Tuesday, January 17th, 2023 and is filed under Industry Reporting

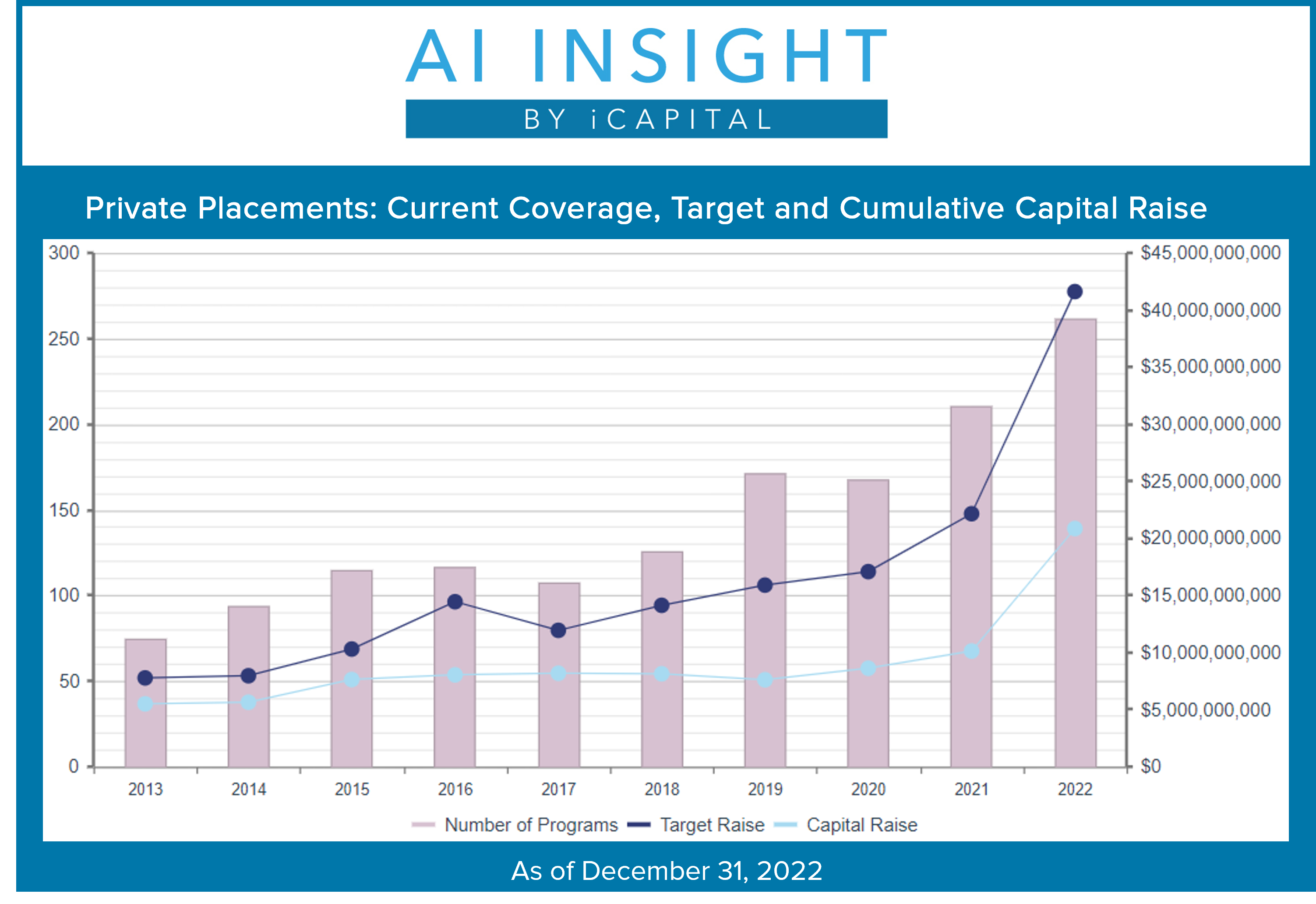

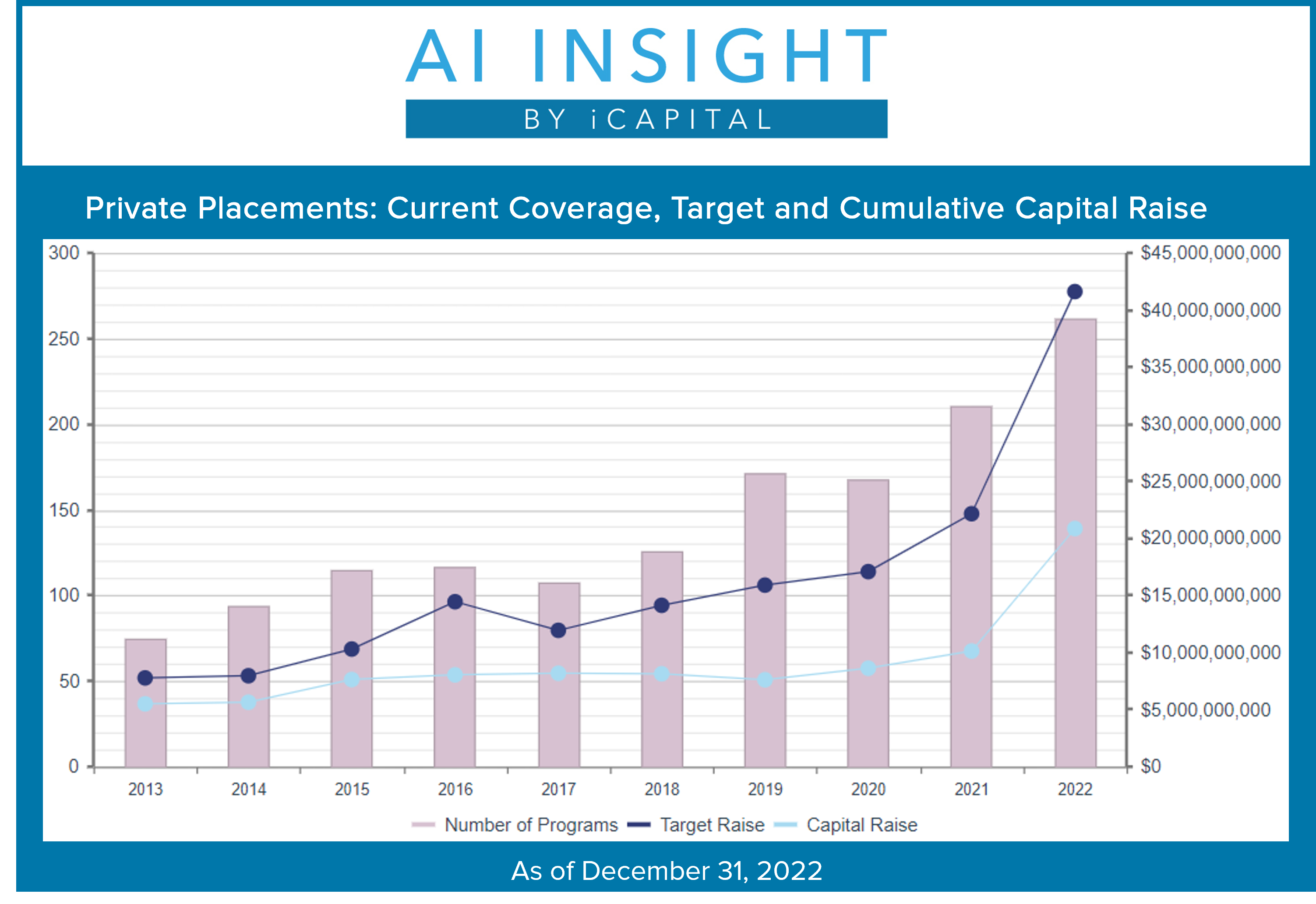

We recently released our December Private Placement Insights report. See the highlights from the report below, or if you are an AI Insight subscriber, log in now to see the entire report.

- 27 new private placements were added to investment product education in December, slightly higher than what was added in November, but well below the highs from mid-year 2022 when more than 30 funds were added each month. Real estate activity noticeably declined through the year, while some of the other categories, including private equity, recovered from a slower start.

- A total of 326 new funds added investment product education in 2022. While we saw a slowdown in Q4, funds adding education was up 10% year-over-year, and those funds are seeking to raise 44% more capital, on average. The two categories down year-over-year are hedge funds and conservation funds, while all others are above what we experienced in 2021.

- As of January 1st, AI Insight covers 262 private placements currently raising capital, with an aggregate target raise of $41.6 billion and an aggregate reported raise of $20.1 billion or 50% of target.

- Real estate-related funds, including 1031s, Opportunity Zone funds, and non-1031 real estate LLCs, LPs, and private REITs represent 75% of the total number of funds, and 56% of aggregate target. The percentage of target is down recently as larger private equity funds have been added. Additionally, private equity’s share of the target raise is likely much higher. There are 13 private equity funds that do not report a target or a raise, as they are seeking instead to raise a percentage of a larger, institutional fund rather than a specific dollar amount.

- In terms of coverage by general objective, income has been and remains the largest component at 60% of funds, while growth and growth & income follow at 22% and 18%, respectively.

- The average size of funds currently raising capital is $159.2 million, up from $120.1 million at the end of Q3 primarily due to the large private equity fund added in November. Funds range in size from $2.6 million for a specified 1031 exchange fund to the $9.7 billion target for a diversified private equity fund.

- 72% of private placements we cover use the 506(b) exemption, 19% use 506(c) and 9% have not yet filed their Form D with the SEC.

- Forty-one private placements closed to new investors in December and 275 closed in full-year 2022. Funds that closed through the year were on the market for an average of 300 days and the 249 funds reporting, raised 86% of target on average.

For illustrative purposes only. Past performance is not indicative of future results.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, Non-Traded BDCs and Interval Funds. Receive up to 22 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of December 31, 2022 based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose.

This material is confidential and the property of iCapital, and may not be shared with any party other than the intended recipient or his or her professional advisors. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital. This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security offered by Institutional Capital Network, Inc. or its affiliates (together “iCapital Network”). Past performance is not indicative of future results. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors. An investment in an alternative investment entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. The information contained herein is subject to change and is also incomplete. This industry information and its importance is an opinion only and should not be relied upon as the only important information available. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed, and iCapital assumes no liability for the information provided.

