Are advisors prepared for the evolution of Alternative Mutual Funds?

Thursday, February 7th, 2019 and is filed under AI Insight News

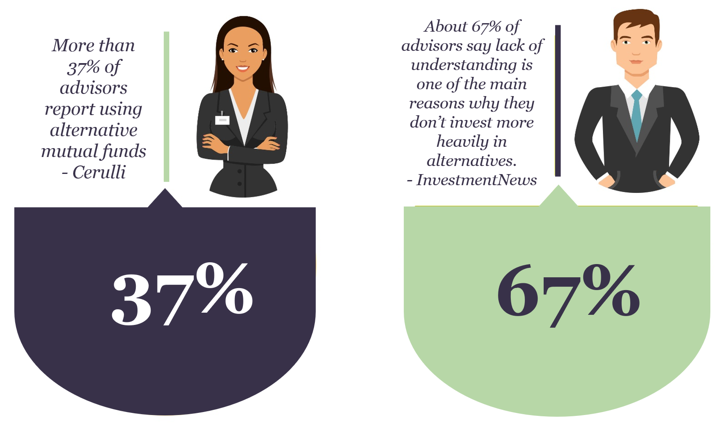

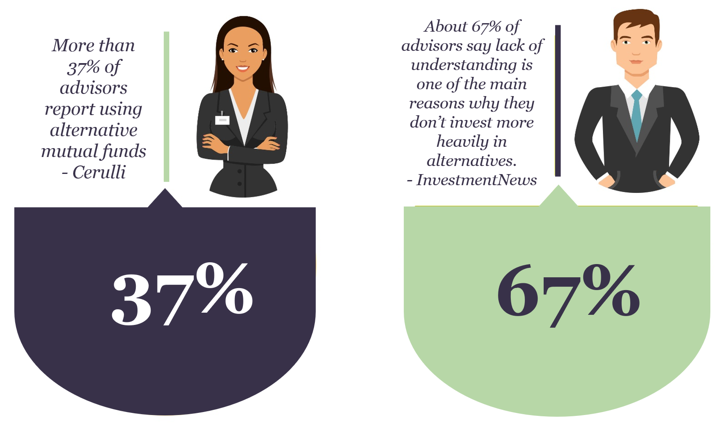

More advisors are working with alternatives as they become more accessible to average investors through the recent evolution of Alternative Mutual Funds. Cerulli’s recent report, “U.S. Alternative Investments 2018: Accessing Evolving Alternative Platforms“, focuses on trends in the U.S. alternative asset market. It concludes that more than 37% of advisors are working with alternative mutual funds.

However, other data tells us that advisors may not have the resources they need to research and apply alternative mutual funds in their practices. According to Investment News, about 67% of advisors say lack of understanding is one of the main reasons why they don’t use alternatives more frequently in their asset allocation models.

Get started now with 3 easy steps to help advisors understand the complexities of alternative mutual funds and help them remain regulatory-compliant.

- First, take 3 minutes to read this Q&A and gain a basic understanding of how Alternative Mutual Funds differ from traditional funds, learn how to address regulatory requirements and view our extensive list of resources.

- Next, take the CE course, “Introduction to Alternative Mutual Funds“ to understand key aspects, benefits and risks of these complex products.

- Finally, request a demo customized to your business needs to take a closer look at how an alternative-centered focus on research on various strategies including managed futures, long-short, market neutral and alternative allocation can help create efficiencies in your business.