AI Insight Enhanced Reporting Capabilities

Thursday, August 30th, 2018 and is filed under AI Insight News

We recently enhanced our reporting capabilities for non-traded REITs to include the ability to sort and review programs by their investment structure, strategy, and primary sector allocation. These enhancements allow subscribers to more efficiently run comparative reports on programs with similar structures and strategies.

Structure

The first enhancement allows you to sort programs by their investment structure – lifecycle or perpetual.

Lifecycle REITs:

- Are intended to have a finite life with distinct stages as a new portfolio is built.

- Typically target a timeframe of five to seven years, with phases including capital raise, growth, maturation, and liquidation.

- Can be purchased only during the capital raise phase at a set public offering price and their NAV is determined no later than 150 days following the second anniversary of breaking escrow. Redemption options for lifecycle REITs are limited until the liquidation phase.

Perpetual REITs:

- Are intended to be managed for a long period of time with no set liquidity phase.

- Many include language in their offering documents that allow for a liquidation, including converting to a publicly traded REIT, but the goal is less about the liquidation than the management of the portfolio.

- Can be purchased or redeemed at any time at the most recent NAV, which is typically determined either monthly or quarterly, however, limitations still apply.

As of August 28th, 2018, the open non-traded REITs on the AI Insight platform include nine perpetual REITs and 12 lifecycle REITs. Based on first quarter 2018 data, the nine perpetual REITs represented 75% of total assets.

Strategy

The second enhancement allows you to sort programs by their investment strategy, which helps to define a program’s risk and return characteristics. The non-traded REITs on the AI Insight platform fall into one of the following five categories, which are based on definitions from CAIA and Preqin: Core, Core-Plus, Value-Add, and Opportunistic. Core programs are theoretically lower risk with lower return potential while opportunistic programs may provide higher returns with higher risk. AI Insight also includes mortgage REITs as an investment strategy, which have a distinct risk return profile.

- Core: Core strategies look to acquire assets that achieve a relatively high percentage of their return from income and are expected to have lower volatility. These tend to be the most liquid, most developed, most recognizable assets in a portfolio. The majority of returns come from cash flows with little appreciation expected. As of August 28th, 2018, there were 13 open programs on the AI Insight platform with a Core investment strategy, representing 84% of NTR AUM.

- Core-Plus: Core-Plus real estate funds invest in moderate risk real estate that provides moderate returns. Investments are predominantly core but with an emphasis on a modest value add approach. These funds typically focus on the main property types in both primary and secondary markets, investing in class A or lower quality buildings that require some form of enhancement. As of August 28th, 2018, there were five open programs on the AI Insight platform with a Core-Plus investment strategy representing 14% of NTR AUM.

- Value-Add: Value-Add programs look to acquire assets that have one or more of the following attributes: (i) achieving a substantial portion of returns from appreciation, (ii) moderate volatility, and (iii) not having the reliability of core properties. This can include hotels, resorts, assisted care living facilities, hospitals, storage, data centers, etc. These properties require a sub-specialty within the real estate market to be managed well and can involve repositioning, renovation or redevelopment. These programs focus on growth and income where opportunities created by dislocation and inefficiencies within segments are capitalized upon to enhance returns. As of August 28th, 2018, there were three open Value-Add programs on the AI Insight platform, representing 0.8% of NTR AUM.

- Opportunistic: Opportunistic programs look to acquire assets that have little or no current cash flow and will derive a substantial part of their return from appreciation. These funds tend to have more equity like characteristics, may have high rollover risk and less liquidity. These are generally distressed properties, new development properties or properties in emerging markets. As of August 28th, 2018, there were no open Opportunistic programs on the AI Insight platform.

- Mortgage: Mortgage programs invest substantially all of their capital raised in commercial real estate mortgages, debt or other real estate fixed income securities. As of August 28th, 2018, there were two open mortgage focused programs on the AI Insight platform representing 0.5% of NTR AUM.

For more information on the characteristics of each of the investment strategies, click here and here.

