92% of their target raise, compared to 160 private placements that closed in FY 2018 which raised approximately 63% of their target.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, BDCs, Closed-End Funds, and Alternative Mutual Funds. Receive up to 24 extensive reports per year to help broaden your alternative investment reviews. Click here to request a sample report.

Watch this tour or request a live demo of AI Insight’s expansive Industry Reports customized to your business needs.

_________________________________

Chart and data as of Sept. 30, 2019, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose. Copyright © 2019 AI Insight. All Rights Reserved.