Non-Traded REIT Industry Capital Raise Early Insights – Full Year 2017

Monday, April 16th, 2018 and is filed under AI Insight News

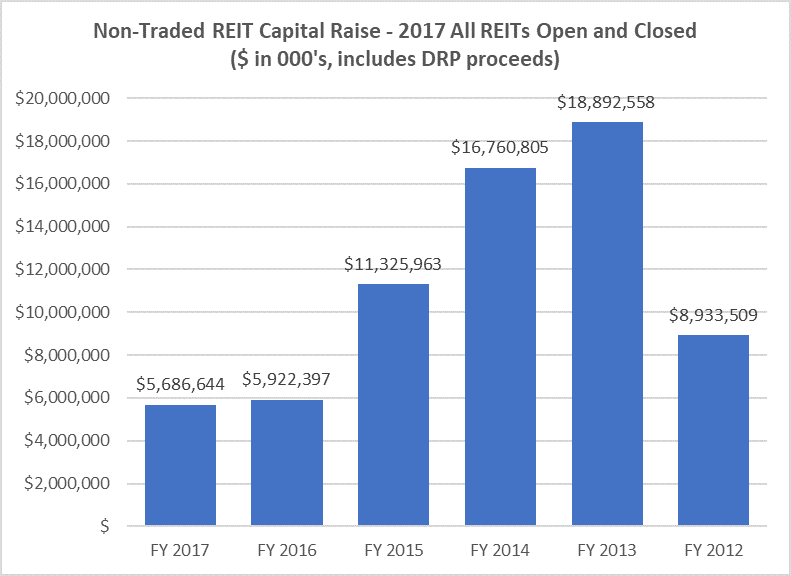

- Non-traded REITs raised $6.6 billion in 2017, an increase over the $5.9 billion raised in 2016 when including DRP and merger proceeds from open and closed programs.

- The $6.6 billion includes $921.9 million from the merger of American Finance Trust, Inc. with Retail Centers of America (RCA). Removing this would reflect a total capital raise for the year of $5.7 billion.

- Approximately $4.3 billion was raised by REITs actively raising capital during the year, with the remainder raised through dividend reinvestment in closed programs.

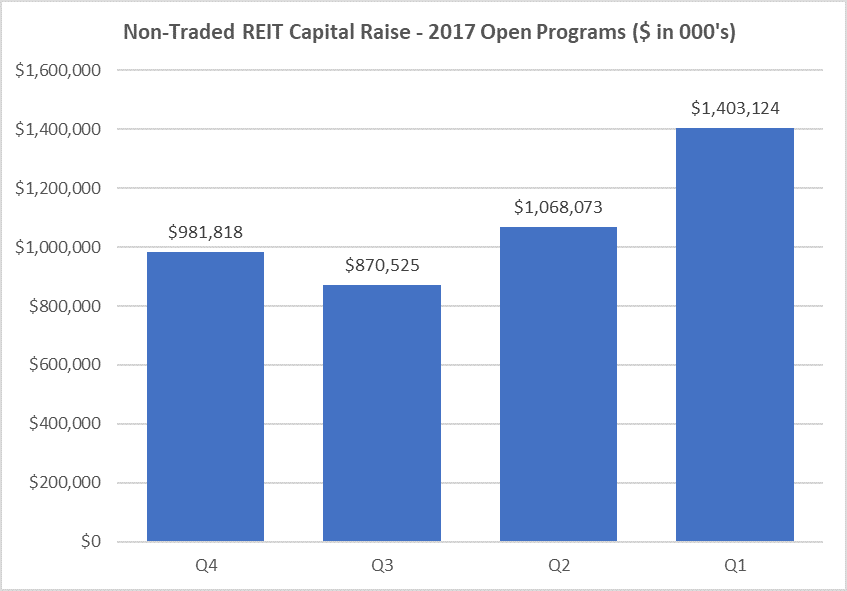

- 11 programs closed during 2017, reducing the number of those actively raising from 33 at the beginning of the year to 22 as of December 31, 2017.

- Capital raise for actively raising funds was highest in Q1. Capital raise slowed in Q2 and Q3 but saw a modest increase in Q4. The higher raise early in the year was likely due to program closures, including those sponsored by W.P. Carey who exited the non-traded REIT business in June.

- Blackstone Real Estate Income Trust, which began its capital raise in January 2017, led the pack. The program raised $1.7 billion, or 40% of the raise for open programs during the year. Carter Validus came in second, raising $418 million or 10%.

Chart Source: AI Insight. Data based on open, closed, or liquidated programs reporting on the AI Insight platform as of December 31, 2017.