Products offered by iCapital are typically private placements that are sold only to qualified clients of iCapital through transactions that are exempt from registration under the Securities Act of 1933 pursuant to Rule 506(b) of Regulation D promulgated thereunder (“Private Placements”). An investment in any product issued pursuant to a Private Placement, such as the funds described, entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. Further, such investments are not subject to the same levels of regulatory scrutiny as publicly listed investments, and as a result, investors may have access to significantly less information than they can access with respect to publicly listed investments. Prospective investors should also note that investments in the products described involve long lock-ups and do not provide investors with liquidity.

Securities may be offered through iCapital Securities, LLC, a registered broker dealer, member of FINRA and SIPC and subsidiary of Institutional Capital Network, Inc. (d/b/a iCapital Network). These registrations and memberships in no way imply that the SEC, FINRA or SIPC have endorsed the entities, products or services discussed herein. iCapital and iCapital Network are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2023 Institutional Capital Network, Inc. All Rights Reserved.

Tuesday, December 13th, 2022 and is filed under Industry Reporting

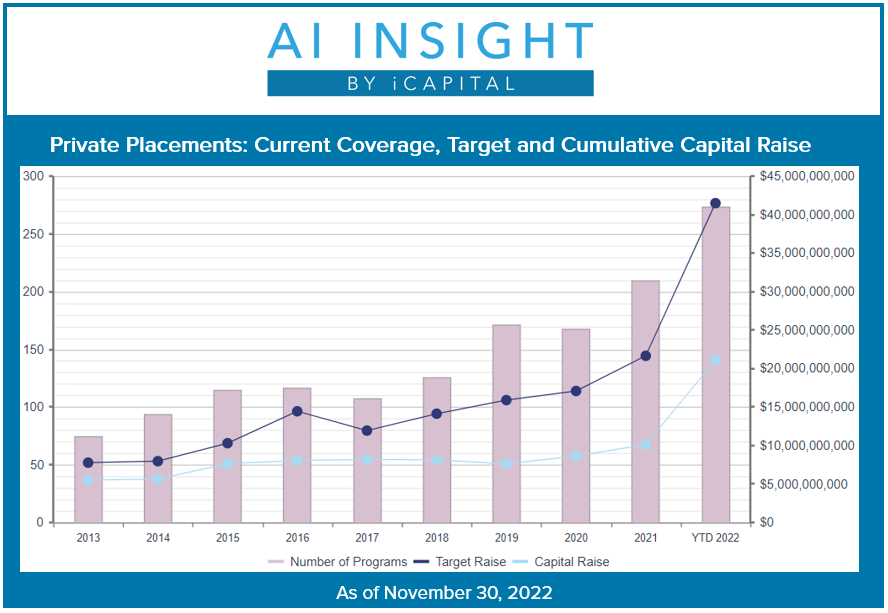

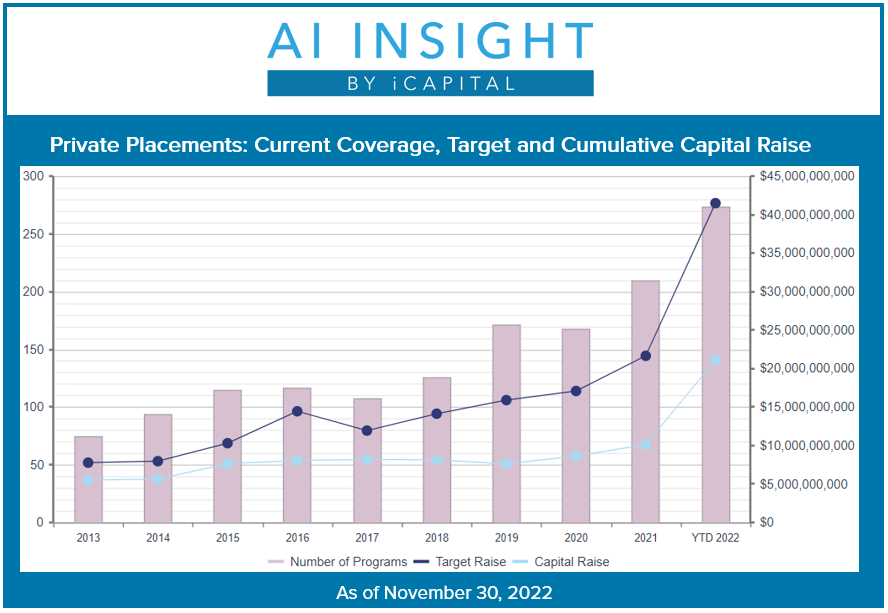

We recently released our November Private Placement Insights report. See the highlights from the report below, or if you are an AI Insight subscriber, log in now to see the entire report.

- 21 new private placements were added to our coverage in December, a notable decline from the 31 added in October. A big part of this is attributable to the slowdown in 1031 exchange activity, where we were seeing 20+ funds added each month, well above November’s nine new additions. We have also seen fewer conservation funds this year, as anticipated, and even the non-tax focused real estate segment has slowed considerably.

- Based on the increased activity early in the year, new fund coverage is still up 15% year-over-year, and those funds are seeking to raise 87% more capital, on average. The two categories that are down year-over-year are hedge funds and conservation funds, while all others are still above.

- As of December 1st, AI Insight covers 274 private placements currently raising capital, with an aggregate target raise of $41.5 billion and an aggregate reported raise of $21.1 billion or 52% of target.

- Real estate-related funds, including 1031s, Opportunity Zone funds, and non-1031 real estate LLCs, LPs, and private REITs have historically represented the largest component of our private placement coverage. While these funds still represent 71% of our coverage by number of funds, private equity and debt funds now represent a much larger amount of aggregate target raise as we have seen larger funds added here recently. Real estate funds are still 55% of aggregate target, down from 73% last month, while private equity and debt funds are 36% of target, up from 16% last month. Private equity’s share of the target is also likely much higher, as there are 13 funds that do not report a target or a raise, as they are seeking instead to raise a percentage of a larger, institutional fund rather than a specific dollar amount.

- In terms of coverage by general objective, income has been and remains the largest component at 61% of funds, while growth and growth & income follow at 21% and 18%, respectively.

- The average size of funds currently raising capital is $151.4 million, up from $120.1 million last month primarily due to the large private equity fund added in November. Funds range in size from $1.2 million for a specified 1031 exchange fund to the $9.7 billion target of the recently added private equity fund.

- 74% of private placements we cover use the 506(b) exemption, 17% use 506(c) and 9% have not yet filed their Form D with the SEC.

- Twelve private placements closed to new investors in October and 234 have closed year-to-date. Funds that closed this year have been on the market for an average of 383 days and the 219 funds reporting raised 86% of target on average.

- According to Pitchbook, overall private markets fundraising is down 7.6% year-over-year as of the end of the third quarter of this year. The steepest declines were seen in fund-of-funds, secondaries, and real estate-focused funds. Pitchbook also reports that firms may be extending offering periods to bridge into 2023, as portfolios are well over-allocated based on 2022 budgets. The largest funds, or those seeking to raise over $1 billion, took in 73% of assets.

For illustrative purposes only. Past performance is not indicative of future results.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, Non-Traded BDCs and Interval Funds. Receive up to 22 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of November 30, 2022, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose.

This material is confidential and the property of iCapital, and may not be shared with any party other than the intended recipient or his or her professional advisors. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital. This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security offered by Institutional Capital Network, Inc. or its affiliates (together “iCapital Network”). Past performance is not indicative of future results. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors. An investment in an alternative investment entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. The information contained herein is subject to change and is also incomplete. This industry information and its importance is an opinion only and should not be relied upon as the only important information available. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed, and iCapital assumes no liability for the information provided.

Products offered by iCapital are typically private placements that are sold only to qualified clients of iCapital through transactions that are exempt from registration under the Securities Act of 1933 pursuant to Rule 506(b) of Regulation D promulgated thereunder (“Private Placements”). An investment in any product issued pursuant to a Private Placement, such as the funds described, entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. Further, such investments are not subject to the same levels of regulatory scrutiny as publicly listed investments, and as a result, investors may have access to significantly less information than they can access with respect to publicly listed investments. Prospective investors should also note that investments in the products described involve long lock-ups and do not provide investors with liquidity.

Securities may be offered through iCapital Securities, LLC, a registered broker dealer, member of FINRA and SIPC and subsidiary of Institutional Capital Network, Inc. (d/b/a iCapital Network). These registrations and memberships in no way imply that the SEC, FINRA or SIPC have endorsed the entities, products or services discussed herein. iCapital and iCapital Network are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2022 Institutional Capital Network, Inc. All Rights Reserved.

Tuesday, November 15th, 2022 and is filed under Industry Reporting

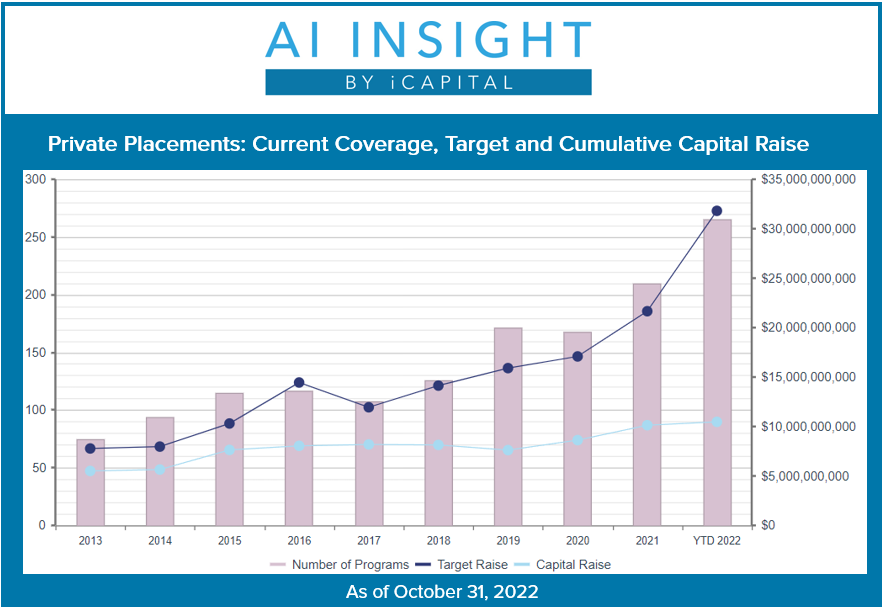

We recently released our October Private Placement Insights report. See the highlights from the report below, or if you are an AI Insight subscriber, log in now to see the entire report.

