Private Placement Industry Insights as of May 31, 2020

Monday, June 8th, 2020 and is filed under Industry Reporting

We recently released our May Private Placement Insights report. See the highlights from the report below, or if you are a Premium Reporting subscriber, log in now to see the entire report. If you don’t have access, you can request a free trial.

- Private placement fund formation has slowed in the wake of COVID-19. Eight new private placements were added to our coverage in May, roughly half of the monthly level we’ve seen on average over the last few years. The first few months of 2020 were strong but with the slowdown in May, we are now flat in terms of new funds added to over coverage year-over-year and down modestly in aggregate target raise.

- The slowdown was most visible in the 1031 category, where only four new funds were added to our coverage in May compared to well over double digit additions for the last several years. This may be partially due to a slowdown in real estate transactions overall as well as a lack of confidence in valuations. Also, fewer highly appreciated properties are being sold right now, which reduces the demand for 1031 exchanges at least in the near-term. The consensus in the industry is that demand will accelerate once transaction activity resumes and valuations are more reliable.

- We are seeing more activity this year in preferred securities and private equity/debt funds, and we are also starting to see sector-specific opportunistic funds ramp up in the wake of the COVID-19 market disruption. Opportunity zone (QOZ) funds, which had paused for several months, are back on track with three in the queue to be added to our coverage soon. Recent events around the US could continue to highlight the importance of QOZ strategies.

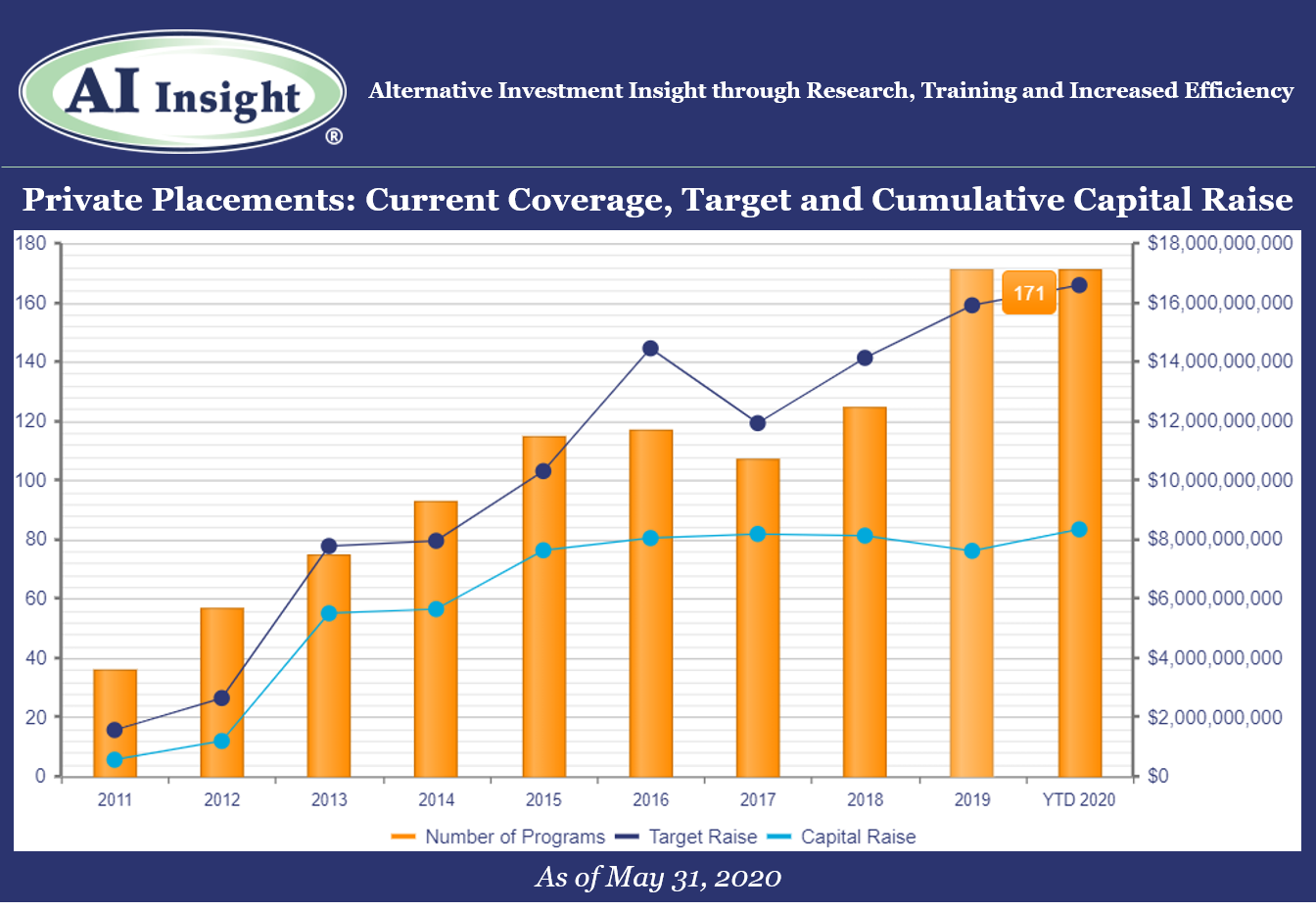

- As of June 1st, AI Insight covers 171 private placements currently raising capital, with an aggregate target raise of $16.6 billion and an aggregate reported raise of $8.3 billion or 50% of target. The average size of the current funds is $97.0 million, ranging from $3.5 million for a single asset real estate fund to $2.7 billion for a sector specific private equity/debt fund.

- 14 private placements closed in May, having raised approximately 52% of their target and having been on the market for an average of 336 days.

- Five private placements suspended offerings due to uncertainties related to COVID-19.

- ON DECK: as of June 1st, there were four new private placements coming soon.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, BDCs, Closed-End Funds, and Alternative Mutual Funds. Receive up to 24 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of May 31, 2020, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose. Copyright ©2020 AI Insight. All Rights Reserved.