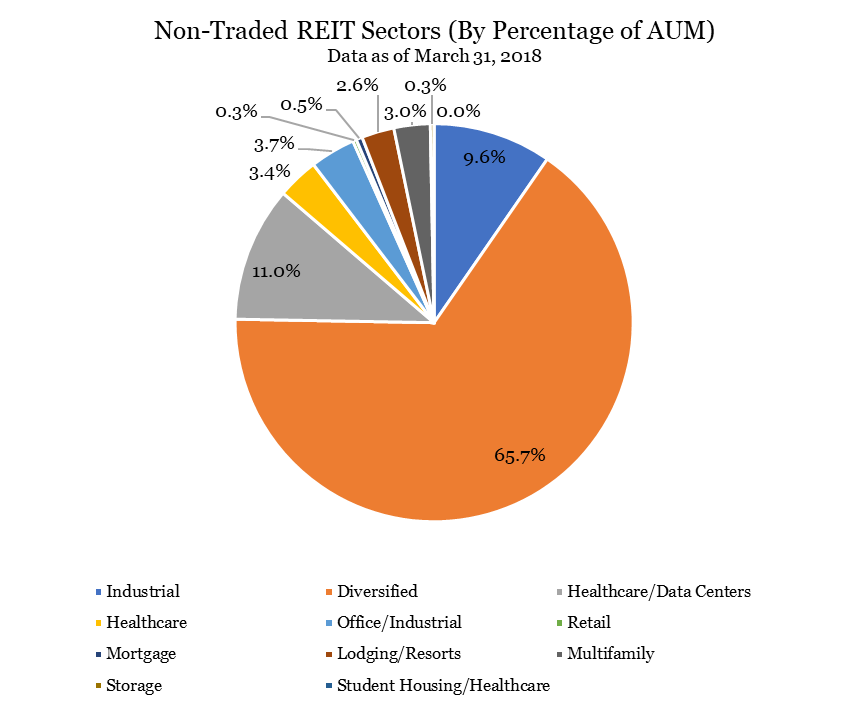

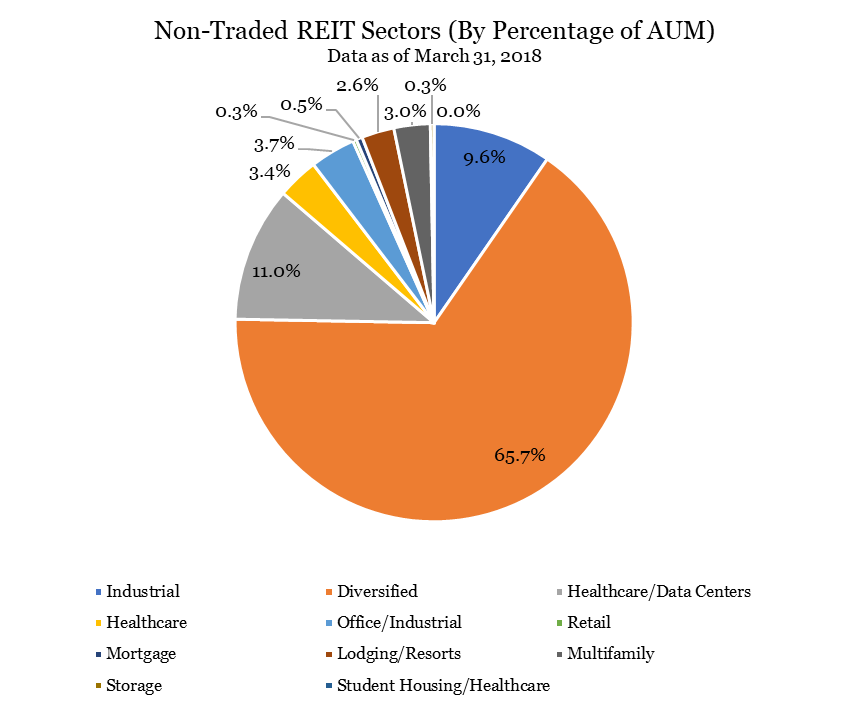

Sector

While the AI Insight platform has always included a sector review, we have streamlined this section to highlight each program’s overarching sector or sectors. This allows subscribers to more efficiently compare and sort programs within each of the primary sector categories. The included pie chart illustrates the allocation to the different sectors for open NTRs on the AI Insight platform with data as of Q1 2018.

Access

Subscribers to the AI Insight platform can access, download, and customize the data related to non-traded REITs on the AI Insight website, using comparative reports and the financial performance reporting tools.

Chart Source: AI Insight