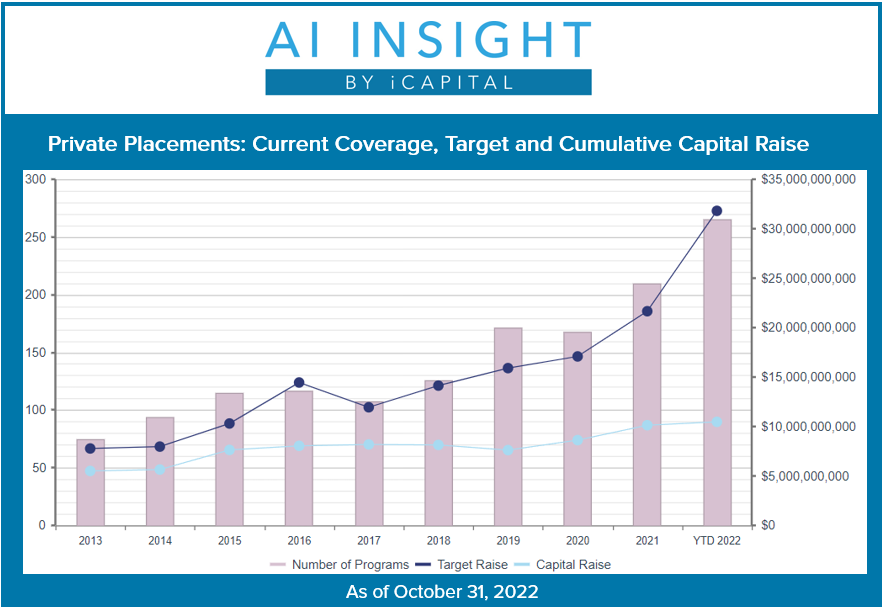

- 31 new private placements were added to our coverage in October, an increase from prior months as the year-end tax strategies start to come in and strength continues in the non-tax-focused real estate category. Five new conservation funds were added during the month and eleven so far this year, 10% more than last year at this time, while 74 new real estate funds have been added, 126% more than last year. The only category with slower growth on a year-over-year basis is the hedge fund category, which was strong last year as iCapital funds were added.

- Overall, on a year-over-year basis, we have added more funds than last year (+23%), and these funds are targeting a larger amount of capital (+100%). We have also added more than 30 new sponsor relationships across the categories. The increase in volume is indicative of the continued growth in alternative investment options for high-net-worth investors, as well as a focus on education within the space.

- As of November 1st, AI Insight covers 265 private placements currently raising capital, with an aggregate target raise of $31.8 billion and an aggregate reported raise of $10.5 billion or 33% of target.

- Real estate-related funds, including 1031s, Opportunity Zone funds, and non-1031 real estate LLCs, LPs, and private REITs represent the largest component of our private placement coverage at 72% of funds and target raise. Private equity/debt funds represent 13% of funds and 16% of target raise, although this does include 12 private market feeder funds that do not specify an offering target.

- In terms of coverage by general objective, income is the largest component at 61% of funds, while growth and growth & income follow at 21% and 18%, respectively.

- The average size of funds currently raising capital is $120.1 million, ranging from $1.2 million for a specified 1031 exchange fund to $2.5 billion for a private REIT focused on single-family housing.

- 72% of private placements we cover use the 506(b) exemption, 18% use 506(c) and 10% have not yet filed their Form D with the SEC.

- 22 private placements closed to new investors in October and 222 have closed year-to-date. Funds that closed this year have been on the market for an average of 293 days and the 207 funds reporting raised 86% of target on average.

Pitchbook recently released its private market benchmark return analysis with final Q1 2022 data and preliminary Q2 data. Overall, private capital funds lost ground in Q2, declining 1.09%, after a positive Q1. Private equity (-3.16%), venture capital (-2.29%), and private debt funds (-1.80%) posted the lowest returns, while real estate (+3.61%), real assets (+2.16%), and secondaries (+4.65%) remained in positive territory. This year is clearly a reversal from the last two years, where growth and venture capital funds led, and the lower-risk income strategies lagged. Further downside risk in returns could be expected given the lag in valuations in the private markets. However, when considering that the S&P 500 lost nearly 16% in Q2, these markets appear to have done their job in diversifying risk and return streams.

For illustrative purposes only. Past performance is not indicative of future results.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, Non-Traded BDCs and Interval Funds. Receive up to 22 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of October 31, 2022, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose.

This material is confidential and the property of iCapital, and may not be shared with any party other than the intended recipient or his or her professional advisors. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital. This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security offered by Institutional Capital Network, Inc. or its affiliates (together “iCapital Network”). Past performance is not indicative of future results. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors. An investment in an alternative investment entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. The information contained herein is subject to change and is also incomplete. This industry information and its importance is an opinion only and should not be relied upon as the only important information available. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed, and iCapital Network assumes no liability for the information provided.

Products offered by iCapital Network are typically private placements that are sold only to qualified clients of iCapital Network through transactions that are exempt from registration under the Securities Act of 1933 pursuant to Rule 506(b) of Regulation D promulgated thereunder (“Private Placements”). An investment in any product issued pursuant to a Private Placement, such as the funds described, entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. Further, such investments are not subject to the same levels of regulatory scrutiny as publicly listed investments, and as a result, investors may have access to significantly less information than they can access with respect to publicly listed investments. Prospective investors should also note that investments in the products described involve long lock-ups and do not provide investors with liquidity.

Securities may be offered through iCapital Securities, LLC, a registered broker dealer, member of FINRA and SIPC and subsidiary of Institutional Capital Network, Inc. (d/b/a iCapital Network). These registrations and memberships in no way imply that the SEC, FINRA or SIPC have endorsed the entities, products or services discussed herein. iCapital and iCapital Network are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2022 Institutional Capital Network, Inc. All Rights Reserved.

Wednesday, September 14th, 2022 and is filed under Industry Reporting

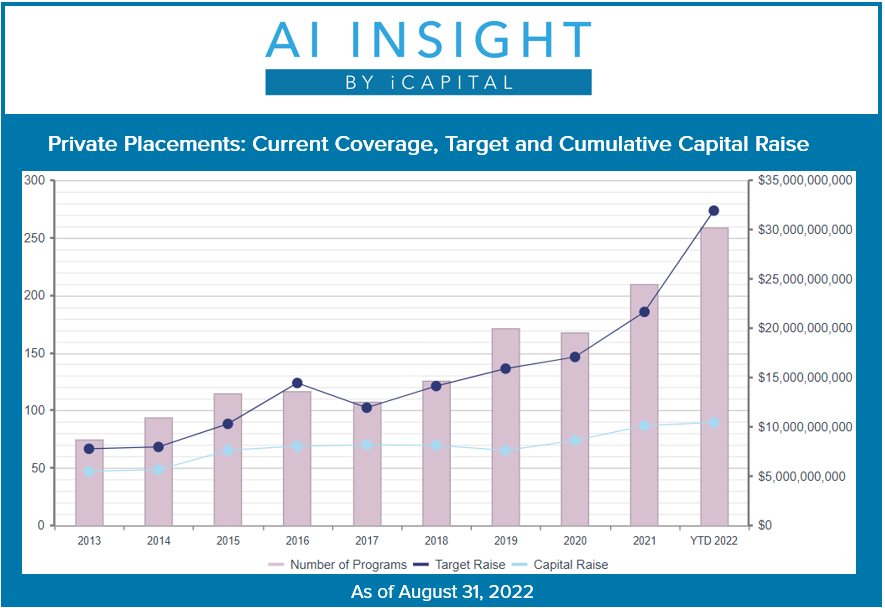

We recently released our August Private Placement Insights report. See the highlights from the report below, or if you are a Premium Reporting subscriber, log in now to see the entire report. If you don’t have access, you can request a free trial.

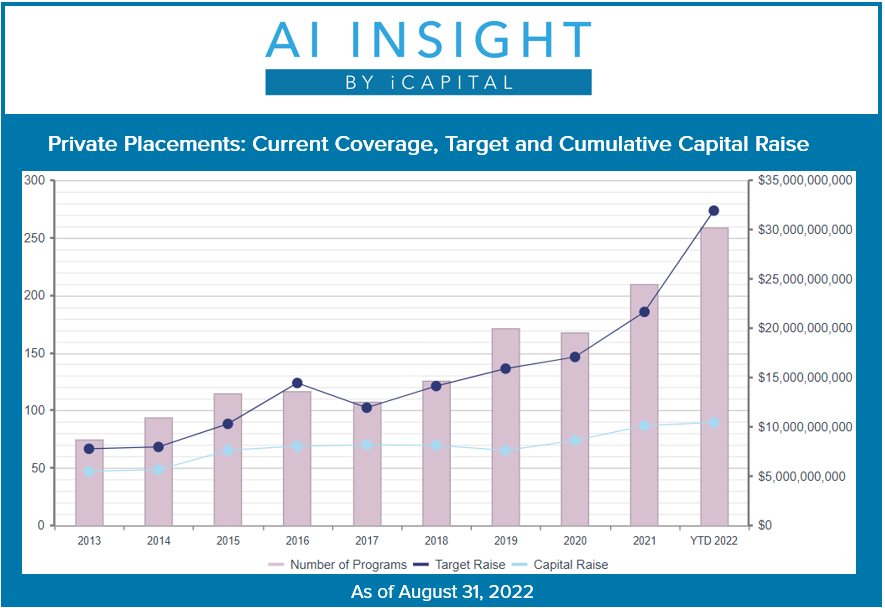

- 36 new private placements were added to our coverage in August, tying July as another record month. We have added more funds in all categories other than hedge funds this year compared to last, although activity is ramping up in that category with new funds coming soon. Real estate funds still lead in terms of funds added and raise targets. Non-tax-focused real estate LLCs, LPs, and private REITs are up 95% from a year ago and are seeking to raise 514% more. 1031 exchange additions have slowed recently although they are still up year-over-year, while we continue to see steady activity in Opportunity Zone fund additions.

- Overall, on a year-over-year basis, we have added more funds than last year (+31%), and these funds are targeting a larger amount of capital (+111%). We have also added nearly 30 new sponsor relationships across the categories. The increase in volume is indicative of the continued growth in alternative investment options for high-net-worth investors, as well as a focus on education within the space.

- As of September 1st, AI Insight covers 259 private placements currently raising capital, with an aggregate target raise of $31.9 billion and an aggregate reported raise of $10.4 billion or 34% of target.

- Real estate-related funds, including 1031s, Opportunity Zone funds, and non-1031 real estate LLCs, LPs, and private REITs represent the largest component of our private placement coverage at 68% of funds and 70% of target raise. Private equity/debt funds represent 16% of funds and 17% of target raise, although this does include 14 private market feeder funds that do not specify an offering target.

- In terms of coverage by general objective, income is the largest component at 56% of funds, while growth and growth & income follow at 26% and 18%, respectively.

- The average size of funds currently raising capital is $122.8 million (up from $117 million as of the beginning of August), ranging from $3.9 million for a specified Opportunity Zone fund to $2.5 billion for a private REIT focused on single-family housing.

- 73% of private placements we cover use the 506(b) exemption, 16% use 506(c), and 11% have not yet filed their Form D with the SEC.

- Twenty-three private placements closed to new investors in August and 176 have closed year-to-date. Funds that closed this year have been on the market for an average of 285 days and the 145 funds reporting, raised 83% of target on average.

- According to Pitchbook, private market fundraising has flattened since peaking pre-pandemic in 2019. However, first half 2022 levels are still on par with 2021, with the difference being fewer funds seeking a larger share of the raise. Larger funds continue to gain more share, taking in 33.6% of commitments in 2022 versus 22.1% in 2021. Additionally, successor funds are getting larger, with the median successor fund in private debt 90.3% larger than its predecessor, and median funds in real assets 87.7% larger than their prior funds. These bigger funds hold a larger percentage of dry powder than ever as well, which may translate into more take-private deals as these dollars are put to work and public market valuations have come down. On the flip side, first-time fundraisers have struggled this year, with the amount raised by new managers and the number of first-time funds well below 2021[1].

- Pitchbook also reports that private equity, private debt, and real estate strategies have taken less a share of the raise in the first half of 2022 compared to 2021, while real assets (excluding real estate) and venture capital strategies have taken a larger share[2].

For illustrative purposes only. Past performance is not indicative of future results.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, Non-Traded BDCs and Interval Funds. Receive up to 22 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of August 31, 2022, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose.

This material is confidential and the property of iCapital, and may not be shared with any party other than the intended recipient or his or her professional advisors. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital. This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security offered by Institutional Capital Network, Inc. or its affiliates (together “iCapital Network”). Past performance is not indicative of future results. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors. An investment in an alternative investment entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. The information contained herein is subject to change and is also incomplete. This industry information and its importance is an opinion only and should not be relied upon as the only important information available. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed, and iCapital Network assumes no liability for the information provided.

Products offered by iCapital Network are typically private placements that are sold only to qualified clients of iCapital Network through transactions that are exempt from registration under the Securities Act of 1933 pursuant to Rule 506(b) of Regulation D promulgated thereunder (“Private Placements”). An investment in any product issued pursuant to a Private Placement, such as the funds described, entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. Further, such investments are not subject to the same levels of regulatory scrutiny as publicly listed investments, and as a result, investors may have access to significantly less information than they can access with respect to publicly listed investments. Prospective investors should also note that investments in the products described involve long lock-ups and do not provide investors with liquidity.

Securities may be offered through iCapital Securities, LLC, a registered broker dealer, member of FINRA and SIPC and subsidiary of Institutional Capital Network, Inc. (d/b/a iCapital Network). These registrations and memberships in no way imply that the SEC, FINRA or SIPC have endorsed the entities, products or services discussed herein. iCapital and iCapital Network are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2022 Institutional Capital Network, Inc. All Rights Reserved.

[1] Source: Pitchbook, August 2022

[2] Source: Pitchbook, August 2022

Wednesday, August 10th, 2022 and is filed under Industry Reporting

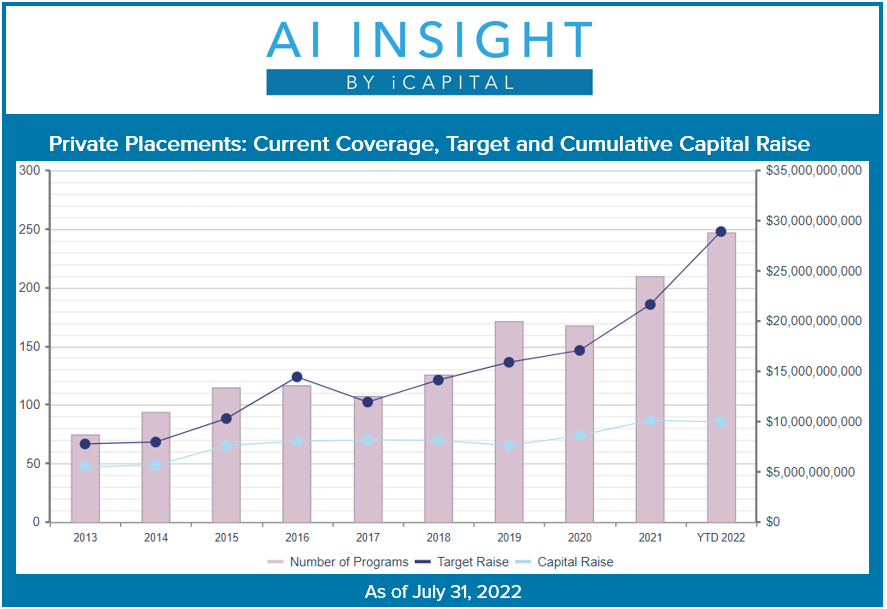

We recently released our July Private Placement Insights report. See the highlights from the report below, or if you are a Premium Reporting subscriber, log in now to see the entire report. If you don’t have access, you can request a free trial.

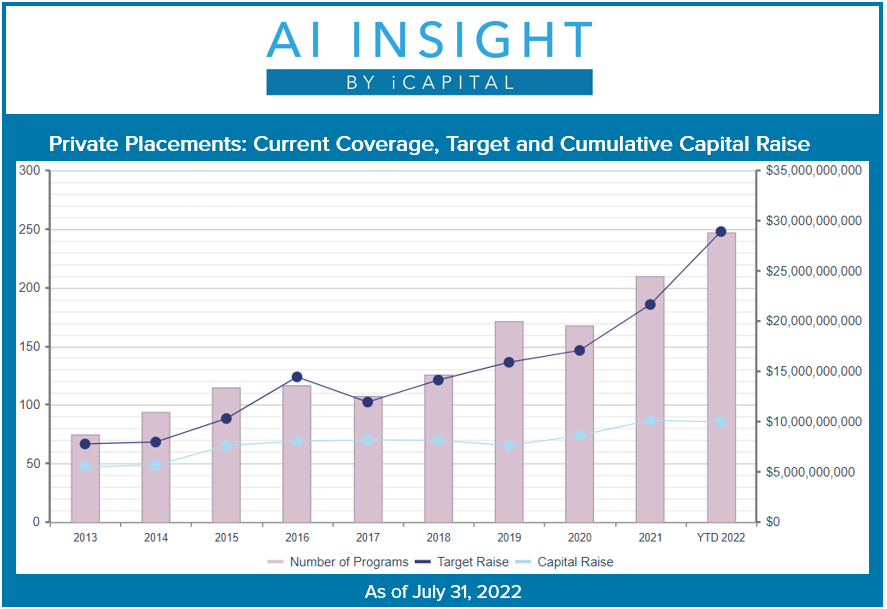

- 36 new private placements were added to our coverage in July, ahead of June and another record month. We have added more funds in all categories other than hedge funds this year compared to last, as some of the early lagging categories including energy, preferred securities, and private equity/debt have ramped up recently. 1031 exchange additions have slowed recently although they are still up year-over-year, while Opportunity Zone funds and the non-tax focused real estate funds are up significantly.

- Overall, on a year-over-year basis, we have added more funds than last year (+33%), and these funds are targeting a larger amount of capital (+97%). We have also added 27 new sponsor relationships across the categories.

- As of August 1st, AI Insight covers 247 private placements currently raising capital, with an aggregate target raise of $28.9 billion and an aggregate reported raise of $10 billion or 34% of target.

- Real estate-related funds, including 1031s, Opportunity Zone funds, and non-1031 real estate LLCs/LPs and private REITs represent the largest component of our private placement coverage at 70% of funds and 68% of target raise. Private equity/debt funds represent 15% of funds and 18% of target raise, although this does include 13 private market feeder funds that do not specify an offering target.

- In terms of coverage by general objective, income is the largest component at 56% of funds, while growth and growth & income follow at 27% and 17%, respectively.

- The average size of funds currently raising capital is $117 million, ranging from $4.0 million for a private managed futures fund to $2.5 billion for a private REIT focused on single-family housing.

- 71% of private placements we cover use the 506(b) exemption, 18% use 506(c) and 10% have not yet filed their Form D with the SEC.

- Sixteen private placements closed to new investors in June and 154 have closed year-to-date. Funds that closed this year have been on the market for an average of 255 days and the 145 funds reporting, raised 88% of target on average.

For illustrative purposes only. Past performance is not indicative of future results.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, Non-Traded BDCs and Interval Funds. Receive up to 22 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of July 31, 2022, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose.

This material is confidential and the property of iCapital, and may not be shared with any party other than the intended recipient or his or her professional advisors. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital. This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security offered by Institutional Capital Network, Inc. or its affiliates (together “iCapital Network”). Past performance is not indicative of future results. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors. An investment in an alternative investment entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. The information contained herein is subject to change and is also incomplete. This industry information and its importance is an opinion only and should not be relied upon as the only important information available. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed, and iCapital Network assumes no liability for the information provided.

Products offered by iCapital Network are typically private placements that are sold only to qualified clients of iCapital Network through transactions that are exempt from registration under the Securities Act of 1933 pursuant to Rule 506(b) of Regulation D promulgated thereunder (“Private Placements”). An investment in any product issued pursuant to a Private Placement, such as the funds described, entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. Further, such investments are not subject to the same levels of regulatory scrutiny as publicly listed investments, and as a result, investors may have access to significantly less information than they can access with respect to publicly listed investments. Prospective investors should also note that investments in the products described involve long lock-ups and do not provide investors with liquidity.

Securities may be offered through iCapital Securities, LLC, a registered broker dealer, member of FINRA and SIPC and subsidiary of Institutional Capital Network, Inc. (d/b/a iCapital Network). These registrations and memberships in no way imply that the SEC, FINRA or SIPC have endorsed the entities, products or services discussed herein. iCapital and iCapital Network are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2022 Institutional Capital Network, Inc. All Rights Reserved.

Tuesday, July 19th, 2022 and is filed under Industry Reporting

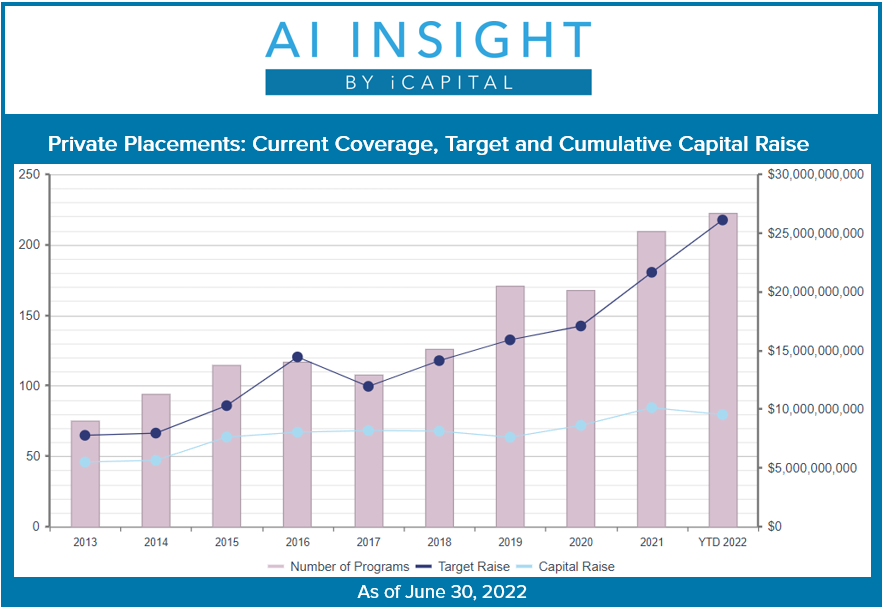

We recently released our June Private Placement Insights report. See the highlights from the report below, or if you are a Premium Reporting subscriber, log in now to see the entire report. If you don’t have access, you can request a free trial.

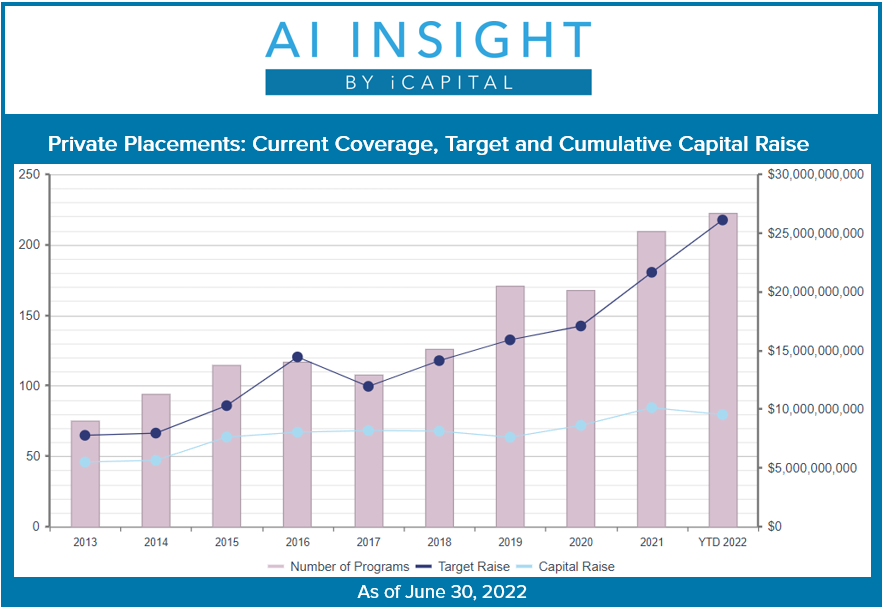

- 34 new private placements were added to our coverage in June, just one fund off from the prior month’s record. Real estate funds including tax-focused and other funds continued to lead the pack, although energy and private equity/debt strategies have seen upticks in recent months. On a year-over-year basis, we have added more funds than last year (+35%), and these funds are targeting a larger amount of capital (+99%).

- As of July 1st, AI Insight covers 223 private placements currently raising capital, with an aggregate target raise of $26.1 billion and an aggregate reported raise of $9.5 billion or 36% of target.

- Real estate-related funds, including 1031s, Opportunity Zone funds, and non-1031 real estate LLCs/LPs and private REITs represent the largest component of our private placement coverage at 71% of funds and 66% of target raise. Private equity/debt funds represent 13% of funds and 19% of target raise, although this does include seven private market feeder funds that do not specify an offering target.

- In terms of coverage by general objective, income is the largest component at 54% of funds, while growth and growth & income follow at 27% and 19%, respectively.

- The average size of the funds currently raising capital is $116 million, ranging from $4.0 million for a private managed futures fund to $2.5 billion for a private REIT focused on single family housing.

- 75% of private placements we cover use the 506(b) exemption, 16% use 506(c) and 9% have not yet filed their Form D with the SEC.

- Fourteen private placements closed to new investors in June and 139 have closed year-to-date. Funds that closed this year have been on the market for an average of 282 days and the 130 funds reporting raised 87% of target on average.

For illustrative purposes only. Past performance is not indicative of future results.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, Non-Traded BDCs and Interval Funds. Receive up to 22 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of June 30, 2022, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose.

This material is confidential and the property of iCapital, and may not be shared with any party other than the intended recipient or his or her professional advisors. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital. This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security offered by Institutional Capital Network, Inc. or its affiliates (together “iCapital Network”). Past performance is not indicative of future results. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors. An investment in an alternative investment entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. The information contained herein is subject to change and is also incomplete. This industry information and its importance is an opinion only and should not be relied upon as the only important information available. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed, and iCapital Network assumes no liability for the information provided.

Products offered by iCapital Network are typically private placements that are sold only to qualified clients of iCapital Network through transactions that are exempt from registration under the Securities Act of 1933 pursuant to Rule 506(b) of Regulation D promulgated thereunder (“Private Placements”). An investment in any product issued pursuant to a Private Placement, such as the funds described, entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. Further, such investments are not subject to the same levels of regulatory scrutiny as publicly listed investments, and as a result, investors may have access to significantly less information than they can access with respect to publicly listed investments. Prospective investors should also note that investments in the products described involve long lock-ups and do not provide investors with liquidity.

Securities may be offered through iCapital Securities, LLC, a registered broker dealer, member of FINRA and SIPC and subsidiary of Institutional Capital Network, Inc. (d/b/a iCapital Network). These registrations and memberships in no way imply that the SEC, FINRA or SIPC have endorsed the entities, products or services discussed herein. iCapital and iCapital Network are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2022 Institutional Capital Network, Inc. All Rights Reserved.

Wednesday, June 22nd, 2022 and is filed under Industry Reporting

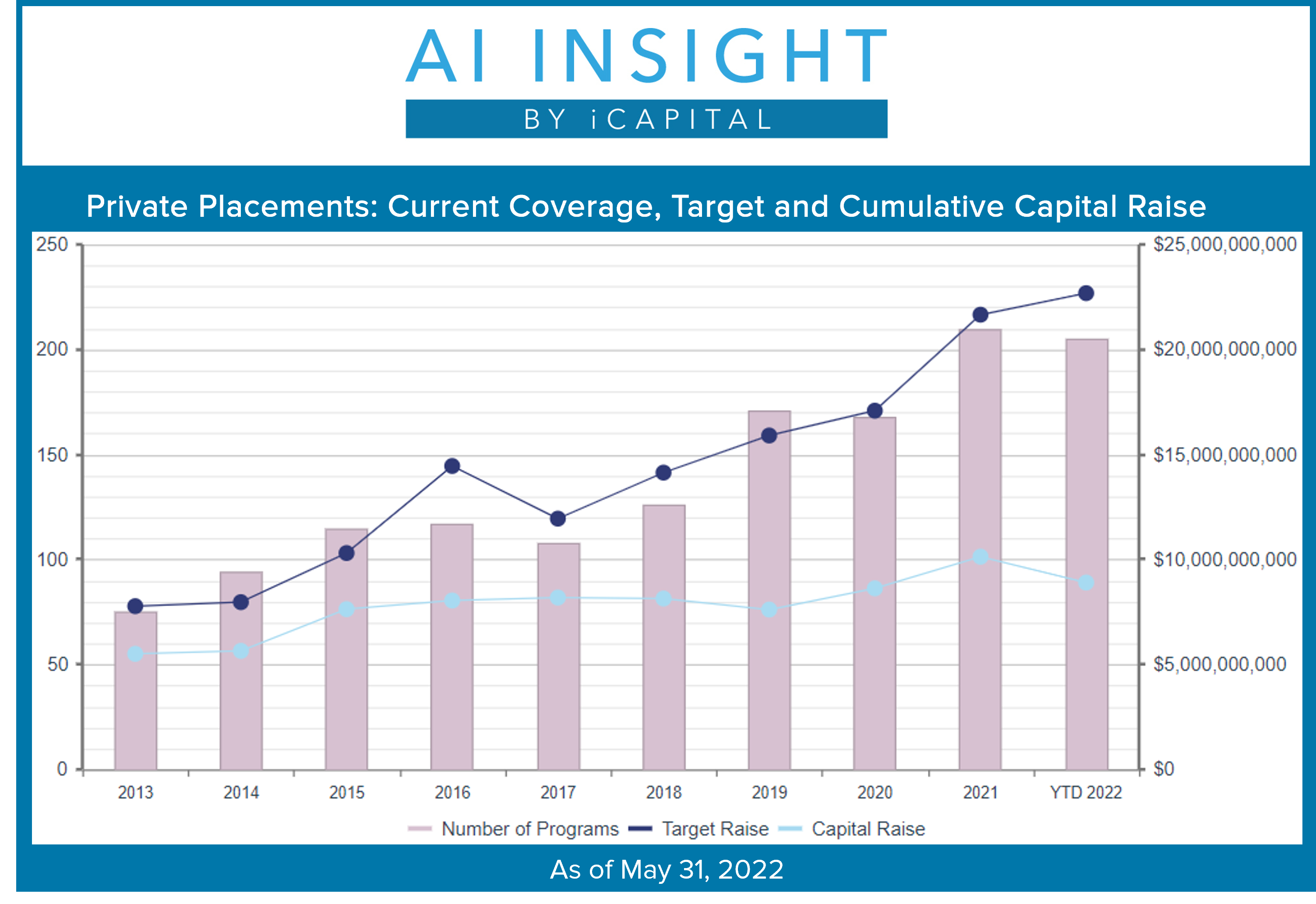

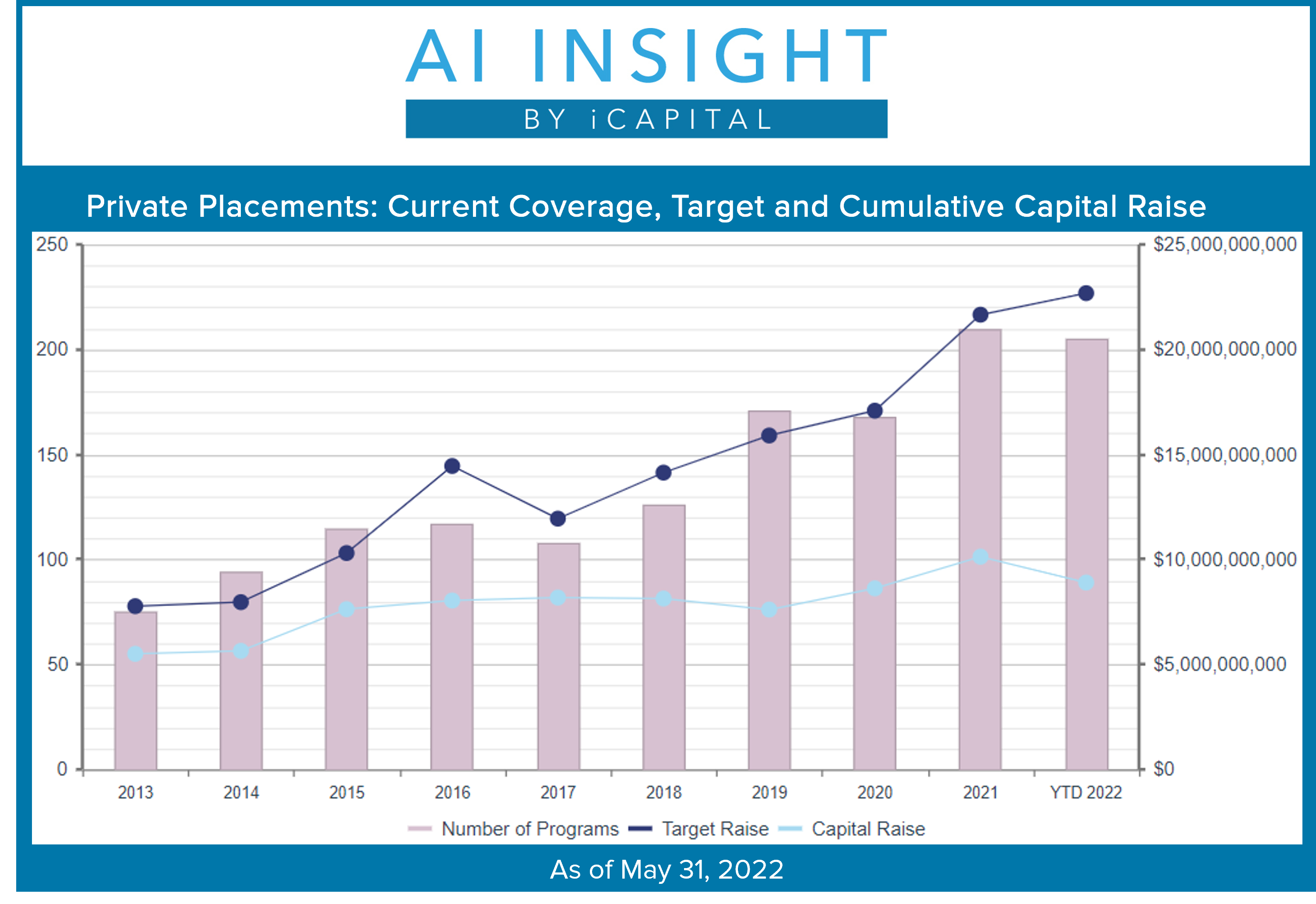

We recently released our May Private Placement Insights report. See the highlights from the report below, or if you are a Premium Reporting subscriber, log in now to see the entire report. If you don’t have access, you can request a free trial.

- 35 new private placements were added to our coverage in May, a record month with all but one category (managed futures) seeing additions. On a year-over-year basis, we have added more funds than last year (+29%), and these funds are targeting a larger amount of capital (+70%).

- Activity this year is led by all of the real estate categories, including Opportunity Zones, real estate LLCs/LPs, private non-traded REITs, and 1031 exchanges. Energy activity is slow on an absolute basis but is up from last year’s anemic levels. Activity has slowed in the private equity/debt and hedge fund categories.

- As of June 1st, AI Insight covers 205 private placements currently raising capital, with an aggregate target raise of $22.7 billion and an aggregate reported raise of $8.9 billion or 39% of target.

- Real estate-related funds, including 1031s, Opportunity Zone funds, and non-1031 real estate LLCs/LPs and private REITs represent the largest component of our private placement coverage at 73% of funds and 62% of target raise. Private equity/debt funds represent 13% of funds and 22% of target raise, although this does include seven private market feeder funds that do not specify an offering target.

- In terms of coverage by general objective, income is the largest component at 55% of funds, while growth and growth & income follow at 26% and 19%, respectively.

- The average size of the funds currently raising capital is $110 million, ranging from $4.0 million for a private managed futures fund to $2.0 billion for a private BDC.

- 78% of private placements we cover use the 506(b) exemption, 16% use 506(c) and 6% have not yet filed their Form D with the SEC.

- 27 private placements closed to new investors in May and 125 have closed year-to-date. Funds that closed this year have been on the market for an average of 273 days and reported they raised 81% of target on average.

For illustrative purposes only.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, Non-Traded BDCs and Interval Funds. Receive up to 22 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of May 31, 2022, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security offered by Institutional Capital Network, Inc. or its affiliates (together “iCapital Network”). Past performance is not indicative of future results. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors. An investment in an alternative investment entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. The information contained herein is subject to change and is also incomplete. This industry information and its importance is an opinion only and should not be relied upon as the only important information available. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed, and iCapital Network assumes no liability for the information provided.

Products offered by iCapital Network are typically private placements that are sold only to qualified clients of iCapital Network through transactions that are exempt from registration under the Securities Act of 1933 pursuant to Rule 506(b) of Regulation D promulgated thereunder (“Private Placements”). An investment in any product issued pursuant to a Private Placement, such as the funds described, entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. Further, such investments are not subject to the same levels of regulatory scrutiny as publicly listed investments, and as a result, investors may have access to significantly less information than they can access with respect to publicly listed investments. Prospective investors should also note that investments in the products described involve long lock-ups and do not provide investors with liquidity.

Securities may be offered through iCapital Securities, LLC, a registered broker dealer, member of FINRA and SIPC and subsidiary of Institutional Capital Network, Inc. (d/b/a iCapital Network). These registrations and memberships in no way imply that the SEC, FINRA or SIPC have endorsed the entities, products or services discussed herein. iCapital and iCapital Network are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2022 Institutional Capital Network, Inc. All Rights Reserved.

Wednesday, May 18th, 2022 and is filed under Industry Reporting

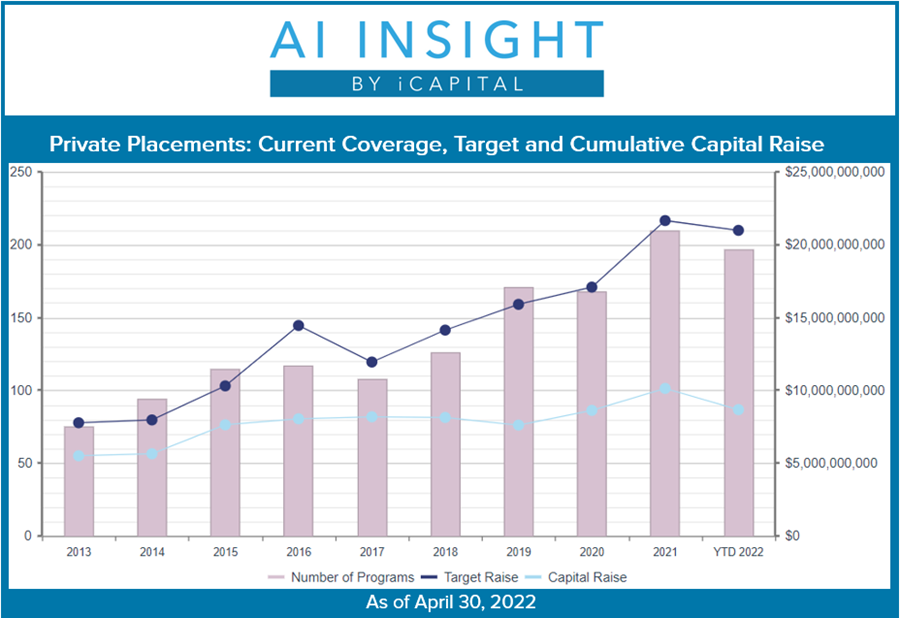

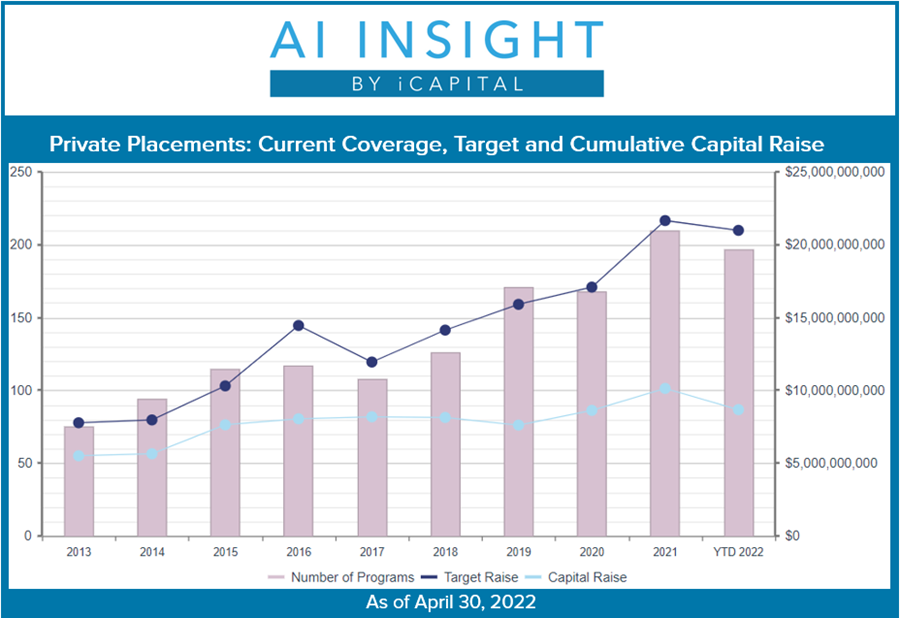

We recently released our April Private Placement Insights report. See the highlights from the report below, or if you are a Premium Reporting subscriber, log in now to see the entire report. If you don’t have access, you can request a free trial.

- 23 new private placements were added to our coverage in April, slower than prior months. On a year-over-year basis, however, we have added more funds than last year (+15%), and these funds are targeting a larger amount of capital (+51%).

- Activity this year is led by the real estate categories, including Opportunity Zones, real estate LLCs/LPs, private non-traded REITs, and 1031 exchanges. Activity has slowed in the private equity/debt and hedge fund categories while activity within the energy, managed futures, and preferred segments are flat year-over-year.

- As of May 1st, AI Insight covers 197 private placements currently raising capital, with an aggregate target raise of $21 billion and an aggregate reported raise of $9 billion or 43% of target.

- Real estate-related funds, including 1031s, Opportunity Zone funds, and non-1031 real estate LLCs/LPs and private REITs represent the largest component of our private placement coverage at 75% of funds and 61% of target raise. Private equity/debt funds represent 13% of funds and 24% of target raise, although this does include six private market feeder funds that do not specify an offering target.

- In terms of coverage by general objective, income is the largest component at 55% of funds, while growth and growth & income follow at 30% and 16%, respectively.

- The average size of the funds currently raising capital is $107 million, ranging from $4.0 million for a private managed futures fund to $2.0 billion for a private BDC.

- 77% of private placements we cover use the 506(b) exemption, 14% use 506(c) and 9% have not yet filed their Form D with the SEC.

- 22 private placements closed to new investors in April and 101 have closed year-to-date. Funds that closed this year have been on the market for an average of 272 days and reported they raised 78% of target on average.

For illustrative purposes only.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, Non-Traded BDCs and Interval Funds. Receive up to 22 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of April 30, 2022, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security offered by Institutional Capital Network, Inc. or its affiliates (together “iCapital Network”). Past performance is not indicative of future results. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors. An investment in an alternative investment entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. The information contained herein is subject to change and is also incomplete. This industry information and its importance is an opinion only and should not be relied upon as the only important information available. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed, and iCapital Network assumes no liability for the information provided.

Products offered by iCapital Network are typically private placements that are sold only to qualified clients of iCapital Network through transactions that are exempt from registration under the Securities Act of 1933 pursuant to Rule 506(b) of Regulation D promulgated thereunder (“Private Placements”). An investment in any product issued pursuant to a Private Placement, such as the funds described, entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. Further, such investments are not subject to the same levels of regulatory scrutiny as publicly listed investments, and as a result, investors may have access to significantly less information than they can access with respect to publicly listed investments. Prospective investors should also note that investments in the products described involve long lock-ups and do not provide investors with liquidity.

Securities may be offered through iCapital Securities, LLC, a registered broker dealer, member of FINRA and SIPC and subsidiary of Institutional Capital Network, Inc. (d/b/a iCapital Network). These registrations and memberships in no way imply that the SEC, FINRA or SIPC have endorsed the entities, products or services discussed herein. iCapital and iCapital Network are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2022 Institutional Capital Network, Inc. All Rights Reserved.

Tuesday, April 12th, 2022 and is filed under Industry Reporting

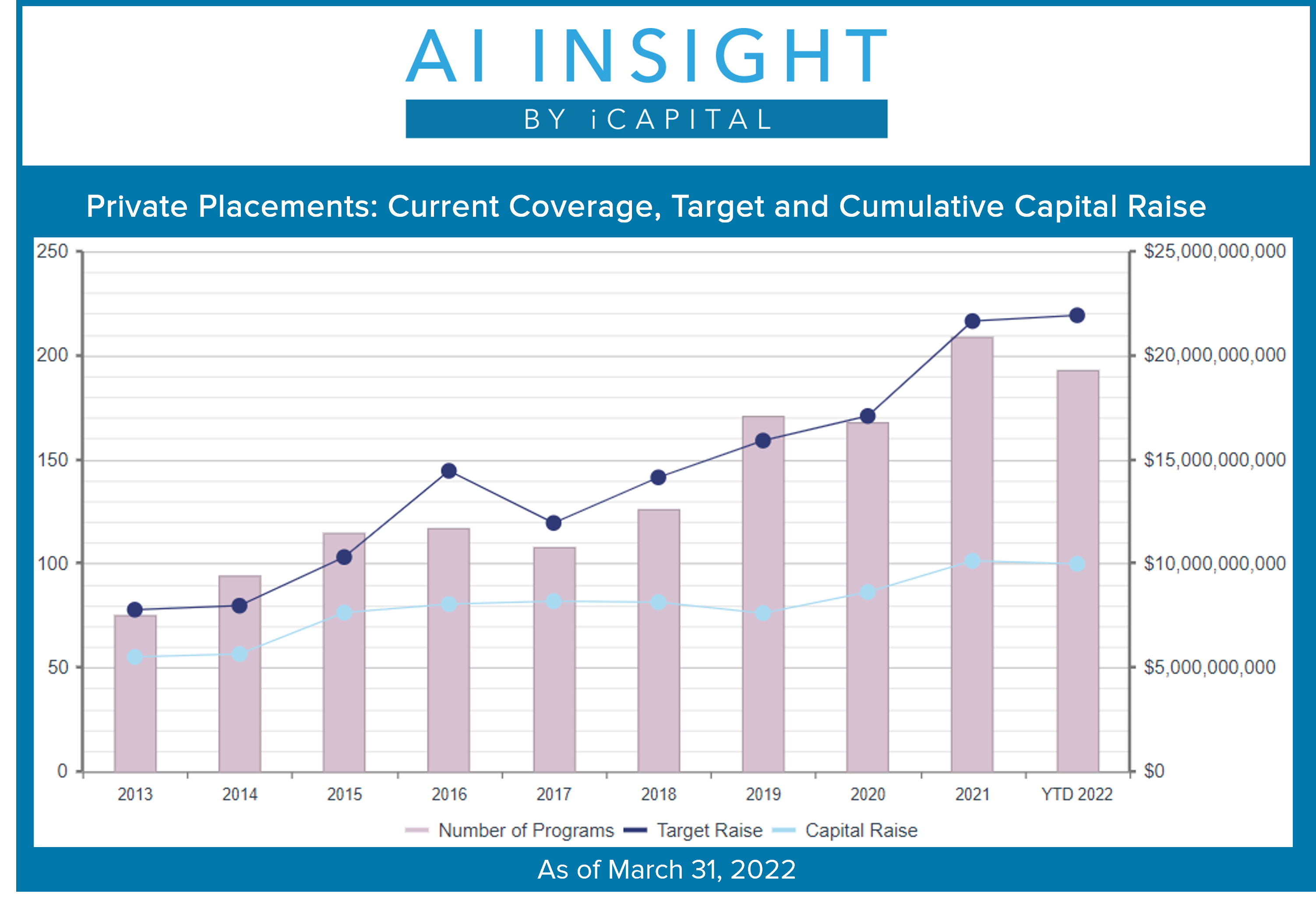

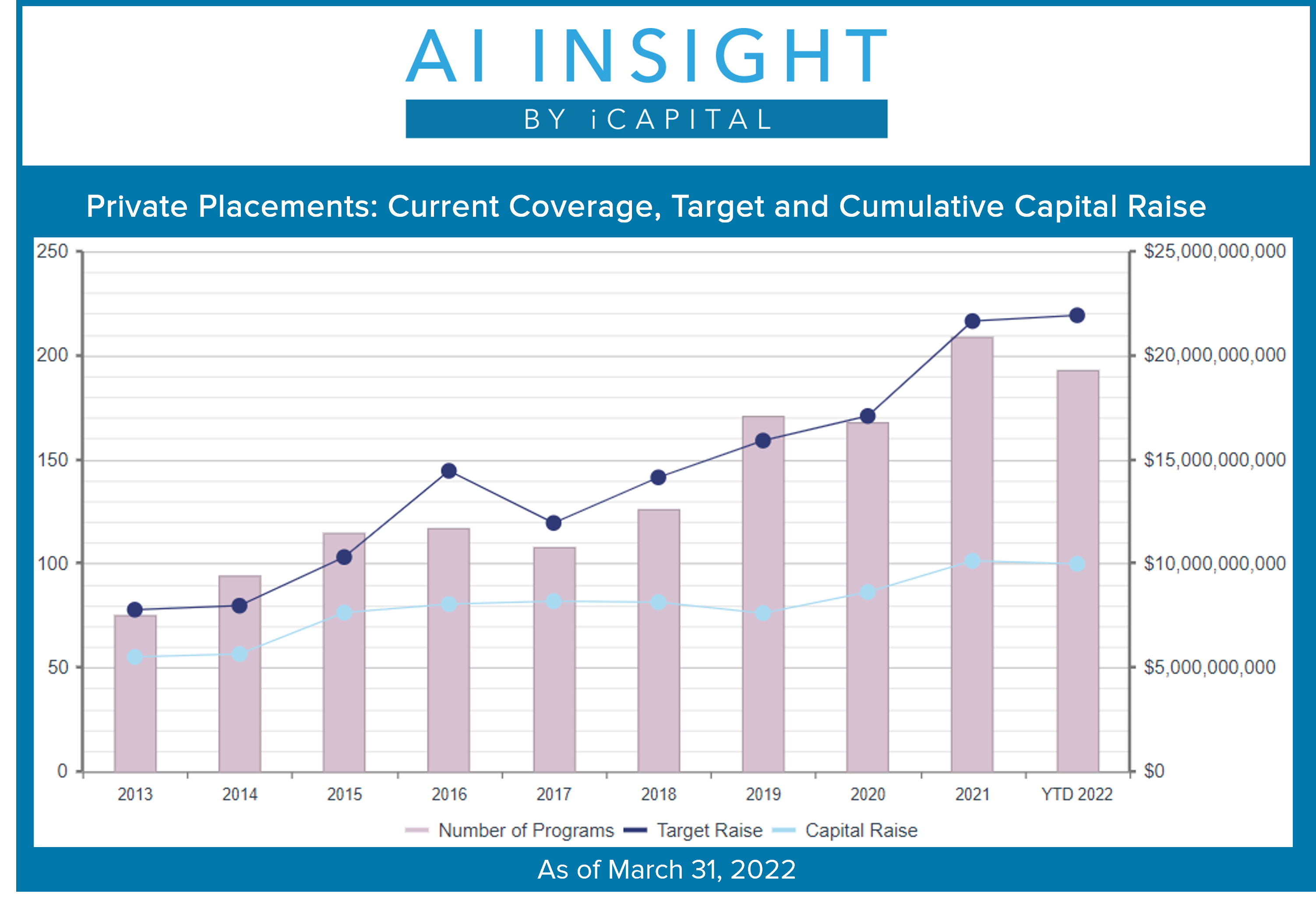

We recently released our March Private Placement Insights report. See the highlights from the report below, or if you are a Premium Reporting subscriber, log in now to see the entire report. If you don’t have access, you can request a free trial.

- 25 new private placements were added to our coverage in March, higher than prior months but still slower than the Q3 and Q4 2021 record levels. On a year-over-year basis we have added roughly the same amount of funds as last year (-2%), but these funds are targeting a larger amount of capital (+49%).

- Activity this year is led by the real estate categories, including 1031 exchanges, real estate LLCs/LPs, private non-traded REITs, and recently Opportunity Zone funds. Activity has slowed in the private equity/debt and hedge fund categories while activity within the energy, hedge fund, and preferred segments are flat year-over-year.

- As of April 1st, AI Insight covers 193 private placements currently raising capital, with an aggregate target raise of $21.9 billion and an aggregate reported raise of $10.0 billion or 46% of target.

- Real estate-related funds, including 1031s, Opportunity Zone funds, and non-1031 real estate LLCs/LPs and private REITs represent the largest component of our private placement coverage at 74% of funds and 62% of target raise. Private equity/debt funds represent 13% of funds and 23% of target raise, although this does include seven private market feeder funds that do not specify an offering target.

- In terms of our coverage by general objective, income is the largest component at 55% of funds, while growth and growth & income follow at 29% and 16%, respectively.

- The average size of the funds currently raising capital is $114.0 million, ranging from $8.0 million for a specified real estate fund to $2.0 billion for a private BDC.

- 77% of private placements we cover use the 506(b) exemption, 14% use 506(c) and 9% have not yet filed their Form D with the SEC.

- 25 private placements closed to new investors in March and 78 have closed year-to-date. Funds that closed this year have been on the market for an average of 263 days and reported they raised 83% of target on average.

For illustrative purposes only.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, Non-Traded BDCs and Interval Funds. Receive up to 22 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of March 31, 2022, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security offered by Institutional Capital Network, Inc. or its affiliates (together “iCapital Network”). Past performance is not indicative of future results. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors. An investment in an alternative investment entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. The information contained herein is subject to change and is also incomplete. This industry information and its importance is an opinion only and should not be relied upon as the only important information available. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed, and iCapital Network assumes no liability for the information provided.

Products offered by iCapital Network are typically private placements that are sold only to qualified clients of iCapital Network through transactions that are exempt from registration under the Securities Act of 1933 pursuant to Rule 506(b) of Regulation D promulgated thereunder (“Private Placements”). An investment in any product issued pursuant to a Private Placement, such as the funds described, entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. Further, such investments are not subject to the same levels of regulatory scrutiny as publicly listed investments, and as a result, investors may have access to significantly less information than they can access with respect to publicly listed investments. Prospective investors should also note that investments in the products described involve long lock-ups and do not provide investors with liquidity.

Securities may be offered through iCapital Securities, LLC, a registered broker dealer, member of FINRA and SIPC and subsidiary of Institutional Capital Network, Inc. (d/b/a iCapital Network). These registrations and memberships in no way imply that the SEC, FINRA or SIPC have endorsed the entities, products or services discussed herein. iCapital and iCapital Network are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2022 Institutional Capital Network, Inc. All Rights Reserved.

Thursday, March 17th, 2022 and is filed under Industry Reporting

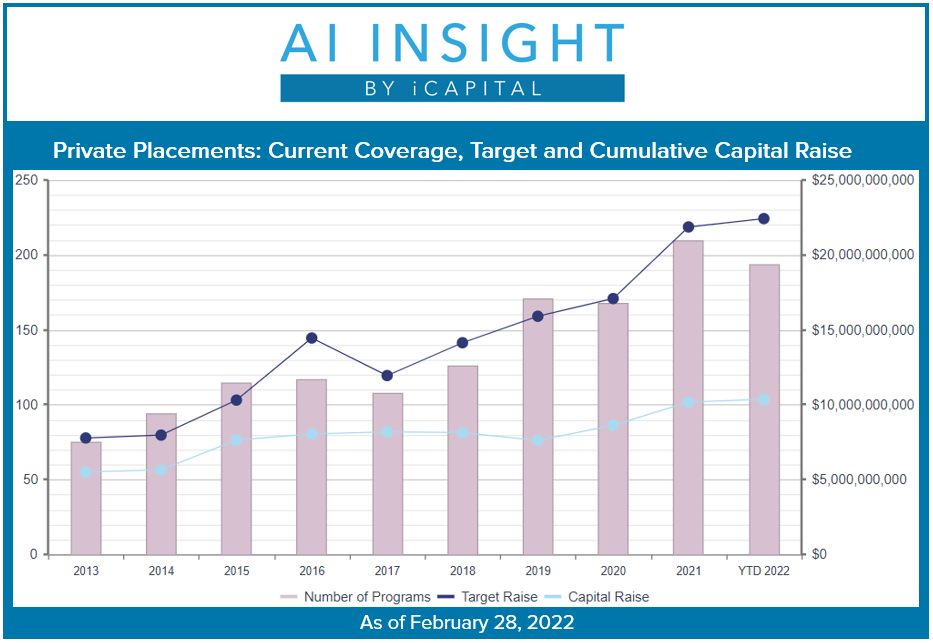

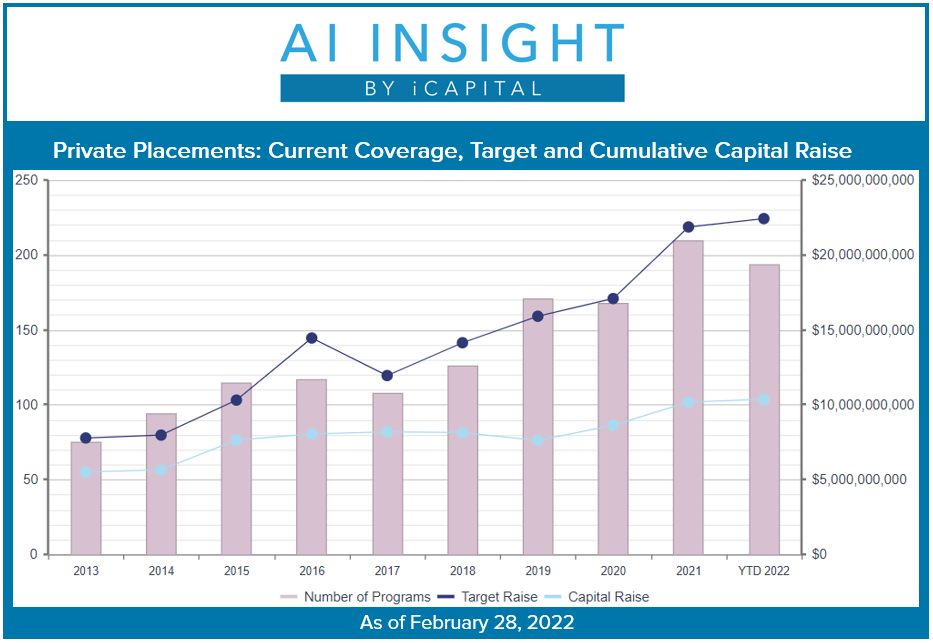

We recently released our February Private Placement Insights report. See the highlights from the report below, or if you are a Premium Reporting subscriber, log in now to see the entire report. If you don’t have access, you can request a free trial.

- 19 new private placements were added to our coverage in February, on par with January though slower than the Q3 and Q4 2021 record levels. On a year-over-year basis we have added roughly the same amount of funds as last year (+3%), but these funds are targeting a larger amount of capital (+87%).

- Activity this year is led by the real estate categories, including 1031 exchanges, real estate LLCs, LPs, and private non-traded REITs. One large Opportunity Zone added in January has kept availability in this category strong, although the addition of one new fund can hardly be considered a win. Activity has slowed in the private equity/debt category while activity within the energy, hedge fund, and preferred segments are flat year-over-year.

- As of March 1st, AI Insight covers 194 private placements currently raising capital, with an aggregate target raise of $22.4 billion and an aggregate reported raise of $10.4 billion or 46% of target.

- Real estate-related funds, including 1031s, Opportunity Zones, and non-1031 real estate LLCs/LPs and private REITs represent the largest component of our private placement coverage at 73% of funds and 63% of target raise. Private equity/debt funds represent 13% of funds and 24% of target raise, although this does include four private market feeder funds that do not specify an offering target.

- In terms of our coverage by general objective, income is the largest component at 56% of funds, while growth and growth & income follow at 28% and 17%, respectively.

- The average size of the funds currently raising capital is $108.0 million, ranging from $5.0 million for a specified real estate fund to $2.0 billion for a private BDC.

- 77% of private placements we cover use the 506(b) exemption, 14% use 506(c) and 9% have not yet filed their Form D with the SEC.

- 20 private placements closed to new investors in February and 53 have closed year-to-date. Funds that closed this year have been on the market for an average of 205 days and reported that they raised 87% of target on average.

For illustrative purposes only.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, Non-Traded BDCs and Interval Funds. Receive up to 22 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of February 28, 2022, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security offered by Institutional Capital Network, Inc. or its affiliates (together “iCapital Network”). Past performance is not indicative of future results. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors. An investment in an alternative investment entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. The information contained herein is subject to change and is also incomplete. This industry information and its importance is an opinion only and should not be relied upon as the only important information available. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed, and iCapital Network assumes no liability for the information provided.

Products offered by iCapital Network are typically private placements that are sold only to qualified clients of iCapital Network through transactions that are exempt from registration under the Securities Act of 1933 pursuant to Rule 506(b) of Regulation D promulgated thereunder (“Private Placements”). An investment in any product issued pursuant to a Private Placement, such as the funds described, entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. Further, such investments are not subject to the same levels of regulatory scrutiny as publicly listed investments, and as a result, investors may have access to significantly less information than they can access with respect to publicly listed investments. Prospective investors should also note that investments in the products described involve long lock-ups and do not provide investors with liquidity.

Securities may be offered through iCapital Securities, LLC, a registered broker dealer, member of FINRA and SIPC and subsidiary of Institutional Capital Network, Inc. (d/b/a iCapital Network). These registrations and memberships in no way imply that the SEC, FINRA or SIPC have endorsed the entities, products or services discussed herein. iCapital and iCapital Network are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2022 Institutional Capital Network, Inc. All Rights Reserved.